To fathom how they might fit into your retirement strategy, consider the present value of an annuity, which calculates the current worth of your annuity’s future payments. This can be an essential step in retirement planning, ensuring that you’re making the most out of your investments and that what you put in today continues to meet your needs tomorrow.

KEY TAKEAWAYS

- The future value of an annuity is the total amount an individual can expect to have from a series of regular payments (annuities) at a specified date in the future, taking into account the compound interest over time.

- To calculate the future value of an annuity, it’s essential to consider the present value, the number of payment periods, and the interest rate per period, as these factors will influence the cumulative effect on the investment.

- Understanding the future value of an annuity is crucial for long-term financial planning, as it aids in forecasting the growth of investments made in retirement funds, mortgage payments, or systematic contributions towards any savings plan.

The Importance of Calculating Future Value in Savings

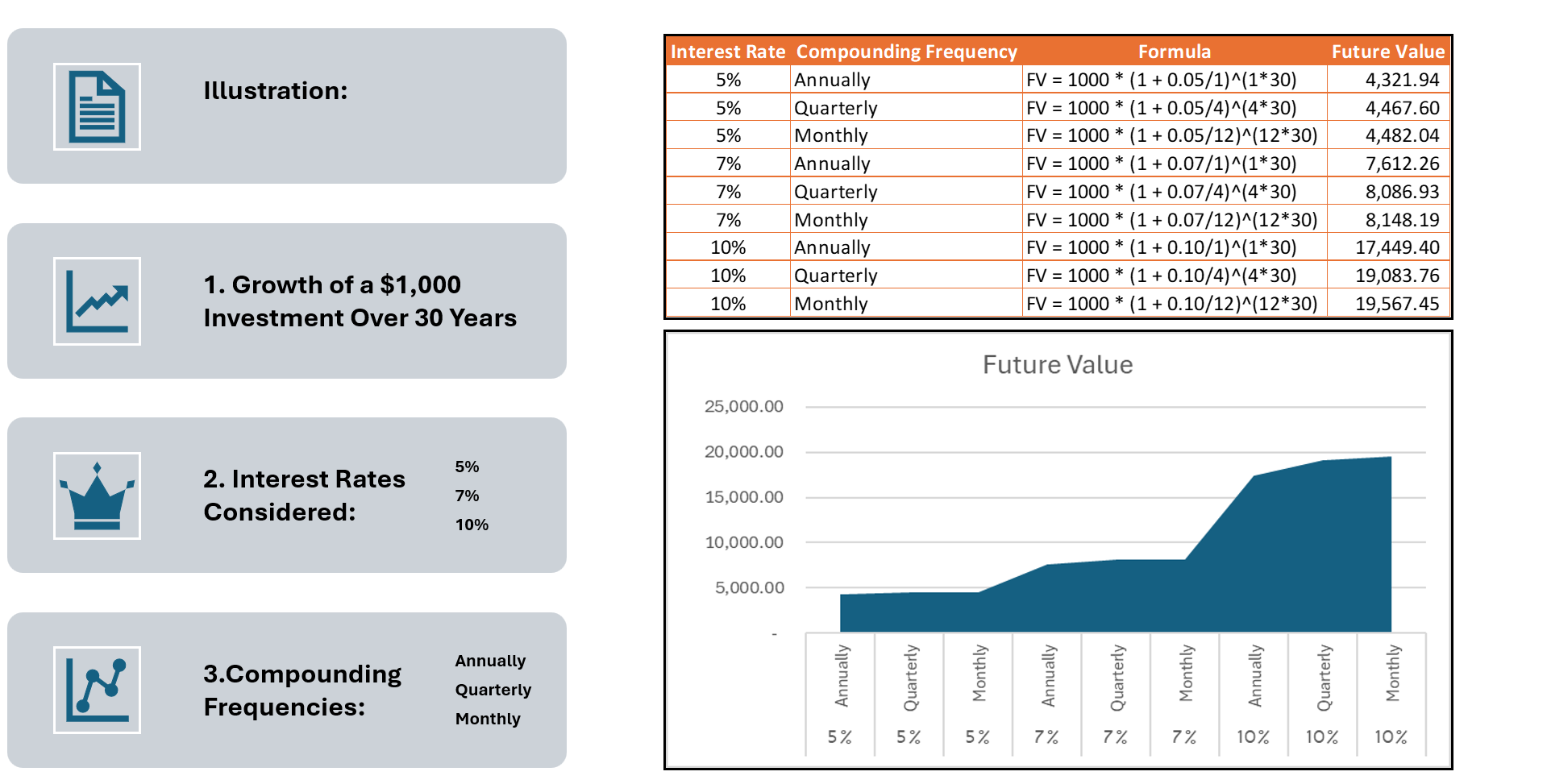

Calculating the future value of your savings is like having a financial crystal ball. It allows you to peek into the future to see the potential worth of your investments. Think of your savings as a seed that grows into a mighty oak tree over time—this is the accumulation of your diligent efforts and strategic financial planning. Understanding the equation that dictates this growth is crucial, as it includes variables like the compounding frequency of your payments, and timing of deposits which all affect how tall and strong that financial oak could become. By mastering these elements, you can tailor your savings strategy to ensure that when the time comes to rely on those funds, they’re adequate to meet your needs. Plus, it can help you decide if it’s time to water your savings more with additional contributions or perhaps expose it to a bit more sunlight with higher-risk investments.

Unpacking the Future Value of an Annuity

Diving into the future value of an annuity opens up a world where financial planning meets the power of compound interest. In simple terms, this is where your money not only earns interest but does so on an ever-increasing scale because each interest payment adds to the principal. Therefore, future value calculations are necessary to forecast how much your series of annuity payments will be worth down the line.

It’s like planting a garden of money trees – with each regular investment akin to watering the plants, your future wealth blossoms, bolstered by the compound interest ‘fertilizer’. When you understand the annuity’s future value—taking into account the timing of your annuity pmt—you can confidently make decisions today that align with your long-term financial goals. Whether you’re looking at retirement or saving for a child’s education, grasping this concept becomes indispensable.

Understanding the present value annuity equation allows investors to determine the current worth of future annuity payments, factoring in the timing and discount rate. This proves essential for informed investment comparisons and financial planning.

