KEY TAKEAWAYS

- The board of directors is a group of individuals elected to represent shareholders and oversee an organization’s activities and strategic direction.

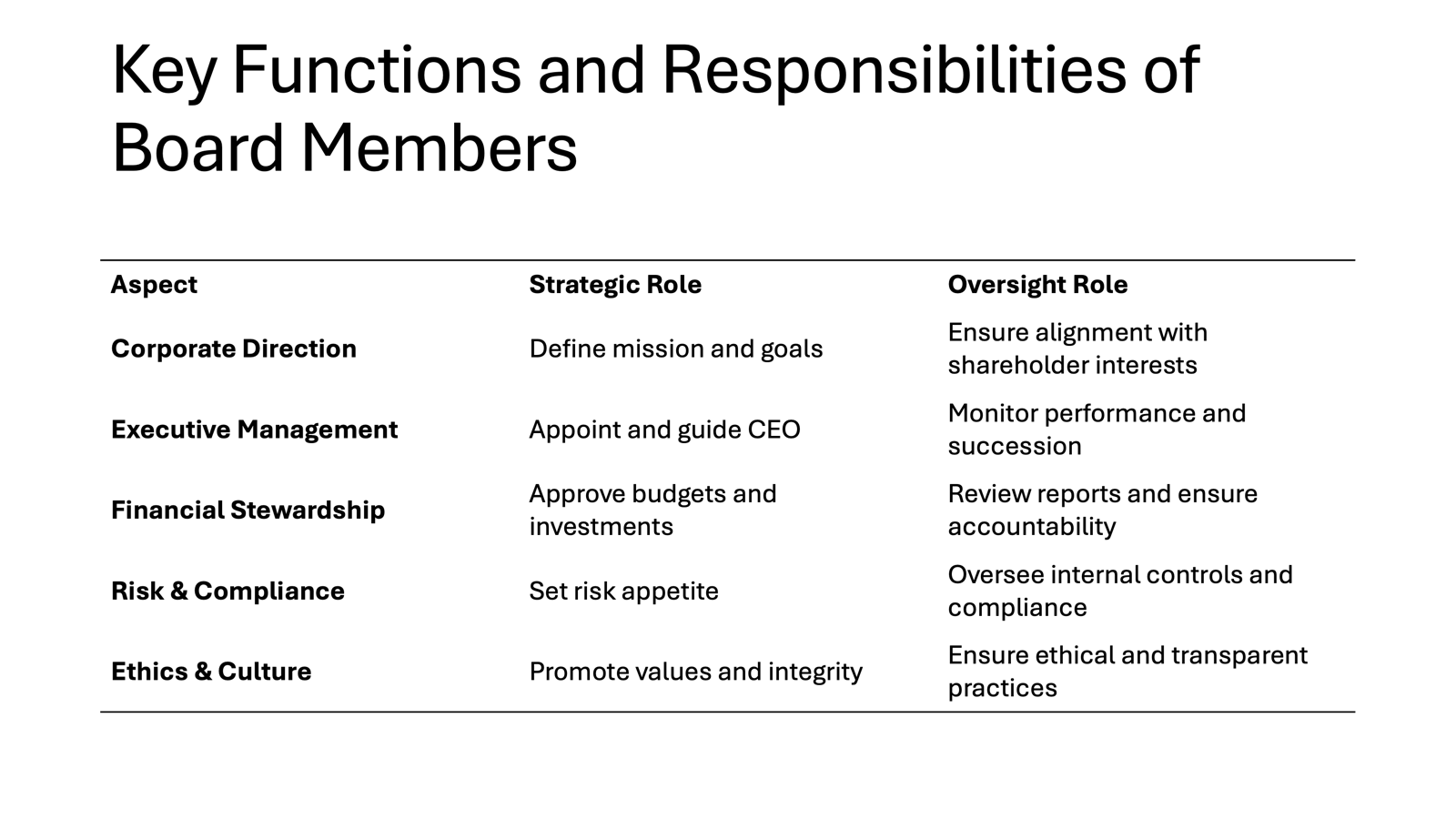

- They play critical roles, including setting strategic goals, ensuring financial accountability, hiring and evaluating the CEO, and safeguarding the organization’s missions and values.

