KEY TAKEAWAYS

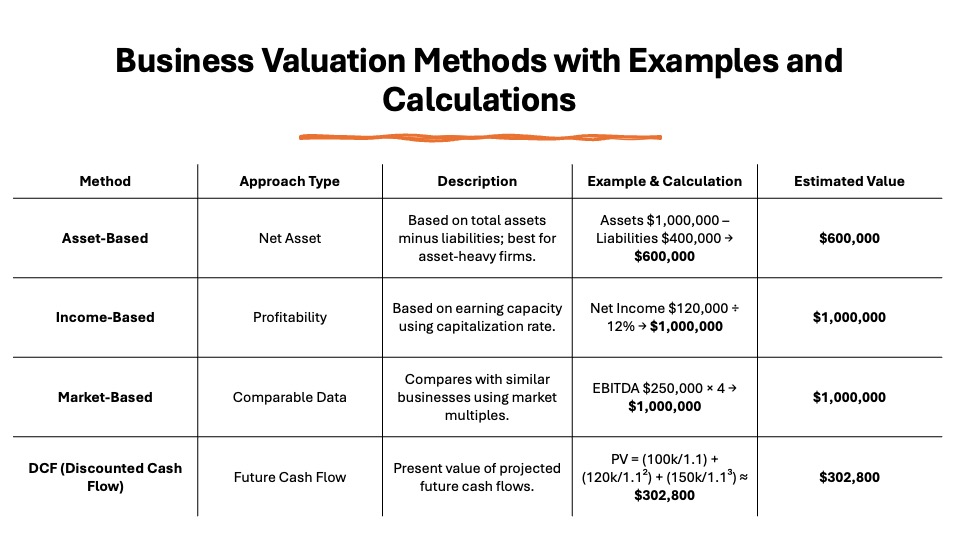

- Variety of Methods: Five main methods are commonly used for valuing businesses, each tailored to different scenarios. These include the adjusted net asset method, capitalization of cash flow method, discounted cash flow (DCF) method, market-based valuation method, and the seller’s discretionary earnings method.

- Combination of Methods: Valuation professionals often utilize a combination of methods, particularly the discounted cash flow and comparable transactions methods, as they provide a comprehensive view of the company’s value. This combination is favored due to the accessibility and reliability of the numerical data involved.

- Purpose and Approach: The ultimate goal of business valuation is to determine a company’s intrinsic value. The chosen valuation method may vary depending on factors such as whether the company is private or public, and the specific reasons for conducting the valuation.

Unpacking Business Valuation

Defining Business Valuation

Business valuation is the process of determining the economic value of a company. This involves a comprehensive analysis of the company’s full operational scope, including assets, liabilities, and income. Whether executed for legal purposes, sales undertakings, or financial reporting, understanding the company’s worth provides insights that drive decision-making. The valuation serves as a bridge between financial theory and real-world applications of assets, underpinned by solid quantitative data Importance in today’s Market.

In today’s volatile market, business valuation is more crucial than ever. It acts as a guiding light for investors seeking new opportunities or companies planning strategic expansions. Accurate valuation empowers stakeholders by revealing a company’s true potential and underlying risks. With globalization and digital transformation shaping markets, understanding a company’s value is essential for negotiating mergers, acquisitions, and partnerships effectively. A well-executed valuation not only enhances fiscal transparency but also strengthens a company’s public image.

Key Business Valuation Techniques

Asset-Based Approach

The asset-based approach to business valuation centers on determining the net asset value of a company, calculated by subtracting liabilities from the total assets. This method is particularly useful for companies with significant tangible assets, like machinery or inventory, as it can accurately assess their replacement value. There are two primary models within this approach: the going concern method, which assumes the business will continue operating, and the liquidation method, which assesses value if assets such as inventory were sold off. Although this approach might seem straightforward, it doesn’t always account for the intangible assets or potential earning value, which are critical when considering ownership stakes and financing strategies like equity financing.

