KEY TAKEAWAYS

- One basis point is equivalent to 0.01%, clearly illustrating their minute measurement scale in financial contexts.

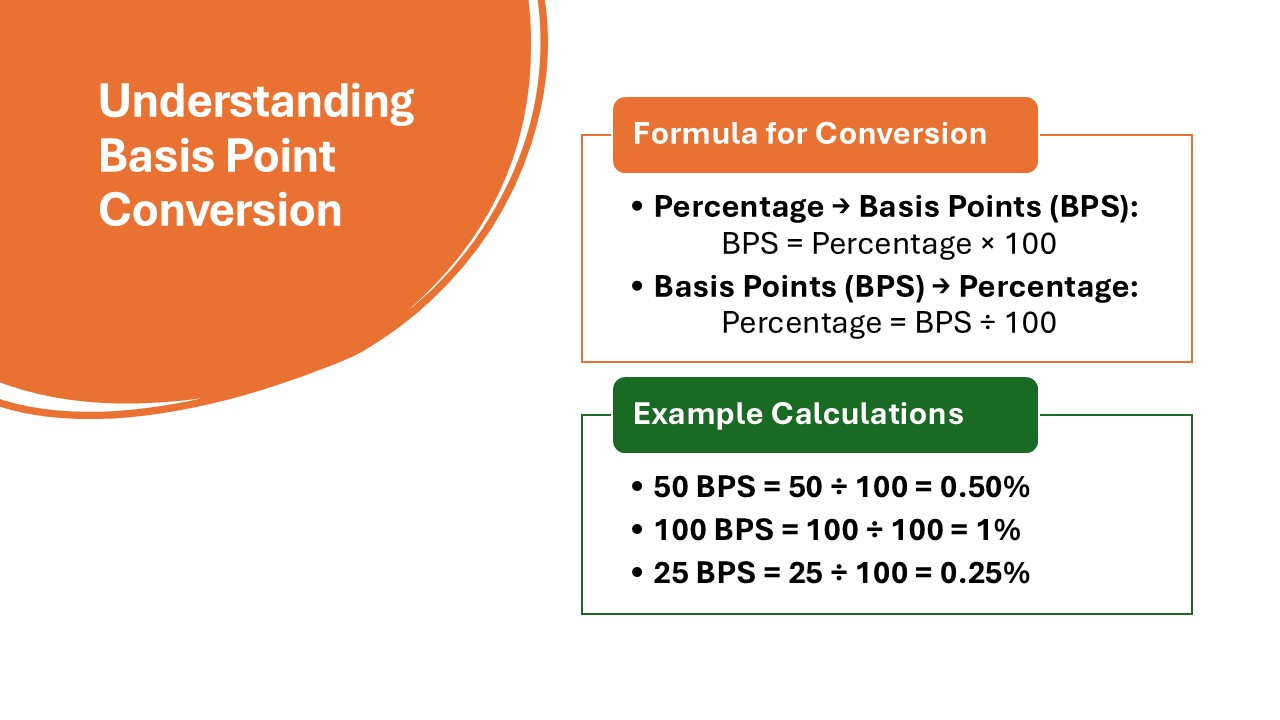

- To convert a percentage to basis points, multiply by 100; likewise, divide by 100 to convert basis points into a percentage.

- Basis points help simplify financial calculations, especially in scenarios involving small percentage changes such as interest rates or stock indexes.

Understanding Basis Points

Definition and Importance

Basis points (BPs) are a unit of measure used in finance to describe percentage changes. One basis point is equivalent to 0.01%, or 1/100th of a percent, making them integral for expressing small changes succinctly. Their importance cannot be overstated, as they allow for precise communication of rate changes, especially when dealing with interest rates, financial benchmarks, and securities. By using basis points, you can avoid potential misunderstandings that might occur with percentages, where changes could appear less significant than they truly are.

