key takeaways

- Essential for Business Planning: The debt service coverage ratio (DSCR) is not just a financial metric but a critical tool for preparing financial projections related to major investments, loans, or strategic planning. This ratio provides insight into a company’s ability to finance future growth, making it a valuable asset for entrepreneurs to ensure their company’s continued financial health.

- Accuracy in Calculation: While the DSCR’s formula appears simple — using Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) divided by interest plus principal payments — accurate calculation requires using the correct data inputs from financial statements or future projections. Missteps in data selection can lead to erroneous results impacting business decisions.

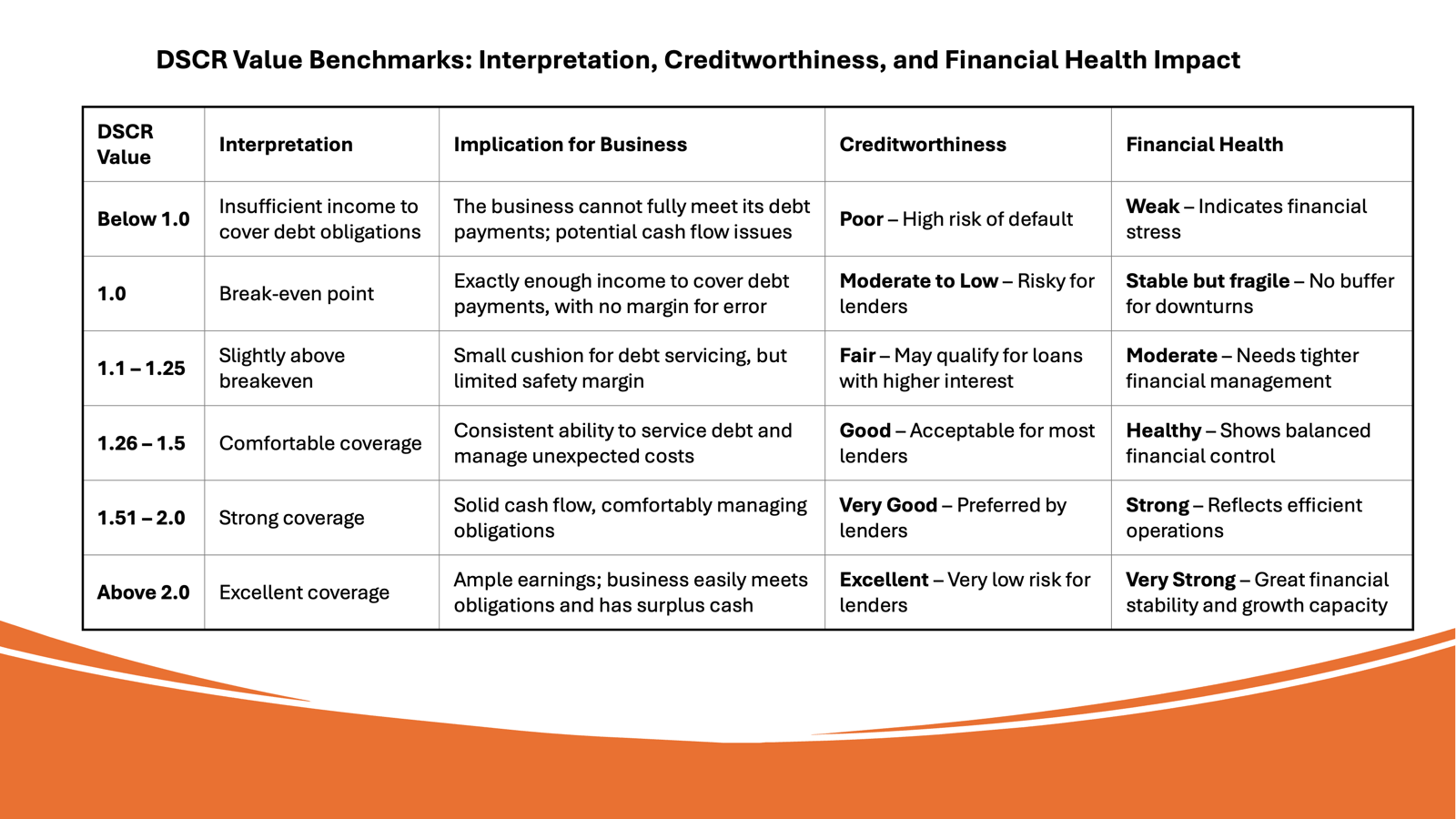

- Indicator of Creditworthiness: Banks and investors commonly use the DSCR to assess a company’s financial health. By evaluating how much profit is available for every dollar used to service debt, the ratio helps determine the company’s capacity to handle current obligations and pursue additional financing, thus indicating its creditworthiness and growth prospects.

