KEY TAKEAWAYS

- Face value refers to the value indicated on the face of something tangible, such as a coin, bill, bond, or insurance policy. It is not merely an estimation but a specified worth that can be distinctly observed.

- It also pertains to the apparent worth or significance of something, such as taking statements or expressions at face value, which can often lead to misconceptions if the underlying context is ignored.

- In financial and collectible contexts, items often have a face value that may differ significantly from their market value, as seen with collectable coins and defaulted bonds, highlighting the necessity to discern between nominal value and actual worth.

Understanding Face Value

Simple Definition Explained

Face value represents the nominal or dollar value stated on financial instruments, such as stocks, bonds, or currency notes. It’s the amount to be paid back at maturity in the case of bonds, the printed value on currency, or the original issue price of stocks. Crucially, the face value doesn’t fluctuate with market changes and provides a foundational basis for various calculations in finance.

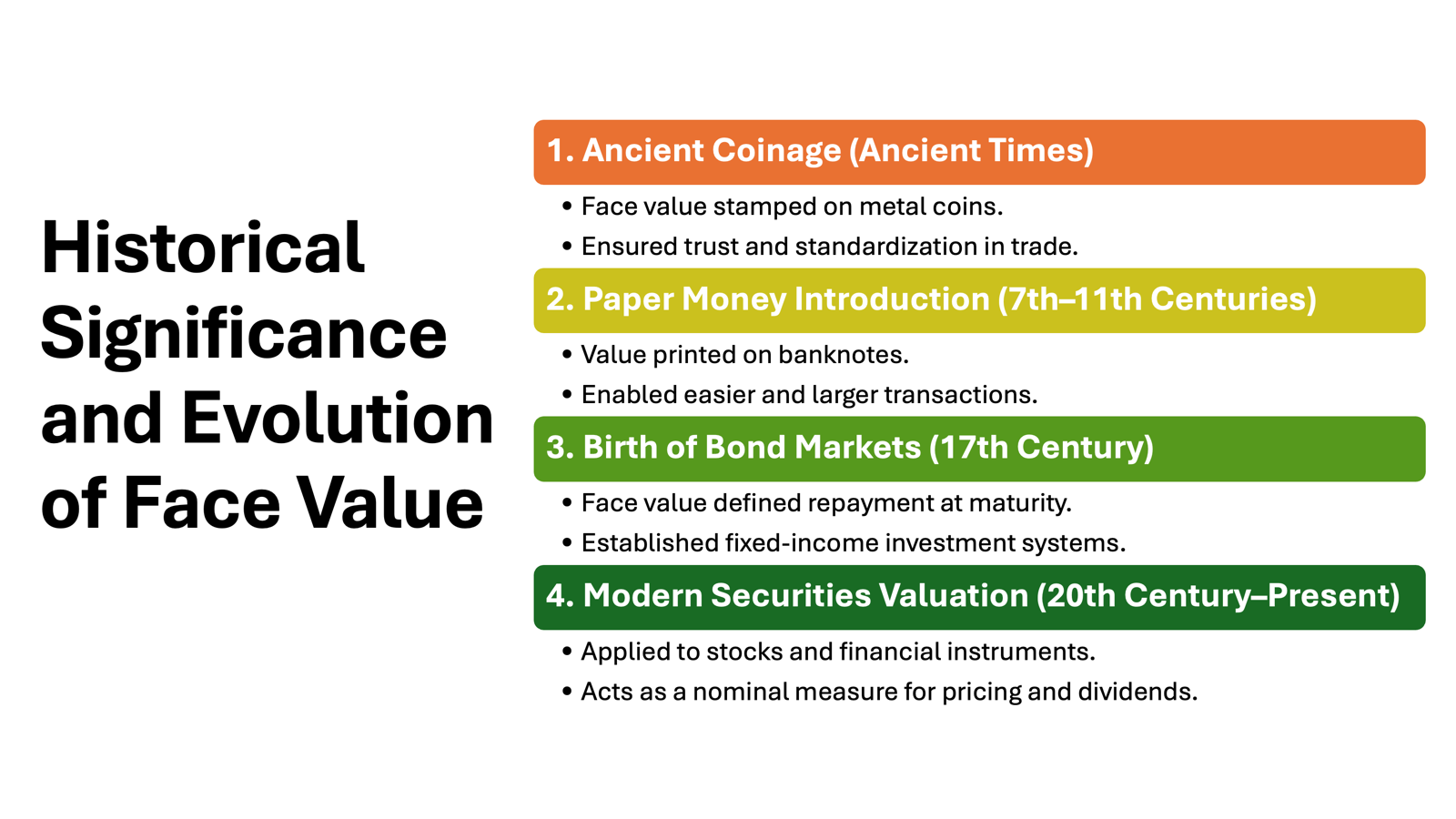

Historical Significance and Evolution

The concept of face value dates back to when commerce relied heavily on tangible currency, where the face value was stamped directly on coins and notes. Much like a postage stamp, which carries a distinct denomination, this visible amount ensured trust in transactions by clearly specifying the value that the currency represented. As financial markets developed, face value evolved to involve complex instruments like bonds and stocks. Here, it gained a broader implication, serving not only as a nominal measure but also affecting pricing strategies and interest payouts. Understanding this evolution is key to grasping how face value functions today, especially as it continues to anchor financial computations despite the advent of digital currencies and complex financial models. Much like the lifespan of a security, the historical impact of face value remains pivotal across its existence in various financial applications.

