KEY TAKEAWAYS

- Immediate Access to Capital: Factoring receivables provides quick access to cash by selling outstanding invoices, typically receiving funds within 3-4 days. This rapid influx of capital can help businesses navigate financial challenges and invest in new opportunities without delay.

- Cash Flow Management: Factoring helps smooth out cash flow, particularly for businesses with inconsistently timed revenues due to annual contracts. By converting unpaid invoices into immediate funds, companies can better manage their financial planning and operational expenses.

- Types of Factoring: There are three main types of accounts receivable factoring—recourse, non-recourse, and maturity factoring. Each type offers different levels of risk and responsibility regarding unpaid invoices, allowing businesses to choose the option that best suits their specific needs and risk tolerance.

What is Factoring Accounts Receivable?

Core Concepts Explained

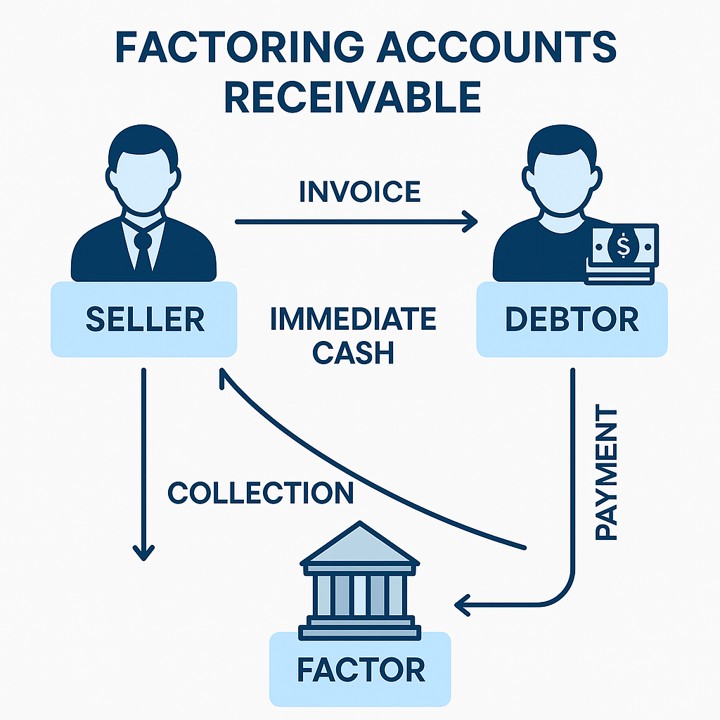

Factoring accounts receivable involves selling a company’s outstanding invoices to a third party, known as a factor, at a discount. This move provides immediate cash to the business, bypassing the time it typically takes to receive customer payments. Factors then assume the responsibility of collecting payments. The process is commonly leveraged by businesses to manage short-term cash flow needs without incurring additional debt.

In essence, the practice centers around three entities—the seller, the debtor, and the factor. The seller is the company selling their invoices, the debtor is the customer who owes payment, and the factor is the financial institution purchasing the invoices. Factors pay a percentage of the invoice value upfront, and the balance, minus a fee, is paid once the debtor settles the invoice. This fee, called the factoring discount, compensates the factor for the risk and service provided.

Historical Context and Evolution

The practice of factoring accounts receivable dates back thousands of years, with its roots in ancient Mesopotamian and Roman civilizations. Early merchants used basic forms of factoring to finance trade expeditions, securing cash against future shipments. This financial arrangement enabled traders to embark on commercial ventures without the burden of waiting for goods to sell.

Over time, factoring evolved significantly, especially during the Middle Ages in Europe, where it supported international trade along vibrant merchant routes. The modern form of factoring as we recognize it today emerged during the 19th century in the United States, primarily serving the textile industry. Industrials relied on factors to mitigate credit risk while growing operations, leading to more structured and sophisticated agreements.

