Stakeholders encompass a broader group which includes shareholders but also employees, customers, suppliers, community members, and anyone else impacted by the company’s operations. Their focus is on the overall impact of the company’s actions.

KEY TAKEAWAYS

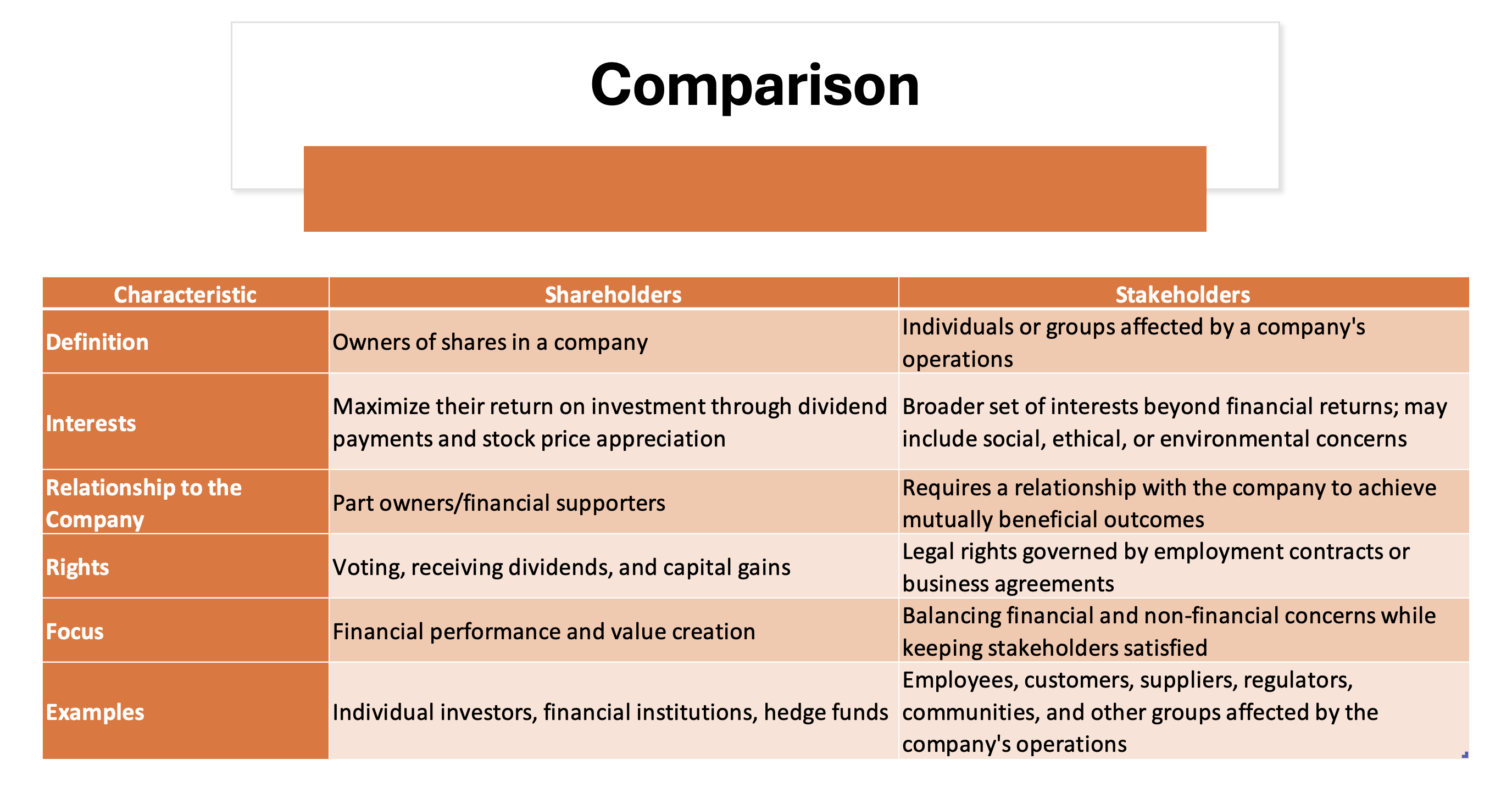

- Shareholders are individuals or entities that own part of a company through stock ownership, which gives them a claim on the company’s assets and earnings, whereas stakeholders include any individuals or groups that have an interest or concern in the company, which may include employees, customers, suppliers, and the community, in addition to shareholders.

