It’s the vanguard of every financial report, showing up first because it’s the starting point of a company’s income. You’ll often hear phrases like “year-over-year top-line growth” in boardrooms or earnings calls. They’re not just talking sales — they’re talking about the trajectory and prospective vitality of their business.

Remember, businesses turn to you, their trusted clientele, to nourish this crucial figure through your purchase decisions. It’s a revenue parade led by everything from the latest gadget to the hottest fashion trend. They want to make sizzling sales that form a robust top-line, signifying a marketplace thumbs-up.

KEY TAKEAWAYS

- The top line is a critical metric in a company’s financial statements, representing the total revenue or gross sales generated within a specific period. It is a direct reflection of the demand for a company’s products or services and is critical for assessing the company’s growth trajectory.

- An increasing top line indicates that a company is selling more goods or services over time, signaling positive growth. However, if growth is stagnant or not meeting targets, it may suggest the need for strategic changes, such as adjustments in marketing, product quality, pricing, or enhancing customer engagement.

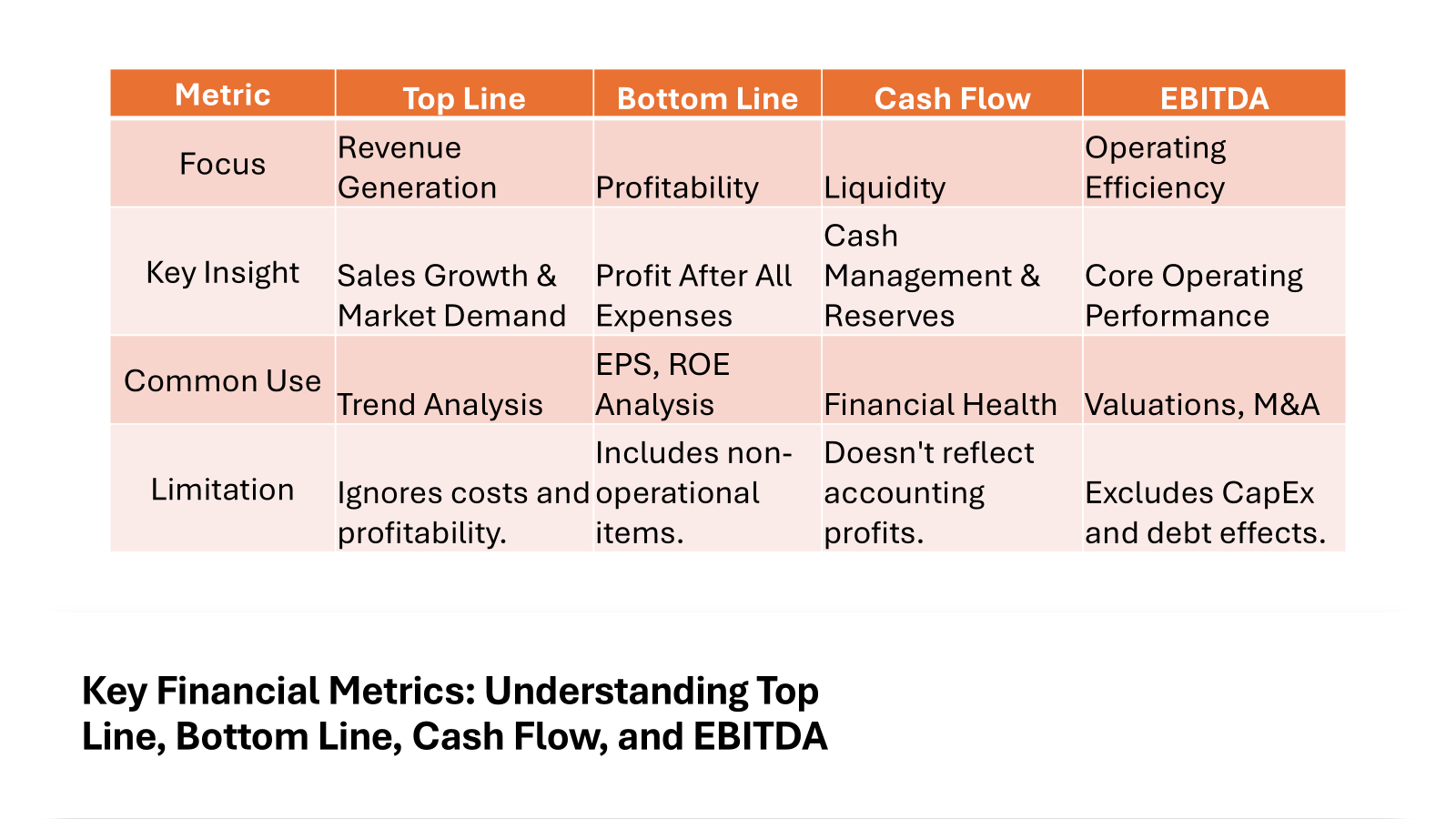

- While the top line measures a company’s effectiveness in generating sales and revenue, it does not account for the operating expenses that affect profit, known as the bottom line. Nevertheless, for newly established or well-funded businesses prioritizing market share, the top line might be a more significant focus before shifting attention to profitability or bottom-line metrics.

How the Top Line Differs from Other Financial Metrics

The top line is like the headline of a story, grabbing your attention with the gross sales figure. But there’s more to the financial narrative than the initial glance. While the top line flaunts a company’s ability to generate sales, it remains silent on profitability. That’s where other metrics like the bottom line come into play — they tell us about net earnings, which is what remains after subtracting costs and expenses.

Think of it as a burger joint’s bustling crowd — the top line is the bustling part, the cash register ringing non-stop. But the bottom line? That’s what the owner takes home after paying for the buns, patties, and the friendly staff flipping burgers. It’s the outcome of every business decision, every efficiency (or lack thereof).

Consider them siblings in the financial family: the top line, outgoing and flashy, is all about revenue. Its introspective sibling, the bottom line, contemplates the costs, taxes, and those sneaky unexpected expenses.

By understanding these differences, you pave your way through the complexities of corporate finance. Knowing how the top line stands apart is your secret to interpreting a company’s financial story — not just what they earn, but how smartly they earn it.

The Essence of Top-Line Performance

Indicators of a Healthy Top-Line

A healthy top-line doesn’t just look good on paper; it signals the beating heart of a thriving enterprise. There are several indicators you can watch for that suggest a company’s revenue engine is purring like a well-tuned sports car. They’re subtle nods to savvy investors and stakeholders that there’s potential for growth and expansion.

- Sustained Revenue Increments: Consistent quarterly or yearly increases in revenue demonstrate a demand for the company’s offerings and an ability to scale up.

- Diversified Revenue Streams: A robust top-line often rests on the shoulders of multiple revenue streams. It’s not enough to sell one hit product; longevity comes from a mix of offerings that guard against market shifts.

