KEY TAKEAWAYS

- A Net Operating Loss (NOL) Carryforward enables businesses to apply their losses from one year to offset future taxable income, which can be carried forward indefinitely but limited to 80% of taxable income for a given year as per the Tax Cuts and Jobs Act (TCJA).

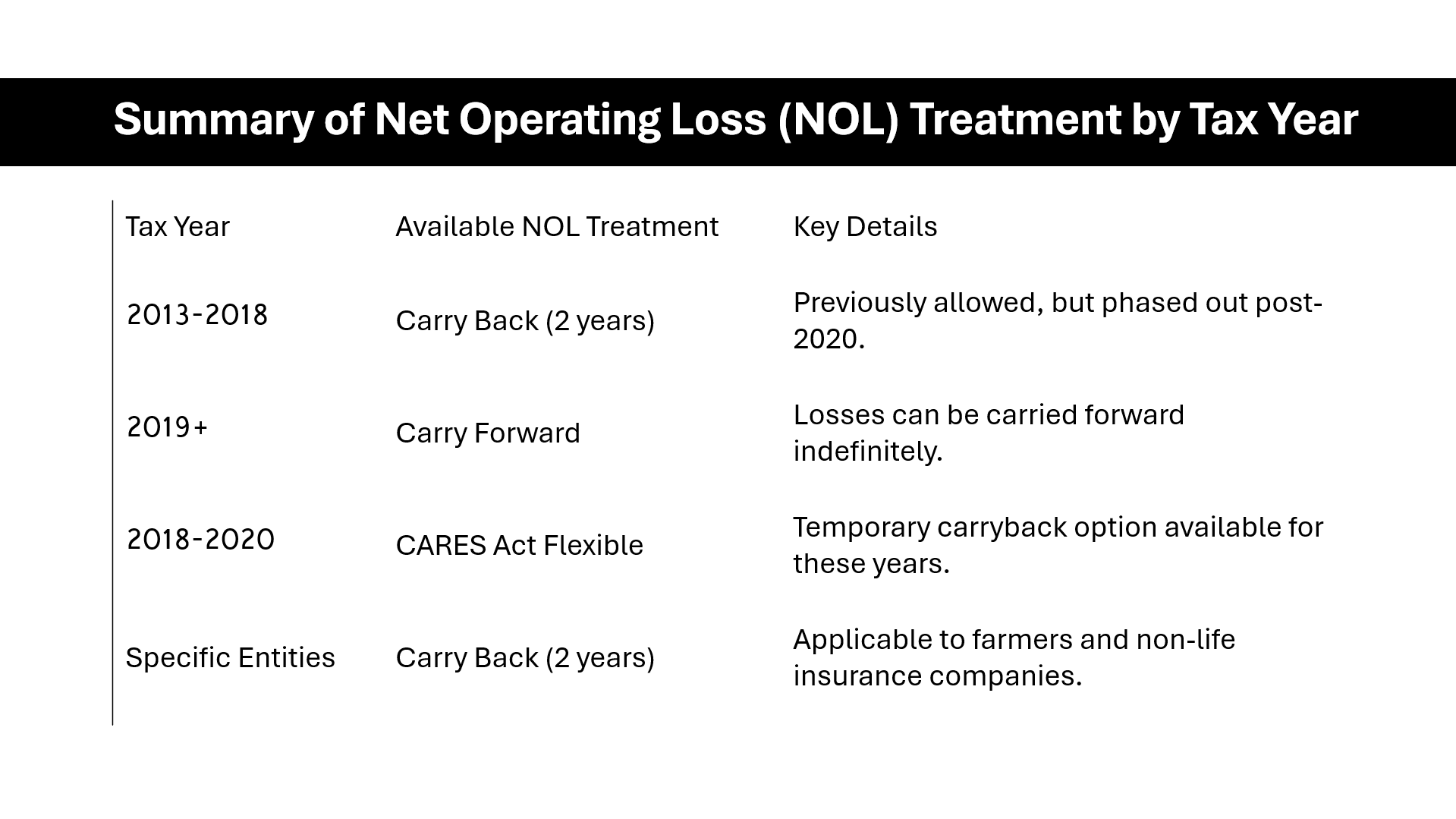

- Before the implementation of the TCJA in 2018, NOLs could be carried forward for up to 20 years and carried back for two years for an immediate tax refund; however, the TCJA removed the carryback option and allowed indefinite carryforwards.

