KEY TAKEAWAYS

- Interest and Fees: The cost of carry includes various expenses like margin interest, short selling dividends, borrowing costs, and trading commissions. These costs reduce net returns and must be carefully considered by investors to ensure accurate return calculations.

- Storage and Insurance: In markets requiring the physical storage of assets, such as commodities, additional costs like obsolescence, storage, and insurance impact the overall cost of carrying an asset. These are crucial for calculating net returns and maintaining an investment position.

- Arbitrage Opportunities: Due to variability in the cost of carry across different markets, astute investors can exploit arbitrage opportunities. By understanding these costs, investors can better evaluate potential returns and strategically position themselves to maximize their financial outcomes.

Importance in Financial Markets

In financial markets, the cost of carry is pivotal in determining pricing and profitability. It plays a crucial role in the derivatives market as it influences futures price calculation, accounting for interest on margin accounts, and the convenience yield. It affects how assets are valued over time, influencing the decision-making process for investors trading commodities, currencies, and securities. By understanding these costs, traders can better anticipate future price movements and execute more effective strategies, such as spreading trades or engaging in arbitrage. The concept ensures fair pricing in markets by accounting for expenses associated with holding or trading an asset. This understanding is essential for those involved in derivative markets, where accurate pricing calculations determine potential returns. Additionally, knowledge of scenarios like contango and backwardation can help traders navigate market complexities.

Core Components of Cost of Carry

Storage and Insurance Costs

Storage and insurance costs are critical elements of the cost of carry, particularly for physical commodities like oil, grains, or metals. These expenses arise from the necessity to safely store the commodities in facilities that protect them from deterioration or theft. Insurance adds another layer of protection, safeguarding against potential losses due to unforeseen events like natural disasters or theft.

For instance, storing crude oil requires specialized tanks that prevent spoilage and leakage, adding to overall costs. These storage fees can be substantial, particularly for bulk commodities. Insurance ensures that financial setbacks due to damage or loss are minimized, though it adds an additional financial burden.

Interest Rates and Their Impact

Interest rates play a significant role in the cost of carry, especially when assets are financed through borrowing. When interest rates climb, the cost of borrowing funds to hold positions in financial instruments likewise increases, directly affecting profitability. Conversely, lower interest rates can diminish these costs, making it cheaper to maintain a position.

This relationship is particularly impactful in markets involving futures and forwards, as the interest cost often comprises a sizeable portion of total carrying costs. As such, market participants closely monitor shifts in interest rates to time their decisions optimally, ensuring effective financial management.

Convenience Yield Explained

Convenience yield refers to the non-monetary benefits derived from physically holding an asset rather than owning a contract for future delivery. These benefits can include immediate access to the asset, potential revenue generation, and reduced risk of supply shortages. This yield is especially relevant in commodities markets, where the immediate availability of raw materials can be crucial for operational stability and strategic advantage.

For example, an agricultural business might prefer immediate possession of grain during a period of high demand, which ensures uninterrupted production. The convenience yield helps explain why a commodity may be more profitable to hold in its physical form than merely through derivative contracts.