What is Debt Service Coverage Ratio?

The Debt Service Coverage Ratio (DSCR) is a financial metric that compares a company’s net operating income to its total debt servicing costs. In simpler terms, it assesses whether a company generates enough revenue to meet its debt obligations, including interest and principal payments. A DSCR greater than 1 indicates a firm can comfortably cover its debts, while a ratio below 1 may signal potential financial difficulty.

Why DSCR Matters in Financial Analysis

- DSCR plays a crucial role in financial analysis by providing insight into a company’s ability to sustain its debt levels. It serves as a litmus test for financial viability and risk assessment, helping lenders and investors evaluate the reliability of their potential investments. A strong DSCR suggests stability and financial prudence, while a weak ratio may warn of underlying financial issues.

Calculating Your DSCR: Step-by-Step

Key Components in the DSCR Formula

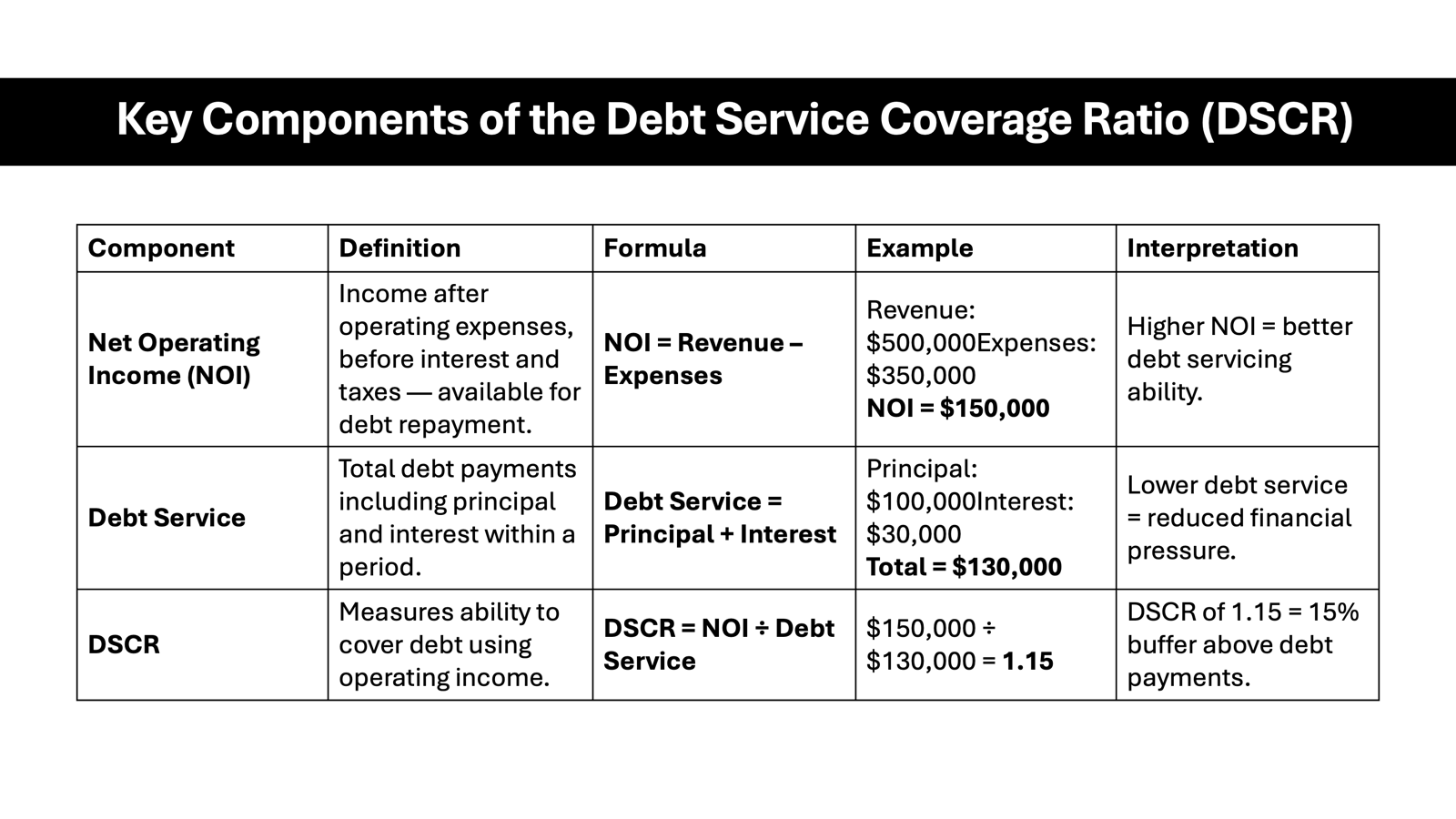

The DSCR formula hinges on two primary components: net operating income and debt service. Net operating income refers to the revenue remaining after operating expenses are deducted, representing the funds available for debt repayment. Debt service comprises the total principal and interest payments due within a specific period. Understanding these components ensures accurate calculation and interpretation of DSCR, aiding financial decision-making.

Sample Calculation for Illustrative Purposes

To illustrate how DSCR is calculated, consider a company with a net operating income of $120,000. Suppose their total annual debt service, which includes both principal and interest payments, amounts to $100,000. The DSCR would be calculated by dividing the net operating income by the total debt service:

