KEY TAKEAWAYS

- Explore and Analyze Options: Before calculating opportunity cost, it’s critical to have a comprehensive understanding of the choices available. This involves exploring various options, such as investments or resource allocations, each of which may come at the expense of another.

- Evaluate Costs and Benefits: Identifying clear costs and potential benefits is essential for making informed decisions. Explicit costs are visible liabilities, while implicit costs might include intangible factors like missed opportunities or additional resource requirements.

- Quantify Trade-offs and Make Informed Decisions: The opportunity cost formula helps quantify trade-offs by comparing the expected return on the chosen option against the next best alternative. The decision should align with the company’s strategy and goals, focusing not just on numerical superiority but also on long-term growth potential.

Understanding Opportunity Cost

Definition and Importance

Opportunity cost is the value of the foregone alternatives when a choice is made. It reflects the benefits that could have been gained if resources were directed towards the best alternative option. Recognizing opportunity cost is crucial as it captures the true cost of a decision by highlighting what is sacrificed. This perspective enables businesses to evaluate options more effectively and allocate resources strategically to maximize potential gains.

In a business context, understanding opportunity costs can lead to improved decision-making and resource management. For example, opting to invest in a new project might mean losing the potential returns from another venture. By clearly defining these costs, businesses can prioritize projects with higher returns on investment and avoid costly mistakes.

