Imagine you own a cake and decide to cut it into more slices to spread it around a bigger group—your slice just got smaller. That’s the gist of dilute. The more shares a company issues, the smaller the portion of that company each shareholder owns.

KEY TAKEAWAYS

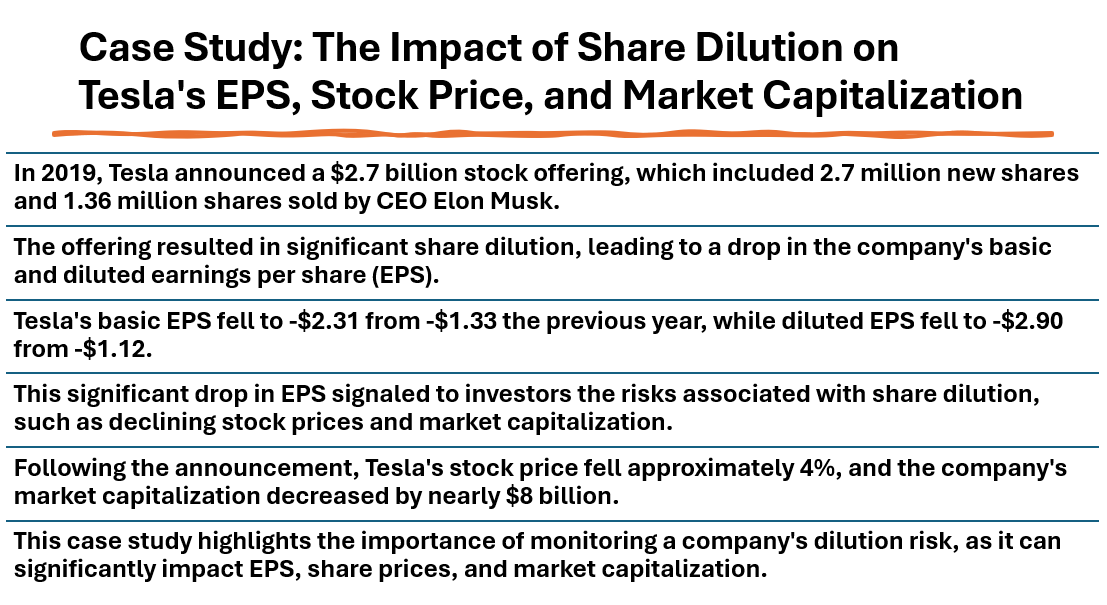

- Dilutive transactions result in a decrease in earnings per share (EPS) or a reduction in the percentage of ownership by existing shareholders due to the issuance of additional shares, convertible debt, options, or warrants.

- A dilutive acquisitions specifically refers to a takeover where the acquiring company’s EPS is reduced, either because the target company contributes lower or negative earnings or because the acquirer has to issue more shares to finance the purchase.

