KEY TAKEAWAYS

- Balance Sheet:

- Provides a snapshot of the company’s financial position at a specific point in time.

- Details the assets, liabilities, and shareholders’ equity, helping assess what the company owns versus owes.

- Essential for understanding a company’s net worth and financial stability.

- Income Statement:

- Outlines the company’s revenue and expenses over a period, resulting in a net profit or loss.

- Offers insights into a company’s operational efficiency and profitability.

- Helps identify trends in sales and expenses, critical for strategic planning.

- Cash Flow Statement:

- Tracks the inflows and outflows of cash, highlighting the company’s liquidity.

- Provides clarity on how well the company manages its cash to fund operations and investments.

- Important for evaluating financial flexibility and ongoing viability.

- Statement of Retained Earnings:

- Shows changes in retained earnings, reflecting profits retained after dividends are paid.

- Indicates how much profit is reinvested back into the company for growth.

- Useful for understanding dividend policies and growth potential.

The Core Four: Exploring Financial Statements

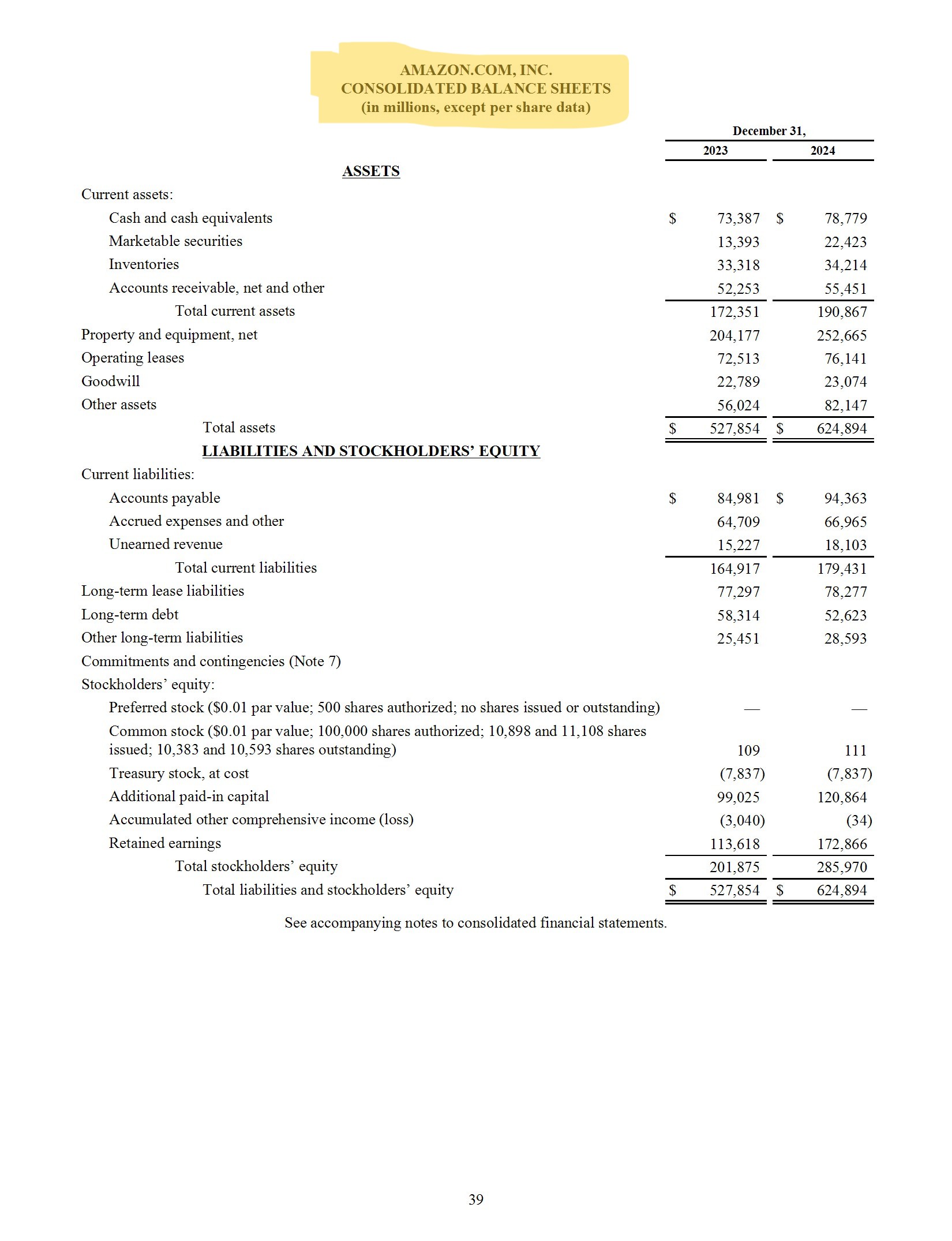

The Balance Sheet: A Snapshot of Financial Health

