KEY TAKEAWAYS

- The Statement of Owner’s Equity, sometimes also known as the Statement of Shareholder’s Equity, offers a detailed account of the equity section found within the Balance Sheet. It is instrumental in showing how the owner’s or shareholders’ equity has changed over a given accounting period.

- Despite its usefulness, the Statement of Owner’s Equity is deemed less critical than the core financial statements — namely, the Income Statement, Balance Sheet, and Cash Flow Statement. Approximately 90% of financial analysis and valuation rests on these primary documents due to their emphasis on cash flows, which can be sufficiently gauged through just the Income Statement and Cash Flow Statement.

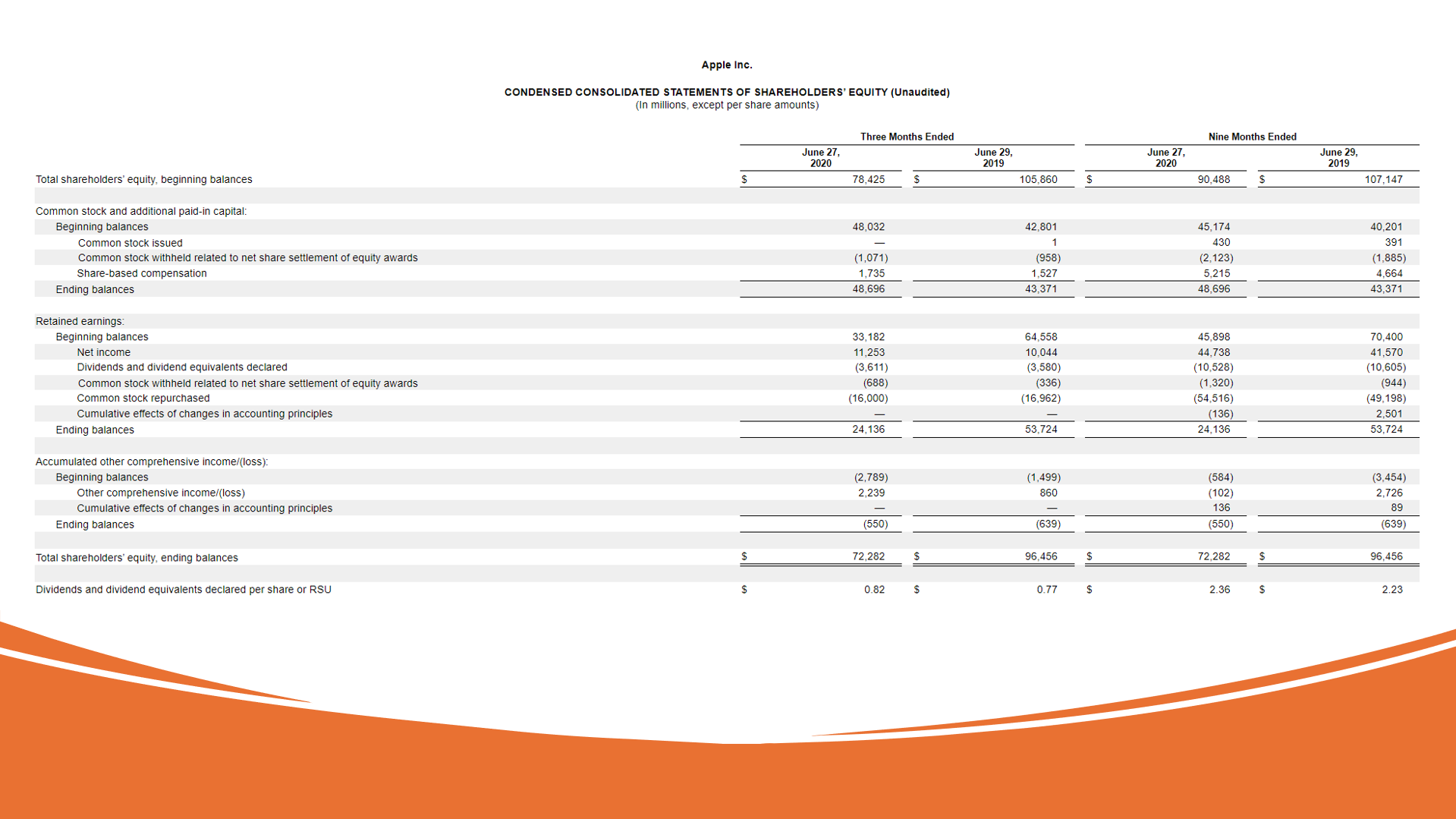

- The Statement of Owner’s Equity is composed of key changes that impact equity: Net Income (which increases equity), Dividends (which decrease equity), Stock Issuances (which increase equity), and Stock Repurchases (which decrease equity). Additionally, the section may include items like Unrealized Gains and Losses, pension adjustments, and foreign currency translations, which affect Accumulated Other Comprehensive Income (AOCI).