Face Value in Different Contexts

Stocks and Bonds

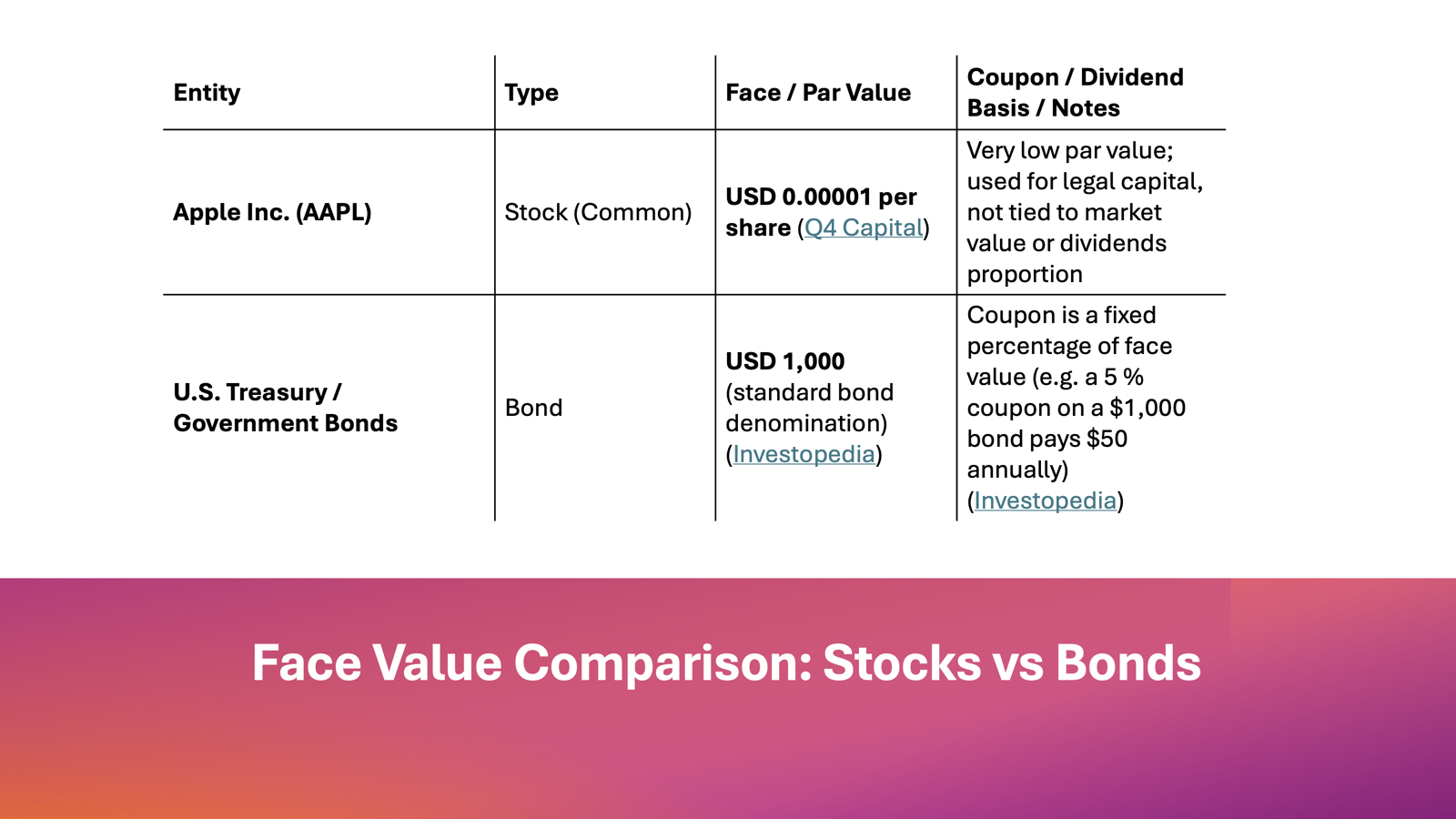

In the world of stocks and bonds, face value plays a pivotal role. For stocks, the face value—sometimes called the par value—is the fixed price at which the share is issued as indicated on the stock certificate. This often holds little importance post-issuance but can affect legal capital minimums. It also serves as a base for calculating the stock dividend percentage. A company’s charter may set the minimal face value. Conversely, with bonds, the face value is much more critical. It represents the amount the bondholder will receive upon maturity and serves as the basis for determining the trading price in bond trading markets. Moreover, the face value determines the interest payments received, known as the coupon rate, and influences both the resale value and redemption value of the bond. Thus, for investors, understanding the face value of these instruments helps in planning returns and assessing cash flow expectations through dividends or interest payments. Additionally, understanding stock trading and the dynamics of exchange-traded funds (ETFs) can give investors further insights into market shifts and opportunities.

Insurance Policies

In the realm of insurance, face value denotes the death benefit amount the policyholder’s beneficiaries will receive upon the insured person’s death. This sum is clearly outlined at the inception of the policy and serves as a guarantee of financial security for the beneficiaries Unlike investments, the face value remains constant throughout its life, ensuring stability and predictability. Additionally, companies often maintain a financial reserve that covers this face value, functioning as a safeguard against defaults. The face value is crucial for determining premium costs, as higher face values typically lead to higher premiums. Policyholders should align the face value with financial needs, such as mortgage payoff or income replacement, to maximize the policy’s utility.

Currency Notes

For currency notes, face value is the denomination printed on the paper or coin, such as $5, $10, or $100. This value determines how the currency is used in everyday transactions and does not fluctuate like market values might. It’s a straightforward representation of worth for economic exchanges, providing a universal basis that facilitates trade and commerce.

Over time, while the purchasing power of the currency might shift due to inflation, the face value remains unchanged. This stability plays a crucial role in both national economies and personal transactions, as it standardizes value across regions and allows for consistent day-to-day usage.

