KEY TAKEAWAYS

- Choose the Appropriate Model: Selecting the right financial forecasting model is crucial. Consider the specific objectives, available data, and required action timeframes. Models such as straight-line, time series, moving averages, and multiple linear regression each offer distinct insights suitable for various scenarios.

- Ensure Data Quality and Model Fit: High-quality data is essential for accurate forecasting. Once confirmed, plug it into a model that matches the complexity needed to achieve your targeted outcomes. The model should align with predictive assumptions and current market conditions.

- Utilize Forecasting Software: Dedicated software simplifies handling large datasets, enhances accuracy, and improves team collaboration. This technological support is invaluable in refining budget accuracy, strengthening strategic planning, and building stakeholder trust.

Understanding Financial Forecasting Models

Definition and Importance

Financial forecasting involves predicting a company’s future financial performance based on current and historical data. It plays a vital role in business planning, enabling organizations to set realistic goals, allocate resources efficiently, and prepare for potential challenges. Accurate forecasts enhance strategic decision-making and improve investor confidence by providing transparency regarding a company’s financial health.

Differentiating Forecasting from Budgeting

While both forecasting and budgeting are essential financial tools, they serve different purposes. Forecasting is a dynamic process that entails predicting future financial outcomes based on various assumptions and historical trends. It is typically more flexible and is updated regularly to reflect new data and changing circumstances. For example, in prediction analysis, data points can be plotted using a scatter diagram with the dependent variable on the y-axis and the independent variable on the x-axis, which helps in refining forecast accuracy. Budgeting, on the other hand, is more static. It involves setting financial targets and allocating resources for specific future periods, often for a fiscal year, based on strategic objectives. In essence, budgets set the financial framework, while forecasts adapt to new inputs and shifts in the business environment. Modules like the cash management module automate essential functions, ensuring streamlined operations across all financial processes.

Types of Financial Forecasting Models

Top-Down vs. Bottom-Up Approaches

In financial forecasting, the top-down approach starts at the macro level, using high-level industry or market data to project financial outcomes. This method can be efficient for gaining a broad perspective, applying industry growth rates or market trends to forecast company performance, as well as estimates of revenue and profitability at a larger scale. However, it might overlook specific internal factors affecting individual business units.

Conversely, the bottom-up approach builds forecasts from detailed, granular data, aggregating projections from individual departments or product lines to create an overall financial outlook. Bottom-up forecasting requires organizations to break down business components that drive growth, revenue, and profits, involving a detailed analysis that provides input from various stakeholders. While more time-consuming, this forecast methodology can offer a more precise financial picture by accounting for internal strengths and weaknesses. Incorporating metrics like monthly recurring revenue (MRR) allows for accurate predictions of revenue fluctuations and financial health. It is often supported by AI-powered tools and engages the forecasting team, thus enhancing forecasting skills across the board.

Qualitative vs. Quantitative Methods

Qualitative forecasting relies on subjective judgment, expertise, and intuition. It is particularly useful when numerical data is scarce or when anticipating the impact of unprecedented events. Methods like expert panels and market research fall under this category. One notable technique here is the Delphi method, which uses multiple rounds of questionnaires to gather consensus among experts. This approach aids in understanding nuanced market phenomena but may lack precision due to its subjective nature. In fields requiring compliance, such as those subject to regulatory certification or billing requirements, qualitative insights can uncover underlying market dynamics.

Quantitative methods, on the other hand, depend on numerical data and statistical tools to predict future financial trends. These methods include time-series analyses and econometric models. Such revenue forecasting methods can provide scalability and connected forecasting units. Quantitative forecasting is often more accurate, making it suitable for environments where historical data is plentiful and patterns are stable. Additionally, these forecasts are often organized into hierarchical forecasting categories, offering structured insights for complex financial environments. Choosing between these methods depends largely on the availability of data and the complexity of the forecasting task. For healthcare organizations, integrating billing data into quantitative methods can enhance accuracy and financial planning.