The Importance of Understanding Owner’s Equity

Understanding owner’s equity isn’t just accounting jargon; it’s a critical component of your financial awareness toolkit. For those in investment banking or handling personal investments, having a firm grasp on this concept is imperative, as it provides you with a clear picture of a company’s financial footing. This knowledge is particularly valuable to stakeholders who utilize it to assess investment risks and opportunities. It helps you make informed decisions about future investments, business expansion, or when it might be time to tighten the purse strings. Moreover, for potential lenders and investors, your equity status is a beacon, signaling your business’s profitability and long-term sustainability. Notably, an increase in shareholders equity indicates a company’s enhanced ability to create value for its owners and equity partners. It also reflects on your equity interest – effectively your skin in the game – and affects how new partnerships, loans, or investment opportunities might be viewed and pursued.

Peeling Back the Layers of the Statement of Owner’s Equity

The Structure and Components Included

When you dissect the statement of owner’s equity, you’ll find a straightforward structure anchored by several key components. These include the owner’s initial capital, additional investments made during the period, withdrawals or dividends paid out, and the net income or loss for that time frame. This is how it generally pans out:

- Initial Capital: The starting point is the equity held at the beginning of the reporting period.

- Additional Investments: If you’ve put more money into the business, it’s accounted for here.

- Net Income/Loss: This is the money your business has made or lost over the period. It comes from your income statement.

- Drawings/Dividends: Money you’ve taken out of the business for personal use or distributed as a profit share.

- Ending Owner’s Equity: What you’re left with at the end. It’s the sum of the above components, factoring in profits and deductions.

Each element represents a separate line item in the statement, ensuring clarity around how equity changes over time. Aligning numerical figures to the right side of the page, using subtotals after each section, and distinctly labeling the final owner’s equity figure helps maintain transparency and readability.