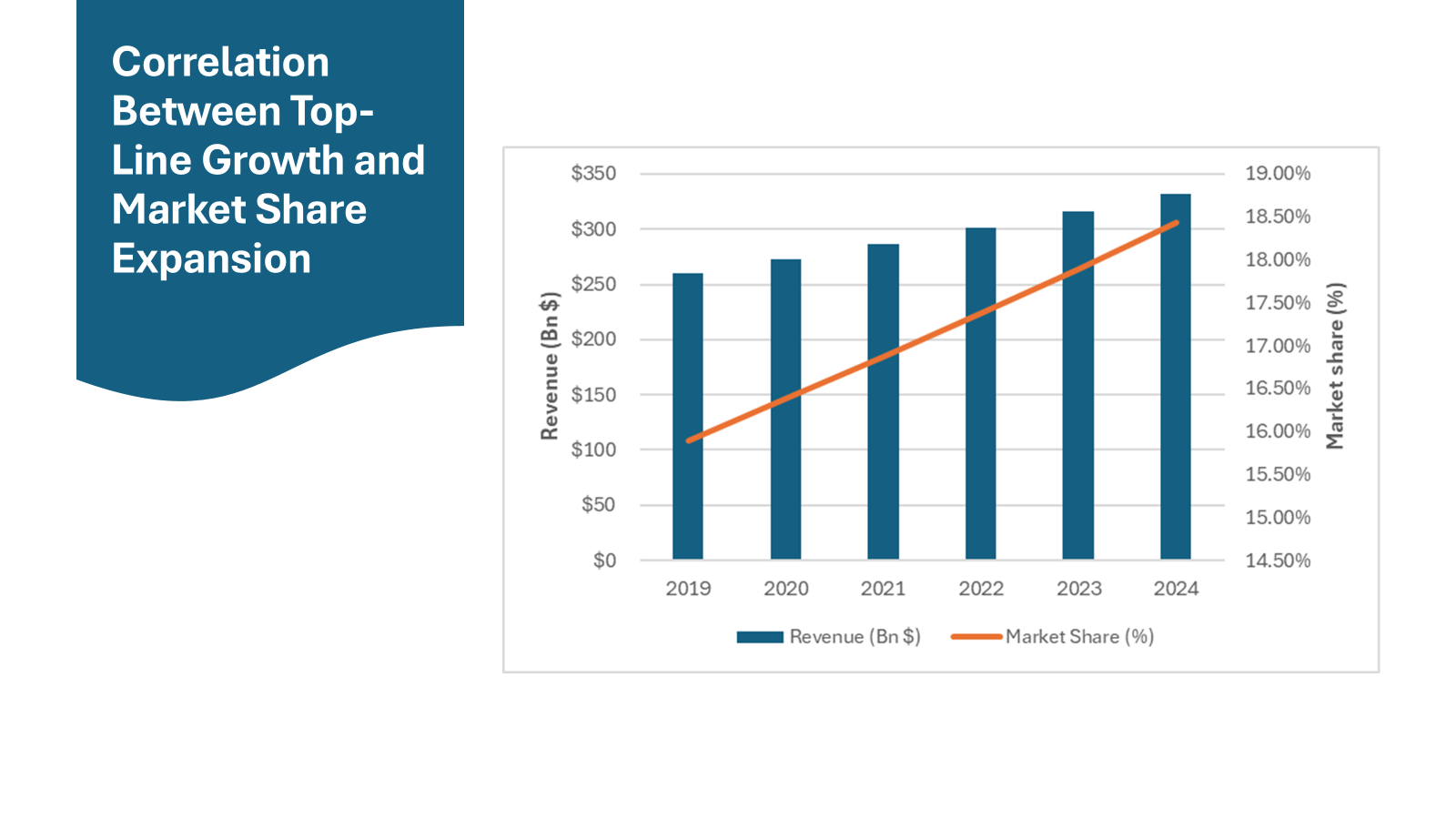

- Market Share Expansion: Increase in market share indicates not only growth but a competitive edge, suggesting that more consumers are choosing their products or services over others.

- Improvements in Sales Metrics: Metrics like sales per representative or per store, and conversion rates from marketing campaigns, can signal the effective capture and monetization of market demand.

- Price Stability or Increases: Maintaining or increasing prices while retaining customers points to a strong value proposition and brand strength in the market.

A company that ticks these boxes isn’t just coasting; they’re actively engaging with the market. They’ve got their finger on the pulse and are responding in real-time, aligning with consumer sentiment and outpacing competitors.

Sure, a dazzling top-line requires more than a product people want; it represents an ongoing conversation with consumers, understanding their needs and evolving with them. It’s this dynamic interplay that spells a healthy top-line and lays a golden pathway to financial success.