In recent decades, the rise of digital technology and globalization has transformed factoring into a versatile financial instrument used by diverse industries worldwide. The introduction of electronic invoice systems and blockchain technology continues to innovate and streamline the process, making factoring more accessible to small and medium-sized enterprises.

The Process of Factoring Accounts Receivable

Step 1: Submission of Invoices

The first step in the factoring process is the submission of invoices. In this phase, the business seeking factoring services selects the invoices they wish to factor and submits them to the factoring company. These invoices represent unpaid amounts owed to the business by its customers for goods or services already delivered.

Before submission, it’s crucial for the business to ensure that the invoices are clear, accurate, and free of any disputes or errors. Factors typically assess the creditworthiness of the debtor — the business’s customer — rather than the business itself. This review process helps determine whether the invoices are eligible for factoring and influences the advance rate, which is the percentage of the invoice value provided upfront. Businesses should gather additional documentation such as purchase orders and delivery confirmations to support this step and minimize processing delays.

Step 2: Segregation of Resources

During the segregation of resources, the factoring company evaluates and separates the invoices based on specific criteria such as the creditworthiness of the debtors and the size of the invoices. This step is pivotal as it influences the terms and conditions of the factoring agreement, including the advance rate and the discount fee.

Factors analyze each debtor’s payment history and credit risk to determine financial reliability. A crucial outcome of this step is identifying high-risk invoices, which might require additional scrutiny or exclusion from the factoring process. This process assists in tailoring the factoring service to the business’s needs, ensuring an optimal balance between cash flow benefits and cost-effectiveness. Effective segregation not only enhances the business’s liquidity but also minimizes the risk of default.

Step 3: Collection of Payment

In the collection of payment phase, the factoring company takes over the responsibility of collecting the payments from the debtors. Once the previous steps are complete, the factor sends out notifications to the debtors, informing them that their payments should now be directed to the factoring company rather than the original business.

The factor utilizes its expertise and systems to efficiently manage collections, which can relieve the business from the administrative burden and hassle of chasing payments. This process also includes monitoring and managing any issues that might arise, such as payment delays or discrepancies. The efficiency and professionalism of the factor during this stage can enhance the overall success of the arrangement, ensuring timely payment and improving cash flow. By outsourcing collections, businesses can focus on core activities, potentially increasing productivity and growth.

Step 4: Final Payment to the Seller

The final step in the factoring process is the payment of the remaining balance to the seller. Once the factoring company successfully collects the invoice payments from the debtors, they remit the balance to the original business, minus any agreed-upon fees. This step ties up the transaction, completing the cycle that began with the submission of invoices.

This final payment provides further financial relief to the business, helping them reinvest in operations, manage expenses, or pursue new opportunities. The efficiency and reliability of this step are crucial, as delayed payments can disrupt the business’s financial planning and expectations. It ensures that businesses gain the full benefit of factoring, mitigating potential cash flow gaps. By leveraging this system, businesses can maintain steady liquidity and financial stability, essential for sustainable growth and development.

Notification vs. Non-Notification Factoring

Factoring can be structured in two primary ways: notification and non-notification factoring, each offering distinct operational advantages.

In notification factoring, the debtor is informed of the change in invoice payment recipient to the factoring company. This method is straightforward and transparent, allowing the factor to manage collections directly. This can also alleviate administrative work for the business by shifting responsibility to the factor. However, it may affect customer perceptions, as they become aware that the business is using factoring to manage cash flow.

Conversely, non-notification factoring involves the factor handling collections in a more discreet manner, where debtors are unaware of the factoring arrangement. Payments are made to a bank account controlled by the factor but appear to be under the business’s name. This approach ensures that customer relationships and perceptions remain unchanged but typically involves higher costs due to the increased complexity and risk for the factor.

Both options have their merits. Notification factoring offers simplicity and lower costs, while non-notification maintains business image and customer relationships. The choice between the two depends on the business’s priorities and customer relationship dynamics.