Examples to Illustrate the Concepts

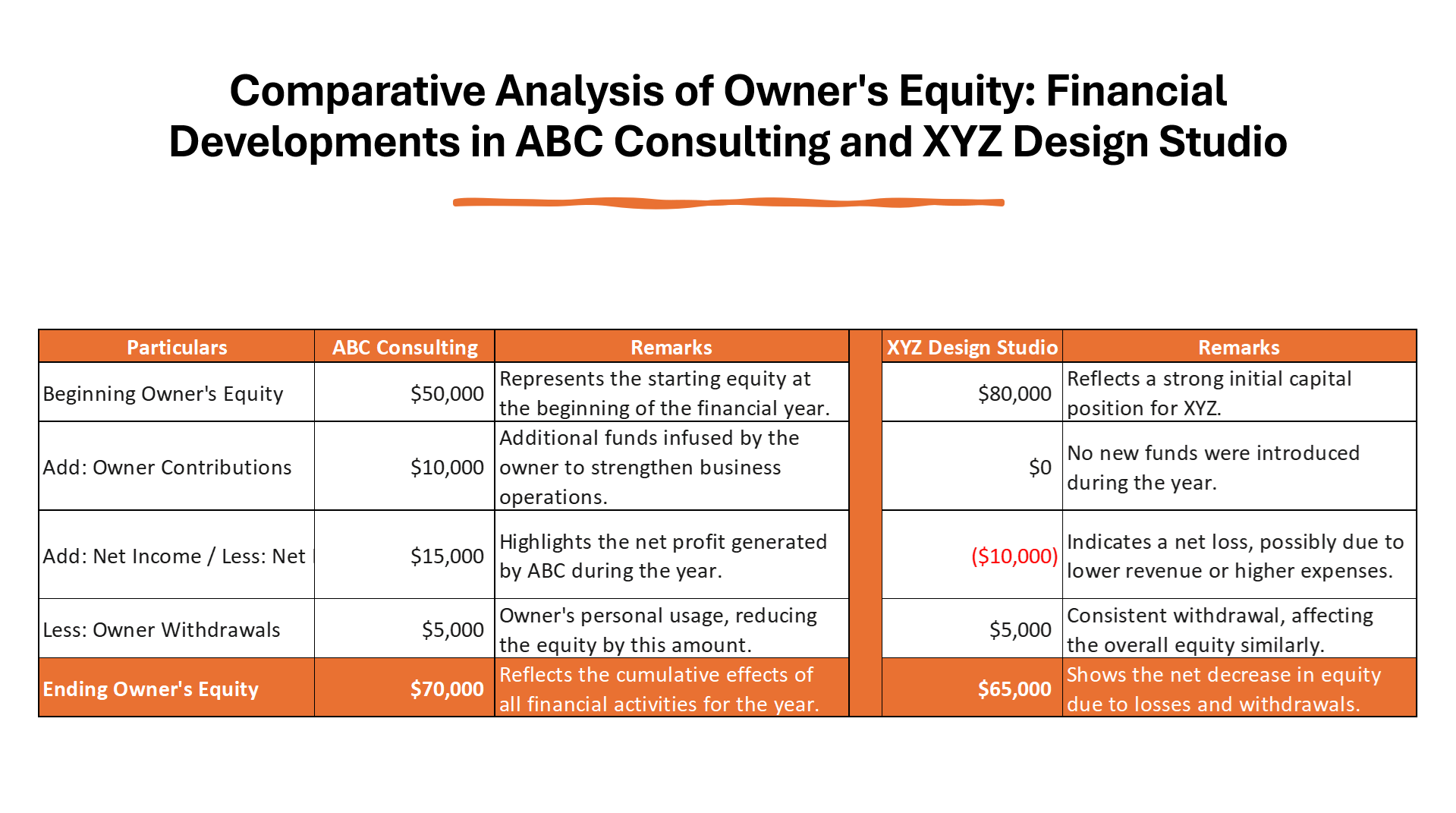

Let’s say we have two small businesses: ABC Consulting and XYZ Design Studio. For ABC Consulting, the beginning owner’s equity was $50,000. Throughout the year, the owner contributed an additional $10,000, and the business earned a net income of $15,000. However, the owner withdrew $5,000 for personal use. For ABC Consulting, the ending owner’s equity would be calculated as follows:

- Beginning owner’s equity: $50,000

- Add: Owner contributions: $10,000

- Add: Net income: $15,000

- Less: Owner withdrawals: $5,000

- Ending Owner’s Equity: $70,000

XYZ Design Studio, on the other hand, started with an owner’s equity of $80,000. They did not make additional capital contributions this year, but they did have a net loss of $10,000 and the owner took out $5,000. XYZ’s ending equity would look like this:

- Beginning owner’s equity: $80,000

- Add: Contributions: $0

- Less: Net loss: $10,000

- Less: Owner withdrawals: $5,000

- Ending Owner’s Equity: $65,000

These examples demonstrate how various financial activities during the year affect the owner’s equity.

Calculating Owner’s Equity: A Step-by-Step Approach

Starting Points: Beginning Balance and Capital Contributions

The starting point of the owner’s equity equation is the beginning balance, which is essential in demonstrating the equity show beginning and setting the stage for financial analysis. This figure reflects the total value your business held at the end of the last period, effectively capturing the equity show beginning. If it’s the company’s first year, this number would understandably be $0, but otherwise, it’s the ending balance from the last year—a springboard for the current period’s finances.

During the period, you might inject additional funds to spur growth or cover expenses, and these capital contributions boost your equity—and thus the equity show beginning with a stronger footing. Whether it’s an injection of cash or assets, every dime you add increases your stake in the business. So if you started with an equity of $20,000 and added another $5,000 during the year, your equation begins with $25,000 before considering other changes like profits or withdrawals.

Subtracting Withdrawals and Factoring in Earnings

Now, consider withdrawing from your equity pile. Each withdrawal—also known as owner’s drawings—acts like financial termites, nibbling away at your stake. Such cash outflows, when you withdraw funds for personal use, aren’t classified as business expenses. Instead, they’re directly subtracted from the owner’s equity since you’re essentially reducing your claim in the business. It’s crucial to monitor these outflows to maintain a solid grasp on your financial base.

