KEY TAKEAWAYS

- Revenue represents the total amount of money a company earns from its main operations, such as selling goods or services. It appears at the top of an income statement and is considered the “top-line” figure.

- Income, or net income, is the remaining amount after all expenses have been deducted from revenue. It is found at the bottom of an income statement and is often referred to as the “bottom line.”

- Understanding the distinction between revenue and income is crucial for evaluating a company’s financial performance. A company with high revenue but equally high expenses may not be profitable, highlighting the importance of analyzing both metrics for more accurate financial assessments.

Defining the Key Terms

What is Revenue?

Revenue is the total amount of money a company brings in from its main business operations before expenses are deducted. Often referred to as the “top line” on an income statement, it includes money received from sales of goods, provision of services, or any other primary business activities. It acts as a crucial measure since it reflects the company’s ability to generate sales and gives insight into market demand for its products or services. Understanding key accounting terms associated with revenue, such as “gross revenue” and “net revenue,” can further enhance this assessment.

Revenue serves as an initial gauge of the company’s earning capabilities and is the starting point to determine profit. It’s essential to remember that while revenue indicates sales volume, it doesn’t reveal the profitability of those sales. For a deeper analysis, getting acquainted with various accounting terms can provide clarity on how different aspects like revenue and profitability relate to each other.

Understanding Income

Income, often referred to as profit, represents the monetary gain a company achieves after subtracting its operating expenses, taxes, and other costs from its total revenue. Frequently shown as the “bottom line” on an income statement, this figure provides a clear picture of a company’s overall profitability. Tracking key performance indicators (KPIs) related to income, such as net income and operating margin, can help identify trends and measure financial health over time. Gross income indicates the total amount earned by an entity before deductions, which is important when assessing accuracy in financial reporting. Additionally, focusing on allowances can help a business adjust its financial strategy and maintain precise earnings records. There are different types of income, such as net income, which is the amount a company keeps after all deductions, and operating income, representing earnings from regular operating activities after deducting operating expenses. Understanding income is crucial as it indicates how effectively a company is managing its costs and converting revenues into actual profit.

By dissecting income figures, businesses can pinpoint operational efficiencies or areas that may need improvement, offering valuable insights for strategic planning and decision-making. Verifying these figures can ultimately enhance productivity and optimize business performance.