- Stakeholders are often directly affected by the company’s operations and decisions on a day-to-day basis, as their interests can extend beyond profit to include aspects such as corporate governance, social responsibility, and environmental impact, while shareholders may primarily focus on the company’s financial performance and stock value, with an interest in long-term profitability and return on investment.

- While shareholders’ main concern is typically the company’s long-term success and the appreciation of their shares over time, stakeholders might prioritize the company’s short-term actions and policies, as they can impact a wider array of interests and goals related to employment, business partnerships, local communities, and ecological sustainability.

Why the Distinction Matters

Understanding the distinction between shareholders and stakeholders is crucial because it influences how a business operates and prioritizes its objectives. Shareholders typically seek financial returns, influencing management to focus on profit-maximization strategies. Conversely, stakeholders consider a wider range of impacts, including social, environmental, and economic factors, which can lead to a more balanced approach to corporate decision-making. Recognizing these differences can help one better appreciate the complex dynamics that drive business practices and their broader consequences.

Unpacking the Shareholder Model

Exploring the Concept of Shareholder Primacy

Shareholder primacy is the theory that a company’s main purpose is to increase the wealth of its shareholders. Rooted in the philosophy of Milton Friedman, this concept suggests that corporate executives should prioritize decisions that improve stock performance, dividends, and overall financial health. This model argues that by focusing on shareholder value, resources are efficiently allocated, markets remain competitive, and the economy thrives.

Shareholder primacy has informed much of corporate America’s focus on earnings reports, share prices, and investor returns. However, it also sparks debate as critics argue it overlooks broader societal and environmental responsibilities.