Understanding the Key Formula

Breakdown of the Cost of Carry Formula

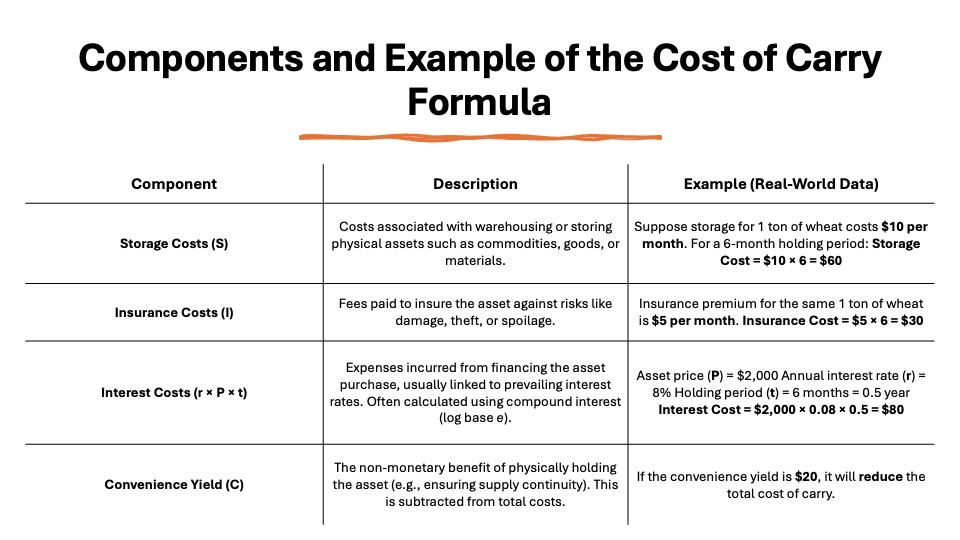

The cost of carry formula is a method for determining the total holding expenses of a financial or physical asset. It is typically expressed as:

Cost of Carry = Storage Costs + Insurance Costs + Interest Costs – Convenience Yield

Each component is fundamental to understanding how maintaining an asset contributes to its future price. For a more detailed calculation, the formula can also be represented as:

- Storage Costs: Costs associated with warehousing or storing physical assets.

- Insurance Costs: Fees for protecting the asset against unforeseen losses.

- Interest Costs: Expenses incurred from financing the asset purchase, often linked directly to prevailing interest rates and frequently analyzed using log base considerations for compound interest scenarios.

- Convenience Yield: The intangible benefits of holding the asset in physical form, often subtracted since these benefits reduce the effective cost.

Additionally, in mathematical computations, the term ‘e’ may be used as a natural log base to represent exponential growth, especially pertinent when interest costs are calculated over time expressed as a fraction of the year. This formula is integral to futures and forward contracts, offering a clear picture of how different expenses and benefits interact to impact pricing. Understanding each element allows for more accurate forecasting and strategic financial planning.

Practical Calculation Examples

Let’s explore how the cost of carry formula can be applied with practical examples. Assume you are evaluating the cost of holding crude oil futures for a year.

- Storage Costs: $1 per barrel for warehousing.

- Insurance Costs: $0.50 per barrel for coverage.

- Interest Costs: Assume an interest rate of 5% on the borrowed capital, with the crude oil price at $70 per barrel, which equals $3.50 per barrel.

- Convenience Yield: It’s estimated at $1 per barrel given the strategic importance of immediate access to oil.

Plug these values into the formula: Cost of Carry = Storage Costs + Insurance Costs + Interest Costs – Convenience Yield

Cost of Carry = $1 + $0.50 + $3.50 – $1 = $4 per barrel

In this scenario, the cost of maintaining each barrel of crude oil futures for a year is $4. A similar approach can be used to calculate costs for other commodities or financial instruments by adjusting the input values according to specific market conditions and asset characteristics.

