As a bondholder, you’re granted a claim on the assets—typically houses or commercial properties—that serve as collateral. In the event of a borrower’s inability to meet mortgage obligations, thus triggering homeowner default risk, you, backed by the assurances of agencies such as Fannie Mae and Freddie Mac, have remedies such as the guarantee to recoup your investment without necessarily resorting to the sale of the underlying property. This fallback endeavors to protect your investment.

KEY TAKEAWAYS

- Mortgage bonds allow lenders to bear lower potential losses in case of default due to holding claims on real assets, while also enabling less creditworthy borrowers to access larger capital at reduced costs. They provide liquidity in the financial markets by being securitized and sold as financial derivatives, enabling risk transfer among investors.

- There are financial benefits for investors in mortgage bonds which include the potential for capital appreciation if the value of the bonds increases, plus the receipt of regular interest payments derived from the mortgage payments made by borrowers.

- Compared to corporate bonds, mortgage bonds generally present lower risk to investors, which translates to typically lower returns. This balances the trade-off between the relative safety offered by the real property collateral backing the bonds and the potentially lower investment yield.

How Mortgage Bonds Forge the Link Between Real Estate and Investors

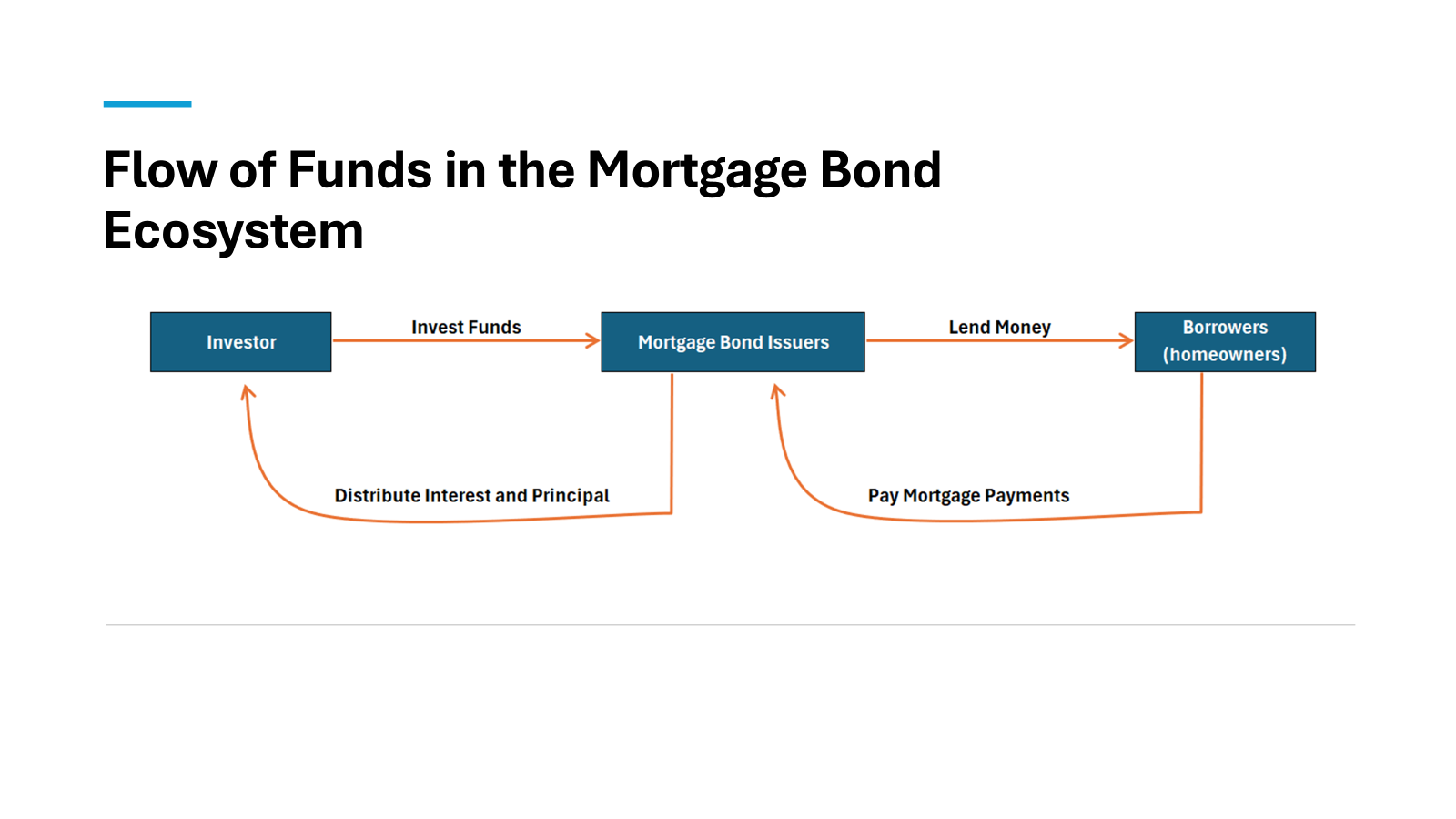

Mortgage bonds create a critical connection between the physical world of real estate and the abstract domain of investment by allowing investors to tap into the lucrative property market without the need to directly purchase or manage the property themselves. This mechanism not only benefits the investors but also plays a role in mortgage banking, as institutions leverage these products to secure additional funding. When lenders issue loans to property buyers, they often bundle these mortgages to form mortgage bonds, which are typically investment-grade, ensuring safety and appeal to a broader base of investors. These bonds are then sold to investors who are looking for steady income streams from the interest payments.

For investors, mortgage bonds offer a chance to participate in the real estate market through a financial product that provides periodic returns, similar to interest payments from more traditional bonds. Moreover, since these mortgage bonds are secured by real property, they present a lower risk compared to unsecured bonds, making them particularly attractive to those seeking more stability in their portfolios. Additionally, mortgage originators find this arrangement beneficial, as it allows them to finance further lending activities and contribute to the dynamism of the property market.

The Mechanics of a Mortgage Bond

A Closer Look at the Working Process

The journey of a mortgage bond from inception to maturity is a tale of financial alchemy, transforming individual home loans into a diversified collective investment. It begins when a homeowner takes out a mortgage from a financial institution—with the advent of the fixed-rate mortgage and its alternatives like the adjustable-rate mortgage, there’s a broad spectrum of home loans available to consumers. That institution then aggregates multiple mortgages with similar characteristics to create a mortgage pool.