The Significance of Revenue in Financial Statements

Revenue as a Business Scale Indicator

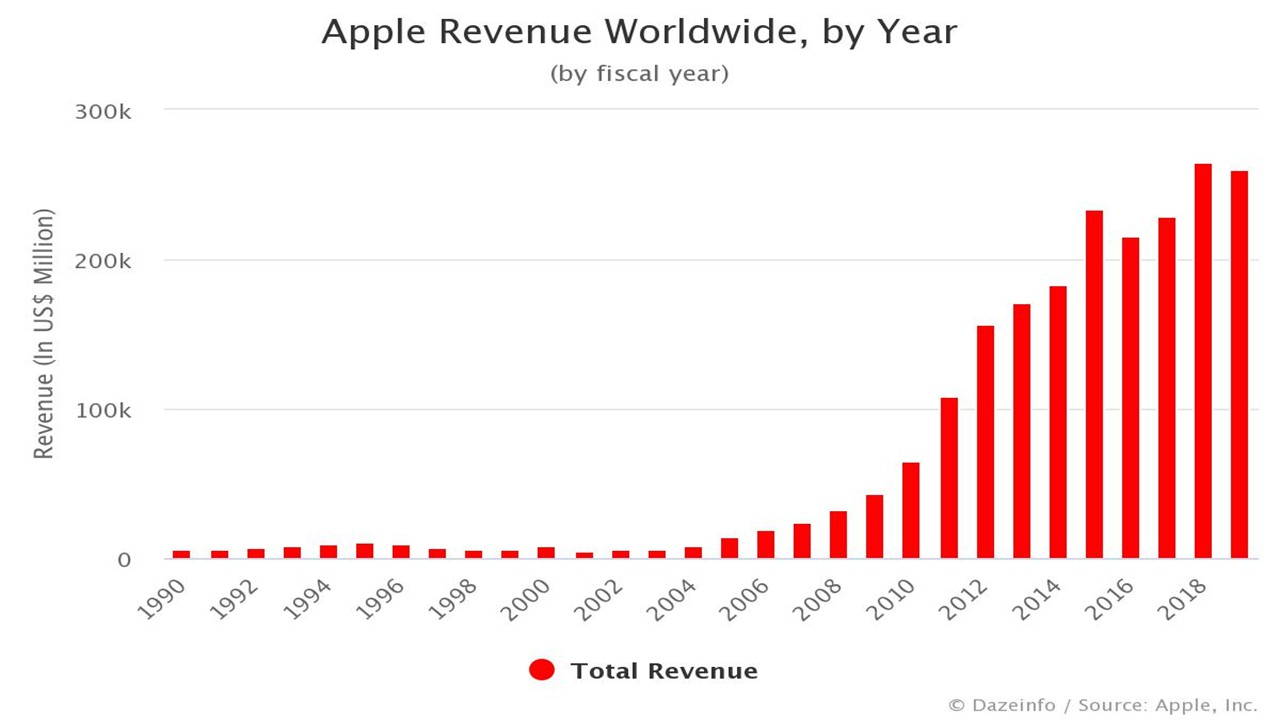

Revenue is a critical indicator of a business’s scale, showcasing its capacity to generate sales and reflect its market reach. It essentially acts like a thermometer measuring the overall market demand for a company’s products or services. When revenue numbers are significantly high, it can suggest strong market presence, expansive customer base, and robust sales channels.

Moreover, investors and analysts often use revenue to evaluate a company’s growth potential. Consistent revenue growth can imply successful business strategies and expansion, potentially attracting more investment. However, it’s important to couple revenue figures with profitability metrics to fully understand the efficiency of operations.

Overall, while revenue highlights operational size, it needs to be assessed alongside income to provide a comprehensive view of a business’s health.