Exploring the Cost of Carry Model

Application in Derivative Markets

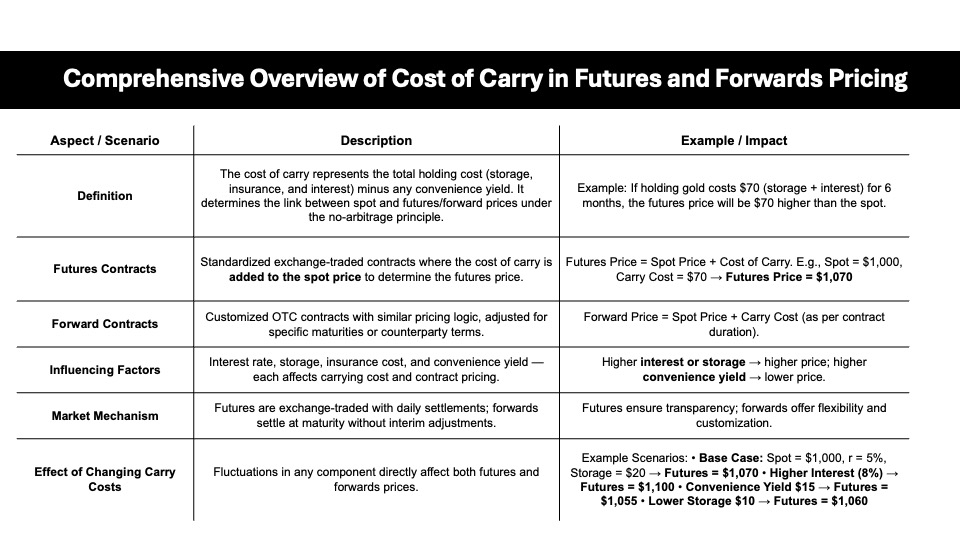

In derivative markets, the concept of cost of carry is integral to the pricing of futures and forwards contracts. Additionally, models like the binomial option pricing model are pivotal in determining the values of American options, providing traders with insights into potential price movements. These contracts rely on the underlying costs associated with holding the actual asset until the contract’s delivery date. By incorporating the cost of carry, traders can better align future price expectations with market realities, ensuring contract prices reflect all associated expenses. For example, when traders anticipate rising interest rates, the resulting increase in carry costs might lead to higher futures prices. Conversely, a high convenience yield might lower these prices, making immediate physical possession more valuable than futures contracts. This dynamic interplay helps maintain market equilibrium, allowing traders to leverage price differentials effectively.

Variations Across Different Assets

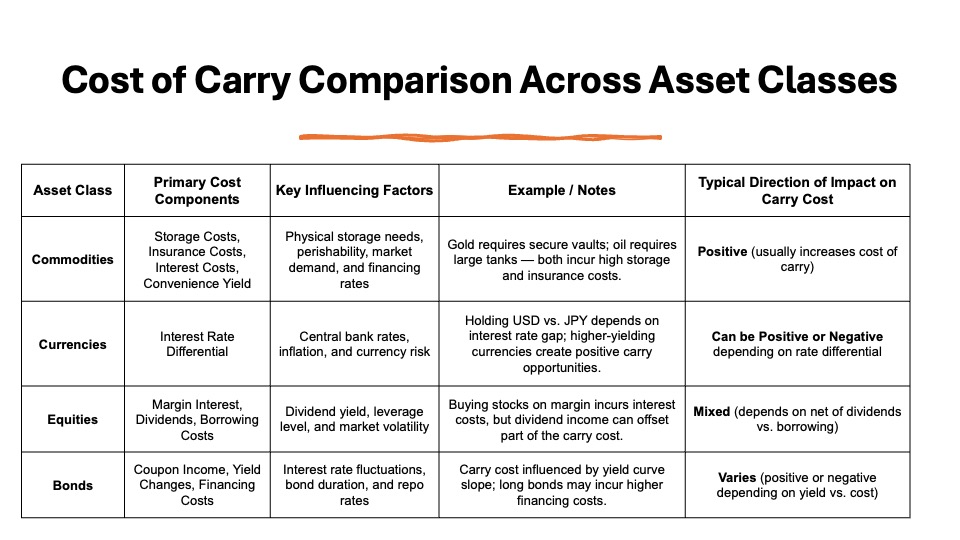

The cost of carry can vary significantly across different asset classes, influenced by unique market characteristics and asset-specific holding requirements. Let’s examine a few asset types:

- Commodities: Physical storage and insurance costs are paramount. For instance, storage for gold differs from that of oil because of differing space and security needs.

- Currencies: The cost of holding currencies mainly revolves around interest rates, as there are typically no storage or insurance costs involved. The interest rate differential between two currencies can significantly impact carry costs.

- Equities: Stock dividends and margin calls play a major role. Borrowing costs to buy on margin and potential dividend payments can either increase or decrease carrying costs.

- Bonds: Interest rate changes directly impact bond carry costs through mechanisms like coupon payments and yield fluctuations.

Each asset’s market dynamics dictate the degree and type of carry costs involved. Understanding these variations can lead to more precise and profitable trading strategies.

Practical Implications for Traders

Strategies to Mitigate Carry Costs

Traders can deploy various strategies to mitigate carry costs, enhancing profitability by reducing overall expenses associated with asset holding. Here are a few effective approaches:Hedging: Use derivatives like options to lock in costs or revenues, protecting against adverse price movements that could inflate carry costs.

