KEY TAKEAWAYS

- Write-offs are critical accounting processes that help recognize and record unrecoverable expenses or losses, ensuring compliance with accounting standards and maintaining accurate financial records.

- They arise from various reasons such as bad debts, obsolete inventory, impaired assets, and unrecoverable costs, which all affect financial statements.

- While debt write-offs can offer financial relief, they may also lead to negative credit score impacts, collection efforts, legal actions, and potential tax liabilities.

Understanding Write-Offs

.

Definition of a Write-Off

A write-off refers to the accounting procedure where a business acknowledges that an asset no longer holds value or that a specific expense must be accounted for in terms of overall financial management. Essentially, it is a way to adjust the books to reflect the true financial state by eliminating obsolete, uncollectible, or inaccurately valued accounts. Write-offs are crucial for maintaining financial accuracy and compliance with accounting standards. They also play a role in tax calculations, often reducing taxable income and thereby affecting a company’s tax liabilities.

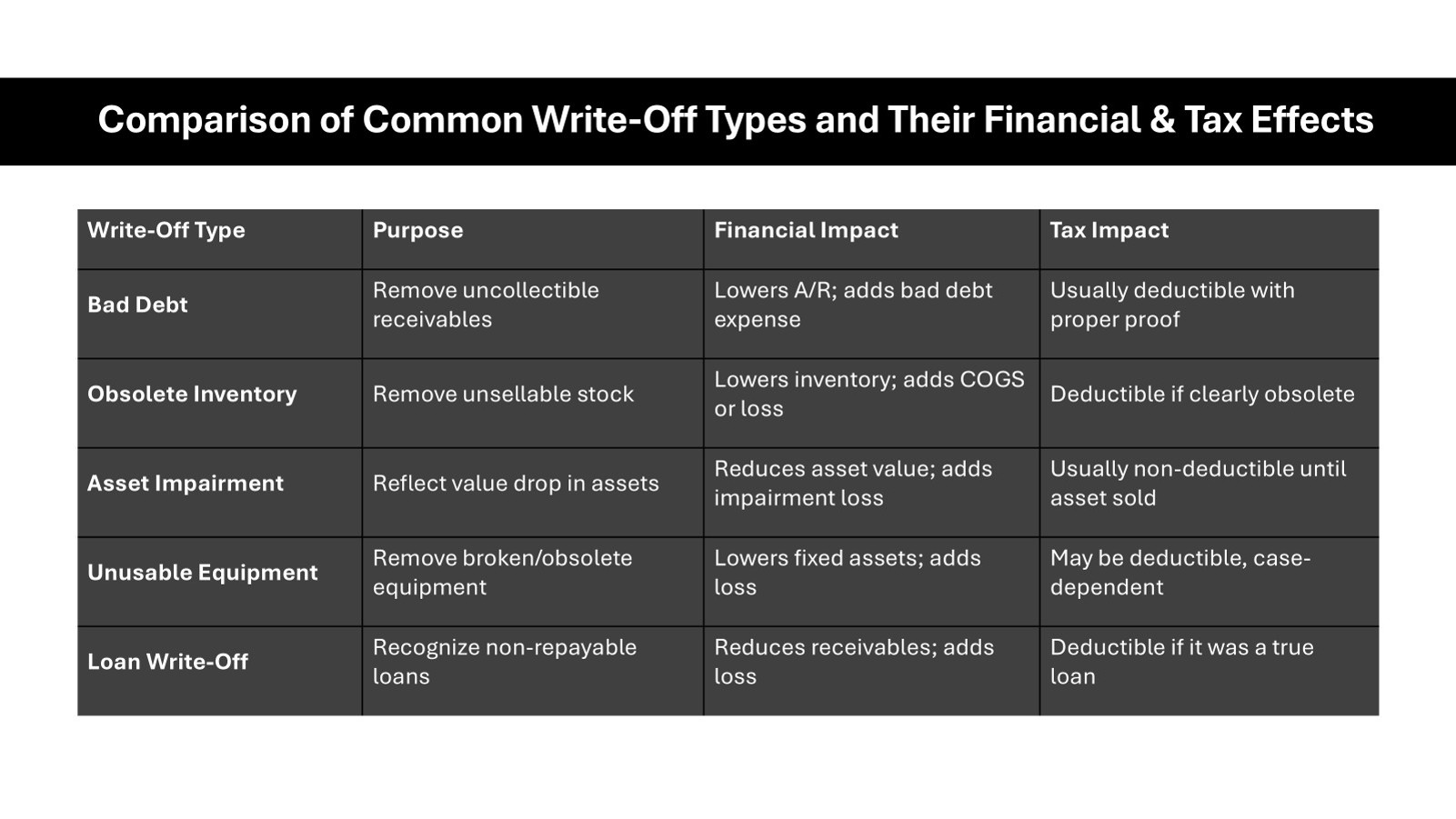

Common Types of Write-Offs

Write-offs come in various forms, each serving a different purpose in financial management. Here are some of the more common types:

- Bad Debt Write-Offs: When debts owed cannot be collected, businesses acknowledge these as losses to avoid inflating assets inaccurately.

- Inventory Write-Offs: Occur when inventory becomes obsolete or damaged and therefore must be removed from accounting records.