Types of Revenue: Operational vs Non-Operational

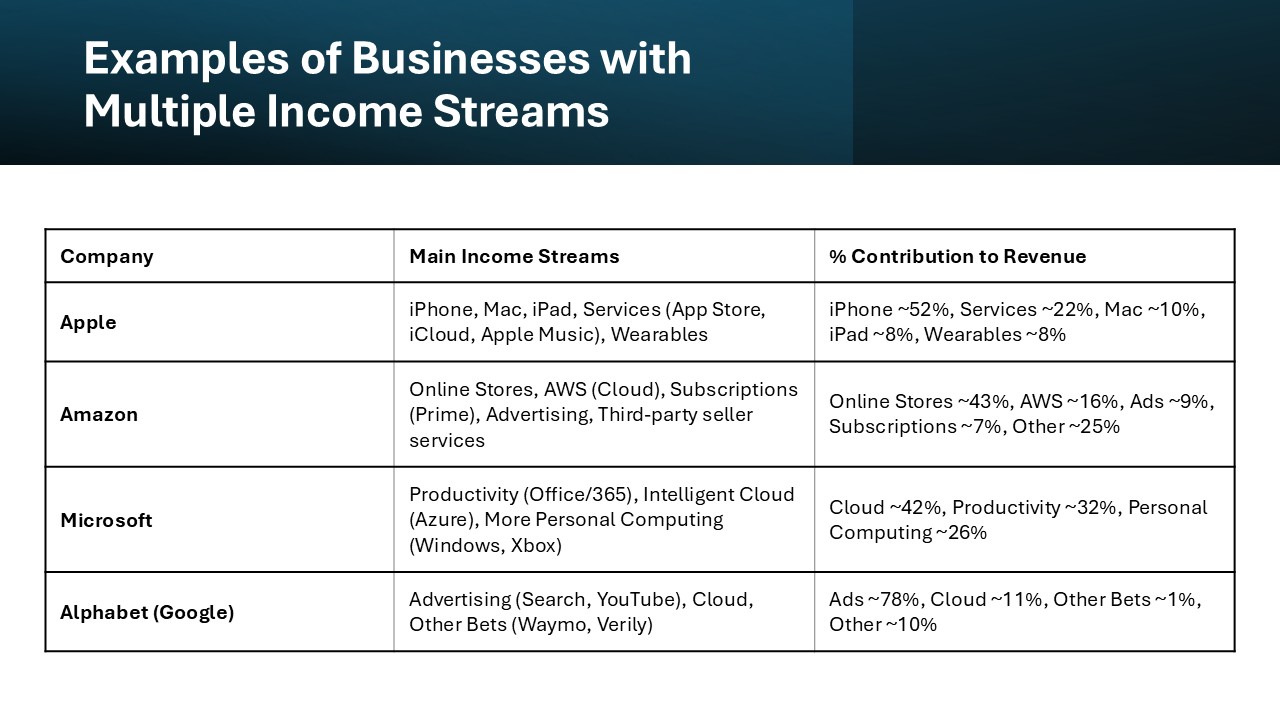

Revenue can be categorized into operational and non-operational, each playing a distinctive role in financial statements. Operational revenue arises from a company’s core business activities. For a retail business, this could be sales of merchandise, while for a service provider, it’s fees received for services rendered. This type of revenue is key to understanding the primary earnings potential and stability of a business. For example, Apple’s income from iPhone sales is a significant source of operational revenue that illustrates its core business activity. Non-operational revenue, on the other hand, is derived from secondary or incidental activities that are not part of the main business operations. This might include rental income from property owned by the company, dividends from investments, or gains from the sale of assets. Such non-operating transactions can boost total revenue, but non-operating expenses can also impact profitability by creating occasional financial setbacks. While these sources can boost total revenue, they are typically less predictable and not sustainable long-term indicators of business health.

By distinguishing between these two types of revenue, businesses and analysts can better assess which income streams are contributing to financial growth and which may be more volatile or less reliable over time. Berkshire Hathaway, for instance, showcases substantial non-operational revenue through its investments, significantly affecting their financial statements. This distinction aids in evaluating the full spectrum of a company’s financial dynamics.

