Decoding the Straight Line Depreciation Formula

Understanding the Basics

At its core, straight-line depreciation involves reducing an asset’s value evenly throughout its useful life. It’s a preferred method due to its straightforward approach, spreading the cost consistently over time. The aim is to match the expense of using the asset with the revenue it generates. This consistency makes budgeting predictable, which is a boon for businesses. Essentially, you’re recognizing the asset’s wear and tear gradually, rather than allowing its value to plummet suddenly. By adopting this method, you can clearly illustrate the decline in value, providing stakeholders with a transparent view of asset expenses.

KEY TAKEAWAYS

- Ease of Calculation: The primary advantage of straight-line depreciation is its simplicity and ease of use. It requires consistent calculations, which significantly reduces the chances of errors and simplifies financial record-keeping for accountants.

- Predictable Expense: This method provides a predictable expense pattern as the same amount is depreciated each year. This uniformity helps in budgeting and financial planning by offering a stable depreciation schedule.

- Applicability: Straight-line depreciation is most appropriate for assets with constant productivity, usage, or cost-to-benefit ratios throughout their useful lives. Common examples include office furniture, buildings, and machinery where the asset’s value diminishes at a steady rate over time.

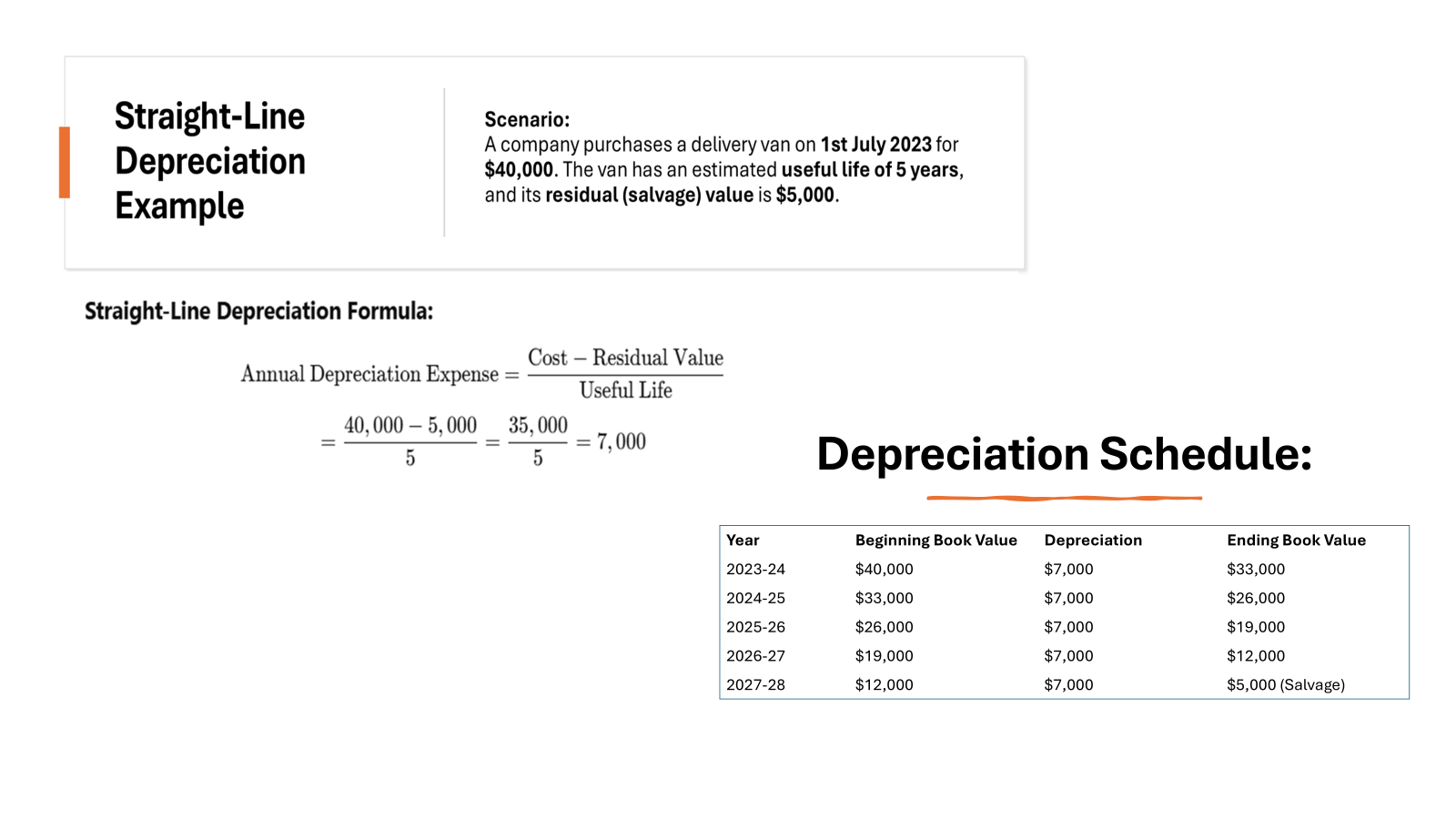

Step-by-Step Calculation Guide

To calculate straight-line depreciation, you’ll need a few key pieces of information: the initial cost of the asset, its salvage value, and its useful life. Here’s a quick guide to calculating depreciation:

- Determine Initial Cost: This is the purchase price plus any additional costs needed to get the asset ready for use.

- Estimate Salvage Value: This is the asset’s expected resale value at the end of its useful life.