The balance sheet acts as the financial portrait of an organization at a specific point in time, clearly delineating assets, liabilities, and shareholders’ equity. It’s akin to a snapshot that reveals what a company owns versus what it owes. Assets on the balance sheet include tangible items like property, machinery, and inventory, alongside intangible ones such as patents and trademarks. In contrast, liabilities consist of obligations, like loans and accounts payable. By understanding the accounting equation in the balance sheet (Total Assets = Total Liabilities + Total Shareholders’ Equity), stakeholders can see how resources are allocated and examine potential risks, such as bankruptcy. By subtracting total liabilities from total assets, you arrive at shareholders’ equity, reflecting the net worth of the company. For those seeking to understand a business’s financial strength, the balance sheet is indispensable. It not only indicates the firm’s ability to meet its obligations but also reveals how it’s financed, offering clues about solvency and operational efficiency. Including depreciation expenses typically helps in understanding the net asset value over time. Additionally, cash or cash equivalents and revenue from property rental income are vital components shown on the balance sheet, enhancing insight into liquidity. For a more comprehensive analysis, comparing balance sheets over time can unearth growth trends and shifts in financial strategy. Thus, Expertise of the balance sheet, including comprehension of the accounting equation, empowers better strategic planning and immediate insight into a company’s financial status.