Income-Based Approach

The income-based approach focuses on a company’s ability to generate revenue in the future. This method involves estimating future cash flows and converting them into present value using a discount rate. There are two main techniques: capitalization of earnings, which applies to businesses with stable earnings, and discounted cash flow (DCF) analysis, useful for companies with fluctuating cash flows. An accurate projection of future cash flows serves as a reliable indicator for a company’s financial success. When conducting a DCF analysis, it’s crucial to accurately estimate future cash flow projections, as discrepancies can significantly affect valuation outcomes. Additionally, the simplicity of this approach allows for clear communication of financial health. For long-term estimations, the terminal value can be calculated using the perpetuity growth model, assuming constant growth in cash flows. Understanding that a dollar today holds more value than a dollar in the future emphasizes the importance of these projections. This approach is ideal for service-oriented businesses or startups with limited physical assets. However, accurate projections are critical, as variations can significantly affect valuation outcomes.

Market-Based Approach

The market-based approach evaluates a company’s worth by comparing it with similar businesses that have been sold recently. It primarily relies on market data, such as price-to-earnings ratios, sales multiples, or book value multiples, drawn from public records and databases. It’s a popular method in business valuation for owners as it provides a practical, reality-check valuation rooted in current market conditions. Additionally, techniques like comparable company analysis (or “comps”) leverage trading multiples to further refine market valuation estimates. However, its efficacy depends on the availability of comparable market data, which may be limited for unique or niche companies. To ensure accurate valuation, adjustments for market conditions and specifics are crucial as the valuation multiples need to reflect current marketplace dynamics accurately. This approach is most effective in active markets with numerous transactions, making it equivalent to having a dynamic and pertinent benchmarking tool.

Discounted Cash Flow (DCF) Analysis

Discounted Cash Flow (DCF) Analysis is a sophisticated valuation method that determines a company’s value by estimating and discounting future cash flows. The process involves forecasting a company’s financial performance over a specific period, usually five to ten years, and then determining the present value by applying a discount rate, such as the Weighted Average Cost of Capital (WACC), which reflects the business’s risk profile. This method provides a thorough value assessment based on intrinsic factors and anticipated performance, making it highly effective for growth-driven companies. By evaluating metrics like earnings before interest, taxes, depreciation, and amortization (EBITDA), one can derive a clearer picture of cash flows to enhance the accuracy of these cash flow projections. Furthermore, understanding that a dollar today holds more value due to its potential earning capacity underscores the importance of timely investments. However, it requires precise forecasts and an understanding of risk factors, such as those involved in equity financing, to ensure accuracy.

Advanced Valuation Strategies

Capitalization of Earnings Method

The Capitalization of Earnings Method is an income-based valuation approach that estimates the value of a company by capitalizing its expected stable earnings. This technique assumes that the company’s future performance will closely reflect its historical earnings, making it particularly suitable for businesses with consistent profit patterns. Investors may also use the earnings multiplier in this method, as it can offer a more realistic valuation by focusing on profits rather than just sales. The method involves dividing the company’s expected earnings by a capitalization rate, which accounts for business risk and expected return. While it offers a straightforward analysis, this approach may not be ideal for companies experiencing significant revenue fluctuations or growth spurts. For comprehensive insights, one might also consider the EBIT or the EBITDA ratio, as they provide a detailed view of financial health.

Precedent Transactions

Precedent Transactions analysis is a market-based valuation method that examines the price paid for similar companies in past transactions. By studying these benchmarks, you gain insights into what buyers have historically considered a fair valuation for businesses in the same sector. This analysis is particularly useful during mergers and acquisitions. One key strength is its foundation on real market prices; however, it can be skewed by atypical deals or varying market conditions. While similar to comparable company analysis (CCA) in its approach, it uniquely applies historical transaction data. When pertinent transaction data is limited, this method can be challenging but offers a reality-based complement to other valuation techniques, especially for checking against market capitalization and specific valuation metrics. Real Option Analysis

Real Option Analysis is an advanced valuation strategy that incorporates flexibility and strategic decision-making into the valuation process, much like financial options. It assesses investment opportunities by evaluating the choices available to a business, like expanding, delaying, or abandoning projects. This method acknowledges the dynamic and uncertain nature of business decisions, offering a more nuanced perspective compared to static valuation approaches. It is particularly valuable for companies in volatile or high-growth industries, where future decisions can significantly impact outcomes. However, it requires complex modeling and assumptions about various business scenarios.