Statistical Techniques

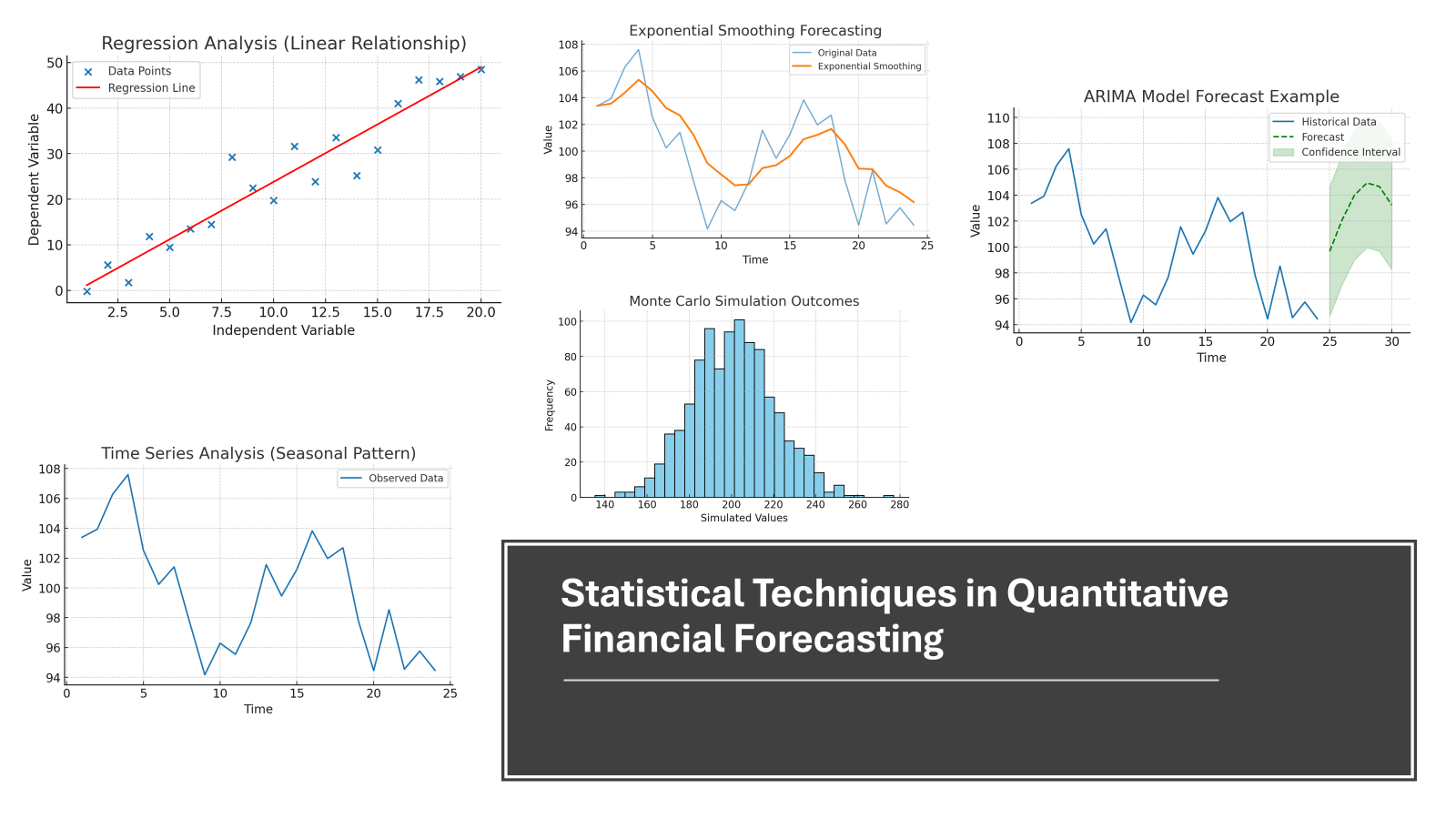

Statistical techniques are pivotal in quantitative financial forecasting, offering tools to analyze historical data and predict future trends. Common statistical methods include:

- Time Series Analysis: This analyzes data points collected or recorded at regular time intervals to identify trends, seasonal patterns, and cycles, which helps in forecasting future values.

- Regression Analysis: Used to determine the relationship between a dependent variable and one or more independent variables, allowing forecasters to predict outcomes based on these relationships. In particular, the linear regression method plays a crucial role, with the linear regression model employing a linear regression line to make predictions. The linear regression forecasting method, including simple linear regression, is effective for examining the impacts of individual variables and understanding the slope of the relationship.

- Exponential Smoothing: A method that applies declining weights to older data points, effectively managing short-term fluctuations to identify longer-term trends.

- ARIMA Models (Auto-Regressive Integrated Moving Average): These are used for complex time-series forecasting, allowing for more detailed trend and seasonal pattern analysis.