\[ \text{DSCR} = \frac{$120,000}{$100,000} = 1.2 \]

A DSCR of 1.2 indicates that the company generates 20% more income than needed to cover its debt obligations, suggesting a moderately healthy financial position.

Advantages & Pitfalls of DSCR

Benefits of a Strong DSCR

A strong DSCR signifies a company’s financial strength, making it an attractive prospect for lenders and investors. Firstly, it indicates that the company can comfortably service its debt, reducing the risk of default. Secondly, a robust DSCR often translates to better loan terms, like lower interest rates or extended payment periods. Thirdly, it enhances a company’s bargaining power, allowing for more favorable contractual negotiations. Lastly, a solid DSCR can attract potential investors looking for stable returns. By maintaining a strong DSCR, a company positions itself for sustainable growth and increased financial stability.

Common Mistakes to Avoid

When calculating DSCR, several common mistakes can potentially skew results and mislead financial analysis. One frequent error is inaccurately determining net operating income by failing to exclude non-operating revenues or one-time gains. Another mistake involves overlooking all components of debt service, such as variable interest rates or hidden fees. Misclassifying expenses, like operating versus capital expenses, can also distort DSCR calculations. Additionally, using outdated or inconsistent financial data can lead to inaccuracies. Double-checking each element and ensuring up-to-date, consistent data is crucial for obtaining a reliable and useful DSCR.

