KEY TAKEAWAYS

- An encumbrance is a legal claim of ownership against a property.

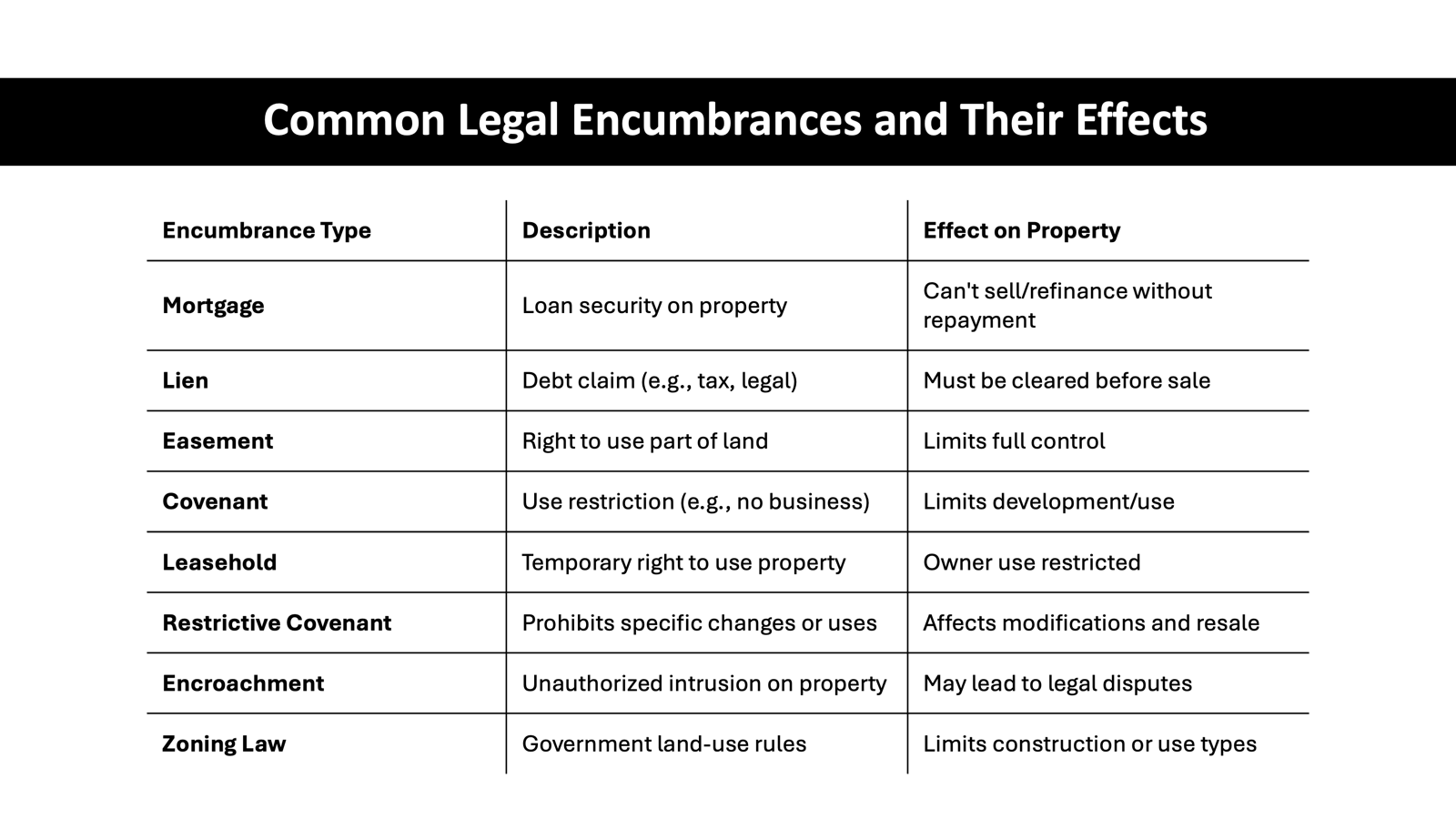

- Encumbrances can be financial or legal and come in many forms, including easements, liens, and encroachments.