The Mathematical Roadmap: Annuity Formulas

The Classic Future Value Annuity Formulas

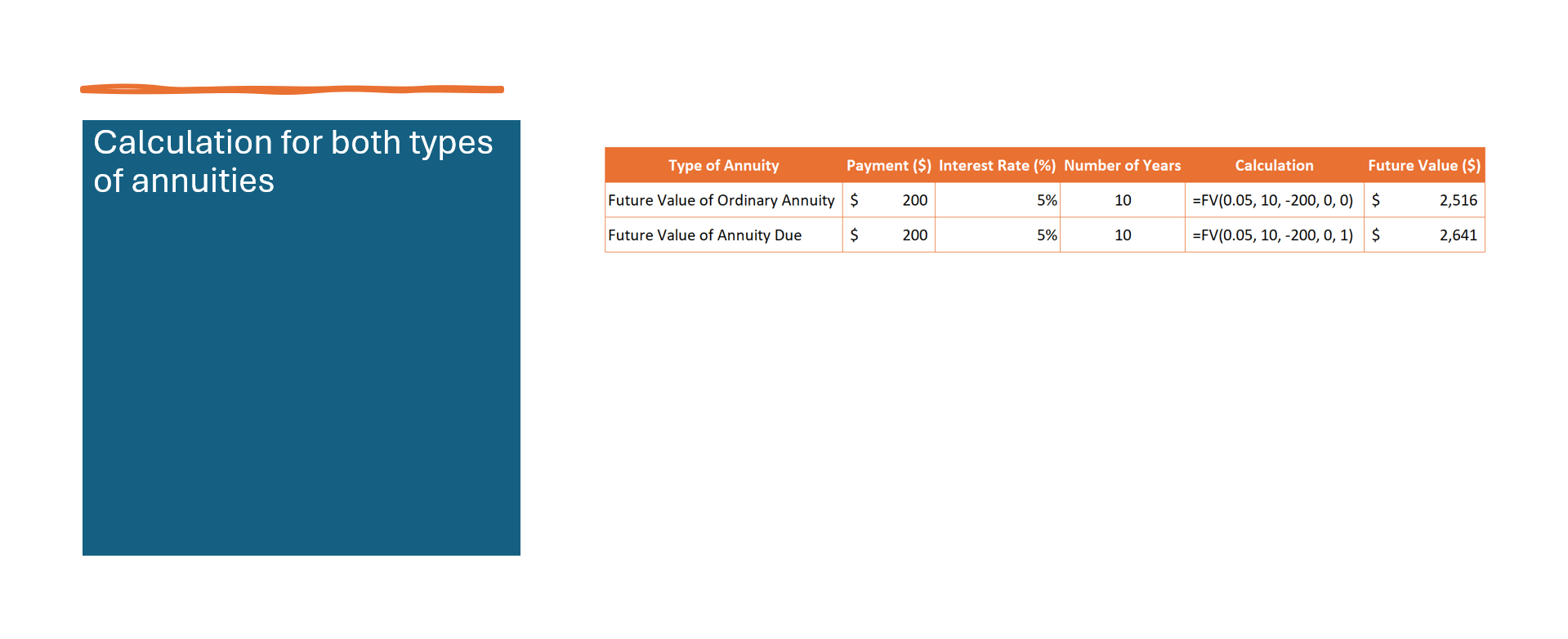

To put it simply, the classic future value annuity formula is your best friend when it comes to understanding how your regular deposits will add up over time. There are two main types: one for an ordinary annuity and another for an annuity due.

In an ordinary annuity, the payments are made at the end of each period. This interval, crucial in the calculation, is where the compounding frequency payment comes into play. The future value here is calculated by multiplying your regular annuity pmt (payment amount) by the result of [(1 + interest rate) to the power of the number of payments) – 1] divided by the interest rate. The compounding of interest during each time interval significantly impacts the growth of your investment.

In contrast, an annuity due has payments at the beginning of each period, which slightly adjusts our formula. This adjustment reflects the difference in timing, as such annuities are invested at a different interval than ordinary annuities. Here, you just multiply the ordinary annuity formula by (1 + interest rate) to account for that extra period of interest – giving your money more time to compound.

Armed with these formulas, and understanding the timing and interval of each payment, you’re set to watch your investments grow at a predictable pace, making it much easier to hit those long-term savings targets.

Growing Annuities and Continuous Compounding: Advanced Formulas

Growing annuities and continuous compounding take the annuity game to a whole new level, perfect for when you’re ready to sharpen your financial acumen. A growing annuity considers that your payments might increase over time, perhaps to keep up with inflation or cost-of-living adjustments. Its formula incorporates a growth rate, shaping the future value in a way that traditional models don’t.

Now, imagine if your money could grow at every conceivable moment—that’s the magic of continuous compounding. Instead of interest piling up monthly or yearly, with continuous compounding, it happens incessantly, as often as the breeze shifts. The math behind continuous compounding involves a unique number known as ‘e’, which is the base of the natural logarithm, and it takes the concept of making your money work harder to an extreme.

While these formulas might sound more complex, they’re merely tools to ensure that your financial planning is as precise as a Swiss watch, ticking perfectly in sync with your life’s timeline.