Real-World Examples from the Shareholder Perspective

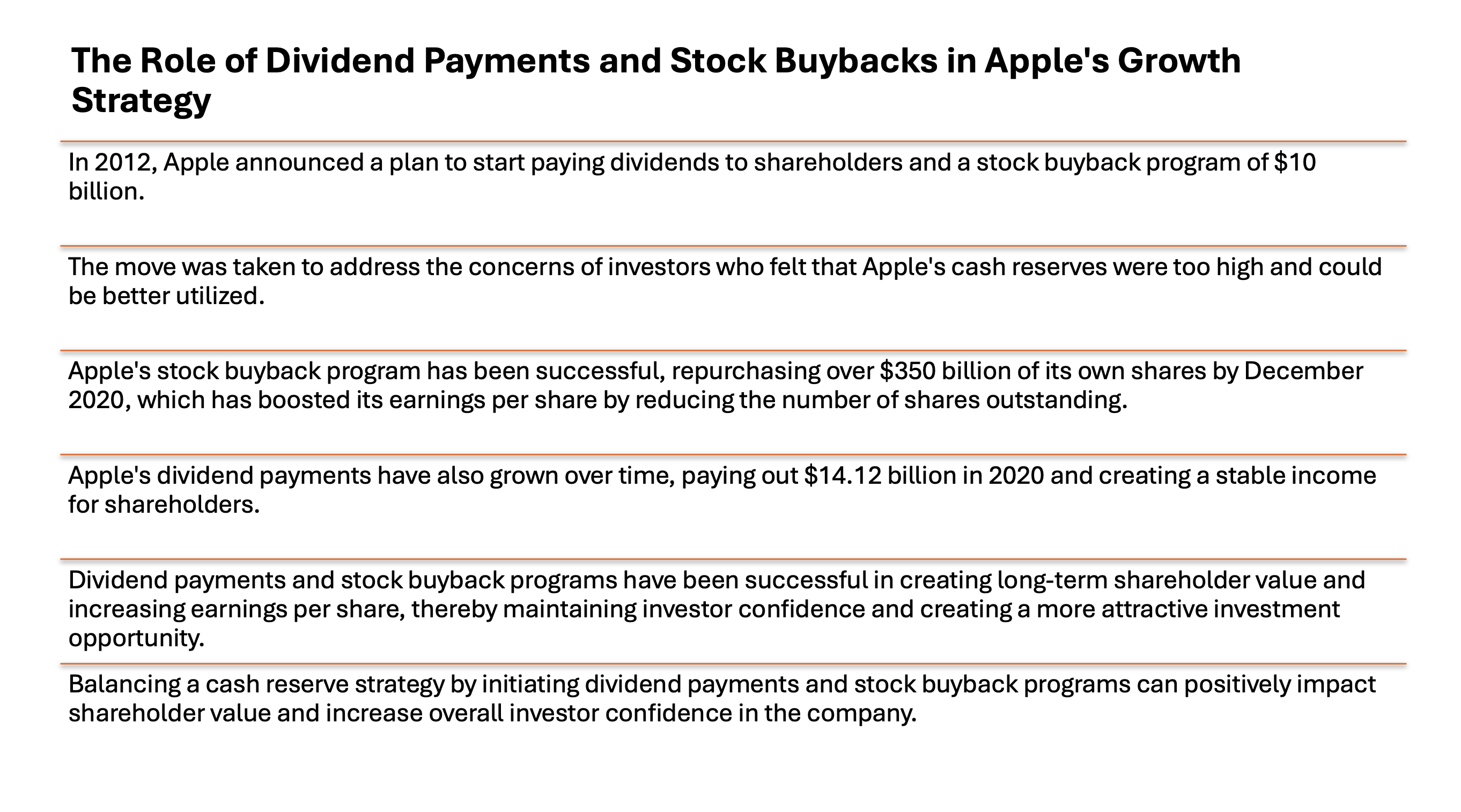

In the world of finance and business, practical examples often speak louder than theories. Consider a well-known tech giant like Apple Inc. which, despite broad customer bases and product lines, often makes headlines for strategies focused on pleasing its shareholders – such as stock buybacks or issuing dividends that serve to enhance share value and returns for its investors.

Another example is ExxonMobil, a company that historically prioritized payouts to shareholders even during market downturns, underscoring a firm commitment to shareholder returns, sometimes at the expense of reinvestment or diversification strategies.

These companies exemplify a shareholder-centric model, where financial metrics and investor interests often take precedence over other considerations.

