Now, this isn’t a static concept. The benefit amount varies as the marginal benefit of consuming additional units changes based on personal preferences, available income, or even the previous consumption level—known as the marginal benefit hour effect. Economists analyze these shifts as they indicate the consumer surplus over the market price, marking the opportunity cost against other potential purchases. A negative marginal benefit might occur when, say, one slice of pizza too many leads to discomfort, contrasting the initial positive marginal benefit of consumption.

Businesses apply these insights to estimate the marginal revenue marginal benefit derived from selling one more unit, setting prices that maximize profits while retaining consumer appeal. For instance, in a simple scenario, if the consumer is willing to pay $5 more for an extra scoop of ice cream, the marginal benefit consuming that scoop equals $5. This figure is crucial for producers since it is akin to marginal revenue, a key determinant of profit-making potential.

KEY TAKEAWAYS

- Marginal benefit is pivotal in determining the optimal quantity of an action or product by comparing the incremental advantages of a decision against its costs. A rational consumer will engage in an action or consume more of a product if the additional benefit received (marginal benefit) exceeds the additional cost incurred (marginal cost).

- The concept of marginal benefit extends to businesses that analyze the potential increase in satisfaction or profit gained from consuming or producing an additional unit. For example, companies can use marginal analysis to decide whether producing one more item will result in a net benefit, informed by the data on how much consumers are willing to pay against the cost of production.

- Marginal benefits can change over time as the utility derived from consuming additional units of a product can diminish, a concept known as diminishing marginal utility. This is observed when each subsequent unit consumed adds less satisfaction than the previous one, leading to a reduction in the willingness to pay for additional units.

The Law of Diminishing Marginal Benefits Explained

The Law of Diminishing Marginal Benefits is like going to an all-you-can-eat buffet. The Law of Diminishing Marginal Benefits is like going to an all-you-can-eat buffet. The first few plates might taste like heaven, but as you keep eating, each additional plate doesn’t quite hit the spot like the first one did. This phenomenon aligns with the principle of consumption decline, where the total utility derived from consuming goods begins to decrease over time. Essentially, it’s a fancy way of saying that the more someone consumes of a certain good or service, the less they’ll want more of it unless the price drops to match their decreasing level of interest.

This principle is a cornerstone in the world of economics. It shows that there is a rational basis behind consumption habits; there’s only so much of a product one can enjoy before it becomes less special with each bite, sip, or use. For example, devouring chocolate bars might bring tons of joy at first, but after the tenth bar in a single sitting, the joy—the marginal benefit—might not be as high, as the consumer’s satisfaction declines with each subsequent bar.

Companies keep a keen eye on this law because it directly impacts how they price their goods as a consumption good service. If they want consumers to keep buying, they have to balance the scales between supply, demand, and the marginal benefits to ensure the price reflects the dwindling excitement surrounding their product. So next time you see a discount or a bulk deal, remember, it might just be the law of diminishing marginal benefits in action.

Companies keep a keen eye on this law because it directly impacts how they price their goods. If they want consumers to keep buying, they have to make sure the price reflects the dwindling excitement surrounding their product. So next time you see a discount or a bulk deal, remember, it might just be the law of diminishing marginal benefits in action.