Why the Top Line Matters for Business Growth

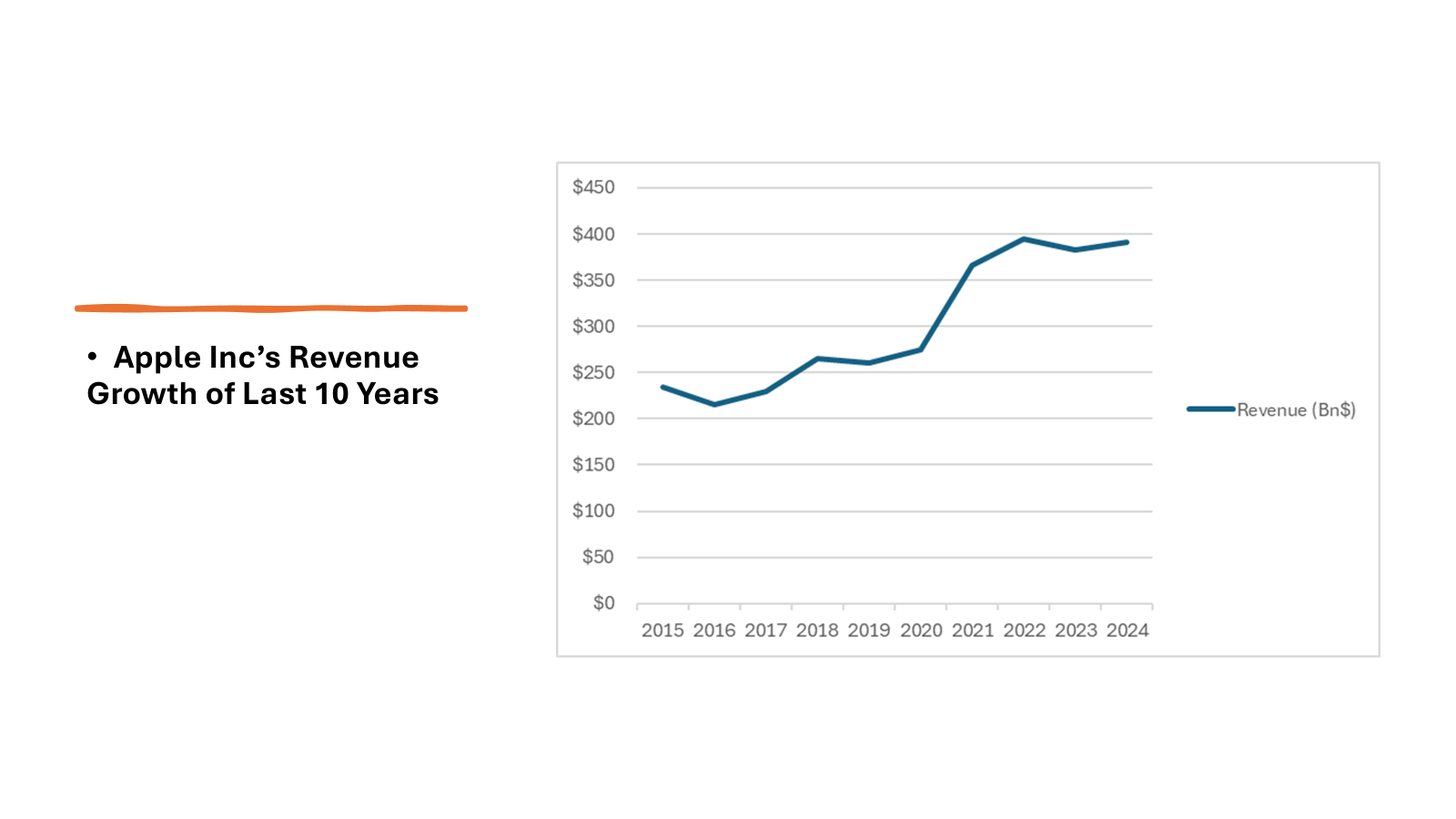

You can think of the top line as a sign of vitality for a company’s growth, akin to green shoots in a garden signaling healthy plants. When a business consistently increases its top line, it’s a sign they’re expanding their reach, enticing more customers, and generally, have a product or service that’s in demand. This upward trajectory in sales means not only immediate funds coming in but also an opportunity for reinvestment — a chance to sow the seeds for future products, markets, and innovation.

A robust top line also opens doors to strategic partnerships and investments. Investors love to see a company growing its revenue; it’s like a beacon of potential that can lead to additional funding or favorable loan terms. It’s the snowball effect — as sales grow, so does the company’s ability to leverage its position for further growth.

But it’s not just about the numbers. A flourishing top line enhances a company’s reputation. It projects market leadership, financial health, and can even contribute to a positive corporate culture as employees feel they’re part of a winning team, further attracting top talent.

Remember, a business without growth is like a ship without wind — stagnant. So, focusing on the top line is crucial for propelling a company forward, ensuring they’re not just staying afloat, but navigating towards broader horizons and greater success.

Decoding the Impact of the Top Line on Your Business

Connecting Top-Line Growth with Overall Success

Top-line growth and overall business success are like dance partners in a tango – one leads, and the other follows. When you see a company’s revenue increasing, it often means they’re dancing to the right tune, winning customer hearts and converting that harmony into sales. But there’s more to the dance than just the opening steps.

This growth isn’t just an isolated number; it’s a catalyst for broader success. By boosting top-line revenue, a company can invest in research and development, expand into new markets, and enhance their offering, making them a star performer in their industry.

What’s more, a thriving top line can improve a company’s valuation, making it more attractive to investors and enhancing its borrowing power. This financial flexibility is crucial when they need capital for growth without diluting ownership through equity financing.

In the grand scheme, top-line growth feeds into a virtuous cycle of investment, expansion, and further growth — it’s the rhythm that keeps business pulsing and growing, setting the stage for long-term sustainability and success.