- Identify Useful Life: The estimated amount of time the asset will be operational and generate economic benefits.

- Apply the Formula:

- Compute Yearly Depreciation: Each year, you’ll subtract the annual depreciation expense from the asset’s book value until it reaches the salvage value.

By following these steps, you ensure that your financial documents reflect a true picture of asset value over time.

Real-World Applications and Examples

A Look at Practical Scenarios

In the real world, straight-line depreciation is applied across diverse industries, from manufacturing to service firms. Consider a coffee shop investing in an espresso machine costing $5,000 with a useful life of 5 years and a salvage value of $500. Using straight-line depreciation, the annual depreciation expense would be ($5000-$500) ÷ 5, equating to $900 per year.

Another example involves a tech company purchasing office furniture for $10,000, expected to last ten years with no salvage value. The annual depreciation would thus be $1,000. These scenarios illustrate how businesses can evenly distribute asset costs, streamlining financial reporting and aligning expenses with usage.

Case Study: Tree Removal Service Example

Imagine a tree removal service company that invests in a new wood chipper. The chipper costs $15,000 and is expected to last 7 years, with a salvage value of $1,000. Using the straight-line depreciation method, the company can evenly spread the cost over its useful life.

- Initial Cost: $15,000

- Salvage Value: $1,000

- Useful Life: 7 years

Plugging into the formula, the annual depreciation expense is ($15,000 – $1,000) ÷ 7, which results in approximately $2,000 per year. This consistent expense reporting allows the company to easily budget for future asset replacements and provides clarity in financial records.

Such a method smooths out costs, aligning them with the income generated by the asset, which is crucial for seasonal businesses like tree removal services.