Unpacking Income and Earnings

Net Income vs Gross Income

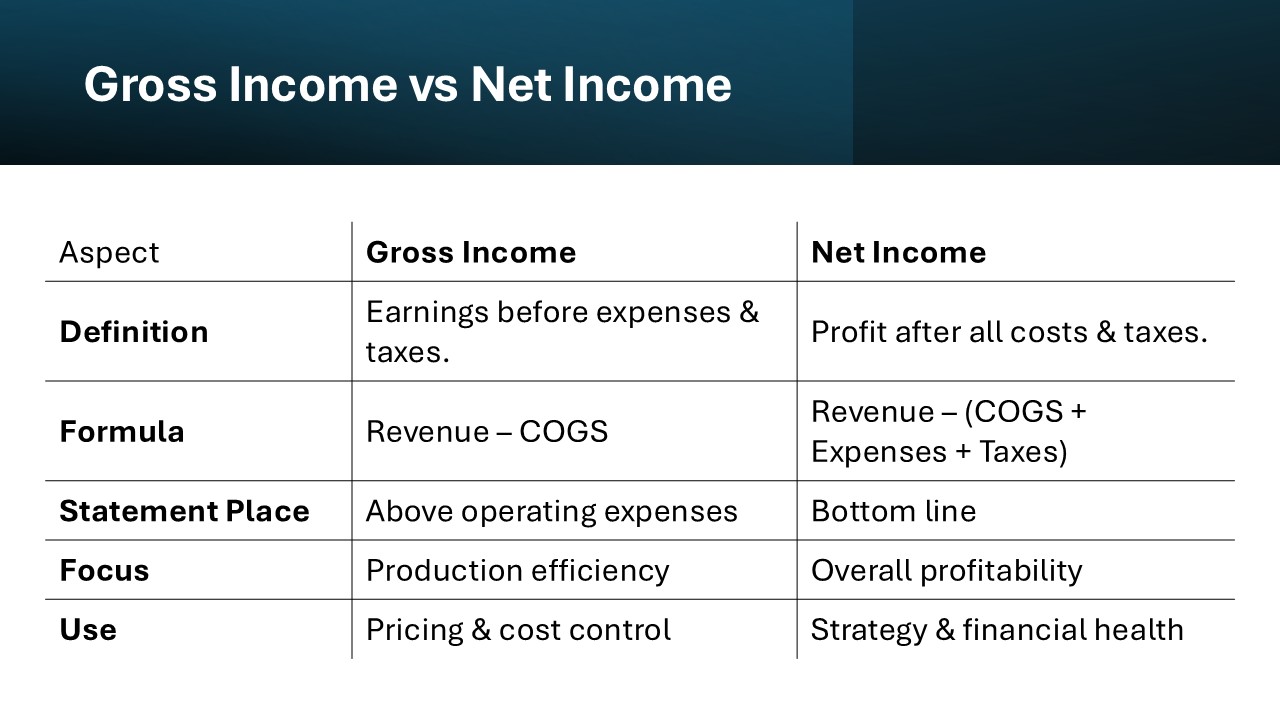

Net income and gross income are two fundamental measures that help articulate a company’s profitability but differ in their scope and calculation.