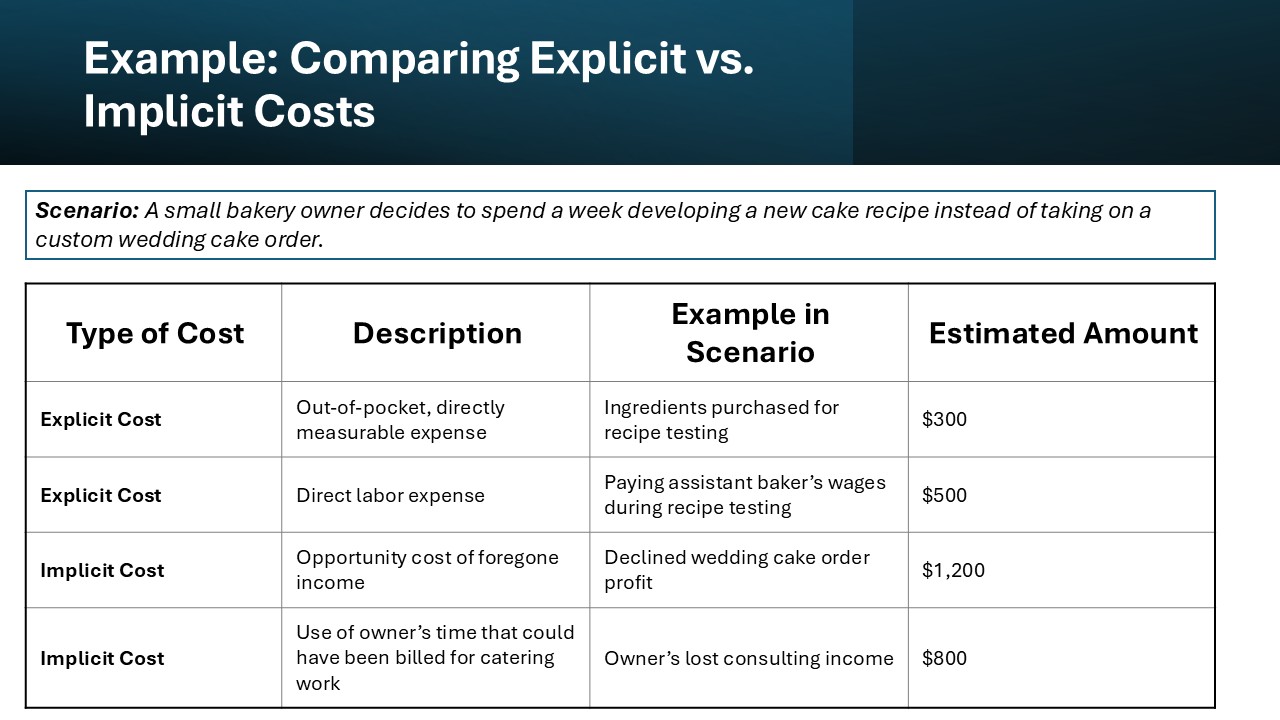

Types of Opportunity Costs

Opportunity costs are generally categorized into explicit and implicit costs. Explicit costs are direct, out-of-pocket expenses, such as wages or material costs, that can be easily identified and quantified. These costs appear in financial statements and are straightforward in their calculation.

On the other hand, implicit costs represent the indirect costs associated with lost opportunities, like the income you forego by choosing not to work overtime. They are often less visible but equally important, requiring more judgment to estimate.

Understanding both types ensures businesses don’t overlook hidden costs when evaluating options, thus promoting better resource allocation and long-term profitability.

The Formula for Opportunity Cost

Key Equations and Calculations

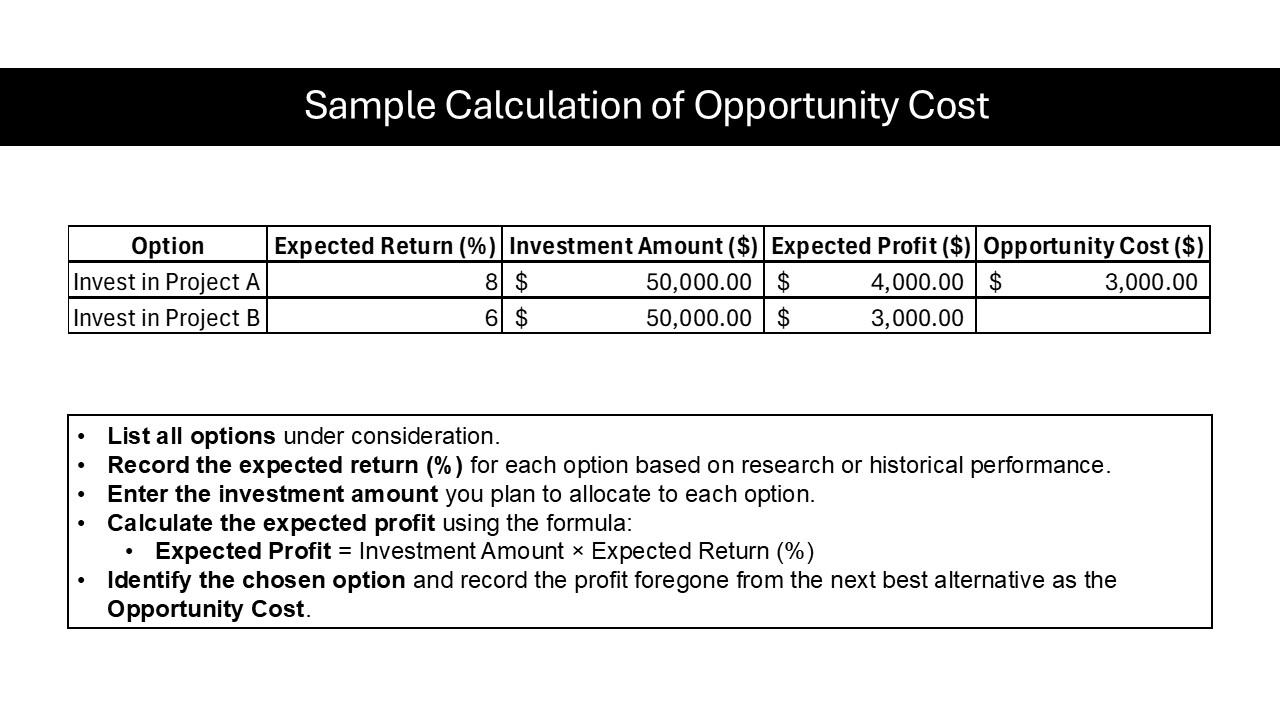

Calculating opportunity cost involves a straightforward formula:

Opportunity Cost = Return on Best Foregone Option – Return on Chosen Option

This formula helps quantify the cost of not pursuing the next best alternative. For example, if investing $10,000 in project A yields a return of 8% while project B offers a return of 5%, the opportunity cost of choosing project B is the difference in returns, amounting to 3% of the investment. This dollar amount reflects missed financial opportunities that could influence your capital structure, including debt and equity financing choices. For businesses, using opportunity cost calculation examples in accounting practices guides capital allocation and resource planning by determining the missed potential gains.

Key points to ensure accuracy in these calculations include:

- Identifying all viable options available.

- Estimating the expected returns for each alternative.

- Ensuring all calculations are based on realistic scenarios and data.

- Re-evaluating with changing trends or data for ongoing decisions.

Remember, while the formula is simple, accurate inputs are crucial to determine a realistic opportunity cost. Incorporating real-time financial data through synced accounting systems, or even automated systems for forecasting and transaction categorizations, can further enhance decision-making processes, particularly in managing a diversified stock portfolio.

Common Mistakes in Calculation

Calculating opportunity cost can seem straightforward, but common mistakes can lead to misinformed decisions.

One frequent error is failing to consider all possible alternatives. Businesses might overlook viable options, leading to an incomplete evaluation. Another mistake is using incorrect data or assumptions, resulting in inaccurate opportunity cost estimations. Misjudging the time horizon over which costs and benefits occur can also skew results, especially when long-term investments are involved.

Additionally, overcomplicating calculations by incorporating too many variables can obscure clarity. Simplifying assumptions and focusing on key factors help maintain accuracy and relevance.

Being mindful of these pitfalls ensures that the analysis provides meaningful insights for decision-making.