Grasping the Stakeholder Approach

The Expansive Scope of Stakeholder Theory

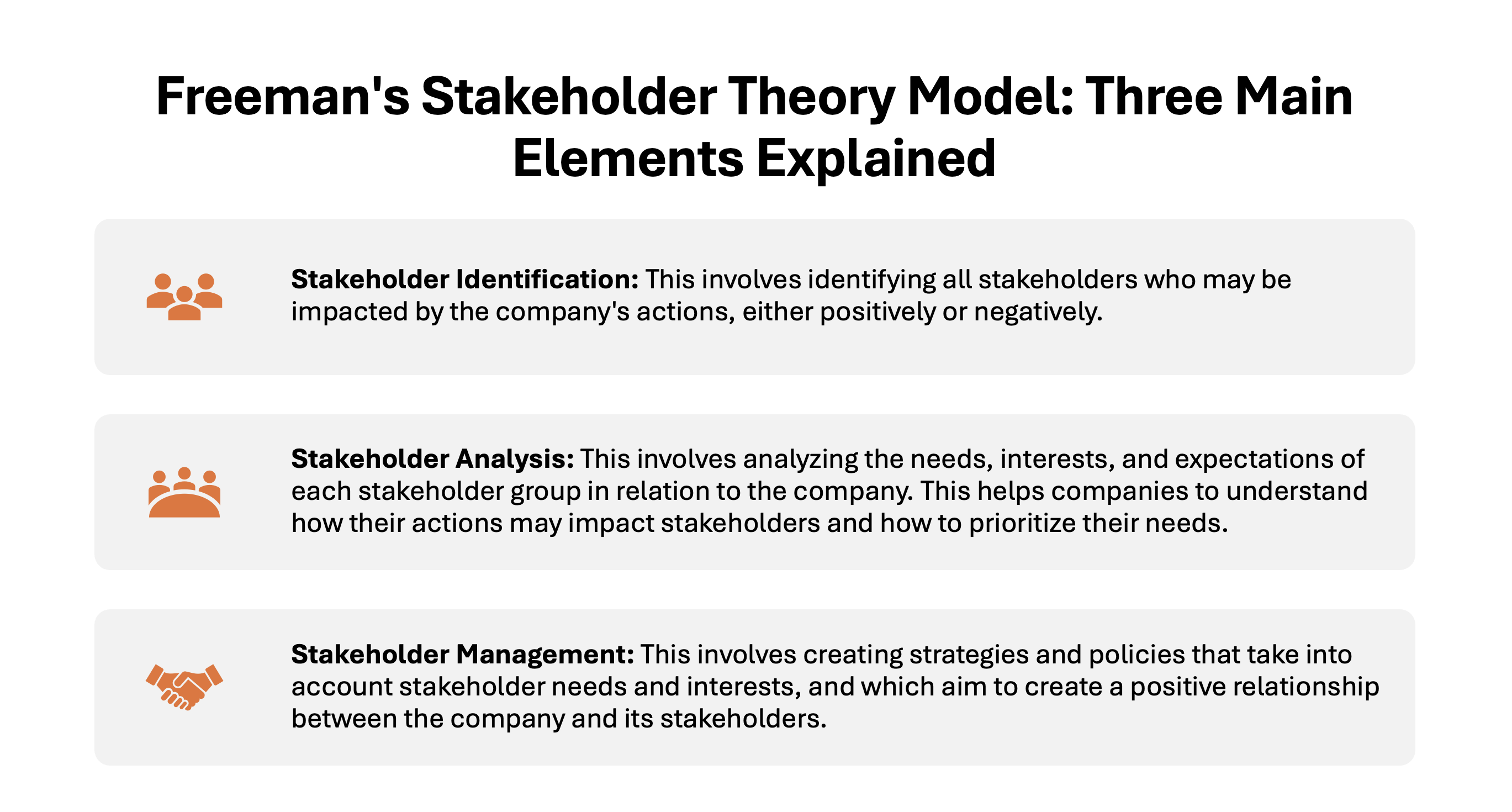

Stakeholder theory, as proposed by Dr. R. Edward Freeman, posits that a company should create value for all its stakeholders, not just shareholders. It expands the company’s responsibility to include customers, employees, suppliers, community members, and even the environment. The expansive scope suggests that when organizations consider the impacts of their decisions on all these stakeholders, they stand to achieve more sustainable and ethical success.

This more holistic approach encourages businesses to engage in practices that are socially responsible and environmentally sustainable, fostering a corporate ecosystem in which profits are balanced with the well-being of all parties involved.

Case Studies Highlighting Stakeholder Impact

Businesses that adopt a stakeholder approach often yield insightful case studies. Patagonia, the outdoor clothing company, is a prime example; they have built their brand around environmental stewardship and ethical practices, gaining loyalty from customers, employees, and partners alike by prioritizing sustainability over immediate profits.

Another noteworthy case is Unilever, renowned for its Sustainable Living Plan, aiming to achieve growth while reducing its environmental footprint and increasing its positive social impact. This strategy has drawn acclaim for demonstrating that corporate success can coincide with making a positive contribution to society and the environment.

These examples showcase the potential for companies to thrive by recognizing the interconnectedness of their operations with wider stakeholder interests and societal objectives.

