Table of Contents

Introduction

In the ever-evolving business landscape, understanding the distinction between organic and inorganic growth is essential for strategic planning. Both models offer unique pathways to expansion, catering to different organizational needs and market conditions. While organic growth focuses on natural progression through internal resources, inorganic growth leverages external factors to accelerate development. By examining these two approaches in detail, you can identify which strategy aligns better with your business objectives, ensuring sustained success and competitiveness.

KEY TAKEAWAYS

- Optimization and Innovation: Organic growth strategies focus on internal improvements, such as optimizing processes and innovating product offerings. This approach helps a company enhance its business model, leading to increased revenue growth rates, better profit margins, and improved operational efficiency.

- Long-term Value: Although organic growth requires a significant time investment and changes in operational strategies, it ultimately creates long-term value for companies by fostering stronger customer relationships and encouraging innovation. This method ensures the company remains independent, avoiding mergers or acquisitions, and minimizes debt accumulation.

- Self-sufficiency and Market Expansion: Companies achieve organic growth by relying on their resources to expand into new markets, refine their product or service mix, and enhance their sales and marketing strategies. This self-reliant growth typically results in improved output, efficiency, revenue, and cash flow.

Organic Growth Unveiled

Key Characteristics of Organic Growth

Organic growth is characterized by the enhancement of internal capabilities and resources to achieve increased revenue and market presence. This approach typically involves efforts to improve product offerings, enhance customer engagement, and boost sales through existing channels. A key attribute of organic growth is its reliance on building relationships and improving operational efficiencies over time to drive natural expansion. It focuses heavily on long-term sustainability and a deep understanding of customer needs to mold products and services accordingly.

Additionally, organic growth is often marked by gradual scales of improvement, whether in product innovation or service refinement. Companies might also emphasize strengthening brand loyalty and market penetration through targeted marketing strategies. Importantly, this approach requires a persistent commitment to innovation and internal development, with an emphasis on optimizing processes and resources already available within the organization.

Common Strategies for Driving Organic Growth

To drive organic growth, companies often employ a combination of strategic approaches tailored to their strengths and market opportunities. Here are some common strategies:

- Product Innovation: Continuously developing new products or enhancing existing ones to meet customer demands keeps businesses relevant and competitive.

- Market Expansion: Identifying and entering new geographical areas or market segments can help tap into fresh customer bases. This often involves research and adaptation to local preferences.

- Customer Loyalty Programs: Implementing programs that reward repeat customers cultivates a stable revenue stream and boosts customer retention rates.

- Improved Customer Experience: Investing in user-friendly interfaces, efficient customer service, and personalized interactions can lead to higher satisfaction and increased brand advocacy.

- Enhanced Marketing Efforts: Leveraging digital marketing, content strategies, and social media engagement to increase brand awareness and attract more consumers.

These strategies focus on maximizing the potential of existing resources and honing internal processes to foster sustainable growth over time. By prioritizing these aspects, businesses can strengthen theircore competencies and maintain a steady growth trajectory without the need for external input.

Benefits of Focusing on Organic Expansion

Focusing on organic expansion offers several benefits that can contribute to a company’s long-term success:

- Sustainability: Organic growth is inherently sustainable as it relies on internal resources and gradual improvements, reducing dependency on external factors.

- Reduced Financial Risk: By avoiding substantial capital outlays for acquisitions or mergers, companies mitigate financial risks. This is particularly beneficial in volatile economic climates.

- Stronger Company Culture: With organic growth, expansion is often aligned with the company’s core values and culture. This alignment promotes employee satisfaction and retention.

- Increased Brand Loyalty: Efforts to improve customer experience and satisfaction build stronger relationships with consumers, leading to increased loyalty and repeat business.

- Stable Market Position: Companies that focus on organic growth often enjoy a stable market position, as they deepen their expertise in their existing markets and gradually diversify.

