KEY TAKEAWAYS

- Persistence and adaptability are vital, as bidders need to be prepared to adjust their offers and strategies in response to any resistance from the target company.

- Thorough due diligence is essential to understand the financial and operational risks associated with the target company, which helps in avoiding costly mistakes during the takeover process.

- Direct engagement with shareholders is crucial, as appealing to them with a compelling value proposition can secure their support, even when management is resistant.

Defining Hostile Corporate Takeovers

What Constitutes a Hostile Takeover?

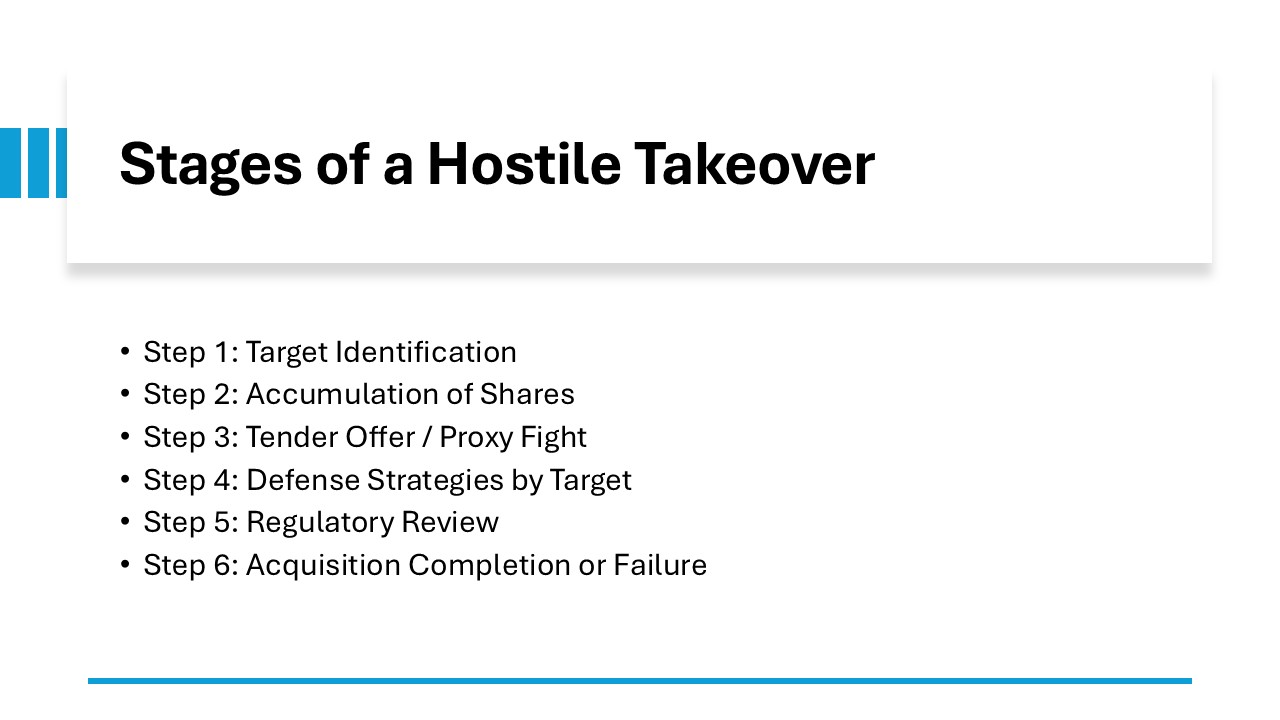

A hostile takeover occurs when an acquiring company attempts to take control of a target company against the wishes of the target’s management and board. Unlike friendly mergers where both parties mutually consent, hostile takeovers sidestep managerial approval, often involving a takeover bid, emphasizing a direct bid offer to shareholders at a premium. This aggressive takeover process might include tactics like tender offers or proxy fights to replace board members favoring the transaction. Corporate raiders may utilize such strategies to capitalize on takeover opportunities.

Key Characteristics of Hostile Takeovers

Hostile takeovers are defined by several distinct characteristics. First, a lack of approval from the target company’s board distinguishes them from other acquisition types. Secondly, the acquirer often employs deceptive or aggressive tactics to bypass management, including directly appealing to shareholders. High-profile, media-intensive negotiations frequently mark these takeovers, as they often involve significant legal and financial maneuvering. Additionally, they can lead to sudden and substantial shifts in management and strategy, leaving uncertainty in their wake.