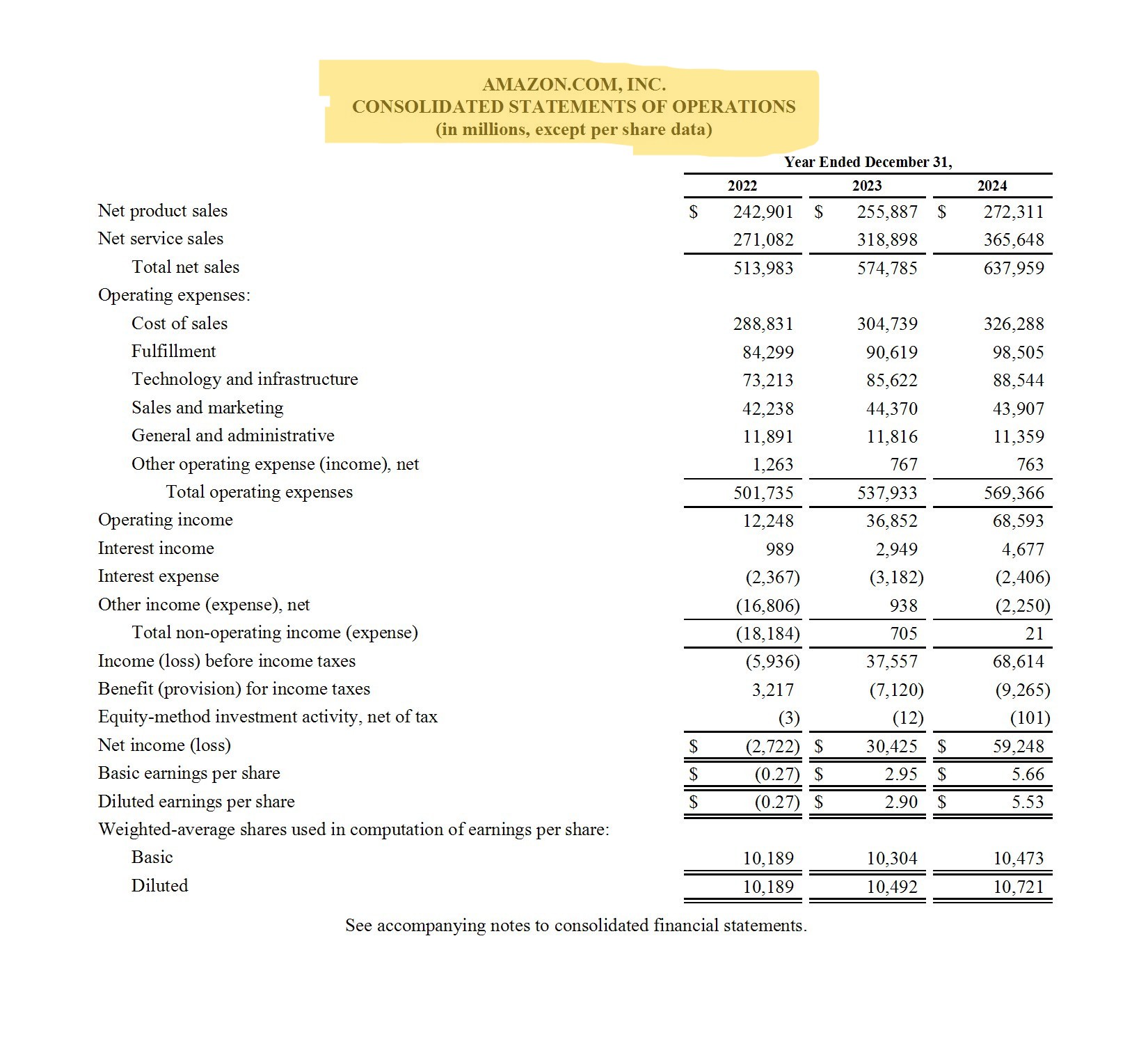

Income Statement: Tracking Profitability

The income statement, also known as the profit and loss statement, provides a summary of a company’s performance over a designated period, illustrating how revenue is transformed into net profit or loss. It essentially tracks profitability by documenting revenue, cost of goods sold (COGS), gross profit, operating expenses, and net income. COGS expenses represent the direct costs attributable to goods produced and sold by the company, making them crucial for accurate financial assessments. By subtracting these costs from revenues, businesses arrive at their gross profit. Significant operating expenses, such as salaries and rent, payroll, and compensation, further erode this figure until you reach operating profit. The ultimate line, net income, accounts for all other financial activities, including taxes and non-operating expenses like sales taxes, depreciation, and amortization expenses.

Analyzing income statements over time allows you to discern trends in profitability and expenses, providing a clearer picture of what drives financial performance. For example, a consistent increase in sales revenue paired with stable operating expenses suggests efficient growth. Additionally, understanding how depreciation and amortization impact financial results can aid in decisions related to pricing strategy and market positioning. In light of major corporate events, such as a merger or acquisition, income statements are vital for understanding financial impacts. With these insights, stakeholders can make informed judgments about business strategies, including decisions on ownership interest and dividend payments, and identify areas for improvement.