Contrasting Views in Corporate Strategy

Profit Maximization vs. Ethical Considerations

When businesses gauge every decision through the lens of profit maximization, they risk skirting ethical considerations, potentially leading to practices that harm society or the environment. Shareholder theory could potentially incentivize cutting corners, reducing labor costs in ways that may affect employee welfare, or neglecting environmental regulations to boost short-term profits.

In contrast, stakeholder theory asserts that ethical considerations should form the bedrock of business decisions, suggesting that a company’s long-term success is intertwined with its moral and social conduct.

Balancing profit with ethics may sometimes seem like walking a tightrope, but history has shown that overlooking ethical considerations for immediate gains can harm reputations, lead to legal issues, and eventually, impact the bottom line.

Short-Term Gains Against Long-term Sustainability

The trade-off between short-term gains and long-term sustainability is a central tension in modern business. A focus on quarterly earnings, stock prices, and immediate financial returns may please shareholders in the short run but can be detrimental if it leads to underinvestment in innovation, employee development, or infrastructure.

On the flip side, stakeholder-oriented models advocate for long-term sustainability. Here, businesses are encouraged to look beyond the next quarter’s profits to consider the enduring health of the company, its workforce, and the environment. For instance, investments in renewable energy might hurt initial profits but promise cost savings, energy independence, and brand enhancement over the long term.

Recognizing that sustainability and resilience are increasingly critical in a rapidly changing world, it’s becoming clear that businesses must balance immediate financial incentives with their long-term strategic vision for continued success.