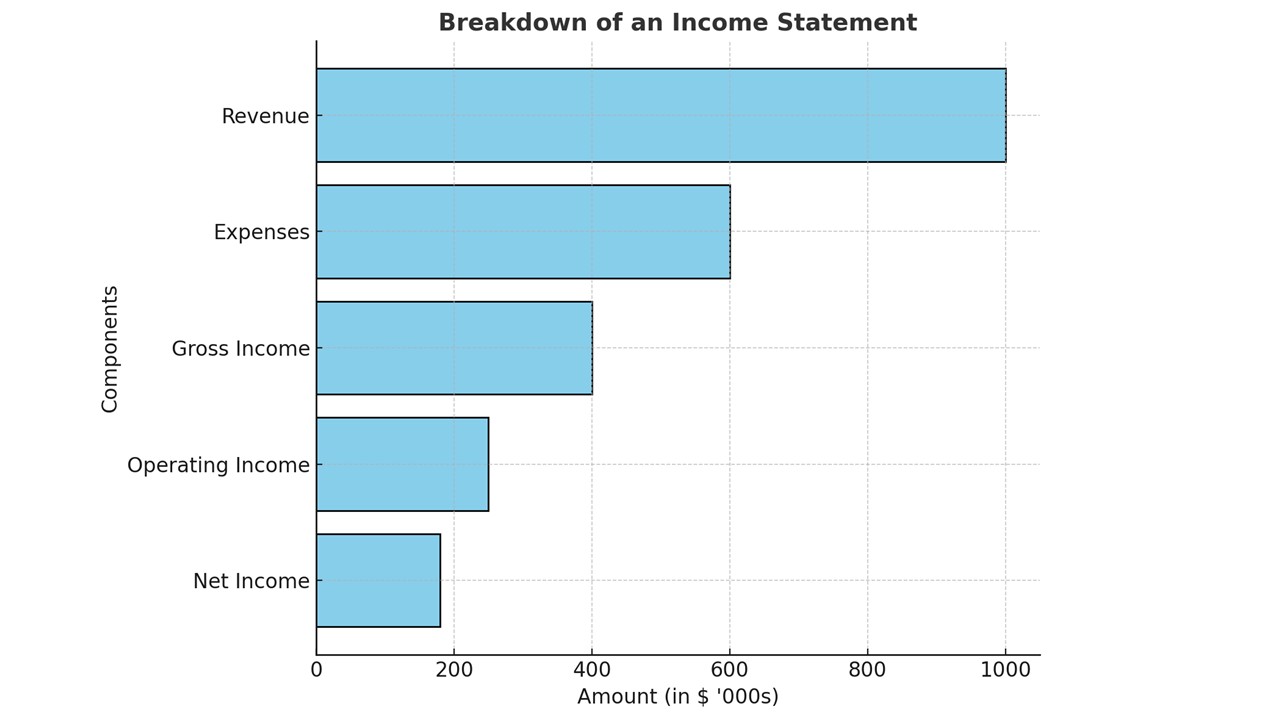

Gross income, or gross profit, is the amount remaining after subtracting the cost of goods sold (COGS) from total revenue. It provides insight into how well a company is managing production and service delivery costs. For example, it highlights the efficiency of production processes and pricing strategies.

Net income, however, goes a step further by deducting all operating expenses, taxes, interest, and other costs from gross income. This figure truly represents the company’s profitability as it accounts for all financial obligations. It’s a crucial indicator for investors as it reflects how much money is actually being retained by the company.

While gross income offers a snapshot of immediate profitability from core activities, net income provides a comprehensive picture of overall financial health, influencing decisions on dividends and reinvestment strategies.

Examples of Various Income Streams

Businesses typically have diverse income streams, each contributing to financial stability and growth. Several examples illustrate the array of possibilities:

- Sales Revenue: This is the primary income source for most companies, derived from selling products or services directly related to their core operations.

- Subscription Fees: Companies like software providers or media streaming services often charge regular subscription fees for access to their platforms, providing predictable, recurring income.

- Rental Income: Businesses owning real estate may earn income by leasing out space or properties, adding a steady revenue stream that doesn’t rely on their primary market.

- Dividend Income: Companies holding shares in other corporations might receive dividend payments, which can add to their financial resources without additional operational efforts.

- Licensing Fees: By granting permission to use technology, patents, or branding, companies can earn significant fees, thus leveraging intellectual property for additional income.

Diversifying income streams allows businesses to mitigate risks associated with market fluctuations and enhances financial resilience. By tapping into a variety of revenue channels, a company can ensure more stable financial health over time.

Revenue vs. Income: Key Differences

Calculation Methods for Revenue and Income

Calculating revenue and income involves understanding various components and using specific formulas tailored to a business’s operations. Revenue Calculation:

To determine total revenue, use the formula: Total Revenue=Price per Unit×Number of Units Sold. This formula captures the gross inflow from sales activities and is versatile across different industries. For instance, an online retailer would multiply the price of products by the total number of items sold during a period. Revenue can be further projected through financial forecasting to anticipate future sales outcomes. Financial planning can also be simplified with the use of premium templates that automate these calculations.

Income Calculation:

Income, particularly net income, is computed as: Net Income=Total Revenue−Total Expenses]. This encompasses all operating costs, taxes, interest, and any additional expenses. Gross income, however, is found by subtracting the cost of goods sold (COGS) from total revenue: Gross Income=Total Revenue−Cost of Goods Sold (COGS). Each calculation provides insights into different business performance aspects—gross income for production efficiency and net income for overall profitability. Adjusted net income excludes non-recurring costs like depreciation for a more accurate performance analysis. To assist in such financial analysis, lenders may also consider operating revenue derived from interest and fees.

Understanding these calculation methods equips businesses with the tools to analyze financial performance comprehensively, aiding in strategic planning and performance assessment. By effectively calculating and differentiating between revenue and income, where income is revenue minus expenses, companies can better gauge their financial health and identify potential areas for improvement or investment. Such analysis may also include filing financial details using forms like Schedule C for sole proprietorships. These processes may benefit from technology, such as integrating troubleshooting solutions for accounting software via cloud services like Cloudflare.

Impact on Financial Health Indicators

Revenue and income significantly influence a company’s financial health indicators, each offering unique insights into business viability and stability. Leveraging determinants like these enables businesses to align their strategies effectively.