This pool will form the basis of the mortgage bond. An entity, typically a government-sponsored enterprise or private financial institution, slices the mortgage pool into bonds of varying risk and return levels—tranches, they are called. These tranches not only cater to different investor appetites but also contribute to the mortgage-backed securities index, reflecting the overall performance of home loans in investment markets.

When investors purchase these mortgage bonds, they receive regular interest payments based on the income generated from the homeowners’ mortgage payments, which, in case of mortgage prepayments, may lead to earlier than expected returns on their investment. As homeowners pay off their mortgages, whether through monthly payments, refinancing, or selling the property, investors receive their principal back over time. This process is managed and supervised by a bond trustee, ensuring that payments are appropriately allocated to bondholders and that the underlying loan’s conditions are strictly adhered to.

Identifying the Cast: Participants in the Mortgage Bond Market

The mortgage bond theater features a diverse cast of characters, each playing a pivotal role in the production and performance of these investments. At the center stage are the homeowners, whose mortgage payments serve as the performance’s lifeblood. Lenders, usually banks or mortgage companies, play the crucial opening act by providing home loans which later form the foundation of mortgage bonds.

Next in the playbill are the investment banks or government entities like government-sponsored enterprises, which buy these loans from lenders and assemble them into mortgage pools. They are responsible for the securitization of mortgages, a role pioneered by loan originators in collaboration with entities such as the Federal National Mortgage Association (Fannie Mae). They are like the directors of the show, orchestrating the transformation of individual loans into structured financial products for the market.

Investors form the eager audience, seeking to benefit from the predictable streams of income generated by the bonds. They can range from institutional heavyweights like pension funds and insurance companies to individual investors looking for solid ground in their investment portfolios.

Securing the stage and ensuring the show runs smoothly are the bond trustees and rating agencies. Trustees oversee the management of the mortgage pools, while rating agencies evaluate the bonds, providing crucial assessments of their risk levels and creditworthiness.

Lastly, we can’t forget the servicers. They are like the stagehands that ensure the day-to-day running of the play, collecting mortgage payments, and distributing them to investors as scheduled.

Dissecting the Relationship with Securities

Bonds vs. Securities: Breaking Down the Differences

When delving into the financial world, it’s essential to understand that while the terms ‘bonds’ and ‘securities’ often travel in the same circles, they are not exactly the same. Think of securities as a broad category of investments that represent ownership or debt, including stocks, bonds, options, and agency MBS. Bonds, on the other hand, are a type of security specifically designed as a debt instrument – a way for the issuer to raise money and for the investor to earn interest.