Identifying the Red Flags in Top-Line Figures

While a booming top line can be a sign of prosperity, savvy observers know that not all that glitters is gold. Some red flags might be waving at you right behind those impressive sales figures, signaling potential trouble ahead.

For instance, if the top-line growth is heavily reliant on one-time sales or aggressive discounting, it may not be sustainable. These tactics can spike sales temporarily but may also indicate desperation or a lack of loyal customer base — a precarious foundation for continued growth.

Another warning sign is if revenue growth outpaces that of the industry or market without a clear explanation, such as a disruptive innovation or a new market captured. It could point to overly aggressive accounting practices or short-term strategies that aren’t sustainable.

Also, keep an eye out for heavy reliance on debt to fuel sales. If a company is borrowing to keep the top line attractive, they may struggle to manage their debt levels, especially if interest rates rise or market conditions shift.

Remember that while a plush top line can dazzle, it’s important to peek behind the curtain. You want to make sure that the growth is backed by a strong performance across other financial and operational metrics — that’s the mark of true business health and resilience.

Strategic Levers to Elevate Your Top Line

Innovations and Initiatives That Drive Revenue Growth

Innovations and strategic initiatives can serve as powerful engines for driving revenue growth, propelling the top line forward with each new advance. Companies that invest in creating or improving products often capture the imagination and wallets of customers, leading to a surge in sales.

Take, for example, technology firms that unveil cutting-edge features or gadgets — these innovations can open up entirely new customer segments and revenue streams. Similarly, service industry players can reinvent customer experience with fresh, personalized options, making their offerings irresistible.

Besides product-led innovations, companies can also introduce initiatives like expanding into new markets, both geographically and demographically. By tapping into previously unexplored customer bases, they can ignite fresh interest and demand.

In the realm of sustainability, embracing green practices and materials can also attract a growing cohort of environmentally conscious consumers, leading to an increase in brand loyalty and, ultimately, sales.

It’s not just what you offer, but how you offer it. A seamless online shopping experience or lightning-fast customer service can differentiate a brand, making convenience and satisfaction key drivers of purchase decisions.

Whether it’s through breakthrough products, entering untapped markets, or redefining customer service, companies that continuously evolve and innovate tend to watch their top lines soar. These innovations and initiatives act as a magnet for both new and repeat business, underlining the adage: innovate or stagnate.

Tapping Into Market Trends to Enhance the Top Line

To enhance the top line in today’s fast-paced world, companies have to surf the waves of market trends, riding them to the shore of revenue growth. Being trend-savvy means identifying and capitalizing on what’s hot, what’s emerging, and what customers are clamoring for, sometimes even before they know they want it.

Think about the upsurge in remote work tools and platforms — companies that recognized the shift towards distributed workforces early on and pivoted to offer relevant products have seen their sales spike. Such agility in adapting to market trends is key to top-line growth.

Similarly, the wellness movement has been a lucrative wave to catch for businesses in food, fitness, and health industries. Brands that align their products with this trend often see their top line benefit from consumer’s heightened health consciousness.

Moreover, sustainability and ethical consumerism are trends that continue to gain momentum. Companies that adjust their practices to be more eco-friendly or socially responsible can tap into a growing demographic of consumers who prioritize these values in their purchasing decisions.

Staying on top of consumer behavior trends is equally important, such as the move towards online shopping over brick-and-mortar stores. Businesses have had to shift their focus to digital sales platforms to capture this growing market.

By keeping a finger on the pulse of market trends, companies can continuously adapt their strategy to meet evolving demands. It’s not just about predicting the future, but shaping it by delivering products and services that align with these trends, thus enhancing the top line with strategic foresight and customer insight.

Analyzing Real-World Examples of Top-Line Success

Case Studies from Industry Leaders

When it comes to top-line success, the proof is often in the proverbial pudding made by industry leaders who adeptly combine strategy with execution. Let’s delve into a few instructive case studies of businesses that have nailed it:

One shining example is a tech giant that revolutionized the market with its innovative products. This company didn’t just launch a new product; they created an ecosystem that customers bought into year after year, reflected in their steady top-line ascent.

Then there’s the fast-fashion retailer that transformed supply chain efficiencies into top-line triumphs. By rapidly turning catwalk trends into affordable garments, they sizzled the retail scene with their dynamic pricing model and inventory turnover rates.