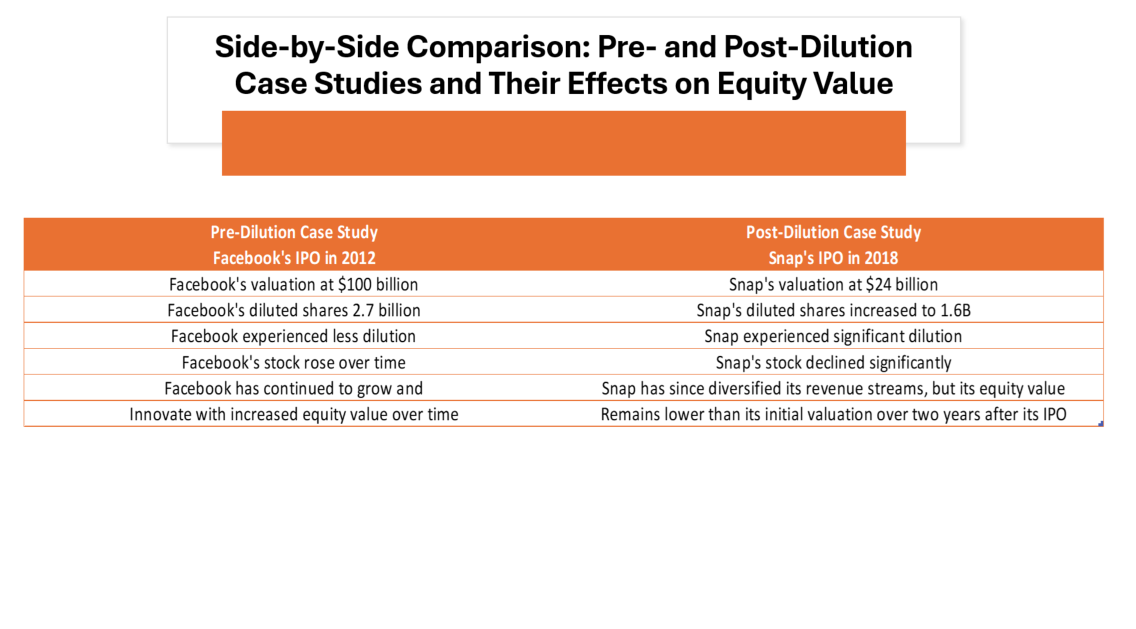

- While dilutive acquisitions can temporarily lower value of Equity by reducing EPS, they have the potential to increase profitability and Equity value in the long run if the acquisition proves beneficial to the company’s financial performance.

The Different Realms Where Dilution is Relevant

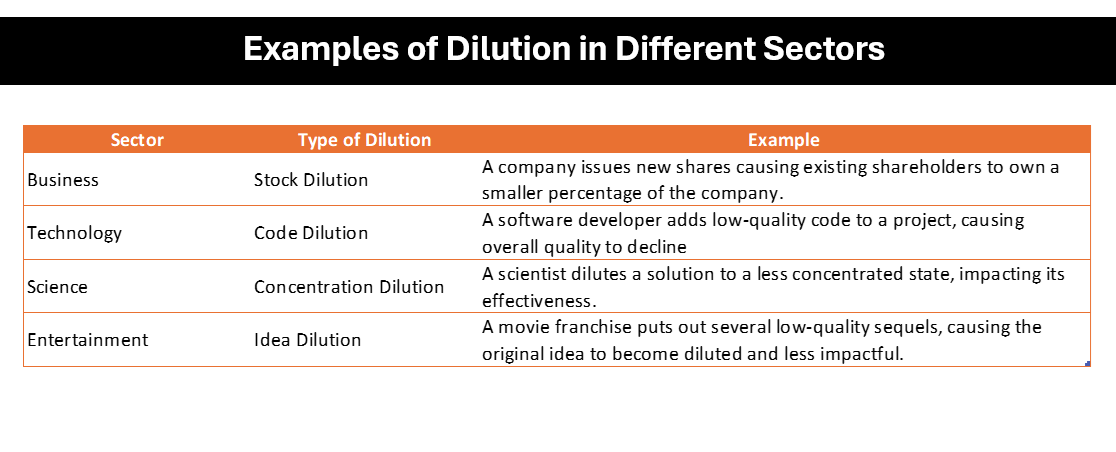

Dilute isn’t just about the stock market—its presence is felt across a range of realms. It touches aspects of science, where the concentration of a solution is decreased by adding more solvent. In environmental studies, it refers to the reduction of pollutant concentration in air or water.

Culturally, Dilute can occur when a brand weakens its identity by overextending into areas outside its expertise. Socially, the concept of dilute is relevant when discussing the diffusion of cultural practices or language purity.

In brief, wherever there’s a reduction in potency or purity—whether that’s the strength of a drink, the concentration of a cultural tradition, or the ownership of a company—dilution is what they call it.

