KEY TAKEAWAYS

- Financial reporting is crucial for providing stakeholders with a clear understanding of a company’s fiscal condition and operations, assisting in informed decision-making through compliance with standards like GAAP and IFRS.

- It enables data-driven decisions by offering insights into key trends, aiding in effective debt management, budget allocation, and identification of future opportunities or risks.

- Financial reports enhance transparency and build trust with investors and lenders by ensuring accuracy through regular audits, which are essential for maintaining credibility and alignment with strategic decision makers.

Defining Financial Reporting

Core Components of Financial Reports

Financial reports comprise several key components, each serving a distinct purpose in showcasing an organization’s financial health. Here’s a quick breakdown:

Balance Sheet: This statement provides a snapshot of a company’s financial situation at a specific point in time, detailing assets, liabilities, and shareholders’ equity. It helps stakeholders understand what the company owns and owes, and how well it manages equity records and owner equity.

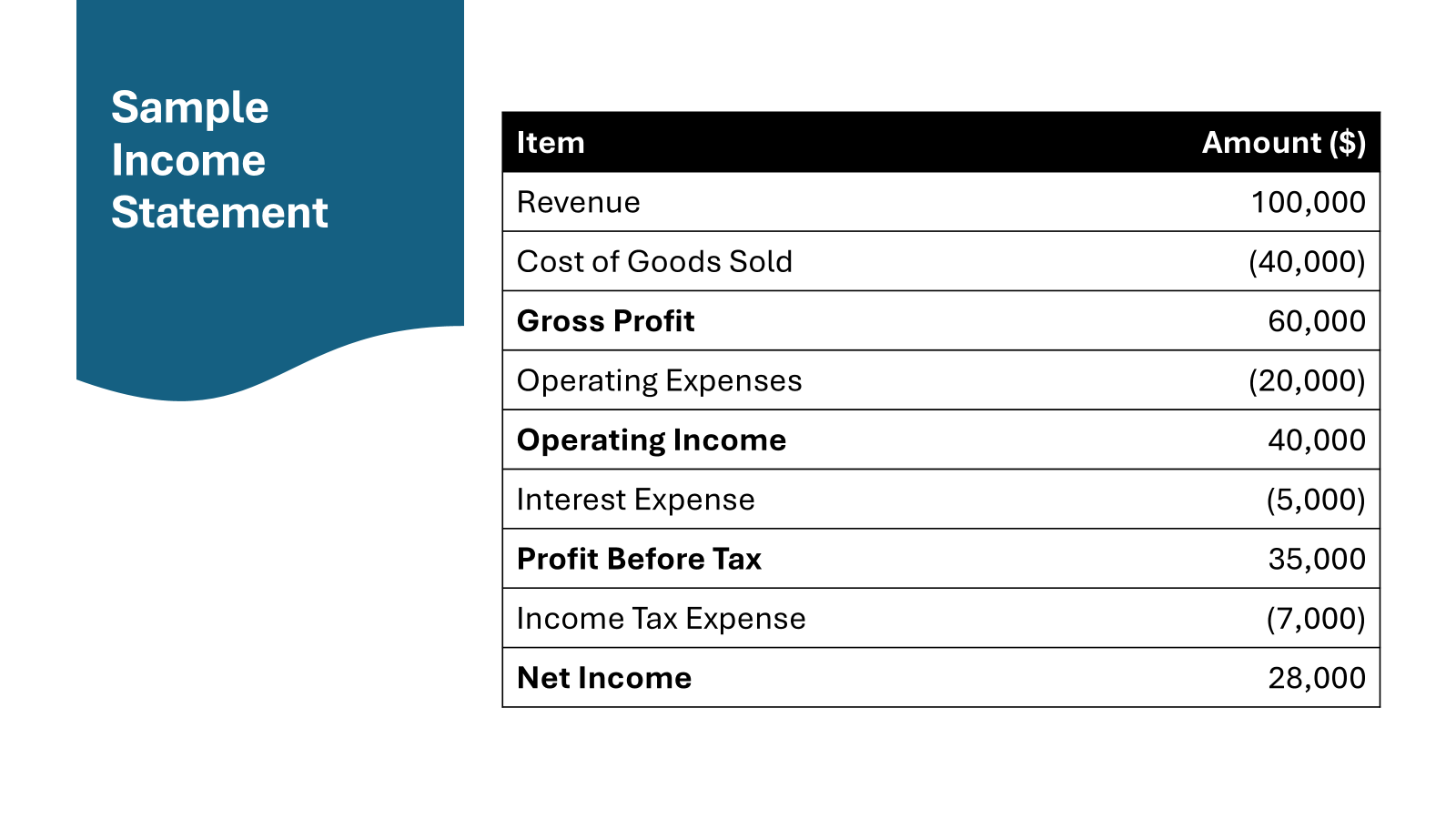

Income Statement: Often referred to as a profit and loss statement, it highlights revenue, expenses, gains, and losses over a period, including capital expenditure and depreciation. This helps in assessing profitability and operational efficiency.

Cash Flow Statement: Crucial for understanding how cash is generated and utilized, it reflects cash in-flows and out-flows from operating, investing, and financing activities like equity withdrawal and issuance. This statement is vital for assessing the company’s liquidity and cash health.

Statement of Changes in Equity: This component shows movements in equity and outlines investors’ interests in the company. It helps track retained earnings, equity investment, dividend payments, and other comprehensive income.

Each of these components plays a critical role in delivering a transparent financial narrative and supporting strategic financial decisions, including reporting liabilities and predicting business opportunities.

Differences between Financial and Managerial Reporting

When diving into the world of business reporting, it’s essential to distinguish between financial and managerial reporting, as they serve different audiences and purposes. Purpose and Audience:

- Financial reporting is designed for external stakeholders such as investors, creditors, and regulatory agencies. Its primary objective is to provide a clear and honest view of the company’s financial health. SEC reporting plays a crucial role here, requiring adherence to strict guidelines to ensure transparency.

- Managerial reporting, on the other hand, is for internal use by managers and executives. It aims to aid in decision-making, planning, and controlling business operations, frequently incorporating key performance indicators (KPIs)to assess the effectiveness of management strategies.

Content and Format:

- Financial reports adhere to standardized formats and accounting principles, such as GAAP or IFRS, ensuring consistency and comparability across different entities. Part of these reports includes detailed disclosure of accounting policies, providing insights into the company’s financial decisions.