Face Value vs. Other Financial Metrics

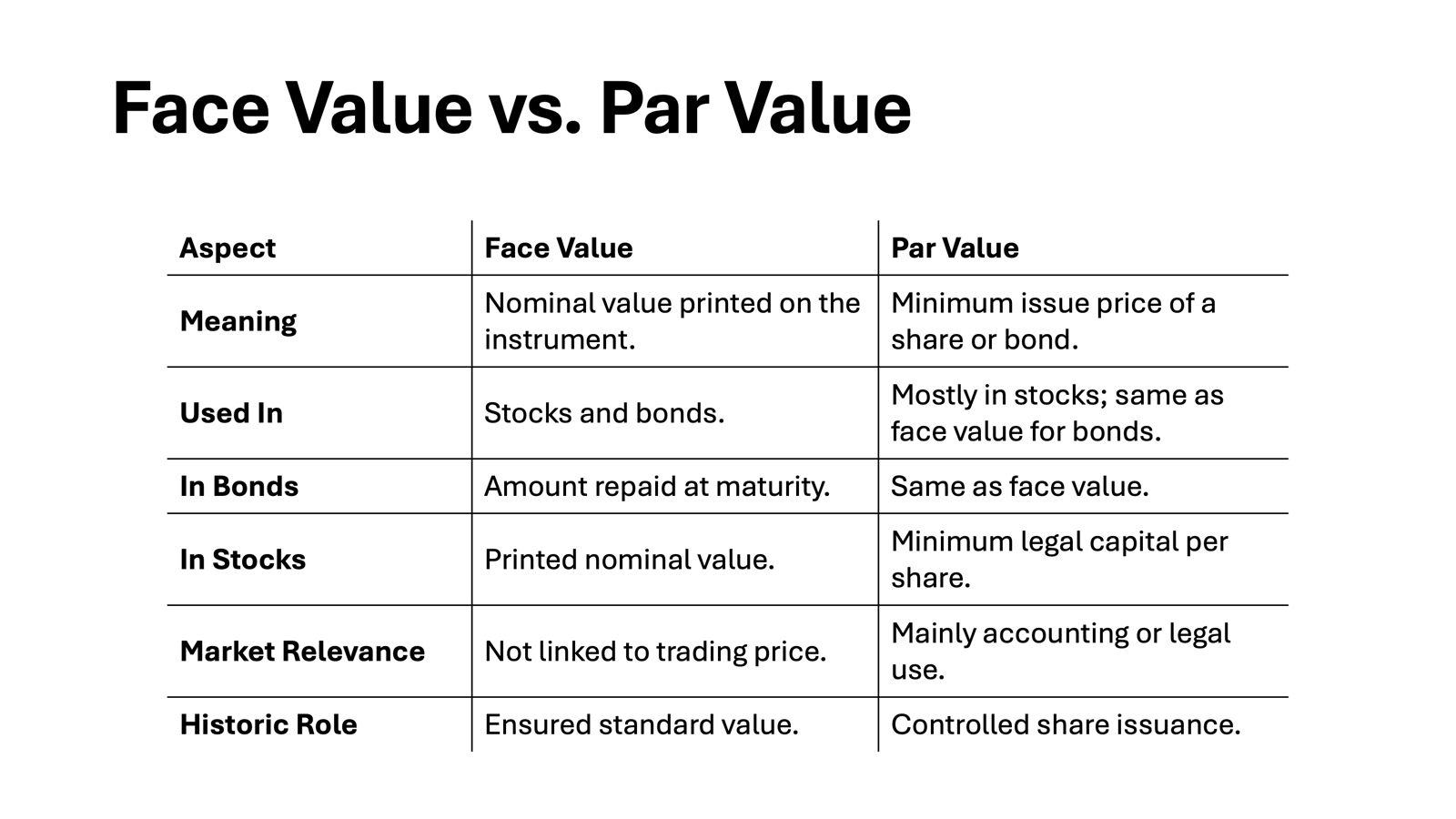

Face Value vs. Par Value

Face value and par value are often used interchangeably, particularly in reference to bonds and stocks. However, subtle differences exist. For bonds, both terms essentially denote the amount to be repaid at maturity. For stocks, the distinction becomes clearer as par value reflects a stock’s minimum issuance price, which can be a mere formality rather than an indicator of market value.

Historically, par value had greater significance in stock issuance due to legal and accounting requirements. Today, it serves more as an accounting measure than a market determinant. Understanding these differences can assist in deciphering financial statements and investment documents.