- Monte Carlo Simulations: This technique assesses risk and uncertainty by simulating a model’s outcome distribution, using random variables to account for variability in predictions.

Each of these techniques has its strengths and applicability depending on the data characteristics and specific forecasting needs. Notably, financial forecasting often involves creating pro forma financial statements, which further refine predictions by encompassing financial metrics and hierarchical forecasting categories. For a more interactive exploration, one can click on statistical dashboards to visualize these methodologies effectively.

Popular Forecasting Methods Explained

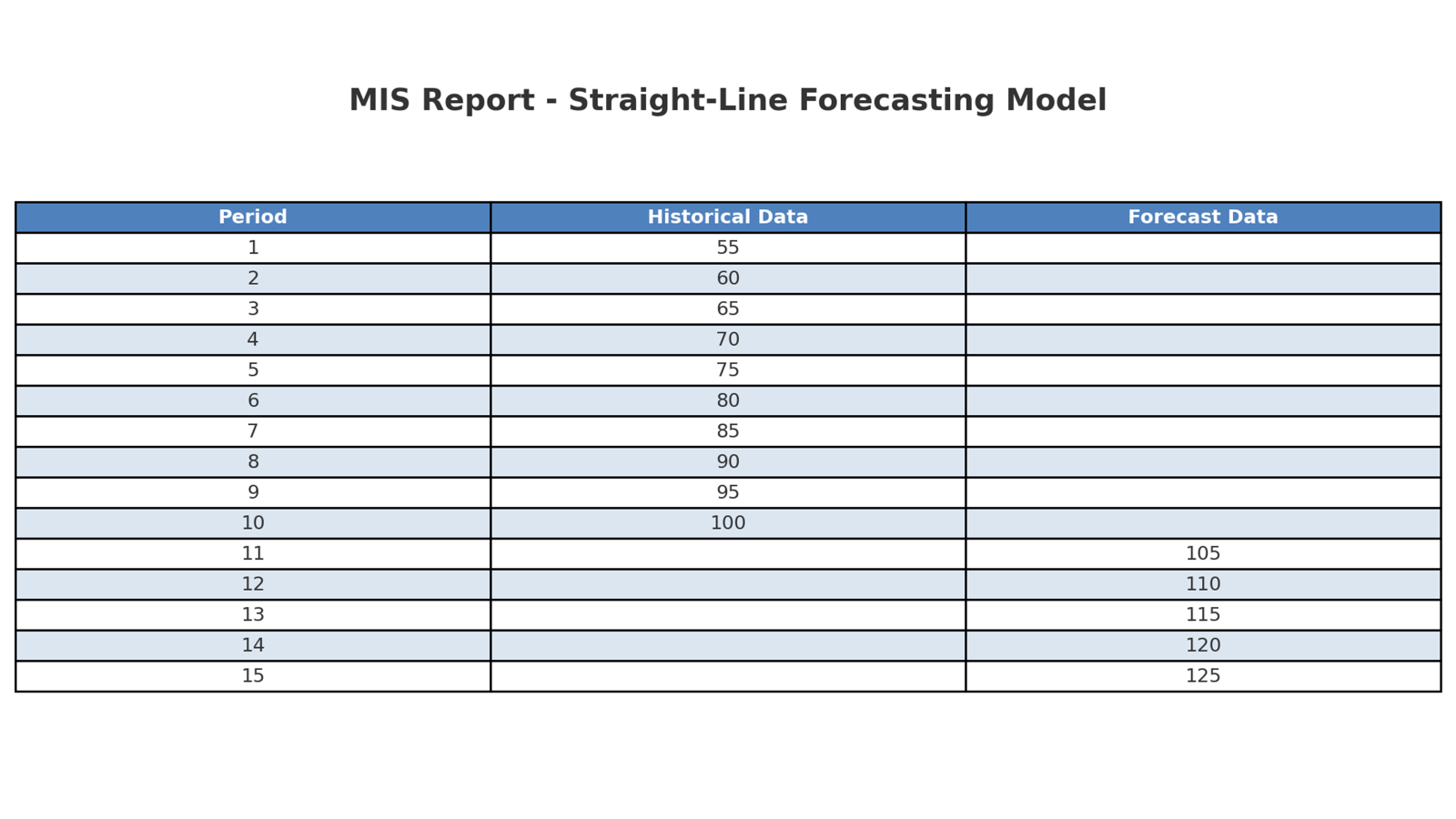

Straight-Line Model

The straight-line model is one of the simplest and most intuitive financial forecasting methods. It assumes that future financial trends will follow a consistent linear path based on historical data. This method is best used in stable environments where growth rates are predictable and steady, such as mature industries with established market dynamics.