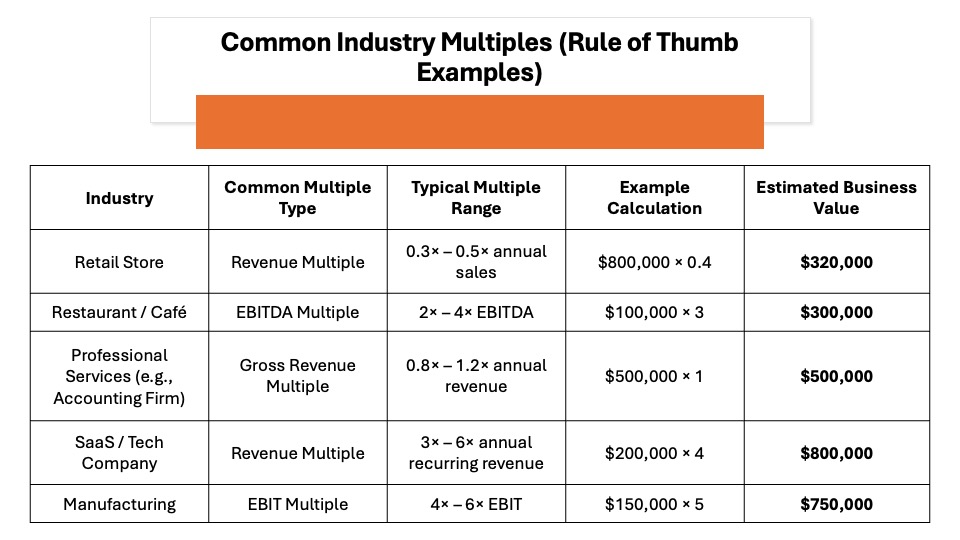

Rule of Thumb Valuation offers a simplified, industry-specific approach to estimating a company’s value. It utilizes industry norms or multiples, such as a certain number of times the annual revenue or earnings, to gauge a company’s market value quickly. This method is particularly popular among small business owners for its ease and speed. However, it lacks precision and doesn’t account for unique operational nuances or future performance prospects. While convenient for initial estimations, it should be complemented with more detailed analyses for informed decision-making.

Challenges in Business Valuation

Addressing Intangible Assets

Addressing intangible assets in business valuation involves recognizing the non-physical elements that contribute to a company’s worth, such as intellectual property, brand reputation, and customer relationships. These assets can significantly influence a company’s market potential and competitive edge. Valuing intangibles typically requires methods like relief-from-royalty or excess earnings approaches, which estimate the economic benefits these assets bring. Financial ratios like return on equity may also serve as important indicators in assessing the overall value contributed by intangible assets. For effective business valuation, leveraging a well-structured business valuation model is key, often involving the expertise of financial analysts to navigate complex valuation formulas. However, identifying and quantifying these can be challenging due to their subjective nature and dependency on market perception. It’s essential to apply rigorous assessment techniques to account for these assets accurately and ensure they are factored into a company’s equity valuation.

Navigating Fluctuating Markets

Navigating fluctuating markets during business valuation requires adaptability and strategic foresight. Volatile economic conditions can significantly impact asset values, risk assessments, and revenue projections. Adopting flexible methodologies like scenario analysis and sensitivity testing can mitigate these challenges by exploring a range of potential outcomes, which plays a pivotal role in establishing a reliable valuation range. It’s crucial to stay informed about market trends and economic forecasts, allowing for timely adjustments in valuation assumptions. Using real-time data and industry benchmarks can also enhance accuracy by improving the clarity of valuation results. Despite uncertainties, a nuanced approach helps maintain a realistic outlook on a company’s true value. Implementing Valuation Methods Effectively

Selecting the Right Technique

Selecting the right valuation technique is crucial and should align with the company’s unique characteristics and objectives. Begin by evaluating the nature of the business, its industry, and the purpose of the valuation. For asset-rich companies, an asset-based approach might be suitable, while income-based methods are better for firms with stable cash flows. The market-based approach fits well in sectors with abundant comparable data. Additionally, hiring a professional business appraiser, especially one with certifications like Chartered Financial Analyst (CFA) or Accredited Senior Appraiser (ASA), can provide expertise and ensure you choose the right valuation method. Consider advanced strategies for dynamic or high-tech industries. Balance the complexity and detail required with the desired precision and practicality of the outcome.

