KEY TAKEAWAYS

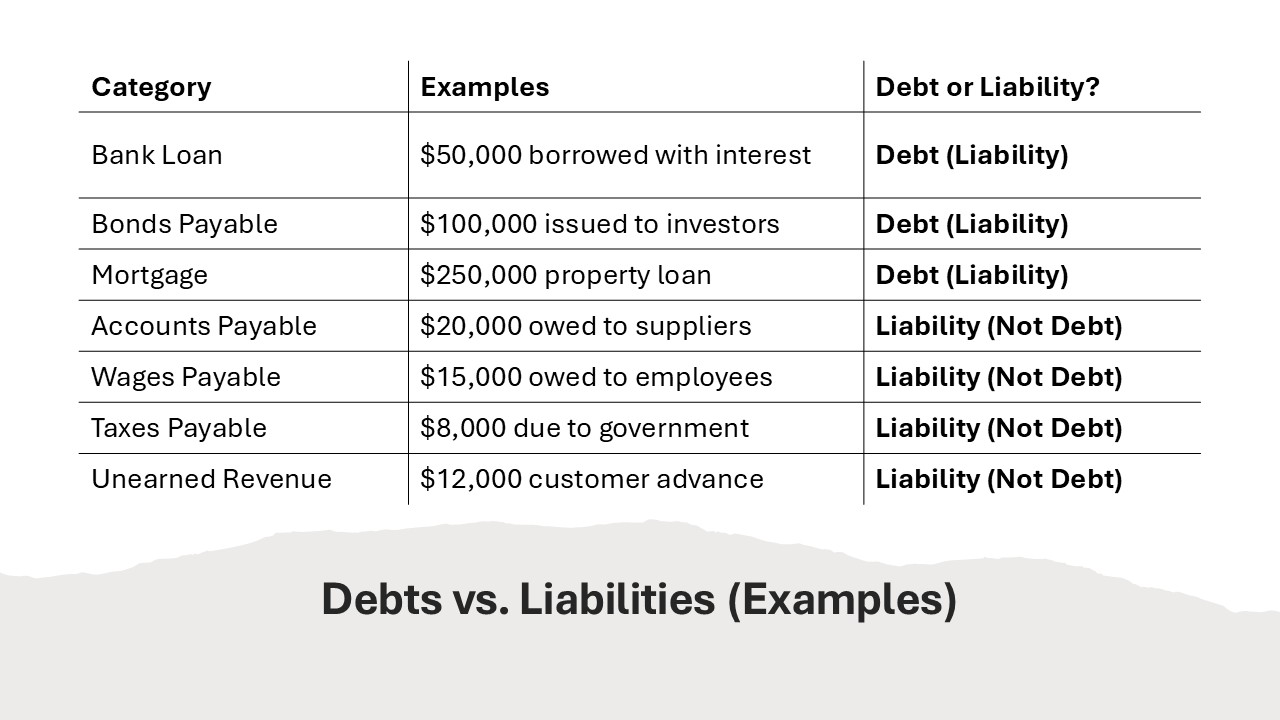

- Definition and Significance: Both debt and liabilities are critical accounting terms with distinct meanings. While they may seem interchangeable in everyday language, these terms have specific definitions in the context of corporate finance. Debt typically refers to borrowed money that a company must repay, often with interest. Liabilities encompass a broader range of financial obligations a company owes, including debts, but also accounts payable, taxes, and other unearned revenues.