Features:

- Simplicity and ease of use

- Requires minimal data inputs

- Delivers quick, straightforward projections

- Applicable to various timeframes

- Ideal for linear growth scenarios

Benefits:

- Quick and easy to implement

- Requires less complex analysis

- Provides clear and concise projections

- Helps identify long-term growth directions

- Useful for preliminary forecasting checks

Cons:

- May oversimplify complex financial dynamics

- Less accurate in volatile or dynamic markets

This model is best for companies operating in stable environments with predictable growth patterns, where a straightforward approach to forecasting is sufficient.

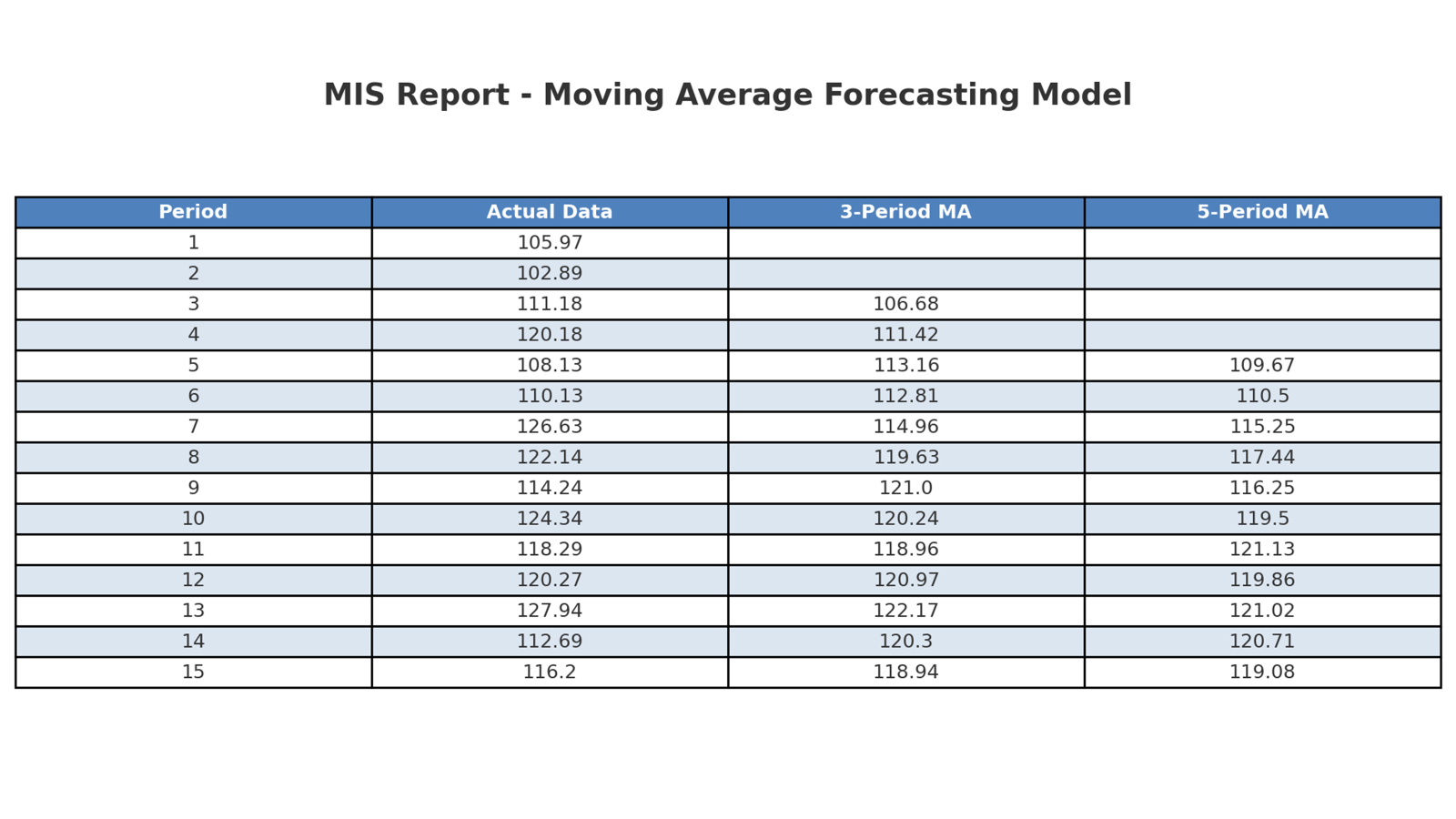

Moving Average Model

The moving average model is a forecasting method used to smooth out short-term fluctuations and highlight longer-term trends. It averages a set number of recent data points to project future values, making it effective in identifying stable patterns over time without noise interference.