The Impact of Dilution on Stakeholders

What Dilution Means for Shareholders

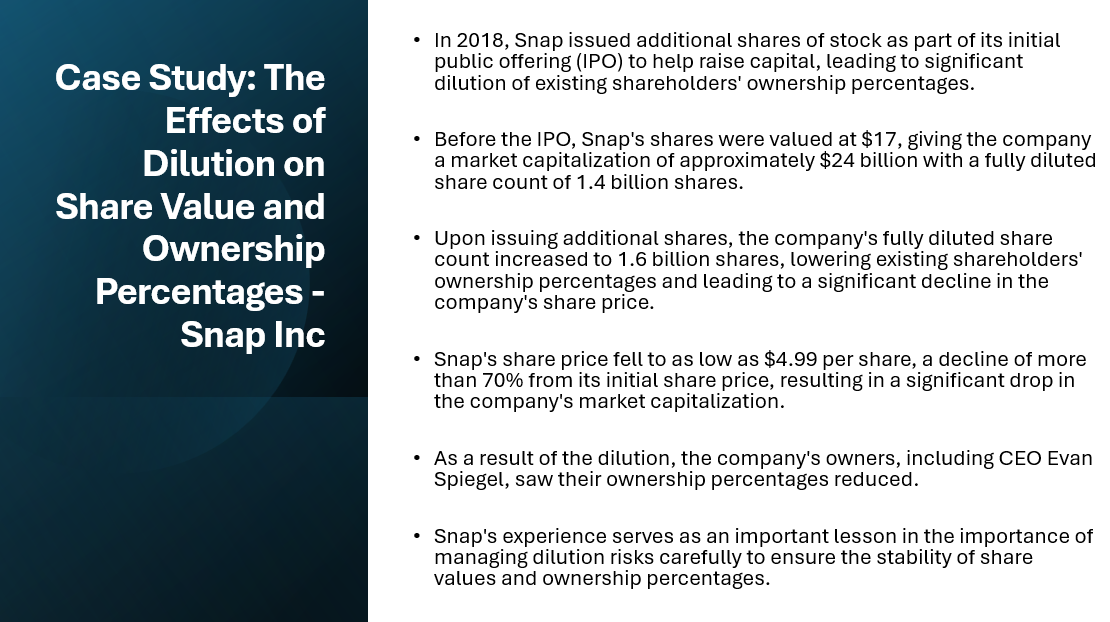

For shareholders, dilution means getting a thinner slice of the pie. When a company issues more shares, your share in the company doesn’t just stay the same—it shrinks. This affects not only your ownership percentage but also how much weight your vote carries in shareholder meetings.

The upshot? Your influence over the company’s decisions and your share of its profits both take a hit. And if the company is doling out dividends, expect your payouts to get lighter too, since they’ll now be spread out over more shares.

How Dilution Affects Company Value and Ownership

Dilution can be a double-edged sword when it comes to company value and ownership. Yes, it can lead to a short-term increase in cash, which might help the company grow. But at the same time, it can decrease the stock’s value because now there are more shares available, and each one represents a smaller stake in the company.

For shareholders who’ve been with the company since the early days, watching new shares being issued can feel like their piece of the pie is being carved up. The value of their investment may be lessened as the increased number of shares potentially reduces the stock price and diminishes their percentage of ownership.

Navigating Through Dilutive Instruments

Common Financial Instruments That Can Lead to Dilution

Several financial instruments could lead to dilution if they’re converted or exercised. Here are a few of the usual suspects:

- Stock Options: When employees capitalize on their stock options, new shares are created and sold to them, usually at a price below market value. This increases the total number of shares and dilutes existing ownership.

- Convertible Bonds: These bonds can be converted into a predetermined amount of the company’s equity, causing an influx of new shares into the market upon conversion.

- Warrants: Similar to options, warrants give the holder the right to purchase shares at a specific price before expiry, potentially increasing the total share count upon exercise.

- Preferred Stocks: Convertible preferred stocks might come with the option to turn into common stock, leading, once again, to a dilution of the common shareholders’ stakes.

When companies engage with these instruments, while they may gain capital, they must also be mindful of the potential dilutive impact on their current shareholders.

Strategic Considerations With Dilutive Funding Options

When a company is mulling over dilutive funding options, they need to strategize smartly. They should assess whether the infusion of capital will spur enough growth to offset the dilutive impact. The timing is key; if market conditions are ripe and the company is poised for explosive growth, then dilution may be a calculated risk worth taking.

They must also gauge investor sentiment. Will existing shareholders support a dilutive fundraising round if it means potentially greater returns down the line? And let’s not forget about the competition—if rivals are raising funds without dilution, they might have an edge when it comes to attracting and maintaining investors who are wary of losing equity.

The bottom line: when considering dilutive funding, companies need a clear-eyed view of the pros and cons, how it fits with their long-term strategy, and the implications for all stakeholders involved.

