KEY TAKEAWAYS

- A statement of account provides a record of transactions between buyer and seller over a specific period, typically monthly, and includes details like outstanding balances, helping businesses determine their financial position and profitability.

- While there’s no standardized format for a statement of account, it typically features a header with business and client information, a summary, an itemized list of transactions with dates and details, and often includes payment terms and company contact information for queries.

- To facilitate quicker payments and clarity, the statement should be straightforward, on company letterhead, show total amounts due, overdue, and not yet due, and include bank details and preferred payment reference, often with credit terms such as “30 days from month end.”

Decoding Financial Snapshots for Businesses

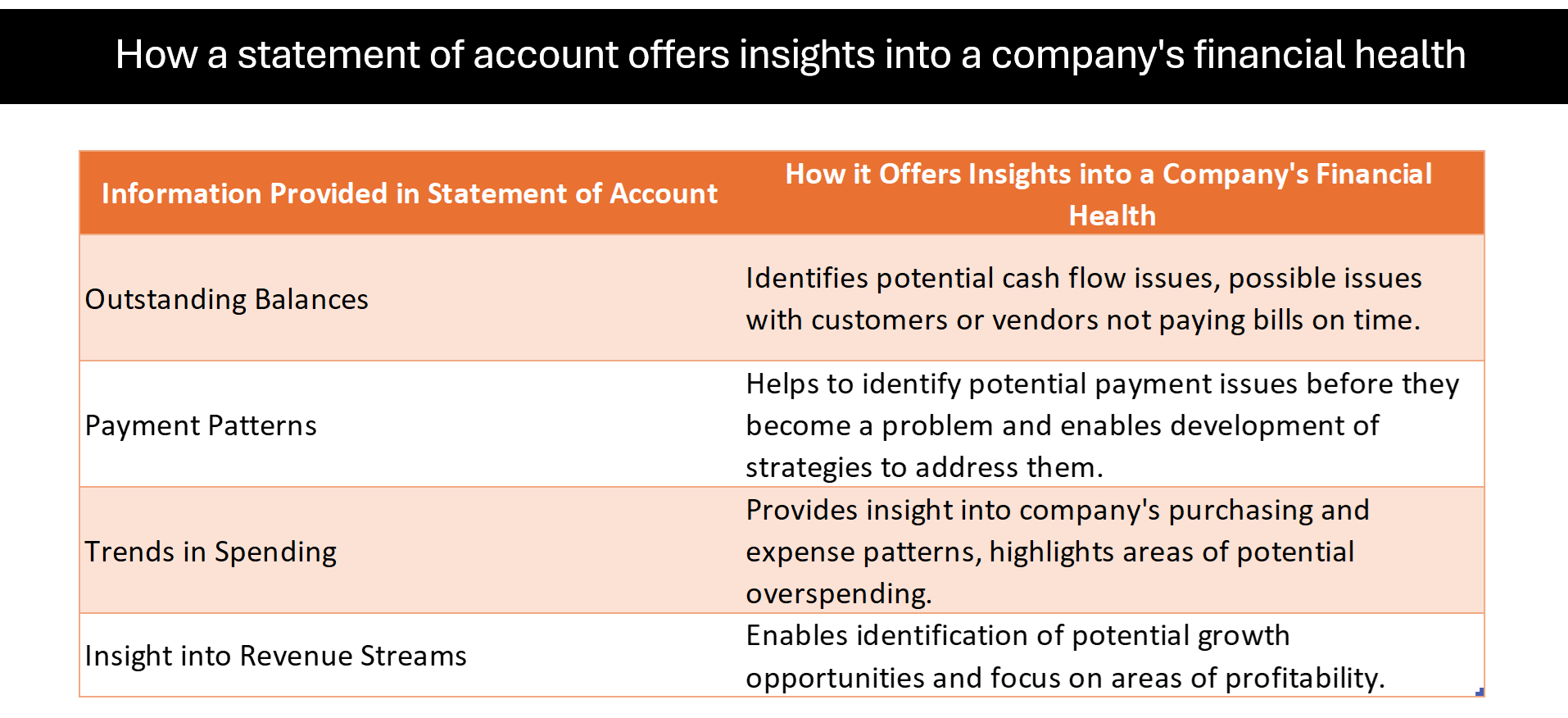

Financial snapshots, like a statement of account, act as a health gauge for a business, balancing assets, liabilities, and equity to show financial standing. These allow businesses to identify trends, make projections, and highlight areas of concern or strength in their day-to-day operations. By distilling complex financial activities into a simplified document, businesses can better manage customer relationships by providing a transparent record of transactions and enhancing trust in their financial dealings.