- Managerial reports are more flexible in format and often tailored to meet managerial needs, providing detailed and real-time data specific to particular segments or departments, often supported by bookkeeping data for precision.

Frequency and Timing:

- Financial reporting is periodic, typically quarterly or annually, aligning with mandatory regulatory filings.

- Managerial reports are generated as needed, often weekly or monthly, to serve the dynamic needs of the business, enabling prompt strategic actions.

Understanding these differences allows better appreciation of how each type of reporting contributes to the broader financial landscape.

Importance of Financial Reporting

Enhancing Transparency and Trust

Financial reporting plays a fundamental role in enhancing transparency and building trust among stakeholders.

Transparent Disclosures: Through detailed financial statements, organizations provide a clear and concise view of their financial activities and health. This transparency helps investors and other stakeholders understand a company’s actual standing, fostering a sense of trust. Companies that provide thorough and honest reports are often perceived as more reliable.

Building Credibility: Regular and accurate reporting builds credibility with banks, investors, and shareholders. When stakeholders trust that the financial information is accurate and timely, it increases their confidence in the company’s governance and operational reliability.

Ethical Standards Compliance: Adhering to high ethical standards in reporting reinforces the image of integrity and respect within the financial community. This includes complying with accounting standards like GAAP or IFRS and ensuring all financial dealings are reported honestly.

By prioritizing transparency and trust, companies can foster long-term relationships with their stakeholders, which is crucial for sustained success.

Supporting Informed Decision Making

Financial reporting is a cornerstone in supporting informed decision-making processes across various levels of an organization.

Data-Driven Insights: Financial reports offer critical insights into a company’s profitability, cash flow, and financial position. Decision-makers use this data to evaluate past performance and predict future trends, ensuring strategies are aligned with financial realities. For example, startups often leverage these financial insights to determine investor interest and funding viability.

Resource Allocation: Managers rely on financial reports to allocate resources effectively. By assessing which areas of the business are most profitable or require more investment, they can optimize operations and capital use. Automating certain financial processes can help startups enhance productivity, streamlining how resources are distributed.

Risk Management: Through detailed analyses of financial statements, companies can identify potential risks early. This proactive approach allows organizations to implement risk mitigation strategies promptly. In the startup world, early identification and management of financial risk are often key takeaways for long-term success.