Legal and Ethical Implications

Rights and Responsibilities of Shareholders

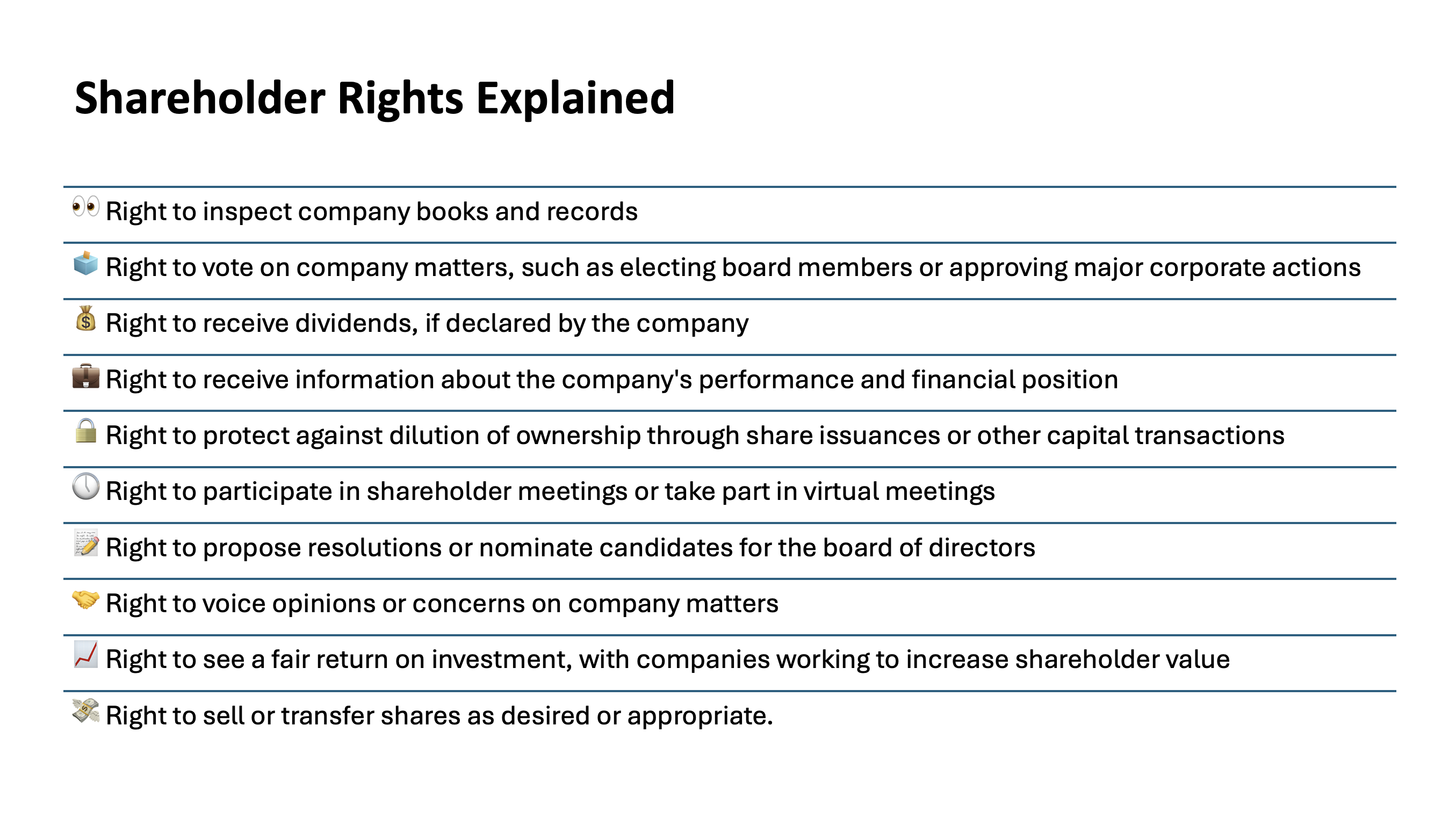

Shareholders, as partial owners of a company, enjoy certain rights protected by law and company charters. One of the key rights includes voting at annual general meetings on significant matters like electing board members or approving mergers. Additionally, they have a right to receive dividends, review the company’s financial documents, and can sell their shares for profit or to mitigate losses.

However, with these rights come the responsibilities of making informed decisions and supporting actions that ensure the long-term success and good governance of the company. Shareholders are expected to engage ethically, reflecting the collective interest of all shareholders rather than pursuing individual agendas.

Ultimately, while shareholders have the power to shape corporate strategies, they also bear the responsibility to do so in ways that promote the company’s stability and growth.

The Evolving Role of Stakeholders in Corporate Governance

The role of stakeholders in corporate governance has evolved significantly in recent years. Stakeholder influence has expanded beyond traditional boundaries, with their input now being sought on issues such as corporate social responsibility, environmental impact, and ethical conduct. This shift is propelled by increased public awareness, sustainability demands, and regulatory changes, all cementing stakeholders’ positions as key players in the governance landscape.

Boards of directors are now expected to consider the interests of a wider array of stakeholders in their decision-making processes. This involves integrating stakeholder feedback into strategic planning and recognizing how corporate actions affect different groups.

With stakeholders increasingly holding companies accountable, their role in governance now includes not just a consultative capacity but also a more robust participative function in shaping corporate values and strategies.

Navigating Complexities with Examples

When Interests Collide: Balancing Act Examples

Navigating conflicts between stakeholders and shareholders is often a complex challenge for companies. A prime example would be when a corporation faces demands from shareholders to cut costs, potentially leading to layoffs or reduced benefits for employees – who are also key stakeholders.

Another situation could be when community interests in environmental protection clash with shareholder pursuits for maximization of oil and gas profits. Such scenarios require diplomatic balancing acts, transparent dialogue, and strategic initiatives that can align differing interests toward mutually beneficial outcomes.

These examples underscore the importance of a balanced approach that respects both shareholder returns and stakeholder well-being, which often leads to innovative solutions and sustainable business models.

Success Stories: Companies Getting It Right

Some companies excel at harmonizing the interests of shareholders and stakeholders, crafting success stories that set industry standards. One standout is Ben & Jerry’s, whose commitment to social causes and environmental responsibility has become intertwined with its brand image, attracting customers and investors alike who value ethical business practices.

