KEY TAKEAWAYS

- Strategic Focus and Core Business Enhancement: Divestiture allows companies to concentrate resources and efforts on their core business by shedding underperforming or non-essential assets. This strategic focus often leads to raised profitability as firms can reinvest generated capital into areas with the highest potential for growth.

- Financial Stability and Debt Management: By converting non-core assets into cash, companies can reduce debt levels, thus improving creditworthiness. This financial restructuring helps strengthen the company’s balance sheet, enhancing its capacity to secure better terms with suppliers and reducing dependency on debt.

- Cost Efficiency and Shareholder Value Increase: Eliminating loss-making divisions through divestiture reduces redundant expenses, increasing overall business efficiency. Additionally, it enhances shareholder value by realigning the company’s operations towards profit-generating segments, generating cash flow, and improving financial ratios like the quick ratio.

The Role of Divestitures in Corporate Strategy

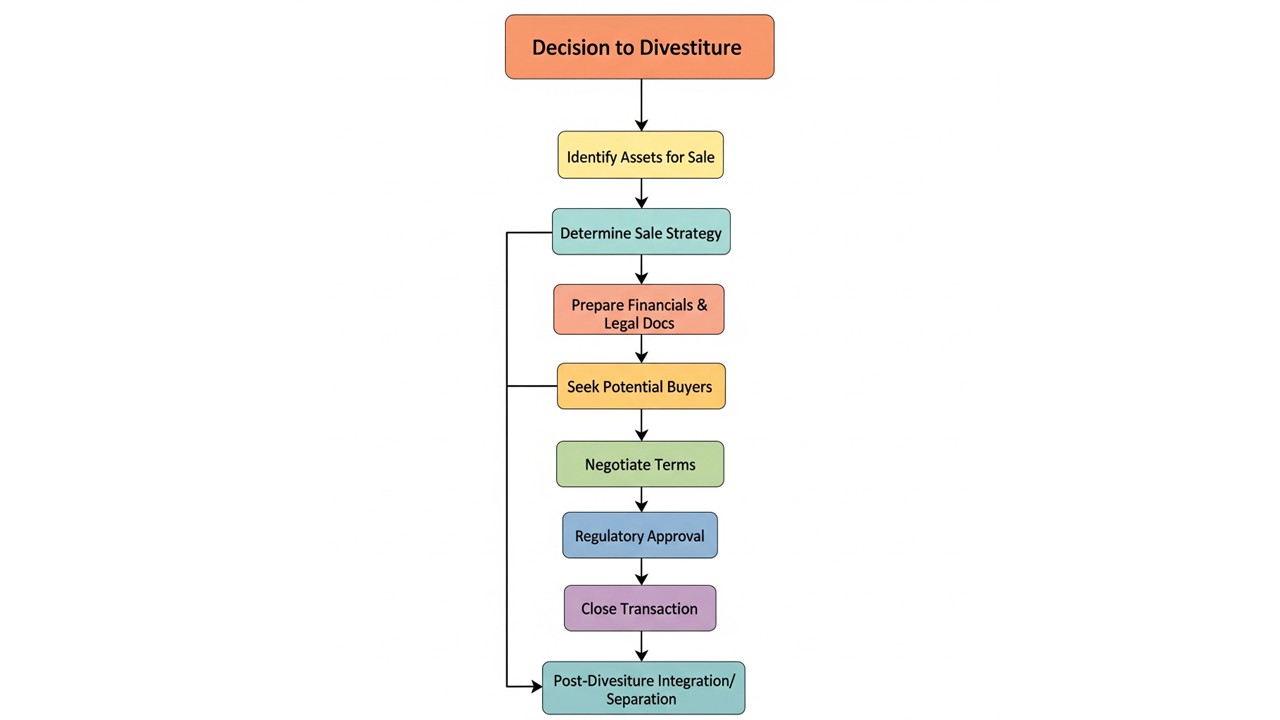

Divestitures play a crucial role in corporate strategy by enabling companies to realign their focus and resources toward core operations. By shedding non-core or underperforming assets through a structured roadmap, businesses can concentrate on areas with the highest growth potential. This strategic refocusing helps in improving overall efficiency and profitability. Additionally, a comprehensive portfolio review can unlock hidden value, often resulting in gains that can be reinvested or returned to shareholders. They help reduce debt, streamline operations, and sometimes are crucial in compliance with regulatory demands. Furthermore, companies might utilize divestitures during mergers and acquisitions to align with antitrust regulations or post-merger integration plans, fostering synergies. This deliberate reallocation can boost agility, allowing companies to respond swiftly to market changes and innovate proactively.