Practical Examples of Opportunity Cost

Buying a New Car vs. Saving for the Future

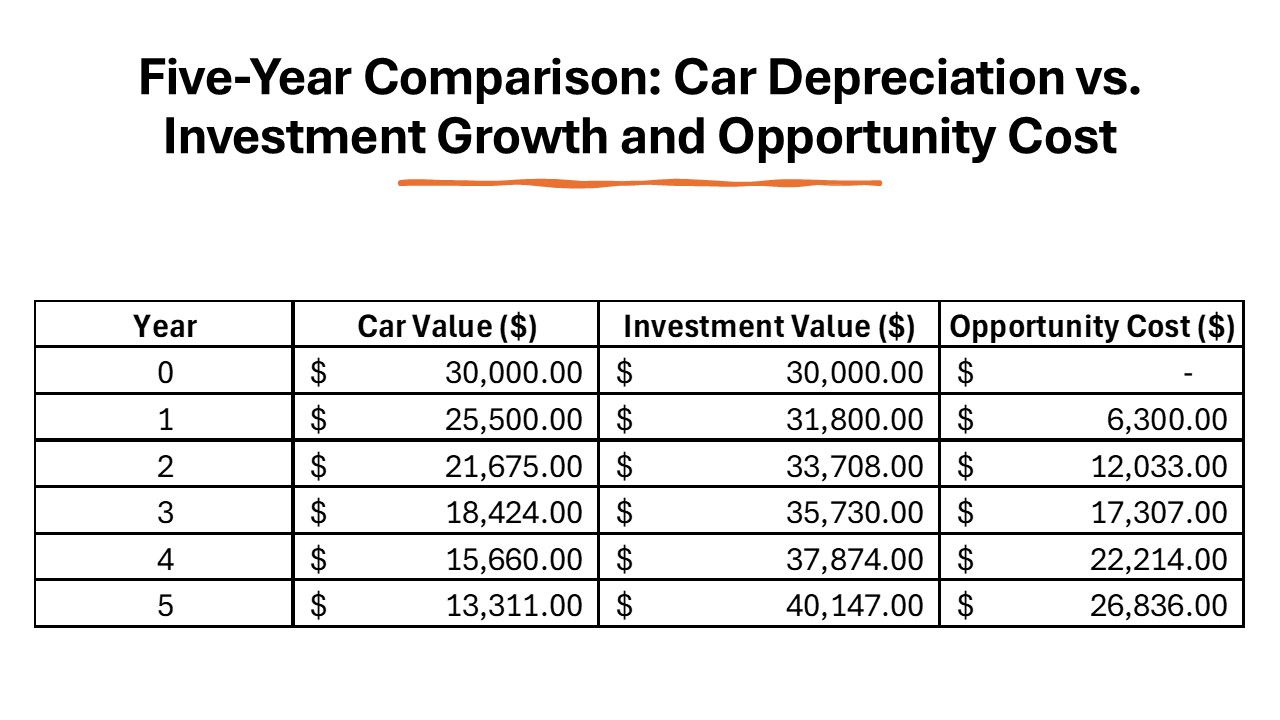

Deciding between purchasing a new car and saving money for the future involves assessing opportunity costs. When you buy a new car, you gain immediate benefits like comfort and convenience, but you might miss out on potential investment growth if those funds were saved or invested. The initial outlay for a vehicle, particularly during a market downturn, could further impact your financial stability, as the value depreciates and other expenses like rent or maintenance costs need to be factored in.

For example, spending $30,000 on a new car with an expected depreciation rate of 15% per year translates into substantial value loss over time. Alternatively, investing that $30,000 in a diversified portfolio with an average annual return of 6% can grow significantly, enhancing your financial security in the long term. To calculate the opportunity cost, compare the projected investment returns with the car’s depreciation. This scenario highlights the financial impact of present consumption against future savings, aiding in making an informed decision.

Investing Decisions and College Savings

Balancing investing decisions and college savings is a classic scenario involving opportunity costs. If you opt to invest money in stocks, you might benefit from higher returns, potentially growing wealth faster compared to a conservative college savings plan. However, such investments carry risks, including market volatility, that might affect your ability to fund college when needed.

On the other hand, placing money into a 529 college savings plan offers tax advantages and assures funds for future education needs. The opportunity cost here includes the potential higher returns you might forgo by not investing in higher-risk, higher-return options.

To weigh these options, consider the projected returns, associated risks, and your financial goals. This analysis helps in deciding which option aligns with long-term educational funding needs while balancing risk tolerance.

Business Expansion Scenarios

Considering opportunity cost is vital when evaluating business expansion scenarios. Suppose a business owner must choose between expanding into a new market or enhancing existing products. Expanding often requires substantial upfront investments in marketing, infrastructure, and operations, attracting new customer bases but with higher risk. In contrast, any projection of entering new markets must account for these potential costs and returns, allowing companies to balance risk against reward effectively. Enhancing existing products may maintain customer loyalty and boost sales with less financial risk. However, it could mean losing out on potentially higher rewards from entering untapped markets. By calculating the opportunity cost, you assess the foregone benefits of the unchosen path, helping prioritize projects based on expected returns, risk levels, and strategic alignment with company goals. This approach ensures resources are allocated to the option promising the greatest benefit, whether that be through business growth or upgrading existing operations.

Opportunity Cost in Business Context

Real-time Financial Analytics

Real-time financial analytics play a critical role in understanding opportunity costs within a business context. These advanced tools provide up-to-the-minute data, enabling swift and informed decision-making by leveraging integration with existing accounting systems. By continuously monitoring financial metrics, companies can quickly identify which projects or investments are underperforming compared to alternatives, allowing for prompt reallocation of resources. The integration ensures your numbers are always accurate and up-to-date, enhancing financial management efficiency. Their value lies in offering a comprehensive view of financial health, including cash flows, profitability, and cost structures in real-time. This capability means you’re better positioned to evaluate potential opportunity costs associated with ongoing projects or new opportunities. Consequently, real-time analytics empower businesses to minimize the cost of missed opportunities by swiftly adapting strategies based on timely insights, thereby improving productivity and maintaining liquidity.