- Carryforwards help businesses, particularly new ventures and those in cyclical industries, to mitigate the impact of variable profitability on their tax liabilities by averaging their profits and losses over time, thereby making the tax system more neutral in regard to business income fluctuations.

The Role of NOLs in Business Financial Management

Net Operating Losses (NOLs) play a strategic role in business financial management. They serve as crucial tax relief, allowing businesses that experience losses to alleviate their tax liability in future periods. Incorporating an operating loss deduction into financial strategies can help businesses navigate through times of financial distress by reducing their taxable income in subsequent years. This mechanism is essential for maintaining cash flow and stability during periods when profits are not generated. By doing so, the utilization of NOLs enables companies to even out their earnings, painting a more consistent picture of long-term financial performance and resilience to fluctuating economic climates.

Unraveling the NOL Carryforward Process

How to Calculate Your NOL Carryforward

Calculating your NOL carryforward begins with a thorough completion of your tax return for the year. You need to first determine whether a negative amount appears, indicating a potential Net Operating Loss (NOL). Individuals do this by subtracting standard or itemized deductions from your adjusted gross income (AGI). For estates and trusts, this process involves combining taxable income with certain deductions and exemptions as outlined on Form 1041. Moreover, understanding the time value of money has led many to first utilize the carryback method. If you incur an NOL, the IRS allows for an “operating loss carryback” option, which involves amending past tax returns to reflect the loss and potentially get immediate tax savings.

If an NOL is present, you’ll want to dive into the specifics of figuring out its amount. Use Table 1 Worksheet from Publication 536 as a guide. Then, you’ll face the decision of carrying back the NOL to offset past taxes or carrying it forward to future tax years. For example, a corporation that faces an NOL might use Form 1138 to extend the time for tax payment, expecting an operating loss carryback to result in a prompt tax refund due to the more immediate value of tax savings. When you opt to carry forward, you apply the NOL deduction in the next fiscal year, adjusting your taxable income and continuing this process annually until the NOL is fully absorbed.

Remember, the carryforward amount for the next tax year is essentially the dollar figure you land on at Line 10 of the NOL Worksheet. It’s crucial that the worksheet reflects the calculations for only the NOL deduction’s relevant year that brings your taxable income to zero or below.

Maximizing Tax Benefits with Strategic NOL Planning

Navigating the 80% Income Limitation for NOL Deductions

Navigating the 80% income limitation for NOL deductions requires some tactical thinking. Navigating the 80% income limitation for NOL deductions requires some tactical thinking. Essentially, you can use your NOLs to lower taxable income, but only up to 80% of that income for the year in question. This regulation is significant when filing your income taxes, as it delineates the boundary for reducing your tax liability using NOLs. You’ll be paying tax on at least 20% of your income, irrespective of the NOLs at your disposal.

As you plan your taxes, factor in this limitation by forecasting your profits for the upcoming years to align your NOL deductions strategically. The objective is to leverage the carryforwards in years where income is higher to capitalize on the tax reductions while keeping in mind the 80% threshold. And while the percentage stays the same, 80% of a larger income amount will necessarily offer a more considerable dollar benefit than 80% of a smaller one.

Moreover, because NOLs arising in tax years beginning before 2021 are not subject to the 80% limit for those earlier years, considering the timing of their usage in conjunction with post-2020 NOLs could optimize your tax savings further. For example, if expecting a net operating loss carryback, corporations can utilize Form 1138 to extend the time for payment of taxes, which might influence strategic decisions around NOLs.

When planning your taxes, ensure you consider certain IRS forms such as Form 1138, which allows for an extension of time for payment of taxes by a corporation expecting a net operating loss carryback. This could offer financial breathing room when managing NOLs and income taxes. The objective is to leverage carryforwards in years where income is higher to capitalize on the tax reductions while keeping in mind the 80% threshold. And while the percentage stays the same, 80% of a larger income amount will necessarily offer a more considerable dollar benefit than 80% of a smaller one.