Why Hostile Takeovers Occur

Common Motivations for Pursuing Hostile Takeovers

Hostile takeovers are pursued for various strategic reasons. Acquirers often aim to access valuable resources or technology proprietary to the target company. Sometimes, the target company is seen as undervalued, presenting a lucrative opportunity for the acquirer to increase their market share or diversify their business operations. Other motivations include gaining a competitive edge by neutralizing a rival or restructuring the target to boost profitability.

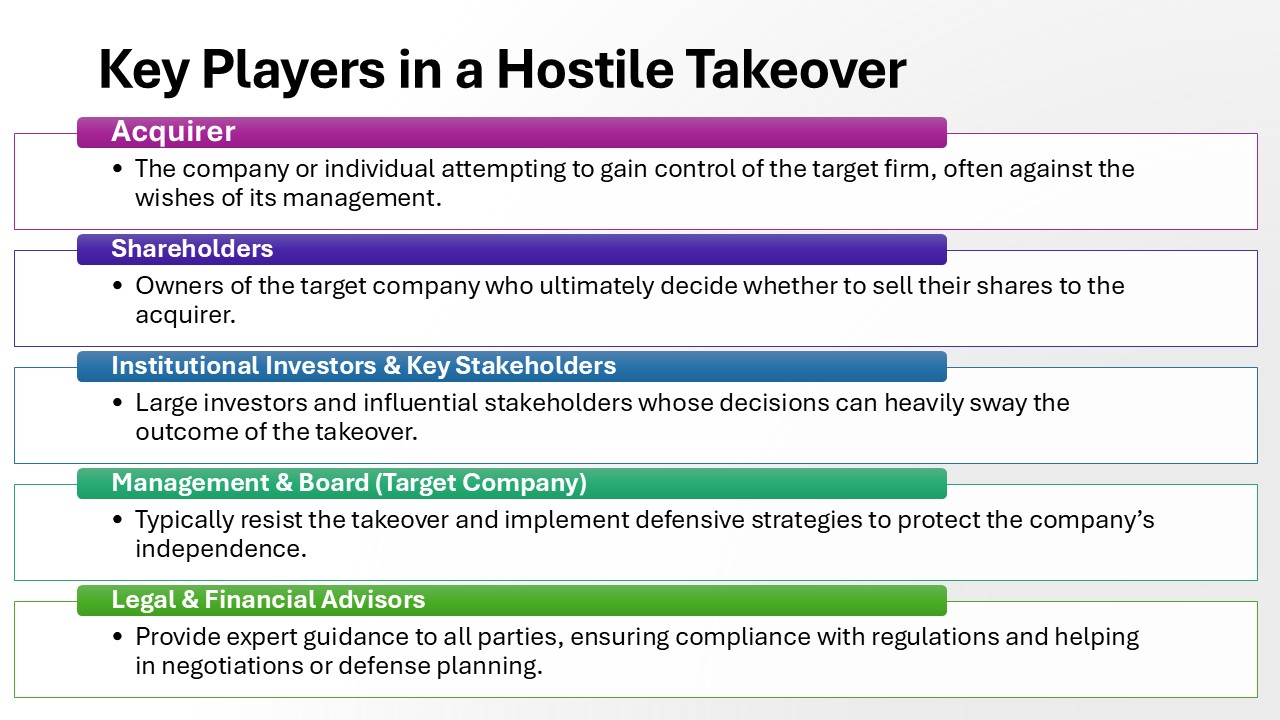

Major Players Involved in Hostile Takeovers

In a hostile takeover, several key players come into play, each with distinct roles. The acquirer is the most apparent, seeking control of the target company. Shareholders of the target company play a crucial role as they ultimately decide whether to sell their shares to the acquirer. Their decisions can be influenced by institutional investors and key stakeholders who hold significant sway. The management and board of directors of the target company are also vital, as they typically resist the takeover and strategize defenses. Lastly, legal and financial advisors provide expertise and guidance to all parties involved, ensuring compliance with regulations and optimizing negotiation strategies.