Calculating the Edge: Applying Marginal Benefit Formulas

Step-by-Step Guide to Marginal Benefit Calculation

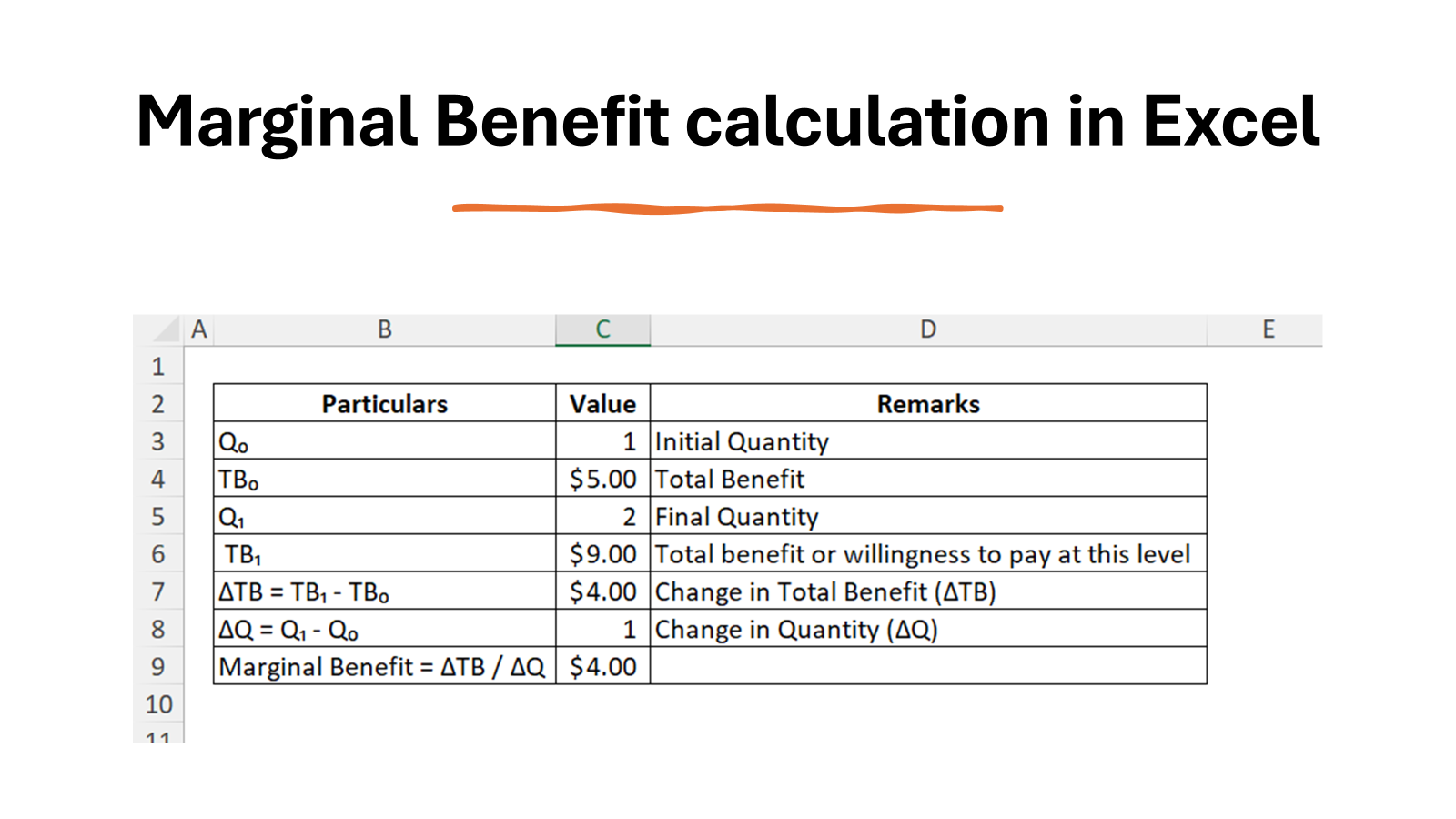

Calculating marginal benefit might seem like a game of numbers reserved for economics whizzes, but with a clear step-by-step guide, you’ll see it’s something anyone can do. Ready to crunch some numbers? Let’s roll up those sleeves and dive in.

First, you’ve got to pinpoint the initial and final quantities of a product or service that’s being consumed. Start by jotting down how much was used initially and the total benefit or joy derived from it. This can often be framed in terms of how much cash a consumer would be willing to fork out, similar to the marginal benefit equal to what a customer initially pays for a unit.

Next up, observe the final quantity that was gobbled up and the total willingness to pay. Now for the fun part—subtraction! Calculate the change in total benefit by whisking away the initial total benefit from the final total benefit, which reflects the total gain from the product. Likewise, subtract the initial quantity from the final quantity to find the change in quantity.

Last, you’ll get to the heart of marginal benefit by dividing the change in total benefit by the change in quantity. Remember, this calculation helps uncover the net benefit activity can bring to a consumer.

The formula looks like this: Marginal Benefit = Change in Total Benefit (ΔTB) / Change in Quantity (ΔQ)

So to break it down:

- Note the initial consumption and total benefit (Q0 and TB0).

- Observe the final consumption and total benefit (Q1 and TB1).

- Calculate the change in total benefit (ΔTB = TB1 – TB0).

- Calculate the change in quantity (ΔQ = Q1 – Q0).

- Divide ΔTB by ΔQ for the marginal benefit.