- Whether serving a nonprofit or a private or public company, the board is vital to governance, leadership, and long-term success, with effectiveness directly correlating to organizational strength.

clarifying the Board of Directors

Understanding the Core Purpose

At its heart, the board of directors serves as the governing body that acts on behalf of shareholders to ensure the company’s prosperity while balancing various stakeholder interests. Within a nonprofit organization, the nonprofit board of directors also plays a pivotal role in governance. Their primary purpose lies in providing the organization with strategic guidance, objective oversight, and ethical leadership. By overseeing executive management, establishing broad policies, and making key decisions, the board plays a crucial role in aligning the organization’s goals with shareholder expectations. The agenda they set often includes discussions on director compensation and executive compensation, which are critical in attracting and retaining talented leadership. Boards are tasked with creating a governance structure that fosters transparency and accountability, ensuring that the organization adheres to its mission. In nonprofit organizations, this governance structure is essential to maintain public trust and ensure that donor contributions are used effectively to serve the mission.

Key Definitions and Terminologies

Understanding the language of corporate governance is key to navigating boardroom discussions and decisions. Here are several important terms:

- Board Director: An individual elected to represent shareholders and guide an organization towards its objectives. They often log in to the board portal to review agendas, provide insightful input, and remain informed for effective decision-making. Certification for board directors can enhance credibility and establish a baseline of knowledge essential for fulfilling their role.

- Chairperson: Leads the board and facilitates meetings, ensuring efficient decision-making processes. The chairperson coordinates with the nominating committee to align board composition with strategic objectives.

- Quorum: The minimum number of board members required to be present to validate any decisions made. This often involves the consent of present members on board agenda items, and its criteria are often outlined in the organization’s articles of incorporation.

- Proxy: Authority to represent someone else, commonly in voting during board meetings.

- Audit Committee: A specialized group within the board that oversees financial reporting and disclosure, focusing on the criteria for accuracy in accounting and financial statements. The incorporation of structured audit procedures ensures rigorous compliance and evaluation.

These terms help define roles and expectations within a board, ensuring clarity in operations while shielding board members from liability, provided decisions are made with reasonable skill and within their authority.

Structure and Composition

Types of Board Members

Board members are typically categorized based on their relationship with the company and the perspectives they bring. Here’s a breakdown:

- Executive Directors: Part of the company’s management team, they have an active role in the day-to-day operations of the company and often communicate regularly with the C-suite to ensure alignment in strategy and operations.

- Non-Executive Directors: They do not engage in daily management but provide an independent perspective to board discussions. Their role supports a balanced board structure and helps avoid hierarchical challenges.

- Independent Directors: These are a subset of non-executive directors with no material relationship with the company beyond their board seat, offering unbiased oversight. They are crucial during considerations of CEO compensation and performance evaluations.

- Advisory Directors: While not formal board members, they provide expert insights in specific areas as needed. Their insights can often influence decisions on the hiring or firing of key executives.

- Honorary Directors: Recognized for their contributions or legacy, they often hold no active decision-making roles.

Each type of board member brings unique insights and expertise, contributing to a well-rounded and effective board. The dynamics around a boardroom table can shape the strategic direction of a company.