Features:

- Smoothing short-term volatilities

- Capturing ongoing trends

- Flexibility with different averaging periods

- Applicability to various data sets

- Supports decision-making under stable conditions

Benefits:

- Reduces data noise for clearer trend analysis

- Adaptable to different time scales

- Enhances trend prediction reliability

- Easy to compute and interpret

- Applicable across diverse industries

Cons:

- Might lag behind actual data due to averaging

- Less effective in rapidly changing environments

This model is ideal for businesses experiencing stable and consistent data trends, where short-term fluctuations are less impactful. It suits industries like retail or production with steady sales patterns.

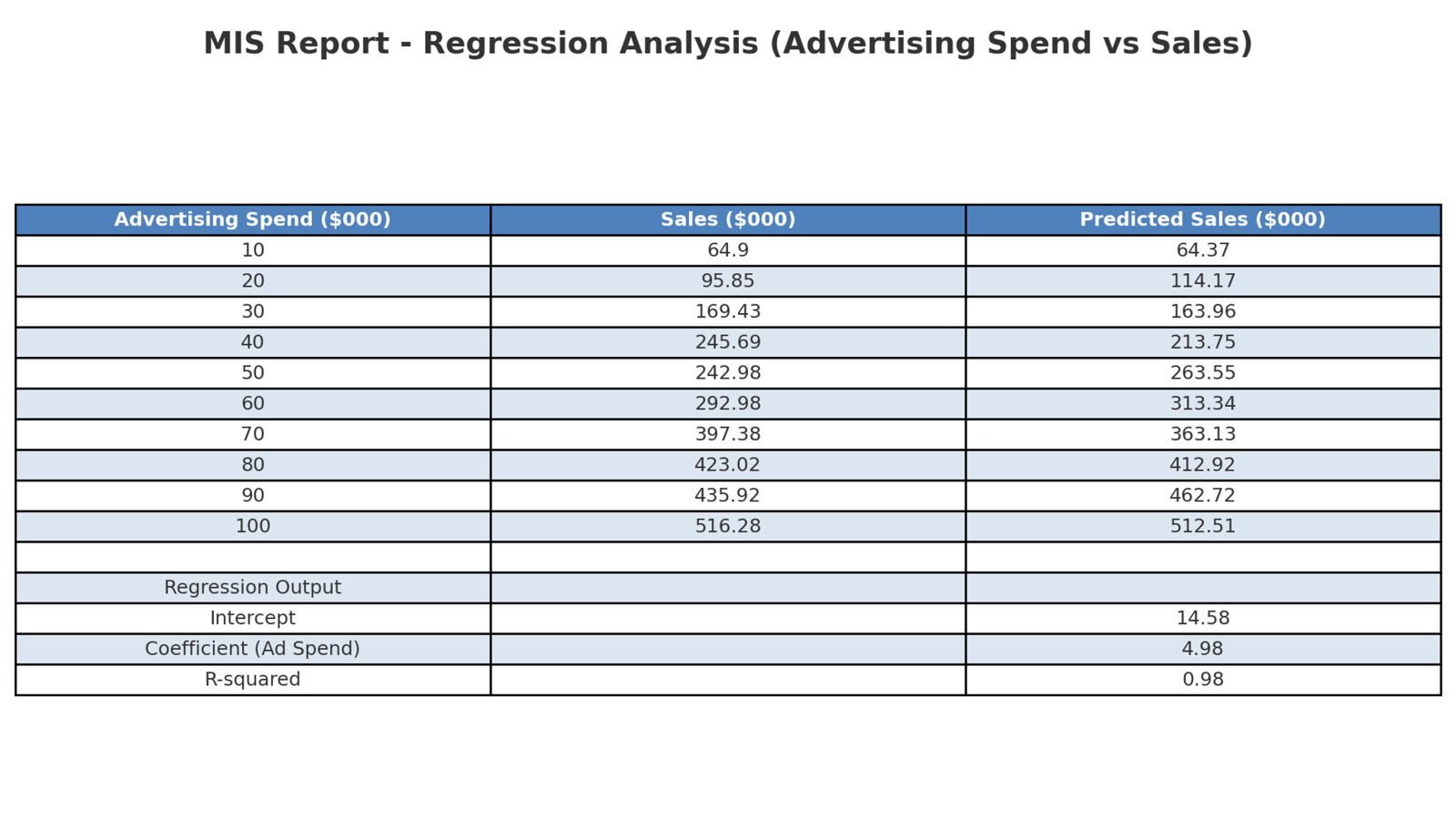

Regression Models

Regression models predict the relationship between a dependent variable and one or more independent variables, offering insights into how various factors influence financial outcomes. These models are particularly useful when you need to understand how specific variables, such as advertising spend, economic indicators, or market conditions, impact sales or profit margins.

Features:

- Analyzes relationships between variables

- Determines predictive accuracy through statistical metrics

- Accommodates multiple influencing factors

- Offers in-depth causal analysis

- Supports both linear and non-linear relationships

Benefits:

- Improved understanding of variable impacts

- Enhanced decision-making with informed predictions

- Ability to model real-world complexities

- Facilitates scenario analysis

- Supports optimization of resources and strategies

Cons:

- Requires substantial and quality data

- Complexity increases with more variables

Regression models are best suited for businesses looking to delve into detailed analysis, where understanding the effects of various factors on financial outcomes is crucial. Companies analyzing performance in sectors like finance, marketing, and economics find these models particularly beneficial.

Scenario-Based Models

Scenario-based models are powerful tools that allow you to explore various “what-if” situations by altering key assumptions to foresee potential outcomes. This approach is great for assessing risks and preparing for diverse future conditions by simulating the effects of different scenarios on your financial forecasts and balance sheet forecasting. By incorporating factors such as assets and liabilities, these models ensure a comprehensive approach to assessing the potential impact of different decisions and market variables.

Features:

- Examines multiple potential outcomes

- Flexible to incorporate varied assumptions

- Addresses best-case, worst-case, and most-likely scenarios

- Supports strategic planning and risk assessment

- Integrates qualitative and quantitative data

Benefits:

- Enhanced preparedness for market changes

- Improved strategic agility

- Facilitates comprehensive risk evaluation

- Provides insights into the impact of extreme events

- Helps prioritize strategic initiatives

Cons:

- Resource-intensive to develop multiple scenarios

- Can become complex with numerous variables

Scenario-based models are ideal for organizations facing high levels of uncertainty or considerable external influences, such as those in the energy, finance, or manufacturing sectors. By supporting balance sheet forecasting, this model is best when preparing for and mitigating risk against volatile markets or critical decision points.

Choosing the Right Model for Your Needs

Aligning with Business Goals

Aligning financial forecasting models with your business goals ensures that predictions are relevant and actionable. This starts with identifying key performance indicators (KPIs) aligned with your strategic objectives, such as revenue targets, market expansion, cost reduction, or refining business decision-making processes. By focusing on these metrics, forecasts can provide meaningful insights that directly support goal achievement. One disadvantage to consider is if forecasts are not thoroughly aligned with business goals, they may lead to misguided strategies. For instance, accurate revenue projections foster better financial strategy and operational planning. Consider what drives your business. For instance, if entering a new market is a priority, incorporate market-entry variables into your forecast. Similarly, if operational efficiency is the focus, closely examine cost-related factors. Ensuring alignment with your goals helps prioritize resources and efforts towards the most impactful areas, ultimately guiding strategic decision-making to effectively forecast revenue and its output.

Industry-Specific Considerations

When choosing a financial forecasting model, industry-specific factors, including equity and revenue forecasting methods, can significantly impact the effectiveness and accuracy of predictions. Each industry has unique characteristics, such as regulatory environments, market volatility, or technological advancements, which should be factored into the forecasting process. For example, in the retail sector, seasonal fluctuations and consumer trends are critical elements to include in forecasts. In contrast, manufacturing might prioritize supply chain stability and production cost projections. Financial services may focus on interest rates and economic indicators, using various revenue forecasting methods to predict financial outcomes accurately.

Understanding these nuances helps tailor models to address the most critical drivers of financial outcomes in your industry, ensuring forecasts are both precise and relevant. This approach can lead to better resource allocation, strategic planning, and competitive advantage.