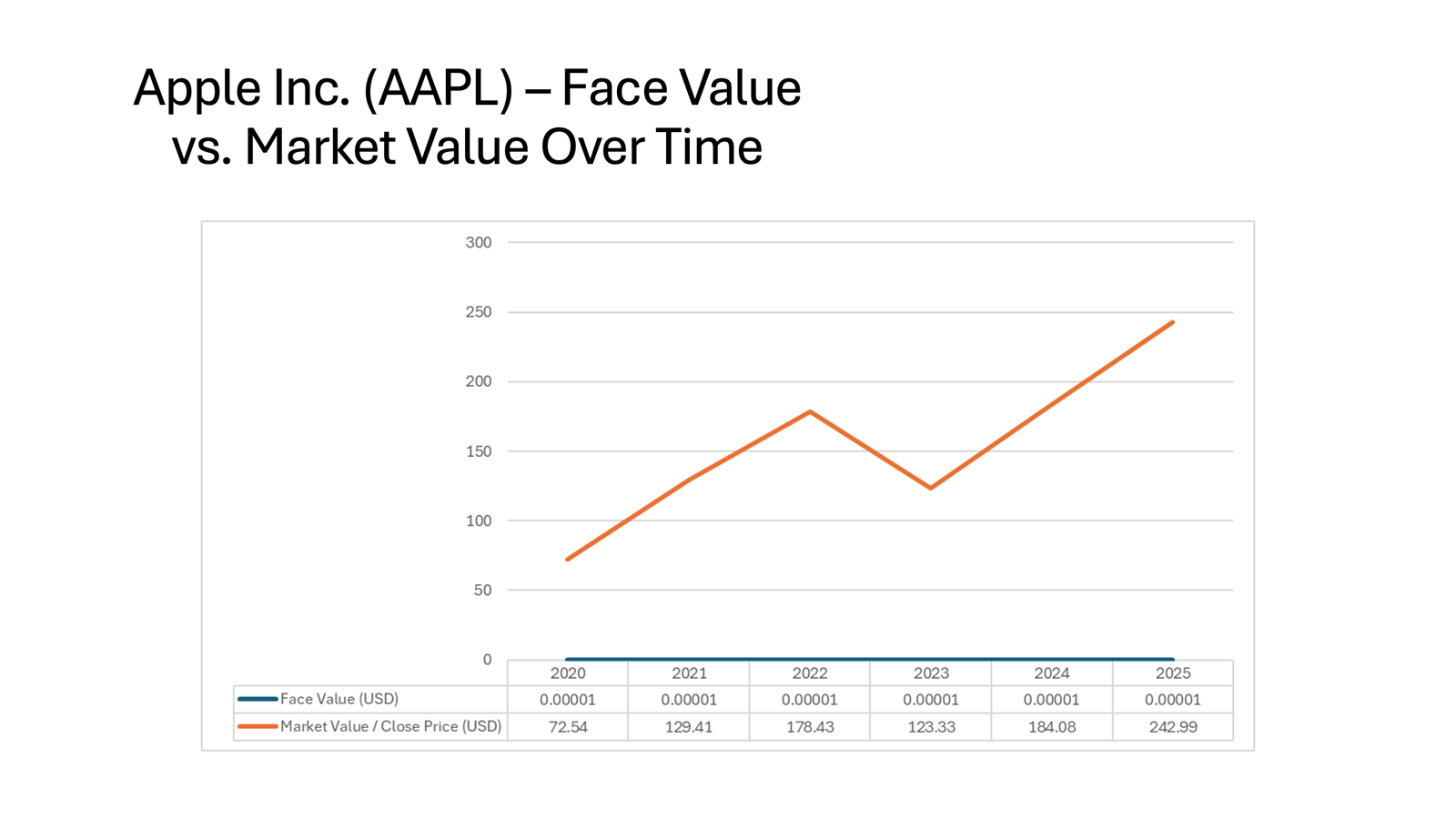

Face Value vs. Market Value

Face value and market value represent two different financial perspectives in assessing the worth of an investment. Face value is the nominal amount assigned by the issuer, crucial in accounting and repayment terms, especially for bonds. Market value, on the other hand, reflects what the asset is currently worth in the marketplace, influenced by supply, demand, economic conditions, and investor perceptions.

For example, a bond might have a face value of $1,000 but trade at a market price of $950 or $1,050 due to interest rate changes or credit market fluctuations. Investors and analysts often compare these metrics to gauge financial instrument performance and potential investment opportunities.

Face Value vs. Book Value

The face value and book value of an asset offer differing insights into its financial standing. Face value,as previously discussed the nominal value stated by the issuer. In contrast, book value represents the net asset value of a company, derived from total assets minus liabilities, as recorded on the balance sheet.

For stocks, while the face value holds little relevance post-issuance, the book value can indicate the company’s intrinsic value and help in assessing investment potential. Comparing these values allows investors to discern whether a stock is potentially undervalued or overvalued, aiding in making informed investment decisions.

Practical Examples of Face Value

Real-Life Applications in Investing

Understanding face value is essential for investors, particularly when dealing with bonds and preferred stocks. For bonds, face value indicates the amount you’ll receive upon maturity, directly affecting interest income calculated from the coupon rate. This makes it a vital factor in forecasting fixed income returns. Furthermore, if a bond is a discount bond, it might be trading below par, potentially offering increased resale value upon maturity if market conditions improve. In bond trading, grasping these nuances with expertise assists in making informed investment projections using real-life web examples of market fluctuations and their outcomes. For stocks with significant face value, it serves to meet statutory capital requirements and can imply investor confidence in the company. Investors are often drawn to preferred stocks due to the fixed stock dividend payments which deliver consistent dividend percentages, adding stability to a portfolio. These applications guide investors in selecting assets aligned with their financial goals, risk tolerance, and portfolio diversification strategies.