Another stellar example is LEGO, which has made significant strides in sustainability, pledging to invest in eco-friendly materials and renewable energy. This focus on corporate responsibility enhances its reputation and secures firm support from stakeholders, without sacrificing shareholder value.

These companies demonstrate that with creativity and commitment, it is possible to serve both shareholders and stakeholders effectively, leading to resilient and respected businesses.

The Future of Business Models

Trends Shifting Towards Stakeholder Inclusivity

Recent trends indicate a significant shift towards stakeholder inclusivity in business models. Factors such as social media transparency, consumer activism, and global sustainability goals have accelerated this move, with companies increasingly recognizing that their operations have vast societal implications.

One observable trend is the rise of Benefit Corporations and B Lab Certification, where businesses commit to higher standards of purpose, accountability, and transparency, considering the impact of their decisions on all stakeholders.

Additionally, the integration of Environmental, Social, and Governance (ESG) criteria into investment strategies is a clear sign of changing priorities. ESG investing is becoming mainstream as it reflects a more holistic understanding of value creation and risk assessment, aligning investor objectives with broader societal outcomes.

These shifts point to a future business landscape where stakeholder inclusivity is not just good ethics but good economics as well.

Predicting the Continual Evolution of Shareholder Values

As the business environment evolves, so do the values of shareholders. Investors are increasingly considering the long-term implications of their investments, looking beyond short-term gains to the sustainability and ethical practices of the companies they support. This change is driven by a growing recognition that responsible business practices can lead to better long-term financial performance and risk management.

Furthermore, the younger generation of investors, with strong inclinations towards social and environmental issues, mirrors this evolution in shareholder values. They are steering the investment community towards companies with strong ESG ratings.

In this context, it’s predicted that shareholder values will continue to evolve, increasingly aligning with stakeholder interests, and fostering business strategies that ensure profitability coexists with positive impacts on society and the environment.

Key Points on Shareholder and Stakeholder Theories

Shareholder Theory:

- Focuses on maximizing shareholder value.

- Originated by Milton Friedman.

- Emphasizes profit maximization.

- Criticized for neglecting social and environmental issues.

Stakeholder Theory:

- Considers interests of all stakeholders (e.g., employees, customers, communities).

- Aims for long-term success and sustainability.

- Balances diverse needs and interests.

- Emphasizes ethical considerations and corporate social responsibility.

FAQ

What is the primary difference between a shareholder and a stakeholder?

The primary difference between a shareholder and a stakeholder is that shareholders are individuals or entities that own shares in a company and are primarily interested in the financial return on their investment. In contrast, stakeholders are any individuals or groups affected by the company’s activities, including employees, customers, suppliers, and the community, whose interests span a broader spectrum than financial gain alone.

Can examples demonstrate how companies address shareholder and stakeholder interests?

Yes, companies like Unilever and Patagonia serve as examples of how businesses address both shareholder and stakeholder interests. They balance financial performance with social and environmental initiatives, thus attracting investors who value ethical business practices while meeting the needs and concerns of other stakeholders.

Why is understanding the distinction between shareholders and stakeholders essential for investors?

Understanding the distinction between shareholders and stakeholders is essential for investors because it helps assess the risks and rewards, understand parties’ rights, prepare for disagreements, evaluate investment choices, and measure the impact of company decisions. These insights enable informed decision-making.

How do shareholder and stakeholder models affect company performance and decision-making?

Shareholder models may lead a company to prioritize short-term financial performance, potentially sacrificing innovation and long-term stability. Stakeholder models encourage a broader approach, considering the impact on all parties, which may enhance reputation, sustainability, and long-term success. Both influence strategic corporate decisions significantly.

What should businesses pay more attention to; shareholders or stakeholders?

Businesses must strike a balance between shareholder expectations for financial returns and stakeholder needs for sustainable and ethical operations. Finding the equilibrium that aligns long-term shareholder value with broad stakeholder engagement is key to modern corporate success.