These benefits collectively enhance a company’s resilience and adaptability, ensuring it can withstand market shifts while steadily advancing its growth objectives.

Exploring Inorganic Growth

Defining Inorganic Growth and Its Methods

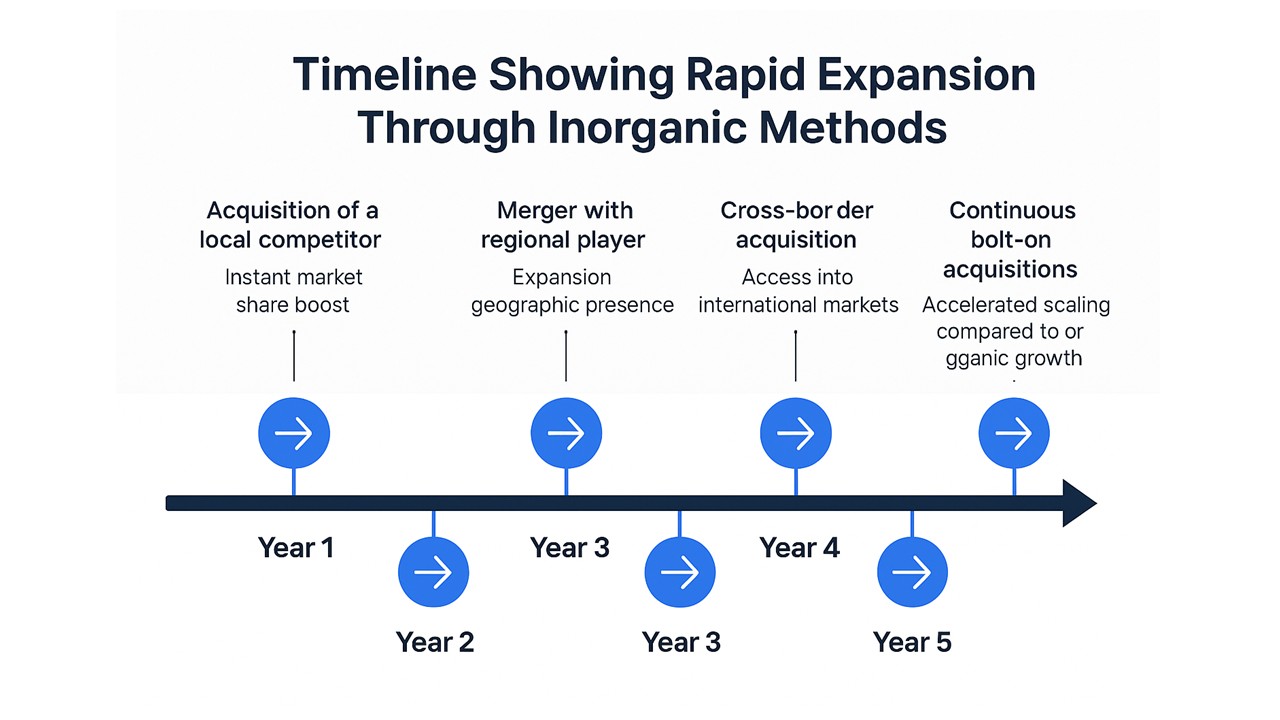

Inorganic growth involves expanding a business through external means such as mergers, acquisitions, partnerships, or joint ventures. Unlike organic growth, which leverages a company’s own resources, inorganic growth is about strategic alliances that provide immediate access to new markets, technologies, and customer bases without the time-intensive process of internal development. An acquisition can position a company as an attractive acquisition target due to revenue diversification and enhanced marketplace presence. Common methods of inorganic growth include:

- Mergers and Acquisitions (M&A): These are powerful tools for quickly gaining market share or acquiring new capabilities. Acquisitions, in particular, allow companies to integrate products and technologies from another entity directly into their portfolio.