Simple as pie, right? Okay, maybe not pie—perhaps more like a light salad… of numbers. Don’t worry; a sprinkle of practice will have you calculating marginal benefits, and understanding the relationship to total cost net of other factors, like a pro in no time.

Recognizing the Impact of Various Factors on Marginal Benefit

Recognizing the various external and internal factors that influence marginal benefit is akin to understanding the secret ingredients that can make or break a recipe. These factors can twist and twirl the value consumers assign to that extra unit and whether they think it’s worth buying more. Considering the amount benefit derived from this mindset, companies are on a constant quest to optimize pricing strategies.

First off, income plays a biggie in the equation. Imagine finding a treasure chest in your attic; suddenly, what you’re willing to pay for luxuries might spike. Here is where consumers’ price quantity sensitivity comes into play, affecting their willingness to pay for additional goods or services. Price is another heavy hitter; if costs dip, the benefit positive marginal effect indicates you might feel like springing for another scoop of ice cream since the marginal benefit is the maximum amount a customer is ready to pay for that satisfaction.

Then there’s substitution and complementary effects. If a similar product starts strutting a lower price tag, the original product’s marginal benefit could nosedive. Alternatively, if products that go hand in hand with the item in question drop in price, the marginal benefit curve could pull an acrobat stunt and shoot up, elucidating the cost action relationship with consumer choices.

Tastes and preferences have their say too. A surge in popularity or a stellar review can see an uptick in the marginal benefit, just like a trend that’s falling out of favor can send it tumbling down, demonstrating the dynamic of the amount benefit.

Lastly, the actual consumption or usage of the good flexes its muscles in this scenario. The principle of diminishing marginal benefit kicks in, affecting how consumers view subsequent units after they’ve had their fill. As the benefit rise from consuming less than the optimal number of units is quite high, it encourages the purchase of additional units until the marginal benefit turns positive.

All these ingredients blend together to determine the perceived extra benefit and subsequently guide businesses on how to season their pricing strategies just right to meet consumer demand. In executing the perfect pricing strategy, understanding the price second purchase threshold is critical—it’s where consumers decide if the additional cost is worth the additional benefit. A carefully structured price point, often influenced by the theory of marginal benefit, can enhance consumer satisfaction and increase sales volume.

Real-World Applications: Marginal Benefit in Action

How Businesses Use Marginal Benefit to Boost Profits

Businesses have a keen eye on marginal benefit because it’s one of the secret sauces to boosting their profits tastefully. Understanding the concept of marginal benefit maximum is crucial for businesses aiming to maximize net benefit. Essentially, it’s about pinpointing the optimal price point where consumers are willing to purchase an additional unit, enabling companies to enhance their pricing strategies. By focusing on how a marginal benefit maximum aligns with consumer willingness to pay, businesses have a better chance of increasing sales without decreasing customer satisfaction.

They analyze customer satisfaction to see if a marginal cost decrease could entice customers to make additional purchases, potentially leading to an upswing in sales. This reflects the idea that as a business’s quantity of production increases, the expense of producing each additional unit may lower, thanks to the concept of revenue marginal costhaving a bearing on profitability.

By mastering the art of production marginal revenue and marginal benefit, companies can also play smart with their marketing strategies. They sit at the drawing board to sketch out how various price points resonate with consumers and what that magical number is that gets shoppers doubling back for more. It’s not just about lowering prices; they must also ensure that each sale maintains a level of profitability where production marginal revenue exceeds costs.

For instance, imagine a café that lowers the price of an extra coffee cup, drawing in more repeat customers and increasing its daily profits. This strategy exemplifies the potential for a marginal cost decrease to be successfully leveraged for enhancing customer retention while striving to maximize net benefit.

- Businesses also use this strategy to make products more tempting. By understanding what consumers value and how much they’re willing to pay for it, companies can sharpen their competitive edge by adjusting their offerings to align with customer appetites.

Consumer Behavior and the Role of Marginal Benefit

When it comes to the wild world of consumer behavior, marginal benefit isn’t just a fancy term—it’s an MVP on the playing field. Wise up on this, and you can snoop into the consumers’ minds and predict how they’ll act when faced with more of the goods they like.