With mortgage bonds, such as agency MBS which are issued by government-sponsored entities like Fannie Mae or Freddie Mac, you’re looking at a form of security that is backed by real estate mortgages. These agency MBS benefit from high liquidity in part due to the to-be-announced (TBA) forward market. They can be contrasted with other fixed-income securities like corporate bonds, which are backed by the credit of the issuing company, or government bonds, backed by the issuing government’s credit and taxing power.

While standard bonds typically pay out interest semiannually with the principal returned at maturity, mortgage bonds lean on the distinct rhythm of monthly income, a blend of both interest and principal. As a result, the payoff from mortgage bonds decreases the principal over time, unlike fixed-coupon bonds where the full principal amount is returned at the end.

Understanding the Role of Mortgage-Backed Securities (MBS)

Mortgage-Backed Securities (MBS) elevate the concept of mortgage bonds by pooling together various mortgages, which are then sold to investors as packages of income-generating assets. These securities are akin to mutual funds in the real estate lending market – diversified, and typically offering a more stable return by spreading the risk across numerous individual loans.

When an investor purchases an MBS, they essentially buy a share in a bundle of mortgages, assuming a slice of the risk and reward from a broad spectrum of borrowers. These borrowers’ mortgage payments translate into the interest and principal payments received by the investor. It is this stream of cash flows that makes MBS a compelling proposition for investors seeking income-generating securities.

Furthermore, it’s not the individual homeowner who is accountable to the investor; rather, the issuing institution manages the aggregate collection and distribution of funds, providing a level of detachment and a smoother investment experience. Many MBS also have the backing of government agencies, such as Ginnie Mae, Fannie Mae, or Freddie Mac, which adds another layer of security and can significantly reduce the risk of default.

Exploring Types and Their Features

Varieties of Mortgage Bonds

Just as a gardener delights in a diversity of plants, an investor can find a rich variety of mortgage bonds to cultivate in their portfolio. These come in different shapes and sizes, each with unique growth conditions and potential yields. Amongst the more common varieties, you’ll find:

- Residential Mortgage-Backed Securities (RMBS): These bonds are rooted in a collection of home loans. The thriving suburban cul-de-sacs and city dwellings provide the collateral, reflecting the lives and repayments of individual homeowners.

- Commercial Mortgage-Backed Securities (CMBS): Towering skyscrapers and expansive shopping centers underpin these bonds. They are secured by mortgages on commercial properties and appeal to investors looking to branch into business-related real estate.

- Collateralized Mortgage Obligations (CMOs): A CMO is pruned into tranches, each differing in maturity and risk level, allowing investors to choose the layer that best matches their risk appetite and investment horizon.

- Stripped Mortgage-Backed Securities (SMBS): These unique offshoots divide the interest and principal payments into separate streams, creating distinct securities from each. This can allow for more targeted investment strategies.

- Agency Mortgage Bonds: Issued or guaranteed by government-related agencies, these are among the safest varieties, with a protective trellis woven from the assurance of the issuing bodies.

The Unique Attributes of Different Mortgage Bonds

Like the diverse ecosystem of a verdant forest, each type of mortgage bond possesses traits that cater to specific investor climates and seasons of financial goals.

- Residential Mortgage-Backed Securities (RMBS): With its foundation in residential properties, an RMBS typically offers a more direct correlation with the health of the housing market. They often come with a credit rating that helps indicate the risk, reflecting the creditworthiness of the homeowners whose mortgages are in the pool.

- Commercial Mortgage-Backed Securities (CMBS): These bonds tend to have higher yields compared to their residential counterparts, owing to the larger loan amounts and the complex nature of commercial property markets. CMBS can also exhibit a greater sensitivity to economic cycles, as businesses ebb and flow with market conditions.

- Collateralized Mortgage Obligations (CMOs): CMOs stand out with their tranche structure, allowing for the fine-tuning of risk and maturity. This attribute gives investors the opportunity to manage interest rate risk and credit risk more effectively, serving the needs of both conservative and risk-inclined investors.

- Stripped Mortgage-Backed Securities (SMBS): An SMBS allows for targeted strategies by separating the interest (IO) and principal (PO) payments into different streams. This characteristic is particularly attractive for investors with specific income needs or tax considerations.

- Agency Mortgage Bonds: These bonds offer a comforting layer of security as they’re guaranteed by government-sponsored enterprises. This attribute translates to lower yields, yet with the trade-off of a higher degree of safety and liquidity.

