Historical Context and Evolution

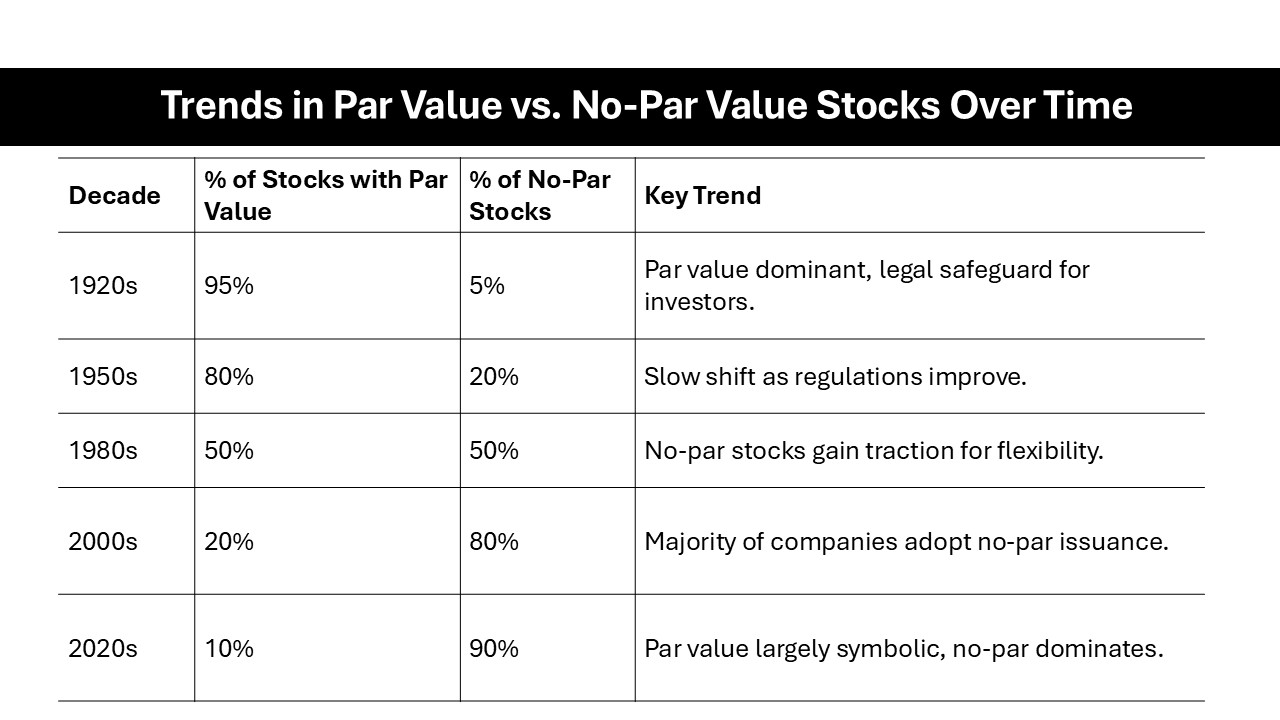

The concept of par value has its roots in the early days of corporate finance when it was introduced as a safeguard to protect investors. Originally, it was used to ensure companies could not sell shares below a minimum level and to provide a fixed reference point for investors. This was especially vital at a time when financial markets were less regulated and more prone to manipulation. In recent times, par value has taken on a different meaning in the banking sector as it continues to play a crucial role in understanding the valuation of financial instruments such as bonds.

Over time, the significance of par value in stocks has decreased, reflecting changes in market regulation and investor protection laws. Companies now often issue no-par stocks, which allow them more flexibility in pricing and reporting. However, the fundamental concept persists in bond markets where it remains critical for calculating interest rates and determining the bond’s redemption value. Within investment banking, professionals still rely on par value for structured finance dealings.

Par Amount in Stocks

Importance for Investors

Par value holds differing implications depending on whether you’re dealing with stocks or bonds. For stock investors, the par value is less about market dynamics and more about legal formalities, primarily existing to meet regulatory requirements. It serves as a nominal value for reporting purposes and rarely influences the stock’s market price or investment decision-making directly. On the other hand, the concept of dividends might be more impactful, as investors must consider how tax implications can affect their total returns. Tax considerations, especially on dividends, might influence whether holding stocks is seen as more of an expense than an investment.