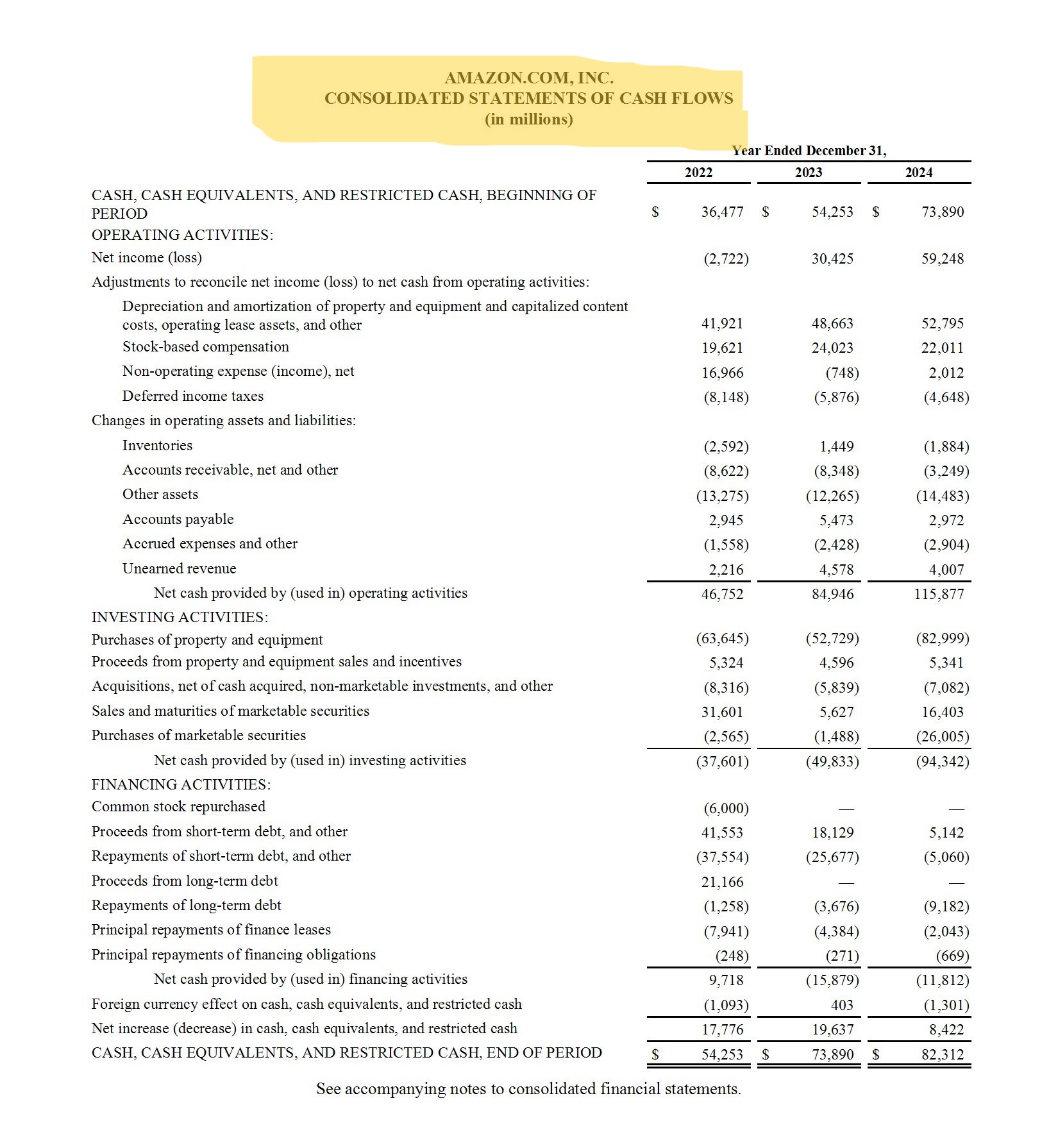

Cash Flow Statement: Understanding Liquidity

The cash flow statement provides a detailed account of how cash is generated and expended during a specific period, offering invaluable insights into a company’s liquidity. It segments cash flows into three main categories: operating, investing, and financing activities. Operating activities encompass the cash inflows and outflows from core business operations, revealing the day-to-day viability of the company. These include significant cash transactions like vendor payments that directly impact the financials. Investing activities show cash used for or generated from buying and selling assets like property or equipment. Finally, financing activities involve transactions that affect the company’s capital structure, such as issuing stocks or repaying debts, which also reflect changes in liability levels. By analyzing these sections, you can ascertain how a company manages its cash to fund operations, serve debts, and plan for future growth. Positive cash flow from operating activities is particularly vital, indicating that a company can sustain itself without needing external financing. For businesses operating internationally, understanding cash flow in different currencies can also be crucial for accurate financial planning. Calculating and reviewing cash flow regularly can ensure accurate financial statement filings, which in turn is essential for maintaining regulatory compliance. Ultimately, regular cash flow analysis equips stakeholders with the knowledge to foresee potential liquidity issues and seek opportunities for reinvestment or expansion. Understanding the cash flow statement is crucial for grasping the overall financial flexibility of a company.