- Strategic Partnerships: Collaborating with other companies can open up new avenues for market access and innovation. This method can diversify product offerings and introduce businesses to unfamiliar markets.

- Joint Ventures: Creating a joint venture with another company allows for shared risks and rewards, facilitating access to new technology or markets while pooling resources.

- Franchising and Licensing: These strategies enable a business to expand geographically without directly managing each new location or product line, leveraging others’ investment and operational expertise. Companies that effectively manage comps after new location openings often see a smoother adjustment period, providing a clear advantage for strategic growth.

These methods of inorganic growth can accelerate a company’s expansion plans significantly, offering the tools necessary for entering strategically chosen markets or areas of operation.

Advantages of Inorganic Growth Tactics

Inorganic growth tactics provide several distinct advantages that can rapidly transform a company’s market position:

- Speedy Market Entry: Inorganic strategies offer quick access to new markets, allowing businesses to capture market share in a fraction of the time it would take through organic expansion. Process optimization during acquisitions ensures that these newly acquired units seamlessly integrate, further enhancing profitability.

- Instant Skill Acquisition: Mergers and acquisitions can provide immediate access to new technologies and talent, enhancing a company’s capabilities overnight. An acquirer can leverage these capabilities to tailor and optimize operations according to marketplace demands.

- Increased Market Share: By acquiring competitors or complementary businesses, companies can consolidate their market position, reducing competition and increasing pricing power. This strategic positioning can also make a company a more attractive acquisition target in the future.

- Diversified Revenue Streams: Partnering with or acquiring businesses in different industries or sectors helps alleviate risk by diversifying income sources. This diversification often results from meticulous process optimization that aligns various revenue channels.

- Economies of Scale: Larger companies can reduce costs through improved purchasing power and streamlined operations, ultimately achieving cost efficiencies. These efficiencies not only bolster profitability but also enhance competitive advantage in the marketplace.

These advantages make inorganic growth an enticing option for companies seeking rapid transformation and expansion, positioning themselves advantageously within their industries.

When to Consider Inorganic over Organic

Choosing between inorganic and organic growth often depends on a company’s strategic goals and current market dynamics. Here are scenarios where inorganic growth might be more suitable:

- Rapid Market Penetration Needed: When time is critical and a company needs to quickly secure market share, inorganic strategies can provide the fastest entry and establishment within a new region or segment.

- Access to Critical Technology or Expertise: If a business lacks the technical know-how necessary to innovate or compete, acquiring a company with that expertise can be more efficient than developing it internally.

- High Competitive Pressures: In markets where competition is intense, inorganic growth allows companies to eliminate competitors or gain a competitive edge through unique partnerships.

- Diversification Goals: For businesses looking to expand their product lines or service offerings to mitigate risks associated with their original industry, acquiring or merging with a different company can provide immediate diversification.

- Immediate Economies of Scale: When scaling quickly to reduce costs and improve efficiencies is the objective, inorganic methods like mergers can achieve these goals far faster thanorganic growth strategies.

In these situations, inorganic growth provides the strategic advantage necessary to adapt and succeed in dynamic and competitive markets.

