KEY TAKEAWAYS

- Comprehensive financial forecasting should encompass all three financial statements—profit and loss, cash flow, and balance sheet—forming a full financial picture, and be executed before setting specific expense limits within the budget.

- Realistic and effective budget forecasts are derived from breaking down the financial picture into manageable periods, such as monthly, quarterly, or annually, which facilitates more detailed tracking and responsiveness to financial performance.

- In budget forecasting, it’s critical to incorporate strategic elements such as revenue and expenses, capital expenditures, debt servicing, and potential strategic partners, allowing for a well-rounded and data-backed financial plan.

The Intersection of Strategic Planning and Financial Management

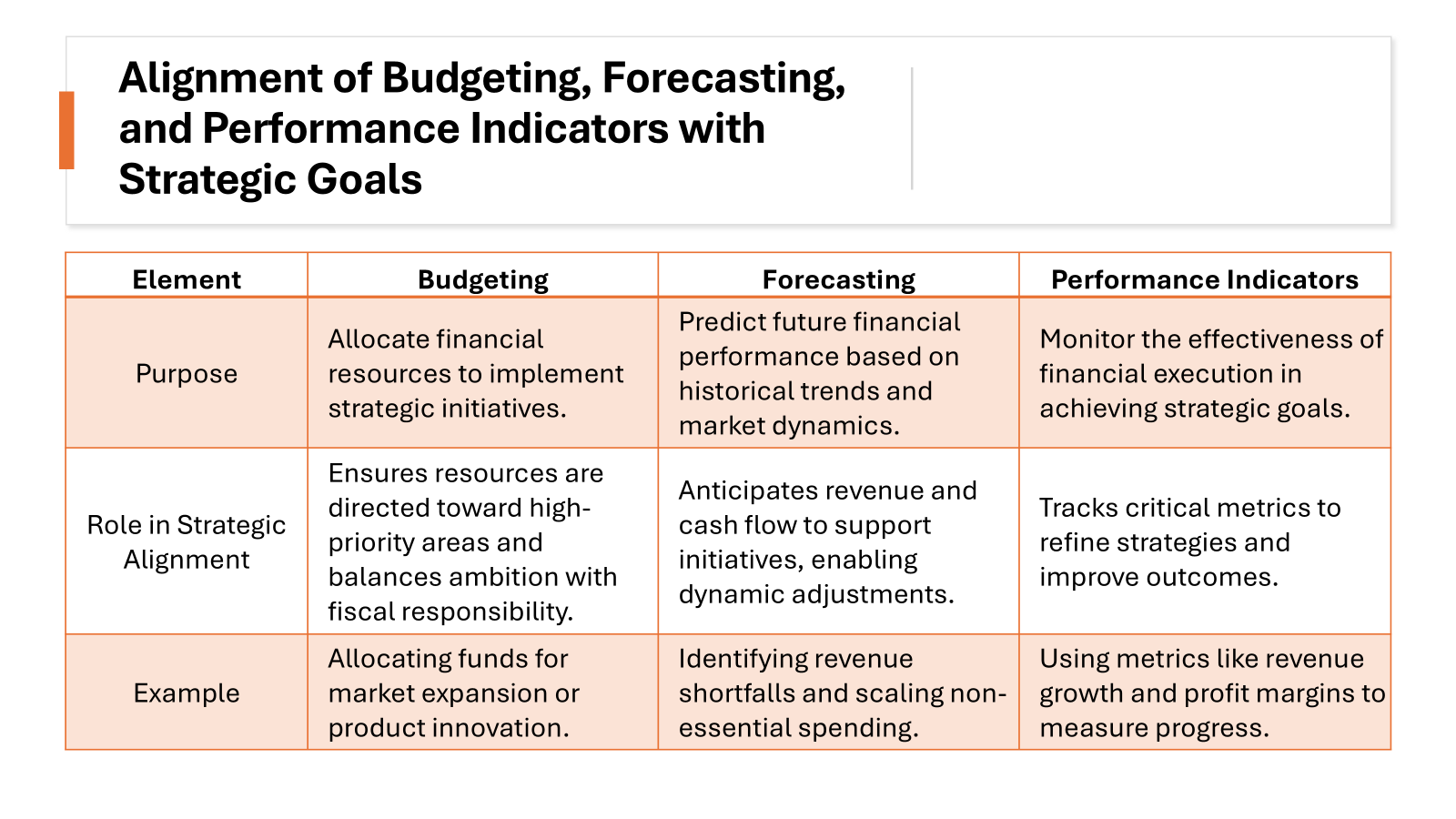

You may wonder where strategic planning meets financial management — they intersect at a critical juncture which can propel your business forward. Strategic planning sets the course for where you want your business to go, while financial management provides the tools to make sure you’re adequately fueled for the journey. By weaving in planning analytics and carefully chosen financial performance indicators, businesses can not only set their strategic goals but also monitor their progress with precision and adapt quickly to changes. It’s about aligning your monetary resources with your long-term vision, ultimately ensuring that each financial decision supports your overarching goals.

Laying the Groundwork for Effective Budget Planning

Starting With a Clear Financial Picture: Year-to-Date Performance Assessment

To lay the foundation for your budget planning, you need to start with a mirror reflecting your business’s financial health — the year-to-date performance assessment. This involves taking a comprehensive look at your revenue data, expenses, cash flow, and comparing these figures against your previous year’s performance. Using data analytics, you’ll establish a baseline that not only measures your current standing but also sets the stage for accurate forecasting. By incorporating this approach, you address vital indicators of financial health, revealing trends, challenges, and opportunities. Thus, your upcoming budget is informed by insights and analytics, not guesswork, optimizing the path for strategic fiscal planning.

Scenario Planning: Preparing for Various Financial Outcomes