- Depreciation Write-Offs: Represent the reduction in value of tangible assets over time, helping businesses allocate costs across an asset’s useful life.

- Asset Impairment Write-Offs: When a long-term asset becomes less valuable than its book value, it’s written down to the marketable value.

- Business Expense Write-Offs: Everyday operational costs, such as business mile expense, that can be deducted from a company’s taxable income. Proper tracking and reporting can maximize reimbursement and reduce taxation liabilities.

Write-offs serve as crucial tools for maintaining financial health, ensuring that accounting records truly reflect business reality. They aid in accurate reporting and promote fiscal accountability.

How Write-Offs Work

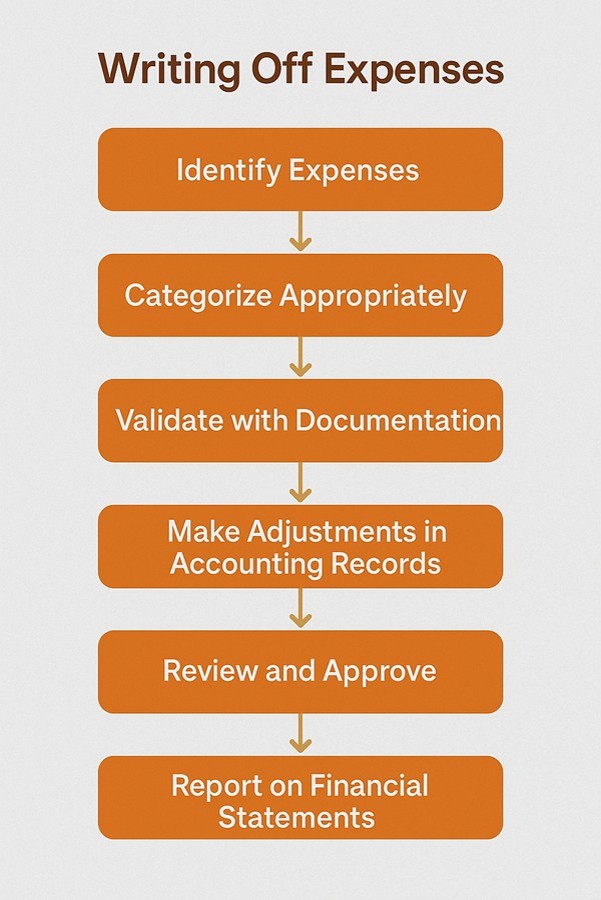

The Process of Writing Off Expenses

Writing off expenses involves a systematic approach to accurately reflect these costs in financial records. Here’s a step-by-step look at the process:

- Identify Expenses: Begin by determining which expenses are eligible for write-offs. This includes reviewing all bills, receipts, and financial transactions, and identifying possible reimbursements or compensation eligible for deductions.

- Categorize Appropriately: Once identified, categorize these expenses according to your accounting software or system’s chart of accounts. This ensures meticulous tracking and management.

- Validate with Documentation: Collect and organize all necessary documentation that supports the legitimacy of the write-offs. This may include invoices, contracts, or payment receipts, along with any related email correspondence that validates the expense.