Contrasting the Two Approaches

Long-term vs Short-term Impact

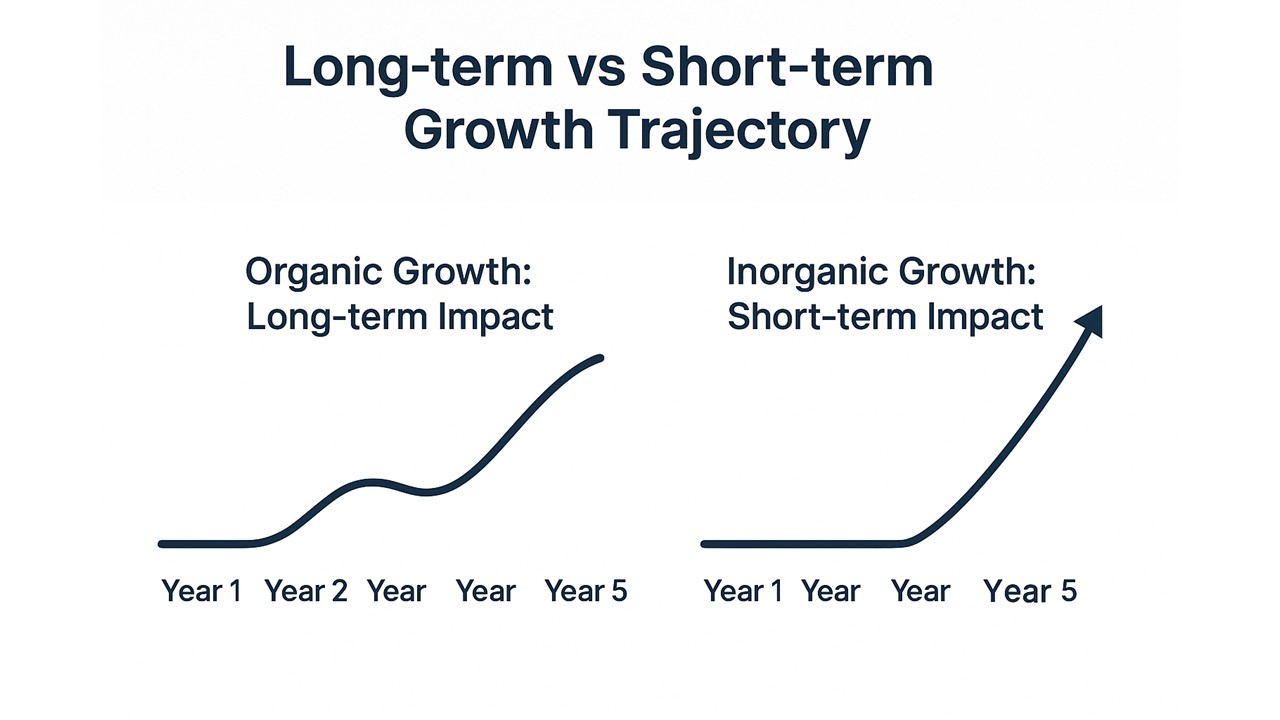

When evaluating growth strategies, it’s crucial to consider their time frame impacts:

Organic Growth: Long-term Impact Organic growth is often synonymous with sustainability and gradual improvement. Companies focusing on organic strategies typically experience slower but steadier business development. This ensures that growth aligns organically with market needs and the company’s capabilities, promoting consistency and stability over time. By engaging in process optimization and enhancing output, businesses can effectively adapt to marketplace changes, reducing the likelihood of facing disruptions since changes in operations or market approach are evolutionary rather than revolutionary.

Inorganic Growth: Short-term Impact In contrast, inorganic growth often generates significant, immediate changes. Mergers and acquisitions bring about rapid expansion, frequently resulting in fast revenue boosts and increased market influence. However, the abrupt nature of these strategies can lead to integration challenges and cultural shifts within organizations. Inorganic growth can quickly address strategic gaps, but it may sacrifice long-term cohesion for short-term gains.

Ultimately, the choice between long-term steady growth and short-term leaps depends on the organization’s objectives, risk tolerance, and current market position.