Strategic Planning: Long-term planning and forecasting depend heavily on accurate financial data. Companies use insights from financial reports to set realistic goals, manage budgets, and evaluate market opportunities. For startups, these insights are crucial in aligning strategic growth plans with financial capability.

By leveraging comprehensive financial data, businesses can make informed decisions that drive growth and stability.

Legal and Regulatory Compliance

Financial reporting is critical for ensuring legal and regulatory compliance, which protects organizations from legal repercussions and maintains their licensing and reputation.

Adherence to Standards: Businesses must adhere to accounting standards such as GAAP or IFRS to meet legal obligations. These frameworks ensure consistency and fairness in financial reporting, creating a level playing field for all entities.

Regulatory Filings: Regular financial reports are mandatory for government filings and audits. Regulatory bodies, like the SEC in the U.S., require periodic filings of financial statements to monitor corporate financial behavior and ensure compliance with financial laws.

Avoiding Penalties: Non-compliance can lead to hefty fines, legal action, and damage to a company’s reputation. By maintaining accurate and timely financial reports, companies can avoid these penalties and the associated loss of stakeholder trust.

Transparency with Stakeholders: Compliance with legal and regulatory frameworks enhances transparency, which is critical for building trust with investors, creditors, and the public. It shows that a company is accountable and operates within the legal boundaries set by regulators.

Through meticulous financial reporting aligned with legal standards, organizations can safeguard their operations and sustain their reputation.

Key Types of Financial Statements

Balance Sheet Overview

The balance sheet is a fundamental component of financial reporting, providing a snapshot of a company’s financial position at a specific point in time. It captures three main categories: assets, liabilities, and shareholders’ equity.

Assets: These are resources owned by the company, which can be classified as current (like cash, inventory, and receivables) or non-current (such as property, plants, and equipment). Assets indicate what the company can use to generate future revenue. Businesses often update this section on their website for accessibility.

Liabilities: These represent the company’s obligations or debts, arising from past transactions. Like assets, they can be current (owed within a year) or long-term (beyond a year). Liabilities help assess the financial commitments and cash flow needs of the business. Many companies prefer sharing their liability management strategies via email newsletters.

Shareholders’ Equity: This is the residual interest in the assets of the entity after deducting liabilities. It includes common stock, retained earnings, and additional paid-in capital, representing the net worth owned by shareholders. The balance sheet is essential for evaluating liquidity, solvency, and capital structure, helping stakeholders make informed assessments about financial health. Through the balance sheet, managers and stakeholders can gauge the company’s stability and make strategic decisions accordingly.

Understanding the Income Statement

The income statement, also known as the profit and loss statement, provides a detailed account of a company’s revenue and expenses over a specific period. This clarity helps in understanding the company’s operational efficiency and profitability.

Revenue: This is the total income generated from the sale of goods or services. It’s the starting point of the income statement and a key indicator of business scale and growth potential.

Cost of Goods Sold (COGS): These are the direct costs attributable to the production of goods sold by a company. Subtracting COGS from revenue gives the gross profit, revealing the business’s core profitability.

Operating Expenses: Operating expenses encompass all costs not directly tied to production, such as administrative expenses, marketing, and selling costs. Keeping these in check is crucial for realizing operating profit.

Net Income: After accounting for all expenses, including interest and taxes, net income (or profit) shows the company’s bottom line. It indicates the true profitability of the business for that period.

**Earnings Per Share (EPS):**While not always listed directly on the income statement, EPS is derived from net income and indicates profitability on a per-share basis, providing critical information to investors.

The income statement is indispensable for assessing operational performance and guiding strategic decision-making. By evaluating these financial details, stakeholders can better understand a company’s profit-generating capabilities and overall financial trajectory.

Cash Flow Statement Essentials

The cash flow statement is a vital financial document that outlines the cash inflows and outflows within a company over a specific period. It is essential for understanding a company’s liquidity and financial flexibility.

Operating Activities: This section records cash transactions related to the core business operations, such as cash received from customers and cash paid to suppliers and employees. It offers insight into the efficiency of the company’s operational cash generation.

Investing Activities: Here, you’ll find cash movements pertaining to asset purchases and sales, investments in securities, and loans made to or received from others. This section highlights the company’s investment strategy and asset management capabilities.