But there’s a silver lining: your earnings. Your net income—from selling services, products, or both—acts as equity fertilizer, nurturing and growing your ownership value. This is where diligent business operations pay off, literally. Any profits earned during the period bolster your equity after you subtract withdrawals, illustrating how proper management of cash flow, including both inflows and outflows, can influence your business’s financial state. By balancing the cash outflows (withdrawals) against the inflows (earnings), you paint the truest picture of your business’s financial health at the end of the period.

Enhance Your Financial Insight with a Statement of Owner’s Equity

How This Statement Influences Business Decisions

The statement of owner’s equity isn’t just for show; it’s a decision-making compass. It keeps you rooted in reality, revealing how your business maneuvers affect your bottom line. For instance, seeing a consistent uptick in equity may steer you towards reinvesting profits for expansion. Conversely, a downward trend might flag the need for a revised strategy or cost-cutting measures.

This financial introspection doesn’t just benefit you; it also informs potentially life-changing decisions for your business. Say you’re pondering a loan to open a new location. Your equity statement narrates your past fiscal responsibility, which can sway lenders in your favor—or hint that it’s time to strengthen your financial position before taking the plunge. Similarly, if attracting investors is on the agenda, presenting a solid history of retained earnings could be the clincher.

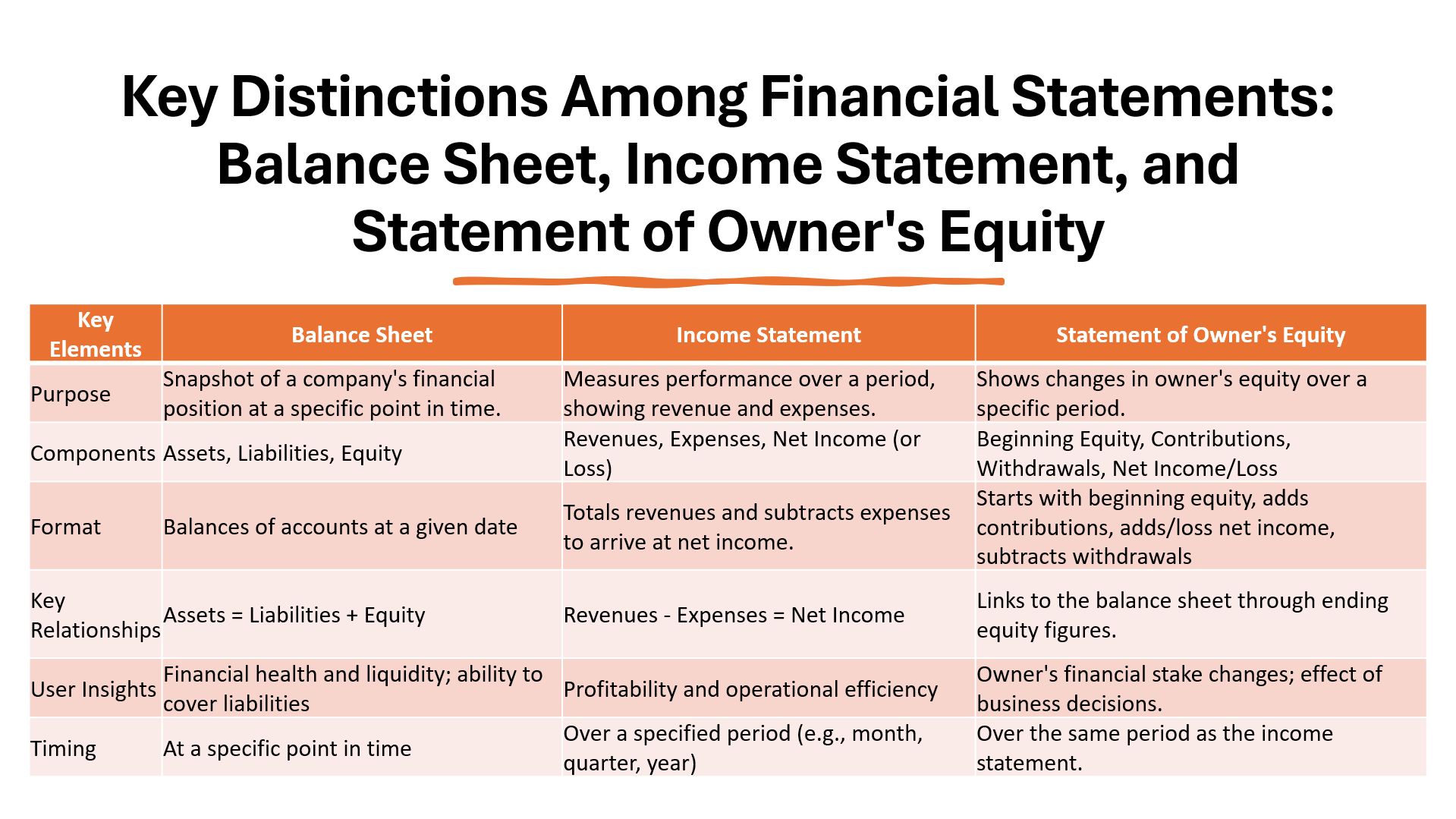

Comparing the Statement of Owner’s Equity with Other Financial Documents