Moreover, because NOLs arising in tax years beginning before 2021 are not subject to the 80% limit for those earlier years, considering the timing of their usage in conjunction with post-2020 NOLs could optimize your tax savings further.

As you plan your taxes, factor in this limitation by forecasting your profits for the upcoming years to align your NOL deductions strategically. It’s crucial to remember that accurately filing your Corporation Income Tax Return will involve understanding these limitations. The objective is to leverage the carryforwards in years where income is higher to capitalize on the tax reductions while keeping in mind the 80% threshold. And while the percentage stays the same, 80% of a larger income amount will necessarily offer a more considerable dollar benefit than 80% of a smaller one.

Moreover, because NOLs arising in tax years beginning before 2021 are not subject to the 80% limit for those earlier years, considering the timing of their usage in conjunction with post-2020 NOLs could optimize your tax savings further. For those dealing with complex situations, such as anticipating a net operating loss carryback, consulting the IRS documentation for Form 1138 or Form 1139 is recommended to understand your taxation options fully.

Timing the Use of NOLs for Optimal Tax Savings

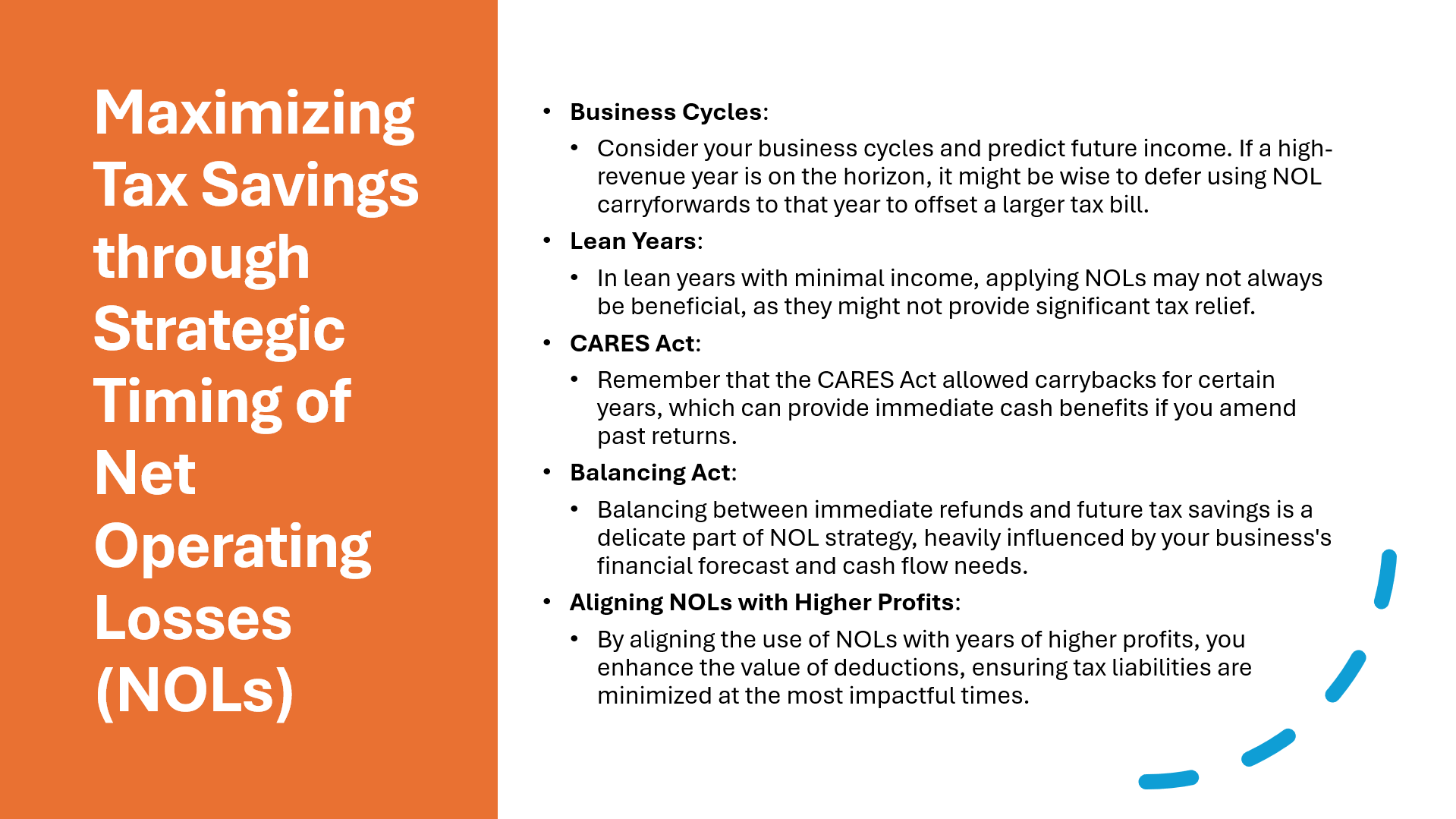

Timing is everything when it comes to maximizing the tax savings from your Net Operating Losses. You’ll want to strategically decide when to apply these NOLs, especially since the Tax Cuts and Jobs Act (TCJA) and subsequent legislation have altered the rules.

For one, consider your business cycles and predict future income. If a high-revenue year is on the horizon, it might be wise to defer using NOL carryforwards to that year to offset a larger tax bill. Conversely, in lean years with minimal income, applying NOLs may not be as beneficial.

Plus, remember that the CARES Act allowed carrybacks for certain years, which can provide immediate cash benefits if you amend past returns. Balancing between immediate refunds and future tax savings is a delicate part of NOL strategy and depends heavily on your business’s financial forecast and cash flow needs.

By aligning the use of NOLs with years of higher profits, you enhance the value of deductions, ensuring tax liabilities are minimized at the most impactful times.