Revenue’s Role:

Revenue serves as a primary measure of business activity, providing insight into market demand and operational scale. Stagnating or declining revenue may signal shrinking demand or market share, while steady or rising revenue suggests growth and customer acquisition. Additionally, revenue is key in determining net sales, which is the total revenue after accounting for sales discounts, returns, and allowances.

Income’s Influence:

Income, particularly net income, directly impacts profitability metrics such as return on equity (ROE) and earnings per share (EPS). High net income indicates effective cost management and operational efficiency, aligning closely with shareholder interests. Utilizing advanced accounting software can aid in accurately tracking these metrics, ensuring financial reports reflect true business performance. Moreover, both individuals and entities must consider how their net income, after expenses and taxes, shapes their overall financial picture.

Both revenue and income affect cash flow statements and balance sheets — revenue through accounts receivable and income through retained earnings. Their interplay shapes key financial ratios, like profit margins, that are crucial for investors’ assessments of profitability relative to industry standards.

For a holistic view, both metrics should be analyzed together. For instance, while robust revenue indicates strong sales, without corresponding net income growth, it may point to inefficiencies. Evaluating these indicators together provides a more nuanced understanding of a company’s financial health.

Real-World Applications: Revenue and Income Analysis

Using Both Metrics for Business Evaluation

Evaluating a business using both revenue and income metrics offers a comprehensive view of its financial landscape. Each metric sheds light on distinct aspects of business performance, and together, they reveal the full picture of financial health, operational efficacy, and detailed valuation. Grasping these metrics is crucial as they encapsulate both the topline and the bottom line implications of business operations.

Revenue shows a company’s ability to generate sales and capture market interest. It’s a leading indicator of business scale, allowing stakeholders to gauge market trends and growth potential. However, high revenue without corresponding income growth might indicate underlying efficiency problems or excessive expense burdens.

Income, particularly net income, reveals the true profitability after all expenses are accounted for. It highlights cost efficiency and the capacity to convert sales into actual profit, crucial for sustainable growth. For investors and analysts, income metrics provide insights into risk management, operational control, and financial stability. By understanding Earnings Before Interest and Taxes (EBIT) as a module, stakeholders can dive deeper into the operational aspects without the noise of financial leverage.

By jointly assessing revenue and income, stakeholders can identify growth opportunities and operational challenges. For instance, an increase in revenue coupled with stagnant net income might flag potential cost issues or needed strategic pivots. Such key takeaways help in refining strategies, optimizing operations, and making informed decisions that align with long-term objectives.

Case Studies of Revenue vs Income in Action

Examining case studies that highlight the dynamics between revenue and income offers valuable lessons in financial management and strategic decision-making.

Case Study 1: Retail Expansion

A popular retail chain experienced soaring revenue due to aggressive store expansion across multiple regions. However, despite revenue growth, their net income remained flat due to increased operational and staffing costs. By integrating exclusive promotions and premium product lines, the company was able to attract more high-value customers, ultimately boosting income while maintaining revenue growth.

Case Study 2: Tech Startup

A tech startup saw a sharp rise in revenue after launching a successful new product. Despite this, their net income declined due to heavy marketing expenses and product development costs. Through participation in a certification program to enhance employee expertise, the company was able to adopt efficient cost-cutting strategies and focus on high-impact marketing channels, thereby enhancing income margins while continuing to drive revenue growth. This adjustment not only improved profitability but also increased investor confidence.

Case Study 3: Subscription Service

An established subscription-based service provider maintained steady revenue but experienced fluctuating net income due to seasonal promotions and customer retention efforts. By refining their pricing strategy and incorporating premium service tiers, they were able to stabilize their income stream and improve profit margins. This strategic shift emphasized the significance of balancing promotional costs with revenue-generated value.

These case studies underscore the critical nature of aligning revenue strategies with income-generating efficiencies, showcasing how businesses can strategically manage their financial health by evaluating both metrics. By learning from these examples, companies can better prepare for similar challenges and align strategies for sustainable success.