Choosing the Right Annuity Calculator

Features of the Best Future Value Annuity Calculators

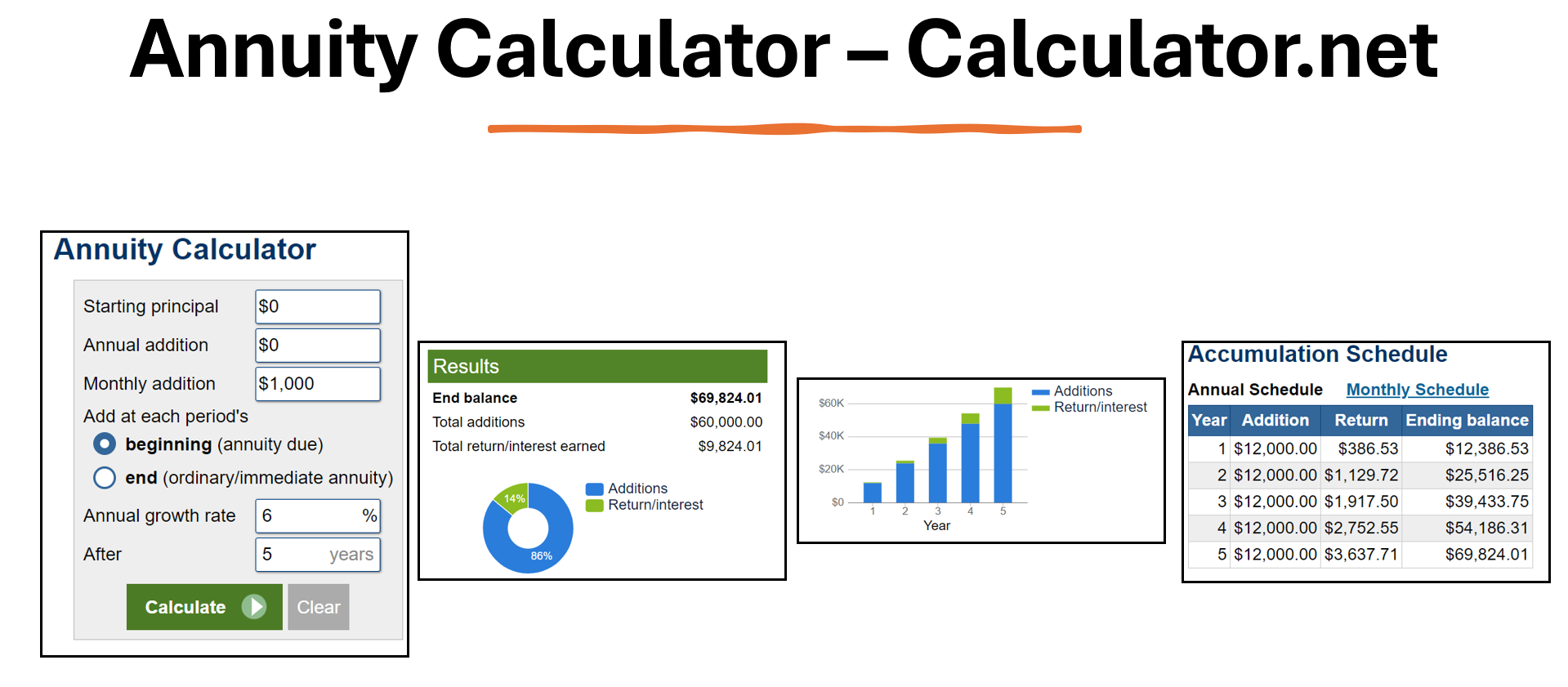

When you’re in the market for the best future value annuity calculator, there are a few standout features to keep your eyes peeled for. One, it should be user-friendly—nobody wants to wrestle with a calculator that’s as confusing as a maze. Two, it must offer flexibility with variable inputs, such as the parameters for differing annuity plans, accommodating different types of annuities, rates, and frequencies.