- Some encumbrances can jeopardize a home sale or reduce a home’s value, while others have little effect.

What is an Encumbrance?

Definition and Scope

In real estate, an encumbrance refers to any claim, lien, charge, or liability attached to a property that may affect its value or restrict its use. These constraints are not just financial in nature; they can also have legal and practical impacts on property rights. For example, an encumbrance might allow someone other than the owner to use the property or to restrict certain actions or developments on it. They often appear on the title of the property and can include anything from mortgages and easements to liens and restrictive covenants. Understanding the scope of each encumbrance is vital since it dictates what can or cannot be done with a property.

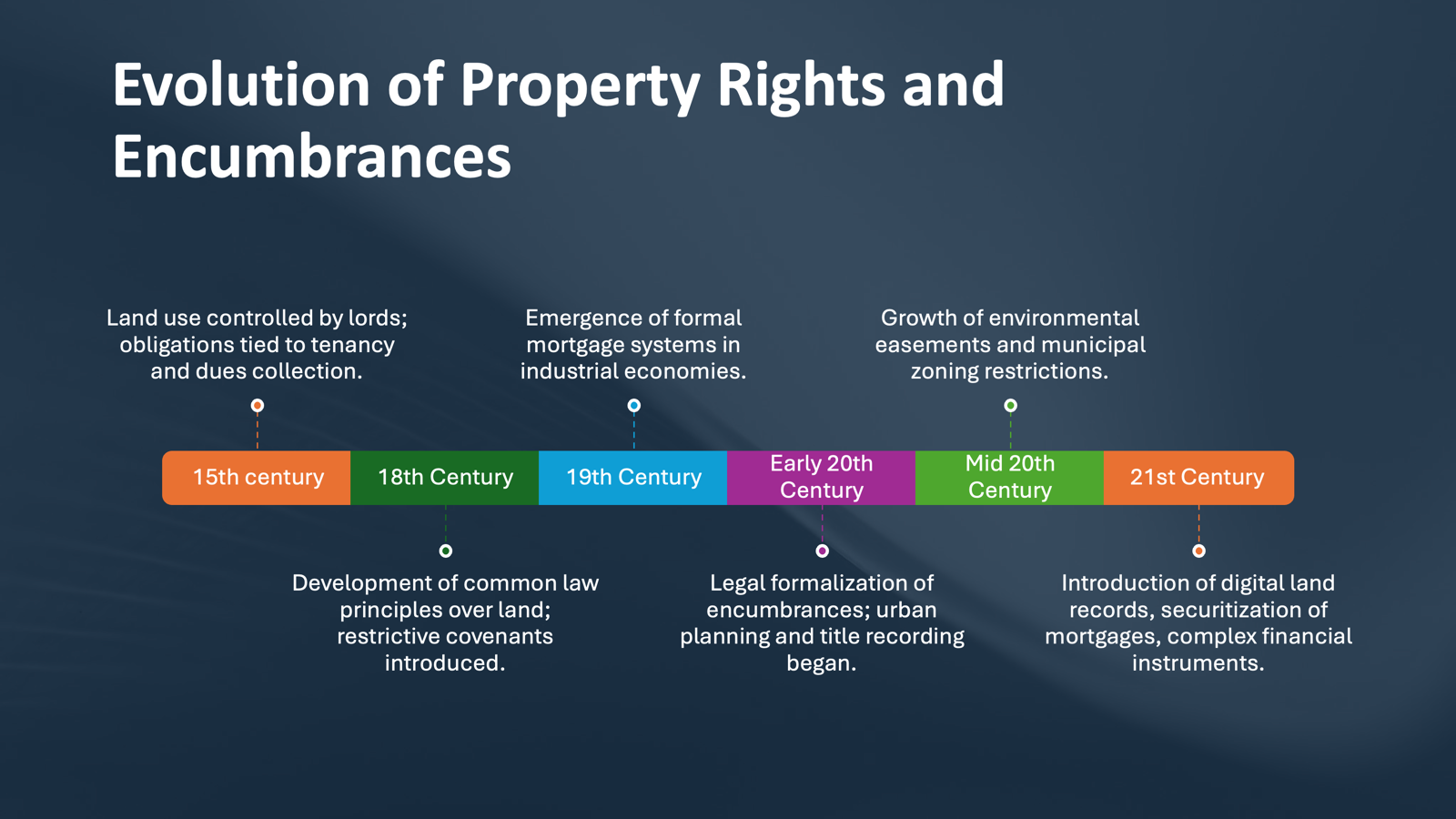

Historical Context

The concept of encumbrances has deep historical roots, dating back to feudal systems where land ownership and rights were heavily regulated. Originally, these restrictions served as mechanisms for lords to exercise control over land use and ensure the collection of dues. As societies evolved, the need to balance individual property rights with public and private interests shaped modern encumbrances. They have since become legal tools for managing land use, protecting environmental interests, and securing financial obligations. Over the centuries, encumbrances have adapted to include modern legal and financial nuances, reflecting changes in property law and economic practices.