Market Conditions Favorable to Hostile Takeovers

Certain market conditions make the environment ripe for hostile takeovers. A bearish market often leads to undervalued stock prices, providing an opportunity for acquirers to buy companies at a bargain. Additionally, fragmented industries with numerous small or medium enterprises lacking economies of scale may present attractive takeover targets. Companies with financial distress, weak management teams, or lack of clear strategic direction also become potential candidates. Industry consolidation trends can further fuel takeovers as companies strive for synergies and competitive advantages.

Strategies Used in Hostile Takeovers

Understanding the Tender Offer Approach

The tender offer is a direct and often swift method employed in hostile takeovers. It involves the acquiring company proposing to buy shares from the target company’s shareholders at a premium over the current market price. By appealing directly to shareholders, the acquiring company bypasses the target company’s management. Shareholders are enticed to sell their shares due to the attractive offer, which often results in the acquisition of a controlling stake. Tender offers typically come with an expiration date, creating a sense of urgency for shareholders to act. This strategy relies heavily on effective communication and compelling financial incentives.

Inside the Proxy Fight Strategy

A proxy fight is a strategic maneuver used in hostile takeovers where the acquiring company attempts to gain control of the target company by persuading shareholders to vote out existing board members in favor of their candidates. By replacing the board with members sympathetic to the takeover, the acquirer can secure the necessary approval for the acquisition. This method often involves extensive campaigns to gather shareholder support, resembling political campaigns with appeals and messaging to gain votes. Proxy fights are typically arduous and require a deep understanding of shareholder sentiments and corporate governance.

