KEY TAKEAWAYS

- “Discretionary” expenses, while not always essential, can be perceived as necessary within different contexts and can include a broad variety of expenditures such as travel, entertainment, and dining out across all business departments.

- Managing these diverse costs can be challenging, especially for finance teams, but taking them seriously and closely monitoring how much is spent and why is crucial to ensure the respect and proper handling of company finances.

- Effective budgeting and management of discretionary expenses are fundamental for achieving both short-term and long-term financial goals, enabling businesses or individuals to optimize spending, reduce debts, and prioritize savings for financial success and stability.

The Clear Divide: Discretionary vs. Fixed Expenses

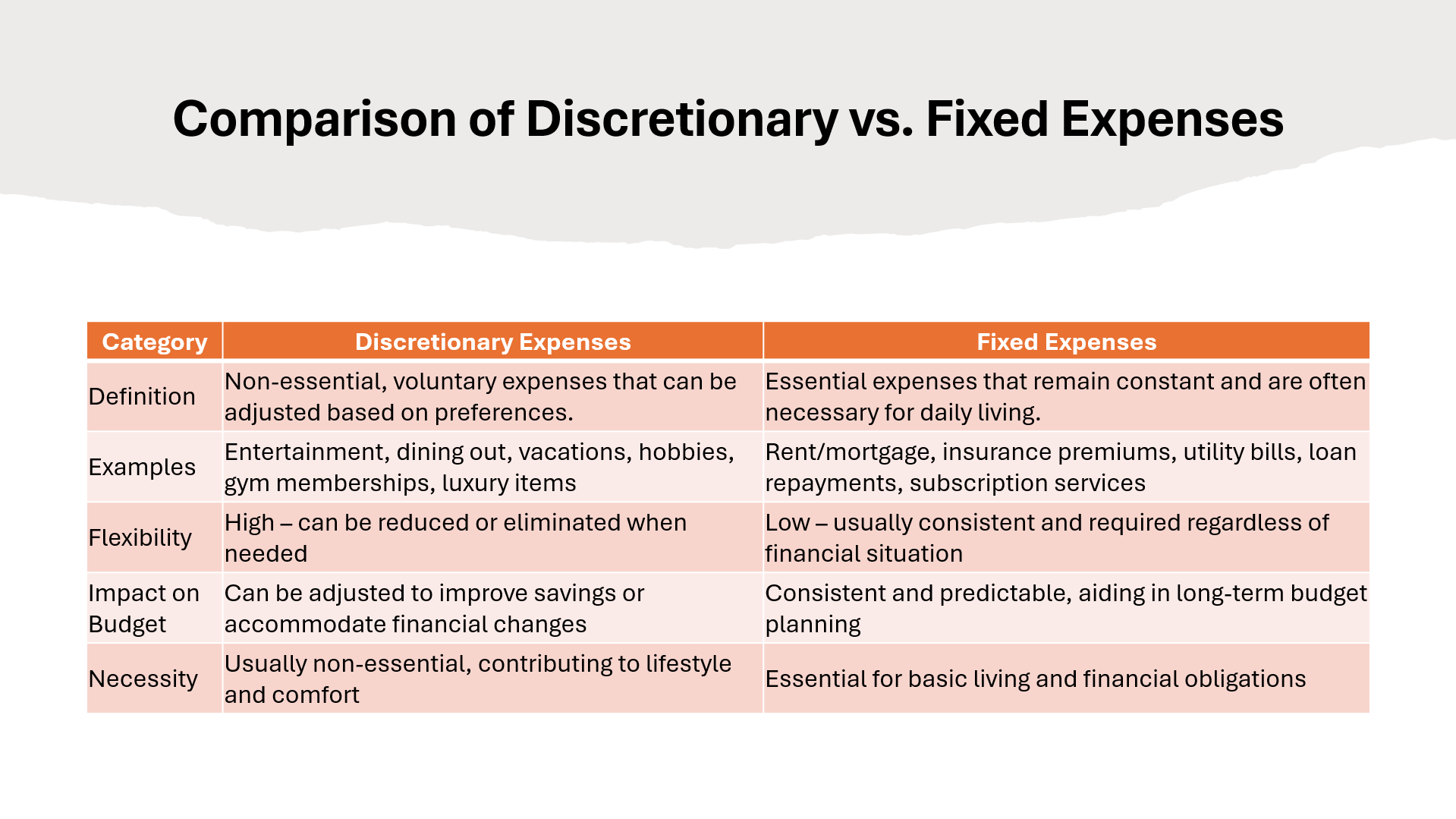

To grasp your financial landscape fully, it’s essential to understand the boundaries between discretionary and fixed expenses. Imagine standing at a crossroads: One path leads to fixed expenses—those costs are like the pavement, predictable and steady, required for the journey. They include rent or mortgage, insurance premiums, and utility bills. In periods of economic downturns, these are the expenses that must continue to be met to maintain stability. Wandering down this path, you can forecast how much you’ll expend regularly, providing a stable groundwork for your budgeting and allowing you to measure expense ROI more succinctly.

Now, turn to the path of discretionary expenses—it’s more like an adventure trail, winding and changeable, filled with the unknown. This is where you have control; you decide if you want to take a spontaneous detour or stick to the planned route. These expenses—dining out, hobbies, and shopping sprees—vary from month to month and require a more qualitative approach when considering their returns on investment (ROI).

Understanding this divide allows you to visualize and design a resilient financial plan that adapts to life’s ever-shifting scenarios, and ensures your rent payments and other fixed costs are responsibly managed to safeguard against the uncertainties of the market.

Scrutinizing Your Spending: Decoding Categories

Typical Examples of Discretionary Expenses

When sifting through your bank statements, you’ll encounter various transactions that are classic examples of discretionary expenses. Think of occasions where you’ve splurged on a fancy dinner, tapped your card for a movie night, or booked that impulse weekend getaway. These are the nibbles of your budget, chosen for pleasure rather than need.