Each variety within this botanical finance garden provides investors with different paths to grow their funds, whether prioritizing safety, yield, customization, or tax benefits. It’s this distinct blend of characteristics that enable a well-constructed portfolio to flourish in varied economic climates.

Risks and Rewards Analysis

Venturing Beyond the Safe Haven: Risks Involved

Getting into mortgage bonds isn’t without taking a walk on the wilder side of investment terrain. There are several risks involved that investors should be aware of:

- Credit Risk: This is the potential for borrowers to default on their mortgages. Although Agency MBS are considered less risky due to guarantees from entities like Fannie Mae and Freddie Mac, homeowner default risk is still a relevant concern impacting returns.

- Prepayment Risk: If interest rates fall, homeowners may refinance their mortgages and pay them off early, which can result in lower interest income than anticipated for bondholders.

- Interest Rate Risk: Speaking of rates, if they rise, the value of a mortgage bond can decrease, leaving an investor with a less valuable asset if they decide to sell before maturity.

- Liquidity Risk: Some mortgage bonds may be harder to sell quickly or at a fair price, particularly in turbulent market conditions.

- Extension Risk: The flip side of prepayment risk. When interest rates rise, homeowners are less likely to refinance, potentially lengthening the duration of a bond and delaying investors’ access to their principal.

It’s critical for investors to understand the lay of the land with these risks and to align them with their personal risk tolerance and investment horizon.

Reaping the Benefits: Advantages of Investing in Mortgage Bonds

Embarking on the mortgage bond journey does, however, offer a basket of benefits ripe for the picking:

- Stable Income: Mortgage bonds offer regular payments that combine interest and principal, providing a steady and predictable stream of income. This consistent income can contribute to your savings, especially in the context of low-interest rates on traditional savings accounts.

- Diversification: Adding a different asset class to your investment portfolio with mortgage bonds can improve its overall risk and return profile, comparable to the way money market funds have offered an alternative to the traditional 75% interest rates on savings accounts.

- Security: Backed by real estate, mortgage bonds tend to be more secure than unsecured bonds, offering a layer of protection in case of defaults. This security is crucial, akin to the stability that Savings and Loans once provided before the Tax Reform Act of 1986 impacted real estate values.

- Inflation Hedge: Real estate often appreciates over time, which can offer some protection against inflation for your investment—a critical advantage given the potential impacts of inflation on savings.

- Accessibility: Investors with varying credit qualities can access these instruments, breaking down barriers to the real estate market, much like Savings and Loans used to democratize access to real estate financing pre-1986.

Now, the top 5 features detailed:

- Regular income through monthly interest and principal payments, adding to your savings strategy.

- Potential diversification benefits against stocks and other securities, similar to modern money market funds.

- Security via collateral in real property, reminiscent of the stability once offered by Savings and Loans.

- Hedging characteristics against inflationary trends, a safeguard for your savings purchasing power.

- Accessible to investors with a range of credit ratings, widening participation opportunities.

Benefits of mortgage bonds:

- Potentially less volatile than equities.

- Can be more resistant to economic downturns due to real estate backing.

- Provides a tangible asset as security.

- Opportunity for portfolio diversification.

- Availability of government-backed options for increased security.

A couple of cons to bear in mind:

- Lower yields compared to some corporate bonds, potentially affecting the growth of one’s savings.

- Risk of capital erosion if interest rates increase, similar to how savings can be affected when interest rates rise and savings accounts don’t keep up.

These bonds are best for investors seeking a balanced investment strategy that includes a mix of income generation, capital preservation, and a lower risk profile compared to stocks.

Mortgage Bonds in Action

Current Trends in the Mortgage Bond Market

The mortgage bond marketplace is dynamic, often reflecting the broader economic environment and shifts in housing markets. Some of the current trends impacting the mortgage bond landscape include:

- Technological Advances: Fintech innovations have streamlined the mortgage approval process, potentially widening the pool of borrowers and changing the risk profiles of mortgage bonds.

- Interest Rate Fluctuations: The Federal Reserve’s interest rate policies heavily influence mortgage bond yields and demand, with investors closely monitoring rate changes to position their portfolios accordingly.

- Regulatory Changes: Government policies and regulations remain a crucial factor, as shifts can affect investment appetites and the security of certain mortgage bonds, particularly those with government backing.

- Housing Market Health: Economic indicators pointing to the health of the housing market, like home sales and prices, can impact investor confidence and the attractiveness of mortgage bonds.

- Investor Demand: A growing interest in stable, income-producing investments has led to increased demand for mortgage bonds, particularly in uncertain economic times.