Tools of the Trade: Creeping and Toehold Acquisition

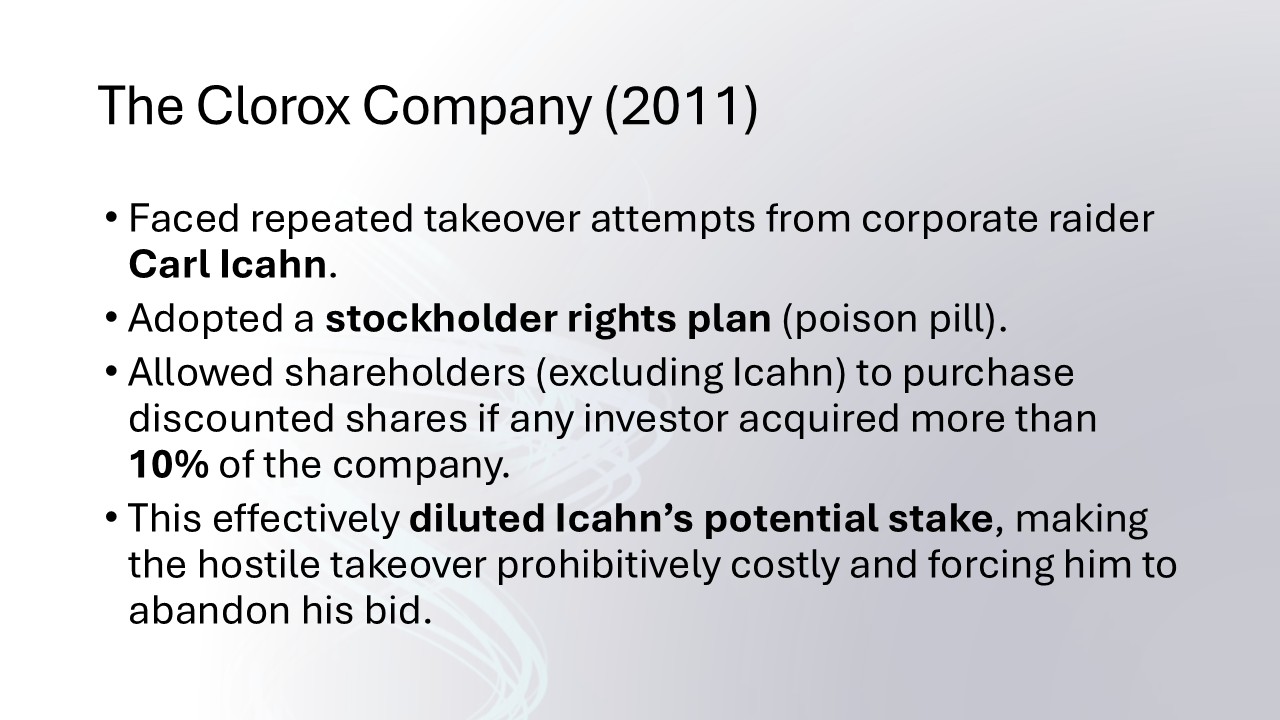

Creeping and toehold acquisitions are nuanced strategies in the hostile takeover playbook. A creeping acquisition involves gradually purchasing shares of the target company over time on the open market, allowing the acquiring company to increase its ownership interest without immediate detection. On the other hand, a toehold acquisition is a more overt strategy where the acquiring company quickly purchases a smaller percentage of the target, usually less than the ownership threshold of 10%, to position itself strategically for a full takeover later. Both approaches enable acquirers to gauge market reactions and refine their strategy, potentially triggering other defensive mechanisms like a stockholder rights plan or other charter clauses if the intent of a hostile bid becomes evident.

Defense Mechanisms Against Hostile Takeovers

The Role of Poison Pills as a Deterrent

Poison pills, officially known as shareholder rights plans or stockholder rights plans, are a well-known defense mechanism against hostile takeovers, designed to make acquisitions prohibitively expensive or unattractive. These strategies allow existing shareholders in the target company to purchase additional shares at a discount if any single entity acquires a certain percentage, thereby diluting the acquirer’s stake and making the takeover costlier. By implementing a poison pill, the board effectively deters unwanted acquirers without needing shareholder approval initially. While effective, they can also discourage potentially beneficial acquisitions and are subject to legal and shareholder scrutiny. A notable example is The Clorox Company, which adopted a stockholder rights plan in response to repeated acquisition attempts by corporate raider Carl Icahn.

Exploring White Knight Scenarios

In a white knight scenario, a target company actively seeks a more favorable acquirer to fend off a hostile takeover. The white knight is typically a company or individual aligned with the target’s interests, offering more agreeable terms. This strategy can preserve the target company’s culture and management while providing a higher offer for shareholders. Engaging a white knight often results in a merger or acquisition still occurring, but under terms that are strategically beneficial to the original company. This approach maintains goodwill while protecting shareholder value. Moreover, engaging a white knight during the takeover process can act as a deterrent to corporate raiders, who might interpret the alliance as a sign of strong defenses against their takeover intent.

Anatomy of a Crown Jewel Defense

The crown jewel defense involves divesting key assets or subsidiaries of a company—the “crown jewels”—to deter hostile acquirers. By selling or threatening to sell these prized assets, the target company can become less attractive to the aggressor seeking specific assets. This strategy can act as a strong deterrent, as it reduces the strategic value the acquirer initially sought. However, this tactic can also result in significant changes to the company’s core operations and value proposition, potentially impacting share prices and future competitiveness. It’s a bold move, often used as a last resort when other defenses might fail.

Real-Life Examples of Hostile Takeovers

Iconic Hostile Takeover: Elon Musk’s Twitter Acquisition

Elon Musk‘s acquisition of Twitter serves as an iconic example of a hostile takeover with a high-profile saga that captured global attention. Much like other American corporate maneuvers, Musk’s strategy displayed how significant individual influence and social media dynamics can be in reshaping corporate landscapes. Despite initial resistance and Musk criticizing Twitter’s management and platform operations, he pursued the acquisition through assertive tactics and public discourse, which included editorial statements and strategic data usage. Musk’s approach involved directly engaging Twitter’s shareholders and capitalizing on public opinion, ultimately compelling the company to agree to the buyout terms. This acquisition underscores how powerful individual influence and social media dynamics can play crucial roles in modern corporate takeovers.

The Tense Battle: Sanofi-Aventis and Genzyme Corp.

The acquisition of Genzyme Corp. by Sanofi-Aventis is a classic example of a tense hostile takeover. Sanofi-Aventis initially faced resistance from Genzyme, prompting it to proceed with a direct appeal to shareholders through a tender offer. Genzyme’s management resisted by highlighting the company’s pipeline potential and eventual shareholder value. The lower valuation of Genzyme compared to its peers initially made it more susceptible to this takeover. Sanofi-Aventis endured a public and strategic battle, which included increasing their offer and negotiating with major stakeholders. Ultimately, the agreement was reached, with Sanofi-Aventis acquiring Genzyme for a substantial premium, exemplifying perseverance and strategic negotiation in hostile takeovers and rigorous due diligence during post-acquisition processes to ensure long-term success.

