KEY TAKEAWAYS

- Predatory pricing involves setting prices below production costs with the intent to drive competitors out of the market.

- It poses significant risks, including potential antitrust claims, damage to market viability, and negative impacts on consumers.

- Warning signs include undercutting competitors, exclusive supplier partnerships, and raising prices after eliminating competitors.

What is Predatory Pricing?

Basic Definition and Concepts

At its core, predatory pricing refers to the strategy of setting prices extremely low, below cost, to drive competitors out of the market. Once competitors exit, the predatory company typically raises prices to recoup losses. This tactic relies on the ability to absorb short-term losses for potential long-term gains. Key concepts include pricing below cost, the intention to eliminate competition, and eventual price increases. Legal sanctions for predatory pricing often involve compensatory damages or administrative penalties. Predatory pricing is frequently scrutinized in antitrust cases, particularly when a plaintiff can prove market competition or potential monopolization. However, differentiating predatory pricing from legitimate competitive pricing where firms cut costs for efficiency can be challenging.

Historical Context and Development

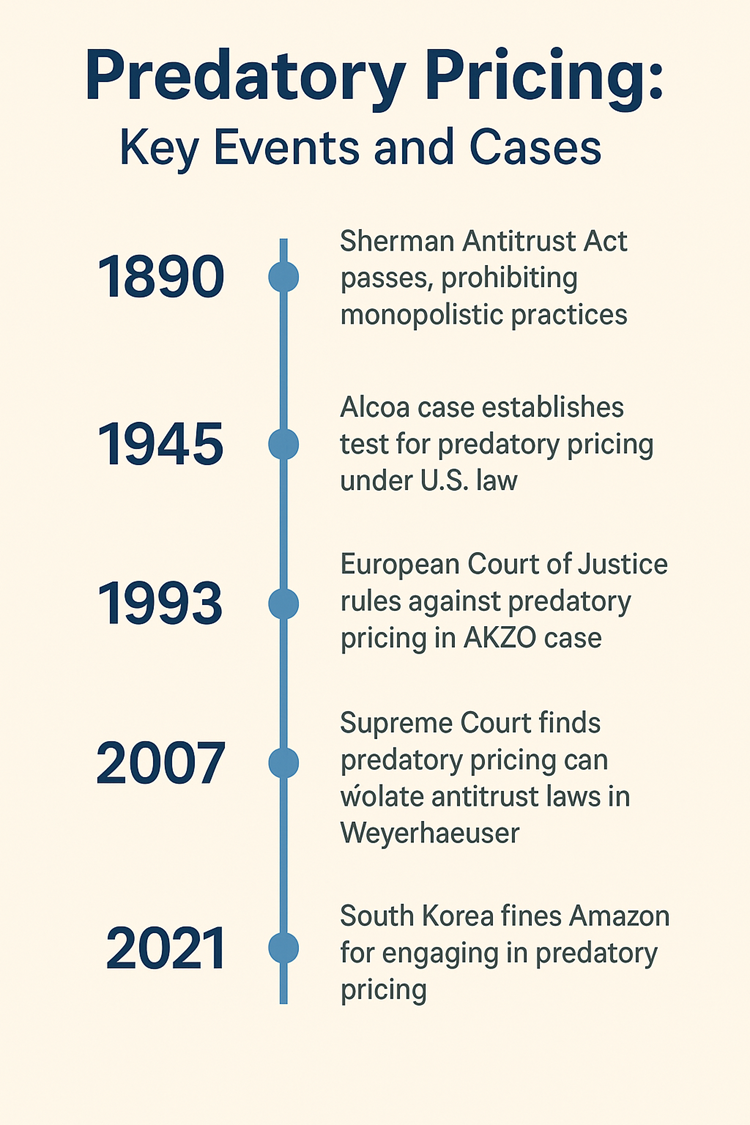

The historical roots of predatory pricing extend back to the 19th century during the era of rapid industrialization and the burgeoning dominance of monopolies. A quintessential example from this period is Standard Oil, which used predatory pricing to undercut competitors and establish its vast empire. The emergence of these strategies prompted legislative interventions, leading to the Sherman Antitrust Act of 1890, aiming to curb monopolistic behaviors.