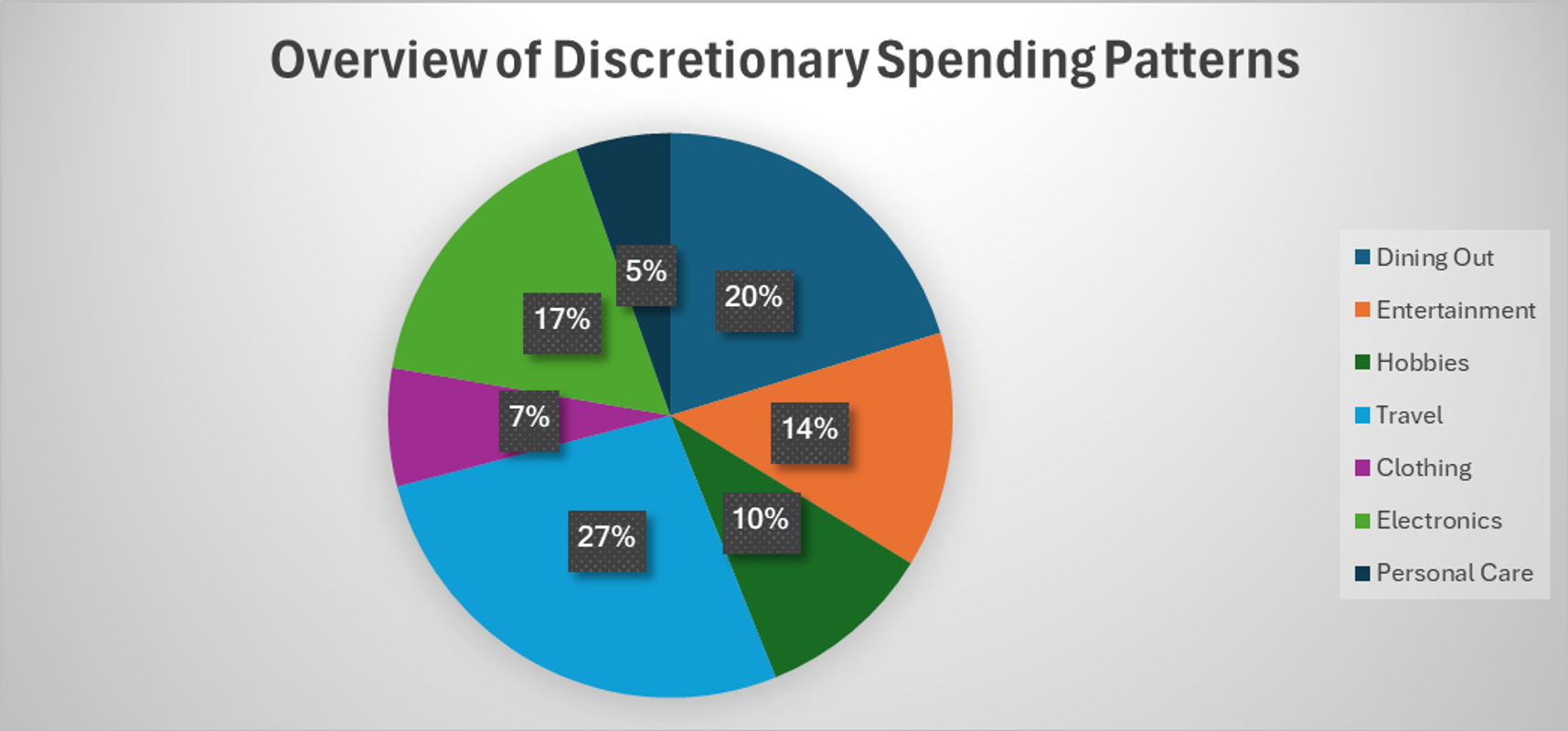

Here’s a quick glance at some typical discretionary expenses:

- Travel and Vacations: The irresistible allure of a sunny beach or a foreign cityscape.

- Dining Out: From that hip new restaurant to your favorite coffee shop’s seasonal latte.

- Entertainment: Concerts, sporting events, or the latest streaming service subscription.

- Hobbies and Recreation: Everything from crafting materials to golfing fees.

- Fashion and Apparel: When retail therapy includes those shoes you don’t really need but must have.

These expenses can add vibrancy to life but nibble away at your finances if left unchecked.