The Essentials of a Statement of Account

Key Components and Layout

A well-organized statement of account is integral for clarity and accuracy. Key components include:

- Business and Customer Contact Information: This includes names, addresses, phone numbers, and email addresses. Including the business logo adds a touch of professionalism, and customer or account ID numbers ensure you’re tracking the right individual or entity.

- Statement Date and Due Dates: Clearly marked dates inform clients of the statement period and payment expectations.

- Transaction Details: Each transaction listed typically specifies date, description, amount, and a unique identifier.

- Balances: Beginning and ending balances give a quick sense of the account’s status.

- Current and Past Due Amounts: Splitting these figures assists clients in understanding what is owed and possibly overdue.

Though account statements may vary based on the issuer and underlying service, you may come across the same elements across statements.

A straightforward layout would have all this information presented in a clear, tabulated format, allowing for easy navigation and understanding at a glance.

Understanding the Time Buckets and Date Range

Time buckets in a statement of account organize debts by age, arranging invoices based on how overdue they are. Think of them as compartments within your financial cabinet, each labeled with a time frame: current (0-30 days), mildly aged (31-60 days), notably aged (61-90 days), and critically aged (90+ days). This visualization aids both you and your clients in prioritizing payments and managing cash flow.

The date range, often a month, sets the temporal boundaries for the transactions included. Defining the date range upfront helps keep track of financial movements within a specific period, enabling consistent and regular finance reviews—key for maintaining the pulse of your business’s economic heartbeat.

The Functions and Significance of Account Statements

Primary Uses in Business Finance

Business finance treats statements of account as indispensable tools. They are primarily used to:

- Track Sales and Invoicing: You can easily monitor which products or services have been delivered and which invoices have been issued or are pending.

- Manage Receivables: By reviewing outstanding balances, you can chase payments efficiently and maintain healthy cash flows.

- Budget Forecasting: With a comprehensive view of income and expenses, it’s simpler to forecast future budgets.

- Financial Reporting: They serve as support documents for financial reports—a pillar for transparency and accountability.

- Customer Account Management: They enhance customer relationship management by offering a clear, concise transaction history, thus reducing disputes and increasing customer satisfaction.

Importance of Accurate Account Statements

Precision in account statements is paramount because:

- They reflect your business’s credibility. Inaccuracies can tarnish your reputation and trust with clients.

- Accurate statements ensure correct billing. Overcharges risk client dissatisfaction, while undercharges affect your revenue.

- They enable precise financial analysis. Incorrect information skews financial insights, potentially leading to poor business decisions.

- An accurate account statement is a legal document that can serve as evidence in dispute resolution.

- They are essential for compliance with accounting standards and tax regulations.

Remember, the truthfulness of your financial records speaks volumes about how you manage your business and, more importantly, how you value the relationships with those you serve.

Concrete Examples: Statement of Account in Action

Real-world Scenarios Where Statements Matter

Account statements play a critical role in various situations, such as:

- Debt Collection: When payment reminders are necessary, a statement of account provides a detailed summary of outstanding amounts.

- Loan Applications: Businesses often need to present their financial statements as part of the due diligence process for securing loans.

- Tax Preparation: These statements serve as a record of income and expenses, proving invaluable come tax season.

- Dispute Settlement: They provide an audit trail that can help quickly resolve billing disputes with clients.

- Customer Relationship Management: Regular statements keep customers informed and can strengthen business relationships.

In essence, whether you’re vying for a loan, preparing taxes, or simply fostering trust with your customers, these financial documents are not just paperwork; they’re the narrative of your business dealings.