As industries grew and evolved, so did the methods and scrutiny of predatory pricing. The mid-20th century saw significant court cases that further defined and reshaped the legal landscape surrounding these practices. Prominent cases during this period helped refine interpretations of antitrust laws, influencing future rulings and economic policy globally.

In more recent decades, the rise of digital markets has shifted predatory pricing into new arenas, with technology and e-commerce companies facing accusations of leveraging extensive data and resources to outprice competitors.

The Economics Behind Predatory Pricing

Key Economic Theories

Several key economic theories provide a framework for understanding the strategic application and effects of predatory pricing. One central theory posits that this strategy involves setting prices deliberately low to force competitors out, with the expectation that eliminating competition will enable higher profitability in the long run through recoupment of the initial losses. Economists consider this a form of market manipulation aimed at achieving monopoly power and potentially extracting monopoly profits. Game theory offers a strategic lens, modeling the interactions and potential outcomes between competing firms. It emphasizes anticipatory actions where predatory pricing is a calculated move, reacting to competitor behaviors and market conditions, ensuring the dominant firm maintains a monopoly advantage. Another significant concept is the limit pricing model, in which a firm sets its prices just low enough to dissuade new entrants without drastically impacting its own profitability. This approach works particularly well in markets with high entry barriers where new competitors are likely deterred by thin margins and the exclusion of competitive threats. These economic theories collectively highlight the underlying motives and potential effectiveness of predatory pricing in altering market structures.

Market Conditions Necessary for Predation

For predatory pricing to be effective, certain market conditions must be present. Firstly, the firm engaging in predation typically needs substantial financial reserves, allowing it to sustain losses over an extended period. This financial cushion makes it feasible to set prices well below cost until competition is eliminated. Walmart, for instance, has been noted for its ability to engage in competitive pricing due to its significant financial strength.

A market must also have barriers to entry that prevent new competitors from easily entering once prices are increased again. These could be regulatory hurdles, significant capital requirements, or brand loyalty that takes time and resources to overcome. Such conditions ensure that once competitors are driven out, new ones do not rapidly replace them. The Brooke Group rule, established by the US Supreme Court, provides a framework to assess if predatory pricing crosses legal boundaries.

Additionally, the demand should be relatively inelastic, ensuring that consumers remain with the predatory business despite price fluctuations. This adherence is crucial for rebuilding profit margins after competitors have exited. Finally, the market structure often involves a few large players where one dominant firm can leverage its size and operational efficiencies to undercut rivals.