What is a Divestiture?

Definition and Key Concepts

A divestiture is the process by which a company sells or disposes of assets, subsidiaries, or business units. This disposal can include selling to another company, spinning off as a separate entity, or liquidating assets for cash. At its core, a divestiture is about restructuring and optimizing a company’s asset base to maximize value. The key concepts around divestitures include ‘non-core assets’—assets that do not align with a company’s primary business focus—and ‘unlocking value,’ which refers to the potential increase in shareholder value following a divestiture. Activist investors often apply pressure for divestitures as a means to unlock hidden value in the company. Actively managing the firm’s asset portfolio by divesting non-performing assets enhances operational focus and corporate strength.

Types of Divestitures

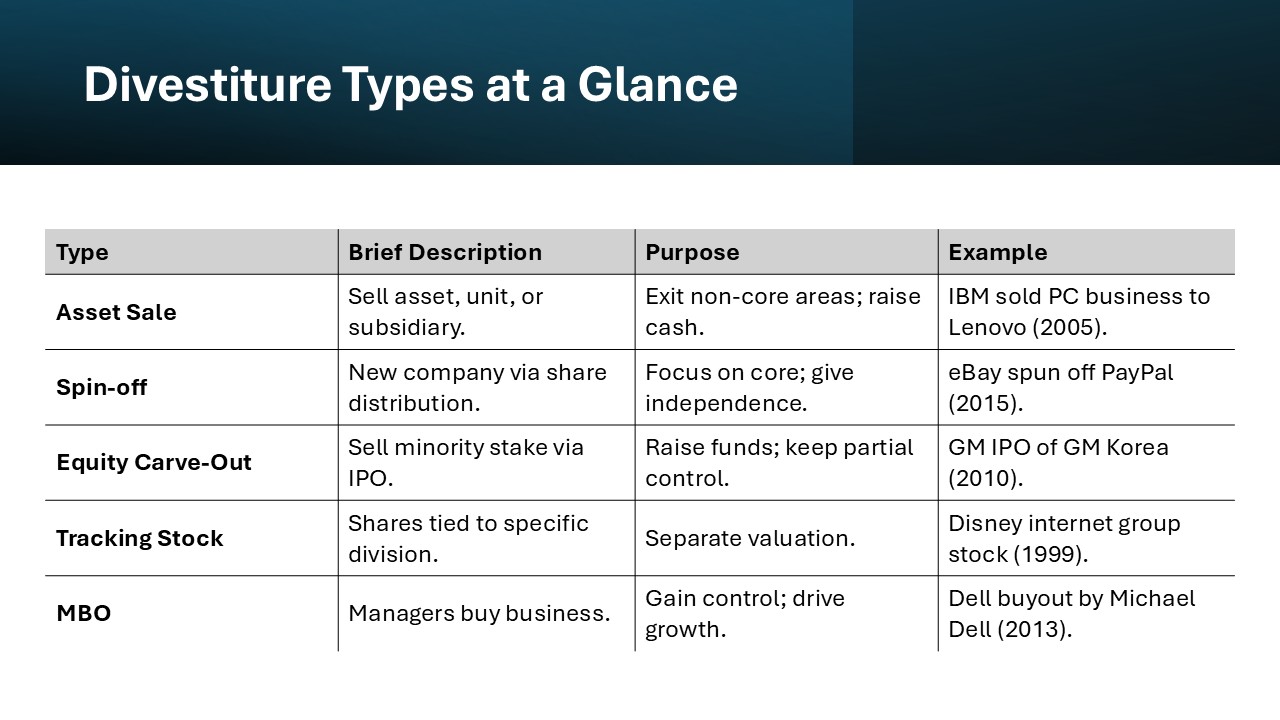

Divestitures can take several forms, each serving different strategic and financial goals:

- Asset Sale: Involves selling a specific asset, business unit, or subsidiary to another company. This type is often used when assets are underperforming or no longer fit strategic goals.

- Spin-off: This creates a new, independent company by distributing shares to existing shareholders. Spin-offs help focus corporate operations on core areas while giving the spun-off company the freedom to capitalize on its market potential.