Leveraging Technological Tools

Incorporating technological tools into financial forecasting can dramatically enhance accuracy and efficiency. Modern software solutions, such as advanced analytics platforms and artificial intelligence, allow for dynamic data analysis and automate complex calculations, facilitating more precise forecasts. Automation plays a crucial role by reducing the time spent on mundane tasks and redirecting focus towards strategic initiatives. These tools can process vast amounts of machine data quickly, uncovering trends and patterns that might not be apparent through manual analysis. They also allow for real-time data updates, enabling you to adjust forecasts promptly in response to new information.

The implementation of automation and AI ensures streamlined workflows and improved productivity. This adaptability is crucial in fast-paced markets or industries characterized by rapid change. Adopting technologies like cloud-based platforms also enables collaboration across departments, improving data access and shared insights. Leveraging such tools aligns forecasting with cutting-edge capabilities, making predictions more robust and action-oriented. Various productivity templates in Excel-like interfaces, as provided by platforms like Cube, further enhance this capability.

Common Challenges in Financial Forecasting

Managing Uncertainty

Managing uncertainty is a critical aspect of financial forecasting, especially in a world where market conditions and economic environments can shift rapidly due to factors like downturns or market fluctuations. To effectively manage uncertainty, it’s essential to incorporate flexibility into your forecasting models. This can be achieved through scenario analysis, sensitivity testing, and maintaining a mix of qualitative and quantitative forecasting methods, as these approaches can account for data changes and seasonality. An integral part of this process is the use of pro forma financial statements, which provide customizable metrics for comprehensive assessment and informed decision-making. The process has a few steps with the pro forma financial statements, but the payoff is worth it. Regularly updating forecasts with new data and insights also helps in addressing uncertainty. It allows for timely adjustments and minimizes the risk of being caught off-guard by unforeseen events. Additionally, engaging with cross-functional teams can enhance forecasts by including diverse perspectives and expertise, increasing the robustness of predictions under uncertain conditions. This collaborative approach not only strengthens forecasts but also prepares your organization to pivot efficiently when the unexpected occurs.

Data Quality and Access Issues

High-quality data and seamless access are the cornerstones of reliable financial forecasting. Data quality is often compromised by inaccuracies, duplication, or incompleteness, leading to misleading forecasts. To mitigate this, ensure data is rigorously checked and validated, establishing strong data governance practices to maintain integrity.

Access issues can arise from departmental silos or incompatible systems, hampering the timely flow of information needed for accurate projections. Integrating data management systems and fostering a culture of transparency are essential to overcoming these issues.

Solutions like centralized databases and cloud-based platforms can enhance accessibility, allowing multiple users to collaborate and share insights effortlessly. Improving data quality and accessibility not only enhances the forecasting process but also supports more informed strategic decision-making.

Adapting to External Changes

Adapting to external changes is crucial for maintaining the relevance and accuracy of financial forecasts. External factors such as economic shifts, regulatory changes, or technological advancements can significantly impact financial outcomes. Market fluctuations, due to new competitors or shifts in the economy, also play a critical role. To effectively adapt, forecasters should regularly monitor these external indicators and integrate them into their models. Using real-time data analytics and third-party data sources can provide valuable insights into market trends and external conditions. This proactive approach ensures that forecasts are continually aligned with the latest external developments.

Moreover, fostering a flexible forecasting framework allows organizations to swiftly adjust scenarios and assumptions in response to external changes, minimizing potential disruptions. This adaptability not only enhances forecast accuracy but also empowers businesses to make strategic decisions with greater confidence in volatile environments.

Best Practices for Accurate Forecasting

Incorporate Historical Data Effectively

Effectively incorporating historical data into financial forecasting can significantly enhance the accuracy and reliability of predictions. Historical data provides a foundation for recognizing patterns and trends, which are crucial for projecting future financial performance. Here are key strategies for utilizing historical data:

- Data Cleaning and Standardization: Ensure that historical data is cleaned, standardized, and accurate. This minimizes errors and supports consistent analysis across different time periods.

- Trend Analysis: Identify and analyze trends and patterns within historical data, such as seasonal sales fluctuations or recurring expense patterns. These trends can inform your future projections.

- Benchmarking: Use historical data to benchmark current performance. This enables you to measure progress and identify areas for improvement.

- Time Series Analysis: Employ time series methods to capture long-term trends and cyclical patterns, which are instrumental in accurate forecasting.

- Adjust for Anomalies: Recognize anomalies in historical data—such as one-time events or temporary market disruptions—and adjust forecasts accordingly to prevent skewed projections.

