Defining Shareholders

What is a Shareholder?

A shareholder is an individual or entity that legally owns one or more shares of stock in a company. Owning shares gives them a claim to a portion of the company’s assets and earnings. Shareholders can be anyone from individual investors to large institutions. Their main goal is to see the value of their shares increase and to receive dividends, if available. They have the power to vote on important company issues, such as electing the board of directors, through their shares.

KEY TAKEAWAYS

- Influence and Responsibilities: Shareholders play a pivotal role in influencing corporate decisions through voting rights and engaging with the company’s board of directors. They contribute to the company’s capital base and have a say in its strategic direction, making their role crucial in the broader economic system.

- Financial Implications: Shareholders have potential financial gains from dividends and capital returns. For instance, real estate investment trusts are obligated to distribute at least 90% of their taxable income as dividends to shareholders, highlighting the direct financial benefits they receive.

- Engagement and Empowerment: Creating avenues for shareholder engagement, such as meetings or online platforms, empowers them and improves their satisfaction. Consistent access to the board of directors and having their voices heard is critical in ensuring they feel valued and part of the decision-making process.

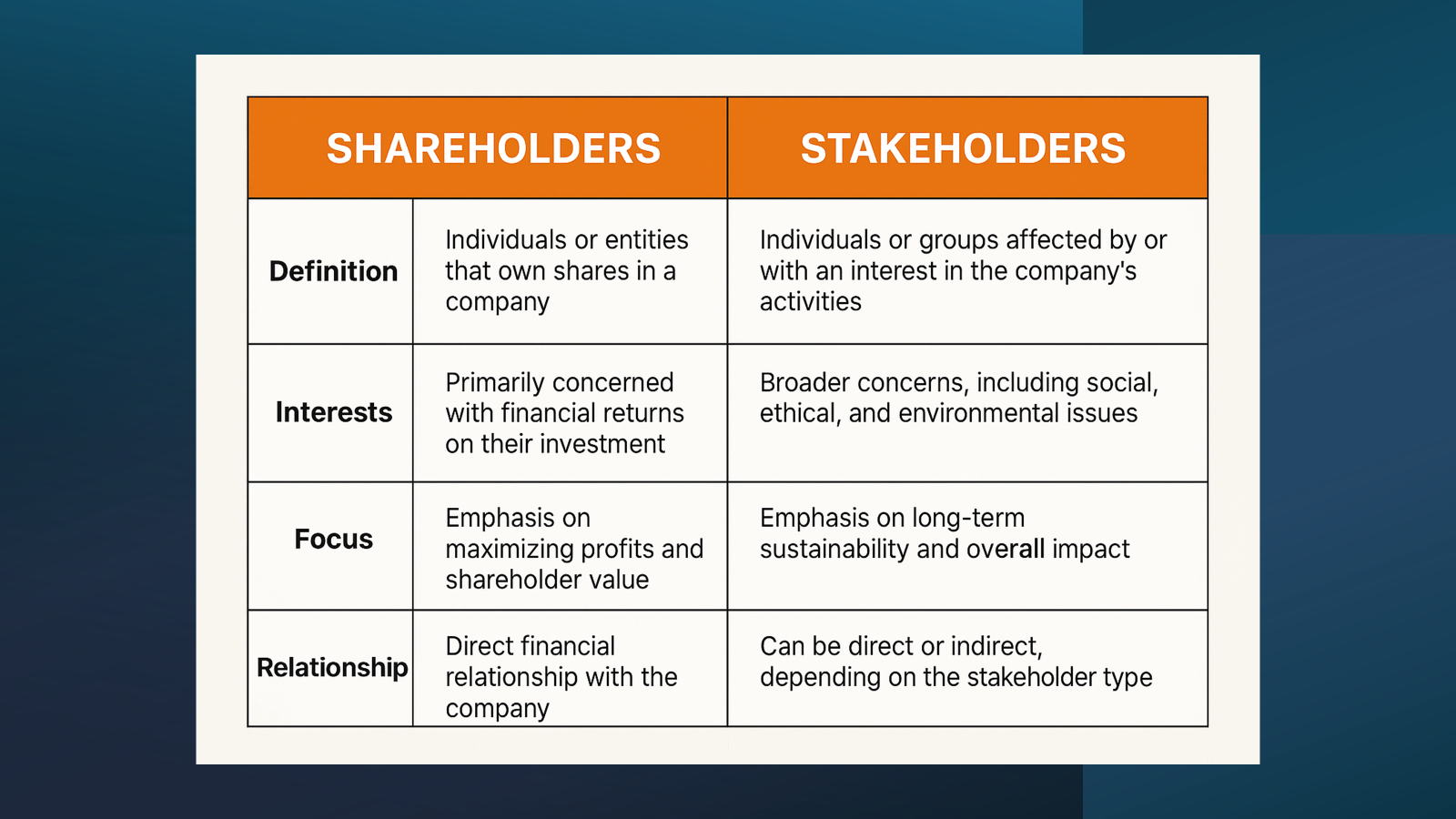

Key Differences Between Shareholders and Stakeholders

While you might hear terms like “shareholder” and “stakeholder” used interchangeably, they represent distinct concepts. Shareholders are a subset of stakeholders, exclusively owning shares in a company and focused primarily on financial returns. In contrast, stakeholders encompass a broader group, including anyone affected by the company’s operations—employees, customers, suppliers, and the wider community. Whereas shareholders’ primary interest lies in the financial performance of the company, stakeholders may be concerned with other factors like environmental impact, product quality, or employee welfare.