- Make Adjustments in Accounting Records: Log the write-offs in the company’s bookkeeping system. This typically involves debiting the expense account and crediting the asset or liability account.

- Review and Approve: A final step involves having a financial officer or accountant review the write-offs for accuracy, compliance with tax laws, and verification of proper employee compensation attributes.

- Report on Financial Statements: Update your financial statements to reflect these write-offs, ensuring that they provide an accurate portrayal of your financial status.

By systematically addressing write-offs, businesses can maintain accurate and legally-compliant financial records, ensuring they reflect the true financial situation. Whether small or large, each write-off should undergo thorough scrutiny for long-term fiscal health and integrity.

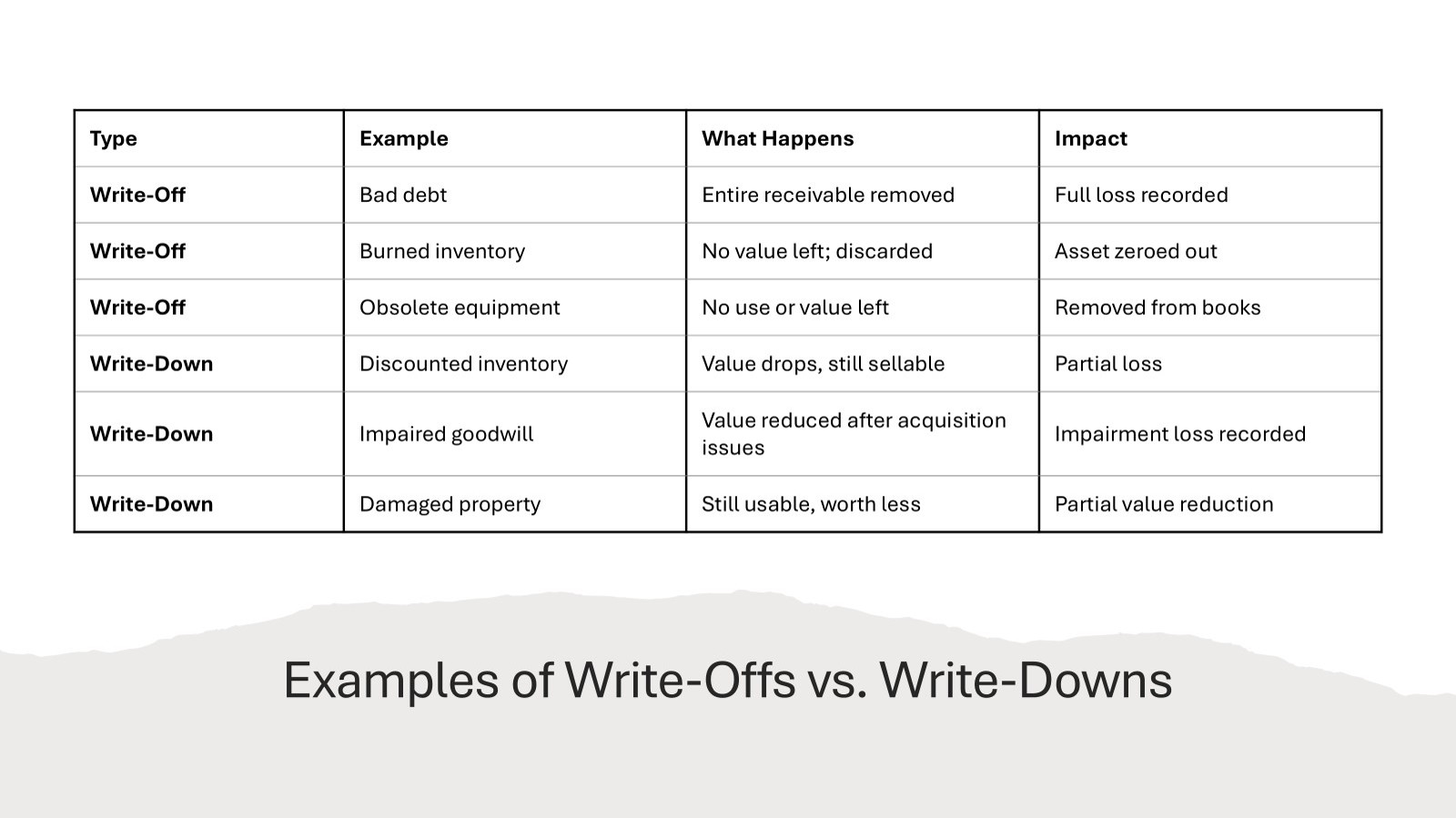

Differences Between Write-Offs and Write-Downs

Write-offs and write-downs are often confused but serve distinct roles in financial accounting. Here is a breakdown of their differences:

- Definition: A write-off completely removes an asset from the books because its value is considered unrecoverable. In contrast, a write-down reduces the book value of an asset, acknowledging that while it has decreased in value, it still holds some worth.

- Scope: Write-offs are more severe, indicating a total loss such as when a debt is deemed uncollectible. Write-downs are less drastic and often occur when an asset, like inventory, declines in value but remains partially usable.

- Application: Write-offs are generally irreversible; once declared, the item is removed from active accounts. Write-downs can sometimes be adjusted or reversed if the asset’s value appreciates in the future.

- Impact on Financial Statements: Write-offs typically lead to larger immediate impacts on profit and loss statements, as they fully remove the asset’s value. Write-downs result in a more moderate loss, maintaining a presence on the balance sheet albeit at a reduced value.

Understanding these distinctions is key in accurate financial reporting and decision-making, protecting a company’s financialintegrity and aiding in strategic planning. Choose the right approach for each situation to ensure compliance with accounting standards.

Examples of Business Write-Offs

Tax-Deductible Business Expenses

Tax-deductible business expenses are costs that businesses can subtract from their gross income, reducing their overall taxable income. This allows companies to lower their tax liability and retain more capital for operational and growth opportunities. Here are some common tax-deductible expenses:

- Office Supplies: Items such as stationery, computers, and furniture can be deducted as they are necessary for maintaining business operations.

- Travel Costs: Traveling for client meetings or conferences, including airfare and lodging, is often deductible. Car expenses, like business mile expense, can also be tracked and deducted.

- Employee Salaries and Benefits: Wages paid to employees and benefits like health insurance are generally deductible. Tuition reimbursement and bonuses also qualify.

- Professional Services: Fees paid for legal, accounting, or consulting services that help maintain and improve business functions.

- Rent or Lease Payments: Costs associated with leasing office space can be deducted as part of operating expenses.

- Donations: Contributions to qualified 501(c)3 organizations may qualify for a deduction if you itemize your expenses.

These deductions must be ordinary and necessary, meaning they are common in your industry and helpful toward your business’s success. Proper documentation and accurate record-keeping are essential for claiming these expenses, ensuring compliance and maximizing deductions.

Non-Deductible Expenses

Non-deductible expenses are costs that cannot be subtracted from a company’s taxable income, as they don’t meet the IRS criteria for deductions. Here’s a list of typical non-deductible expenses:

- Personal Expenses: Costs that are personal in nature and not directly related to business operations, such as personal travel or entertainment.

- Lobbying and Political Contributions: Any funds allocated to influence legislation or political campaigns are not deductible.

- Fines and Penalties: Expenses incurred from legal fines, penalties, or violations of law do not qualify.

- Capital Expenditures: While not immediately deductible, costs for acquiring or improving long-term assets must be capitalized and depreciated over time.

- Commuting Costs: Daily travel expenses between home and primary work location are not allowed as deductions.

Understanding non-deductible expenses helps businesses avoid issues during audits and ensures they are not incorrectly lowering their taxable income. Keeping these expenses separate and properly accounted for is crucial for maintaining compliance with tax regulations.

Advantages and Disadvantages of Write-Offs

Financial Benefits for Businesses

Write-offs offer several financial benefits for businesses, enhancing their economic flexibility and resilience. Here’s how:

- Tax Savings: By reducing taxable income, write-offs can lead to significant savings on tax bills, freeing up resources for reinvestment or operational expenses. Effective guidance from tax professionals can maximize these savings, especially when understanding individual deduction levels and tax brackets.

- Accurate Financial Reporting: Write-offs help maintain accurate financial statements by removing unrealizable assets, which reflects the true financial health of a business.