Understanding Low DSCR Challenges

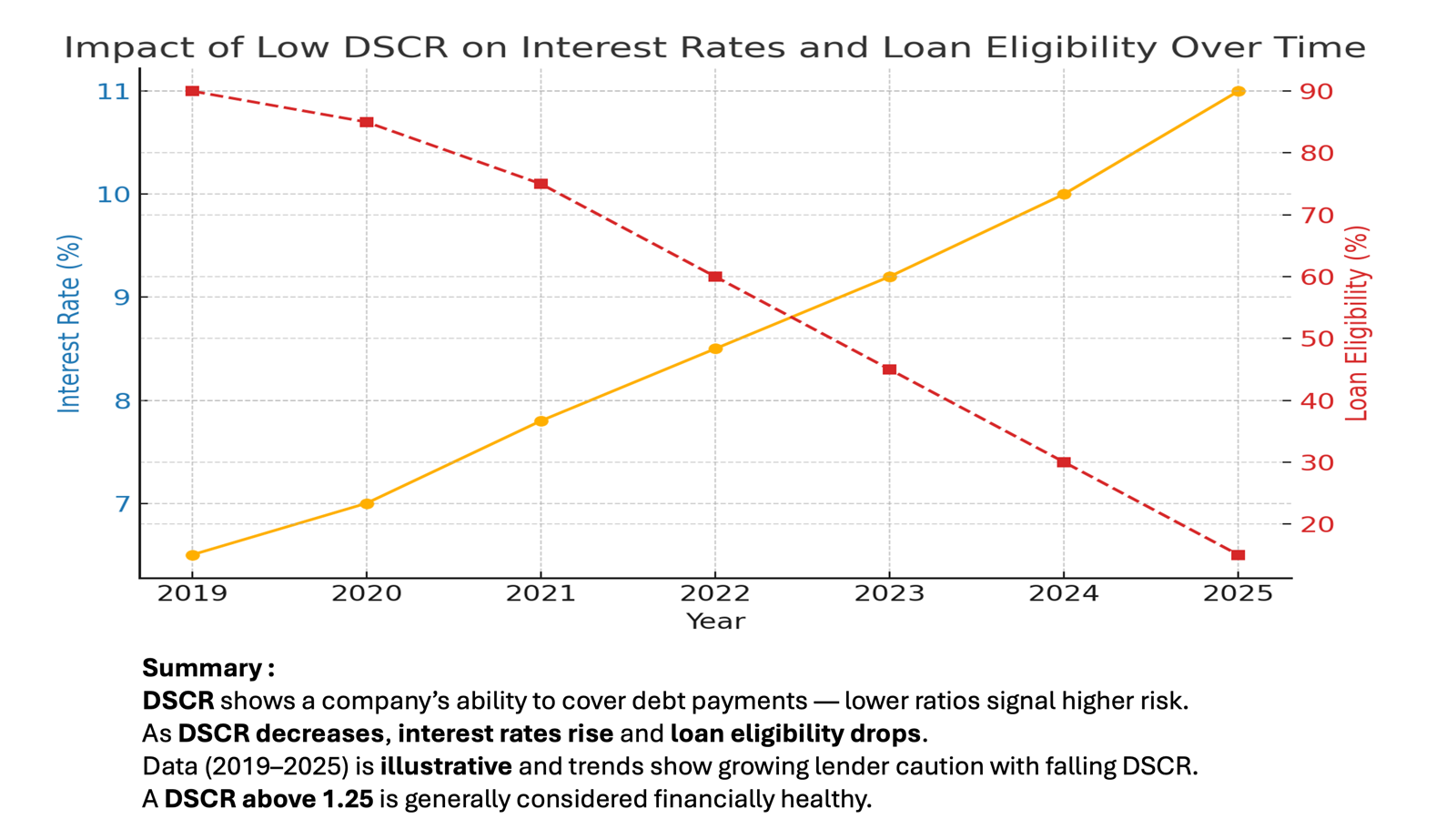

A low DSCR signals that a company may struggle to meet its debt obligations, which can lead to several challenges. First and foremost, it raises red flags for potential lenders, often resulting in difficulty securing favorable loan terms or even obtaining loans. Additionally, it reflects constrained cash flow, which can limit a company’s ability to invest in growth opportunities. Companies with low DSCRs might face higher interest rates due to the perceived risk, increasing financial burden. Moreover, a persistently low DSCR could indicate underlying operational inefficiencies requiring strategic intervention to bolster financial health. Addressing these challenges promptly is essential to prevent further financial deterioration.

Applications of DSCR in Business

Using DSCR to Secure Loans

When seeking loans, a strong DSCR is a significant advantage. Lenders, including mortgage lenders and business bankers, use this metric to assess a borrower’s ability to repay the loan, ensuring that the company’s net operating income sufficiently covers debt service obligations, including principal repayments. A higher DSCR can enhance a company’s creditworthiness, making it eligible for favorable loan terms such as lower interest rates or larger loan amounts. Understanding the debt service ratio lenders apply is crucial as it can aid business financing by gauging additional borrowing capacities. Conversely, a low DSCR can hinder loan approval chances or result in stricter conditions, often embedded in loan covenants. Companies should aim to present a robust DSCR to lenders to secure the best possible financing options, thus supporting their overall growth objectives and maintaining a healthy loan portfolio.

Attracting Investors with a Solid DSCR

A solid DSCR is a powerful tool for attracting investors, as it demonstrates a company’s financial health and ability to manage debt effectively. Investors view a high DSCR as an indicator of stability and efficient management, fostering confidence in the company’s long-term viability. It suggests consistent cash flow, reducing investment risks and signaling the potential for sustainable returns. Moreover, a strong DSCR reflects prudent financial practices, making the company an attractive prospect in competitive markets. Companies with robust DSCRs are often perceived as safer investments, leading to increased interest and higher capital inflows.