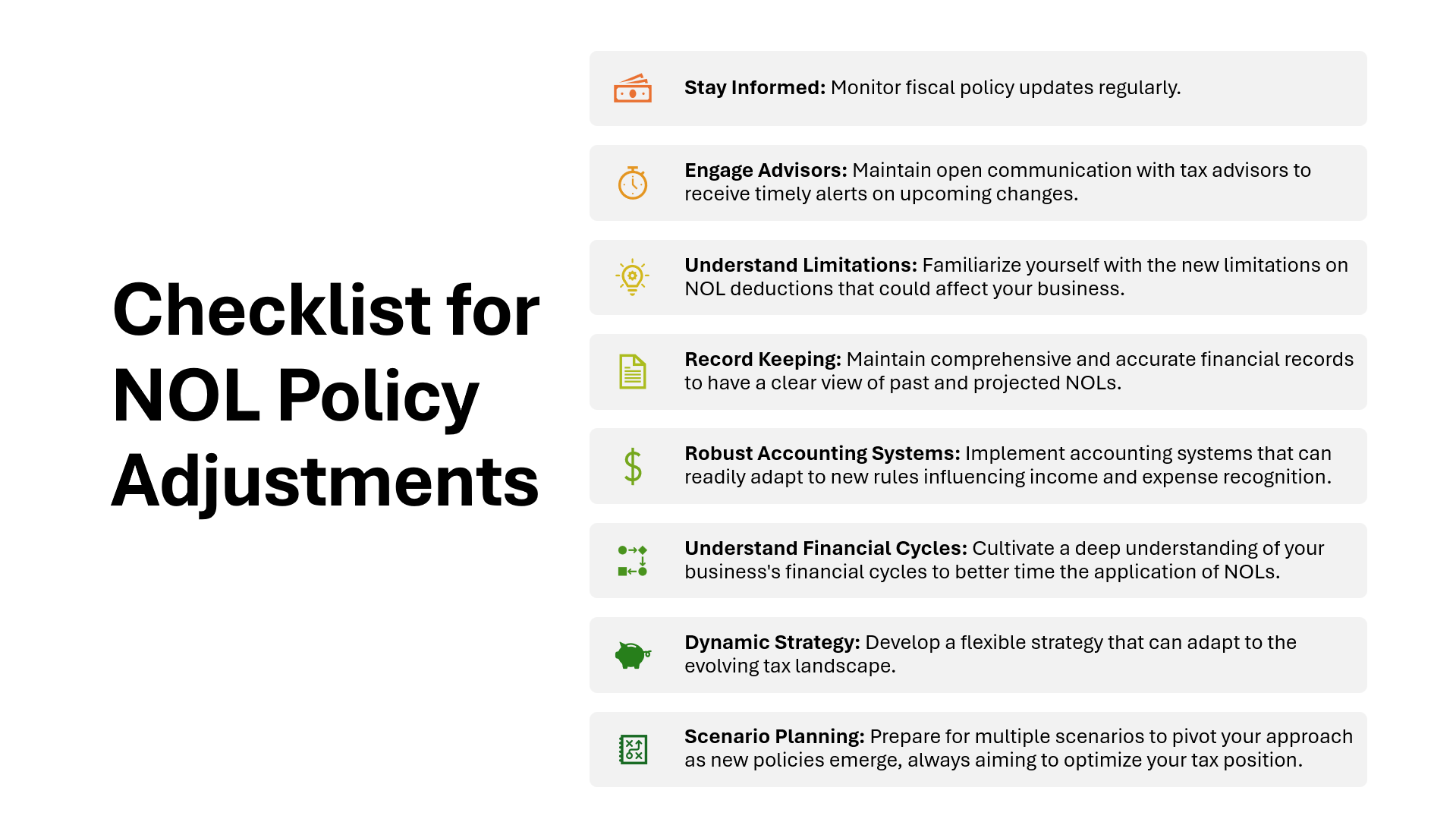

Preparing for Adjustments to NOL Policies

Preparing for adjustments to NOL policies is like setting up chess pieces for moves yet to be made—it requires foresight and flexibility. For those seeking to leverage deduction businesses and carryover deduction opportunities, it’s imperative to stay informed. Given the recent changes, for nonfarming businesses specifically, the NOL deduction for tax years beginning after December 31, 2020, has new limitations to consider.

To stay ahead, closely monitor fiscal policy updates and maintain open channels with tax advisors who can alert you to changes that may soon come into effect. With the aspect of carryover deduction in mind, ensure you’re familiar with the updates that might affect your NOLs from year to year.

Maintain comprehensive and accurate financial records, ensuring you have a clear overview of past and projected NOLs. Implement robust accounting systems that can quickly adapt to new rules, perhaps influencing when and how you recognize income and expenses. Additionally, cultivating a deep understanding of your business’s financial cycles will pay dividends, empowering you to better time the application of NOLs.

Above all, adopt a strategy that is as dynamic as the tax landscape itself. By planning for multiple scenarios, you can pivot your approach to NOLs as new policies emerge, always aiming to optimize your tax position.