Vodafone AirTouch vs. Mannesmann AG

The hostile takeover of Mannesmann AG by Vodafone AirTouch marked a landmark in corporate acquisition history, particularly within the telecommunications sector. This acquisition occurred despite strong opposition from Mannesmann’s management and seemed to challenge traditional German corporate governance. Vodafone initiated the takeover to secure a strategic industry foothold in the European telecom industry. To achieve this, they increased their takeover bid multiple times during a protracted legal and strategic battle. Ultimately, Vodafone succeeded by persuading key shareholders, negotiating a historic deal worth roughly $180 billion. This deal set new records and highlighted the increasing globalization and consolidation trends within the telecom industry.

Ethical Considerations and Risks

Assessing the Morality of Hostile Takeovers

The morality of hostile takeovers is a topic of ongoing debate, characterized by a clash between business efficiency and ethical considerations. Proponents argue that such takeovers can revitalize underperforming companies, enhance shareholder value, and improve market efficiencies by pushing for necessary changes. Critics, however, highlight the potential negative impacts, such as job losses, cultural upheaval, and disregard for stakeholder interests beyond immediate financial gains. Hostile takeovers often raise questions about the balance between shareholder profits and broader social responsibilities, making them a complex issue within corporate ethics.

Potential Risks and Rewards for Stakeholders

Hostile takeovers present a mixed bag of risks and rewards for stakeholders. On the positive side, shareholders often see immediate financial benefits from the premium offered for their shares. The acquiring company might bring new management practices and innovation, potentially elevating the company’s market position. However, these takeovers can also introduce significant risks, such as workforce disruptions, cultural clashes, and integration challenges that may impact long-term performance. Moreover, employees and smaller stakeholders might face uncertainty and realignment of priorities, which can destabilize established relationships and operational continuity.

Conclusion and Key Takeaways

Summarizing the Dynamics of Hostile Takeovers

Hostile takeovers embody a complex interplay of strategy, finance, and corporate governance. At their core, they are attempts by an acquiring company to gain control of a reluctant target, often using aggressive tactics like tender offers and proxy fights. These takeovers are driven by motivations such as undervalued targets, strategic asset acquisition, and market expansion. While they can inject fresh capital and ideas into a stagnating company, they also bring potential upheaval and ethical concerns. Defenses like poison pills and white knights illustrate the strategic depth involved in both pursuing and resisting such takeovers. Understanding these dynamics helps stakeholders evaluate the implications for their interests.

Final Thoughts on Navigating Hostile Takeover Risks

Navigating the risks associated with hostile takeovers requires a careful balance of strategic vision and stakeholder engagement. For companies, proactive measures like the Pac-Man defense, robust corporate governance, and strategic defenses such as poison pills are vital. Other defensive options include employing strategies like establishing an employee stock ownership plan or using greenmail payments to deter potential acquirers. For shareholders and stakeholders, staying informed and critically assessing both the short-term gains and long-term impacts is crucial for informed decision-making. Remaining resilient and adaptable to change allows companies and stakeholders to mitigate risks while capitalizing on the opportunities hostile takeovers may present.

FAQs

What is the meaning of a company hostile takeover?

A hostile takeover is an acquisition attempt by a company to gain control of another company against the wishes of the target company’s management and board. The acquiring company often uses strategies like tender offers to shareholders or proxy fights to secure enough shares or replace board members to push the takeover through.

Are hostile takeovers legal?

Yes, hostile takeovers are legal and are part of the corporate landscape. They operate within the framework of market regulations and laws, although the tactics used must comply with legal standards to ensure fairness in how shares are purchased and shareholders are engaged.

How do companies prevent hostile takeovers?

Companies prevent hostile takeovers through strategic defenses like poison pills, which dilute shares if a takeover occurs, and white knight strategies, involving a friendly party that acquires the company under favorable terms. Strong corporate governance and diversified shareholder bases also help in deterring hostile acquirers.

What impact does a hostile takeover have on shareholders?

Shareholders often benefit financially in the short term due to the premium price offered for their shares. However, they also face uncertainty regarding the company’s future direction and performance following the takeover, which could affect long-term value and stability.

How does a hostile takeover of a company work?

A hostile takeover typically involves the acquiring company bypassing the target company’s management by directly appealing to shareholders through a tender offer for shares at a premium or instigating a proxy fight to replace the board. These actions enable the acquirer to gain control, either by acquiring sufficient shares or changing management to favor the takeover.