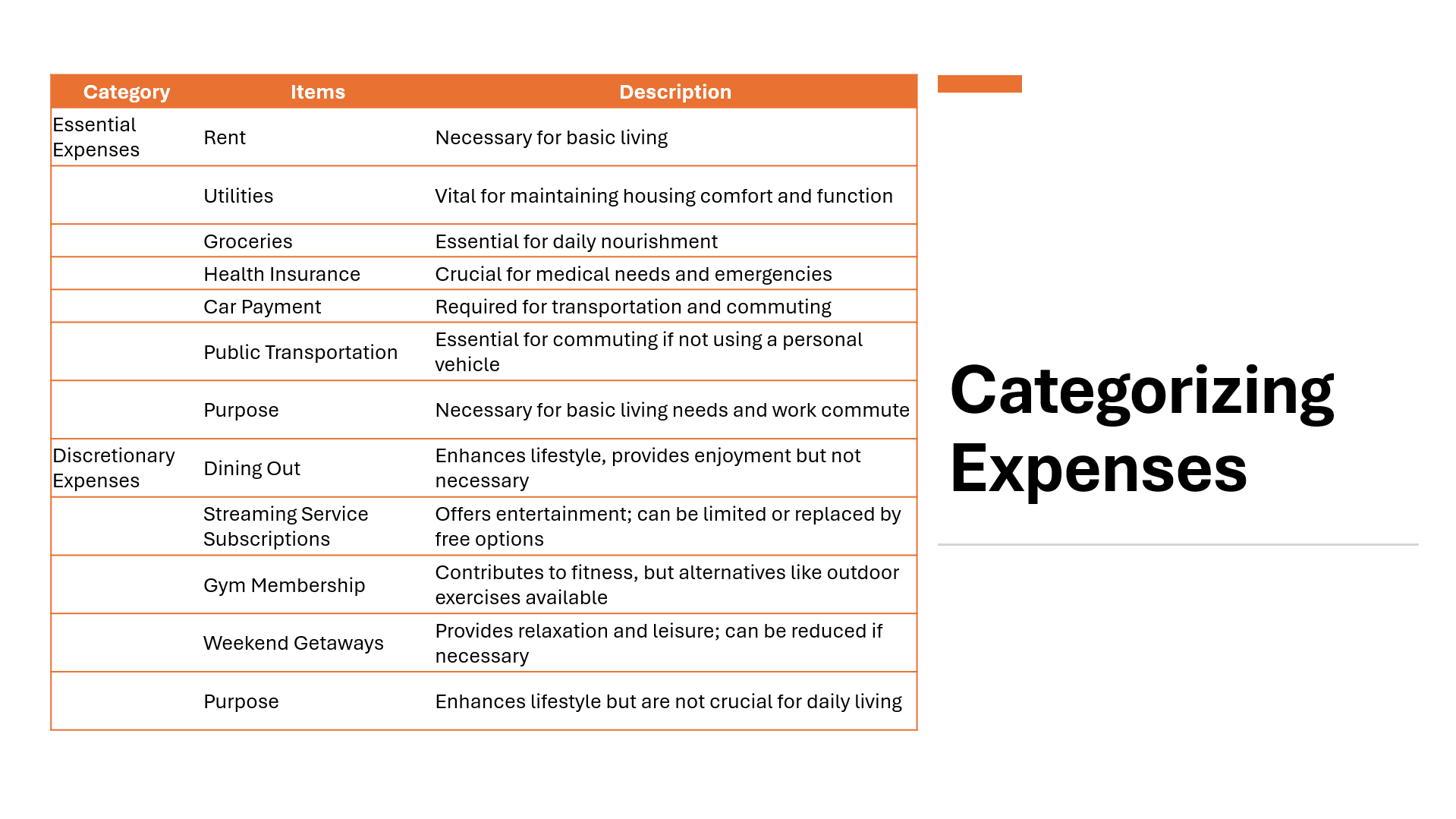

Diagnosing Discretionary vs. Essential Expenses

To effectively manage your money, it’s critical to diagnose which of your expenses are truly essential and which are discretionary. Essential expenses are the bare bones of your budget, the non-negotiables required to maintain a basic quality of life. These include housing, groceries, healthcare, transportation, and utilities. For instance, accommodation is a fundamental expense for everyone, as it ensures a safe place to live—be it a modest apartment or luxury downtown condo.

Conversely, discretionary expenses are the embellishments that augment your lifestyle. Luxury items often fall into this category, such as high-end dining experiences or luxury travel, which, while enjoyable, aren’t necessary for daily living. Determining what’s essential can vary for everyone, but generally, if you can delay the expense without major consequence, it likely falls into the discretionary category.

Here’s a simple method to diagnose your expenses:

- Step 1: List out all your monthly expenses, including necessary ones like payroll and unavoidable taxes, alongside your discretionary spending.

- Step 2: Label each as ‘Essential’ or ‘Discretionary’. Remember, expenses such as payroll taxes are essential as they’re mandated by law, implying dire consequences if neglected.

- Step 3: Review and consider the immediate impact of removing a line item.