- Equity Carve-Out: A portion of a subsidiary’s equity is sold to outside investors through an initial public offering (IPO), raising capital while retaining some control over the subsidiary.

- Tracking Stock Issuance: A unique stock is created to track the performance of a specific division or asset, allowing investors to value it separately from the parent company.

- Management Buyout (MBO): Management team members purchase a part or all of the company, usually with the help of external financiers, to drive growth independently from the parent company.

Each type of divestiture serves distinct strategic purposes and is chosen based on the specific needs and context of the firm.

This comprehensive understanding of the different types ensures informed decision-making for companies looking to optimize their portfolios and refocus their strategic goals.

Common Reasons for Divesting

Companies choose to divest assets for several strategic, operational, or financial reasons:

- Focus on Core Business: By selling off non-core assets, companies can streamline operations and dedicate resources to areas with the highest growth potential.

- Debt Reduction: Proceeds from divestitures can help pay down debt, improving financial health and operational flexibility.

- Underperformance: Divesting underperforming units can enhance overall corporate profitability and allow management to focus on more profitable areas.

- Regulatory Compliance: Regulatory compliance is critical as regulators often mandate divestitures to preserve competitive market conditions, particularly during mergers and acquisitions to prevent monopolies.

- Shareholder Value Maximization: Companies might divest to unlock hidden value in a subsidiary or business unit, often leading to a positive reaction in share prices.

- Liquidity Needs: When companies face cash flow constraints, divesting assets can provide much-needed liquidity to stabilize finances.