Sample Format of an Account Statement

A sample account statement would typically flow as follows:

- Header: Business name, contact details, statement date, and customer information.

- Account Summary: Start with the opening balance, list all new charges, payments, and adjustments, and then provide the closing balance.

- Transaction Listing: Organize transactions by date with descriptions, amounts, and cumulative balance.

- Time Buckets: Segment past due amounts by 30-day increments to highlight urgency.

- Messages and Notes: Include any personal notes, thank you messages, or reminders for upcoming promotions or policies.

- Footer: Place for additional information, such as customer service contact details or a thank you statement.

This is a blueprint you might follow, but remember to customize your statement of account to suit your business’s style and needs.

Comparison between Statement of Account and Invoices

How They Differ and Complement Each Other

While both essential, an invoice and a statement of account serve different purposes. An invoice is a request for payment for services or goods already provided, typically issued shortly after the sale. It’s like a detailed receipt that states what was purchased, the cost, and when the payment is due. In contrast, a statement of “account compiles all outstanding invoices and payments made over a period, providing a broader overview of the account’s status.

Together, they complement each other; invoices provide the specifics of each transaction, while statements give a comprehensive view of the financial relationship over time, thereby keeping the financial dialogue between business and client clear and consistent.

Creating invoices through Excel sheets can run the risk of invoicing mistakes, which can then reflect poorly on your business and the subsequent account statement.

When Each Document Is Utilized

An invoice is utilized immediately following a transaction—it’s the size-specific tag that itemizes the sale and calls for payment. It’s used every time a customer purchases products or employs services, often paving the way for transparent financial dealings.

On the flip side, a statement of account is typically used periodically—think of it as a periodic summary report that bundles transactions, usually on a monthly basis. It’s especially handy for clients with multiple invoices, serving as a regular financial touchpoint to ensure both parties are aligned on account activity.

Together, invoices and statements of account form the heartbeat of business transactions, pulsing at different but complementary intervals to maintain the financial health of a business relationship.

Common Misconceptions and Red Flags

Spotting Errors and Discrepancies

Spotting errors on a statement of account is crucial as they could signify billing mistakes, unauthorized transactions, or even fraud. Keep an eye out for red flags such as charges for goods or services not received, duplicate entries, or adjustments you don’t recognize. If you see transactions from locations you haven’t visited or items that seem out of line with typical spending habits, these too could indicate errors or unauthorized use.

It’s important to review statements as soon as they arrive or are accessible. Time is of the essence; you may only have a limited window to dispute inaccuracies—usually 30 days from the statement date—so frequent reviews are your best defense against potential financial discrepancies.

Is It Proof of Billing?

Yes, a statement of account often doubles as proof of billing. When you need to verify your identity or confirm your place of residence, this document can be quite the ally. It not only illustrates your financial activities but also validates your association with the address and name listed on the statement. This can come in particularly handy for establishing creditworthiness or satisfying documentation requirements for various services.

However, it’s important to note that different organizations have varying criteria for what constitutes valid proof, so checking in advance if a statement of account meets their requirements is a wise move.

Best Practices for Managing Account Statements

Keeping Records: Digital vs. Paper Statements

When it comes to keeping track of your account statements, you have two main choices: digital or paper. Both have their merits.

Digital statements are the way to go for convenience and environmental friendliness. They’re typically accessible 24/7 in your online account, can be downloaded and stored on various devices, and are easily searchable—making it easier to pull up a specific transaction. Plus, they often come password-protected and delivered through secure channels, reducing the chances of unauthorized access.

Paper statements, on the other hand, are tangible and don’t rely on technology, which can be a substantial advantage for those wary of digital hacks or for those in regions with inconsistent internet access. They can be a reliable backup if digital records are temporarily unavailable due to technical issues. However, remember to shred them after use to protect sensitive information from falling into the wrong hands.

Integrating Account Statements into Accounting Systems

Integrating statements of account into your accounting systems streamlines your financial processes and reduces manual errors. Here’s why and how:

- Streamlining data entry saves time and minimizes mistakes. Automated systems can import data directly from statements, ensuring integrity and accuracy.

- Real-time updates and synchronization mean you can see a continuously updated financial picture without the lag of manual updates.