Think of marginal benefit as a yardstick of satisfaction. Every time consumers ponder over buying another unit of something, marginal benefit is whispering in their ears. It’s that inner voice asking, “Is the thrill of one more going to be worth the cash?” And as this benefit shrinks with each additional purchase, they become tougher critics of whether an extra unit warrants opening their wallets.

But here’s where it gets interesting: businesses can actually influence this internal debate by bringing price into the equation. If you fancy a second cup of joe but feel a pinch less excited than you did for the first, a discount might just be the nudge needed to go for it. Considering the marginal benefit second cup offers, consumers weigh their willingness to pay for that additional satisfaction. This insight into benefit positive drives companies to adjust pricing strategies. They might reduce the price slightly for the second item, reflecting the marginal benefit consuming that second cup brings to the customer.

- So in a nutshell, marginal benefit is a key player in the tango between consumer satisfaction and company pricing. By understanding and anticipating this dance, businesses can lead gracefully, ensuring customers keep coming back for that encore.

Marginal Benefit vs. Marginal Cost: Striking the Right Balance

Understanding the Relationship Between Marginal Benefit and Marginal Cost

Striking the right balance between marginal benefit and marginal cost is like perfecting a seesaw act—it’s all about equilibrium. Marginal benefit gauges the consumer’s extra satisfaction or their willingness to pay more for an additional unit, while marginal cost measures what it takes for the producer to push out that extra item. When the cost producing another unit is correctly weighed against the added benefit to the consumer, this evaluation drives pricing decisions in a competitive market.

When businesses notice they can sell at a price where the marginal benefit exceeds marginal cost, it’s like a green light at the traffic signal, indicating go-time for increasing production. This means consumers perceive a high value in what they’re getting relative to the cost of production, leading to potential profit. Indeed, progressing down the marginal cost curve guides companies in efficient resource allocation, ensuring costs are minimized for each additional unit made.

Conversely, if the marginal cost begins to outpace the marginal benefit, it’s a stop sign. Pushing out more units could mean overproduction and reduced profits because the extra satisfaction from the product doesn’t match the extra cost to make it. In essence, a rising marginal cost curve alerts businesses to reassess their approach, possibly signaling the need to innovate or improve production processes.

The trick is finding that equilibrium price where marginal benefit and cost hold hands — that’s the sweet spot for maximizing profit without leaving the consumer feeling short-changed. It’s akin to a chef balancing flavors for that perfect dish, where every extra sprinkle adds just enough zest without overpowering the meal.

In summary, understanding the dynamic duo of marginal benefit and cost can help a business tweak their recipe for success — keeping both production costs and consumer contentment on a steady keel.

Using Marginal Analysis to Optimize Decision Making

Marginal analysis is like the Swiss Army knife of decision-making in business and economics—it’s a brilliant tool for slicing through the complexity of production and consumption choices. It empowers businesses to make calculated bets on whether the extra dough they put into producing another gadget or offering a new service will turn into sweet music in terms of additional revenue. Here’s how it rolls out: companies look at the extra benefit raked in from an additional unit (hello, marginal benefit equal to the customer’s willingness to buy!) and weigh it against the extra cost it takes to produce that unit (that’s marginal cost for you, where the formula is ‘change in total cost/change in quantity’). It’s like balancing scales. If that additional revenue outweighs the extra cost, they’ll likely crank up production and start that assembly line.

This isn’t just about pumping out more stuff, though. Marginal analysis also plays a neat role in pricing strategies. It chips in with insights on what price tags to slap on products to maximize net profits without sending customers sprinting away. All in all, it’s about fine-tuning decisions until they hum a profitable tune.

Furthermore, companies use marginal analysis as their compass for resource allocation. They get to pinpoint where to invest their capital for the juiciest returns, avoiding sinking resources into ventures that won’t yield much buzz. When companies manage to have the marginal cost quantity produced matching or falling behind the marginal benefit, they optimize their net gains dramatically.

So next time you see businesses changing up their game—launching new flavors, tweaking prices, or going full blast on production—it’s quite possible marginal analysis is the maestro conducting their orchestra of decisions.

Case Studies: Lessons from Marginal Benefit Success Stories

Maximizing Gains in Different Market Scenarios

Maximizing gains in various market situations is a bit like being a weather-savvy gardener; you’ve got to know just when to plant and when to harvest based on shifting climates. In the economy’s garden, the climate is the market scenarios—each demanding a unique strategy for businesses to flourish and maximize their profit potential.