Common Uses in Finance

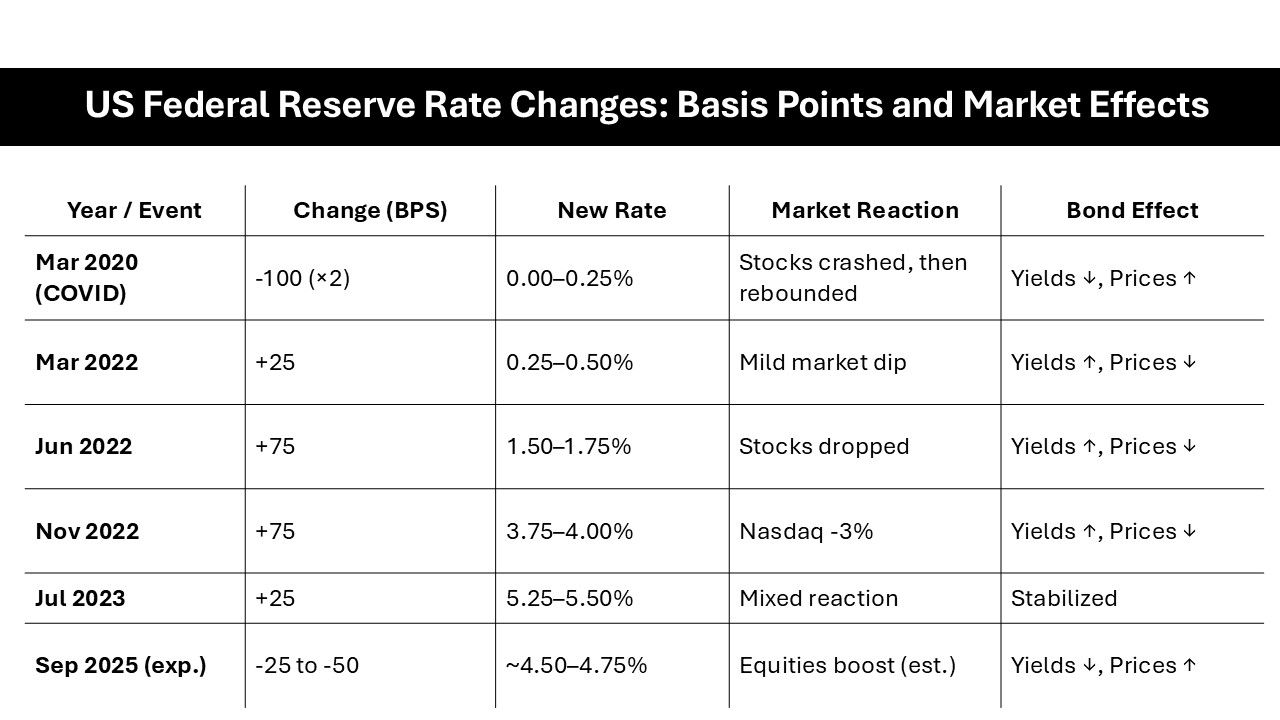

Basis points are widely used across various financial sectors to express the differences or changes in rates and percentages. In the world of investments, they’re critical for articulating shifts in interest rates, mutual fund fees, and yield spreads. For instance, when central banks like the Federal Reserve adjust monetary policies, the changes are often communicated in basis points to ensure clarity—each ‘beep’ signifies a crucial shift in monetary policy. Similarly, in corporate finance, bond yield changes and treasury bond rates are often described using basis points, illustrating the precise impact on bond prices without the ambiguity that can accompany percentage points. To further understand its practical usage, consider the recent increase in the Federal Reserve’s rate by 50 basis points, which significantly affected the dollar value against other currencies. Additionally, short-term investments like treasury bills also see rate fluctuations detailed in basis points. Credit derivatives may also reference basis points to describe pricing changes or risk assessments in lending markets.