Financing Activities: This part tracks cash changes from borrowing, repaying loans, issuing, or buying back shares. It provides a view of how the company finances its operations and growth, which is crucial for understanding its long-term financial strategy.

Net Cash Flow: The sum of cash from operating, investing, and financing activities results in net cash flow. A positive net cash flow indicates that a company is generating sufficient cash to grow and manage debts.

Understanding the cash flow statement is crucial for assessing a company’s liquidity position, ensuring it has enough cash to meet its obligations without additional financing. It offers stakeholders a realistic view of cash availability, crucial for strategic planning and operational stability.

Changes in Equity Breakdown

The statement of changes in equity provides a detailed account of all changes in a company’s equity during a specific period. It offers insights into how various components of equity, such as retained earnings and contributed capital, fluctuate.

Opening Balance: This is the equity at the beginning of the period, reflecting the previous year’s closing figures. It establishes a baseline for tracking changes throughout the period.

Contributions and Distributions: These are changes due to transactions with owners, such as issuing new shares or distributing dividends. Such activities directly impact the company’s equity structure and shareholder returns.

Retained Earnings: This section depicts profits retained in the business after distributing dividends. It indicates how profits are being reinvested into the company for growth or reserved for future needs.

Revaluation Surpluses: Any revaluation of assets can cause changes in equity. An increase indicates that certain assets have appreciated, contributing to overall equity growth.

Net Profit or Loss: Profits or losses during the period directly modify shareholders’ equity, offering a clear picture of howbusiness activities impact overall equity value. A positive net profit increases retained earnings, while losses would decrease them.

Understanding the changes in equity allows stakeholders to see how a company is using its retained income and adjusting its capital structure for growth or stability. Tracking these changes is crucial for long-term financial planning and maintaining shareholder value.

Financial Reporting Standards and Regulations

Comparing GAAP and IFRS

When it comes to financial reporting, two primary frameworks guide the practices and principles: Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). Understanding the differences between these frameworks is essential for companies operating globally.

Origin and Application:

- GAAP is primarily used in the United States and focuses on the rules outlined by the Financial Accounting Standards Board (FASB).

- IFRS is used internationally and developed by the International Accounting Standards Board (IASB) to provide a global accounting standard that enhances comparability across borders.

Principles-Based vs. Rules-Based:

- GAAP is often categorized as rules-based, offering specific guidelines and detailed procedures for various accounting scenarios.

- IFRS is more principles-based, providing broad guidelines that emphasize the reasonableness and transparency of financial statements, which allows for greater flexibility in application.

Revenue Recognition:

- Under GAAP, revenue recognition includes detailed criteria and industry-specific guidelines to standardize when and how revenue is recognized.

- IFRS offers general principles for revenue recognition, which may result in earlier or differently interpreted revenue identification compared to GAAP.

Inventory Valuation:

- GAAP allows for different methods of inventory valuation, including Last In, First Out (LIFO), a method not permitted under IFRS.

- IFRS only supports First In, First Out (FIFO) and weighted-average cost methods, impacting how inventory costs are measured on balance sheets.

Financial Statement Presentation:

- GAAP provides more rigid formats for financial statement presentation, ensuring uniformity among US companies.

- IFRS gives companies greater freedom in how they present their financial statements, encouraging entities to cater the presentation to their specific business contexts.

Understanding GAAP and IFRS distinctions is critical for multinational companies aiming to maintain compliance and engage meaningfully in diverse financial markets. These frameworks play a crucial role in shaping how financial results are communicated globally.

Navigating Compliance Challenges

Compliance challenges in financial reporting can be complex and multifaceted, requiring diligence and strategic planning to navigate effectively.

Complex Regulations: Companies must adhere to various accounting standards and regulatory requirements, such as GAAP and IFRS, which can vary significantly across jurisdictions. Staying abreast of these regulations requires continual learning and adaptation.

Cross-Border Differences: For multinational organizations, differences in accounting practices and tax laws in various countries add layers of complexity. Companies must ensure that their financial reporting aligns with local regulations while maintaining global consistency.

Technological Integration: As technology becomes integral to financial operations, ensuring that IT systems and processes comply with regulatory standards is essential. This includes safeguarding data privacy and security, which are increasingly scrutinized by regulatory bodies.