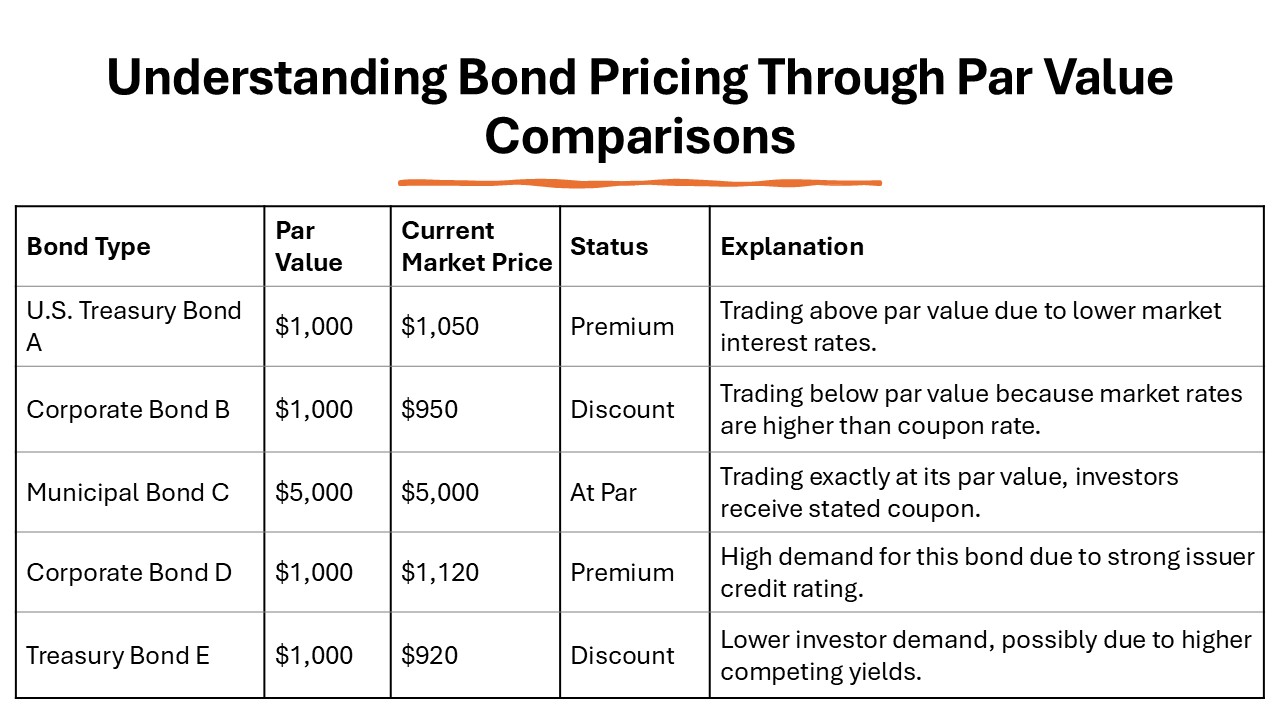

Conversely, for bond investors, par value is crucial. It forms the basis for calculating interest payments and evaluating yield. Understanding a bond’s par value helps investors assess whether a bond is trading at a premium or discount, which can influence potential returns. When buying bonds below par value, investors should also consider the tax implications, as gains or losses are taxed based on the difference between the purchase price and par value if the bond is held until maturity. With bonds, the coupon rate, a fixed dollar amount, is typically based on this par value—providing bondholders with regular interest payments for loaning the bond issuer money. For bonds, a bond trading significantly below its par value might offer opportunities for higher yields, provided the investor is comfortable with the associated risks.