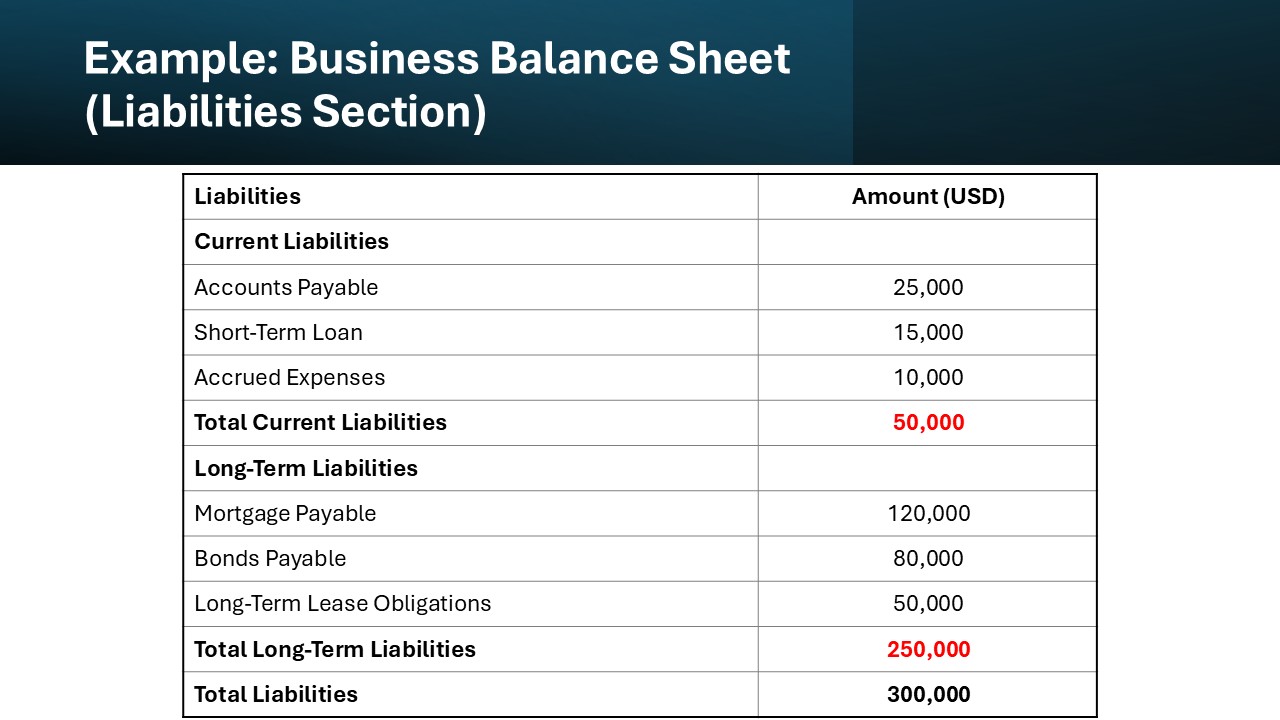

- Balance Sheet Placement: On the balance sheet, both debts and liabilities appear under the liabilities section. However, debts are often categorized as long-term liabilities unless they are due within the year, in which case they are considered current liabilities. This distinction is crucial for stakeholders analyzing a company’s financial health and for making strategic business decisions.