Resource Allocation: Compliance requires significant resources, including dedicated personnel and financial investments in compliance programs and ongoing training. Companies need to allocate resources carefully to meet compliance obligations without detracting from other business operations.

Risk of Non-Compliance: Non-compliance can lead to penalties, lawsuits, and reputational damage. Therefore,companies must implement robust internal controls and audit processes to detect and rectify compliance issues promptly.

Navigating these challenges requires a proactive approach, where continuous monitoring, training, and technology play crucial roles in maintaining alignment with ever-evolving compliance standards. By doing so, companies safeguard their financial integrity and build stakeholder confidence.

Role of Technology in Financial Reporting

Automation and Efficiency Gains

Incorporating automation into financial reporting processes offers significant efficiency gains, transforming how companies manage and analyze financial data.

Streamlining Processes: Automation can drastically reduce the time taken to compile and verify financial reports. By using software tools that automatically extract and process data from various sources, companies can streamline tasks that traditionally consume substantial manual effort.

Error Reduction: Manual data entry and complex calculations are prone to human error, which can be mitigated through automated systems. These systems improve accuracy by ensuring data consistency and flagging discrepancies for review.

Real-Time Data Access: Automation enables real-time data collection and reporting, providing managers with up-to-the-minute insights into financial performance. This immediate access supports quicker decision-making and more dynamic financial management.

Cost Savings: Although there is an initial investment in automation technologies, the long-term savings from reduced labor costs and improved efficiency often outweigh these expenses. Businesses can reallocate resources to more strategic initiatives as less time is spent on routine tasks.

Scalability: Automated systems can easilyadapt to handle larger volumes of data as a company grows, ensuring that scaling up operations does not compromise the speed or accuracy of financial reporting. This flexibility allows for seamless adjustments and expansion.

By embracing automation, organizations can optimize their financial reporting processes, enhancing their capability to respond to business needs with greater precision and speed. This technological shift not only improves current efficiencies but also paves the way for future innovations in financial management.

Leveraging Predictive Analytics

Predictive analytics is revolutionizing financial reporting by providing deeper insights into future financial trends and potential risks, enabling more strategic decisions.

Forecasting Future Trends: Predictive analytics tools analyze historical data to forecast future business conditions. This allows companies to prepare for changes in market dynamics and financial outcomes, optimizing their strategic planning and resource allocation.

Risk Management: By identifying patterns and anomalies in financial data, predictive analytics helps companies anticipate potential risks and implement preventive measures. This proactive approach reduces uncertainties in financial reporting and enhances decision-making confidence.

Enhanced Decision-Making: Predictive models provide actionable insights that are pivotal in crafting more informed policies and decisions. They enable financial teams to explore different scenarios and outcomes, enhancing the planning process.

Resource Optimization: Analytics tools help identify which areas of a business are yielding the highest returns, enabling better investment of resources towards the most promising opportunities. This strategic use of data maximizes financial performance.

Competitive Advantage: By gaining advanced insights into financial trends and behaviors, companies can stay ahead of competitors, anticipatingmarket shifts and making informed adjustments faster than those relying solely on traditional methods. This foresight can lead to improved market positioning and profitability.

Leveraging predictive analytics in financial reporting enables organizations to not only enhance current operations but also strategically plan for future growth. This powerful tool transforms data from just information into a robust mechanism for business evolution and competitiveness.

Common Challenges in Financial Reporting

Ensuring Accuracy and Consistency

Ensuring accuracy and consistency in financial reporting is vital for building stakeholder trust and maintaining a company’s reputation. Here’s how companies can achieve it:

Robust Internal Controls: Implementing strong internal controls is essential to prevent errors and fraud. These controls include checks and balances such as segregation of duties, regular audits, and reconciliation processes.

Standardized Processes: Establishing standardized procedures for report preparation ensures that financial data is consistently recorded and presented. This standardization facilitates comparisons across time periods and between different organizational units.

Regular Audits and Reviews: Conducting periodic internal and external audits helps verify the accuracy of financial reports and identify areas for improvement. These reviews ensure compliance with relevant accounting standards and verify that reports reflect true financial status.

Staff Training and Development: Continuous training programs equip financial professionals with the skills needed to maintain accuracy in reporting. Training ensures that staff are up-to-date with the latest accounting regulations and technologies.

Technology Utilization: Leveraging technology such as accounting software or automated systems can reduce manualerrors and enhance data consistency. These tools help streamline the data entry and reporting process, ensuring that figures are accurate and timely.