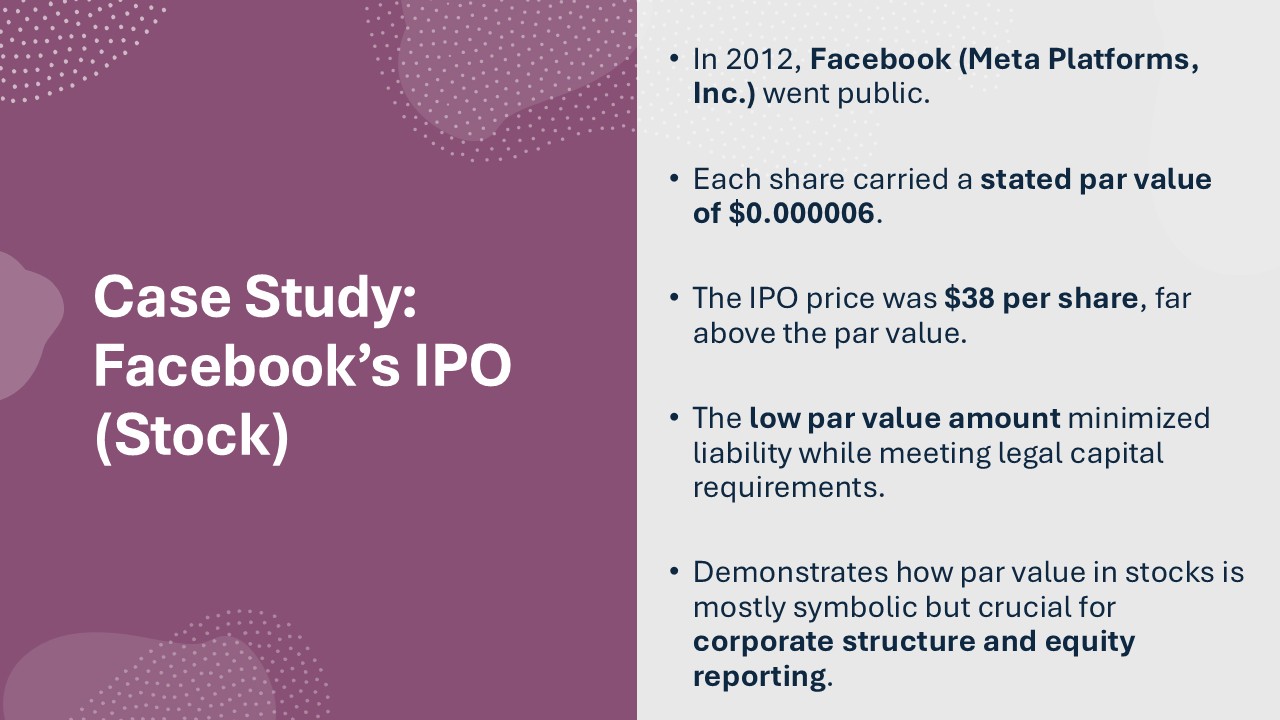

How Par Value Affects Stock Issuance

When companies issue stocks, par value plays a fundamental role in setting the minimum price for which shares can be sold, particularly during an initial public offering (IPO). This ensures a basic structure for accounting and legal compliance, safeguarding the interests of shareholders. The par value definition helps preserve the par value in the company’s financial statements, often in the shareholders’ equity section, as a part of called-up share capital. Despite its limited influence on shares trading prices, par value impacts organizational practices by determining the allocation of proceeds from stock sales between contributed capital and additional paid-in capital. Companies strategically select very low par values to avoid potential legal issues associated with selling shares below this amount and to maintain flexibility in financial reporting. This practice also limits legal liability and ensures compliance with articles of incorporation requirements.

Common Misunderstandings

One common misunderstanding is that par value reflects the actual worth or market price of a stock, which is not the case. Par value is merely a bookkeeping device and holds little relevance to the stock’s trading price, which is determined by market demand, investor sentiment, and company performance.

Additionally, some investors mistakenly believe that par value correlates with a company’s potential for success or failure, which it doesn’t. Par value serves more legal and historical functions rather than financial predictions. For bonds, another common misconception is that the par value will be received at any selling point, whereas, in reality, bond prices fluctuate based on interest rate changes and market conditions, often leading to trading at a premium or discount.

Par Amount in Bonds

Role in Bond Pricing and Yield Calculation

The par value of a bond is pivotal in determining both its pricing and the calculation of its yield. With bonds, the par value is the fixed dollar amount that bond issuers agree to repay to the purchaser at the bond’s maturity date. When priced at par, the bond’s market value equals its face value, meaning the issuer will repay this amount upon maturity. This assigned value acts as a pricing benchmark for evaluating whether bonds are trading at a premium or discount due to changes in interest rates or issuer credit quality. For yield calculations, the bond’s coupon rate, based on the par value, determines the annual interest income. Yields are often expressed as a percentage of the par value, allowing investors to compare the returns of different bonds consistently. When the market interest rate climbs above the coupon rate, the bond’s price typically falls below par, increasing its yield, which impacts the dollar amount an investor might receive. Conversely, if market rates fall, the bond might trade above par, decreasing its yield.