If cutting out an expense results in significant discomfort or jeopardizes your ability to function normally, it’s essential. Anything else is discretionary, such as expenses that could potentially be fraud risks if not monitored carefully.

Becoming a Budget Maestro: Tips and Strategies

Adopting a Spending Plan: From 50/30/20 Rule to Personalized Budgets

Whether you’re a thrifty saver or a free-spending shopper, finding a spending plan that resonates with your money habits is pivotal. Enter the famed 50/30/20 rule, a blueprint for divvying up your income into structured compartments—50% for necessities, 30% for wants, and 20% for savings.

The beauty of this rule lies in its simplicity and built-in balance. It ensures that your essentials are covered, your savings are growing, and yes, there’s still room for fun. But remember, like any one-size-fits-all solution, it may require tailoring to suit your unique financial threads.

If the classic 50/30/20 doesn’t quite fit, don’t fret. Consider other models like the 50/15/5 approach, prioritizing retirement and short-term savings, or zero-based budgeting, assigning every dollar a mission. Alternatively, create a personalized budget that aligns with your financial pulse and goals.

The key is consistency and finding joy in the process. Whether you’re using a sophisticated app or a simple spreadsheet, arm yourself with a method that doesn’t feel like a straightjacket but rather a well-tailored suit, comfy and designed just for you.