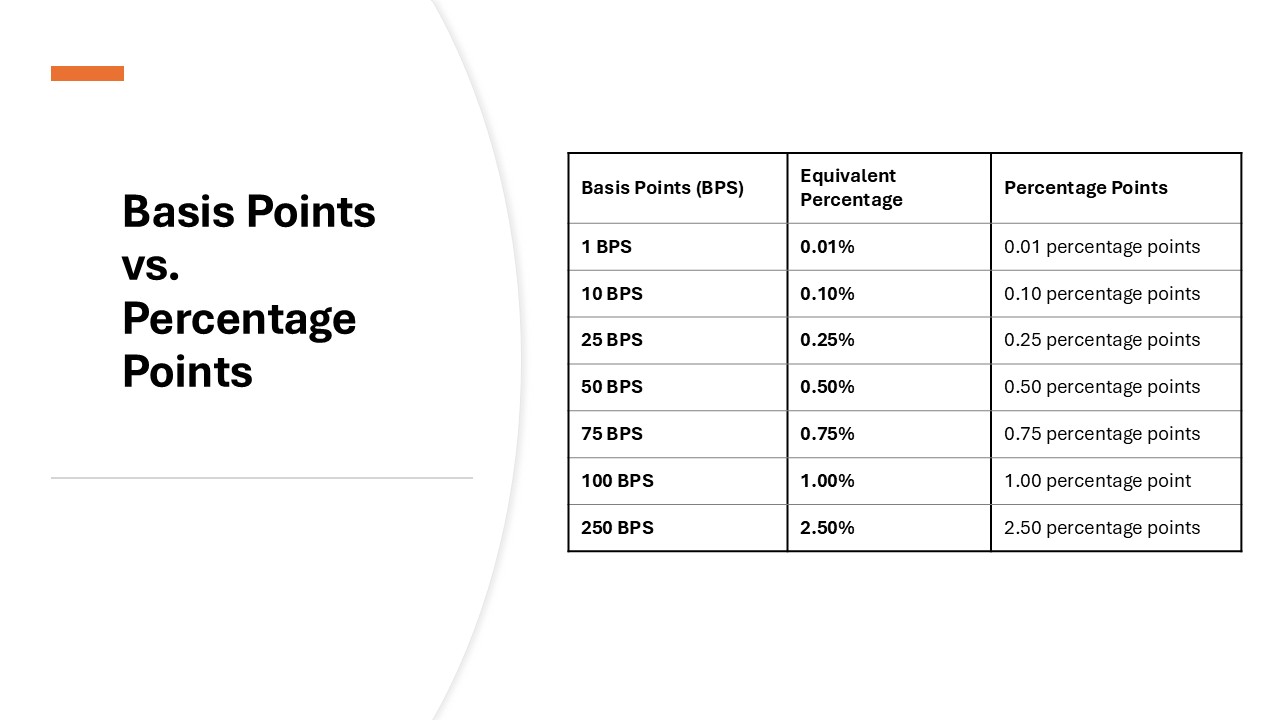

Basis Points vs. Percentage Points

While both basis points and percentage points convey changes in rates or values, they serve different purposes and levels of precision. A basis point is one-hundredth of a percentage point, equating to one permyriad, meaning that its granularity is better for describing minute fluctuations. For example, a 1% increase is equal to a 100 basis point increase, allowing for more accurate communications in scenarios where even small variations carry significant weight. This precision is crucial in fields like finance, where even a tick size can have substantial implications. On the other hand, percentage points are more suitable when large rate changes occur, such as reporting annual growth or declines. Using basis points helps prevent ambiguity, especially in finance, where precise measurements can lead to a better understanding of financial implications.

The Conversion Process

Simple Formula for Conversion

Converting basis points to percentages is a straightforward process. The formula is simple:

Basis Points ÷ 100 = Percentage

This means you divide the number of basis points by 100 to get the equivalent percentage. For instance, if you have 250 basis points, dividing 250 by 100 results in 2.5%, clearly demonstrating the proportional relationship. This concise formula ensures precise and quick conversions, critical for financial reports and analyses.

Practical Examples

Let’s explore some practical examples to cement the concept of converting basis points to percentages:

- Interest Rate Changes: Suppose a central bank increases interest rates by 50 basis points. Using the conversion formula, this becomes 0.5%, indicating a modest change that may significantly impact loans and mortgages.

- Investment Fund Fees: An investment fund reduces its management fee by 20 basis points. The percentage reduction is 0.2%, which might seem minor but could result in substantial savings over time, especially in large portfolios.