Benefits of Factoring Accounts Receivable

Immediate Cash Flow and Working Capital

Factoring accounts receivable offers businesses a direct and immediate influx of cash, significantly enhancing their working capital. By converting outstanding invoices into liquid funds almost instantaneously, businesses can address urgent financial obligations, such as payroll, inventory purchases, or operational expenses without the wait associated with traditional payment cycles.

This boost in cash flow is particularly beneficial for small to medium-sized enterprises, which may face challenges accessing conventional financing. Instead of resorting to loans and incurring debt, businesses can use the funds from factoring to maintain operational continuity and responsiveness. The improved liquidity also allows for strategic investments in growth initiatives, enhancing competitiveness in the market.

Improved Risk Management

Factoring accounts receivable can significantly enhance a business’s risk management strategy. By transferring the responsibility of timely invoice collection to the factoring company, businesses effectively mitigate the risk of late payments or defaults. This risk transfer can stabilize a company’s financial performance and reduce uncertainty, providing a more predictable cash flow.

Moreover, factoring companies often conduct thorough credit checks on debtors, offering businesses an additional layer of financial assurance. Through this vetting process, factors can identify the likelihood of payment defaults and assist businesses in selecting more reliable customers. Consequently, businesses benefit not only from immediate cash flow but also from the reduced risk of incurring bad debts.

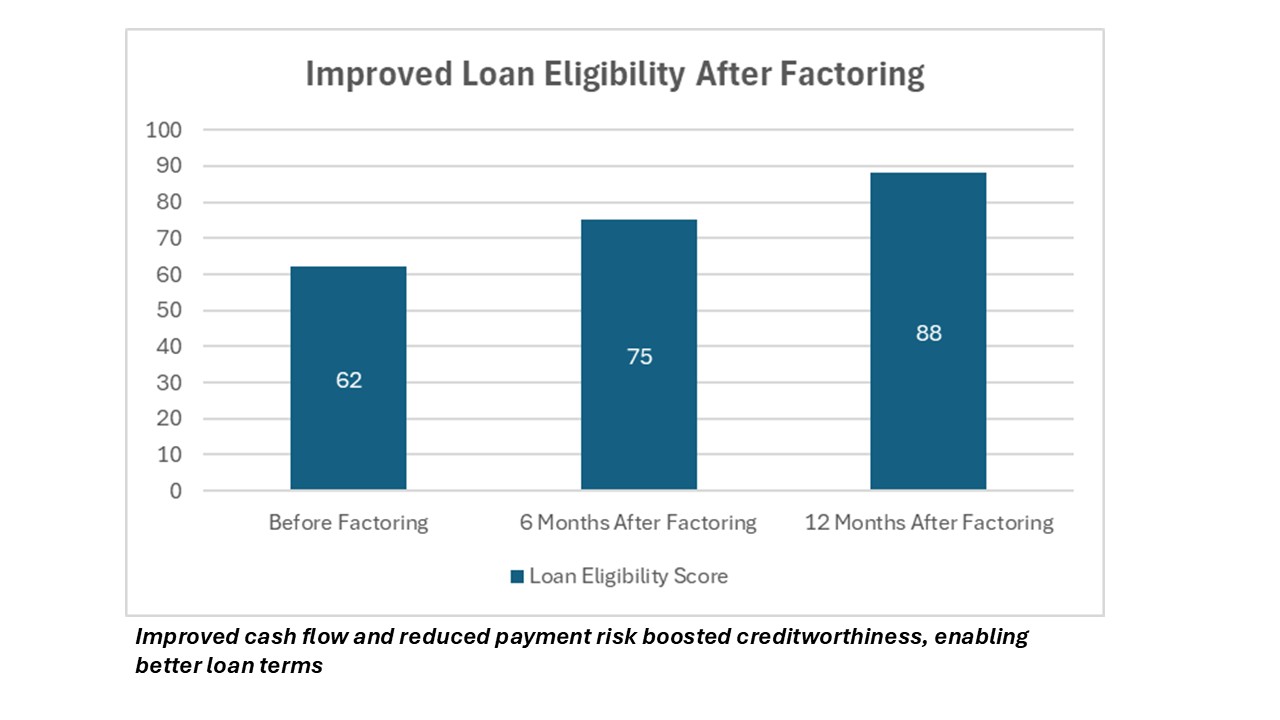

Easier Loan Process

Engaging in factoring accounts receivable can streamline the process of securing traditional loans. One of the primary hurdles businesses face when applying for loans is demonstrating financial health and consistent cash flow. By utilizing factoring to enhance liquidity, businesses can present stronger financial statements, making them more attractive to lenders.