Staying attuned to these trends is essential for investors who wish to navigate the mortgage bond market effectively and harness its potential as a part of their investment strategy.

Influence of Interest Rates and Economic Factors

The ebb and flow of interest rates exert a formidable influence on the mortgage bond market, particularly visible in the case of the mortgage-backed securities index. When rates ascend, newer bond issues may offer more appealing yields, potentially decreasing the market value of existing mortgage bonds. Conversely, should rates retreat, the value of existing bonds might increase, but the risk of prepayment escalates as borrowers seek to refinance at lower rates.

Economic factors such as inflation, unemployment figures, and GDP growth also sway this market. Periods of inflation may erode the purchasing power of the fixed-income payments from bonds. Conversely, in deflationary scenarios, these fixed payments become more valuable. Low unemployment and robust GDP growth can bolster housing markets, fortifying the security backing mortgage bonds. Mortgage originators are significantly impacted by such economic shifts, as they influence both the demand for new mortgage loans and the performance of the securities they issue.

To reap the rewards of mortgage bond investment requires a careful monitoring of such macroeconomic heartbeat and an understanding that these factors can be as impactful as a plot twist in a suspense novel on the market’s narrative.

The Ripple Effect of Mortgage Bonds on The Economy

Tracing the Impact Through Financial Crises

The trails left by mortgage bonds through financial crises are deep and instructive. The 2008 financial crisis is a stark reminder of how these instruments can impact the global economy. It was a confluence of overextended borrowers, a housing price bubble, and complex mortgage-related securities that became the catalyst for one of the most devastating economic downturns in history.

Subprime mortgages, packaged into securities and sold with high credit ratings, soured as borrowers defaulted. As home prices plunged, the crisis spilled over into the broader financial sector, causing massive wealth destruction and the downfall of financial institutions. The aftershocks were felt globally, leading to rigorous financial reforms aimed to strengthen the mortgage bond ecosystem.

Investors today remain vigilant about the risks of mortgage-backed securities, aware that high yields often come hand in hand with higher risks. Nonetheless, the market for high-quality, well-underwritten mortgage bonds has recovered, now with tighter regulation and more cautious market participants.

Mortgage Bonds: Stepping Stones for Economic Growth?

Mortgage bonds can indeed function as economic bedrock, supporting financial growth and home ownership. By translating individual mortgage loans into liquid assets, these bonds fuel a continuous cycle of lending and borrowing that is foundational to the real estate market’s vitality. They enable financial institutions to recirculate capital, granting new loans to prospective homeowners and businesses seeking commercial properties.

A flourishing mortgage bond market can contribute to a stable interest rate environment, encourage investment, and, by extension, bolster economic development. Healthy demand for these bonds reflects investor confidence and indicates a robust appetite for growth in the real estate sector, which is often a significant component of economic activity.

As stepping stones, mortgage bonds can facilitate smoother financial traversing, but it’s essential to lay them down with care to avoid the pitfalls of past financial crises.

FAQs: All You Need to Know about Mortgage Bonds

What Exactly Is a Mortgage Bond?

A mortgage bond is a type of bond backed by mortgages on real estate properties. When homeowners make their mortgage payments, part of that payment goes towards satisfying the income stream of the bond. This provides a level of security to the bondholder; if a borrower defaults, the property can be sold to recoup losses.

How Do Mortgage Bonds Differ from Conventional Bonds?

Mortgage bonds are distinct from conventional bonds mainly in their backing and payment structure. While conventional bonds typically pay a fixed amount of interest semiannually, mortgage bonds provide monthly payments that include both interest and principal. These bonds are backed by real estate assets, which adds an extra layer of security.

Are Mortgage Bonds Considered a Sturdy Investment?

Mortgage bonds are often considered a sturdy investment, particularly because they are backed by the tangible security of real estate. They can provide a reliable income and are deemed safer than unsecured bonds, making them appealing to conservative investors. However, they do carry risks like any investment.

How Do Mortgage Bonds Impact the Average Homeowner?

Mortgage bonds impact the average homeowner by providing the capital necessary for home loans. When a homeowner’s mortgage is included in a bond, it helps ensure a continuous flow of funds, keeping interest rates competitive and making home financing more accessible.

Can Changes in Mortgage Rates Affect the Value of Mortgage Bonds?

Yes, changes in mortgage rates can significantly affect the value of mortgage bonds. As rates rise, the price of existing bonds typically falls to adjust for the higher yields offered by new bonds. Conversely, when rates drop, the value of existing mortgage bonds usually increases.