- Bond Yield Adjustments: A bond’s yield increases by 150 basis points. The percentage change is 1.5%, reflecting a considerable improvement in returns for bondholders.

These examples illustrate how even seemingly small changes in basis points can translate into impactful shifts in financial contexts.

Use Cases for Basis Point Conversion

Application in Mortgages

In the mortgage industry, basis points play a vital role in illustrating changes that directly affect borrowing costs. For instance, a 25 basis point increase in mortgage rates translates to a 0.25% rise, affecting monthly payments significantly over the loan’s term. This precision is crucial when comparing mortgage offers, as slight differences in rates can result in substantial financial implications over time. Homebuyers and homeowners looking to refinance must pay close attention to these shifts, as they directly impact loan affordability and overall long-term costs.

Investment Analysis and Comparisons

In investment analysis, basis points are frequently used to compare performance metrics between different assets and portfolios. For instance, when evaluating an investment’s expense ratio, a difference of just 10 basis points (0.10%) could lead to significant cost implications over time. Basis points are also vital in analyzing yield spreads between different bonds or financial products, helping investors assess potential returns and risks. Additionally, our basis point calculator can be a helpful tool for converting basis points to percents, permilles, or decimals, ensuring precise calculations. By providing a granular level of detail, basis points allow for more accurate and meaningful comparisons—vital for making informed investment decisions. In the fast-paced world of trading, having a precise understanding of these metrics is essential. Additionally, effective site navigation when accessing various listings of financial products can enhance decision-making.

Bonds and Interest Rates

Basis points are essential in the bond market, where even minute changes in interest rates can have profound effects on bond prices and yields. A change of, say, 100 basis points (1%) in interest rates can dramatically alter a bond’s yield, impacting both investors and issuers. For investors, understanding these changes can mean the difference between a profitable and a suboptimal investment. Similarly, issuers must consider how interest rate shifts could affect their borrowing costs and market conditions. Bonds, a form of fixed income securities often sensitive to interest rate fluctuations, thus demonstrate the critical nature of accurately measuring and responding to changes in basis points. Investment calculators can also be helpful tools for investors assessing bond yield impacts due to basis point changes. Additionally, financial instruments like treasury bonds and treasury bills are deeply intertwined with credit derivatives, which further highlights the complex interplay between different types of securities in response to basis point alterations.

Tools and Resources

Using a Basis Points Calculator

A basis points calculator is an invaluable tool for swiftly converting basis points into percentages, providing quick and accurate results essential in financial tasks. These calculators are typically user-friendly, requiring you to simply input the number of basis points. They instantly display the equivalent percentage, removing any potential for manual calculation errors. Whether embedded on a financial website or part of a dedicated app, these calculators enhance efficiency, enabling finance professionals and individual investors to make timely decisions.

Online Converters and Apps

For those frequently engaged in financial activities, online converters and mobile apps offer convenient solutions for basis point conversions. These tools typically feature intuitive interfaces that allow quick input of basis points to yield the equivalent percentage in seconds. Many apps extend functionality with additional features, such as tracking historical rate changes or comparing financial instruments across multiple currencies. These digital resources are ideal for professionals on-the-go who require precision and efficiency in their financial calculations.