Real Estate and DSCR: A Winning Combo

In the real estate sector, DSCR serves as a critical assessment tool for evaluating property investments. It helps investors and lenders determine whether a property can generate enough income to meet its debt obligations, including rent expenses and lease payments. A high DSCR in real estate implies a lower risk of default, thus enhancing borrower credibility and access to favorable financing terms. Additionally, factors like capital expenditure (CAPEX) often play a role in altering DSCR outcomes, requiring careful analysis to accurately predict long-term financial health. Investors often exclude one-time projects, like roof replacement, and instead factor in a set annual amount for ongoing capital expenditures. This ratio aids in comparing potential investments, allowing stakeholders to make informed decisions based on cash flow reliability. Furthermore, maintaining a strong DSCR can increase property value and attractiveness in the market. For real estate ventures, leveraging DSCR effectively ensures financial stability and investment appeal, contributing to growth in rental properties and equity over time.Enhancing Your DSCR for Better Outcomes

Strategies to Improve Your Ratio

Enhancing your DSCR involves strategic initiatives to boost income and manage debt effectively. Start by increasing revenue streams through diversification or augmenting operational efficiencies to boost net income. Reducing operating expenses without compromising quality can also improve the margin available for debt service. Refinancing existing debt to secure lower interest rates or extended terms can diminish annual debt service costs. Be aware that these interest payments can be tax-deductible, further improving cash flow. Regularly monitoring financial statements helps identify areas for further optimization, including accounting for cash taxes and income taxes, ensuring that the cash portion of taxes is managed efficiently. Implementing these tactics not only improves DSCR but also strengthens overall financial health, making your business more appealing to lenders and investors. Additionally, maintain awareness of covenants tied to loan agreements, as falling below specified ratios may constitute default. Efficient cash tax management and strategic handling of dividends can also play a role in further strengthening financial health and improving DSCR.