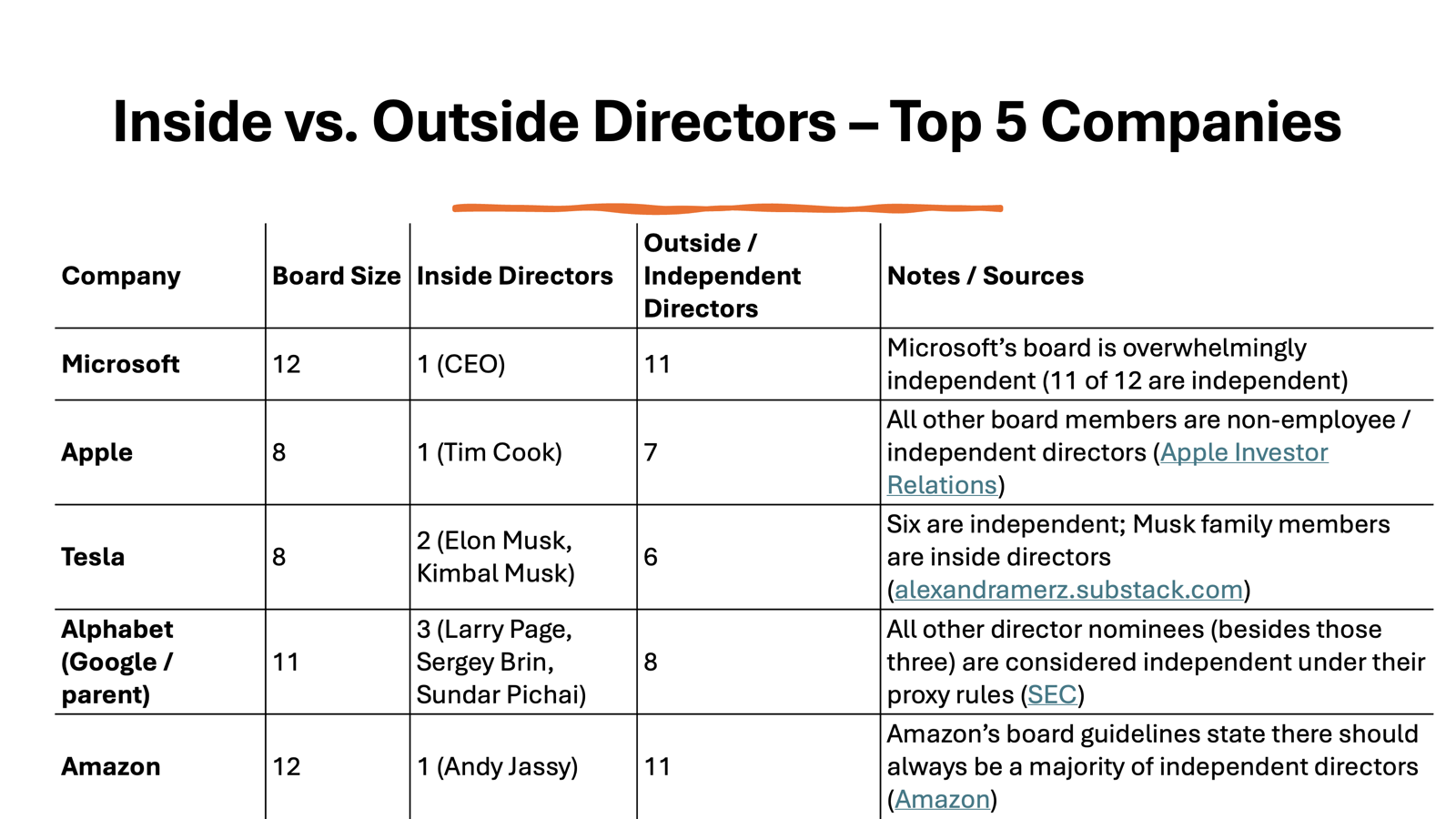

Inside vs. Outside Directors

Understanding the distinction between inside and outside directors is crucial for grasping board dynamics.

Inside Directors: These are typically members who hold executive positions within the company, such as CEOs or other senior managers. Their intimate knowledge of the company’s operations and internal challenges can drive strategy execution and operational efficiencies. However, it is important for inside directors to disclose any conflicts of interest that may arise from their dual roles to maintain transparency between management and board responsibilities.