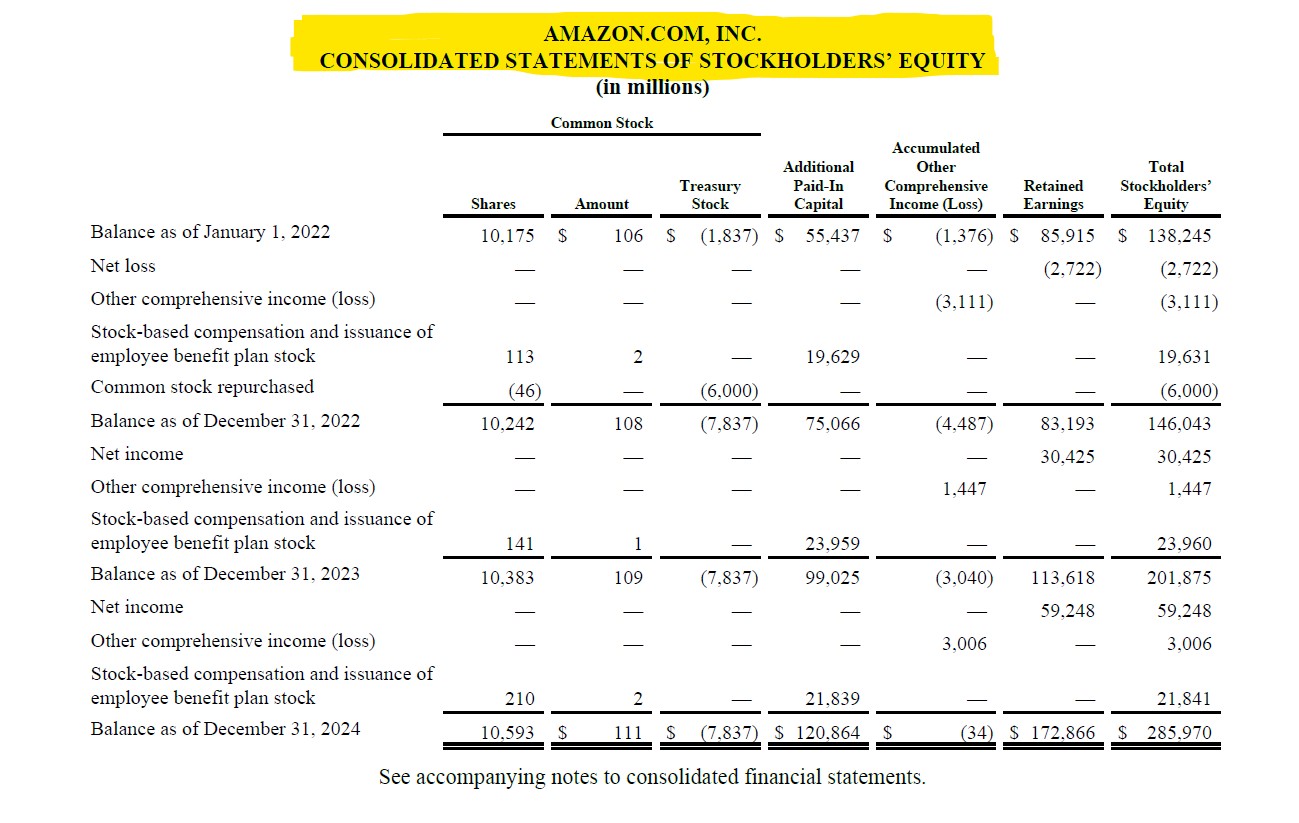

Statement of Shareholders’ Equity: Ownership Insights

The statement of shareholders’ equity provides a detailed view of changes in the equity portion of the balance sheet, offering insight into the ownership and structure of a company. This equity report details transactions that affect the equity accounts, making it essential for understanding how a company’s financial and operational decisions alter the underlying value held by shareholders. Key components often include common stock, preferred stock, additional paid-in capital, treasury stock, and retained earnings. Each of these elements captures different facets of equity transactions, from the issuance of new shares to the repurchase of treasury shares and distribution of dividends.

Think of it as a business log that shows all the movements in the equity portion over time, much like how revenue and expenses are tracked in financial records. Monitoring changes in shareholders’ equity allows you to see how profits are reinvested into the company or returned to investors. An increase in retained earnings signifies profitable operations, whereas significant treasury stock might reflect stock buybacks, potentially indicating confidence in future growth.

This statement is particularly valuable for investors seeking to understand how their ownership stake in a company might evolve, providing transparency into shareholder returns and the impact of corporate strategies on equity. Tracking ownership interest changes is crucial for assessing the effect of repurchases and new share issuances on investor holdings.

Practical Applications in Business

Decision-Making for Management

Financial statements serve as a critical tool for management in navigating various business decisions. By analyzing these documents, managers can identify trends, detect anomalies, and craft strategies to propel the company forward. For instance, the operating margins derived from the income statement can suggest areas where cost control measures may be necessary or where efficiencies can be improved.

The balance sheet offers insights into the company’s financial positioning, allowing leaders to decide on potential investments or divestitures. Cash flow statements equip them with the foresight to manage liquidity, ensuring that the company maintains sufficient cash to meet obligations, fund operations, and seize growth opportunities.

With these insights, management can make informed decisions on resource allocation, budgeting, and performance measurements. Pairing statistical data with financial metrics can enhance decision-making, identifying the most lucrative avenues for the company.