Another example comes from the food and beverage industry, where a once-stagnant establisher stirred the market with health-conscious products. By tuning into shifting consumer preferences towards organic and natural ingredients, they spiced up their top line with an emphasis on wellness.

Each of these leaders tells a story of how understanding one’s market, innovating within it, and delivering value to customers can dramatically enhance top-line figures. By learning from these success stories, other companies can draft blueprints for their revenue-driving strategies.

Learning from Top-Line Turnarounds

Top-line turnarounds are the comeback stories of the business world, often teaching some of the most vital lessons on resilience and adaptability. These are the tales of companies that faced headwinds in sales and managed to reverse the trend, reinvigorating their growth trajectory.

For instance, there’s the consumer goods company that revitalized its brand by re-engaging with its core customer base and introducing product innovations in line with current consumer tastes. Through strategic branding and new product lines, they rekindled their sales figures.

Another success story circles around a tech enterprise that shifted its focus from hardware to software and services, tapping into the recurring revenue models of cloud-based solutions. This pivot transformed their slumping sales into a vibrant top line.

Then there’s the traditional retailer who embraced e-commerce, not just as a sales channel, but as an integral part of their business strategy. By integrating online and in-store experiences, they crafted a recipe for renewed top-line growth.

These turnaround tales serve as beacons for companies navigating rough sales waters. They showcase how companies can leverage market research, customer feedback, and a willingness to transform business models to discover new avenues for revenue and breathe life back into their top line.