- Cash Flow Management: Lower tax burdens from write-offs can improve cash flow, providing businesses with more liquidity for day-to-day operations or unexpected expenses, including marketplace expansions or handling insurance premiums.

- Risk Mitigation: Writing off bad debts or obsolete inventory reduces the financial risks associated with holding unproductive assets, supporting more strategic decision-making.

- Improved Creditworthiness: Accurate books, reflecting realistic financial conditions, can enhance a business’s appeal to potential creditors and investors.

Embracing the strategic use of write-offs allows businesses to enhance their financial planning and achieve greater stability, paving the way for growth and innovation.

Potential Pitfalls and Misconceptions

While write-offs provide clear benefits, there are potential pitfalls and misconceptions that businesses must navigate:

- Over-Reliance on Write-Offs: Some businesses excessively depend on write-offs to improve short-term financial appearances, which can be misleading and unsustainable.

- Misclassifying Expenses: Mistakes in classifying expenses as deductible write-offs when they are non-deductible can lead to compliance issues and possible penalties during audits.

- Inflated Write-Offs: Overestimating the necessity to write off certain assets can distort financial statements, presenting an inaccurate picture of financial health.

- Neglecting Regular Assessment: Failing to periodically review and assess the necessity of write-offs can result in outdated financial records, impacting decision-making and reporting.

- Confusion with Write-Downs: Misunderstanding the difference between write-offs and write-downs can lead to incorrect financial entries, affecting balance sheets and asset valuation.

Avoiding these pitfalls requires diligent record-keeping and a clear understanding of accounting principles. Consulting with financial professionals and staying updated on accounting standards can mitigate risks and enhance business transparency.

Regularly educating employees involved in accounting processes also ensures that everyone is aligned with proper procedures, maintaining both compliance and accuracy in financial management.

Legal and Tax Implications

Regulatory Considerations

Navigating regulatory considerations is crucial for businesses engaging in write-offs. Here’s what to keep in mind:

- Compliance with Accounting Standards: Adhering to Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) ensures write-offs are recorded accurately and transparently.

- IRS Guidelines: Businesses must comply with IRS regulations regarding what constitutes a permissible write-off, including documentation and substantiation requirements.

- Audit Trails: Maintaining clear, detailed audit trails for every write-off helps prevent scrutiny and penalties during audits by tax authorities.

- Industry-Specific Rules: Certain sectors might have additional write-off requirements or restrictions, necessitating tailored approaches to compliance.

- Record-Keeping: Proper documentation and record retention are mandated by law, ensuring all write-offs are verifiable and justified if questioned by regulatory bodies.

Understanding and applying the correct regulatory framework helps businesses avoid legal issues and fosters trust and credibility with investors and stakeholders.