- With data consolidation, integrating statements into accounting systems facilitates comprehensive reporting and analysis, providing valuable insights for decision-making.

The path to integration usually involves selecting compatible software that communicates seamlessly with your banking institutions or automates the capture of statement information. This can be a game-changer for maintaining up-to-date financial records and providing actionable business insights.

Navigating Through Your Own Account Statements

Creating and Sending Your Statement of Account

When it’s time to create and send out your statement of account, follow these essential steps:

- Use a template or bookkeeping software to ensure consistency and professionalism. Customize it with your company’s branding for added polish.

- Include the pertinent details such as transaction dates, descriptions, amounts, running totals, and overall account balance.

- Carefully review the statement for accuracy before sending. Double-check figures and client information to avoid confusion or delay.

- Send the document securely. If it’s electronic, use encrypted email or a secure client portal. If it’s paper, utilize mail services that offer tracking and receipt confirmation.

Remember that while sending statements is a routine task, each one reflects on your business and affects your cash flow, so handle them with care and precision. And a gentle reminder: don’t send out statements of account to customers with zero balance, unless they request one.

Guidelines for Effective Use and Interpretation

To effectively use and interpret statements of account, consider these guidelines:

- Regular Reviews: Make a habit of examining statements at consistent intervals; this helps pinpoint trends and catch errors early.

- Understanding Terminology: Familiarize yourself with financial jargon such as ‘debit,’ ‘credit,’ and ‘balance brought forward’ to correctly interpret the data.

- Analyzing Patterns: Look for patterns in spending, payments, and purchasing. They can reveal important insights into cash flow and customer behavior.

- Question Inconsistencies: If something doesn’t add up, investigate. A healthy skepticism can prevent misunderstandings or even fraud.

- Leveraging Technology: Use bookkeeping software with analytic tools to delve deeper into your financial data, giving you a more sophisticated interpretation.

Applying these tips can turn statements from a mere formality into a strategic tool for financial management.

FAQs on Statement of Account

How Do You Write and Send a Statement of Account?

To write and send a statement of account, you can make the process easier by following these simple steps:

- Choose a reliable template or use accounting software that fits your business needs.

- Fill in accurate details including date range, transactions, and customer information.

- Review the statement carefully to ensure all data is correct and complete.

- Deliver the statement—electronically through secure email or accounting platforms, or via physical mail if necessary.

- Follow up with the client to confirm receipt and address any questions or concerns they may have.

Remember, consistency is key, so make sure to send out statements at regular intervals to maintain good accounting practices and customer relations.

Why Is a Statement of Account Important?

A statement of account is pivotal because it consolidates all transactions between a business and a client over a specific period, providing a clear and complete picture of the financial interactions. It’s not just a courtesy but a tool for transparency that can prevent disputes, remind customers of due payments, and reinforce trust. Furthermore, these statements are vital for accurate bookkeeping, cash flow management, and preparing financial statements, all of which are essential for informed decision-making and maintaining business health.

What Should You Do If You Find an Error on Your Account Statement?

If you spot an error on your account statement, don’t delay:

- Contact your bank or issuer right away to notify them of the discrepancy.

- Provide details of the erroneous transaction for a thorough investigation.

- Keep a record of your communication and follow up regularly until the issue is resolved.

Acting swiftly is key to correcting errors and safeguarding your finances.

When Should a Statement of Account Be Issued?

A statement of account should be issued regularly, typically monthly or quarterly, as part of your standard billing cycle. It’s also prudent to send one when payment is overdue or if a client requests an itemized statement. In Australia, for instance, the law requires issuing an itemized statement within seven days upon request. Issuing statements at consistent intervals helps keep both parties informed and can significantly streamline the payment collection process.

How can I use my account statements for budgeting and financial planning?

Leverage your account statements to master budgeting and financial planning by:

- Tracking income and expenses to understand cash flow and spending habits.

- Identifying areas where you can cut costs or allocate funds more efficiently.

- Adjusting your budget according to the patterns and trends you observe in the statements.

By transforming your account statements into actionable insights, you’re stepping up your financial game and paving the way for a healthier monetary future.