Roles of a Shareholder

Shareholders in Corporate Governance

In corporate governance, shareholders are crucial players. They wield influence through voting rights on major decisions, such as mergers, acquisitions, and the election of the board of directors. Shareholder voting is a pivotal process, as it can significantly impact the company’s equity and strategic direction. Their votes can shape the company’s strategic direction and management policies. Shareholder meetings, often annual, provide a platform for them to express their views and raise concerns about corporate practices. This participation ensures accountability and transparency from the company’s leadership, aligning company actions with shareholder expectations.

Shareholders often exercise their influence via proxy votes, allowing them to participate in corporate voting without being physically present. This can be particularly important for minority shareholders who wish to safeguard their interests. For instance, attending annual meetings by proxy or influencing shareholder profits through strategic voting are vital aspects of corporate governance that ensure diverse shareholder engagement and protect shareholder privileges. Shareholder verification processes are essential in maintaining accurate records and ensuring fair voting practices.

Rights and Responsibilities

Shareholders possess distinct rights and responsibilities within a company. Key rights include voting on major corporate matters, receiving dividends, and accessing important company information. They also have the privilege of attending annual general meetings and inspecting financial statements, ensuring transparency. Furthermore, shareholders often exercise their rights through charter agreements that outline the company’s governance structure. It’s crucial for them to realize that creditors, bondholders, and preferred stockholders have precedence over common stockholders when a company liquidates its assets. Responsibilities, although less formalized, include staying informed about company performance and actively participating in key decisions, which may involve accounting analysis for better decision-making. Shareholders must also consider the broader impact of their decisions on the company’s sustainability and overall health. Receiving and providing feedback is essential to maintaining a healthy dialogue with the company’s management. Verification of information shared by the company is fundamental in safeguarding shareholder interests.

Types of Shareholders

Common vs. Preferred Shareholders

Common and preferred shareholders differ mainly in terms of rights and benefits. Common shareholders have voting rights, allowing them to influence corporate decisions. They benefit from potential dividends and appreciation in stock value. However, their claim on assets comes last during liquidation. In contrast, preferred shareholders usually lack voting rights but enjoy a fixed dividend and priority over common shareholders in asset liquidation. They also typically receive dividends before any are distributed to common shareholders. Class B shares, for instance, might offer different voting rights to common shareholders, such as having only one vote per share compared to Class A shares. Despite these differences, both share types play integral roles in raising capital and providing investment options.

Institutional vs. Individual Shareholders

Institutional and individual shareholders vary significantly in their influence and investment capacity. Institutional shareholders include entities like pension funds, mutual funds, and insurance companies. They own large volumes of shares, providing them significant clout in policymaking and company strategy. Their interests often focus on long-term stability and returns. Individual shareholders, on the other hand, are everyday investors with potentially smaller shareholdings. They enjoy the benefits of ownership, such as dividends and voting rights, but their individual influence is generally limited compared to institutional counterparts. Despite these differences, both contribute significantly to the shareholder base and overall market dynamics.

Ordinary vs. Preference Shareholders

Ordinary shareholders, also known as common shareholders, are typically granted voting rights and participate in decision-making processes through shareholder meetings. They may receive dividends, but these are not guaranteed and are subject to the company’s profitability. In contrast, preference shareholders are prioritized over ordinary shareholders when it comes to dividend payments and claims on assets in the event of liquidation. However, they generally do not hold voting rights. Preference shares come with a fixed dividend, offering a more stable income stream. Both types of shareholders play vital roles in a company’s financial structure, balancing risk and return for investors with varying priorities.

Why Shareholders Matter

Influence on Company Strategy

Shareholders wield significant influence over company strategy through their voting rights and investment decisions. By voting on key issues such as board elections, mergers, and corporate policies, they can shape the direction the company takes. Large shareholders, particularly institutional investors, can impact management decisions and strategic initiatives through their substantial influence. Additionally, when shareholders voice their opinions or concerns, especially during annual meetings, it can lead to strategic adjustments aligning with their expectations. For example, some companies in the marketplace can observe shifts in strategic direction due to substantial shareholder feedback, ensuring creditors do not disrupt the balance between growth ambitions and shareholder interests. This relationship ensures that companies remain accountable to those who fund them, fostering a balance between growth ambitions and shareholder interests.

Economic Impact

Shareholders greatly contribute to the economic impact of companies and the broader market. Their investment injects capital into businesses, enabling growth, innovation, and expansion. This influx of funds can lead to job creation, enhanced goods and services, and increased tax revenues for governments. A vibrant shareholder base supports stock market stability, affecting economic indicators like consumer confidence and economic growth. Furthermore, active shareholder participation can drive companies to adopt sustainable practices that positively impact the economy in the long term. Ultimately, shareholders play a vital role in the economic ecosystem by fostering financial stability and growth.