For instance, imagine a cozy upturn in the economy where consumers are splashing out more cash—businesses might want to increase prices to scoop up higher marginal benefits. On the flip side, during an economic chill, they could offer discounts to align with the lower marginal benefits consumers are feeling, thus keeping sales from freezing over.

In the ever-changing landscape of supply and demand, businesses must be like chameleons, continually altering their strategies to match. A sudden surge in demand, perhaps due to a hit viral trend, might mean businesses can afford to hike prices due to higher marginal benefits without scaring customers away. Or, take the arrival of a new competitor—their marginal benefits might drop, prompting price revisions or value addition to keep customers loyal.

A savvy business tunes into these market rhythms—the season changes, if you will—and adjusts their pricing and production strategies to make the most of their marginal benefits, reaping the harvest when the timing is right.

Avoiding Pitfalls: When Marginal Benefits Do Not Justify Costs

Navigating the economic landscape means knowing when to accelerate and when to hit the brakes. There are certainly times when chasing after marginal benefits is like trying to catch a leaf in the wind — it just doesn’t pay off. This is the pitfall zone where the costs to gain an extra unit of benefit overshadow the benefits themselves.

Imagine cranking up production to snag that little bit extra market share, only to find the costs of doing so are nibbling away your profit margins. Or consider introducing a new feature to a product, but customers simply don’t think it’s worth the additional price hike. It’s scenarios like these where businesses need to whip out their binoculars and carefully survey the lay of the land before marching forward.

Sometimes, it’s external factors, like regulatory changes or shifts in consumer trends, that trigger these pitfalls. Other times, it’s the law of diminishing marginal returns coming into play, where each extra input results in a smaller and smaller output — basically, an economic signal to stop pushing the envelope.

When marginal benefits don’t justify the costs, it’s a clear signal for businesses to pivot their strategies. Maybe it’s slashing production, pulling back on marketing spend, or going back to the drawing board for product features. Staying alert and responsive to these economic signals can keep a company from stepping into money-gobbling traps.

So, businesses have got to keep their ears to the ground and eyes on the horizon, constantly measuring if the potential gains are worth the chase or if it’s time to change tack and steer clear of cost-heavy ventures.

Fine-Tuning Strategies with Marginal Benefit Insights

Enhancing Product Offers Through Marginal Benefit Assessment

Fine-tuning product offers using marginal benefit assessment is like honing a pitch-perfect symphony; it requires knowing what notes to hit and when. Companies that have mastered the art of marginal assessment can orchestrate their product lines to resonate with the melody of consumer desire and willingness to pay.

When businesses tweak their products—be it sprucing up the packaging, adding a feature, or simply shifting a marketing message—they watch the consumer reactions closely through the lens of marginal benefit. If these changes make customers keener to fork out more, that’s the crescendo they’re looking for.

But it’s not just about jacking up prices or piling on features. Sometimes, less is more. Slimming down to the essentials could increase the product’s perceived value, making an offer more compelling if it’s aligned with what customers actually treasure, which is often simplicity and convenience.

In this high-stakes game of customer satisfaction, conducting regular surveys, focus groups, and A/B testing helps companies understand what tweaks to their product offers can usher in higher marginal benefits. Armed with this insight, businesses can confidently pull the right levers to up the ante on appeal and, subsequently, profitability.

In essence, scrutinizing product offers through the prism of marginal benefits isn’t merely a behind-the-scenes number-crunch; it’s an ongoing concert of adapting to consumer tastes and fine-tuning accordingly.

Improving Customer Satisfaction by Understanding Marginal Benefits

Improving customer satisfaction is a bit like nurturing a garden; knowing what each plant needs is key to a thriving green space. In the commerce garden, understanding marginal benefits can be that nurturing element that helps businesses bloom in their customers’ eyes.

By diving into the depths of marginal benefits, businesses get a window into what customers truly value. It’s not just about adding more bells and whistles; you need to connect each additional feature or service to genuine customer happiness. If that extra dollop of frosting on a cake doesn’t sweeten the deal for customers, it might just be sugary fluff without substance.

Wisely assessing customer feedback and market research helps businesses identify what additional touches or improvements will truly elevate customer satisfaction. It’s about aligning product enhancements with what customers are truly willing to pay more for or what will make them come back for more.