Thirdly, an excellent calculator should come equipped with explanatory texts or even mini tutorial videos to guide you through the process (because sometimes financial jargon seems like it’s written in hieroglyphics). For example, understanding parameters such as the Payment amount (PMT) and the Growth rate of the annuity (g) is crucial for accuracy. Additionally, the ability to adjust for inflation or changing interest rates would be significant pluses; this functionality can make your projections more realistic. If you’re someone who will soon rent or make annuity due payments at the start of each period, such as rental lease payments, ensure the tool considers Annuity due calculations.

Lastly, the best calculators will spit out detailed tables and graphs, giving you a clear visual of how your savings could grow over time. With these features, a future value annuity calculator doesn’t just perform calculations; it paints a vivid picture of your financial future.

Overcoming Practical Limitations of Annuity Calculators

While annuity calculators are nifty tools, they do have their Achilles’ heel. For starters, they can’t account for every twist and turn of life’s unpredictable path — economic fluctuations, changes in your personal circumstances, and unexpected financial needs can throw a wrench in the works. Moreover, online calculators often work under the assumption of constant rates of return, which, in the real-world, ebb and flow like the tide.

However, don’t let this deter you from using these calculators; they’re still incredibly powerful for approximations. To overcome these limitations, it’s wise to run different scenarios with varying rates and timelines to simulate a range of outcomes. Think of it as having a financial dress rehearsal for several potential futures.

Additionally, touching base with a financial advisor can fill in the gaps that calculators can’t reach. Their expertise can help navigate those tricky variables and ensure your financial plan is robust enough to weather any storm.

Future Value Annuity Calculator in Action

Step-by-Step Guide to Using an Annuity Calculator

To use an annuity calculator effectively, follow these step-by-step instructions. Ensure you have all necessary inputs like payment amount, number of periods, and interest rate before you begin.

- Locate an online annuity calculator, such as the one provided by CalculatorSoup or another of your choosing.

- Input the Present Value (PV) if known. This is the current total value of all future annuity payments.

- When inputting PV, be mindful of the cash flow sign convention:

- If you’re investing, the payment (PMT) should have the same sign as the PV.

- If you’re borrowing, the PMPS should have the opposite sign of the PV.

- Key in the Payment amount (PMT), which is the regular payment amount for the annuity.

- Enter the number of periods (N), which is how many times the payment will be made.

- Input the interest rate (I/Y), which is the rate per period.

- Input the number of payments per year (P/Y) and the number of compounding periods per year (C/Y).

- After entering a value into P/Y, some calculators will automatically copy this value to C/Y.

- If the compounding frequency is different from the payment frequency – Find a reputable online annuity calculator, for instance, the CalculatorSoup annuity calculator.

- Fill in the value for the Present Value (PV), if you already know this figure. Remember to:

- Use the correct sign for the PV based on whether you’re making an investment or taking out a loan. Payments (PMT) should have the same sign for investments and the opposite sign for loans.

- Enter the Payment amount (PMT), which is the amount of each annuity payment.

- Specify the number of periods (N), which represent how many payments you will receive or make.

- Insert the interest rate (I/Y), which is the annual interest rate for the annuity.

- Enter the number of payments per year (P/Y). After this, the calculator might automatically assume the same value for the compounding frequency (C/Y).

- If the compounding frequency (C/Y) differs from the payment frequency (P/Y), adjust the C/Y value accordingly.

- Review all inputs to ensure accuracy and consistency with the annuity terms.

- Execute the calculation by pressing the ‘Calculate’ or ‘Submit’ button on the calculator.

- Interpret the results, which will typically include the future value of the annuity and may provide additional details For an accurate computation using an annuity calculator online, please follow these instructions:

- Initiate the process by locating a reliable online annuity calculator, such as the one available at CalculatorSoup, or another calculator of your preference.

- Begin with the entry for Present Value (PV) if you have this information. Adhere to the cash flow sign convention by:

- Making sure that if you are investing, the present value (PV) and the payment (PMT) are input with the same sign.

- If you are borrowing, enter the payment (PMT) with a sign opposite to that of the present value (PV).