Types of Encumbrances Explained

Legal Encumbrances

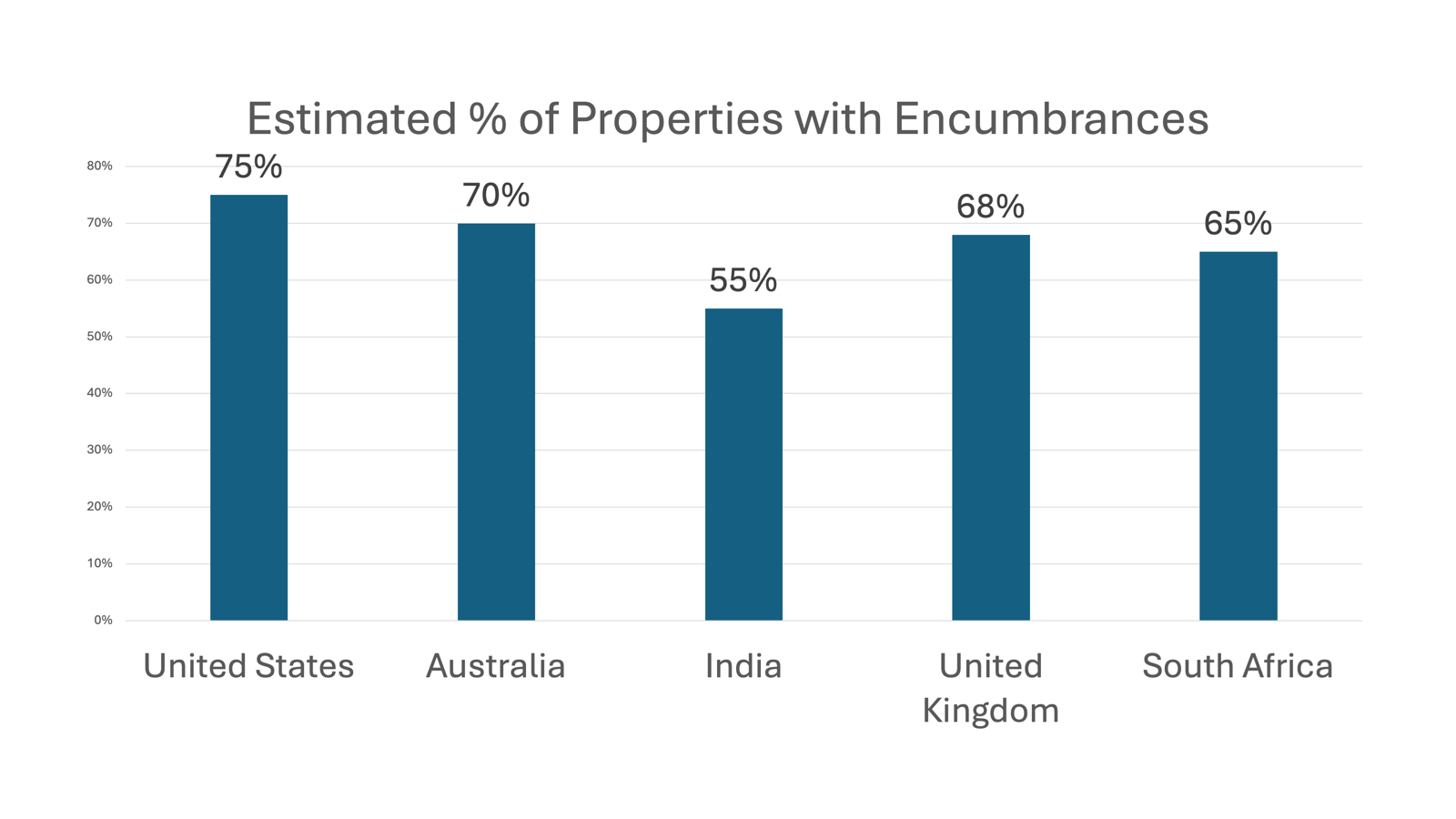

Legal encumbrances are restrictions that arise from laws or legal actions affecting the rights associated with property ownership. These can include a range of legal instruments such as liens, easements, and restrictive covenants. Liens, for instance, are claims made by creditors to ensure debt payment, automatically attaching to the property until obligations are met. Easements, on the other hand, grant the right for others to use part of a property for a specific purpose, like utility maintenance. Restrictive covenants are agreements that limit what can be done with a property, often used to maintain neighborhood aesthetics and norms. Understanding these legal encumbrances is crucial, as they can significantly impact your ability to freely use or sell the property. Additionally, nearly every property in the United States has at least one incumbrance, with burdens sometimes imposed by a third party which encumbers the owner’s freedom. In certain jurisdictions, homeowners associations may impose rules and regulations that further influence how you can manage your property. In property management, encumbrance accounting can play a vital role in ensuring that funds are reserved to address any anticipated liabilities caused by these encumbrances effectively. These can often require a requisition of additional documentation during transactions.

Financial Encumbrances