Notable Examples of Divestitures

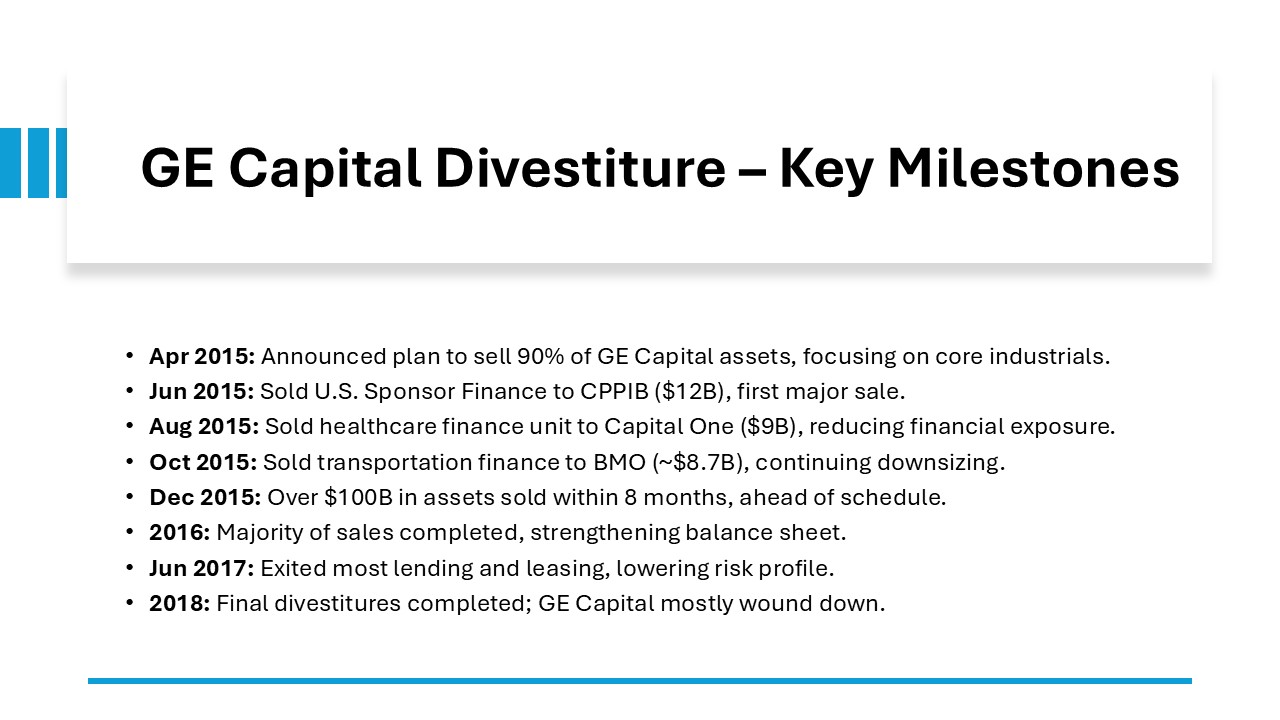

General Electric’s Strategic Exit from GE Capital

General Electric’s divestiture of GE Capital marked one of the most significant restructurings in its history, reflecting a strategic pivot toward core industrial operations. Announced in 2015, this move aimed to reduce GE’s exposure to financial markets and concentrate on its strengths in industrial technology and manufacturing. By divesting a substantial portion of GE Capital’s assets, GE freed up capital, strengthened its balance sheet, and significantly reduced its financial segment’s risks.

This divestment enhanced GE’s credit profile and simplified its corporate structure. However, the transition wasn’t without challenges, including managing a vast array of asset sales and navigating regulatory requirements. These challenges involved infrastructure updates to support the restructuring plan and addressing any unforeseen liabilities. The strategic exit from GE Capital served as a pivotal step in transforming GE into a more focused industrial leader, aiming to enhance long-term shareholder value and operational efficiencies.