It’s like comparing different brushes in an artist’s toolkit: each financial document paints a unique part of your business’s financial picture. The statement of owner’s equity, for example, zooms in on the changes in your equity over time, tracking the ebb and flow of your investments and withdrawals against profits.

Now, let’s contrast it briefly with the big shots—the balance sheet and the income statement. The balance sheet is a snapshot of your company’s financial standing at a given moment, listing assets, liabilities, and owner’s equity as a summary. Meanwhile, the income statement, also known as the profit and loss statement, chronicles your revenue, expenses, and profits or losses over a period.

Each document serves its purpose. The income statement addresses your business’s operational efficiency, the balance sheet shows financial solidity, and the statement of owner’s equity details the narrative of your investment over time.

Common Confusions and Clarifications in Owner’s Equity

Can Owner’s Equity Ever be Negative?

You might be surprised, but yes, owner’s equity can dip into the negatives. This financial quagmire happens when your company’s liabilities overshoot its assets. It’s like being underwater on a mortgage when you owe more than the property’s worth. In the business world, this could crop up if you’ve been a little too generous with personal withdrawals or if the company has been hemorrhaging money, expenses outpacing revenue, leading to a loss.

Negative owner’s equity isn’t just a red mark in the books; it sends out distress signals about your business’s health. It could indicate potential solvency issues, meaning your business might not have the legs to meet its obligations in the long run. However, it’s not an endgame scenario. Many businesses rebound by adjusting strategies, improving cash flow, or finding new capital injections to resuscitate equity back into the positive.