Delving into the world of ‘what-ifs’ is where scenario planning becomes your trusty compass. It is a crucial strategic tool designed for predicting and preparing for various financial outcomes, making your business more resilient against the winds of change. By forecasting potential scenarios, businesses can generate accurate predictions and polished budgets with fewer errors. You’ll create several vivid scenarios that could unfold, ranging from the sunny skies of a best-case situation, grounded in optimistic forecast outcomes, to the storm clouds of a worst-case disaster. By modeling these different futures—considering historical data and current market conditions—you can construct different plausible futures to see how changes in external conditions might affect outcomes. This approach can formulate contingency plans, prioritize strategic responses, and adapt to shifts in your business climate with agility and confidence.

Deep Dive into the Budget Creation Process

Breaking Down Budgets into Time Periods and Detail Levels

A critical step in nurturing your budget is slicing it into time periods that align with your business rhythm. Will you dance to the monthly beat, stride with quarterly milestones, or align with annual achievements? Deciding on the timeframe you will cover in your forecast is vital—whether you choose a monthly, quarterly, or annual timeframe, consistency in tracking performance and comparing over time is key. This breakdown into shorter time frames helps you chew on your financial goals without taking too large a bite at once. It’s also crucial to decipher the granularity of your budget; will you scrutinize every expense or keep it high-level? The detail level you choose will determine how tightly you can steer your business’s financial reins and whether your consolidations and rollups are done automatically to easily meet deadlines.

Using Historical Data and Market Trends to Inform Your Budget

Tapping into the wisdom of the past ensures your budget is informed, realistic, and strategic. Historical data isn’t just numbers in old reports—it’s a storyline of your business’s financial journey, highlighting successes to replicate and pitfalls to avoid. By leveraging data sources that trace your organizational history, you’re embracing a narrative that can help refine revenue forecasts and future financial strategies. Pair this retrospective insight with current market trends, and you’re equipping yourself with a powerful foresight. You’ll be able to allocate resources more effectively, capitalize on emerging opportunities, and brace for potential headwinds—all key to crafting a budget that’s both grounded and forward-looking.