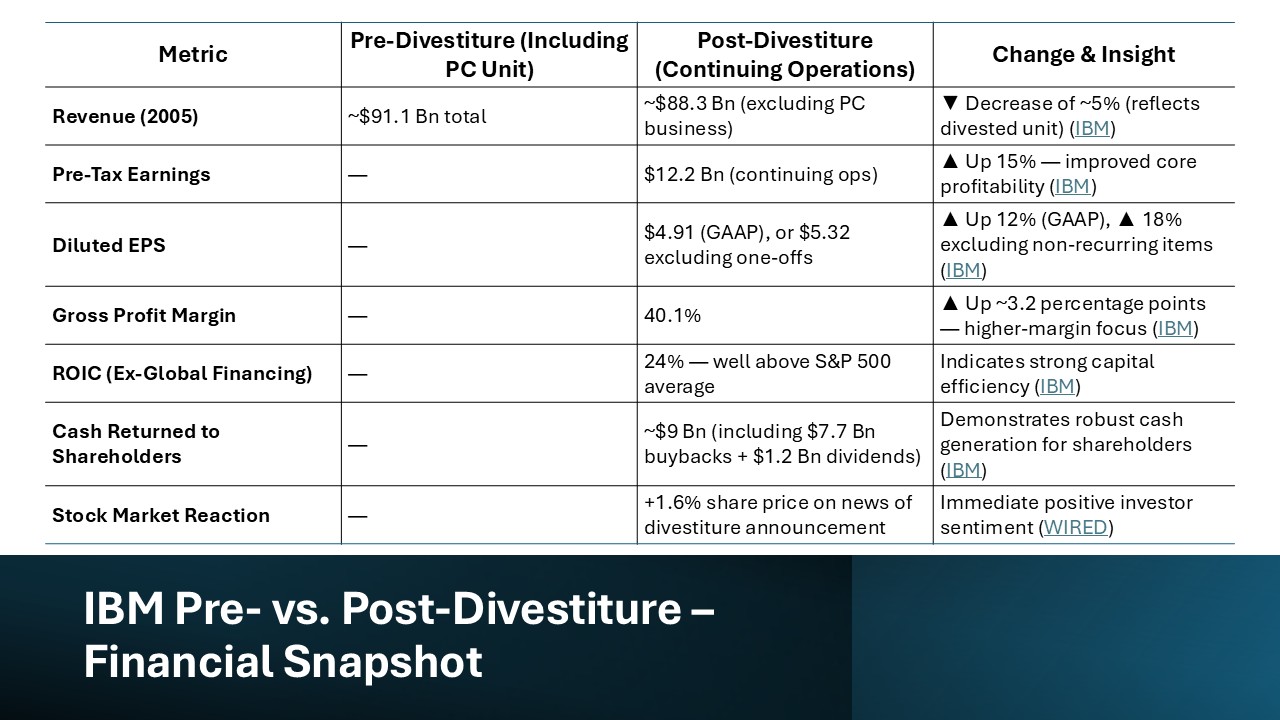

IBM Sells Off Its PC Division to Lenovo

In 2004, IBM’s decision to sell its PC division to Lenovo was a landmark deal that signaled a significant shift in IBM’s business strategy. This $1.75 billion divestiture allowed IBM to pivot away from low-margin consumer electronics to focus on higher-value enterprise services, such as cloud computing, software, and services. The key takeaways from this strategic move include IBM’s sharpened focus on innovation and appealing to more lucrative corporate markets. This is essential for tech companies aiming to maintain competitive viability amidst marketplace shifts across regions like the United States and globally. For Lenovo, acquiring IBM’s PC division propelled it to become the world’s third-largest PC maker and greatly expanded its global reach, especially in Western markets like the United States. Although IBM faced challenges such as integrating new strategic focuses and reassuring stakeholders, the divestiture work was instrumental in redefining its business model. Investment bankers played a significant role in facilitating this transition, employing their expertise to manage the deal effectively. The divestiture offered a discount to investors keen on a company refocusing its core assets, enhancing overall performance. Meanwhile, Lenovo benefited by significantly enhancing its product portfolio and brand recognition on a global scale. This deal exemplified effective corporate realignment while catering to the strengths of both companies involved. Realigning portfolios through a divestiture, especially for a conglomerate, enables businesses to focus on core assets and enhance overall performance.

Ford and Jaguar Land Rover: A Financial Retooling

In 2008, Ford’s decision to divest Jaguar Land Rover (JLR) to Tata Motors was a strategic move aimed at financial optimization amidst economic challenges. The $2.3 billion sale helped Ford streamline its operations, focusing on revitalizing its core brands and improving its financial standing during a period of significant industry turmoil. By offloading JLR, Ford was able to allocate more resources towards innovation, efficiency, and the development of its flagship models.

For Tata Motors, the acquisition provided an entry into the luxury automotive market, significantly expanding its portfolio and global presence. While the initial transition presented hurdles such as cultural integration and aligning management strategies, Tata’s investment in brand revival and product development paid off. JLR flourished under Tata’s stewardship, launching successful new models and establishing itself as a major player in the luxury car market. This divestiture illustrated how strategic retooling could benefit both selling and acquiring parties by aligning with their respective long-term goals.

eBay and PayPal Separation: Unlocking Hidden Value

In 2015, eBay’s separation from PayPal marked a significant divestiture designed to unlock the full potential of both companies. As independent entities, eBay and PayPal could focus on their respective businesses—marketplace and payment services—without conflicting interests. This move allowed eBay to streamline its operations, while PayPal could aggressively pursue partnerships and innovations in the growing digital payments industry. This strategic decision was made after conducting a comprehensive business valuation to establish a realistic trajectory for both entities.

The split enabled both companies to tailor their growth strategies specifically to their core strengths, with PayPal experiencing accelerated growth in customer base and transaction volume thanks to increased flexibility in extending service offerings globally. The transaction structure was crafted to maximize transaction value by precisely aligning with each company’s objectives. Meanwhile, eBay benefitted by concentrating on enhancing its competitive position within the e-commerce sector. Although the separation involved complexities such as restructuring and realigning resources, the results proved advantageous, leading to significant cash proceeds. This strategic divestiture illustrated how uncoupling closely linked businesses can enhance shareholder value and drive market success by ensuring both entities were structurally ready.

How Divestitures Are Executed

Planning and Strategy

Effective planning and strategy are crucial to the success of any divestiture. The process begins with a comprehensive evaluation of the asset’s alignment with the company’s core business objectives and future goals. This involves thorough financial analysis to assess the potential value unlocking of the divestiture. Strategic planning also requires understanding the market environment and identifying the appropriate timing for the divestiture to maximize value.

Companies must also define clear objectives for the divestiture, such as reducing debt, refocusing on core operations, or complying with regulatory requirements. Developing a robust communication plan is essential, as stakeholders, including investors, employees, and customers, must be informed and engaged throughout the process.

Running simulations and scenario planning allow companies to anticipate risks and devise mitigation strategies, while competitive analysis ensures the chosen strategy aligns with broader market trends. Ultimately, a well-conceived strategic plan enhances operational execution, ensuring that both financial and strategic objectives are met.

Steps in the Divestiture Process

The divestiture process is a structured approach encompassing several steps to ensure a smooth transition and maximize value:

- Initial Assessment: Companies begin by evaluating the asset, determining its worth, and assessing its fit within the organization’s strategic goals.