Overall, Utilizing the power of financial statements leads to more strategic and data-driven management, enhancing the company’s ability to execute and achieve its objectives effectively.

Communicating with Investors and Stakeholders

Financial statements are the cornerstone of transparent communication with investors and stakeholders, acting as the primary vehicle for conveying a company’s financial health and strategic direction. By providing clear and comprehensive financial data, businesses can build trust and credibility with their audience. As noted by Investopedia, these statements follow specific formats to detail assets, liabilities, and equity, ensuring consistency and comparability across reporting periods. Investors closely scrutinize these documents to assess profitability, liquidity, and overall financial performance, aiding in decision-making about investing or divesting. Statements like the income statement and balance sheet are vital in demonstrating revenue growth and asset management effectiveness, while the cash flow statement offers insights into operational efficiency and financial stability.

Collaborative data rooms facilitate secure data review, enhancing transparency in financial communications. This thorough overview assists in making accurate projections based on historical trends present in these records. For stakeholders, these documents unveil the fiscal impact of management decisions and long-term company viability. Regular and transparent reporting can foster stronger relationships and align stakeholder expectations with company objectives.

Moreover, Investopedia highlights that clear communication through detailed financial statements can attract potential investors, offering them assurance about the company’s fiscal integrity and growth prospects. Sending a well-crafted program brochure email can also be an effective tool for updating stakeholders about financial strategies and new growth initiatives. In sum, consistently accurate and transparent financial reporting solidifies stakeholder confidence and can lead to increased investment and support.

Importance and Benefits

Ensuring Accurate Reporting

Accurate financial reporting is essential for establishing trust and maintaining credibility with internal and external stakeholders. To ensure precision in reporting, companies must implement robust accounting systems and controls, which can significantly simplify the paperwork process required by regulatory bodies. These systems help in maintaining consistent data accuracy and coherence across all financial statements, which vary in format between companies and might use specific templates tailored to their needs.