Real-World Scenarios: Examples of Dilution

Case Studies of Dilutive Corporate Actions

Studying real-world examples sheds light on how dilutive corporate actions play out in practice. Here are a couple of case studies:

- Tech Giant’s Growth Play: An emerging tech company might issue additional shares to raise capital for a major expansion. While this dilutes the ownership, the strategy pays off handsomely as the expansion leads to market dominance and a surge in share price, eventually benefiting all shareholders.

- Pharma Company’s Patent Woes: A pharmaceutical company facing the expiration of a key drug patent could use dilutive financing to fund R&D for new products. Although the dilution initially displeases shareholders, the successful development of new drugs could lead to a rebound in stock value over time.

In each case, although the actions were dilutive, the companies managed to harness the capital raised to create value, validating the strategy in the eyes of investors.

Simulating the Effects of Dilution with Practical Examples

To get a grasp on the impact of dilution, let’s run through a couple of simulations. Imagine a small tech startup has 1 million shares outstanding. If you own 10,000 shares, you’ve got a 1% stake in the company. Now, suppose the company issues 200,000 new shares to raise capital. Post-dilution, your ownership drops to approximately 0.83%.

But it’s not all about percentages—let’s talk money. Say the pre-dilution share price is $10. With 10,000 shares, your stake is worth $100,000. If the share price remains stable after dilution (though it often doesn’t), the value of your stake wouldn’t change, but your percentage of the total shares would decrease. However, if the market perceives the dilution negatively and the share price drops to $9, your stake’s value would go down to $90,000.

Through these simulations, you can see how dilution affects both your percentage of ownership and the potential market value of your investment.

Dilution versus Concentration: Implications in Various Spheres

Contrast Between Dilutive and Concentrative Impact on Equity

Dilutive and concentrative actions are opposite forces affecting company equity—while dilution spreads equity thinner, concentration beefs it up. With dilutive actions, you’re looking at an increase in the number of shares, which in turn dilutes the value of existing shares. On the flip side, concentrative actions like share buybacks reduce the total number of shares and increase the value of the remaining shares—think of it as concentrating the flavor in a sauce by simmering it down.

So, when a company buys back its own shares, it’s concentrating ownership among fewer shares, giving each remaining share a larger slice of the pie. This can be great for shareholders, as it often leads to a rise in the share price, making their stakes more valuable.

It’s a balancing act between these two forces, and companies must weigh their options carefully to decide which direction to steer their equity strategy.

Application in Science, Technology, and Medicine

Beyond the trading floor, dilution plays a significant role in science, technology, and medicine, demonstrating its versatility as a concept. For example, in chemistry, dilution is a critical process used to achieve the desired concentration of a solution, essential for precise reactions and analyses.

In the field of technology, software and content can be diluted when the source code or intellectual property is shared across too many licensees, potentially diminishing the original creator’s control and revenue.

Regarding medicine, dilution is fundamental for achieving accurate dosages of medications, ensuring patients receive treatment that’s potent enough to be effective while avoiding concentrations that could be harmful.

FAQ: Grasping the Concept of Dilution

What does it mean to be dilutive?

Being dilutive refers to the reduction in value of a company’s shares or the percentage of equity owned by each shareholder. This typically occurs when a company issues more shares, giving out a piece of the ownership to more people and thus decreasing each existing shareholder’s slice of the business pie.

When there is a significant gap between a company’s basic earnings per share (EPS) and diluted EPS, this may indicate a risk of share dilution. Such a scenario can raise concerns among investors and analysts who closely monitor EPS to assess a company’s financial health.

Is Dilution Always a Negative Outcome for Investors?

No, dilution isn’t always negative for investors. While it can mean a smaller ownership share, if the added capital / acquisitions leads to significant company growth, the overall value of an investor’s shares could actually increase over time despite owning a smaller piece of the larger pie.

Can Dilution Be Avoided or Managed Effectively?

Yes, dilution can be managed effectively. Companies can opt for non-dilutive funding sources, like debt financing or strategic partnerships. When dilution is necessary, communicating the potential for growth and maintaining transparency with shareholders can help mitigate concerns and manage dilution’s impact.