- Preliminary Planning: This stage involves defining objectives, selecting the type of divestiture method (e.g., sale, spin-off), and mapping out potential buyers or stakeholders.

- Due Diligence: Comprehensive due diligence is conducted to prepare financial reports, asset valuations, and compliance documentation, ensuring all information is transparent and accurate.

- Marketing and Buyer Engagement: The company markets the asset, engaging with potential buyers through proposals and negotiations. This step may involve roadshows and presentations to attract interest.

- Deal Structuring: Terms of the deal are outlined, including price negotiations, legal structuring, and identifying key terms and conditions.

- Transaction Execution: The final agreement is signed, transferring ownership following comprehensive legal and regulatory clearance.

- Closing and Transition: Completion of the transaction includes transitioning operations, communicating changes to affected parties, and post-sale adjustments based on deal specifics.

- Post-Divestiture Operations: Focus on the integration or winding down of processes to ensure minimaldisruption to ongoing operations, while also monitoring performance to affirm the success of the divestiture.

Each step requires meticulous planning and execution, as even minor oversights can lead to financial and operational hurdles. Following these structured steps helps ensure that organizations achieve desired outcomes from their divestiture efforts.

Challenges in Execution

Executing a divestiture can present several challenges that require careful management to ensure a successful outcome. One major hurdle is accurately valuing the asset to be divested, as this impacts the attractiveness of the deal to potential buyers. It’s important to develop a transaction structure that maximizes the asset liquidation value. Companies must conduct thorough due diligence to provide an accurate valuation, which can be time-consuming and resource-intensive. Moreover, issues like liabilities or other concerns that might emerge during a bankruptcy proceeding often complicate the process further.

Another challenge lies in the complex negotiations involved, which can extend beyond financial terms to include regulatory issues, employee matters, and contract renegotiations with existing partners. Navigating these facets requires skilled negotiation and a robust legal strategy. Transitioning operations smoothly is also significant, as divestitures can lead to disruptions in business processes, particularly if the asset is integral to the company’s supply chain or product offerings. Companies must plan comprehensive transition strategies that minimize operational disruption and maintain business continuity. Communication is another critical area, where companies must manage stakeholder expectations and keep employees, investors, and partners informed throughout the process. Poor communication can lead to uncertainty, impacting employee morale and customer confidence. Finally, aligning the divestiture with broader corporate strategy while ensuring the remaining organization remains cohesive and strong post-divestiture requires strategic foresight. Understanding and addressing these challenges are essential for ensuring that divestitures enhance strategic goals rather than detract from them. Companies that successfully navigate these hurdles often emerge stronger and more focused in their strategic pursuits.

Post-Divestiture Integration

Post-divestiture integration is a crucial phase for both the selling and acquiring entities, focusing on ensuring smooth continuity and leveraging the newly defined organizational structure. For the sellers, this involves recalibrating resources and operational strategies to align with the leaner business model. It often includes reallocating workforce, revising operational processes, and focusing on core business areas, which may yield efficiency improvements and cost savings.

For the acquiring company, integration requires merging the acquired asset into its existing operations without disrupting business continuity. This involves aligning cultures, harmonizing IT systems, and integrating supply chains. Challenges such as employee acclimatization and customer retention need to be addressed proactively.

Both parties must maintain clear communication, emphasizing transparency to ease transitions, alleviate uncertainties, and secure stakeholder trust. Embracing a flexible approach can also help in adapting to unforeseen changes and challenges in the integration process.

Additionally, setting clear, post-divestiture performance metrics is essential to monitor progress and measure the success of integration efforts. With careful planning and execution, post-divestiture integration can lead to significant long-term benefits and strategic gains for both parties involved.

Impact of Divestitures on Companies

Financial Outcomes

The financial outcomes of a divestiture can significantly impact a company’s balance sheet and market performance. Positive financial outcomes are typically characterized by a strengthened balance sheet through the inflow of capital, leading to improved liquidity and reduced debt levels. This financial revitalization can position a company for future investments and strategic initiatives.

Divestitures often aim to enhance shareholder value, as they can lead to increased stock prices following an announcement, reflecting investor confidence in the refocused business strategy. Additionally, by removing underperforming assets, companies may see a rise in return on investment (ROI) and improved profit margins due to streamlined operations.

However, challenges can arise, notably if the divestiture’s proceeds do not meet expectations or if execution costs are higher than anticipated, potentially leading to temporary financial strain. Monitoring these impacts requires vigilant financial oversight to ensure expected outcomes align with strategic objectives.