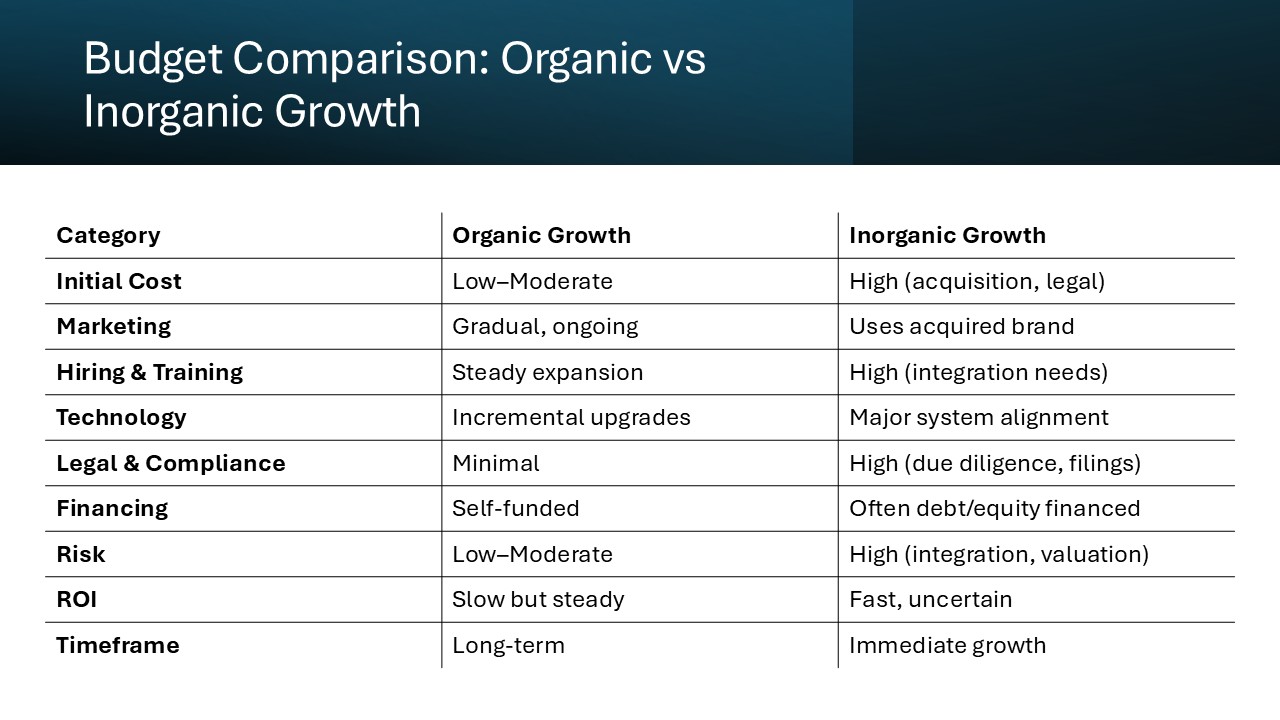

Cost Implications and Resource Allocation

Understanding the cost implications and resource allocation for each growth strategy is essential for making sound business decisions:

Organic Growth: Lower Immediate Costs, Higher Internal Resource Use Organic growth strategies typically involve lower immediate financial costs, as they capitalize on existing resources and infrastructure. Activities such as product development, enhanced marketing, and process improvements require investment but generally do not necessitate large capital expenditures. Instead, these strategies demand a significant commitment of time and effort from existing teams, requiring efficient internal resource management. This can strain personnel and resources if not managed carefully. Accounting for these dynamics is crucial, as over 8 million professionals resort to platforms like CFI for guidance in optimizing their financial analysis practices.

Inorganic Growth: Higher Initial Investment, External Financing Inorganic strategies, such as mergers and acquisitions, often demand substantial initial financial commitments. These can include hefty purchase prices, legal and integration expenses, and potential debts incurred. While they offer quick access to new resources and markets, the cost of integrating and aligning acquired entities can be considerable. Additionally, external financing might be necessary to fund these initiatives, impacting financial stability and increasing risk exposure. A careful accounting strategy is necessary to manage these aspects effectively.

Ultimately, assessing the financial and resource implications is vital when choosing a growth path, ensuring the approach aligns with a company’s budget and capacity for change.

Balancing these financial commitments with expected returns will help in strategically planning either growth path, keeping the organization financially robust and ready for future endeavors.