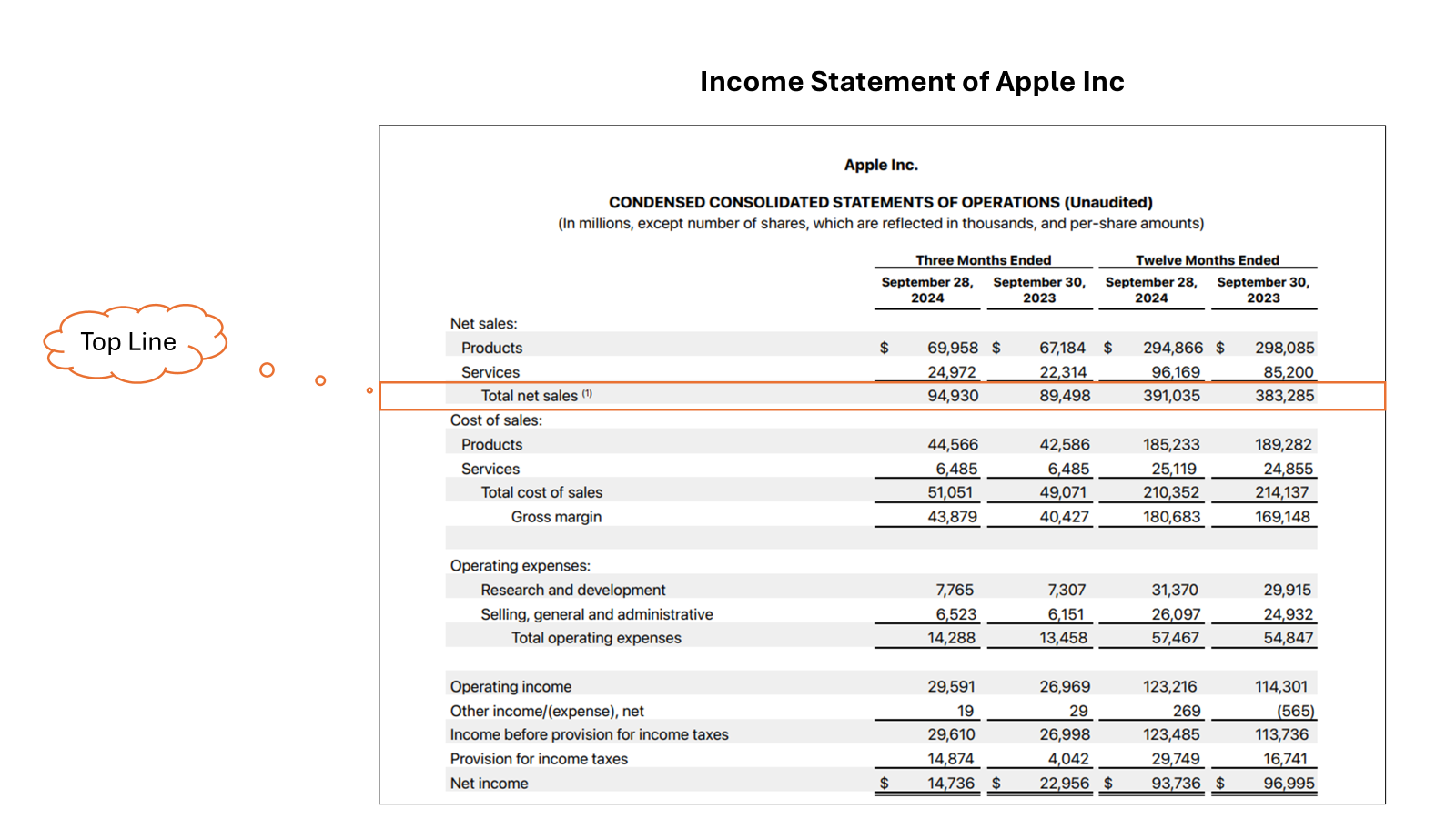

The top line, often referred to as revenue, represents the starting point in a company’s financial calculation of profitability. It plays a crucial role in determining gross profit, which is derived after deducting the cost of goods sold. During economic downturns, maintaining a strong top line is essential, as it reflects the company’s ability to generate sales despite challenging conditions. Industries such as banking often prioritize top-line growth to demonstrate their financial strength and resilience.

An outline of a company’s financial performance typically begins with the top line, which also impacts critical business metrics, such as valuations in listings or acquisitions. For example, during the closing of financial deals or partnerships, a healthy top line is often used as a benchmark to gauge a company’s market position and future growth potential. Accurately calculating and analyzing the top line ensures that businesses can navigate economic fluctuations while aligning with their strategic goals.

FAQs on Understanding the Top Line

What does topline mean in financial terminology?

In financial terminology, the topline refers to a company’s gross revenue or sales. It’s the initial figure you’ll see at the top of an income statement, hence the name ‘topline,’ reflecting the total amount earned from goods or services sold before any expenses are deducted. This number shows the company’s effectiveness in generating sales and serves as a key indicator of its growth and market reach.

What is Considered a Good Top-Line Growth Rate?

A good top-line growth rate is one that outpaces inflation and industry averages, signaling that a company is expanding its market share and revenues faster than its competitors and the costs of goods and services. However, what qualifies as ‘good’ can vary widely by industry, market conditions, and the size and maturity of the company. Ideally, consistent growth aligned with or exceeding the business’s strategic targets would be considered healthy and indicative of strong performance.

How Can a Company Improve Its Top Line Without Compromising Quality?