By focusing on these strategies, companies can significantly enhance the accuracy and consistency of their financial reporting. This leads to stronger financial integrity, increases stakeholder confidence, and positions the company as a reliable and transparent entity in the market.

Mitigating Errors and Risks

Mitigating errors and risks in financial reporting is critical to safeguarding a company’s financial credibility and operational efficiency. Here’s how organizations can effectively manage these challenges:

Comprehensive Reviews: Implementing thorough review processes for all financial reports is essential. Multiple levels of review help catch potential errors and ensure that all figures are correct and compliant with accounting standards.

Advanced Technology Solutions: Utilizing technology, such as advanced data analytics and accounting software, can help identify inconsistencies and automate error-prone tasks, reducing the likelihood of human mistakes.

Continuous Training Programs: Regular training keeps financial teams updated on the latest regulations and reporting techniques. This education empowers them to produce accurate reports and understand potential pitfalls.

Risk Assessment Frameworks: Establishing a comprehensive risk management framework allows businesses to identify, assess, and prioritize potential risks within the financial reporting process. Regular assessments can help mitigate these risks before they escalate.

Clear Communication Channels: Open communication among financial team members, departments, and management is crucial. Aligning goals and expectations ensures everyone is awareof their role in maintaining accuracy and managing risks. This encourages proactive discussion and resolution of potential issues before they affect the financial statements.

By focusing on these strategies to mitigate errors and risks, companies can protect their reputational integrity and ensure compliance with financial regulations. This proactive approach not only enhances reporting accuracy but also fosters a culture of accountability and continuous improvement.

Future Trends in Financial Reporting

Impact of ESG on Financial Disclosures

The integration of Environmental, Social, and Governance (ESG) factors into financial disclosures is increasingly influencing how businesses report and operate. Here’s how ESG impacts financial disclosures:

Enhanced Transparency: As investors and stakeholders demand more transparency regarding ESG practices, companies are incorporating detailed ESG metrics and narratives into their financial disclosures. This includes reporting on carbon footprints, social policies, and governance structures, which can significantly impact investment decisions.

Regulatory Pressures: Regulatory bodies worldwide are beginning to mandate ESG reporting, making it a critical component of financial disclosures. Compliance with these regulations ensures that companies are mitigated against legal and financial penalties while meeting investor expectations.

Investor Appeal: ESG-focused disclosures are becoming a key factor in attracting investments, as more investors look to support sustainable and ethically responsible companies. Clear ESG reporting can enhance a company’s reputation, driving shareholder value and long-term growth.

Risk Management: Incorporating ESG considerations helps companies identify and manage potential risks related to environmental issues, social responsibilities, and governance practices. This proactive approach improves resilience and can lead to more stable financial performance.

Long-Term Strategy Alignment: Companies aligning ESG initiatives with their financial reporting demonstrate a commitment to sustainable and responsible growth. This alignment not only meets the current demands of stakeholders but also sets the stage for future success, balancing profitability with societal impact.

The impact of ESG on financial disclosures is profound, driving a shift towards more comprehensive and responsible reporting practices. By embracing ESG factors, companies can enhance their transparency, satisfy regulatory and investor demands, and position themselves as forward-thinking leaders in the marketplace.

The Rise of Real-Time Reporting

Real-time reporting is changing the landscape of financial reporting by providing immediate, up-to-date financial information that enhances decision-making and responsiveness. Here’s a closer look at its impact:Immediate Data Availability: Real-time reporting provides companies with instant access to financial data, eliminating the delays inherent in traditional reporting cycles. This immediacy allows businesses to respond swiftly to market changes, optimize cash flow, and adjust strategies in near real-time.

Improved Decision Making: With access to current data, decision-makers can analyze trends and performance metrics as they happen, leading to more informed and timely business decisions. This proactive approach helps managers adjust operations and seize opportunities more effectively.

Enhanced Accuracy: Automation and continuous data flow inherent in real-time reporting reduce errors associated with manual data entry and reconciliation, increasing the accuracy and reliability of financial information.

Competitive Advantage: Companies that embrace real-time reporting can stay ahead of competitors by leveraging instant insights for strategic planning and innovation. This agility allows businesses to respond to market demands swiftly and cater more effectively to customer needs.