When to Use Straight Line Depreciation

Evaluating Suitability for Your Business

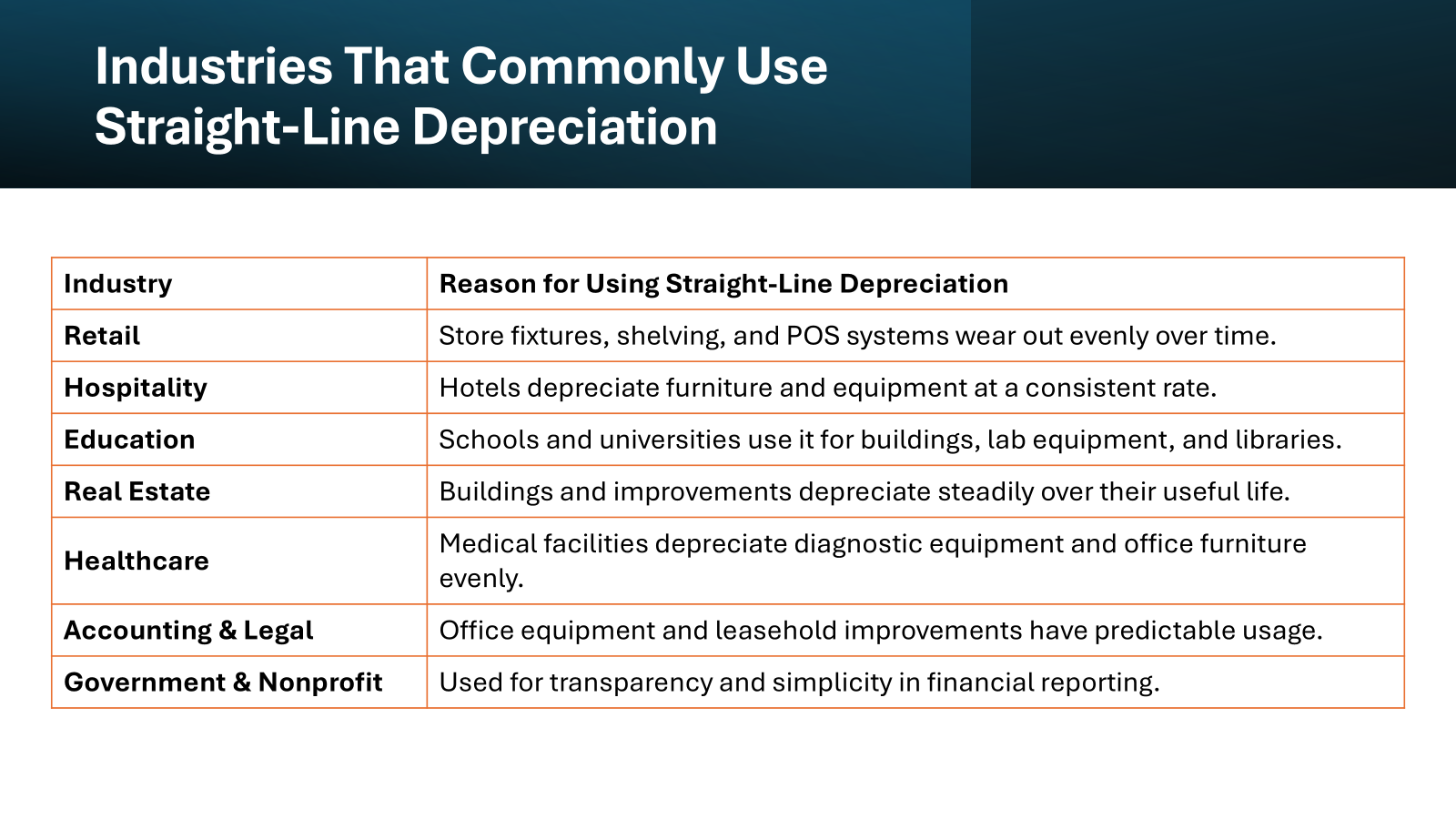

Determining if the straight-line depreciation method suits your business involves a few considerations. Firstly, assess the nature of your assets. If they depreciate uniformly over time, this method aligns perfectly. Businesses with assets that offer consistent utility, like office furniture, find it advantageous.

Next, consider your financial reporting needs. Straight-line depreciation simplifies accounting due to its predictability, making it ideal for businesses needing straightforward, easy-to-maintain records. Additionally, it seamlessly aligns with budgeting processes due to consistent expense allocation.

Lastly, examine your industry standards. Some sectors may prefer this method for its transparency and ease of use. Ultimately, this method is well-suited for businesses seeking simplicity and consistency in their financial documentation.