Comparison with Face Value

In the realm of bonds, “par value” and “face value” are often used interchangeably, both representing the amount the issuer agrees to pay back at the bond’s maturity. However, subtle distinctions can arise in certain contexts, particularly in financial reporting and discussion.

While the par value is the base for calculating interest payments and determining the redemption amount, the face value might sometimes be adjusted slightly to reflect currency or inflation adjustments, though this is relatively rare. Investors typically use these terms interchangeably since both indicate the same nominal repayment amount. Understanding the dual usage clarifies investment analysis, especially when comparing these values to market conditions that affect a bond’s current trading price.

Legal and Regulatory Considerations

Par value holds specific legal and regulatory implications, serving as a fundamental concept in maintaining corporate accounting and shareholder equity structures. For stocks, par value is critical in ensuring shares aren’t issued below a stipulated legal level, protecting against potential undervaluation in financial reporting. Many states, such as Delaware, allow issuing no-par stocks, providing flexibility and reducing liability concerns. This often entails setting a minimal par value, enabling companies to comply with jurisdictional legal requirements and simplify corporate governance.

In bond markets, par value lays the groundwork for standardized pricing, required disclosures, and compliance with securities regulations. This is especially relevant for corporate bonds where adherence to par value guidelines ensures transparency in financial statements and safeguards investor interests. The coupon rate, representing the interest payments made to bondholders, influences whether a bond trades at, below, or above par value. Regulatory bodies often scrutinize how these values are represented to ensure fair trading practice and accurate financial reporting.

No-Par Value Stock Explained

Differences from Par Value Stocks

No-par value stocks differ fundamentally from par value stocks in that they do not have a nominal value assigned on the stock certificate. This provides companies with greater flexibility in pricing and issuing shares without the constraints of maintaining a par value. No-par stocks simplify accounting practices, as they remove the necessity to manage the par value-based financial statement entries.

Given their lack of a predefined nominal value, no-par stocks rely on the board of directors to determine pricing based more closely on market conditions and company valuation. This can enable more adaptive fundraising strategies and potentially enhance investor confidence by aligning stock issuance more closely with actual market assessments. However, this might lead to less predictability in shareholder equity calculations.

Advantages and Drawbacks

No-par value stocks offer several advantages over their par value counterparts. They allow companies greater flexibility in setting and adjusting share prices, based more closely on current market conditions. This flexibility can be particularly beneficial during volatile market periods, enabling quicker capitalization strategies without legal restrictions tied to an arbitrary par value. Additionally, the absence of a par value can simplify financial accounting and reporting processes.

However, these stocks also come with certain drawbacks. The lack of a nominal value might create complexities in initial share pricing, requiring careful consideration by the company’s board to avoid undervaluation or investor skepticism. Moreover, without a set par value as a reference point, it can be more challenging for investors to assess the minimum legal capital or perceive traditional equity stability.