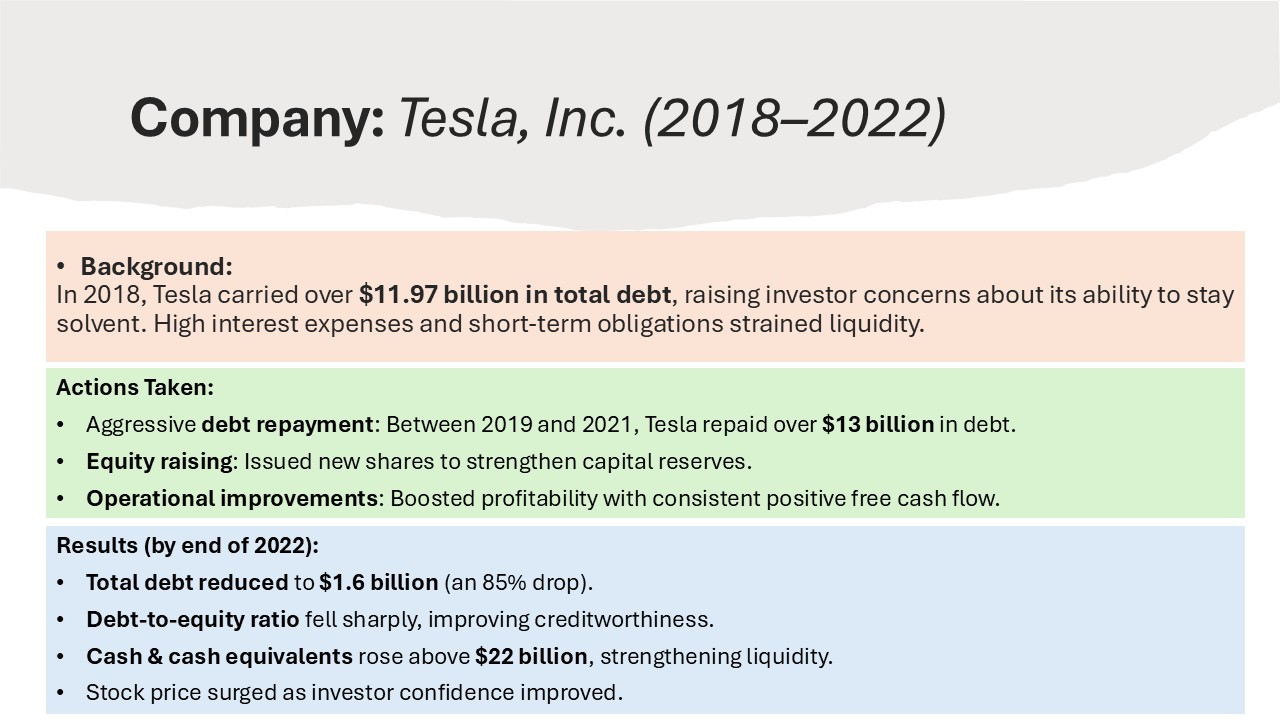

- Financial Analysis Implications: In long-term financial analysis and investment decisions, the focus is usually on debts due to their impacts on interest rates and repayment schedules. Meanwhile, current liabilities become more relevant when calculating short-term ratios like the current ratio or quick ratio, which assess a company’s ability to meet short-term obligations. Understanding when each should take precedence can greatly influence managerial decisions and investor confidence.

Defining Debt and Liabilities

What is Debt?

Debt refers to the money that an individual or organization borrows with the promise to repay it within a specified period, typically with interest. It can emerge from various sources like loans, credit agreements, or bonds obtained through a debt repayment agreement. Unlike general liabilities that encompass all financial obligations, debt is more specific and focused on agreements documented with a creditor or lender. Individuals leverage debt for financing necessary purchases like homes or cars, while businesses may issue bonds or take out loans to finance expansion and manage their equity total. A comparative table could illustrate different types of debt, such as personal loans, mortgages, and bonds, by highlighting key features like interest rates, repayment terms, and common uses. A case study illustrating effective debt management in personal or business contexts can provide insight into successfully navigating such financial transactions. Furthermore, expert quotes on best practices can guide individuals and businesses alike in managing debt while avoiding common pitfalls.

Understanding Liabilities

Liabilities represent the financial obligations a person or company owes to others.

Key Differences Between Debt and Liabilities

Short-term vs. Long-term Obligations

Short-term obligations, often referred to as current liabilities, are debts and other financial commitments due within one year. These include accounts payable, short-term loans, and accrued expenses. On the other hand, long-term obligations, or non-current liabilities, extend beyond a year and comprise items like mortgages, bonds payable, and long-term lease obligations. The duration of these liabilities plays a crucial role in financial reporting, as it affects the company’s debt-to-equity ratio, which influences its equity total and indicates financial health. Understanding these distinctions helps accurately assess liquidity and long-term financial strategies.

Financial Reporting Implications

Financial reporting involves categorizing and recording debts and liabilities accurately to provide a clear picture of an entity’s financial health. Adhering to generally accepted accounting principles (GAAP standards) is crucial, as misrepresenting these figures can lead to inaccurate assessments of creditworthiness and financial stability. Debts often require detailed notes due to interest rates and repayment terms, whereas liabilities include a broader scope of future financial obligations. Proper reporting ensures compliance with accounting standards and aids stakeholders in decision-making. By understanding essential accounting terms, organizations can prevent costly errors.