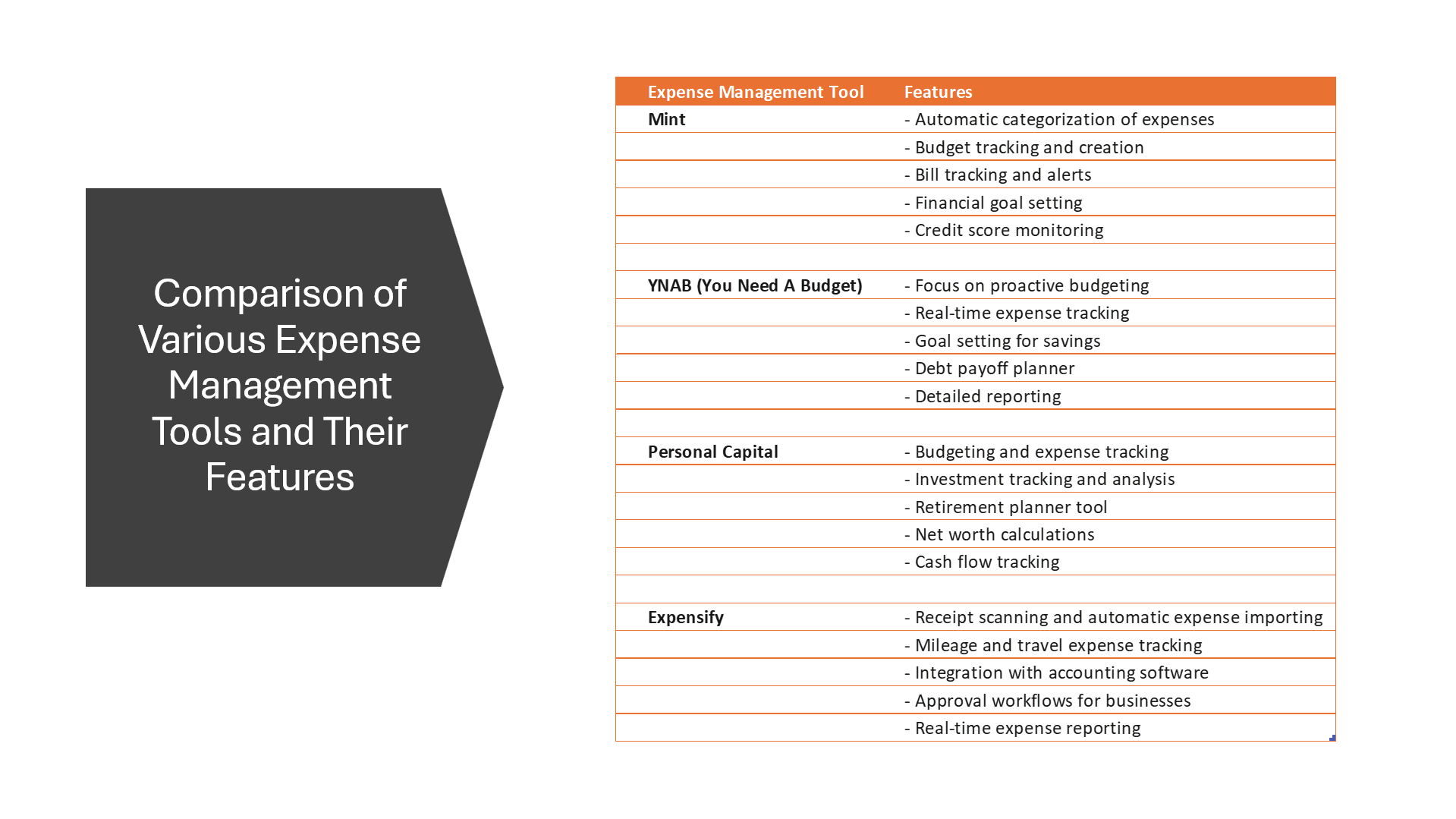

Applying Tools and Techniques for Expense Management

Navigating the world of expense management without the right tools is like sailing without a compass—you might move forward, but you risk going off course. Leveraging technology through spend management software, an essential productivity tool in today’s SaaS landscape, is your beacon in the murky waters of finances. Such platforms, like BILL Spend & Expense, offer seamless integration with your accounting systems, ensuring that your financial data is continually in sync and updated with accuracy.

And here’s where the magic happens. Once you’re plugged into these tools, you can:

- Create bespoke dashboards to monitor spending categories or departments.

- Generate real-time reports that shine a light on your spending habits.

- Set up automated alerts to keep spending within predefined thresholds.

- Design and implement approval workflows that prevent unapproved expenses, a key enhancement to your financial operations.

- Forecast future spending with integrated budgeting and predictive analytics.

By utilizing these techniques, you embrace a level of spend visibility that empowers you to make informed decisions. With a clearer picture of your discretionary spending, you can pinpoint areas for refinement, such as identifying non-essential SaaS subscriptions or suggesting office upgrades, and keep your financial ship sailing smoothly towards your goals.