Corporate Cards for Spending Control

Corporate cards are an effective tool for managing spending and controlling opportunity costs within a business. By providing detailed transaction records, they allow businesses to track expenditures in real-time. This transparency facilitates better budget management and helps identify areas where spending might not be delivering optimal returns. Moreover, corporate cards often offer integrated analytics platforms that highlight spending patterns and trends. These insights, combined with strategic vendor relationships and clear invoice terms, help in assessing whether the funds could be better utilized elsewhere, thereby evaluating the opportunity cost of existing expenditures. Additionally, many corporate cards come with benefits such as cashback or points, contributing to cost savings. By using corporate cards strategically, companies can ensure every dollar counts, minimizing wasted resources and maximizing financial returns while effectively planning for investor payouts.

Limitations and Challenges

Assumptions in Calculating Opportunity Cost

Calculating opportunity cost often relies on several assumptions that can influence the accuracy of the analysis. One key assumption is that all potential alternatives are known and quantified, which isn’t always feasible in dynamic or uncertain environments. Another assumption is that the decision-maker has perfect foresight regarding future returns, which may not account for changing market conditions or unforeseen risks.

Furthermore, calculations usually presume that the resources used in a particular investment or decision cannot be simultaneously allocated to another option, i.e., they are mutually exclusive. This assumption may oversimplify complex decisions involving shared resources.

To mitigate the influence of these assumptions, it’s crucial to continuously update calculations with the most current data and adjust for variables as they change. This approach ensures the opportunity cost reflects the real-world scenario as closely as possible.

Pitfalls in Overcomplicating Calculations

While calculating opportunity cost is essential, overcomplicating the process can obscure insights and lead to confusion. Adding too many variables or hypothetical scenarios can detract from straightforward comparisons, making it difficult to determine the relative value of different options. It’s important to focus on the key factors that most significantly impact the decision.

Another pitfall is the excessive reliance on complex financial models which may not always account for qualitative factors, such as market dynamics or consumer behavior. This complexity can result in analysis paralysis, where decision-makers become overwhelmed by the data and delay making choices.

To avoid these issues, keep calculations as simple as possible, refining definitions and criteria to reflect core priorities. This simplicity ensures clarity, allowing you to leverage opportunity cost as an effective decision-making tool.

Opportunity Cost vs. Other Economic Concepts

Sunk Cost Considerations

Sunk cost considerations are crucial when differentiating between costs that affect future decisions and those that should not. Sunk costs are past expenditures that cannot be recovered regardless of future actions. For instance, money spent on a project that was later terminated is a sunk cost because it cannot be retrieved.

Understanding that sunk costs should not influence ongoing decisions allows you to focus on current and future benefits and costs. It’s a common mistake to let these irrecoverable costs affect new decisions, often leading to the “sunk cost fallacy,” where resources continue to be poured into an unprofitable venture purely because of previous investments.

By acknowledging sunk costs as part of a decision-making process, you ensure that focus remains on maximizing future returns and making rational choices based on opportunity costs.