Examples in Real Life

In real life, understanding the distinction between debt and liabilities can enhance financial clarity. For instance, consider a homeowner with a mortgage. The mortgage itself is a debt, but the total obligations, including property taxes and home insurance, form their liabilities. On a corporate level, a company might issue bonds as a form of debt, while their liabilities include supplier dues and accrued expenses. These examples demonstrate how debts are specific commitments, whereas liabilities encompass the broader spectrum of financial responsibilities.

Practical Applications

Business Scenarios

In business scenarios, distinguishing between debt and liabilities is critical for strategic planning and financial management. For instance, a startup might take on debt through a bank loan to finance its initial operations, but its liabilities include that loan along with outstanding payments to suppliers and employee wages. Larger corporations might issue bonds to raise capital, which is classified as debt, while their liabilities also cover accounts payable and long-term employee benefits. Precise categorization aids businesses in managing cash flow and meeting regulatory requirements.

Personal Finance Considerations

In personal finance, understanding the distinction between debt and liabilities can elevate your financial management skills. Debts, such as credit card balances and personal loans, are specific financial commitments that often accrue interest. Liabilities, however, encompass a wider range of obligations, including monthly utility bills, rent, and taxes. By distinguishing between these, you can prioritize debt repayment and better allocate your income towards necessary expenses, ultimately improving your financial health. Notably, about 30% of a typical household’s total liabilities can be attributed to personal debts, signaling the importance of managing these debts efficiently.