Financial encumbrances primarily involve obligations that can affect the ownership and financial standing of a property. They commonly include mortgages and tax liens. A mortgage is a type of financial encumbrance where the property itself secures a loan. Until the mortgage loan is satisfied, the lender holds an interest in the property, restricting its sale or transfer without lender approval. Proceeds from the sale of the property are often used to resolve these mortgages at closing. Tax liens occur when property taxes become delinquent, granting the government a legal claim against the property to secure the payment of taxes owed.

These financial encumbrances can influence the property’s marketability and potentially reduce its resale value, making it essential to address them promptly. Additionally, human encumbrances, such as tenancy rights or ex commitment arrangements, can impact property transactions, adding another layer of complexity. For those buying or selling real estate, understanding these financial and human constraints can prevent legal hurdles and ensure smooth transactions. As an accounting term, “encumbrance” indicates reserved funds for specific liabilities, such as these potential expenditures.

Easements and their Impact

Easements are legal rights granted to individuals or entities to use a portion of someone else’s property for a specific purpose, without owning it. They can have various implications for property owners, depending on their nature and extent. For instance, a common type is a utility easement that allows companies to install and maintain infrastructure like power lines or pipelines on private property. In some neighborhoods, easements can affect routine activities such as lawn mowing, emphasizing the importance of awareness about existing agreements. While easements are essential for public utility, they can limit how you can develop or modify your property.