Real-World Examples of Predatory Pricing

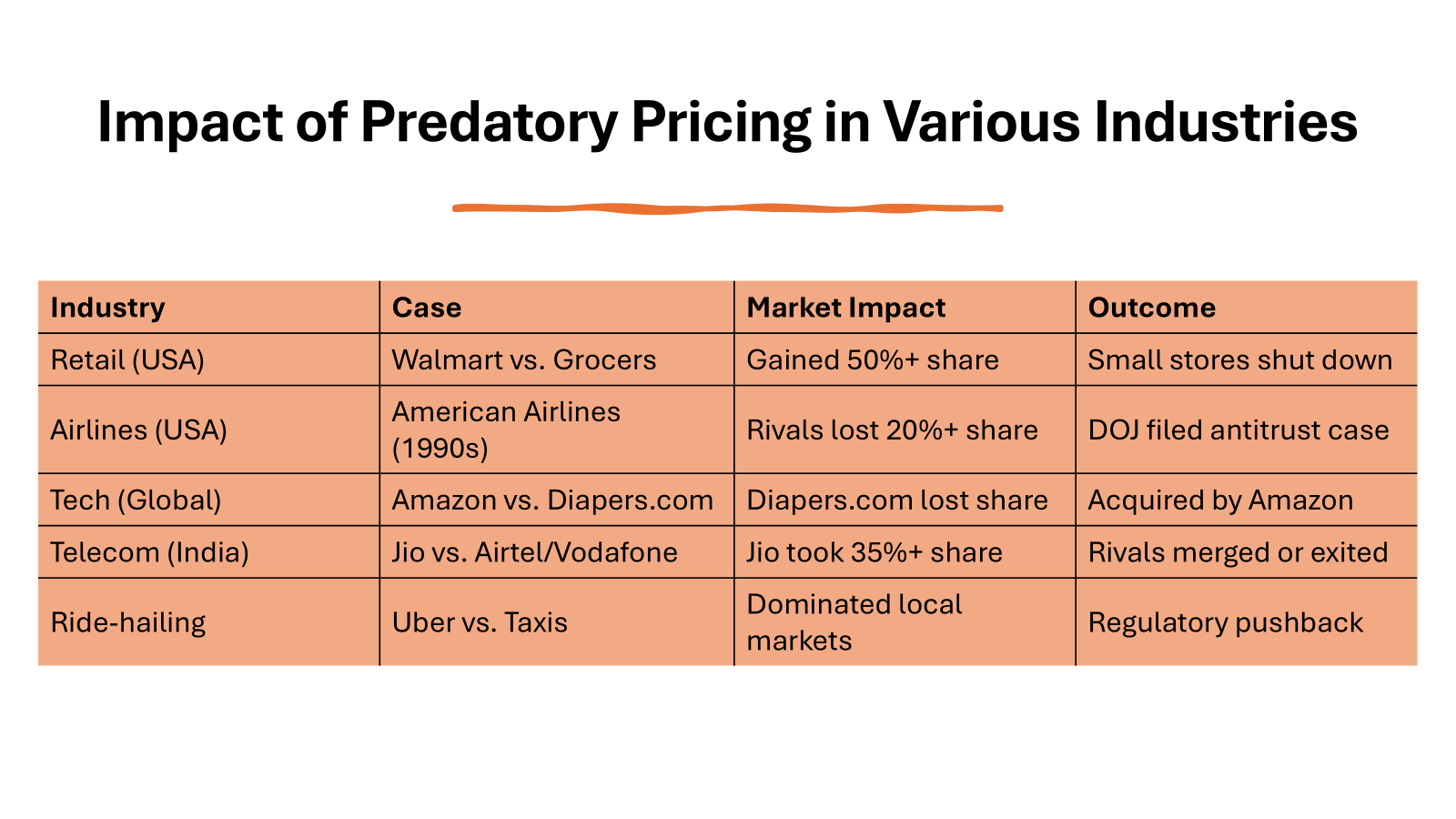

Case Studies from Various Industries

Predatory pricing is a tactic observed in various industries, each offering unique insights into its implementation and consequences. One example is the airline industry, where established carriers have used predatory pricing to deter new entrants after deregulation. By temporarily slashing ticket prices and absorbing the financial loss, these incumbents maintained market dominance once competitors exited.

In the retail sector, a well-known case involved a significant retail chain reducing prices on essential goods to unsustainable levels, forcing smaller, locally-owned stores out of business. This strategy enabled the retailer to capture a significant market share before gradually increasing prices again.

The technology sector offers another notable example. A large tech firm was accused of bundling software products and using aggressive pricing to marginalize competitors. This strategy allowed it to dominate specific market segments, leading to legal challenges and eventual settlements.

Notable Accusations and Outcomes

There have been several high-profile accusations of predatory pricing across different sectors, each highlighting the complexity of proving such cases. One landmark case involved a major retailer accused of driving competitors out through unsustainable pricing strategies. This resulted in legal scrutiny and eventually changes in pricing practices, although proving malintent posed significant challenges to regulators. Similar allegations were previously leveled at well-known companies like Walmart and Air Canada, showing the recurring nature of such accusations. In the technology sector, a prominent tech giant faced accusations of using predatory pricing to expand its market share at the expense of smaller software developers. The case led to intense legal battles, ultimately resulting in a settlement where the company agreed to alter its pricing strategies and increase transparency.