Regular audits play a critical role in this process, acting as a safeguard against errors and discrepancies. They provide an independent assessment of financial statements, reinforcing their reliability and compliance with accepted accounting standards. Additionally, using technology like automated accounting software can significantly reduce human error, streamline data entry, and enhance real-time financial tracking. Implementing a culture of continuous training and awareness among staff can further ensure that everyone understands the importance of precise financial reporting and stays updated with the latest standards and regulations.

Ultimately, commitment to accurate reporting not only aids in fulfilling legal obligations but also lays a solid foundation for financial planning and decision-making. This diligence in financial accountability, alongside efficient handling of financial paperwork, can enhance a company’s reputation and performance, benefiting all stakeholders involved.

Enhancing Financial Transparency

Enhancing financial transparency is fundamental to fostering trust and building robust relationships with investors, regulators, and other stakeholders. By openly sharing accurate financial information, companies demonstrate their commitment to ethical practices and accountability. Transparency begins with clear, detailed financial reporting that adheres to established standards like GAAP or IFRS, facilitating easier comparisons and understanding by stakeholders.

To achieve transparency, companies should provide comprehensive financial disclosures in their reports, outlining not just the numbers but the context behind them. This includes explaining any notable changes in financial performance, unusual transactions, or shifts in accounting practices.

Moreover, adopting integrated reporting, which combines financial and non-financial data, offers a more holistic view of the business’s long-term value creation. This approach not only satisfies stakeholder curiosity but aligns their interests with company strategies.

Enhancing financial transparency fosters an environment where stakeholders feel informed and valued, promoting long-term investment and support. It turns financial reporting from a mere compliance exercise into a strategic tool for engagement and growth.

Compliance and Standards

Adhering to GAAP and IFRS

Adhering to Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) is crucial for ensuring consistency and comparability in financial reporting. These frameworks provide a structured approach, outlining the principles and procedures for preparing financial statements. While GAAP is predominantly used in the United States, IFRS is adopted in over 140 countries around the globe.

Compliance with these standards enables companies to present financial information that is reliable and understandable to stakeholders across different jurisdictions. This adherence not only facilitates cross-border investments but also enhances credibility in the eyes of global investors.

For companies operating internationally, the challenge often lies in navigating the differences between GAAP and IFRS, such as their treatment of revenue recognition and asset valuation. Nonetheless, harmonizing these standards across operations ensures that financial statements accurately reflect the company’s economic reality.

Ultimately, strict adherence to GAAP and IFRS positions a company advantageously in the global market, ensuring regulatory compliance and fostering transparency and trust among stakeholders.

Navigating Regulatory Requirements

Navigating regulatory requirements in financial reporting is a critical function for any business, as non-compliance can result in significant penalties and reputation damage. These regulations are set by governmental and financial bodies to ensure transparency, accuracy, and fairness in financial disclosure. To comply, companies must stay informed about all relevant local, national, and international regulations that apply to their operations.

Effective navigation of these requirements typically involves establishing a robust compliance framework. This framework often includes dedicated compliance officers or teams responsible for monitoring changes in regulations and ensuring that all financial reporting processes align with current laws.

Additionally, investing in compliance software can streamline processes and automate some of the more complex regulatory tasks, reducing the possibility of human error. Staff training on compliance issues is also crucial, ensuring that all employees understand their role in upholding these standards.

By focusing on compliance, businesses not only avoid legal repercussions but also enhance their reputation as trustworthy and transparent entities. Confidence in the company’s financial integrity can lead to stronger relationships with customers, investors, and regulators alike.

Future Trends in Financial Reporting

Automation and Technology in Financial Reporting

Automation and technology are revolutionizing financial reporting processes, bringing unparalleled efficiency and accuracy. By integrating advanced financial software and tools, companies can streamline data collection, analysis, and presentation. With the help of automation, financial reporting now simplifies complex procedures, including those related to suppliers and current liabilities, aiding companies in managing finances effectively. Automation minimizes human error in data entry and effortless updates, allowing for real-time reporting that aids swift decision-making.