The impact of easements can vary. On the one hand, they often enhance community and infrastructure functionality, with practical semblance observed through web examples showing diverse usage like shared driveways or pathways. On the other, they may decrease property value due to usage restrictions. Being aware of existing easements and their terms is crucial for effective property management and planning.

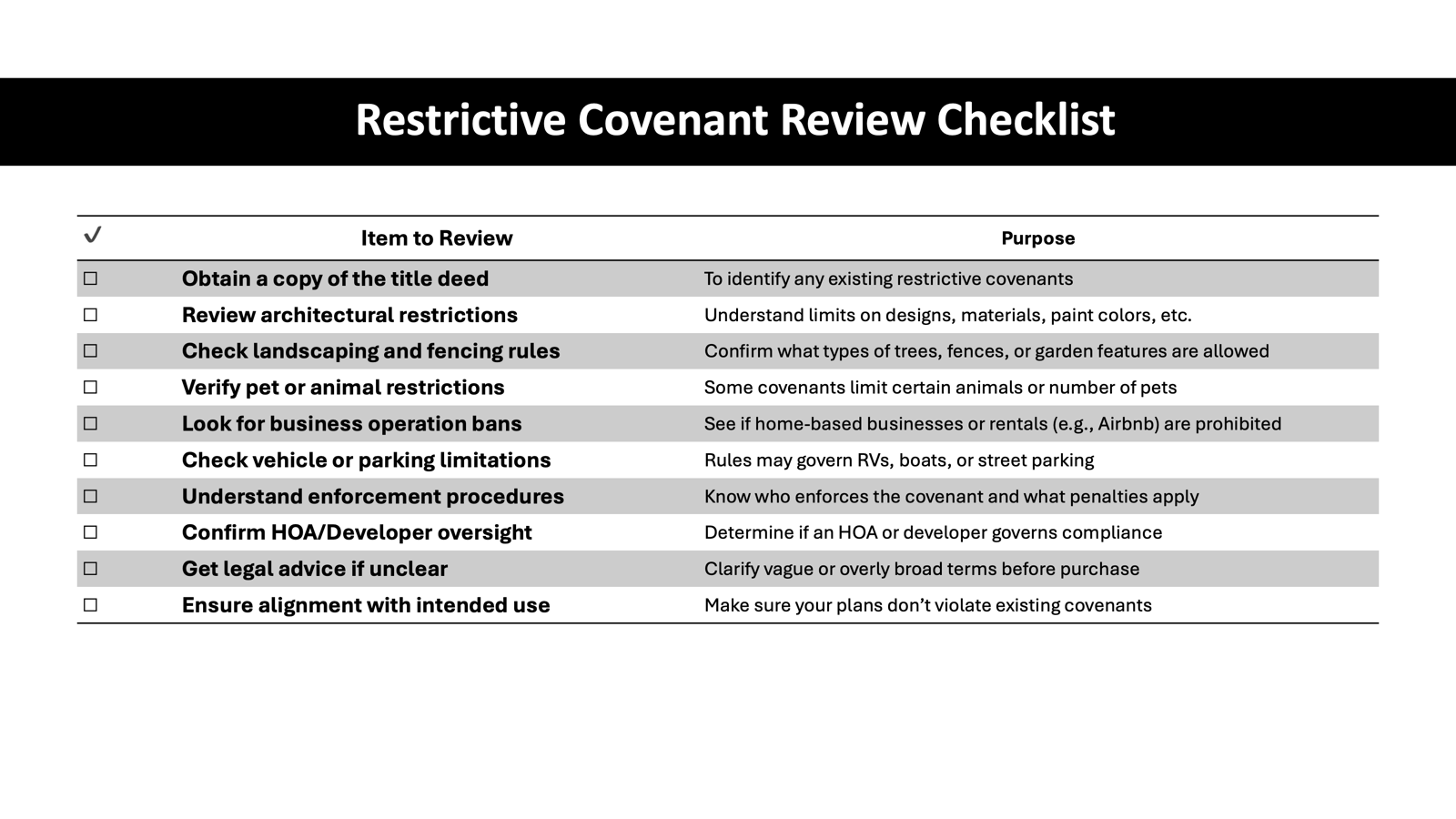

Restrictive Covenants

Restrictive covenants are legal obligations imposed on property deeds that limit how the property can be used, ensuring that certain standards or aesthetics are maintained within a neighborhood or development. These covenants often originate from developers to create uniformity and uphold property values. For example, they might stipulate architectural guidelines, landscaping rules, or restrictions on business operations within residential properties.

While restrictive covenants can help preserve community character and provide a sense of order, they can also restrict individual freedoms and property use. Property owners must adhere to these covenants or face legal challenges, which can impose additional costs or complications. Hence, reviewing any applicable restrictive covenants before purchasing a property is vital to ensure they align with your intended use and lifestyle.

Leases and Real Estate

Leases are agreements where a property owner grants a tenant the right to use the property for a specified period under agreed terms. In the context of encumbrances, a lease can heavily influence property value and use. For landlords, leasing creates a continuous income stream; however, it also places limitations on how the property can be altered or further developed during the lease term.

From a tenant’s perspective, understanding the lease terms is crucial as they dictate rights such as duration, rent conditions, and responsible property use. Also, leases can include provisions that could affect property resale, as potential buyers need to honor existing leases. Therefore, both parties must clearly understand and agree to the lease terms to avoid future disputes.

How Encumbrances Affect Property Value and Usage

Impact on Marketability

Encumbrances can significantly affect a property’s marketability, influencing both buyer interest and sale conditions. Properties with multiple or complex encumbrances often face challenges in attracting potential buyers, as these restrictions can limit the usability and enjoyment of the property. For instance, legal encumbrances such as liens require resolution before a sale can proceed, which might delay transactions and add to costs. Sellers should actively seek feedback to identify any barriers encumbrances might pose to a successful transaction.