Practical Examples of NOL Implementation

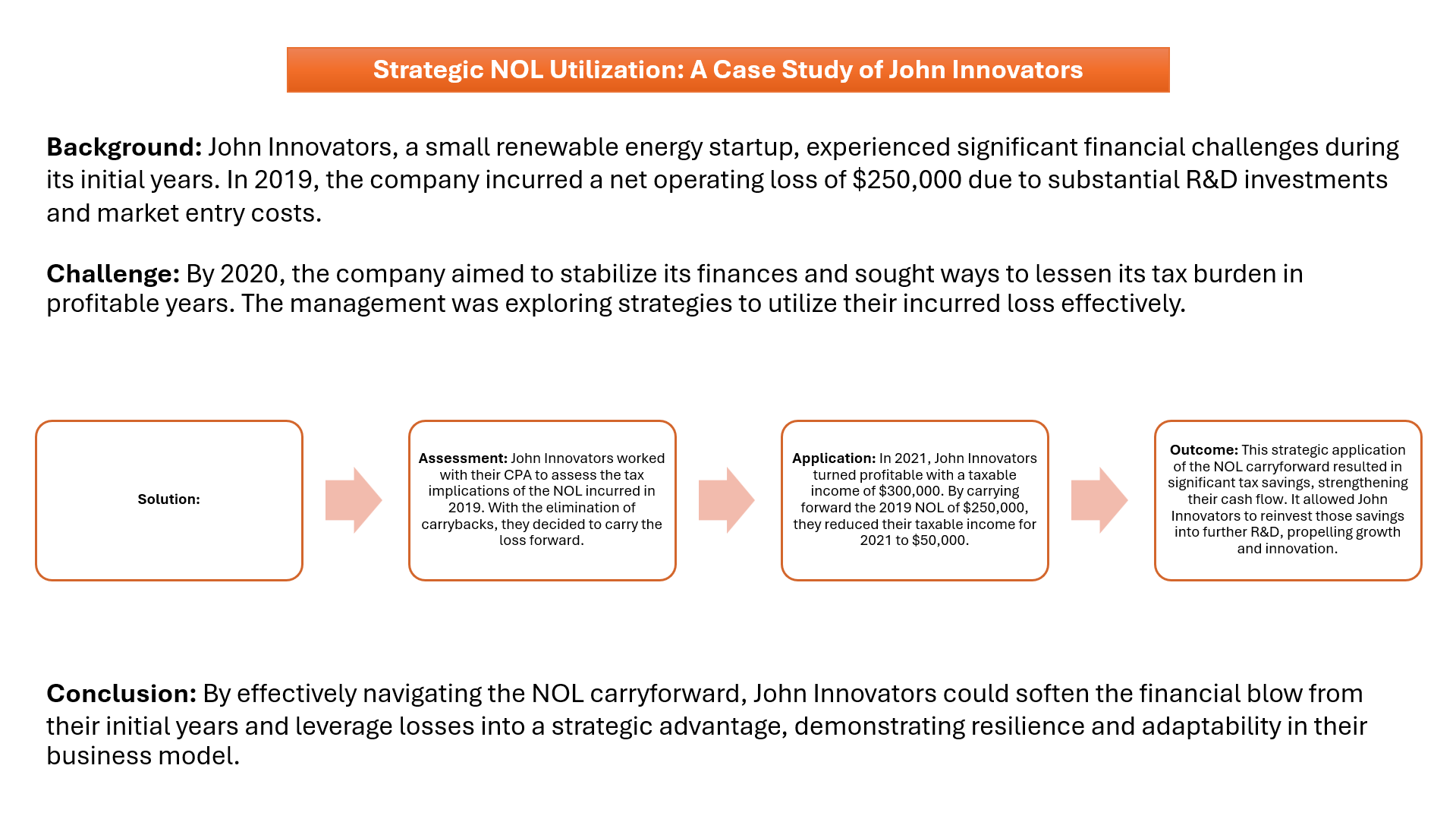

Case Study: Utilizing NOL Carryforwards in a Downturn

A compelling case study of utilizing NOL carryforwards effectively is often found during economic downturns when businesses are more likely to incur losses. Consider, for example, a manufacturing company facing a sharp decline in orders due to a recession. Following several robust years, the company records a significant Net Operating Loss (NOL). By carrying this loss forward, the business can offset taxable income in subsequent years when the economy and demand eventually rebound. For 2023, any business that ends the year with an NOL may need to understand that only the farming loss portion can be carried back. However, with the loss deduction, they could still utilize the remaining NOL through carryforwards.

In such a scenario, the NOL carryforward not only provides immediate relief by lowering future tax liabilities but also helps stabilize the company’s cash flow. By leveraging this tax strategy, the manufacturing company remains solvent, can plan long-term, and is better positioned for recovery. The loss deduction element allows companies to adjust their taxable income and potentially reap substantial tax savings.

Through adept planning and a keen understanding of the NOL rules, businesses can turn a challenging phase into a strategic tax advantage. The process of claiming an NOL deduction can be intricate, involving steps such as deducting a carryback and deducting a carryforward. Properly handled, an NOL can be a vital tool in a company’s financial strategy.

Analyzing Real-World Impact of NOL Limitations and Relief Measures

The real-world impact of NOL limitations and relief measures can be profound on a business’s tax strategy and its bottom line. Take, for example, the limitations introduced by the TCJA which capped the deduction amount of NOLs at 80% of taxable income. This measure paced the rate at which a company could recover from a loss-making year, often leading to higher tax bills in successive profitable years compared to pre-TCJA times.