Over the long term, when executed effectively, divestitures pave the way for organic growth and the redistribution of capital towards more profitable ventures, securing a robust financial foundation.

Employee Implications

Divestitures often have significant implications for employees, necessitating thoughtful management to maintain morale and productivity. For employees of the divested unit, there’s often uncertainty about job security and changes in workplace culture. Companies must communicate clearly and openly to mitigate anxiety, detailing what the divestiture entails and how it might affect roles.

For those remaining with the selling company, adjustments to the organizational structure and operational focus can occur. This might result in changes in roles or workload as the organization shifts its strategic priorities. Offering retraining and development opportunities can support employees in adapting to these changes.

Acquiring companies face the challenge of integrating new employees into their corporate culture and systems. This requires fostering a cohesive environment to merge differing corporate cultures and practices effectively.

Both selling and acquiring companies should provide support systems such as counseling services or job transition assistance to ease the transition period. Prioritizing employee well-being during a divestiture not only boosts morale but can also enhance the overall success and smooth transition of the divestiture process.

Market Reactions and Shareholder Value

The market’s reaction to a divestiture announcement can be pivotal in determining its perceived success. Positive market reactions usually stem from the belief that the divestiture will streamline operations, enhance efficiency, and focus the company on core competencies, thereby increasing its competitive edge. Conducting a thorough business valuation prior to the divestiture can set realistic expectations, contributing to a more favorable reception. Shareholders often view divestitures as a proactive step toward unlocking hidden value and correcting undervaluation, potentially leading to an uptick in stock prices.

However, market reactions can vary depending on the clarity and communication of the strategic rationale behind the divestiture. A well-articulated strategy that aligns with long-term growth objectives tends to receive favorable market feedback. Conversely, if investors and analysts perceive the divestiture as financially necessary or poorly aligned with the company’s strategic vision, it may lead to skepticism and negative market reactions.

For shareholders, divestitures can result in enhanced value over time, primarily through improved business focus and performance. Ensuring that transaction value is maximized is critical to this process. It’s crucial for companies to monitor shareholder sentiment and address concerns promptly to maintain confidence.

Ultimately, how a divestiture is planned, communicated, and implemented directly influences market perception and shareholder value, reinforcing the importance of strategic execution and transparent communication throughout the process. By managing these factors effectively and securing the right cash proceeds, companies can maximize the positive impact on market performance and shareholder confidence.

FAQs

What is the meaning of divestitures?

Divestitures refer to the process where a company sells, spins off, or otherwise disposes of an asset, business unit, or subsidiary. This strategic decision helps companies streamline operations, concentrate on core businesses, and unlock or maximize shareholder value by reallocating resources to more profitable areas.

What are the different types of divestitures?

Divestitures can take several forms, including asset sales, where a company sells part of its business to another entity; spin-offs, which create independent companies by distributing new shares to existing shareholders; equity carve-outs, where a portion of a subsidiary’s shares is sold via an IPO; and tracking stock issuance, which tracks the performance of a particular segment of the company.

How does a divestiture differ from a carve-out?

A divestiture involves a company selling or disposing of a business unit, subsidiary, or asset entirely, often to refocus on core operations. A carve-out, however, entails selling a minority interest in a subsidiary by issuing new shares through an IPO, allowing the parent company to retain control while raising capital and highlighting the subsidiary’s potential value.

Why do companies choose to divest certain assets?

Companies choose to divest certain assets to focus on core operations, reduce debt, improve cash flow, or eliminate underperforming segments. Divestitures can also be driven by regulatory requirements, strategic realignment to enhance competitiveness, or the opportunity to unlock hidden value, thereby increasing shareholder returns.

What happens to employees during a divestiture?

During a divestiture, employees might be transferred to the acquiring company, retain their roles within the divesting organization, or face restructuring changes. Communication and support, such as reassignment help and job training, are critical during this transition to minimize uncertainty and maintain morale.

How do you divest a business?

To divest a business, start by conducting a thorough assessment to identify the asset’s value and alignment with strategic objectives. Develop a clear plan outlining goals and potential buyers. Conduct due diligence to prepare financials and legal documents. Market the asset, engage with buyers, negotiate terms, execute the transaction, and manage the transition to ensure a smooth operational handover.