Furthermore, the infusion of immediate cash through factoring helps businesses maintain and build a solid credit profile, which is often scrutinized during loan evaluations. Factors’ involvement implicitly signals financial competence and robust business operations. Consequently, securing additional financing for expansion or other purposes can become more attainable. This synergy between factoring and traditional loans can be particularly beneficial for growing businesses seeking to expand their market presence.

Facilitating Business Growth

Factoring accounts receivable can play a pivotal role in facilitating business growth by providing the financial resources needed to capitalize on new opportunities. When businesses have quick access to cash, they can make timely investments in equipment, technology, or personnel that drive expansion. This financial agility allows companies to seize market opportunities ahead of competitors who might be restricted by cash flow constraints.

With factoring, businesses can focus on scaling operations without worrying about the unpredictable nature of customer payments. The stability afforded by consistent cash flow enables strategic planning and risk-taking, essential components for growth-focused initiatives. Whether launching new products, entering new markets, or expanding marketing efforts, the funds obtained through factoring can significantly enhance strategic flexibility and competitiveness.

Key Differences Between Factoring and Other Financing Options

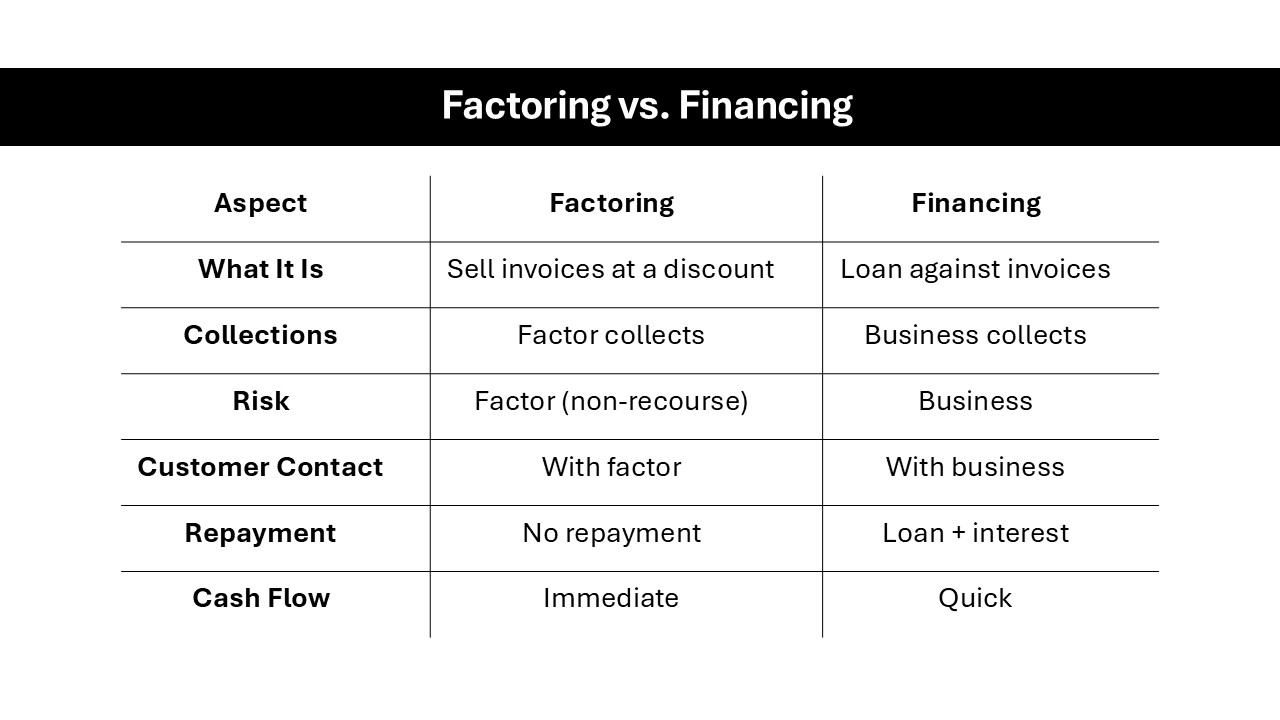

Accounts Receivable Factoring vs. Accounts Receivable Financing

While both accounts receivable factoring and accounts receivable financing provide businesses with access to working capital, they differ significantly in structure and impact on operations. Accounts receivable factoring involves selling invoices to a third-party company at a discount. Here, the factor assumes the responsibility for collecting payments directly from customers, which transfers the risk associated with collection management away from the business. This approach can lead to immediate cash flow and simplified receivables management.

In contrast, accounts receivable financing involves using invoices as collateral for a loan. The business retains control over collections and bears the full risk of unpaid invoices. Unlike factoring, financing does not transfer debtor communication to a third party, helping maintain customer relations. Moreover, businesses repay the loan with interest, meaning they’re responsible for managing these financial obligations carefully. Choosing between the two depends largely on a business’s preference for immediate cash flow versus maintaining control over collections and customer relationships.

Factoring vs. Line of Credit