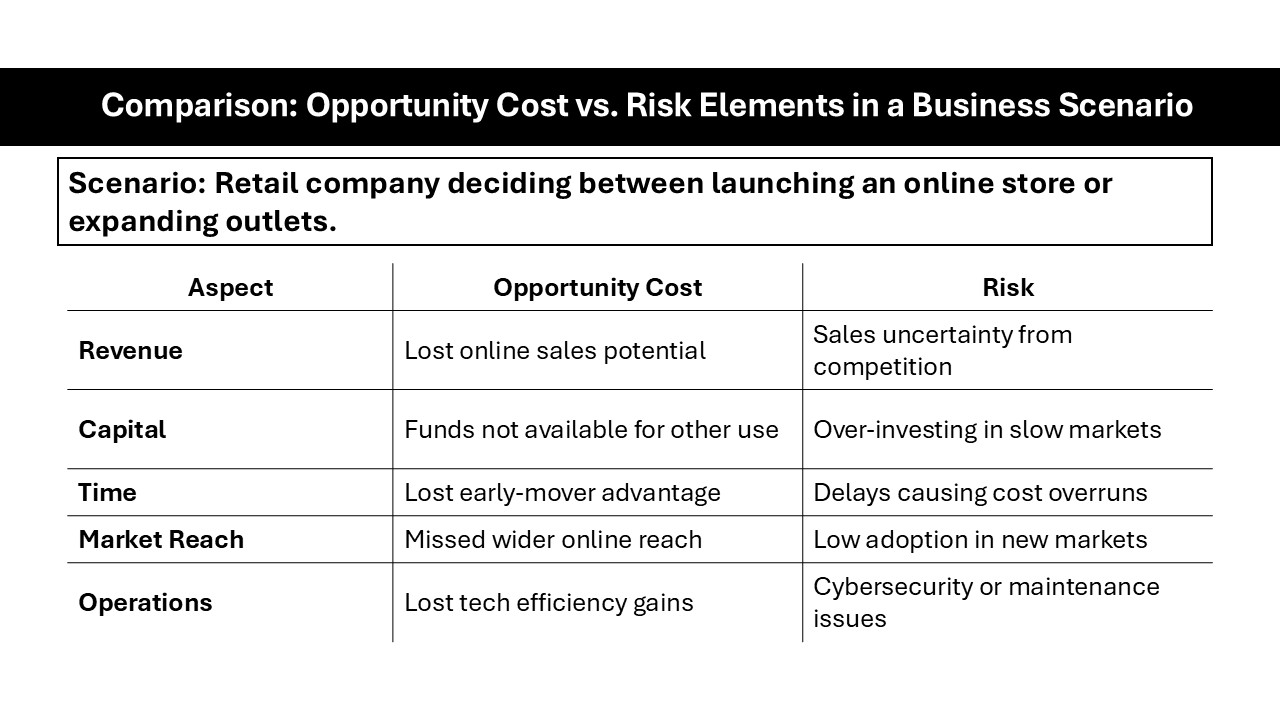

Opportunity Cost vs. Risk Analysis

Opportunity cost and risk analysis are distinct yet interconnected concepts in financial decision-making. Opportunity cost focuses on the benefits you miss when choosing one alternative over another, inherently reflecting trade-offs between options. It helps prioritize decisions based on potential returns relative to forgone opportunities.

Risk analysis, meanwhile, evaluates the uncertainties associated with a decision, considering factors like market volatility, potential losses, and probability of outcomes. It aims to understand the impact of variability and to help in selecting options that align with the business’s risk tolerance.

While opportunity cost considers the potential benefits lost, risk analysis assesses the likelihood of different outcomes and their potential impact. A comprehensive decision-making process integrates both perspectives, ensuring choices are optimized not only for potential gains but also for acceptable risk levels.

FAQs

Can you define opportunity costs in simple terms?

Opportunity costs represent the benefits you miss out on when you choose one option over another. It’s about understanding what you’re giving up to pursue a certain choice.

What is the basic formula for calculating opportunity cost?

The basic formula for calculating opportunity cost is: Opportunity Cost = Return on Best Foregone Option – Return on Chosen Option. This comparison highlights what you sacrifice by not choosing the next best alternative.

How do opportunity costs impact investment strategies?

Opportunity costs impact investment strategies by helping prioritize options with the highest potential returns. They guide investors to weigh the benefits of different choices, ensuring resources are allocated to maximize profitability.

What are some common misperceptions about opportunity cost?

Common misperceptions about opportunity cost include the belief that it only involves financial loss, underestimating its role in strategic decision-making, and confusing it with sunk costs. These misunderstandings can lead to poor resource allocation.

How do I find opportunity cost when comparing choices?

To find opportunity cost when comparing choices, evaluate the return of the best alternative forgone and subtract the return of the option chosen. This calculation highlights the value of what you forgo with each decision.