Similarly, easements or restrictive covenants can deter buyers who seek flexibility in property use, especially if they desire extensive modifications or redevelopment. While encumbrances like leases might appeal to investors looking for rental income, they could dissuade buyers interested in immediate occupancy. Transparent discussions through email about existing encumbrances are essential to build trust and manage buyer expectations.

Therefore, clear communication about existing encumbrances is essential in real estate transactions, as transparent information builds trust and helps manage buyer expectations.

Restrictions on Property Use

Encumbrances often impose various restrictions on property use, which can directly impact both daily operations and long-term plans. Legal encumbrances such as easements may limit the types of structures you can build or where you can construct on your land. For instance, a utility easement might restrict building above certain areas, effectively reducing available land for development.

Restrictive covenants can further limit property use, often including rules that regulate everything from architectural designs to exterior paint colors. These covenants may require homeowners to maintain specific aesthetic qualities or prohibit certain activities, such as commercial enterprises in residential zones.

Understanding these restrictions is crucial for any property owner, as failing to comply can lead to legal disputes, fines, or forced modifications. For potential buyers, reviewing these restrictions in advance helps assess whether a property can meet their needs and lifestyle desires.

Potential Financial Implications

Encumbrances can carry significant financial implications for property owners, potentially affecting both immediate budgets and long-term financial plans. For example, financial encumbrances such as liens need resolution before a property can be sold, which might involve substantial expenses to clear outstanding debts. Liens can accrue interest, leading to increased payoff amounts if left unaddressed over time. Encumbrance accounting helps ensure that businesses allocate funds wisely, preventing overspending of the encumbrance amount. Moreover, legal encumbrances like easements can impact property value and appeal adversely, limiting its resale potential. This is particularly true if the encumbrances restrict buyers’ intended uses, ultimately requiring price negotiations or concessions. Tenants and lessors should be aware that leases can also influence property valuation, especially if rental terms are perceived as unfavorable or overly restrictive. Implementing an effective accounting system can offer valuable insights into managing these complexities. Understanding these financial aspects and planning accordingly is critical for anyone invested in real estate, whether buying, selling, or managing rental properties.