Outside Directors: On the other hand, outside directors are not employed by the company. They bring independent and objective judgment to board discussions, leveraging their external perspectives and experiences. Their independence is essential for avoiding potential biases or conflicts that inside directors might have. Outside directors must also be cautious not to inadvertently disclose confidential corporate information. Additionally, with the support of a robust governance structure, outside directors can effectively contribute to identifying risks and ensuring compliance with regulatory standards.

Both inside and outside directors are necessary for a balanced board that can provide oversight and strategic vision. Including tools such as a board portal facilitates secure and effective communication, enhancing the input and decision-making process of the governing group.

Ideal Size of a Board

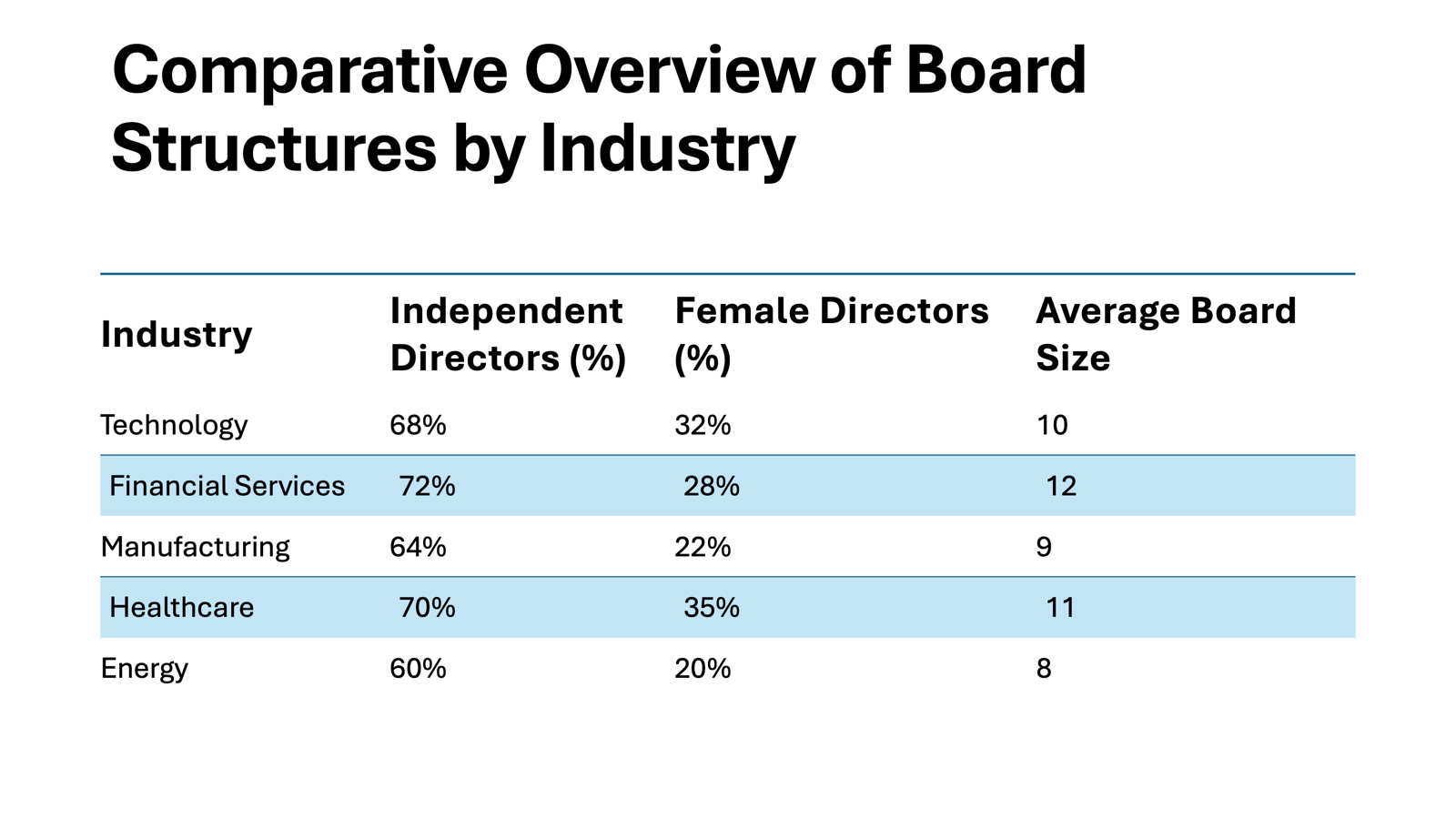

The ideal size of a board of directors can significantly impact its effectiveness and functionality. Generally, a board with 7 to 11 members strikes a comfortable balance for most organizations. This range allows for diverse perspectives and expertise while maintaining manageable group dynamics.

Smaller boards might struggle with limited viewpoints and an increased workload per member. On the other hand, larger boards can encounter challenges in decision-making, coordination, and maintaining engagement. Ultimately, the optimal board size depends on the organization’s complexity, industry, and specific governance needs.

What does the term board directorship mean

Board directorship refers to the role and responsibilities assigned to a member of a board of directors. It involves guiding the organization’s strategic direction, overseeing its management, and ensuring accountability to shareholders and stakeholders. Directors uphold governance standards, participate in decision-making, and protect the organization’s interests. This role requires a blend of expertise, impartiality, and dedication.

What is included in the job description of a board director?

A board director’s job description encompasses several key responsibilities aimed at steering an organization’s success. Primarily, directors are tasked with setting and approving organizational strategy and policies. They monitor executive leadership performance and ensure compliance with legal and ethical standards.

Additionally, directors must prepare for and actively participate in board meetings, bringing informed perspectives to discussions. Financial oversight is crucial, as directors review and analyze financial statements and budgets. They must also safeguard the company’s reputation by considering stakeholder interests and public perception.

Essential skills for this role include strategic thinking, financial acumen, leadership, and strong communication abilities. The position demands a commitment to continuous learning and staying updated on industry trends and governance practices.