When comparing factoring and a line of credit, it’s essential to focus on their financial structures and operational impacts. Factoring involves selling your accounts receivable to a factor for immediate cash. The factor then manages and collects payments from your customers, providing a quick solution to cash flow needs without incurring debt. Factoring is beneficial for businesses that need significant working capital quickly and want to avoid increasing their debt load.

On the other hand, a line of credit is a revolving loan from a financial institution that you can draw from as needed. Unlike factoring, a line of credit requires regular interest payments and increases your liabilities. The credit limit is typically based on the company’s creditworthiness, and funds can be used for any business expense. This flexibility is advantageous for managing predictable cash flow gaps. Choosing between factoring and a line of credit hinges on a company’s cash flow needs, its ability to manage debt, and its preference for payment autonomy.

Understanding Costs and Fees in Factoring

Discount Rate or Factoring Fee

The discount rate or factoring fee is the cost associated with the factoring service, charged by the factor for purchasing and collecting a company’s invoices. Typically expressed as a percentage of the invoice amount, this fee compensates the factor for the risk and administrative responsibilities they shoulder. The discount rate can vary significantly based on several factors, including the creditworthiness of the debtors, the volume of invoices factored, and the industry in which the business operates.

Businesses should carefully negotiate and review the terms of the factoring agreement to understand how the discount rate will impact their financials. Some factors may offer lower fees for high-volume or low-risk portfolios, making it crucial for businesses to provide accurate and comprehensive debtor information. By doing so, companies can secure better terms and minimize costs, ensuring that factoring remains a cost-effective solution for liquidity needs.

Calculation of Factoring Cost

Calculating the factoring cost involves understanding the various components that contribute to the total expense of the factoring service. The primary element is the discount rate, which is the percentage charged on the total value of the invoices being factored. To calculate the total factoring cost, multiply the invoice value by the discount rate. For instance, if you factor $100,000 in invoices with a 3% discount rate, your factoring cost would be $3,000.

Additionally, factors may impose other fees, such as service fees for managing the invoice collections or fees for early termination of the factoring agreement. Some agreements might include tiered pricing, where the rate decreases as volumes or credit quality improve. It’s essential for businesses to review the complete terms, including any ancillary fees, to accurately determine the total cost of factoring.