Aligning Splurges with Strategy: Wise Financial Moves

Balancing Wants and Needs: A Closer Look at Discretionary Fund Usage

Striking a balance between your wants and needs is like mastering a seesaw—it requires awareness and adjustment. Recognize that while needs are your financial foundation, wants are the decorations that make life colorful, like adding artwork to an otherwise drab office. Using discretionary funds wisely means allocating them in ways that enhance life without undermining your financial stability.

Here’s a closer look at wise discretionary spend practices:

- Prioritize Experiences Over Things: Memories often outlast material goods. Investing in employee morale through team-building exercises is a testament to this principle.

- Invest in Personal Development: Use discretionary funds to improve skills or health, thereby boosting not only individual capabilities but also employee retention in organizations.

- Splurge Strategically: Save these funds for truly special occasions or desired items, much like a company might allocate budget for a team-building retreat to enhance collaboration and camaraderie.

- Practice Mindful Spending: Reflect on whether the purchase aligns with your values, similar to how a business might consider if the expense will contribute to employee satisfaction and engagement.

- Seek Quality: It’s better to invest a bit more in something long-lasting than to repeatedly spend on replacements, akin to choosing durable, quality artwork that elevates the office environment for years to come.

Remember, discretionary doesn’t mean dispensable. It’s the strategic use of these funds that accentuates life’s pleasure without financial pressure. Incorporating elements like engaging team-building activities or carefully selected office artwork can have a surprisingly positive effect on productivity and employee morale.

Intelligent Investment: Measuring the ROI of Discretionary Spending

Diving into discretionary spending with an investor’s eye can turn those spends into strategic strokes. Assessing the Return on Investment (ROI) is how you distinguish a frivolous purchase from an investment that pays dividends in happiness, convenience, or even cash. For instance, if you decide to invest in additional office decor, you might measure its ROI by observing the subsequent enhancement in workplace productivity – a form of emotional return which could translate into profitability.

To measure the ROI of discretionary spending, consider the following:

- Value Over Time: Will this expense continue to provide benefits down the line? For example, investing in high-quality office equipment could yield cost savings by reducing the need for frequent replacements, and a warranty could further protect your investment.

- Emotional Return: Does the satisfaction and joy justify the cost? It’s essential to factor in how morale-boosting investments, such as team outings, can increase productivity and potentially decrease employee turnover.

- Opportunity Cost: What are you foregoing, and could that alternative have a better payoff? This can include evaluating company subscriptions to determine if they are essential and if their cost is justified by the utility they provide.

- Long-Term Impact: Could this expense lead to more significant savings or earnings? For instance, renegotiating with vendors might offer substantial annual savings and add to the long-term financial sustainability and profitability of the business.

Think of it this way: investing in a quality piece of furniture might seem hefty upfront but could save you from future costs of replacement. Or a gym membership might seem extravagant, but if it translates into better health and fewer medical bills, it has a solid return. Such an approach can lead to significant cost savings over time.

Cutting Costs without Cutting Corners

Fine-tuning Your Finances: When to Trim Down Discretionary Spending

Fine-tuning your finances occasionally requires a trim of discretionary spending. If you notice your savings plateau or descend, or if financial goals seem suddenly out of reach, it may indicate that your discretionary spending limits need reevaluation. This is particularly true when considering business expenditures, which can often be optimized to enhance cost savings. Moments that call for this include:

- Income Changes: A job loss or pay cut naturally warrants a spending reassessment, potentially leading to immediate adjustments in business expenditures.

- Life Events: Major events like marriage or starting a family can shift financial priorities, prompting a fresh look at donations or charitable contributions under Corporate Social Responsibility (CSR) efforts.

- Economic Fluctuations: Inflation or recession can eat into your purchasing power, emphasizing the need to measure expense ROI to ensure every dollar spent works towards long-term stability.

- Debt Load: Increasing debt levels are a red flag signaling it’s time to cut back on non-essentials and reexamine your discretionary spending to identify potential cost savings.

- Goal Realignment: As personal or business goals evolve, so must the strategy to achieve them, mandating a reshuffling of financial allocations, including scrutinizing investments to maximize their return on investment.

By staying attuned to these life beats and incorporating strategic oversight over spending—in areas from team-building to research and development—you can proactively adjust your spending and ensure your financial health remains robust.