- Timing the Market: Enter positions when interest rates are low or during off-peak storage demand periods to reduce costs.

- Choose High-Yield Assets: Favor assets with high convenience yields that naturally lower effective carry costs.

- Efficient Financing: Negotiate lower interest rates or leverage currency differentials to reduce interest-related carry costs.

- Optimized Storage: Use cheaper, efficient storage options or strategic partnerships to minimize storage expenses.

By applying these strategies, traders can effectively reduce unnecessary costs, increasing their potential returns.

Leveraging Cost of Carry in Arbitrage

Arbitrage opportunities often arise from discrepancies in the cost of carry across different markets or instruments. Traders can capitalize on these discrepancies by simultaneously buying and selling equivalent assets in different markets to benefit from price differentials, effectively offsetting the carry costs.

One common strategy involves trading futures and spot markets. For instance, if the cost of carry is underestimated in the futures market, a trader could sell futures and buy the underlying asset in the spot market, profiting from the carry cost difference. This approach requires precise calculation and execution to ensure that potential profits exceed transactional costs, including carry expenses.

Moreover, leveraging carry cost differences between international markets through currency arbitrage can yield opportunities, particularly when interest rates differ significantly across countries. By understanding and exploiting these cost variations, traders can achieve risk-free profits.

The Role of Cost of Carry in Pricing

Influence on Futures and Forwards Contracts

The cost of carry plays a crucial role in pricing futures and forwards contracts, as it reflects the total costs associated with holding the underlying asset until the contract’s maturity. This pricing is governed by the principle of no-arbitrage, ensuring that the contract price reflects all expenses and potential benefits from holding or investing in the asset. When trading online, it’s essential to click through platform details on your browser to understand these pricing components clearly.

For futures, the cost of carry, including storage, insurance, and interest, is added to the spot price to calculate the futures price. Conversely, for forwards, which are less standardized and often tailored to specific needs, the cost of carry ensures that the forward price compensates the holder for any associated holding expenses and opportunity costs. Therefore, any alteration in the cost of carry, such as changes in interest rates or storage fees, directly impacts these contract prices. Understanding this influence helps in making more informed trading and hedging decisions.

Impact on Options Pricing

Cost of carry significantly influences options pricing, primarily through its effect on the underlying asset’s future price expectations. In options pricing models like Black-Scholes, the cost of carry is integrated into the calculation to determine the theoretical price of an option.

For call options, a higher cost of carry typically increases the option’s premium, as holding the underlying asset becomes more expensive. Conversely, for put options, a higher cost of carry might decrease the premium, reflecting decreased asset value for future resale.

The interest rate component of the cost of carry is particularly impactful. Changes in interest rates can alter the options’ carry costs, thereby affecting the intrinsic and extrinsic values. Efficiently analyzing these dynamics allows traders to optimize entry and exit strategies in markets with volatile interest rate environments.