To ensure that factoring remains a financially viable option, businesses should compare factoring costs to potential gains in cash flow and operational efficiency.

Challenges and Risks of Factoring Receivables

Potential for Increased Costs

While factoring accounts receivable provides many financial advantages, it’s important to note the potential for increased costs associated with this financing method. The primary cost component is the factoring fee or discount rate, which can vary based on the terms of the agreement and the perceived risk of the invoice portfolio. Higher fees may apply to businesses with low credit scores or whose customers are deemed risky.

Moreover, additional charges such as administrative fees, setup charges, and late payment penalties can add to the overall factoring cost. Businesses should also be aware of hidden fees that might not be initially apparent in the contract, such as fees for minimum volume commitments or account maintenance. These can accumulate over time, potentially impacting net revenue and eroding anticipated cash flow benefits.

To manage costs effectively, companies should perform a thorough analysis of all charges included in their factoring agreement. Comparing offers from multiple factoring companies can also help secure competitive rates and terms. Understanding these potential costs ensures that businesses accurately assess the financial trade-offs associated with factoring.

Impact on Customer Relationships

Factoring accounts receivable can have a notable impact on customer relationships, depending on how the process is managed. In notification factoring, the factor directly communicates with the customers about payment collections, which may affect how customers perceive the business. Customers might interpret the use of factoring as an indication of financial struggles, potentially influencing their confidence in the business.

On the other hand, if the factor employs professional and courteous communication, it can maintain or even strengthen customer relationships by offering a streamlined and efficient payment process. It’s crucial for businesses to partner with factors who understand the importance of customer interaction and are committed to upholding the business’s reputation.

In non-notification factoring, the impact is minimized as customers typically remain unaware of the factoring arrangement. This discretion helps preserve the existing relationship dynamic. Ultimately, businesses need to carefully select factoring partners and communicate openly about their choice to factor, emphasizing the advantages such as improved service and product delivery that result from enhanced cash flow.

Industries That Benefit from Factoring

Transportation and Freight Factoring

Transportation and freight companies often leverage factoring services to address the industry’s unique cash flow challenges. These businesses typically face extended payment terms, often reaching 30 to 60 days or more, which can strain operational budgets and limit their ability to invest in fleet maintenance, fuel, and staffing. Factoring provides an immediate liquidity boost, allowing transportation companies to meet their financial obligations promptly.

Freight factoring involves selling invoices to a factor, which then collects payments directly from shippers or brokers. By converting these accounts receivable into immediate cash, transportation companies can keep their operations running smoothly without waiting for payments. This financial flexibility is especially important in an industry where fuel costs and regulatory compliance require consistent capital expenditure.

Additionally, factoring companies often provide valuable services such as credit checks on potential customers and accounts receivable management, further supporting transportation businesses in risk mitigation and administrative efficiency.

Medical Factoring

Medical factoring offers healthcare providers a vital solution to the cash flow challenges associated with insurance reimbursement delays. In the healthcare industry, payments from Medicare, Medicaid, and private insurers can take weeks or even months to process, which can create financial pressure on medical practices, hospitals, and clinics. By factoring medical receivables, these institutions can convert their accounts receivable into immediate cash.

This influx of funds allows healthcare providers to cover essential expenses, such as payroll, equipment purchases, or facility upgrades, without the stress of waiting for insurance payments. Medical factoring companies typically possess specialized knowledge of the healthcare industry, allowing them to manage collections effectively and efficiently while navigating complex insurance claim processes.

Moreover, factoring companies often offer additional services like billing and collections support, reducing administrative burdens and allowing healthcare professionals to focus more on patient care. Partnering with a reputable factor can significantly enhance operational stability and growth potential for healthcare providers.

Manufacturing and Wholesale Distribution

In the manufacturing and wholesale distribution sectors, cash flow management is critical due to high operational costs and extended payment terms. Factoring accounts receivable provides an effective solution for these industries by converting outstanding invoices into immediate cash. This liquidity enables manufacturers and distributors to purchase raw materials, manage inventory, and fund labor costs without waiting for customer payments.