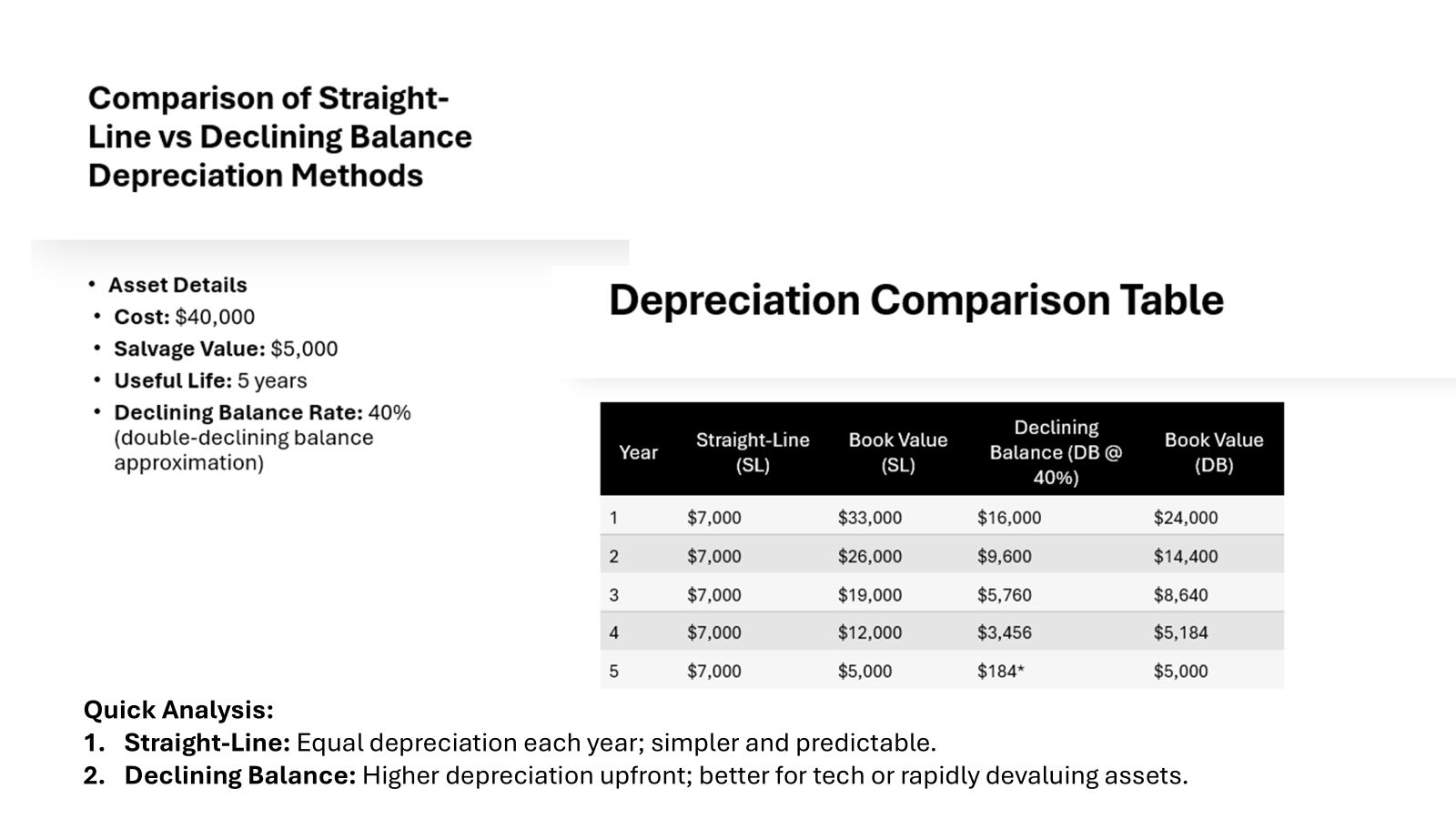

Comparing with Other Methods

When comparing straight-line depreciation with other methods, such as declining balance and units of production, differences in cost allocation become apparent. The declining balance method accelerates depreciation, applying a higher expense in early years and tapering off toward the end. This suits assets that lose value quickly or become obsolete. Conversely, the units of production method ties depreciation to an asset’s usage or output, offering precision for assets like machinery heavily dependent on production levels.

The straight-line method stands out for its simplicity, providing a uniform expense distribution. However, it might not accurately portray depreciation for assets with variable performance over time. Choose based on the asset’s usage, financial strategy, and industry preferences.

Advantages and Disadvantages of the Straight Line Method

Key Benefits

The straight-line depreciation method offers several compelling advantages for businesses:

- Simplicity: Its straightforward calculation, involving just the initial cost, salvage value, and useful life, makes it easy to implement.

- Consistency: With even depreciation yearly, it aids in predictable budgeting and financial planning.

- Clarity: This method provides a clear representation of asset cost allocation on financial statements, enhancing transparency.

- Compliance: It aligns well with generally accepted accounting principles (GAAP), ensuring regulatory adherence.

- Cost-Effectiveness: Reduces administrative effort due to its uncomplicated nature.

These benefits make it an attractive option for businesses seeking a no-fuss, reliable depreciation strategy.

Potential Drawbacks

Despite its benefits, the straight-line depreciation method has some limitations:

- Lack of Precision: It doesn’t account for an asset’s actual usage pattern or potential for rapid obsolescence.