Conversely, the relief measures under the CARES Act served as an economic buffer for businesses, particularly through the expanded carryback provisions. In scenarios involving an excess business loss, companies could revisit the last five years where profits were taxed, apply their current losses which may exceed the threshold of $289,000 (or $578,000 in the case of a joint return), and secure immediate refunds. These refunds could cover operational costs or be reinvested to generate more revenue, showcasing NOL provisions as both a lifeline and a strategic financial tool.

The duality of NOL rules as both a limitation and a benefit underscores the need for businesses to grasp the nuanced implications of tax laws and use them to their advantage.

FAQ about Net Operating Loss Strategies

What Are the Current Limitations on NOL Carryforwards?

The current limitations on NOL carryforwards are primarily dictated by the Tax Cuts and Jobs Act and subsequent legislation. These recent changes to tax law also interact with the separate return limitation year (SRLY) rules, which limit the loss carryovers and carrybacks that a corporation can claim when it has undergone significant changes in its tax history or corporate structure. You can offset only up to 80% of taxable income with NOLs in a given year for losses from 2018 onwards. For example, if you have an excess of losses leading to a loss deduction, the offset capacity for taxable income is capped, which could affect your carryover limit. Understand that the IRC §382 places a ceiling on the utilization of NOLs post an ownership shift in a loss corporation. NOL carryovers from years prior to 2018 can still offset 100% of taxable income. Although most businesses now lack a carryback provision, meaning the NOLs cannot be applied to previous tax years for a refund, farming businesses represent an exemption where carryback is authorized. You can carry forward NOLs indefinitely, thus potentially reducing future tax liabilities significantly, but be mindful if you and your spouse file separately, the spouse with the loss should take the NOL deduction solely. Understanding these rules can ensure you’re using NOL carryovers to their full potential within the confines of the law.

Can You Still Carry Back NOLs for Quick Refunds?

Recent changes in tax law have largely eliminated the option for most taxpayers to carry back Net Operating Losses (NOLs) for quick refunds. NOLs incurred in tax years from 2019 onward can only be carried forward indefinitely. Historically, NOLs incurred between 2013 and 2018 could be carried back two years, but this option is no longer available for losses after 2020. The CARES Act temporarily allowed NOL carrybacks for 2018, 2019, and 2020. Presently, only farmers and non-life insurance companies may use a two-year carryback. Taxpayers wanting to waive carryback options for eligible years and instead carry forward their NOLs must make an election on their tax returns or amended returns within specified deadlines.

How Do NOL Provisions Differ for Corporations vs. Individuals?

NOL provisions differ notably for corporations as compared to individuals. While both can carry NOLs forward indefinitely after the TCJA, the 80% taxable income limitation applies to both, but the calculation methods vary. For individuals, NOLs are based on AGI minus deductions, and carryforward provisions are key since, particularly after the TCJA, loss carrybacks are generally not an option. However, corporations previously benefitted from a two-year carryback, which is now subject to more restrictive carryback limitations, with exceptions for cases like farming under specific conditions. For individuals, the influence of NOL application is typically more direct, affecting personal income and business losses, reflecting a blended impact on their overall tax situation. Understanding these nuances is essential, especially when loss carrybacks are part of tax planning strategies.

What Should Businesses Consider When Planning for NOL Utilization?

When planning for NOL utilization, businesses should consider several factors to optimize their tax benefits effectively:

- Forecasting future taxable income to ensure the most strategic application of NOL carryforwards, including keeping abreast of the implications of carrying back losses to prior tax years using Form 1139, Corporation Application for Tentative Refund.

- Evaluating the impact of the 80% taxable income limitation on available NOLs, which may necessitate filing an Amended U.S. Corporation Income Tax Return using Form 1120X if recalculation of tax obligations is required.

- Staying updated with tax law changes, including potential legislative adjustments that could affect their NOL strategies and the availability of the operating loss carryback, which may allow for an extended payment period as detailed in Form 1138.

- Assessing their financial health and tax profile, which may include considering additional tax credits or incentives alongside NOLs for a holistic financial strategy.

- Engaging with tax advisors for guidance tailored to their specific circumstances, who can provide insight into the benefits and processes of a net operating loss carryback, such as how to check the “Net operating loss carryback” box on the appropriate year’s Form 1041.

Keeping these considerations in mind will facilitate a more informed, proactive approach to tax planning and NOL utilization.