Common Examples of Encumbrances in Real Estate

Liens and Their Importance

Liens are a type of encumbrance that represents a legal claim or right over a property due to an unpaid debt. They are essential because they provide a mechanism for creditors to secure repayment by tying the obligation to the property’s value. Common types of liens, as explained by sources like Merriam-Webster, include mortgage liens, tax liens, and mechanic’s liens, each serving specific purposes based on the nature of the debt owed. For instance, the New York Times has reported on the complexities of tax liens when property taxes go unpaid, allowing the government to claim the property until the debt is resolved. At closing, the seller must resolve the lien, typically using proceeds from the sale to pay off the outstanding debt. Mortgage liens are created when a property is used as collateral for a loan, and they must be resolved before the title can be transferred. Mechanic’s liens, meanwhile, can be filed by contractors or suppliers for unpaid work or materials.

Liens are critical in maintaining the integrity of financial agreements, ensuring that creditors have a means to collect what is due. They can, however, impede property transactions by complicating the transfer of ownership and potentially reducing market value. Addressing liens promptly and understanding their terms is vital for both property owners and prospective buyers. Encumbrance accounting can also play a key role in tracking and managing encumbrance amounts, helping ensure that liabilities do not exceed budgeted funds, thus preventing overspending.

Easements in Practice

Easements are practical arrangements that play a vital role in everyday property operations, granting specific usage rights to entities or individuals other than the property owner. A common example is a utility easement, which allows service providers to maintain power lines or pipelines across private land, enabling essential infrastructure access without transferring ownership.

In practice, easements can also cater to neighbors, such as granting pedestrian access or establishing a shared driveway. They are generally permanent and run with the land, meaning they persist through changes in ownership. Because of their potential to influence the property’s usability, understanding the scope and limitations of existing easements is crucial.

These agreements facilitate cooperative use of land and resources, sometimes increasing communal efficiency but occasionally limiting development opportunities. Property buyers should carefully review any easements on a property to assess how they align with personal use goals or investment plans.

Encroachments to Watch For

Encroachments occur when structures or improvements illegally extend beyond a property owner’s boundaries, intruding upon a neighbor’s land. They can range from minor intrusions, like fences extending slightly beyond a boundary line, to significant violations involving buildings. Unlike easements, encroachments are usually unintentional and can lead to disputes between neighbors if left unresolved.

Encroachments can affect property value and usability, as they often complicate legal descriptions and may require alterations or compensation. They can also hinder the sale or redevelopment of affected properties unless addressed properly. In some cases, long-standing encroachments might even lead to claims of adverse possession, where the encroaching owner can legally acquire the land in question.

To protect against potential encroachments, property owners are encouraged to conduct land surveys regularly, ensuring boundary lines are respected and disputes minimized. Prospective buyers should also invest in thorough surveys to identify and resolve any encroachment issues before purchasing a property.

Strategies for Managing Encumbrances

Identifying Encumbrances

Identifying encumbrances is a crucial step in property management and transactions. It involves a thorough examination of property records to uncover any claims or restrictions that might affect ownership or use. Here’s how you can efficiently identify encumbrances:

- Title Search: Engage a title company to conduct a detailed search of public records. This will reveal existing liens, easements, leases, and covenants tied to the property.

- Property Survey: Hiring a professional surveyor can help determine any physical encroachments or boundary disputes, ensuring that all boundary lines are correctly established and known.

- Review Property Documents: Carefully examine deeds, title insurance policies, and mortgage agreements for any previously recorded encumbrances.

- Check with Local Government: Visit local municipal offices to search for unpaid taxes, building code violations, and zoning restrictions that may impact the property.