Additionally, manufacturing and wholesaling involve large orders and significant upfront costs, making the timely inflow of funds crucial. Factoring eases these pressures by facilitating smoother financial operations and allowing companies to meet production and distribution demands consistently.

Moreover, factoring companies often provide valuable insights into debtor creditworthiness, aiding businesses in making informed decisions about customer engagements. By choosing factoring, manufacturers and distributors enhance their financial agility, improve supplier relationships through timely payments, and maintain competitive market positions.

Conclusion

Factoring receivables—also referred to as accounts receivable factoring—is a form of business lending that allows companies to improve cash flow without taking on traditional debt liability. Instead of waiting 30, 60, or 90 days for customers to pay, businesses can sell their invoices to a seller factoring company at a discount. This process provides immediate deposit of funds, enabling them to continue paying invoices, cover operating costs, or reinvest in growth. Unlike bank lending or equity financing, factoring is based on the strength of your receivables rather than your balance sheet.

Factoring can help reduce the disruption caused by customer non-payment, as most agreements include recourse or non-recourse terms to manage that risk. Under a recourse arrangement, the business is still liable if the customer doesn’t pay. In contrast, non-recourse factoring shifts that risk to the factoring company, albeit often at a higher premium. A reserve account or reserve amount is usually held back by the factor to account for adjustments or non-payment risks, ensuring accuracy in future settlements. In some cases, allowances are made for bad debts based on receivables accounting practices and the company’s ledger history.

This financing service can also integrate with purchase order financing, allowing businesses to fund both product purchases and invoice collections. Factoring enhances the receivables process by simplifying the effort required in collecting receivables, issuing reminders, and managing liens. Companies like FundThrough have modernized this model through tech-driven platforms, offering faster access to working capital and better visibility into AR insights. While it’s not the same as invoice discounting, factoring is a practical financing arrangement for startups, vendors, and growing firms seeking fast access to loan proceeds without compromising their invoicing practices or increasing long-term liability.

FAQs

What is factoring trade receivables?

Factoring trade receivables involves selling a business’s outstanding invoices to a third-party company, known as a factor, in exchange for immediate cash. This practice helps improve cash flow by providing instant access to funds tied up in unpaid invoices, allowing companies to meet operational needs without waiting for customers to pay.

How much does accounts receivable factoring cost?

The cost of accounts receivable factoring typically ranges from 1% to 5% of the invoice value, depending on factors such as debtor creditworthiness, invoice volume, and industry. Additional fees like service, processing, or administrative charges may also apply, influencing the overall expense.

How do I find an accounts receivable factoring company?

To find an accounts receivable factoring company, research online for factoring firms with experience in your industry. Compare their terms, fees, and reputation. Seek recommendations from industry peers or financial advisors, and read reviews to ensure reliability. Consulting with multiple companies will help you find a factor that aligns with your business needs.

What types of businesses employ A/R factoring?

Businesses across various industries, such as transportation, healthcare, manufacturing, wholesale distribution, staffing, and construction, commonly employ accounts receivable factoring. These companies benefit from improved cash flow to manage operational costs, invest in growth, and stabilize financial operations. Factoring is particularly useful for industries with lengthy payment terms or significant upfront costs.

What are the pros and cons of factoring accounts receivable?

Factoring accounts receivable offers several advantages, such as improved cash flow, reduced collections burden, access to working capital without incurring debt, enhanced credit management, and the flexibility to seize growth opportunities. However, it also has its drawbacks, including potentially high costs, the impact on customer relationships, loss of control over collections, possible hidden fees, and dependence on the factor’s terms.

How does factoring trade receivables work in business finance?

Factoring trade receivables in business finance involves selling outstanding invoices to a factor, which provides immediate cash advance to the business. The factor then manages the collection of payments from the business’s customers. This arrangement enhances cash flow, allowing businesses to meet operational needs while maintaining financial stability without incurring additional debt.