Resource Efficiency: Real-time reporting reduces the need for periodic, labor-intensive closing processes, enabling finance teams to focus on higher-value tasks. This efficiency not only saves time but also reallocates resources towards strategic initiatives.

As businesses navigate the complexities of the modern market, real-time reporting stands out as a pivotal tool that fosters agility, enhances performance insights, and solidifies a competitive stance. By adopting this approach, companies are better equipped to navigate an ever-evolving business environment and achieve sustained growth.

Conclusion

Financial reporting is the process of producing statements that disclose an organization’s financial status to management, investors, and the government. These reports include the balance sheet, income statement, and cash flow statement, which provide insights into the company’s financial health and performance. Financial reporting is essential for making informed business decisions, ensuring transparency, and maintaining regulatory compliance.

One of the key aspects of financial reporting is the use of projections. Projections help businesses forecast future financial performance based on historical data and current trends. This forward-looking approach is crucial for strategic planning and resource allocation. Accurate projections require thorough data gathering and analysis, often supported by advanced tools like artificial intelligence, which can enhance the accuracy and reliability of financial forecasts.

Due diligence is another critical component of financial reporting. It involves a comprehensive review of a company’s financial records, including documentation of transactions, billing, and repayment schedules. Due diligence helps assess the creditworthiness of the business, ensuring that it meets its financial obligations and maintains a good standing with lenders and investors. This process is vital during acquisitions, mergers, and other significant financial transactions.

Modern financial reporting also leverages technology to improve efficiency and accuracy. Dashboards and performance indicators provide real-time insights into key financial metrics, enabling better decision-making. Accrual accounting methods ensure that financial statements reflect the true economic activities of the business, while equity compensation tools and disclosure reports help maintain transparency and compliance. Effective site navigation and user-friendly interfaces on financial reporting platforms enhance the overall user experience, making it easier for stakeholders to access and interpret financial information.

In summary, financial reporting is a comprehensive process that involves projections, due diligence, and the use of advanced technologies to provide accurate and transparent financial information. It plays a crucial role in strategic planning, regulatory compliance, and maintaining the trust of stakeholders.

FAQs

What is finance reporting?

Financial reporting involves the systematic preparation and presentation of financial statements, which reflect the financial health and performance of a company over a specific period. This process provides critical information to stakeholders such as investors, regulators, and management, aiding them in assessing the company’s viability and making informed decisions.

What is the ultimate goal of financial reporting?

The ultimate goal of financial reporting is to provide accurate and comprehensive information about a company’s financial position, performance, and cash flows. This transparency helps stakeholders make informed decisions regarding investments, credit, and management, ensuring the company’s accountability and fostering trust among investors and regulators.

How are financial reports used by management?

Management uses financial reports to make strategic decisions, monitor the company’s performance, and allocate resources efficiently. These reports help identify areas for improvement, plan future investments, manage risks, and ensure the company meets its financial goals, supporting overall business strategy and operational effectiveness.

Are there different types of financial reporting?

Yes, financial reporting encompasses various types, including financial statements like the balance sheet, income statement, cash flow statement, and statement of changes in equity. Each serves a unique purpose, providing different insights into a company’s financial health, performance, and operational efficiency, tailored for diverse stakeholder needs.

Can technology replace traditional financial reporting practices?

Technology can enhance traditional financial reporting practices by automating processes, improving accuracy, and enabling real-time data analysis. However, it cannot entirely replace the need for human oversight, strategic interpretation, and decision-making, making the integration of both technology and traditional practices essential for effective financial reporting.

What is the financial reporting purpose?

The purpose of financial reporting is to offer a clear and consistent financial overview of a company’s performance and position. It provides stakeholders with essential information needed for decision-making, evaluates the company’s financial health, ensures regulatory compliance, and aids in strategic planning and resource allocation.

How do accounting financial reports differ from other financial reports?

Accounting financial reports focus on adhering to accounting standards and principles, providing detailed financial statements like the balance sheet and income statement. In contrast, other financial reports might include managerial reports and budgets, which cater to internal decision-making needs and may not adhere to strict accounting formats.

What are the benefits of financial reporting for business?

Financial reporting benefits businesses by enhancing transparency, aiding in informed decision-making, ensuring regulatory compliance, and building stakeholder trust. It helps identify financial strengths and weaknesses, guides strategic planning, and attracts investors by showcasing a company’s financial health and potential for growth.