Fine-tuning your finances occasionally requires a trim of discretionary spending. If you notice your savings plateau or descend, or if financial goals seem suddenly out of reach, it may indicate that your discretionary spending limits need reevaluation to bolster business expenditures and donations responsibly. Moments that call for this include:

- Income Changes: A job loss or potential reduction in business revenue warrants a reassessment, prompting strategies for immediate cost savings.

- Life Events: Major events like marriage or starting a family can pivot financial priorities. It might be wise to reevaluate expenses, such as discretionary spending on sponsorships or CSR initiatives.

- Economic Fluctuations: Inflation or recession can erode purchasing power, making it crucial to find qualitative or quantitative ways to measure expense ROI.

- Debt Load: Escalating debt levels signal it’s time to curtail non-essentials, which could include reassessing investments in buyouts or intellectual property.

- Goal Realignment: Sometimes, goals evolve, necessitating a financial reallocation, such as diverting resources from research and development towards more profitable ventures.

By staying attuned to these indicators, you can proactively adjust your spending and ensure your financial health remains robust.

The Art of Delayed Gratification: Implementing a Waiting Period for Major Purchases

Embracing the art of delayed gratification by implementing a waiting period before splurging on major purchases is a masterstroke in personal finance. Consider it a cooling-off phase—a time to ponder the necessity and impact of the expense. Here’s how to practice it:

- Set a Waiting Rule: Establish a self-imposed wait time, like 30 days, before buying anything over a certain amount.

- Evaluate the Need: During the wait, assess whether the item is a need or a want. Reflect on if the purchase will truly matter in the long term, or if it’s a passing desire.

- Research Alternatives: Use the time to find better deals or more cost-effective options. This can include exploring affiliate websites for discounts or considering pre-owned alternatives.

- Mind Your Emotions: Stepping back can reduce the hold of impulse and heighten rational decision-making. This aligns with the concept that the best financial takeaways come from making informed, non-emotional decisions.

By taking a thoughtful pause, you often realize that the urge to buy diminishes, or the necessity of the purchase wasn’t as pressing as you first thought. It’s a significant step towards more mindful spending and a healthier financial future.

By introducing a corporate-like discipline into personal spending with the waiting rule, similar to how companies assess marketing expenses against potential ROI, one can better manage discretionary spending. This principle could directly benefit businesses concerned with expenses in advertising, content production, or even corporate travel management. Keep track of how these savings could contribute to your company’s CSR initiatives or to strengthen your financial planning and analysis programs. The key takeaway is to become intentional with both short-term spending and long-term financial strategies.

FAQs

How Can I Differentiate Between Discretionary and Non-Discretionary Expenses in My Budget?

To differentiate between discretionary and non-discretionary expenses in your budget, list all your expenses and mark them as ‘needs’ or ‘wants’. Fundamental costs like housing, food, transport, and debt payments are non-discretionary. In contrast, costs you can forego, like dining out or entertainment, are discretionary. Track your spending to identify and categorize each expense appropriately.

Is It Possible to Eliminate All Discretionary Expenses? Should I?

While you can technically eliminate all discretionary expenses, it’s not typically recommended. Doing so may lead to burnout and could be unsustainable long-term. It’s about finding a healthy balance that allows for occasional treats while meeting financial goals. Consider reducing, rather than eliminating discretionary spending, to maintain overall well-being.

Can Discretionary Spending Impact My Long-Term Financial Goals?

Absolutely, discretionary spending can significantly impact your long-term financial goals. Overspending in this category might delay retirement plans, minimize savings, and increase debt. Conversely, wise discretionary spending, aligned with strategic budgeting, can accelerate goal achievement. Keeping a check on these expenses is crucial for sturdy financial growth.

What are examples of discretionary expenses?

Examples of discretionary expenses include dinner dates at fancy restaurants, weekend road trips, high-end gadgets for entertainment, premium coffee instead of home-brew, or splurging on designer clothes. These are the expenses that enhance your lifestyle but aren’t essential for your day-to-day survival.

What are the common rules businesses set for discretionary spending?

Businesses often set rules for discretionary spending to maintain financial discipline. Common ones include requiring management approval for purchases over a certain dollar amount, setting clear budgets for departments, using purchase orders for tracking, and mandating that all expenditures align with company goals. Regular reviews and audits ensure compliance and prevent overspending.