- Proceed to enter the Payment amount (PMT), which is the regular annuity payment.

- Next, input the number of payment periods (N), which represents the total number of annuity payments over the term.

- Enter the interest rate (I/Y), specifying the annual interest rate for your annuity.

- Fill out the number of payments per year (P/Y) and the compounding periods per year (C/Y).

- Ensure that once you put in the value for P/Y, you verify if the C/Y field is automatically filled with the same value. If the compounding frequency is different from the payment

Real-life Scenarios: When to Use an Annuity Calculator

Imagine you’re contemplating retirement and you’re curious about the potential income from your current savings – that’s the perfect time to pull up an annuity calculator. Or say you’ve got a chunk of change and you’re considering buying an annuity to secure a steady payout during your golden years. Calculators can help forecast the payouts based on the lump sum you currently have.

They’re also fantastic for parents mapping out a college savings plan for their children, allowing them to see how regular contributions to a college fund might grow over time. And if you’ve received a windfall or an inheritance and are considering an annuity as a way to manage that money, running the numbers through a calculator can lay out a future income stream for you to consider.

For the financially savvy, an annuity calculator is also a handy tool to compare the potential growth of annuity investments against other financial products like stocks or real estate. It can also help business owners looking to establish a guaranteed income after selling their business or stepping back from day-to-day operations.

Each of these scenarios encapsulates the practical benefits of forecasting future payouts, guiding crucial financial decisions, and planning for a secure and comfortable future.

Tips for Maximizing Your Annuity Investment

Alright, you’re ready to make the most of your annuity investment, right? Here are some golden nuggets to keep in your pocket:

- Start Early and Invest Often: The earlier you start plowing money into your annuity, the more time it has to grow. Even small, regular contributions can swell into significant sums over the years, thanks to compounding interest.

- Reinvest Your Payouts: If you’re not in immediate need of the payouts, consider reinvesting them. This could potentially increase the future value of your annuity, turning a stream into a river of income down the road.

- Shop Around: Don’t just jump into the first annuity that catches your eye. Different annuities offer different features and fees. Take your time to compare options and select one that aligns with your financial goals and needs.

- Update Regularly: As your life circumstances change, so too should your annuity investment. Revisit your annuity periodically to ensure it still fits your retirement plan like a glove.

- Seek Professional Advice: Annuities can be complex. Consulting with a financial advisor can help you navigate the options and pick an annuity that’s the cherry on top of your retirement plan.

By following these tips, you’ll be well on your way to maximizing your annuity investment, paving a golden path to a retirement that’s as stress-free as a day at the beach.

FAQs on Future Value Annuity Calculators

What is a Future Value Annuity Calculator?

A Future Value Annuity Calculator is a digital financial tool designed to project the value of a series of regular payments at a certain date in the future. It’s perfect for estimating how much your periodic investments, like retirement contributions or savings plans, will grow over a set period, considering variables such as interest rates and payment frequency. Use it to steer your savings strategy and forecast your financial readiness when you need those funds the most.

How Do I Choose the Best Calculator for My Annuity?

To pick the best calculator for your annuity, focus on finding one that’s user-friendly and matches your specific financial situation. Look for calculators that allow you to accurately reflect the type, rate, and frequency of your annuity payments. It should also let you adjust for inflation or changing interest rates. Reading reviews and comparing features can help you select an efficient and effective calculator that’ll serve as a reliable partner in figuring out your financial future.

Can I Predict My Retirement Savings Using an Annuity Calculator?

Absolutely! An annuity calculator is an ideal companion for painting a picture of your retirement savings. By inputting details like your current savings, regular contributions, and the annuity’s interest rate, you can estimate how much you’ll have tucked away when you retire. It’s a fantastic way to check if you’re on track or if you need to adjust your sails to reach your retirement goals. Remember, though, it’s a forecast, not a crystal ball—regular reviews and adjustments are key!