One key advantage of using technology in financial reporting is the facilitation of comprehensive data analysis through machine learning and artificial intelligence. These technologies can uncover patterns and trends that might be missed in manual reporting, enabling more informed strategic decisions.

Furthermore, technology enhances the speed and transparency of financial disclosures, which can significantly improve stakeholder communication. Automated systems can quickly generate regulatory reports, ensuring compliance with minimal manual intervention. In understanding the basics of financial technology, companies can achieve competitiveness by adapting to new regulatory environments.

As businesses increasingly adopt cloud-based accounting solutions, financial data becomes more accessible and secure. This accessibility ensures that leaders and stakeholders can obtain the most current information no matter where they are, promoting flexibility and informed decision-making.

In summary, embracing automation and technology in financial reporting empowers companies to maintain competitive agility and precision in a rapidly evolving business landscape.

Impact of ESG on Financial Statements

Environmental, Social, and Governance (ESG) factors are becoming increasingly pivotal in financial statements, influencing both reporting practices and investor perceptions. As stakeholders demand greater accountability for sustainable and ethical practices, companies are compelled to include ESG metrics in their financial disclosures.

The integration of ESG considerations impacts financial statements by affecting cost assessments, asset valuations, and potential liabilities. For instance, investments in sustainable technologies or energy-efficient processes may initially appear as costs but can lead to long-term savings and improved asset value. Similarly, liabilities arising from non-compliance with environmental regulations can change the risk profile reflected on the balance sheet.

Moreover, companies reporting strong ESG performance often experience enhanced investor appeal and competitive advantage, as these metrics increasingly drive investment decisions. This shift necessitates transparency in how ESG initiatives contribute to a company’s financial health and long-term strategy.

Incorporating ESG into financial reporting not only aligns with evolving regulatory expectations but also fortifies a company’s market reputation, demonstrating a commitment to sustainable growth and ethical governance.

FAQs

Why are these four financial statements necessary?

These four financial statements—balance sheet, income statement, cash flow statement, and statement of shareholders’ equity—are essential because they collectively provide a comprehensive view of a company’s financial health. They offer crucial insights into assets, liabilities, profitability, cash management, and equity changes, enabling stakeholders to make informed decisions about investments, strategy, and operations.

How do these statements interrelate?

The financial statements are intrinsically linked. The income statement’s net income feeds into the cash flow statement and impacts the balance sheet through retained earnings. The cash flow statement shows cash generated or used in operating, investing, and financing, affecting the company’s cash position on the balance sheet. Meanwhile, the statement of shareholders’ equity reflects changes in equity, including dividends, which are derived from net income.

What common mistakes occur with financial statements?

Common financial statement mistakes include improper revenue recognition, incorrect categorization of expenses, and misvaluation of assets or liabilities. Errors in depreciation or failing to account for contingent liabilities can distort the balance sheet. Additionally, overlooking cash flow discrepancies and inconsistencies between statements can lead to an inaccurate portrayal of financial health.

How can technology streamline the preparation of financial statements?

Technology streamlines financial statement preparation by automating data entry, reducing human errors, and ensuring compliance with accounting standards. Advanced software can integrate data across departments for real-time analysis and reporting. Cloud-based solutions provide secure access from anywhere, enhancing collaboration and efficiency in the preparation and review process.

Why are finance statements important for a business?

Financial statements are crucial as they provide a clear and structured view of a company’s financial performance and condition. They help businesses track profitability, manage cash flow, and make informed strategic decisions. Moreover, these statements are essential for communicating financial health to investors, lenders, and regulators, thus supporting funding and compliance efforts.

Can you provide financial statements examples for better understanding?

Examples of financial statements can illustrate the key components and layout of each document. A balance sheet example would show assets categorized as current and non-current, while a sample income statement would list revenue, expenses, and net income. Similarly, a cash flow statement example details cash movements in operations, investments, and financing, and a statement of shareholders’ equity example would display changes in equity accounts such as retained earnings and common stock.