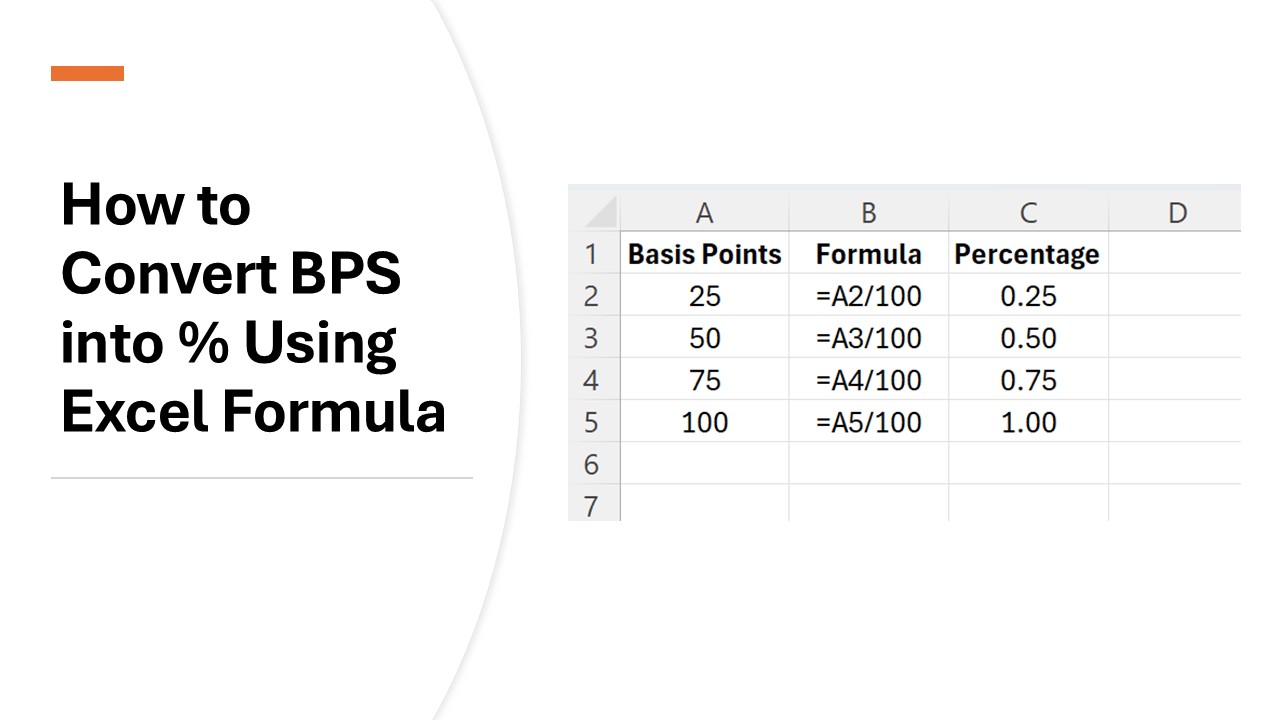

Excel and Spreadsheet Formulas

Excel and other spreadsheet applications offer robust capabilities for converting basis points into percentages, utilizing simple formulas for efficiency. By inputting a basic formula like “=A1/100” in a spreadsheet cell, where ‘A1’ contains the basis point value, you instantly calculate the percentage equivalent. This is particularly useful for big datasets requiring consistent calculations. Advanced users might integrate these conversions into larger financial models or dashboards, streamlining complex analyses. Spreadsheets can thus transform raw data into actionable insights effortlessly.

FAQ

How to calculate basis points? What is the formula for calculating basis points?

To calculate basis points, use the formula:

Basis Points (BPS)=Percentage (%)×100

For example, if you have a percentage change of 0.75%, you would multiply by 100 to get 75 basis points. This formula enables precise conversion between percentages and basis points, essential for accurate financial reporting.

What is 50 basis points in percentage terms?

50 basis points is equivalent to 0.50% in percentage terms. To convert, you simply divide the basis points by 100, arriving at the percentage. This conversion is essential for understanding rate adjustments reported in financial contexts.

How do I convert 0.25% to basis points?

To convert 0.25% to basis points, multiply the percentage by 100. This calculation results in 25 basis points. This simple conversion helps when precision in financial transactions and reports is required.

Why are basis points used instead of percentages?

Basis points are used instead of percentages for precision and clarity, particularly in financial contexts where minor rate changes can have significant impacts. They prevent ambiguity by clearly denoting small increments, crucial for accurate financial communication and analysis.

Are basis points applicable to all financial instruments?

Yes, basis points are applicable to all financial instruments where precise measurement of changes is needed, such as bonds, stocks, or loans. They offer a standardized way to express small changes, making them universally relevant across different financial sectors.

Can basis points be negative?

Yes, basis points can be negative, indicating a decrease in rates or values. Negative basis points are used to show reductions, such as when interest rates fall or fees decrease, reflecting declining financial metrics.