The Art and Science of Forecasting

Time Series and Regression Analysis: Predicting Your Financial Future

Imagine being able to forecast your financial future with clarity and precision. That’s the power of Time Series and Regression Analysis. By looking into the rhythm of your past revenue streams, the time series model anticipates future performance, spotlighting trends and seasonal fluctuations. With regression analysis, every dollar spent on marketing, every market shift, becomes a variable in a sophisticated equation predicting sales revenue. Harness these analytical arts, and you’ll be able to foresee and navigate future financial landscapes with a navigator’s confidence.

Rolling Forecasts: The Agile Approach to Modern Business Planning

Rolling forecasts are like having your hand on the financial pulse of your business, offering a dynamic and agile approach to planning that traditional methods can’t match. They enable you to look beyond the static confines of an annual budget by continuously adapting to the latest information. Every month or quarter, the forecast updates, extending out to keep a constant 12-month or more perspective. This way, you never lose sight of your long-term horizon, even as you navigate the choppy waters of short-term volatility.

Applying Technology for Smarter Financial Planning

From Spreadsheets to Advanced Software Solutions

Gone are the days when spreadsheets were the only tool at your disposal for budgeting and forecasting. Today, advanced analytics software solutions have transformed the landscape, offering the agility and foresight needed for smart financial planning. Such platforms step beyond the capabilities of Microsoft Excel, facilitating seamless data integration, enhanced collaboration, and real-time insights. By adopting these powerful forecasting tools, businesses can turn the time-consuming process of financial management into a strategic asset. This shift not only enhances data integrity but also significantly improves decision-making, propelling organizations towards more accurate and efficient financial strategies.

Automating Manual Processes for Efficiency and Accuracy

Picture this: a world where tedious data entry is a thing of the past. Automation is your ticket to this world, offering a more efficient and accurate way to handle the repetitive tasks involved in budgeting and forecasting. Say goodbye to manual errors and the mundane task of updating spreadsheets. Automated data entries ensure that numbers are always current, making it easier to spot trends and generate forecasts quickly. This frees up your time to focus on analysis and strategic planning—the kind of work that really moves the needle for your business.

Budget Versus Forecast: Knowing the Difference and When to Use Each

Key Differences and Special Considerations

Navigating the financial waters of your business requires understanding the distinct vessels of budgeting and forecasting. A budget is your detailed financial blueprint, laying out your goals and the resources you’ve allocated to achieve them, typically fixed until the next cycle. In contrast, a forecast is like a captain’s spyglass, constantly adjusted with the most current data to predict where the financial currents will take you. Special considerations include the level of flexibility a forecast offers over a budget and how each serves different managerial needs. While a budget sets limits and expectations, a forecast helps you to anticipate and react to the unexpected, making both essential tools in your financial planning toolkit.

Combining Budgeting and Forecasting for Comprehensive Planning

Melding together the structured nature of budgeting with the fluidity of forecasting gives you a comprehensive financial playbook. This dual approach equips you to set firm financial targets while staying nimble enough to pivot with real-time business dynamics. By integrating the two, your financial strategy becomes a living, breathing entity that can inform decision-making at any point in time. This convergence ensures that you’re not only working towards predefined goals, but also acting on up-to-date information, ready to seize opportunities or dodge unforeseen obstacles as your fiscal landscape evolves.

Common Pitfalls in the Budget and Forecasting Process

Overcoming Challenges with Disparate Data and Manual Processes

The challenges of disconnected data and manual processes can stymie your budgeting and forecasting efforts like roadblocks on your path to financial clarity. Data silos within different company divisions can lead to inefficiencies and decision-making blunders. To overcome these setbacks, you need a cohesive strategy that brings disparate data into synergy. Implementing integrated financial planning systems can help you to weave these fragmented threads into a tapestry of coherent, actionable information. This approach eliminates redundancy, reduces errors, and ensures that everyone works from the same financial script.