- Non-reflective of Real Wear and Tear: Fails to capture varying depreciation rates due to seasonality or uneven usage.

These drawbacks suggest it may not be suitable for assets that depreciate irregularly or have a fast-paced loss in utility. Businesses must weigh these factors against the method’s simplicity and predictability.

Tools and Resources

Using a Straight-Line Depreciation Calculator

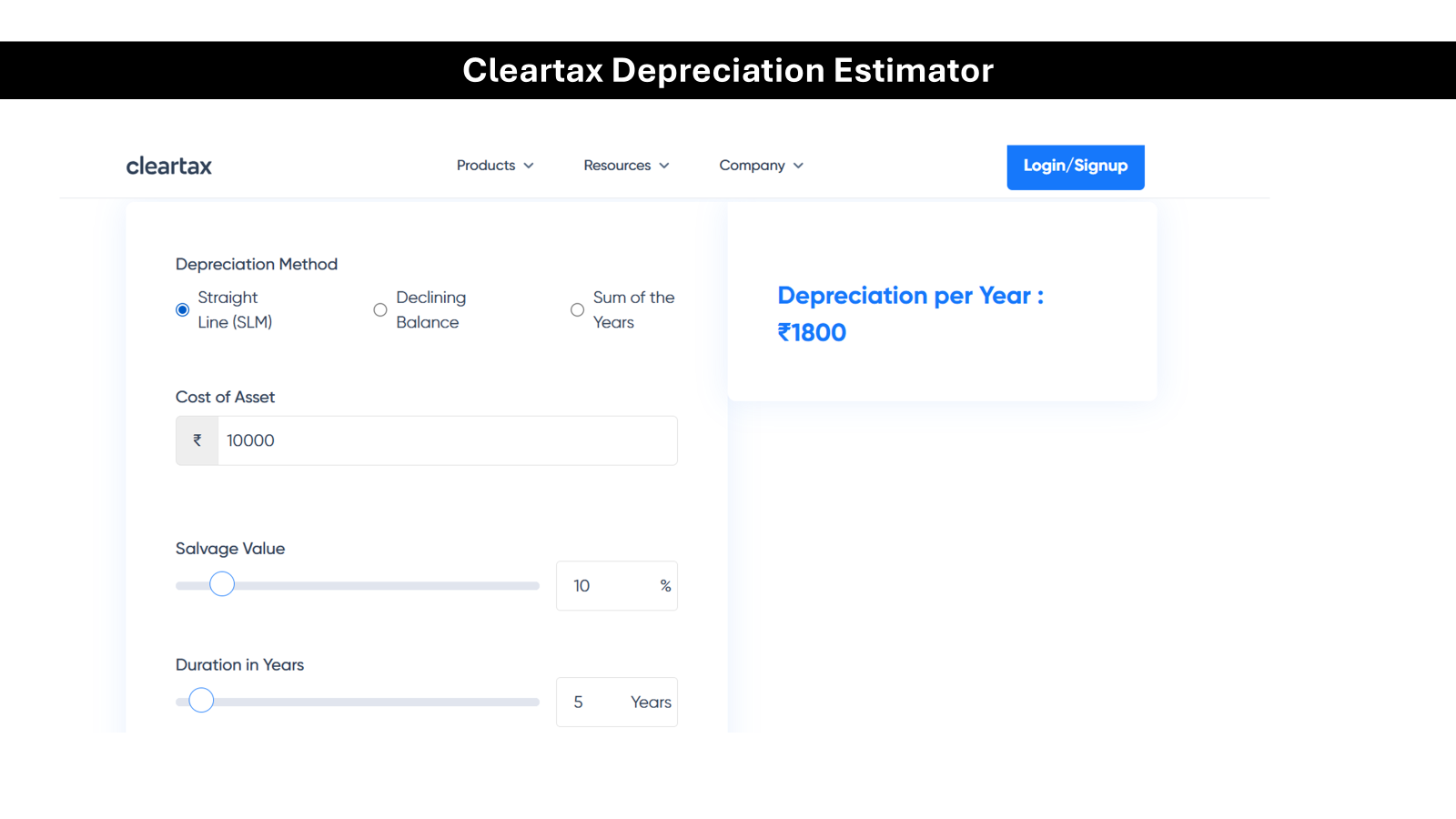

Utilizing a straight-line depreciation calculator is an efficient way to automate and streamline the depreciation process. These calculators simplify the task by requiring you to input just the initial asset cost, salvage value, and useful life. Once entered, the calculator quickly computes your annual depreciation expense, saving you time and reducing the risk of error.