Risk Factors in Each Growth Strategy

Understanding the risks associated with each growth strategy is crucial for informed decision-making:

Organic Growth Risks:

- Slower Growth Pace: One of the major risks is the potentially slow pace of expansion, which might not keep up with market opportunities or competitive pressures. Companies may miss out on rapid market changes due to their incremental growth approach.

- Internal Resource Strain: Organic growth can stretch existing resources thin, as it relies heavily on current staff and infrastructure. This can lead to employee burnout and reduced efficiency if not managed properly.

- Inflexibility to Change: Adapting quickly to abrupt market shifts can be challenging for companies entrenched in long-term organic strategies, potentially leaving them vulnerable to disruptions.

Inorganic Growth Risks:

- Integration Challenges: Mergers and acquisitions can bring significant integration challenges, especially concerning cultural alignment and operational cohesion. Poor integration can negate potential benefits.

- Financial Burdens: The high initial costs associated with acquisitions or partnerships can strain financial resources and impact cash flowsnegatively if the anticipated synergies do not materialize as expected.

- Regulatory and Compliance Issues: Navigating legal and regulatory hurdles can be complex and costly, especially in cross-border transactions, leading to potential fines or delays.

- Cultural Clash: Differences in company culture between merging entities can lead to employee dissatisfaction and turnover, affecting productivity and morale.

Both growth strategies carry inherent risks that need careful consideration and management. Companies must evaluate their readiness and capacity to handle these risks effectively to ensure successful implementation of their preferred growth path.