Essential Roles and Responsibilities

The Role in Corporate Governance

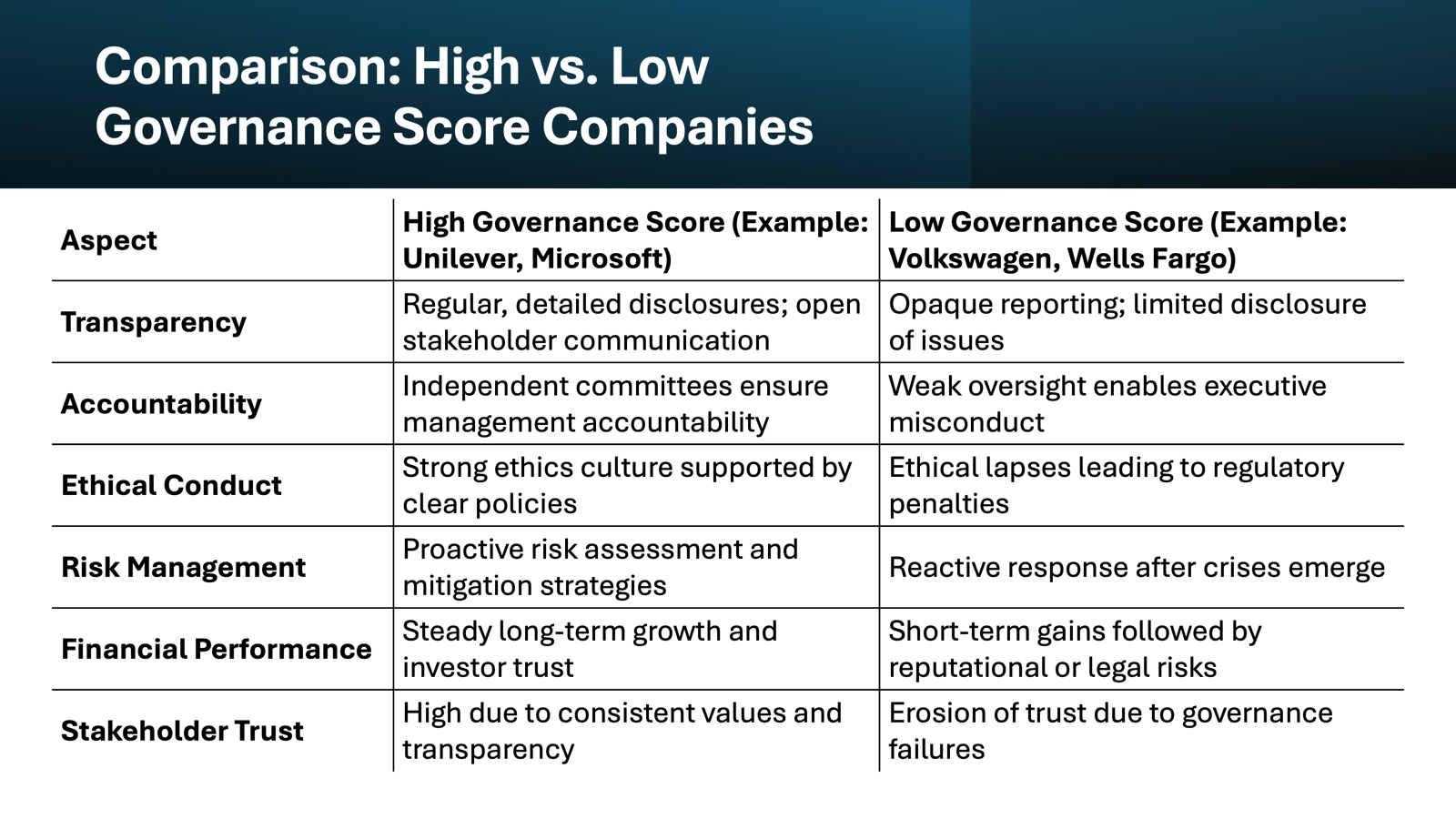

In corporate governance, the board of directors plays a pivotal role in defining and upholding the framework that ensures ethical conduct, accountability, and transparency within an organization. They establish governance policies that align with corporate goals while managing risks and evaluating strategic opportunities.

Their oversight responsibilities include enforcing compliance with regulations, evaluating management effectiveness, and auditing processes to maintain integrity and transparency in financial reporting. Through these functions, the board provides checks and balances to ensure that executive actions align with shareholder interests.

Additionally, the board is instrumental in shaping corporate culture and values, influencing everything from ethical standards to environmental and social responsibilities.

Fiduciary Duties and Ethical Considerations

Board directors are entrusted with fiduciary duties that require them to act in good faith for the organization’s best interest. This involves three principal responsibilities: the duty of care, the duty of loyalty, and the duty of obedience.

- Duty of Care: Directors must make informed decisions, exercising due diligence in evaluating business proposals and company affairs. This means understanding reports, attending meetings, seeking expert advice when necessary, and carefully overseeing executive compensation plans, which can impact corporate health.

- Duty of Loyalty: Directors must prioritize the corporation’s interests over their personal gains, avoiding conflicts of interest, including those arising from CEO compensation debates, and maintaining confidentiality about sensitive board matters.

- Duty of Obedience: Directors should ensure that the organization adheres to its mission, bylaws, and pertinent legal and ethical norms, serving as the backbone of effective governance. Failure to comply can lead to the prohibition of certain actions by the board and may necessitate reforms in governance practices.