Understanding Shareholder Theory

Origins and Principles

Shareholder theory, attributed largely to economist Milton Friedman, posits that the primary responsibility of a business is to maximize shareholder value. Emerging prominently in the 20th century, this theory underlines that management’s primary obligation is towards its shareholders, aiming to increase profitability within legal and ethical boundaries. It emphasizes efficiency, competitiveness, and financial gains as core objectives. Over time, the principles have evolved to include considerations of transparency and accountability, ensuring that companies meet shareholder expectations while sustaining growth and innovation. Understanding these origins helps explain the pivotal role shareholders play in shaping corporate priorities.

Shareholder Theory vs. Stakeholder Theory

Shareholder theory and stakeholder theory represent two different paradigms of corporate responsibility. Shareholder theory maintains that a company’s primary obligation is to maximize financial returns for its shareholders. According to Yurle Villegas of Investopedia, this theory emphasizes profit maximization, efficiency, and shareholder value. Conversely, stakeholder theory posits that businesses should consider the interests of all stakeholders—employees, customers, suppliers, and the community—alongside shareholders. This approach advocates for balancing various interests to achieve long-term sustainability and ethical responsibility. The dictionary definition of a shareholder is an entity owning shares in a company’s stock or mutual fund, illustrating the primary focus of shareholder theory. While shareholder theory emphasizes financial gains, stakeholder theory broadens corporate accountability to include social and environmental concerns.

Shareholder Rights and Liabilities

What rights do stock holders have?

Stockholders have the right to vote on significant corporate matters, receive dividends if declared, and attend annual general meetings. They also enjoy privileges such as inspecting company financials and other pertinent information, thus ensuring transparency and accountability from company management. Additionally, shareholders can influence substantial business changes and propose shareholder resolutions. Verification of their ownership status is crucial to exercising these rights and privileges effectively.

Legal Protections

Shareholders benefit from various privileges and legal protections to ensure their interests are safeguarded. These include laws that protect against fraudulent practices, ensuring they receive accurate financial verifications, disclosures, and reports. Shareholders also have recourse to take legal action against a company for breaches of fiduciary duties by executives, mitigating potential liabilities. Anti-discrimination laws and regulations maintain fair treatment, and shareholder agreements can offer additional protective measures. These legal frameworks aim to uphold trust and ensure fair play in the shareholder-company relationship.

How Shareholders Make Money

Dividends and Capital Gains

Shareholders can earn money primarily through dividends and capital gains. Dividends are portions of a company’s earnings distributed to shareholders, typically on a regular basis, providing a steady income stream. The amount depends on the company’s profitability and dividend policy. Capital gains, on the other hand, occur when shareholders sell their shares for more than the purchase price, offering potential for substantial profit through appreciation in stock value. Both dividends and capital gains are influenced by the company’s financial health and market conditions, providing diversity in earning opportunities for shareholders.

Risk and Rewards

Investing as a shareholder involves balancing risks and rewards. Potential rewards include earning dividends, capital gains from stock appreciation, and influence over company decisions. However, risks also accompany these opportunities. Market volatility can lead to fluctuating stock values, and economic downturns can impact dividends. Moreover, shareholders are generally last in line for asset claims if a company faces bankruptcy. Despite these risks, the potential for significant financial growth and active participation in business governance appeals to many investors. Informed decision-making and diversification can help mitigate risks and enhance the rewards for shareholders.

FAQs

What is the meaning of shareholders?

Shareholders are individuals or entities that own shares in a company. By holding shares, they possess an ownership stake in the company and have the right to vote on key corporate matters, receive dividends, and benefit from the company’s financial growth. Their primary interest is in the company’s profitability and share value increase.

Are shareholders the same as stakeholders?

No, shareholders and stakeholders are not the same. Shareholders specifically own shares in a company and focus on financial returns. Stakeholders, however, include anyone affected by the company’s actions, such as employees, customers, suppliers, and the community, extending beyond shareholders to consider broader interests and impacts.

Can anyone become a shareholder?

Yes, anyone can become a shareholder by purchasing shares through a brokerage platform or a stock market. All you need is an investment account and capital to invest in the company’s stocks of choice. It’s accessible to individuals globally, allowing participation in corporate growth and financial benefits.

What are the main benefits of being a shareholder?

As a shareholder, you gain potential financial benefits like dividends and capital gains from stock value appreciation. You also have voting rights to influence corporate decisions and access to company reports, offering transparency into operations. Shareholding can diversify your investment portfolio.

How do shareholders influence company decisions?

Shareholders influence company decisions mainly through voting on critical issues such as electing directors, approving mergers, and setting executive compensation. They can propose shareholder resolutions and engage in dialogue with management to express their viewpoints, driving strategic directions.

How can I use Shareowneronline to manage my shares?

You can manage your shares using Shareowneronline by registering for an account, which enables you to view and update your shareholder information, monitor your investment portfolio, and reinvest dividends. The platform also allows you to buy or sell shares and communicate with company representatives, streamlining your shareholder activities.