Integrating historical data effectively ensures that your forecasts are grounded in reality, drawing on past performance to illuminate future paths.

Regular Monitoring and Adjustments

Regular monitoring and adjustments are essential practices in financial forecasting to ensure continued accuracy and relevance. By organizing data into forecasting categories, you can effectively manage the organization of information into structured levels or hierarchies. Financial environments are dynamic, with factors such as market conditions, consumer behavior, and economic indicators shifting over time. Here’s how to keep forecasts aligned with reality:

- Frequent Reviews: Set a regular schedule to revisit and review forecasts, whether monthly, quarterly, or in response to significant market changes. This ensures that predictions remain current.

- Key Performance Indicator (KPI) Tracking: Continuously track key performance indicators against forecasted values. Any divergences can signal the need for adjustments.

- Incorporate Real-Time Data: Use real-time data collection and analysis to inform your forecasts. This allows for immediate adjustments as new information becomes available.

- Scenario Updates: Reassess and update scenario analysis in response to new trends or unexpected events.

- Feedback Loops: Implement feedback loops from all relevant departments to gain insights and adapt forecasts based on the latest operational realities.

By integrating these practices, which may also include hierarchical consolidation of cash categories and company codes, forecasts remain a reliable tool for strategic planning, enabling quicker responses to changes and better-informed decision-making.

Integration of Cross-Departmental Inputs

Integrating cross-departmental inputs into financial forecasting enhances both the richness and accuracy of predictions. Collaboration between departments ensures that forecasts reflect diverse perspectives and comprehensive insights.

- Holistic View: Engage departments like marketing, sales, operations, and finance to gather a wide array of data and insights. This amalgamation captures various business aspects, contributing to more complete forecasts.

- Enhanced Accuracy: Department-specific insights, such as sales pipeline forecasts or marketing campaign impacts, can refine financial predictions, making them more precise.

- Strategic Alignment: Cross-departmental collaboration ensures that forecasts align with overall strategic objectives and operational realities, promoting unified business goals.

- Improved Communication: Regular inter-departmental meetings and data sharing foster a culture of cooperation, reducing silos and enhancing organizational agility.

- Resource Optimization: Insights from various departments help in optimizing resource allocation and identifying potential cost-saving opportunities.

By integrating inputs from diverse business areas, forecasts become not only more comprehensive but also more aligned with organizational priorities, resulting in better-informed strategies and actions.

FAQs

What is forecasting in finance?

Forecasting in finance is the process of estimating future financial outcomes for an organization. It uses historical data, current market trends, and specific assumptions to project future revenues, expenses, and financial performance. By predicting these financial trends, businesses can plan strategically, allocate resources efficiently, and make informed decisions to achieve their financial goals.

What distinguishes financial forecasting from financial modeling?

Financial forecasting focuses on predicting future financial outcomes based on historical data and assumptions about future trends. In contrast, financial modeling is the creation of a representation of a company’s financial performance, typically using spreadsheets to project cash flows, financial statements, and assess investments. While forecasting estimates future performance, modeling provides a framework for scenario analysis and decision-making.

Which financial forecasting method is most applicable to startups?

For startups, scenario-based forecasting is often the most applicable method. It allows for flexibility in uncertain environments by considering multiple possible outcomes. This approach helps startups account for rapid market changes and emerging opportunities, providing a versatile framework to plan resource allocation and manage risk effectively. Additionally, startups can benefit by combining qualitative insights with limited historical data.

How do external factors impact forecasting accuracy?

External factors such as economic conditions, regulatory changes, and market trends can significantly impact forecasting accuracy by altering assumptions and affecting business operations. These factors can introduce variability and unexpected shifts in a company’s financial landscape, necessitating frequent model updates and scenario planning to maintain reliable predictions.

What are examples of financial forecasting in business?

Examples of financial forecasting in business include projecting quarterly revenue based on previous sales trends, estimating future cash flows to ensure liquidity, and forecasting expenses to plan for upcoming operational costs. Companies also use forecasting to anticipate market demand and to strategize around investment opportunities. These predictions help guide budgeting and strategic planning.

What data is required to prepare a forecast in accounting?

To prepare a forecast in accounting, you need historical financial data such as sales figures, expense records, and profit margins. Additional data includes economic indicators, market trends, and industry benchmarks. Input from various departments, assumptions about future market conditions, and any anticipated changes in business operations are also crucial for accurate forecasting.