Another case in telecommunications saw a leading provider accused of predatory pricing to eliminate smaller competitors and reinforce its dominance. Legal proceedings brought to light the provider’s strategic pricing intentions, although outcomes varied; in some instances, accusations were dismissed, while others resulted in significant fines and procedural overhauls. The situation mirrors historical transport pricing disputes, such as between the New York Central Railroad (NYCR) and Erie Railroad, emphasizing the challenges across different industries.

Legal Implications and Challenges

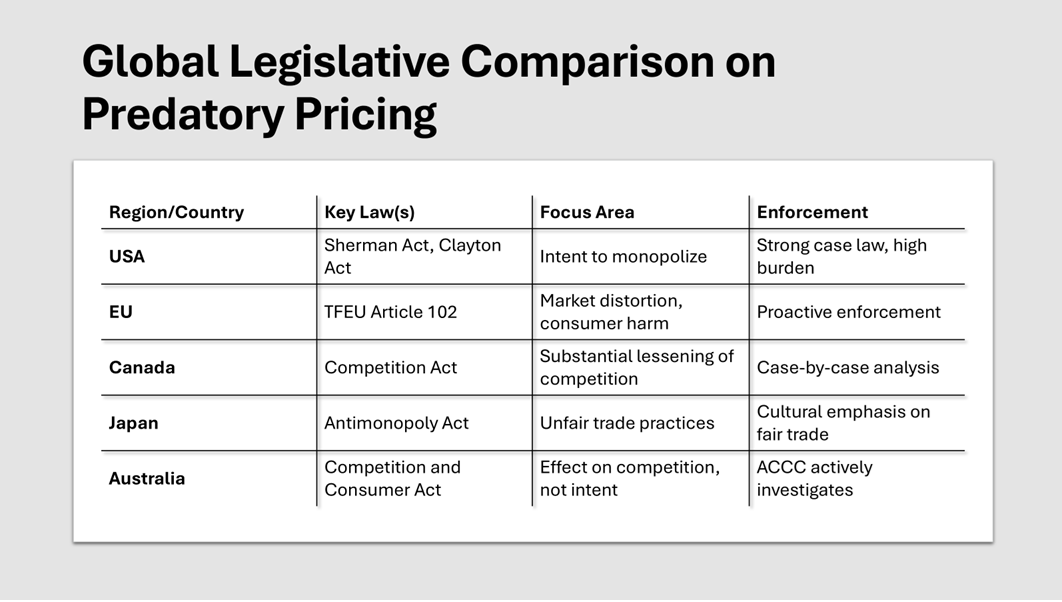

Global Perspectives on Legality

Globally, the legality of predatory pricing varies, reflecting different economic priorities and legal frameworks. In the United States, antitrust laws such as the Sherman Act and Clayton Act provide the foundation for regulating predatory pricing. These laws emphasize the intent to monopolize as a crucial factor in evaluating wrongdoing and practices deemed as potentially anti-competitive. In the European Union, competition laws focus on consumer harm and market distortion, stressing the dominance of the firm and the potential to eliminate competition. The EU’s legal framework often involves stringent scrutiny of pricing strategies, with several high-profile cases setting precedents. In countries like Japan and Australia, the emphasis is on preventing unfair market practices that harm consumer interests and competition. Australia’s Competition and Consumer Act, for instance, targets substantial lessening of competition as a key indicator of illegal pricing tactics. An example of consumer protection initiatives includes discounts and savings schemes which encourage fair market play. Despite these differences, a common challenge across jurisdictions is the burden of proof, requiring clear evidence of intent and resultant market harm. Allegations of wrongdoing are difficult to substantiate, as firms often argue they are merely being competitive.