How to Calculate Par Amount

Calculating for Stocks

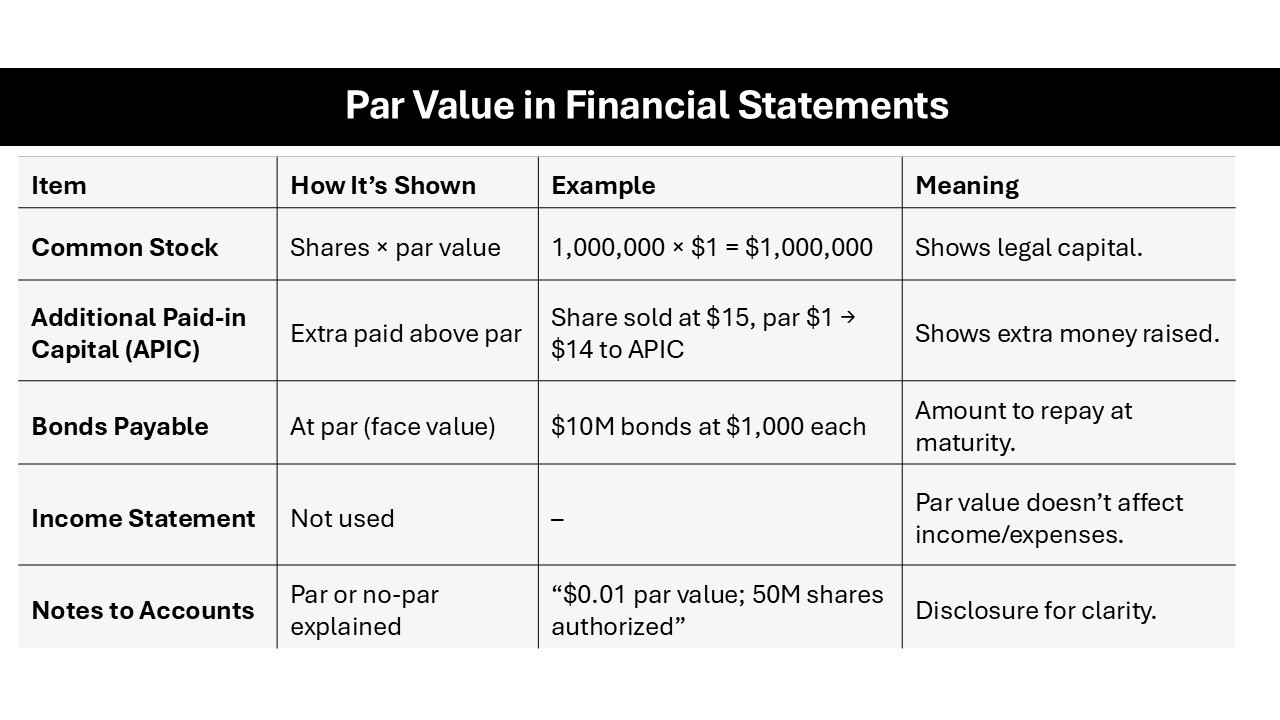

When dealing with stocks, the calculation involving par value is primarily straightforward since the par value remains constant. To determine the total par value of stock issued, simply multiply the par value per share by the total number of shares issued. This figure becomes a part of the company’s financial records, often reflected in the shareholder’s equity section of the balance sheet.

For instance, if a company issues 100,000 shares with a par value of $0.01 per share, the total par value would be $1,000. Understanding this calculation is crucial for maintaining accurate financial statements and meeting regulatory requirements, even if the par value itself does not significantly impact the stock’s market trading dynamics.

Calculating for Bonds

Calculating the par value for bonds is essential, as it serves as the reference point for interest calculations and repayment at maturity. The par value, or face value, is usually predetermined, often set at $1,000 per bond. When assessing bond transactions, it’s crucial to identify this fixed amount since it dictates the bond’s coupon payments, which are typically a percentage of the par value.

For example, if a bond has a par value of $1,000 and a coupon rate of 5%, it pays $50 in interest annually. The coupon rate helps investors determine the annual revenue they’ll receive from holding the bond. This calculation is pivotal in assessing the bond’s yield, particularly when its market price deviates from its par value due to fluctuating interest rates. Understanding these basics helps in evaluating the bond’s potential performance and comparing it to other investment opportunities.

Real-World Applications

In real-world financial markets, understanding the par amount’s intricacies plays a vital role across various applications. For stocks, while the par value might not directly influence the market price, it affects how companies report and categorize equity on their balance sheets, impacting investor perception and corporate financial strategies. Ensuring accurate calculations aids in compliance with accounting standards and regulatory requirements.

On the bond side, the par value directly links to interest computations and yield analyses. Investors and analysts often use par value to determine whether a bond is being traded at a premium or discount. This affects investment strategies, such as deciding the optimal time to buy or sell bonds, given interest rate shifts. Properly understanding and applying these principles can lead to more informed and beneficial investment decisions, aligning portfolios with investor risk tolerance and income objectives.

Par Amount vs. Market Value

Key Differences and Implications

Par value and market value are distinct financial metrics that serve different purposes and hold varying implications for investors and issuers. Par value represents the nominal value of a financial instrument, set during issuance and often unrelated to its market dynamics. This value establishes a baseline for stock issuance and bond interest calculations, providing a legal and accounting framework.

In contrast, market value fluctuates based on real-time supply and demand dynamics, investor sentiment, and economic factors, offering a true picture of what buyers are willing to pay. The implications are significant: while par value is critical for internal accounting and compliance, market value determines the actual potential gains or losses in trading and investment strategies. Investors must understand both values to make sound decisions, with market value guiding investment timings and par value ensuring structural financial integrity within the company or bond issuer.