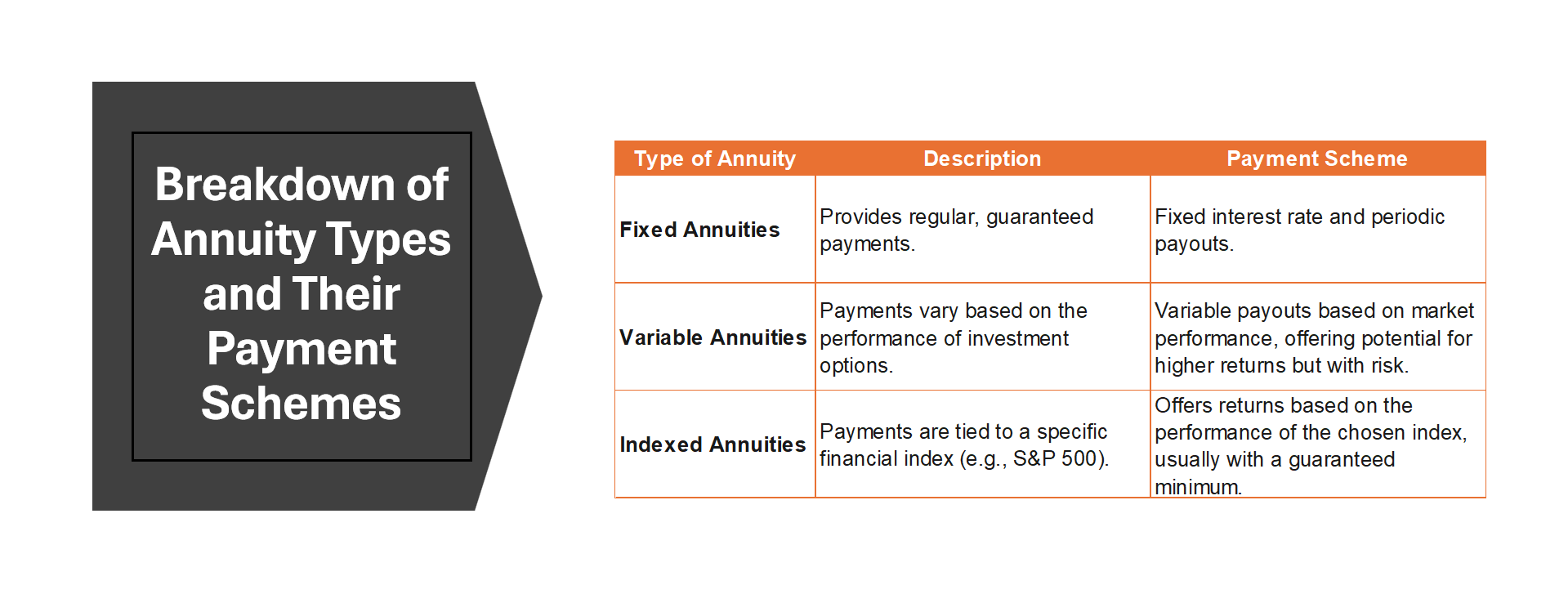

Are There Different Types of Annuities I Should Consider?

Yes, there are several types of annuities to consider, each with their own flavor. Fixed annuities offer a stable return, akin to a certificate of deposit (CD), making them ideal if you’re after predictability. Unlike CDs, a fixed annuity provides a consistent stream of income during retirement. Variable annuities, on the other hand, are more like stocks, with returns linked to the performance of investments, which means the potential for higher gains (but also higher risk). Additionally, the variable annuity allows for participation in various investment options through sub-accounts which can be tailored to suit different risk tolerances and investment goals. There’s also indexed annuities that tie your returns to a market index, offering a middle ground between fixed and variable options. Leveraging the protection offered by a fixed annuity with the growth potential of a variable annuity, indexed annuities can be suitable for retirees looking for a balanced approach. Choosing the right one hinges on balancing your appetite for risk with your desire for growth or stability.