- Consult with Legal Experts: Engaging real estate attorneys can provide insight into complex legal encumbrances and guide potential solutions or negotiations.

Identifying encumbrances early can prevent costly legal disputes and ensure clear, marketable title transfers.

Navigating Legal Challenges

Navigating legal challenges related to encumbrances requires a strategic approach to mitigate potential pitfalls during property transactions and ownership. Here are some key strategies to consider:

- Consult with Real Estate Attorneys: Legal professionals can provide expert advice on the implications of encumbrances, guiding you through complex legalities and ensuring compliance with all relevant laws.

- Detailed Documentation Review: Scrutinize all property-related documents to understand fully the nature of encumbrances. Legal experts can help decipher complex terms and predict their impact on property use and value.

- Negotiation Skills: Often, encumbrances can be renegotiated or modified. Effective negotiation can sometimes lead to the removal or alteration of restrictive encumbrances, facilitating better property use.

- Consider Alternative Solutions: If faced with a restrictive encumbrance, explore creative solutions such as easement adjustments or boundary agreements with neighboring properties.

- Litigation as a Last Resort: When negotiations fail, legal action may be necessary. Having a skilled attorney can make the process smoother and increase the chances of a favorable outcome.

Legal challenges can be daunting, but with the right preparation and professional guidance, you can effectively manage or resolve encumbrance-related issues.

Steps to Mitigate Risks

Mitigating risks associated with encumbrances is essential for protecting your investment and ensuring smooth property transactions. Here are key steps to consider:

- Conduct Thorough Due Diligence: Before buying, investing in comprehensive title searches, property surveys, and legal reviews can reveal existing encumbrances.

- Title Insurance: Purchase title insurance to protect against future claims against the property’s title. This insurance covers legal fees and any resulting damages from undisclosed encumbrances.

- Consult Professionals: Engage real estate agents, attorneys, and surveyors early in the process to provide insights and identify potential encumbrance issues.

- Renegotiate Terms: If an encumbrance poses significant obstacles, consider renegotiating terms with the relevant parties. This might involve modifying easements or settling liens.

- Clear Communication: Maintain open and clear communication with all parties involved, including neighbors and local authorities, to address and resolve potential concerns proactively.

Proactively managing these risks can prevent costly legal battles and ensure that your property rights are secure.

FAQs

What is encumberment in legal or financial terms?

Encumberment in legal or financial terms refers to a claim, charge, or liability attached to a property. It affects the property’s usability, value, or saleability and can include liens, easements, leases, and restrictive covenants. These legally enforceable claims can limit how an owner can use or transfer the property.

What does it mean if a property is encumbered?

If a property is encumbered, it means there are claims or restrictions attached to it, such as mortgages, liens, or easements. These encumbrances can affect the property’s value, how it can be used, and the ease with which it can be sold or transferred. An encumbered property typically requires these issues to be resolved before full ownership rights can be exercised.

Can an encumbrance be removed?

Yes, an encumbrance can be removed, but the process depends on the type. Financial encumbrances like liens can be cleared by settling the outstanding debt. Easements and restrictive covenants might be negotiated or legally challenged, but this can be complex. Consulting with legal professionals ensures proper handling.

How can I find out if a property has encumbrances?

To find out if a property has encumbrances, start by conducting a title search through a title company to reveal any liens, easements, or covenants. Reviewing the property deed and consulting with a real estate attorney can also uncover existing encumbrances. In Hong Kong, for instance, the seller is legally required to inform the real estate agent and purchaser of any encumbrances to avoid complications in the sales process. Additionally, property surveys can help identify any physical encroachments.

How do you define encumbrance?

An encumbrance is a legal claim, restriction, or liability on a property that may limit its use or transferability. It includes various constraints like liens, easements, leases, and restrictive covenants that affect ownership rights and property value. These encumbrances must be addressed before a clear property title can be secured.