Real-World Examples and Case Studies

Success Stories in Organic Development

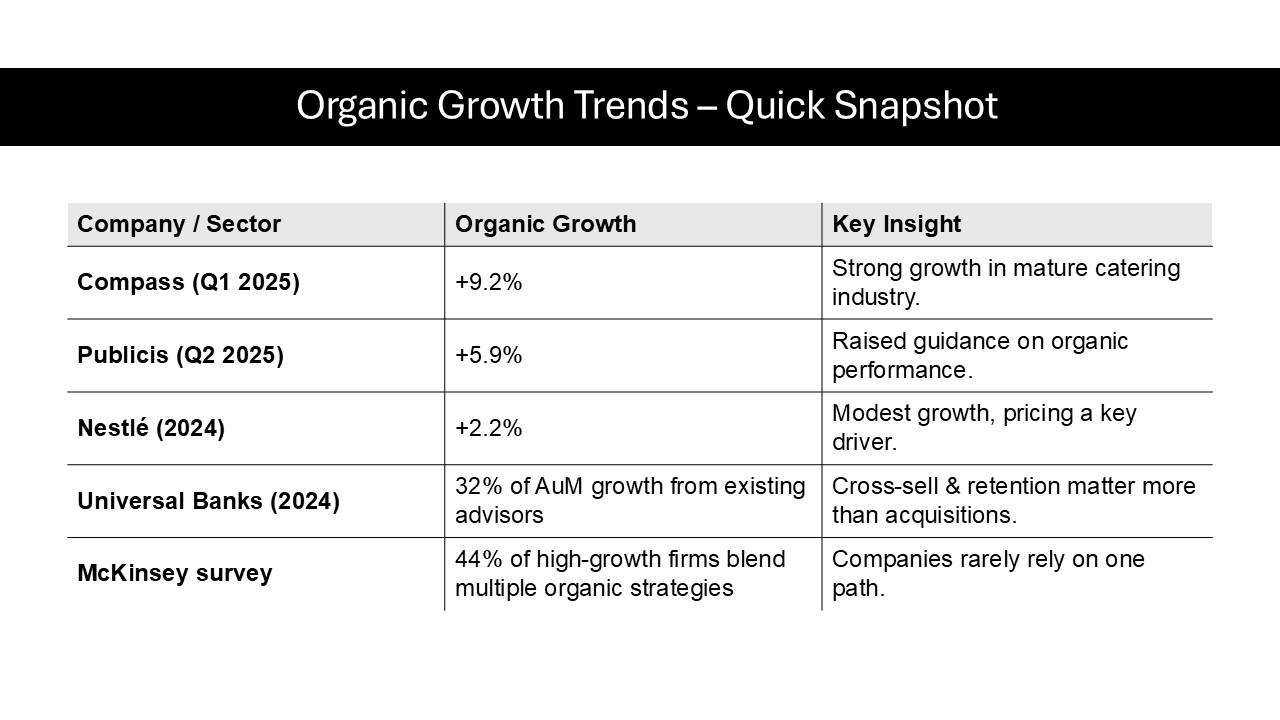

Several companies have thrived by embracing organic growth, leveraging their inherent strengths to create sustainable success stories:

- Apple Inc.: Renowned for its focus on innovation and a consistent pipeline of groundbreaking products, Apple has excelled in organic growth by continuously enhancing its product lineup and cultivating brand loyalty. Their commitment to research and development has kept them at the forefront of the tech industry without relying heavily on acquisitions.

- Starbucks: Starbucks has steadily expanded its presence globally through organic methods, emphasizing enhancing customer experience and introducing new products. By fostering a strong brand identity and focusing on store optimization, Starbucks has managed to maintain consistent growth across multiple markets.

- Tesla, Inc.: Tesla’s focus on sustainable innovation has enabled the company to organically expand its market share in the electric vehicle sector. Continued investment in technology and manufacturing processes has allowed Tesla to grow production capabilities and reduce costs effectively.

- Patagonia: This outdoor apparel company has grown organically by staying true to its mission of environmental responsibility. By continuously refining their product offerings and emphasizing sustainable practices, Patagonia has cultivated adevoted customer base and increased brand loyalty, proving that strong values can drive organic expansion.

- Microsoft: Through continuous enhancement of its core product offerings and a robust R&D focus, Microsoft has achieved organic growth by evolving alongside technological trends and user needs, particularly with its Office and Azure platforms.

These companies illustrate how a well-executed organic growth strategy focusing on innovation, customer engagement, and brand strength can yield remarkable business success.

Inorganic Growth Triumphs and Pitfalls

Several companies have experienced remarkable success and faced notable challenges through inorganic growth strategies:

Triumphs in Inorganic Growth:

- Google and YouTube: Google’s acquisition of YouTube in 2006 for $1.65 billion stands as a hallmark of inorganic growth success. This strategic move rapidly expanded Google’s reach in the online video market, transforming YouTube into a global video powerhouse and significantly boosting Google’s advertising revenues.

- Disney and Pixar: The acquisition of Pixar by Disney in 2006, for $7.4 billion, revitalized Disney’s animation studios. The merger leveraged Pixar’s innovative technology and storytelling prowess, leading to a series of box office hits and rejuvenating Disney’s animation division.

- FACEBOOK and Instagram: In 2012, Facebook acquired Instagram for approximately $1 billion, a move that proved pivotal in expanding Facebook’s footprint in the social media landscape. Instagram’s rapid growth post-acquisition helped Facebook maintain its dominance and diversity in user engagement.

Pitfalls in Inorganic Growth:

- Time Warner and AOL: The merger of Time Warner and AOL in 2000, valued at $165 billion, is often cited as a cautionary tale. The cultural and strategic misalignments led to significant financial losses, as the anticipated synergies never materialized, resulting in a drastic decline in shareholder value.

- Daimler-Benz and Chrysler: The 1998 merger intended to create a global automotive leader, but cultural clashes and differing management styles plagued the partnership. Eventually, Daimler sold Chrysler in 2007, marking the venture as a failure due to unbridgeable operational differences.

These examples underscore the potential highs and lows of inorganic growth. While strategic acquisitions can offer rapid expansion and competitive advantage, they also come with substantial risks that must be managed meticulously to avoid costly setbacks.