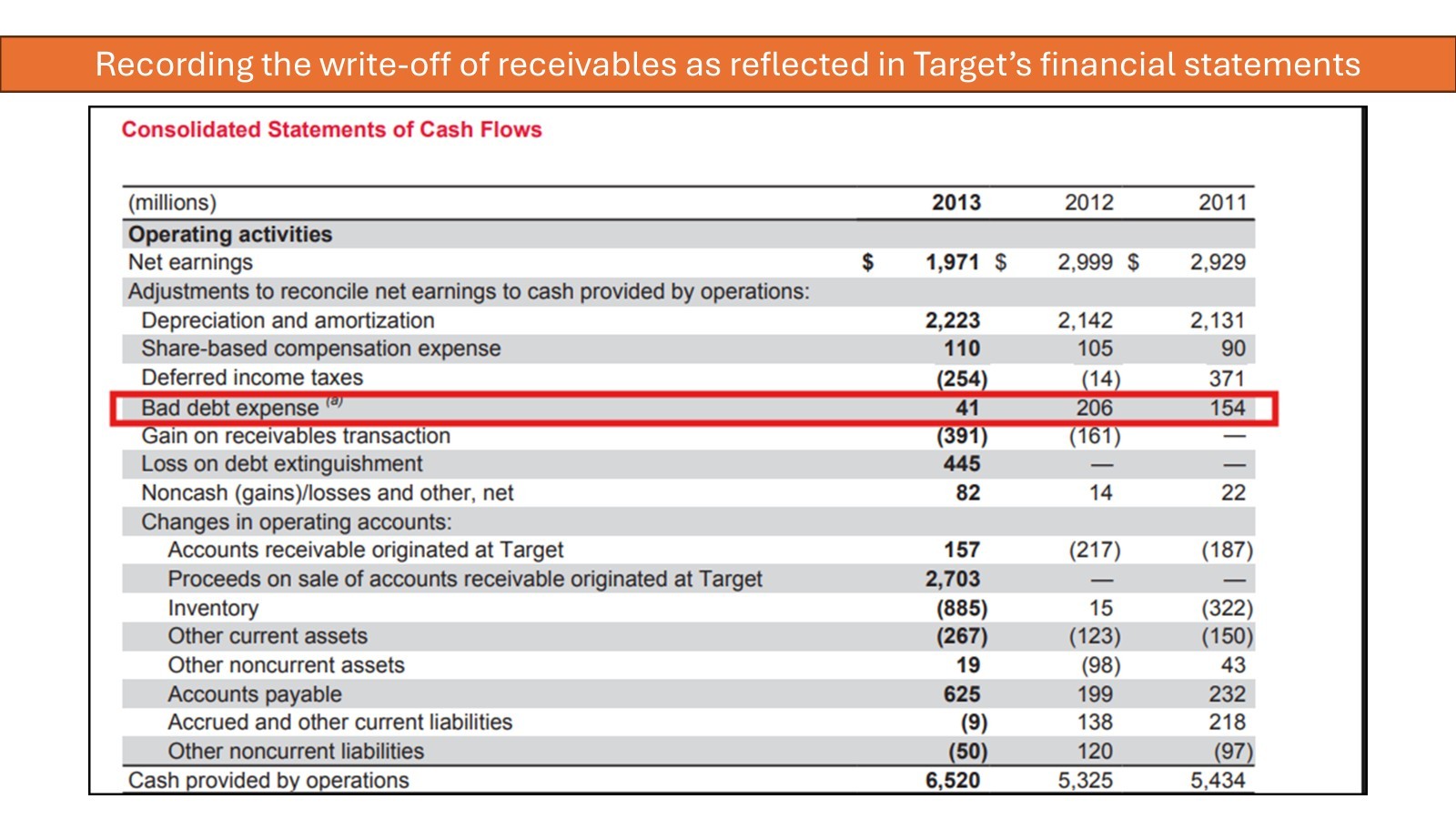

Impact on Financial Statements

Write-offs significantly impact a company’s financial statements, influencing various aspects:

- Income Statement: Write-offs reduce reported income by reflecting losses directly tied to uncollectible debts or obsolete inventory. This can lower net profit and affect shareholder perceptions.

- Balance Sheet: When assets are written off, asset values decrease, leading to a reduction in total asset balance. This can affect liquidity ratios and the overall health of the financial position.

- Cash Flow Statement: Although write-offs are non-cash expenses, they can positively impact the cash flow from operating activities by reducing taxable income and thus tax payable.

- Equity Position: Consistent write-offs may signal to investors potential issues with asset management or collection efficiency, potentially impacting stock valuation and equity attractiveness.

- Financial Ratios: Key ratios like return on assets, debt to equity, and profit margins may fluctuate as a result of significant write-offs, necessitating a more nuanced analysis of financial health.

Overall, while write-offs adjust the financial statements to more accurately represent business conditions, they must be managed carefully to communicate clear, honest financial health.

Organizations must regularly review their write-offs to ensure that financial statements remain a true and fair representation of their financial standing. This proactive approach helps in building trust with investors and regulatory bodies alike.

Strategies for Maximizing Write-Off Opportunities

Maintaining Accurate Records

Maintaining accurate records is essential for effectively managing write-offs and ensuring compliance, including safeguarding against losses like theft. Here’s how businesses can achieve precise record-keeping:

- Organize Documentation: Keep meticulous files of all financial documents, such as invoices, receipts, and correspondence related to potential write-offs, including notes on any incurred goodwill asset account adjustments.

- Use Accounting Software: Implement robust accounting software to track expenses and write-offs, which helps automate entries and can accurately update the goodwill account.