Key Legislation in Different Countries

Different countries have implemented specific legislation targeting predatory pricing, shaped by their respective economic goals and regulatory environments. In the United States, key legislative measures include the Sherman Antitrust Act and the Clayton Act, which focus on preventing monopolistic power and unfair market manipulation. These acts empower federal agencies and courts to take action against pricing strategies that threaten competition. In the case of the Erie Railroad, predatory pricing strategies were employed in the cattle transport industry, a scenario equivalent to today’s anti-competitive practices, which caught the attention of regulatory frameworks.

In the European Union, Article 102 of the Treaty on the Functioning of the European Union specifically addresses the abuse of a dominant market position, which includes predatory pricing practices. The EU’s approach emphasizes the protection of competitive market structures and consumer welfare. Exclusion of competitors from the market due to unfair practices is also monitored under these regulations.

Australia’s Competition and Consumer Act aims at maintaining fair competition by prohibiting pricing tactics that substantially lessen competition. This legislation empowers regulatory bodies to impose penalties and enforce corrective measures.

In Canada, the Competition Act includes provisions against abuse of dominance, incorporating predatory pricing as a potential violation. The act is designed to ensure a competitive market environment beneficial to consumers and businesses alike.

These legislative frameworks illustrate the varied approaches nations take in regulating predatory pricing, highlighting the importance of context-specific legal strategies to safeguard market integrity.

Consequences for Businesses Found Guilty

Businesses found guilty of engaging in predatory pricing often face significant financial and reputational repercussions. Legal penalties typically include substantial fines designed to serve as both punishment and deterrence. These fines, in response to identified wrongdoing, can run into millions of dollars, impacting a company’s financial health significantly. Beyond financial penalties, businesses may also be subject to mandated divestitures or operational changes. This could involve selling off parts of their business or altering their pricing and competitive strategies to restore market fairness. In some cases, companies have been ordered to enhance transparency in their pricing structures to prevent future violations. Reputation-wise, being found guilty of predatory pricing can lead to a loss of consumer trust and a tarnished brand image, which can be difficult to rebuild. Competitors who have been driven out or harmed by such practices may pursue civil litigation, seeking to recover damages from the wrongdoing they endured.