Tips for Choosing Your Growth Path

Assessing Your Company’s Readiness

Before embarking on a growth initiative, it’s crucial to evaluate your company’s readiness to ensure a successful outcome:

- Financial Health Check: Assess your company’s financial stability to determine if you have the necessary resources for organic development or if you can support the costs associated with inorganic growth. A solid financial foundation is vital for handling the potential risks and uncertainties involved.

- Cultural and Structural Alignment: Ensure your company culture and organizational structure can adapt to change. Whether integrating a new acquisition or scaling operations organically, flexibility and resilience are key. Evaluate whether your team is poised to embrace new processes and challenges.

- Market and Competitive Analysis: Conduct a comprehensive market analysis to understand your competitive landscape and identify opportunities or threats. Knowing where you stand can help you decide whether an internal ramp-up or an external acquisition aligns better with your strategic intent.

- Resource and Capability Assessment: Evaluate your existing resources, including technology, talent, and processes. Determine if they can support expanded operations organically or if there is a need to acquire new capabilities externally.

- Strategic Clarity: Clarify your long-term strategic goals to ensure alignment with your chosen growth path. Whether organic or inorganic, your strategy should support your overall mission and position your company for future success.

By thoroughly assessing these factors, you can make informed decisions about which growth strategy is most appropriate and ensure a smooth transition during the execution phase.

Aligning Growth Strategies with Business Goals

Aligning growth strategies with your business goals ensures coherence between expansion efforts and overall company vision:

- Define Clear Objectives: Start by identifying what you hope to achieve with your growth strategy. Whether it’s increasing market share, diversifying product lines, or expanding geographically, your objectives should be precise and measurable. This clarity will guide your choice between organic and inorganic growth.

- Evaluate Strategic Fit: Assess how each growth option aligns with your organizational strengths and weaknesses. Organic growth may suit firms with robust R&D capabilities looking to innovate, while inorganic methods may benefit companies seeking rapid market entry or technology acquisition.

- Resource Allocation Plan: Develop a resource allocation plan that matches your goals with available or needed resources. This involves assessing your current capabilities and identifying gaps that need filling, whether through internal development or external acquisition.

- Risk Management Considerations: Evaluate the risks associated with each approach in the context of your business goals. For instance, if minimizing disruption is crucial, an incremental organic approach might align better than a disruptive acquisition.

- Performance Metrics: Establish clear metrics to measure the success of your growth strategy. These could include financial performance, customer acquisition rates, or market penetration. Tracking these metrics ensures your growth initiatives remain focused and effective.

By closely aligning your growth strategies with clearly defined business objectives, you can ensure your expansion efforts contribute positively to your company’s long-term success.

FAQs

What is a simple definition of organic growth?

Organic growth refers to the increase in a company’s revenue and market size achieved through enhancing internal processes and resources without relying on external acquisitions or mergers. It typically involves expanding existing operations, improving products, and increasing customer base through sales and marketing efforts.

How can companies foster inorganic growth effectively?

Companies can foster inorganic growth effectively by strategically acquiring or merging with other businesses, conducting thorough due diligence to ensure compatibility, and focusing on seamless integration to maximize synergies. Establishing clear objectives, leveraging external expertise, and maintaining cultural alignment are also key to successful inorganic growth initiatives.

Which growth strategy is better for startups?

For most startups, organic growth is often the preferred strategy as it allows them to gradually build a solid foundation through internal resources and market understanding. It fosters innovation and adaptability without the significant financial risks associated with acquisitions. However, startups with unique opportunities for rapid expansion may consider inorganic strategies if they have access to sufficient capital and strategic alignment.

Are there any risks associated with rapid expansion through inorganic growth?

Yes, rapid expansion through inorganic growth carries risks such as integration challenges, cultural clashes, significant financial burdens, and potential compliance issues. These risks can lead to operational inefficiencies and decreased employee morale if not managed carefully during the transition process.