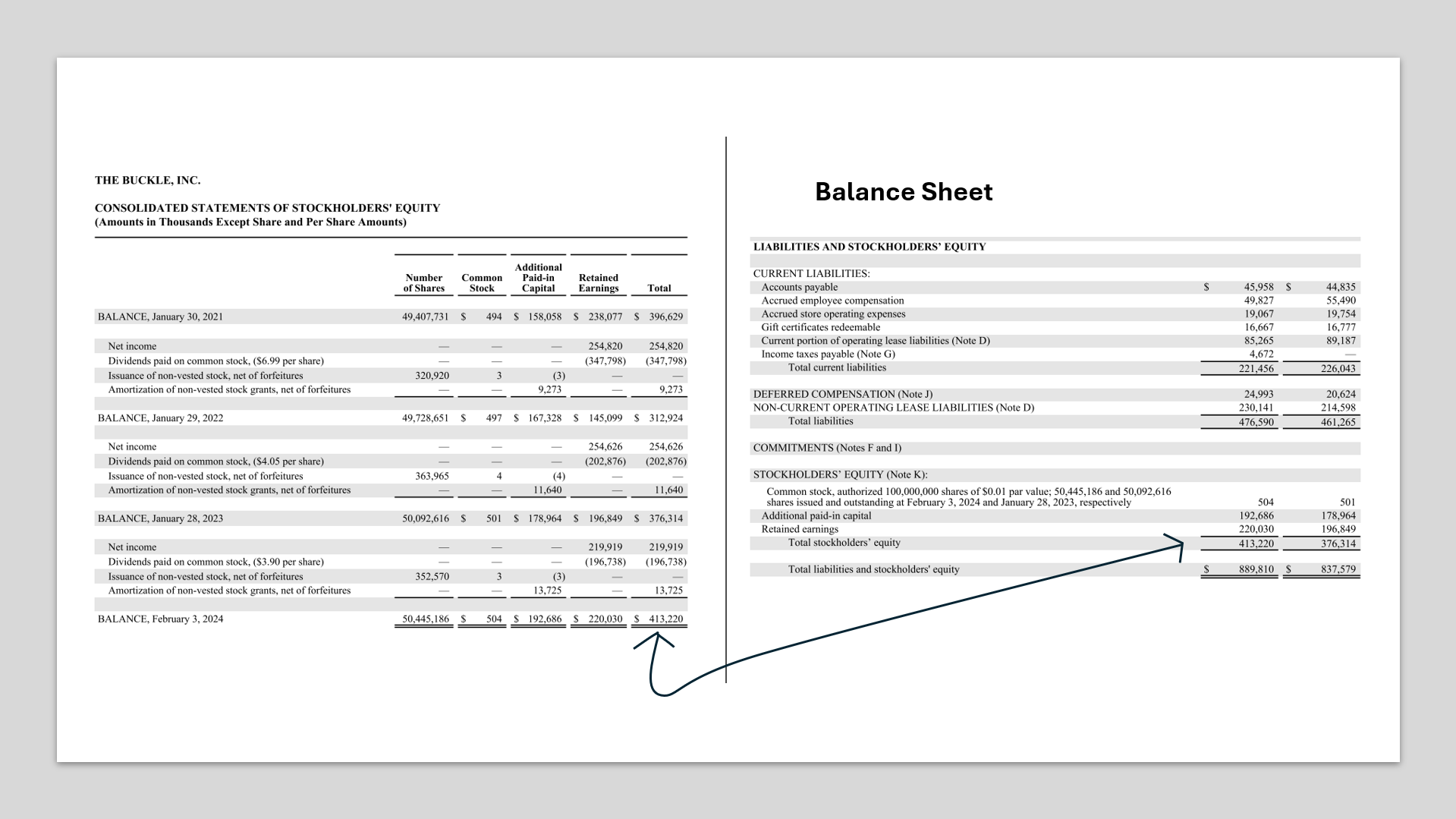

Equity on the Balance Sheet vs. Owner’s Equity Statement

At first blush, the equity on a balance sheet and the owner’s equity statement may look like they’re playing the same tune, but in essence, they perform a duet with crucial differences. The balance sheet presents equity at a singular point in time, showing the cumulative result of all your business’s operations and financial activities up until that moment—a snapshot, if you will.

On the flip side, the owner’s equity statement is like a mini-biography, telling the story of how your stake in the business has evolved over a set period. It maps out the trajectory of investments, earnings, and distributions, putting up signposts that signify how and why your ownership’s value changed. Think of it as the lifeline of your financial contribution, tracing from the opening balance to the closing equity.

By examining both, you get the double advantage: a current status update from the balance sheet and a historical, dynamic overview from the statement of owner’s equity.

Owner’s Equity FAQs

What Ultimately Affects the Changes in Owner’s Equity?

Ultimately, the changes in owner’s equity are influenced by a mix of contributions and distributions associated with the owner, and the financial performance of the business. Owner contributions increase equity, while owner withdrawals, such as taking out cash or dividends, reduce it. Furthermore, company repurchases of stock can also affect equity—the repurchased shares, known as treasury stocks, usually result in a reduction of owner’s equity as they are often recorded negative on the balance sheet. Most impactful, though, is the company’s net income or loss: profits boost equity, and persistent losses can diminish it significantly over time.

How Often Should a Statement of Owner’s Equity Be Prepared?

A statement of owner’s equity should be prepared as often as needed to provide timely and relevant financial information for decision-making. Common practice is to prepare it annually, aligning with the fiscal year-end. However, for more dynamic insight or in times of significant changes in ownership structure, preparing it quarterly might be advantageous.

What is on the statement of owner’s equity?

The statement of owner’s equity typically includes the beginning equity balance, any additional owner contributions, net income or loss for the period, owner withdrawals or dividends, and ends with the final equity balance. It outlines how the business’s performance and owner transactions impact the owner’s stake in the company.

Why would a business need a statement of owner’s equity?

A business needs a statement of owner’s equity to assess how well it generates value for its owner, inform decisions on reinvestment or withdrawals, and showcase financial health to potential investors or lenders. It’s also crucial for tax reporting and performance evaluation.