These tools are widely available online, often integrated with accounting software, making them accessible for businesses of all sizes. Whether you’re a small business owner or managing larger financial accounts, a calculator can significantly ease the management of your depreciation records.

Downloadable Templates and Guides

Downloadable templates and guides provide a structured approach to managing straight-line depreciation. These resources offer pre-formatted spreadsheets, typically in Excel or Google Sheets, making it easy to plug in your numbers and track depreciation over time. They often include formulas, ensuring accurate computations and minimizing manual errors.

Guides accompanying these templates walk you through each step, from setting up initial assets to adjusting for any changes down the line. They are invaluable for both accounting novices and experienced professionals, empowering you to maintain organized and clear financial records.

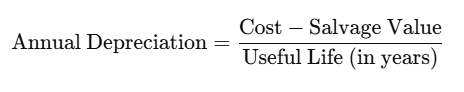

Conclusion

Straight-line depreciation is a method used to allocate the cost of a tangible asset over its useful life in equal annual amounts. This method is straightforward and widely used in accounting practices due to its simplicity and consistency. The formula for straight-line depreciation is:

Depreciation Amount = (Cost of Asset−Salvage Value) ÷ Useful Life

The use of straight-line depreciation can significantly impact a company’s profitability. By spreading the cost of an asset evenly over its useful life, businesses can better match their expenses with revenues, leading to more stable profit margins. The salvage value, or the estimated residual value of the asset at the end of its useful life, is subtracted from the initial cost to determine the depreciable amount. This salvage value is crucial for accurate accounting estimates and ensuring that the depreciation deduction reflects the true wear and tear of the asset.

Depreciation is a non-cash expenditure that reduces the book value of an asset over time. This reduction is recorded as a depreciation deduction on financial statements, which can lower taxable income and, consequently, the taxes owed by the business. For fixtures and other tangible assets, the straight-line method provides a clear and predictable depreciation schedule, aiding in financial planning and tax filing. The scrap value, or the amount expected to be received from selling the asset at the end of its useful life, also plays a role in determining the annual depreciation expense.

In accounting terms, straight-line depreciation is an essential tool for managing the valuation of assets. It ensures that the depreciation amount is consistent each year, making it easier to track and report. This method is also applicable to intangible assets through amortization, which spreads the cost of intangible assets like patents or trademarks over their useful life. Accurate accounting estimates and adherence to established accounting practices are vital for maintaining the integrity of financial statements and ensuring compliance with regulatory requirements.

FAQs

What qualifies as a depreciable asset?

A depreciable asset is any long-term item that a business uses for operations, such as machinery, vehicles, or buildings, with a finite useful life. It must be expected to last for more than one year, gradually losing value while providing economic benefits during its tenure. Land, however, does not qualify, as it generally does not depreciate over time.

What is the straight-line depreciation equation?

The straight-line depreciation equation is:

Annual Depreciation Expense = (Cost of Asset – Salvage Value) ÷ Useful Life

This formula distributes the depreciation evenly across each year of the asset’s useful life. It’s a simple and widely-used method for calculating depreciation, offering consistency and ease of use.

How is the useful life of an asset determined?

The useful life of an asset is determined based on several factors, including the asset’s expected usage, industry standards, technological advancements, and any historical data from similar assets. Consult manufacturer guidelines and consider the asset’s depreciation policy as per tax regulations. This estimation ensures accurate financial reporting and planning.

Is monthly depreciation necessary?

Monthly depreciation is not mandatory but can provide a more accurate reflection of financial performance, especially beneficial for businesses needing detailed monthly reports. It spreads the asset’s cost more evenly over its useful life, aligning expenses with monthly revenue. This practice supports better cash flow management and enhances budget accuracy.

Can straight-line depreciation be applied to all assets?

Straight-line depreciation can be applied to most assets with a predictable and consistent loss of value, such as office furniture and buildings. However, it’s not ideal for assets that depreciate quickly or have usage-dependent value loss, like vehicles or production machinery. These may be better suited to other methods such as declining balance or units of production.