Ethical considerations involve fostering transparency and cultivating a culture of integrity. By upholding these duties and ethics, directors protect the organization’s reputation, minimizing liability, and promoting stakeholder trust. In certain circumstances, inappropriate actions can prompt the removal of board members, especially if they breach fitness-to-serve rules. Another consideration is the hierarchy of responsibilities within the board, which must be managed to prevent de facto control by any single member.

Strategic Oversight Functions

The strategic oversight functions of a board are pivotal in guiding an organization toward sustainable success. Directors engage in high-level decision-making processes to shape long-term objectives and strategies. They evaluate the competitive landscape, assess potential risks, and determine growth opportunities. With an effective governance structure, directors save time by efficiently setting the board agenda, which involves prioritizing fundraising initiatives and shareholder nominations.

Proactive succession planning is crucial for maintaining continuity in leadership, especially when a board vacancy arises. By strategically planning for succession, directors ensure that new appointees can seamlessly integrate into existing operations, thereby sustaining the company’s strategic vision.

Actively monitoring the implementation of strategic plans, directors track key performance indicators (KPIs) to ensure alignment with the company’s goals. They challenge management’s assumptions, providing critical insights and alternative strategies if necessary. Additionally, directors play a crucial role in capital allocation, mergers and acquisitions, and major investment decisions, ensuring that every choice supports the organization’s strategic vision. Listed companies on major stock exchanges like NASDAQ and the New York Stock Exchange must often report on decisions concerning dividends and director compensation.

By effectively fulfilling these oversight functions, boards help create value, mitigate risks, and drive the organization toward long-term profitability and stability. Boards also ensure that C-suite leaders and other senior executives align with strategic goals, facilitating a smooth transition in leadership when necessary.

Building a Strong and Diverse Board

Importance of Skill Diversity

Skill diversity within a board of directors is a critical element for driving innovation and informed decision-making. A varied set of skills among board members allows for a broader perspective on challenges and opportunities, enabling the board to address complex issues more effectively. Engaging members through a board portal can streamline the process of gathering feedback, input, and meeting materials. Regularly seeking feedback and input from diverse skills ensures comprehensive discussions that lead to well-rounded conclusions. This diversity enhances problem-solving capabilities and equips the board to respond swiftly to industry changes and technological advancements.

Moreover, skill diversity helps mitigate risks through diverse risk assessment techniques and strategic thinking processes, promoting sustainable growth and competitive advantage. Governance structures that embrace skill diversity empower boards in hierarchy-less settings like collective boards.

By valuing skill diversity, organizations can utiliz a wider range of insights that contribute to dynamic and resilient leadership. Feedback offered by board members during decision-making ensures robust governance structures.

Demographic diversity within a board of directors significantly contributes to an organization’s adaptability, reputation, and overall performance. A diverse board that includes a range of ages, genders, ethnicities, and cultural backgrounds brings varied experiences and worldviews to the table, enhancing the board’s ability to understand and anticipate the diverse needs of stakeholders.

Studies have shown that companies with diverse boards often experience improved financial performance, as they are better positioned to reach broader markets and foster innovation. Demographically diverse boards can also boost the organization’s image, reflecting a commitment to inclusivity and social responsibility.

Moreover, demographic diversity helps prevent groupthink by encouraging healthy debate and varied perspectives, ultimately leading to more robust decision-making. By prioritizing demographic diversity, boards not only embody equity and inclusion but also drive a competitive edge in a dynamic business landscape.