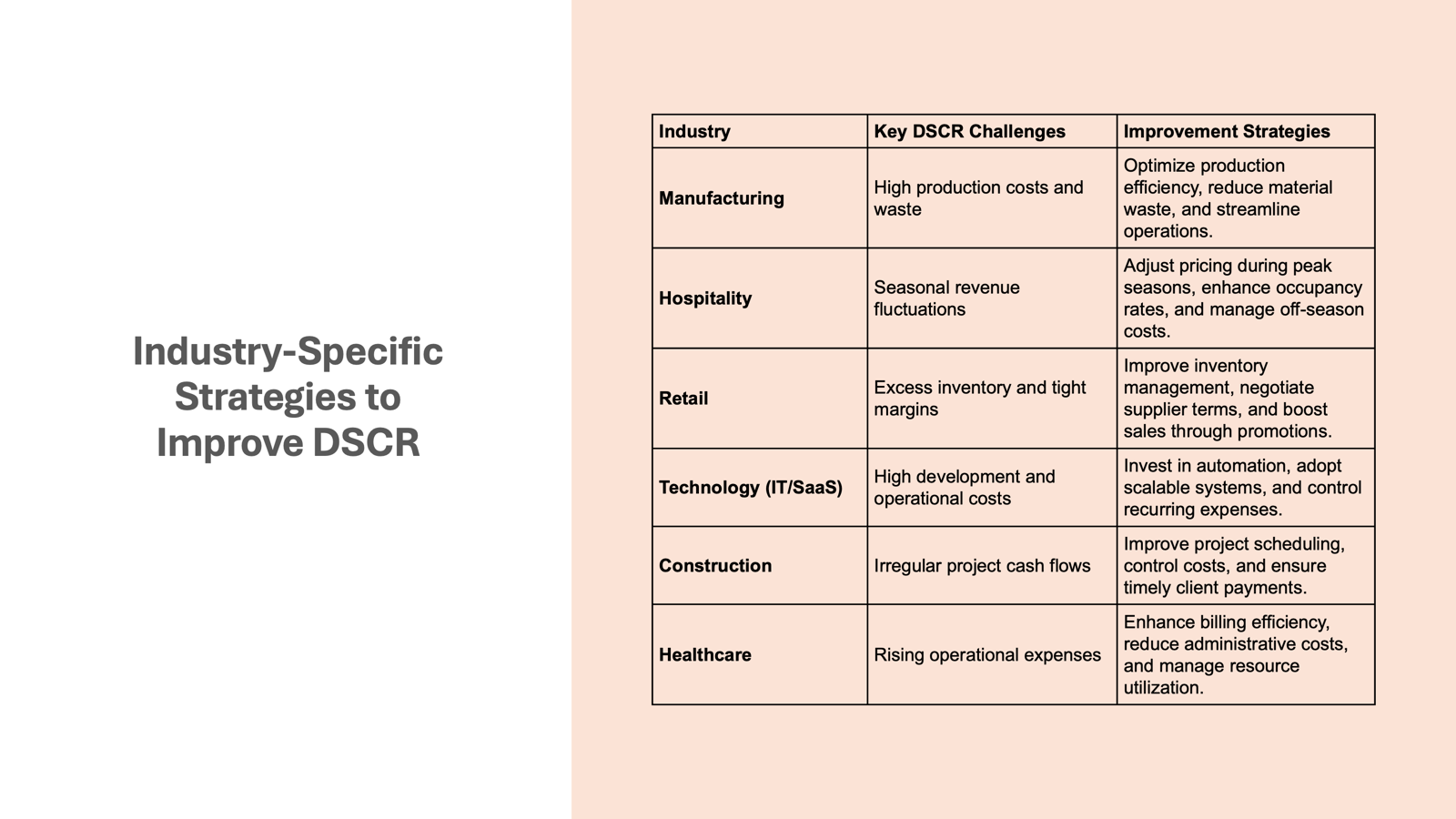

Tailored Advice for Different Industries

Different industries face unique challenges and opportunities when it comes to improving DSCR. For the manufacturing sector, optimizing production processes to reduce waste and enhance efficiency can significantly boost net income. In the hospitality industry, adjusting pricing strategies during peak seasons can increase revenue. Retail businesses might focus on inventory management to reduce costs and improve cash flow. For the tech industry, investing in automation could lead to significant operational savings, improving DSCR. By continuing to browse industry-specific resources and insights, businesses can discover more effective strategies tailored to their needs. Each industry’s approach should leverage its specific strengths and address its inherent limitations by adopting tailored strategies that resonate with their unique operational dynamics.

FAQs

How is DSCR different from other financial ratios?

DSCR is distinct in its focus on a company’s ability to service debt rather than just profitability or asset utilization. Unlike the quick ratio that measures liquidity, which provides a snapshot of financial health at a single point in time, or the profit margin reflecting profitability, DSCR provides a direct insight into debt repayment capability. It combines income and expense elements, uniquely highlighting financial sustainability and risk regarding debt obligations.

What constitutes a good or bad DSCR?

A good DSCR typically exceeds 1, indicating that a company can cover its debt service with its net operating income. In many cases, lenders set a minimum DSCR in loan covenants, as falling below this threshold may trigger a default. Ratios above 1.2 or 1.5 are often viewed favorably, suggesting financial stability. Conversely, a DSCR below 1 suggests insufficient income to cover debt obligations, signaling potential financial distress. It’s important to assess an entity’s specific situation, as industry standards can vary, so it’s crucial to consider sector-specific benchmarks.

How does DSCR affect loan eligibility?

A strong DSCR positively impacts loan eligibility by demonstrating a borrower’s ability to manage and repay debt, making them more attractive to lenders. It influences the terms offered, such as interest rates and loan limits. Conversely, a low DSCR might limit options, resulting in higher interest rates, restrictive terms, or loan rejection due to perceived risk.

What does DSCR mean in a loan?

In a loan context, DSCR refers to the borrower’s ability to use their income to cover debt obligations. It indicates financial health and stability, assessing whether the income generated is sufficient to meet principal and interest payments. Lenders rely on DSCR to evaluate risk, determining the suitability of terms and the likelihood of loan approval.

How to calculate the Debt Service Coverage Ratio (DSCR)?

To calculate the DSCR, divide the net operating income (NOI) of your business by the total debt service. The formula is: DSCR = ( \frac{\text{Net Operating Income}}{\text{Total Debt Service}} ). Net operating income is the revenue remaining after deducting operating expenses, while total debt service includes all principal and interest payments due within a period. A result above 1 indicates that income exceeds debt payments.