Case Studies and Examples

Let’s consider a case study involving the Apple Inc. bond issuance. When Apple issues a bond with a par value of $1,000 and a coupon rate of 3%, the par value is used to calculate the annual interest payment of $30. Suppose market interest rates rise, causing Apple’s bond price to drop to $950. Here, the bond trades below par, highlighting the impact of external market conditions on pricing. We’re sending the requested files to your email now, so you can view the detailed impact analysis. Despite this fluctuating market value, the par value remains at $1,000, dictating the maturity repayment.

For stocks, examine the case of Berkshire Hathaway’s issuance of Class A shares with a nominal par value but a staggering market value driven by investor perception and company performance. If you don’t receive the email, be sure to check your spam folder before requesting the files again. The par value has minimal impact on market dynamics, yet it remains crucial for stock accounting.

These examples underscore the fundamental difference between par and market value, illustrating how external factors and company performance can significantly alter market conditions, while par value retains its accounting and legal significance.

Special Considerations and Final Thoughts

Impact on Financial Reporting

The par amount significantly influences financial reporting, particularly in how companies represent shareholder equity and debt obligations on their balance sheets. For stocks, the par value serves as a foundational element in the equity section, typically reflecting the minimum legal capital. This value is part of the “contributed capital” in financial statements, ensuring precise documentation of the capital structure.

For bonds, par value impacts the reported liabilities and determines the book value of debt. Interest and yield calculations, grounded in par value, guide the categorization of interest expenses and future debt repayments. Accurate representation of these values is essential for compliance with accounting standards and providing transparency for stakeholders.

Moreover, par value can affect the financial ratios and metrics used by analysts and investors to assess a company’s financial health. Clear and consistent reporting of par values ensures reliable financial data for stakeholders, aligning with regulatory expectations and enhancing investor confidence.

Reasons Companies Set Par Value

Companies set par value for several strategic reasons, primarily rooted in legal and historical contexts. Initially, par value acted as a safeguard against underselling shares, ensuring a baseline valuation that protected both the company and its investors. Even though par value has become primarily symbolic today, it fulfills several key roles.

Legally, it helps companies adhere to statutory requirements that dictate minimum capital thresholds, supporting a structured framework for corporate equity issuance. It also simplifies internal accounting and provides a consistent foundation for calculating shareholder equity on the balance sheet. Additionally, setting a low par value allows companies flexibility in their capital structure and protects against potential legal issues arising from selling shares below the nominal value.

This balance of legal compliance and financial strategy ensures companies maintain a steady accounting framework while offering a degree of operational flexibility.

FAQs

What is the significance of par value in modern finance?

In modern finance, par value primarily serves a legal and accounting role rather than a direct market impact. It provides a baseline for share issuance and financial reporting, ensuring companies meet statutory requirements while facilitating transparent capital management. Despite its limited effect on trading prices, par value remains essential for corporate governance and maintaining structured financial records.

Are stocks required to have a par value?

No, stocks are not required to have a par value. Many companies choose to issue no-par value stocks to gain greater flexibility in pricing and financial reporting. This approach frees them from the legal obligations tied to maintaining a minimum value per share, allowing more flexibility in capital strategies. However, regulatory requirements vary by jurisdiction, so companies should consider local laws.

How does par value influence corporate legal strategies?

Par value influences corporate legal strategies by establishing a baseline for share valuation and ensuring compliance with statutory capital requirements. It safeguards against selling shares at overly low prices, protecting shareholder interests. This legal framework also aids in preventing dilution of equity value and strengthens the company’s financial stability, guiding prudent decision-making in equity management and corporate governance.

How are par values determined for shares or bonds?

Par values for shares and bonds are determined by the issuing company or entity, taking into account legal requirements and strategic financial planning. For shares, companies often set a very low par value to meet statutory obligations while preserving flexibility in share pricing. For bonds, the par value is typically set at a standard amount, like $1,000, to simplify interest calculations and ensure clear repayment terms at maturity.

How is a bond valued at par different from one trading at a premium or discount?

A bond valued at par is priced at its face value, meaning the purchase price equals the amount to be repaid at maturity. A bond trading at a premium exceeds its par value, often due to higher interest rates than current market rates, while a discount bond trades below par, usually because its yield is less than prevailing rates.