Challenges and Opportunities

Navigating AI and Digital Transformation

As organizations face the wave of AI and digital transformation, boards of directors have the crucial task of steering these transitions strategically and responsibly. The rapid advancement of technology reshapes business models and operational processes, and boards must be equipped to understand and guide these changes. A board portal, often a secure website or mobile app, can facilitate communication among board members and enhance decision-making processes during these transitions. A primary role of the board is to assess how AI and digital tools can enhance operational efficiencies, improve customer experiences, and create new revenue streams. Directors should ensure that strategic investments in technology align with the organization’s goals and provide a clear ROI. Additionally, boards must address ethical and security implications associated with digital transformation, such as data privacy and algorithmic biases. They need to establish governance frameworks that ensure the responsible use of AI technologies. By cultivating a culture of continuous learning and staying informed about technological trends, board members can effectively support and oversee digital initiatives. Navigating these changes with foresight and responsibility positions the organization to capitalize on technological advancements while maintaining stakeholder trust.

Post-COVID Operational Changes

The COVID-19 pandemic has necessitated significant operational changes across organizations, and boards of directors are at the forefront of managing these transformations. One of the key areas of focus is enhancing organizational resilience. Boards have had to reassess risk management strategies, ensuring that crisis response plans are robust and adaptable to future disruptions.

Remote work technologies have transformed workforce dynamics, prompting boards to reconsider policies relating to workplace flexibility and employee well-being. Embracing digital collaboration tools and supporting mental health initiatives became priorities to sustain productivity and morale.

Boards also play a critical role in revisiting supply chain strategies, ensuring that they are resilient and diversified to avoid disruptions. Alongside this, directors must oversee adjustments in financial strategies to maintain liquidity and support strategic investments during recovery.

Given the pandemic’s impact on consumer behavior, boards need to encourage agile marketing and innovation strategies to meet evolving demands. The post-COVID landscape offers boards the opportunity to redefine operational strategies, promote sustainable practices, and enhance stakeholder trust.

Addressing Future Challenges

Boards of directors face an array of future challenges that require strategic foresight and adaptability. Climate change is at the forefront, necessitating proactive environmental strategies to mitigate risks and comply with evolving regulations. Boards should guide the organization in adopting sustainable practices and innovations that minimize their carbon footprint.

The ongoing evolution of technology presents another challenge, demanding that boards continually hone their digital literacy and cybersecurity vigilance. Directors must ensure that robust, proactive security measures safeguard against cyber threats while leveraging technology to drive competitive advantage.

Economic uncertainties and geopolitical tensions further complicate decision-making. Boards should prepare for market volatility by fostering financial resilience through diversified investments and strategic risk management.

Workforce dynamics continue to evolve, with the need for boards to address talent acquisition and development. Emphasizing diversity, equity, and inclusion within leadership and throughout the organization attracts top talent and promotes a positive corporate culture.

By preparing for these challenges, boards can position their organizations to not only navigate but also thrive amidst an evolving global landscape.

Embracing these challenges with strategic vision ensures long-term sustainability and success.

FAQs

What is the primary purpose of a board of directors?

The primary purpose of a board of directors is to govern and guide the organization, ensuring its strategic direction aligns with stakeholder interests. They provide oversight, establish policies, and monitor management performance. Additionally, they protect shareholders’ interests by making informed decisions that promote the organization’s long-term success and accountability.

How are board members typically appointed?

Board members are typically appointed through a nomination and election process. Shareholders vote for directors during the annual general meeting. The nomination committee recommends candidates based on their skills, experience, and alignment with the organization’s needs. This process ensures that the board is comprised of individuals who can effectively govern and guide the company.

Can a board influence company culture and talent?

Yes, a board can significantly influence company culture and talent by setting the tone at the top. They establish core values and policies that shape organizational behavior, foster an inclusive work environment, and prioritize talent development. Through strategic oversight and leadership selection, the board helps cultivate a positive culture and attract skilled employees.

How does diversity improve board performance?

Diversity improves board performance by bringing varied perspectives and experiences, which enhances decision-making and problem-solving. It fosters innovation through different viewpoints and reduces groupthink, leading to more robust discussions. Diverse boards better understand and relate to diverse stakeholders, improving insights into customer needs and market opportunities, ultimately driving better business outcomes.