Understanding financial documentation is fundamental for accurate business valuation. Financial statements, such as balance sheets, income statements, and cash flow statements, provide a snapshot of a company’s financial health. Thoroughly analyzing these documents allows you to gauge profitability, liquidity, and solvency. Pay attention to notes and disclosures for insight into accounting policies and potential liabilities. It’s crucial to verify the accuracy and completeness of financial records, as they form the backbone of most valuation methods. Familiarity with financial ratios and metrics is also key for contextual analysis.

Case Studies and Applications

Startups vs Established Companies

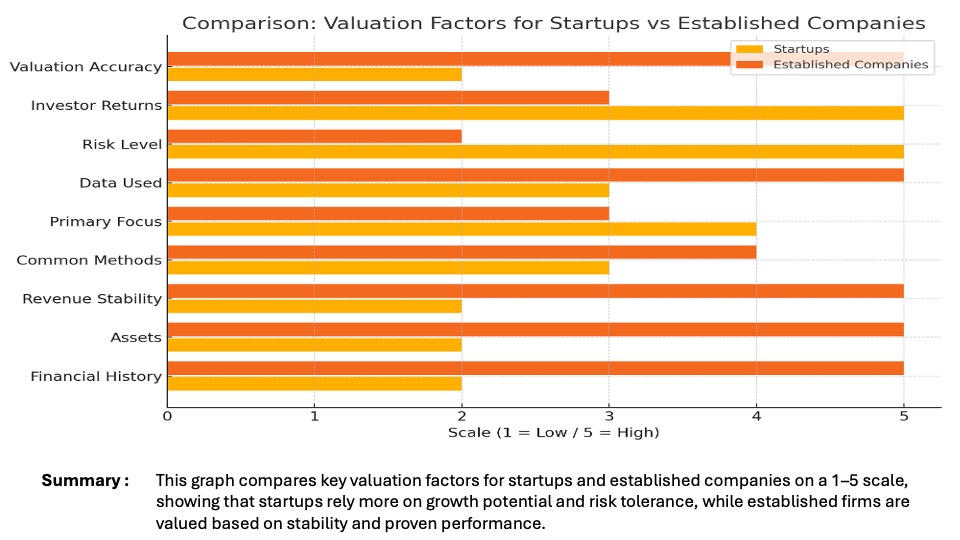

Valuing startups versus established companies requires distinct approaches due to their differing characteristics. Startups often lack extensive financial histories and tangible assets, making income-based methods or techniques like venture capital and scorecard methods more appropriate. These focus on potential growth, market size, and intangible assets. Conversely, established companies benefit from detailed financial records and asset bases, which allow for the use of traditional methods like DCF or market-based approaches. The key is tailoring your approach to reflect the company’s maturity, market position, and growth potential.

Sector-Specific Examples

Sector-specific examples highlight how valuation methods can vary significantly depending on industry characteristics. For instance, in the tech sector, where intangible assets like patents and software are crucial, methods focusing on future growth potential, such as DCF or real option analysis, are often favored. In contrast, manufacturing companies might rely more on asset-based approaches due to their substantial physical asset holdings. Retail valuations may look closely at market trends and customer demographics, using market-based approaches. Tailoring valuation methods to the sector ensures a realistic and relevant assessment of a company’s value.

Technological Innovations

Technological innovations are revolutionizing the business valuation landscape, bringing efficiency and precision. Advanced software tools and algorithms can handle large datasets, providing faster and more accurate analyses. Machine learning applications are enhancing predictive analytics, helping valuators assess future cash flows and risks with greater clarity. Furthermore, blockchain technology ensures transparency and traceability in financial records, bolstering trustworthiness. By leveraging these technologies, valuators can meet the demands of rapidly evolving markets, offering insights that were previously unattainable.