Effects of Predatory Pricing on Markets

Short-Term vs Long-Term Impacts

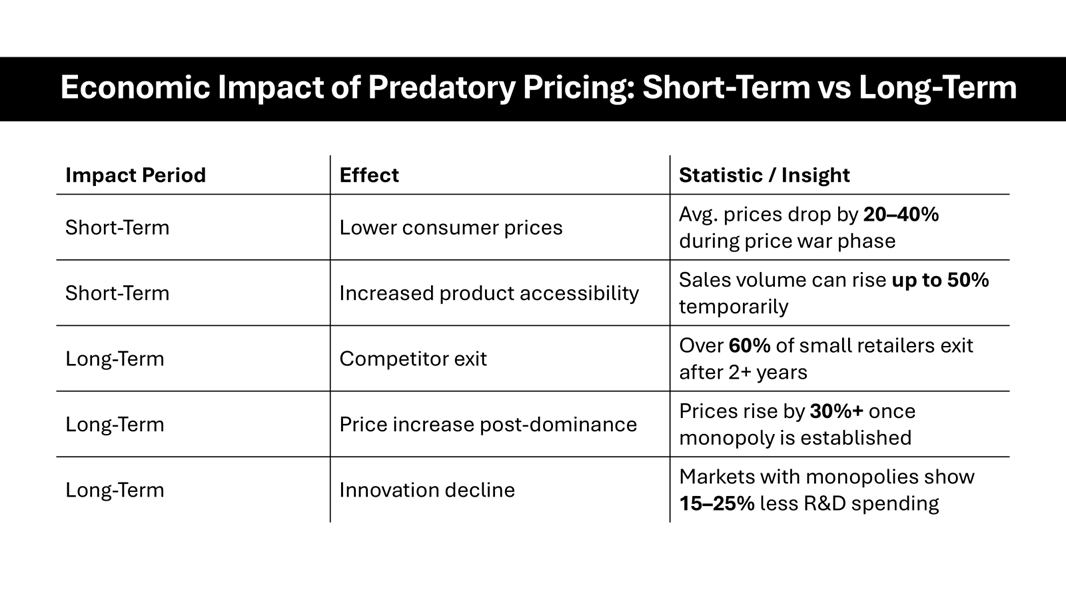

Predatory pricing can produce contrasting impacts over the short term versus the long term. In the short term, consumers often benefit from significantly lower prices, which can increase buying power and accessibility to various products and services. This temporary boon can lead to a surge in sales volume for the predatory company as consumers flock to these more affordable options. For instance, transport services may witness a spike in ridership when fares are slashed temporarily to outcompete rivals.

However, the long-term implications tend to be more detrimental. Once competitors have been driven out of the market, the predatory firm may raise prices to recoup losses, often resulting in higher costs for consumers than before. With reduced competition, there is less pressure to innovate, potentially leading to a stagnation in product development and quality. Additionally, transport networks might suffer from reduced investment and innovation when monopolistic practices limit competition.

Moreover, the market may become monopolistic or oligopolistic, limiting consumer choice and potentially resulting in fewer industry advancements. These dynamics illustrate why vigilance and effective legislation are essential to prevent the negative long-term impacts of predatory pricing on market competition and consumer welfare.

Implications for Competition and Consumers

The implications of predatory pricing for competition and consumers can be wide-ranging. For competition, predatory pricing works as a formidable barrier to entry, effectively eliminating smaller or less financially robust competitors. This reduces the number of firms in the market, leading to decreased competitive pressure and potentially allowing a dominant firm to gain a monopoly advantage. Over time, this can stifle innovation, as fewer competitors mean less need for improvement and customer satisfaction. The remaining dominant firm gains significant market power, potentially setting prices and dictating terms unchallenged. For consumers, the immediate impact is typically positive, thanks to lower prices and increased purchasing power resulting from such pricing strategies. However, this short-term benefit is often overshadowed by long-term detriments. Once competition is reduced, the dominant firm may increase prices, leading to higher costs for consumers. Additionally, with fewer alternatives in the market, consumer choice is restricted, which can affect product quality and service standards. Balancing effective competition with consumer interests is crucial for maintaining a healthy and dynamic market landscape. Transport considerations also come into play as dominant firms may lower transport fees to undercut competitors but later increase them once monopoly status is achieved.

Strategies to Counteract Predatory Pricing

Regulatory Actions and Interventions

Regulatory actions and interventions are critical in addressing and mitigating the effects of predatory pricing. Authorities in various countries employ a range of strategies to ensure markets remain competitive and fair. Regulatory bodies, such as the Federal Trade Commission (FTC) in the United States, the European Commission in the EU, and similar agencies worldwide, actively monitor and investigate pricing strategies that may indicate predatory intent. The resumption of stringent monitoring and enforcement can act as a significant deterrent against wrongdoing by curbing practices such as exclusionary abuses and cartel formations.

One common intervention is the imposition of fines and legal penalties on companies found guilty of predatory pricing. These financial repercussions serve as both punishment and a deterrent to prevent future violations. Cases deemed as clear-cut abuses of market power can also lead to structural remedies, such as breaking up portions of a business to reduce dominance. Additionally, issues related to wrongdoing can involve intricate investigations to ensure the exclusion of anti-competitive barriers.

In addition to punitive measures, regulatory agencies may promote transparency and accountability by mandating regular audits and requiring firms to submit detailed pricing data. Education and guidance on competitive practices are also provided to businesses to encourage compliance with fair trading laws.

Business Tactics to Compete Fairly

Businesses can deploy a variety of fair tactics to compete effectively without resorting to predatory pricing. One effective strategy is focusing on differentiation. By offering unique products or superior services, businesses can create a niche for themselves that makes them less vulnerable to price-based competition. Innovation, quality, customer service, and branding play crucial roles in cementing such a competitive edge.