Ensuring Accuracy and Reliability in your Financial Plans

The bedrock of all financial planning is trust – trust in the accuracy and reliability of your data. To establish this, thorough validation measures are essential. It starts with a structured data collection process, continues with rigorous analysis and cross-referencing, and is maintained by consistent review protocols. Establishing checks and balances, such as double-entry bookkeeping and periodic audits, helps ensure that every figure in your budget or forecast can be relied upon. When accuracy is a priority, you safeguard your company against costly mistakes and build a robust foundation for sound financial decision-making.

Moving from Planning to Action

Finalizing, Summarizing, and Presenting Your Financial Plan

The finale of your financial planning process is like the last act of a play—everything comes together, ready for the big reveal. Finalizing your financial plan means dotting the i’s and crossing the t’s; ensuring every number is correct and every assumption is justified. Summarizing your findings turns detailed data into a compelling narrative that speaks to stakeholders of all levels. When presenting, clarity is key—use visual aids like charts and graphs to make your points clear and impactful. Remember, this is where you get everyone on board with the financial direction of the enterprise, so make it count.

Regular Monitoring and Updating: Keeping Your Budget and Forecast Relevant

Think of your budget and forecast as a garden – it needs regular tending to thrive. Keep these instruments relevant by frequently monitoring actual performance against your projections, and be prepared to update them as you encounter new information and changing circumstances. Set regular intervals for review and use these check-ins as opportunities to make informed adjustments. This ongoing vigilance ensures that your financial plans remain a true compass, directing you through the ever-changing landscape of business.

Best Practices for Mastering the Budget and Forecasting Lifecycle

Building an Agile, Ongoing Cycle of Budgets and Forecasts

To master the budget and forecasting cycle, aim for agility; treat it as an ongoing process rather than a one-time event. Incorporate regular checkpoints to compare actuals against your plan, allowing you to adjust and respond with speed. This cycle should be a continuous loop of assessment, adjustment, and execution. Celebrate when you hit milestones as they confirm you’re on track. Agility in your budgeting and forecasting processes helps you quickly align your financial strategies with the evolving business environment and market conditions.

Turning Financial Planning Into a Competitive Advantage

Astute financial planning isn’t just about keeping your books in order; it’s a strategic lever you can pull to outmaneuver competitors. When you refine your processes, embrace technology, and foster collaboration, you transform budgets and forecasts from administrative chores into competitive weaponry. This prowess allows you to foresee trends, innovate with purpose, and allocate resources smartly. Ultimately, it positions you to lead rather than follow in the marketplace, making financial planning a cornerstone of your competitive strategy.

Budgeting and forecasting are essential processes for ensuring profitability and effective financial management. They involve creating detailed workbooks to map out financial projections, accounting for taxes, equity, and potential divestments. Regularly updating forecasts helps organizations identify deviations from expected performance, allowing for timely adjustments to achieve strategic goals. By integrating these elements into a structured approach, businesses can better align resources, enhance decision-making, and maintain robust financial health. This iterative process ensures that even minor adjustments in profitability, taxes, or equity are captured, fostering long-term sustainability and growth.

FAQ: Expert Answers to Your Budgeting and Forecasting Questions

Why Is a Realistic Budget Foundation Essential?

A realistic budget foundation is essential because it ensures your financial goals are attainable and based on actual data. Unrealistic expectations can lead to missed targets, financial strain, and morale dips. Reality-based budgets keep you grounded and help manage risk effectively.

How Can Organizations Benefit from Integrating Budgets and Forecasts?

Integrating budgets and forecasts allows organizations to harmonize their financial strategy with real-time business operations. This enables proactive decision-making, more effective resource allocation, and improved financial performance.

What Comes First in the Financial Planning Process – A Budget or a Forecast?

In the financial planning process, a budget often comes first as it sets a blueprint for your goals and expenditures. A forecast then builds on that, using real-time data to predict future performance and make necessary adjustments.

How Can Current Technologies Improve the Budgeting and Forecasting Processes?

Current technologies streamline budgeting and forecasting by automating data collection and analysis, improving accuracy, and facilitating real-time scenario planning. They foster collaboration, making financial planning more integrated and dynamic.