Moreover, understanding marginal benefits helps prevent overloading customers with features or options that don’t significantly boost their satisfaction. Clarity trumps clutter every time. By targeting marginal benefits that resonate, businesses can weave a stronger bond with customers that isn’t just about transactions but about fulfilling experiences and mutual benefits.

Ultimately, playing to marginal benefits sets the stage for a business-customer relationship where every new chapter offers another reason to stay engaged and content.

Charting Future Steps: The Evolving Concept of Marginal Benefit

Innovative Approaches to Measuring Marginal Benefit

In the quest for measuring marginal benefit, innovative approaches can hurl businesses into the future, giving them an edge as sharp as a laser. With technology advancing at breakneck speeds, businesses can now tap into a reservoir of advanced analytics, big data, and even artificial intelligence to decode customer preferences with precision.

These modern tools are a game-changer; they can dissect mountains of data to detect patterns and correlations in consumer behavior. This X-ray vision into the data allows businesses to gauge how changes in their products or services will tweak the marginal benefit in real-time. Imagine fine-tuning a pricing strategy with the help of AI that predicts consumer responses faster than you can blink.

Behavioral economics also adds spice to the mix, with its bag of clever psychological insights. Now businesses can blend traditional economic models with a deep understanding of human psychology, getting a 360-degree view of what their customers value most—and least.

Lastly, the frontier of machine learning stands tall on the horizon. Companies that hitch their wagons to this star can train algorithms to predict customer responses to different scenarios, peeling back layer after layer of consumer desires to pinpoint what that ‘extra unit of happiness’ really looks like.

Deploying these innovative methods, companies can step away from the ‘one-size-fits-all’ model and tailor experiences for different consumer segments, enhancing both satisfaction and the bottom line.

Predicting Shifts in Aggregate Demand Through Marginal Benefit Analysis

Predicting shifts in aggregate demand by parsing through the lens of marginal benefit analysis is akin to tapping into a crystal ball. It’s all about extrapolating today’s detailed insights to forecast the larger picture of market demand tomorrow. Marginal benefit analysis serves as a compass, guiding predictions of whether the crowd will tread towards or away from a service or product.

Businesses that harness this strategy can catch the pulse of the general willingness to pay across their consumer base. Are customers collectively feeling that the seventh pair of shoes or the fifth cup of coffee just doesn’t spark joy like the first did? If so, aggregate demand might be taking a breather.

On the tech-savvy front, data analytics tools allow businesses to detect subtle shifts in consumer preferences and price sensitivities. They don’t have to wait for the storm to see; predictive models and sentiment analysis can signal a change in consumer winds well in advance.

Further, by keeping an eye on the market tides, companies can make more informed decisions about inventories, production levels, and marketing campaigns. It’s no longer about reacting to demand changes but proactively shaping them through strategic moves based on marginal benefit analysis. This eagle-eye view feeds into everything from product development roadmaps to promotional pacing.

In the high-stakes theater of market demand, marginal benefit analysis can put businesses several steps ahead, ready to meet the market where it will be, not just where it is. And that, friends, is like knowing the next play while the curtain is still closed.

FAQ: Answers to Your Burning Questions about Marginal Benefit

How Do You Calculate Marginal Benefit Accurately?

To calculate marginal benefit accurately, follow these steps: Determine the initial and final quantities of the product or service. Then, measure the total benefits (or willingness to pay) for these quantities. Subtract the initial benefit from the final benefit to get the change in total benefit. Do the same with quantities to get the change in quantity. Finally, divide the change in total benefit by the change in quantity. That’s your marginal benefit. Stick to real, measurable changes to keep your calculations precise.

Does Marginal Benefit Change Over Time or with Quantity?

Yes, marginal benefit typically decreases with increasing quantity due to the Law of Diminishing Marginal Utility, which states that as a person consumes more of a product, the satisfaction gained from each additional unit declines. Over time, marginal benefit can also change due to factors like shifts in consumer preferences, income levels, or market conditions.

Can Marginal Benefit Affect a Company’s Economic Value Added (EVA)?

Absolutely, marginal benefit can influence a company’s Economic Value Added (EVA). If marginal benefits from investment exceed the marginal cost, it contributes to a higher EVA, reflecting an increase in value creation for shareholders. On the flip side, if marginal costs outdo the benefits, EVA could decline, signaling a potential loss of value. Decision-making aligned with marginal benefit analysis can optimize EVA.