Why It Matters

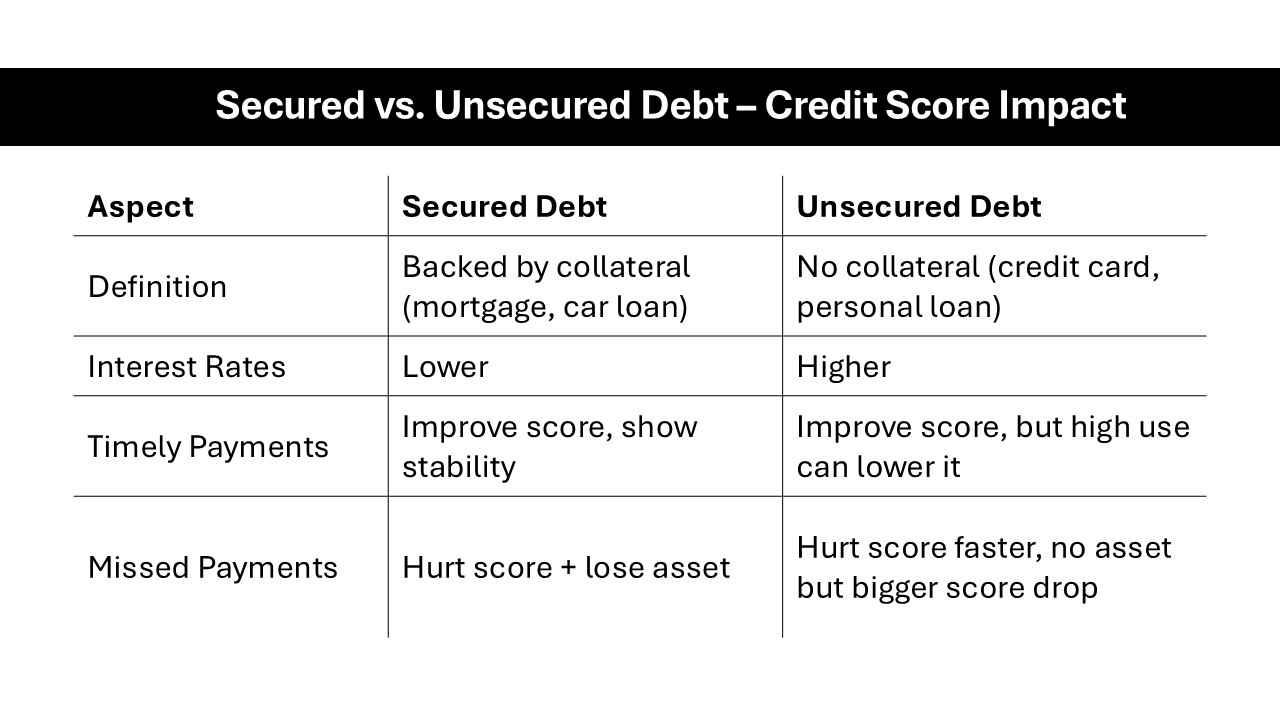

Impact on Creditworthiness

Creditworthiness is significantly influenced by both debts and liabilities. Debts, like loans and credit card balances, are directly reported to credit agencies, impacting your credit score based on factors such as timely repayment and the amount of debt relative to your credit limit. Liabilities, including recurring bills and expenses, indirectly affect your ability to manage debts, which can also affect creditworthiness. Additionally, a company’s financial standing, such as shareholder equity and its relationship with creditors, can play a pivotal role in its credit ratings. Analyzing and optimizing these financial commitments carefully can improve your credit profile and open up better borrowing opportunities. Financing options like issuing bonds allow companies to manage their liabilities without affecting shareholder equity directly, which might appeal to potential lenders.

Importance in Financial Planning

Incorporating a clear understanding of debt and liabilities into your financial planning is essential for achieving long-term goals. Proper distinction allows for more accurate budgeting, investment decisions, and risk assessment. When you comprehend the weight of your liabilities, you can prioritize high-interest debt repayment and allocate funds effectively. By focusing on equity total and maintaining an organized inventory of financial obligations, you can apply a more robust calculation for future projections. This approach not only safeguards against financial pitfalls but also enhances savings growth and investment potential.

FAQs

How do liabilities affect a company’s financial statements?

Liabilities appear on a company’s balance sheet and impact its financial health by affecting the net worth and solvency ratios. They need to be managed carefully to ensure liquidity and the ability to meet short-term obligations while planning long-term financial strategies. Business liability includes short-term and long-term loans, bonds payable, and income taxes payable, all of which can influence a company’s financial standing. According to GAAP standards, accurately reporting liability accounts is crucial for reflecting true financial positions. When liabilities exceed assets, it may indicate potential financial distress.

Can a liability also be considered a debt?

Yes, a liability can be considered a debt when it involves borrowed money with a repayment obligation, such as loans or bonds. However, liabilities can also encompass broader obligations, like rent and utilities, which are not classified as debt. Liabilities often include obligations to creditors that must be fulfilled according to a debt repayment agreement. Understanding these distinctions is crucial for accurate financial assessment and managing liability levels effectively.

What are the penalties for failing to settle debts?

Failing to settle debts can lead to various penalties, including increased interest rates, late fees, and damage to your credit score. Persistent non-payment might result in legal action, garnishment of wages, or seizure of assets. It’s crucial to address debts promptly to avoid these serious financial consequences.

Are all financial obligations considered liabilities?

Not all financial obligations are considered liabilities. Liabilities are financial obligations recognized on balance sheets, like loans and accounts payable. However, some obligations, such as future planned expenses or potential contingent liabilities, may not be recorded until they become due or certain. Understanding this distinction helps in accurate financial reporting. It’s important to consider different liability levels, as they affect how a business manages its liability accounts, like short-term loans and accrued wages.

What is the difference between current liabilities vs long term liabilities?

Current liabilities are obligations due within one year, such as accounts payable and short-term loans. They impact a company’s short-term liquidity and operational efficiency. These liability accounts need regular attention to maintain the right liability levels and avoid financial strain. Long-term liabilities extend beyond one year, like mortgages and bonds, and are crucial for strategizing future growth and financial stability. Both require careful management, as mismanagement of business liability can lead to increased risk and potential penalties.

Is total liabilities the same as total debt in financial statements?

No, total liabilities encompass all financial obligations, including both debts and other liabilities like accounts payable, deferred taxes, and income taxes payable. Total debt specifically refers to borrowed money, such as loans and bonds. Understanding these categories, including the impact of short-term and long-term loans and adherence to GAAP standards, helps in evaluating a company’s overall financial obligations and stability.