Market Analysis: Real-World Cases

Commodities Market Insights

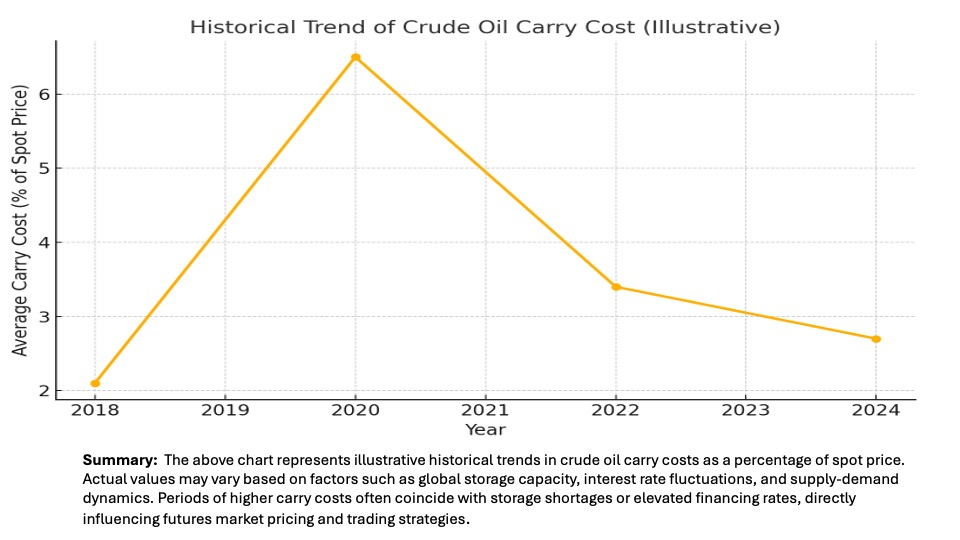

The commodities market is deeply impacted by the cost of carry, given the tangible nature of most commodities and the necessity for physical storage. For instance, in markets like crude oil, gold, and agricultural products, the cost of carry includes significant storage fees, insurance, and opportunity costs associated with capital tied up in inventory.

In the oil market, fluctuations in storage capacity can drastically alter carry costs, influencing futures prices to reflect these changes in supply chain efficiency. Similarly, for agricultural commodities, seasonal variations can affect both storage availability and insurance premiums, altering carry costs throughout the year.

Understanding these carry cost dynamics is essential for traders, as they directly impact supply-demand balances and price volatility. By closely monitoring these costs, traders can better anticipate market shifts and position themselves to capitalize on emerging opportunities.

Effects on Currency and Forex Trading

In currency and forex trading, cost of carry is a critical consideration, primarily influenced by interest rate differentials between two currencies in a currency pair. This differential, known as the carry trade, allows traders to earn when holding currencies from economies with higher interest rates relative to those with lower rates. A popular strategy involves borrowing funds in a currency with a low interest rate and investing in a currency offering a higher rate, profiting from the difference. However, this strategy comes with risks, particularly if exchange rates move unfavorably or if interest rates shift, affecting the cost of carry directly. Currency volatility, geopolitical factors, and economic data releases can impact these rates, making it essential for traders to stay informed and responsive to market changes. By Utilizing the advantages of a trusted web platform, traders can access real-time data and execute strategies seamlessly. Understanding and leveraging the cost of carry allow traders to optimize their forex positions for maximum profitability.

FAQs

What is the cost of carry formula?

The cost of carry formula is:

Cost of Carry = Storage Costs + Insurance Costs + Interest Costs – Convenience Yield.

This formula calculates the total expenses involved in holding an asset over time, ensuring accurate pricing of futures and forwards contracts. Each component reflects different aspects of carrying costs, from physical storage and protection to financial interest and intangible benefits.

How does cost of carry affect future prices?

The cost of carry affects future prices by incorporating all holding expenses into the pricing of futures and forward contracts. Higher carry costs generally lead to higher future prices, as these expenses are added to the current spot price. Conversely, a significant convenience yield can lower future prices, as the immediate benefits of holding the asset reduce the total carrying cost.

Can investors influence their carrying costs?

Yes, investors can influence their carrying costs by strategically choosing storage options, negotiating lower insurance premiums, securing favorable interest rates, and timing asset acquisition to coincide with low interest periods. Additionally, selecting assets with high convenience yields can naturally reduce effective carrying costs, enhancing overall profitability.

Does cost of carry vary by market type?

Yes, the cost of carry varies by market type due to differences in asset characteristics, storage requirements, and market conditions. For instance, physical commodities may include storage and insurance costs, while currency markets are more influenced by interest rate differentials. Each market’s unique elements dictate how carrying costs are calculated and affect investment strategies.

What does cost per carry mean in inventory or investment terms?

In inventory or investment terms, “cost per carry” refers to the cumulative expenses incurred for holding an asset over time. This may include storage, insurance, and interest costs associated with maintaining inventory or financial positions. It reflects the financial burden of holding assets, directly impacting inventory management and investment decision-making.

How are carrying charges calculated in futures contracts?

Carrying charges in futures contracts are calculated by adding the storage and insurance costs, along with the interest costs for financing the asset purchase, and then subtracting any convenience yield. These charges ensure that the futures price reflects the total cost of holding the underlying asset until the contract’s expiration, helping align the futures market with true economic carrying costs.