Impact on Personal Finance Decisions

Face value plays a significant role in shaping personal finance decisions by providing clarity and predictability. In bonds, the assurance of receiving the face value at maturity aids in planning for future financial needs, such as retirement or major life events. Additionally, leveraging various data sources can help ensure your financial strategies are well-informed and robust. Similarly, in insurance, knowing the face value of a policy helps in gauging how well it meets family financial security goals. Savvy financial planning aligns these face values with life goals, allowing for tailored strategies that maximize benefits and minimize risks across personal financial landscapes. Always feel free to send us feedback on how these strategies impact your decisions.

How to Calculate Face Value

Calculating for Bonds

Calculating the face value for bonds is straightforward, as it is typically specified in the security certificate of the bond’s legal issuing documents. This value represents the amount the issuer promises to repay at maturity, excluding interest. It also helps determine the bond’s coupon payments, calculated as a percentage of its face value. To understand the bond’s full financial benefit, you’ll need to consider its yield, which includes face value, coupon rate, and current market price. Additionally, it’s essential to note that the face value is integral in assessing options like discount bond purchases, especially if concerns about default arise. Ultimately, recognizing the bond’s face value is crucial for evaluating its return potential within your investment portfolio.

Simplifying for Stock Shares

Calculating the face value for stock shares involves identifying the nominal or par value defined by the issuing company. This value is typically minimal and serves primarily as an accounting tool. It’s found in the company’s stock issuance documents and remains unchanged over the stock’s life. It does not influence the stock’s market price, which fluctuates based on supply, demand, and investor sentiment.

To calculate, simply multiply the number of shares by their individual face value. This can help in understanding the company’s capital structure, though it often provides limited practical information for assessing stock market performance. Companies may use low face values to minimize the impact on legal capital requirements, simplifying corporate financial management.

Why Understanding Face Value Matters

Importance in Financial Literacy

Understanding face value is fundamental to financial literacy, as it lays the groundwork for interpreting financial instruments across various sectors. One cannot overlook the importance of learning this concept, as it is akin to taking things at face value, a common idiom suggesting acceptance of something as it appears without considering deeper implications. Whether you’re dealing with bonds, stocks, or insurance policies, knowing their face value helps assess their true worth and predict future benefits. This overview of face value allows you to make informed decisions about risk management, investment potential, and financial planning. Moreover, a solid grasp of face value concepts can lead to enhanced confidence in navigating more complex financial products and investment strategies, ultimately supporting better financial outcomes. Crafting a well-rounded blog post about these topics can further spread awareness and enhance financial literacy among readers.

Influence on Investment Strategies

Face value can significantly influence investment strategies by offering a baseline for evaluating financial products like bonds and stocks. For bond investors, face value helps in calculating yield and assessing repayment expectations at maturity. These figures assist in constructing diversified portfolios balancing risk and reward.

For stocks, although face value holds minimal impact on market actions, understanding it can provide insights into company equity structures, especially in IPOs and legal capital contexts. Recognizing the face value’s role in your investment strategy ensures you align your financial decisions with long-term goals, ultimately optimizing opportunity assessment and risk management.

FAQs

What is the significance of face value in bonds?

Face value in bonds signifies the amount the issuer agrees to repay upon maturity. This value is crucial for calculating the bond’s interest payments, which are typically a percentage of the face value. Understanding face value helps investors forecast returns and evaluate whether the bond suits their financial goals.

How does face value affect insurance policies?

Face value in insurance policies determines the death benefit paid to beneficiaries upon the insured individual’s death. It’s a key factor in setting the policy’s premiums and ensures that the coverage meets the financial needs of the policyholder’s dependents.

Can face value differ from market value?

Yes, face value often differs from market value. Face value is the fixed nominal amount on financial instruments, while market value fluctuates based on current market conditions, investor demand, and economic factors. These variations can significantly impact investment decisions.

How is the face amount of bond different from its market value?

The face amount of a bond is its nominal value, or the amount to be repaid at maturity. Market value is the price at which the bond currently trades, which can be higher or lower than the face amount due to interest rates and market demand. These differences affect yield and investment returns.

Are face amount bonds always issued at par value?

No, face amount bonds are not always issued at par value. They can be issued at a discount or premium depending on market interest rates and issuer credit ratings. Issuing at par occurs when the face value equals the issue price, often aligning interest with market conditions.