Emerging Trends

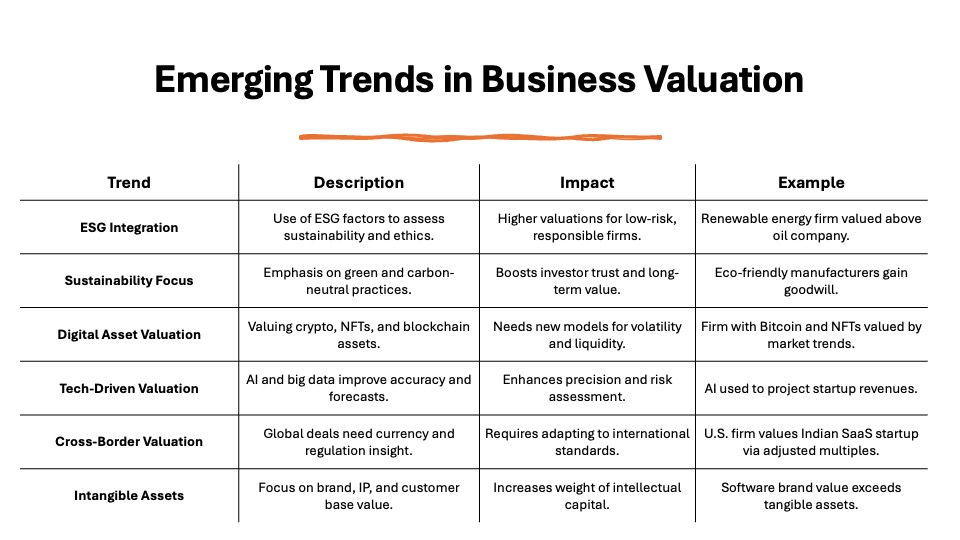

Emerging trends in business valuation reflect the dynamic nature of the global economy and technological advancement. Environmental, Social, and Governance (ESG). factors are increasingly integrated into valuations, recognizing their impact on long-term viability. There’s a growing emphasis on sustainability, particularly in sectors like energy and manufacturing. Additionally, the rise of digital assets, such as cryptocurrencies and NFTs, is prompting new valuation frameworks. Cross-border valuations are also gaining prominence due to globalization, necessitating a grasp of international market nuances. Staying updated on these trends is essential for accurate and forward-thinking valuations.

FAQs

What are the most common mistakes in business valuation?

Common mistakes in business valuation include using outdated financial data, ignoring intangible assets, and relying solely on one valuation method. Overestimating future cash flows or using incorrect discount rates also leads to inaccuracies. Lack of understanding of market conditions and ignoring sector-specific risks can skew results. Always use a comprehensive approach and verify assumptions to avoid these pitfalls.

How often should a business be valued?

A business should typically be valued annually to monitor its progress and adapt to market changes. Additionally, valuations are crucial during significant events like mergers, acquisitions, or management buyouts. Frequent assessment helps in strategic planning and maintaining investment attractiveness.

Can you use multiple valuation methods for one business?

Yes, using multiple valuation methods for a single business is common and advisable. It provides a comprehensive view and helps cross-verify results, enhancing accuracy. Different methods may emphasize various aspects of a business, offering a well-rounded valuation when combined.

How are businesses valued in practice?

In practice, businesses are valued by collecting and analyzing financial statements, assessing market conditions, and selecting appropriate valuation methods. Analysts often use a combination of asset-based, income-based, and market-based approaches to triangulate a realistic value, adjusting for specific risks and growth prospects.

What are the different types of valuation methods for a company?

The main types of valuation methods include asset-based approaches, income-based approaches such as the discounted cash flow (DCF) analysis, market-based approaches, and advanced techniques like real option analysis and precedent transactions. Each method serves different business scenarios and valuation needs.

What are the main business valuation methodologies used today?

The main business valuation methodologies used today are the asset-based approach, income-based approach (such as discounted cash flow), and market-based approach. Advanced methods like real option analysis and precedent transactions are gaining popularity for their nuanced insights into complex business valuations.

How to value a company for sale accurately?

To value a company for sale accurately, analyze financial statements thoroughly, choose a suitable valuation method like a discounted cash flow (DCF) for future earning potential, or market-based for current transaction comparisons. Consider employing small business valuation techniques, such as adjusted net asset or seller’s discretionary earnings methods, which are vital for understanding the full scope of the business’s worth, especially if you’re a seller. Additionally, consulting with valuation experts ensures a precise and fair valuation while considering tax implications and control premiums.

How do business valuations work?

Business valuations assess a company’s worth by analyzing financial data, market conditions, and strategic prospects. Valuators select methods like asset-based or income-based approaches, adjusting for industry-specific risks and growth potential. The result is a comprehensive estimate of a company’s market value.

What factors can affect a business valuation?

Numerous factors can impact a business valuation, including financial performance, market conditions, growth prospects, and industry trends. Intangible assets like brand reputation and intellectual property, along with macroeconomic factors such as interest rates and regulatory changes, also play crucial roles in determining value.