Another tactic involves operational efficiency. By optimizing supply chain management, reducing production costs, and enhancing resource management, a business can sustain healthy profit margins even while maintaining competitive pricing. Efficient operations enable firms to compete with larger players on value rather than cost alone.

Partnerships and alliances can also be beneficial, allowing smaller firms to share resources and capabilities. Joint marketing initiatives, shared technology, or R&D collaborations can better position these firms against larger competitors.

Moreover, businesses should invest in robust market analysis to anticipate competitive moves and consumer trends. Staying informed enables a proactive approach rather than reactive measures in response to predatory pricing.

Conclusion

Predatory pricing is a controversial pricing strategy wherein a seller deliberately sets prices below cost to drive out competition, often by targeting weaker prey in the marketplace. The tactic is typically seen as a form of dumping, especially when the output sold at a loss aims to eliminate rivals and create a monopoly. While commonly associated with large players like Amazon in the ecommerce sector, predatory pricing is observed across industries, including the retail industry and even in commodity markets such as bromine. Once the competition is weakened or forced into bankruptcy, the dominant seller may then increase prices, reaping monopoly profits.

The rationale behind this behaviour often rests on the presumption that the firm has enough financial resilience and willingness to bear short-term losses for long-term gains. This strategy may violate antitrust laws when the pricing decisions cannot be justified by legitimate business needs and fail the AVC rule (Average Variable Cost), as established in legal and economic frameworks. Legal scholars like Phillip Areeda and Baumol I have contributed to the development of predatory pricing guidelines, focusing on cost-based tests and market impact to establish whether a pricing strategy is truly predatory.

Predatory pricing also intersects with loss leader pricing, although the latter is often a legitimate promotional tool when used temporarily and without harmful intent. Distinguishing between aggressive competition and illegal pricing behaviour requires careful accounting, economic analysis, and sometimes judicial determination. Cases often depend on evidence of intent, such as internal emails, templates, or transactions showing an effort to exclude rivals, and not merely on below-cost prices alone.

In practice, regulators face challenges in proving predatory conduct due to the inability to isolate clear motives or outcomes, especially in dynamic sectors. Petitions from suppliers and smaller sellers, however, frequently prompt investigation when sustained losses signal systemic price undercutting. Ultimately, enforcing restraint through sound policy and expert determination ensures that the market remains competitive, protects consumer welfare, and maintains fair play, regardless of a seller’s size or expertise.

FAQs

How does predatory pricing differ from competitive pricing?

Predatory pricing involves setting prices below cost with the intent to drive competitors out of the market, ultimately to raise prices once they’ve exited. Competitive pricing, however, is about setting prices based on market conditions to attract consumers, typically without intending to harm competition or create monopolistic control.

Are there any industries particularly vulnerable to predatory pricing?

Industries with high fixed costs and significant barriers to entry, such as airlines, telecommunications, and technology, are particularly vulnerable to predatory pricing. These sectors often feature a few dominant players capable of absorbing losses for strategic advantage. Low product differentiation and price sensitivity among consumers also increase the susceptibility of these industries.

What measures can a business take if they suspect a competitor is using predatory pricing?

If a business suspects a competitor of using predatory pricing, it can gather evidence of below-cost pricing over time and report it to relevant regulatory authorities. Legal advice should be sought to evaluate the situation’s merit. Additionally, the business might consider enhancing product differentiation, improving efficiency, or forming alliances with other firms to withstand competitive pressure.

How do you define predatory pricing in a competitive market?

In a competitive market, predatory pricing is defined as the tactic of pricing goods or services below cost with the intention of eliminating competitors. Once these competitors exit the market, the predatory firm plans to raise prices to recoup losses. It’s considered anti-competitive as it aims to secure market dominance rather than promote healthy competition.

How is undercutting prices different from predatory pricing?

Undercutting prices involves setting prices lower than competitors to attract customers and increase market share, typically within sustainable limits. Predatory pricing, on the other hand, is a deliberate strategy to set prices below cost to drive competitors out of the market, intending to increase prices subsequently once competition is reduced or eliminated.