A company can improve its top line without compromising quality by focusing on innovation, enhancing customer experience, and expanding market outreach organically. Investing in research and development can lead to superior products, while ensuring efficient processes can keep costs in check. Building brand loyalty through exceptional service and reliability also contributes to sustainable revenue growth, attracting customers willing to pay a premium for assured quality.

Is It Possible for a Company to Have Strong Top-Line Growth but Weak Bottom-Line Growth?

Yes, it’s quite possible for a company to experience robust top-line growth with weak bottom-line growth. This scenario can happen if the costs of driving sales, like high marketing expenses, R&D costs, or increased production expenses, grow faster than the revenue. While sales are soaring, the money left after covering all expenses might not be keeping pace. It’s a delicate balance and a reminder that increasing revenue doesn’t always translate to higher net profits.

How Does Consumer Behavior Influence a Company’s Top Line?

Consumer behavior directly influences a company’s top line, as changes in trends, preferences, and purchasing patterns dictate demand for products and services. Positive shifts, such as a growing preference for a brand or product, can boost sales while negative trends can reduce them. By staying attuned to shifting consumer behaviors and adapting accordingly, a company can nimbly respond to market demands, positively impacting its top line.

What is top line auto, and how does it relate to premium features in vehicles?

Top line auto typically refers to the best and most premium tier in an automotive company’s range of vehicle offerings. These high-end models usually boast the latest technology, superior performance, luxury interiors, and cutting-edge safety features. When consumers opt for these top-of-the-line vehicles, the automaker’s sales revenue—the top line—benefits from the premium pricing that these feature-rich cars command. This enhances the company’s revenue profile, illustrating how product differentiation aimed at higher-spending clientele can help boost top-line figures.