- Regular Audits: Conduct periodic internal audits to verify the accuracy of recorded write-offs and ensure all are justified and properly documented, helping identify discrepancies early.

- Clear Categorization: Establish a clear system for categorizing expenses and assets, making it easier to identify which items qualify as write-offs, such as losses from theft or depreciation.

- Back-Up Records: Regularly back up financial data to prevent loss and ensure accessibility. Cloud storage solutions can provide secure, off-site archives.

By consistently maintaining accurate records, businesses not only streamline the management of their goodwill asset account but also bolster their defense against audits and improve their ability to make informed financial decisions.

Consulting with Tax Professionals

Engaging with tax professionals can be a game-changer for businesses looking to optimize their write-off strategies. Here’s how they can add value:

- Expert Advice: Tax professionals can offer tailored insights into allowable write-offs based on current tax laws, ensuring your business leverages all eligible deductions. Additionally, they provide crucial feedback on best practices for documentation, disclosure, and straightening out reimbursements while maintaining transparency.

- Compliance Assurance: They help navigate complex IRS regulations and standards, minimizing the risk of non-compliance and potential penalties during audits.

- Maximizing Deductions: With their expertise, you can identify overlooked deductions or credits and make the most of your tax position, potentially enhancing tax savings. Using proper citation of tax codes, they can also help you justify various deductions, including travel-related mileage expenses which could provide significant financial relief.

- Strategic Planning: Tax professionals assist in developing long-term strategies that align with financial goals, considering both short-term and future implications of write-offs.

- Audit Support: Should an audit occur, they provide valuable support in preparing necessary documentation and presenting your case to regulatory bodies. Their assistance can be invaluable when addressing reimbursement claims or clarifying email correspondence related to deductions.

Collaborating with tax professionals ensures your business’s write-off practices are not only compliant but also strategically beneficial. This partnership can lead to better financial health, with a keen eye on taxation matters and sustained growth. Considering the corpora of tax regulations, it’s crucial to consult experts who can tailor their advice to your unique situation.

FAQs

How do you define write-off in accounting?

In accounting, a write-off is the formal recognition that an asset no longer has value or that an expense is irrecoverable, requiring its removal from financial statements. This procedure helps maintain accurate records by acknowledging losses or uncollectible amounts. Write-offs adjust the books to reflect a more realistic financial position.

What is the difference between a tax deduction and a write-off?

A tax deduction reduces taxable income, potentially lowering tax liability. A write-off is a broader term that includes specific expenses or losses deducted from total revenue to establish net income for tax purposes. Both serve to reduce taxes but apply to different financial aspects.

Can personal expenses be written off as business expenses?

No, personal expenses cannot be written off as business expenses. The IRS strictly requires that only expenses directly related to business operations are eligible for write-offs. Personal costs must be kept separate to ensure compliance and avoid legal issues.

How do write-offs affect overall business profitability?

Write-offs can impact overall business profitability by reducing taxable income, which might lower tax liabilities and improve cash flow. By allowing deductions for expenses like compensation and reimbursement, businesses can better manage their tax obligations. For example, covering business mile expenses as deductions can also be advantageous. However, they may also signal losses or uncollectible assets, affecting net income. While they can provide immediate financial relief, excessive write-offs might indicate underlying financial issues, which necessitates careful examination of taxation and expense management.

What is the tax write-offs definition according to the IRS?

According to the IRS, tax write-offs refer to business expenses that are both ordinary and necessary, which can be deducted to reduce taxable income. These deductions help manage tax liabilities effectively. For instance, business mile expenses and employee reimbursements are commonly deducted to offset taxable income. Using platforms like QuickBooks Self-Employed can simplify tracking and integrate seamlessly with your tax return.

What does it mean when a loan is written off?

When a loan is written off, it means the lender has recognized the loan as uncollectible and removes it from their financial statements. This typically occurs after all attempts to collect have failed, impacting the lender’s financial health and potentially their taxation obligations by acknowledging the loss on their balance sheet. Writing off a loan doesn’t erase the debt; the borrower may still be pursued for repayment. In some cases, lenders might consider compensation, like restructuring the loan terms. Moreover, understanding the nuances of write-offs is crucial as they can influence a company’s taxable income and overall financial standing due to potential credits or deductions.