Common Misconceptions Debunked

Is Higher Revenue Always Better?

While higher revenue might initially seem advantageous, it isn’t always indicative of overall business health or profitability. Revenue growth can suggest market expansion and increased sales, which are positive signs of a company’s reach and consumer demand. However, without accompanying improvements in efficiency and cost management, rising revenue might lead to disproportionately higher expenses, including amortization and other non-cash items.

Consider a company that’s aggressively expanding its market presence. Although this results in higher revenue, the costs associated with expansion—like increased staffing, marketing, logistics, and amortization of intangible assets—can lead to reduced net income or even losses. Thus, focusing solely on revenue without managing the associated costs might mask financial vulnerabilities.

Therefore, the key lies in evaluating revenue in conjunction with other metrics like profit margins, operational costs, net income, and business valuation. A balanced approach ensures sustainable growth and profitability rather than relying solely on high revenue figures. For a practical understanding, you might consider learning more through a Financial Modeling and Valuation Analyst (FMVA) certification.

The Myth of Revenue Guaranteeing Profitability

Many people believe that high revenue automatically translates to profitability, but this is a common misconception. Revenue represents the total earnings from sales before any costs or liabilities are subtracted, whereas profitability is determined after accounting for all expenses, including costs of goods sold, operating expenses, taxes, and interest. A company might report impressive revenue figures, but if its expenses outweigh these earnings, it will still incur losses. For instance, a startup might excel in generating buzz and securing sales, but extensive marketing expenses and high acquisition costs could erode profits. In addition to these costs, accounting practices such as amortization expense and depreciation expense play a significant role in determining net income, further impacting profitability. Additionally, focusing purely on revenue can sometimes lead businesses to neglect cost control measures or operational efficiencies. This oversight can result in diminished net income, despite high sales volumes. For sustainable success, businesses need to optimize both revenue and expenses, ensuring a solid profit margin that genuinely reflects financial health.

FAQs

What is the difference between income versus revenue?

Revenue is the total money a company earns from its business activities, while income, particularly net income, is what’s left after all expenses, taxes, and costs are deducted from revenue. In essence, revenue shows sales volume, whereas income illustrates profitability. They reflect different aspects of financial performance and are critical in evaluating a company’s fiscal health.

How do I calculate my business revenue?

To calculate your business revenue, multiply the price per unit by the number of units sold. For service-based businesses, multiply the service fee by the number of services provided. Include all sales-related income but exclude returns and discounts. This calculation provides your total sales revenue, essential for financial analysis.

Can a company have high revenue but low income?

Yes, a company can have high revenue but low income if its expenses and costs significantly reduce its net income. During a recession, for instance, businesses may face decreased revenue and additional pressures that make profitability challenging. Heavy marketing spending, high operational costs, and inefficient resource management can all contribute to lower profitability despite strong sales figures, and accounting teams are crucial in managing these aspects. Balancing revenue generation with effective cost control, such as managing discounts and refunds, is vital for maintaining a healthy bottom dollar.

What are common sources of revenue for companies?

Common sources of revenue for companies include sales of products and services, subscription fees, licensing and royalty payments, rental income from property, and investment gains like interest and dividends. Each revenue stream contributes differently to the overall financial health and stability of a business, allowing for diverse income avenues.

How does net income reflect a company’s performance?

Net income reflects a company’s performance by showing its profitability after accounting for all expenses, taxes, and costs. It indicates how effectively a company is managing resources and turning revenue into actual profit. A healthy net income suggests efficient operations and financial health, making it a crucial indicator for investors and stakeholders.

Which is more important for investors: revenues vs income?

For investors, income often holds more importance as it highlights the company’s profitability and financial health. Revenue shows the ability to generate sales, but income reflects how well the company controls costs and converts revenue into profit. Therefore, a balanced evaluation of both metrics provides the most comprehensive insight into a company’s potential for sustainable growth.