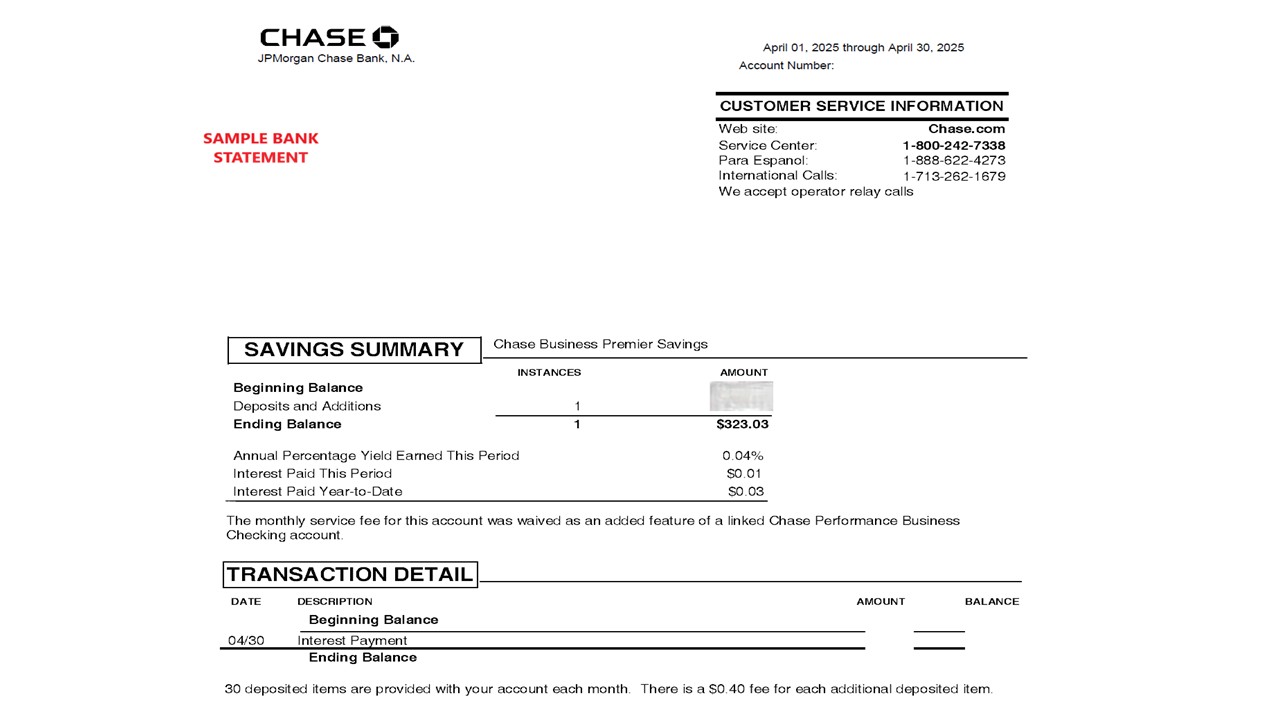

- Account Information: This section includes your account number, the statement period, your financial institution’s contact details, and account holder information. Understanding your basic account information is crucial for verifying the statement accurately.

- Summary of Account Activity: Here, you’ll find snapshots of your opening and closing balances, total deposits, total withdrawals, and any fees incurred during the period. This overview provides quick insight into your account’s overall activity within your bank deposit account.

- Transaction Details: A comprehensive list of every transaction, including dates, descriptions, and amounts. This section is akin to a bank statement template, where each entry helps you track your spending habits and confirm that all movements in your deposit accounts are authorized.

- Fees Charged: Details about any fees that have been applied, such as maintenance fees, overdraft fees, or ATM charges. Understanding these helps you avoid unnecessary charges in the future and manage expenses effectively beyond your means.

- Interest Earned: If applicable, this notes any interest accrued on your account balance, contributing to your total income. Each customer authorizes banks to hold funds in accounts for earning interest and facilitating check deposits.

By familiarizing yourself with these components, which include transaction history and receipts, you can more effectively manage your funds and address any discrepancies that may arise.

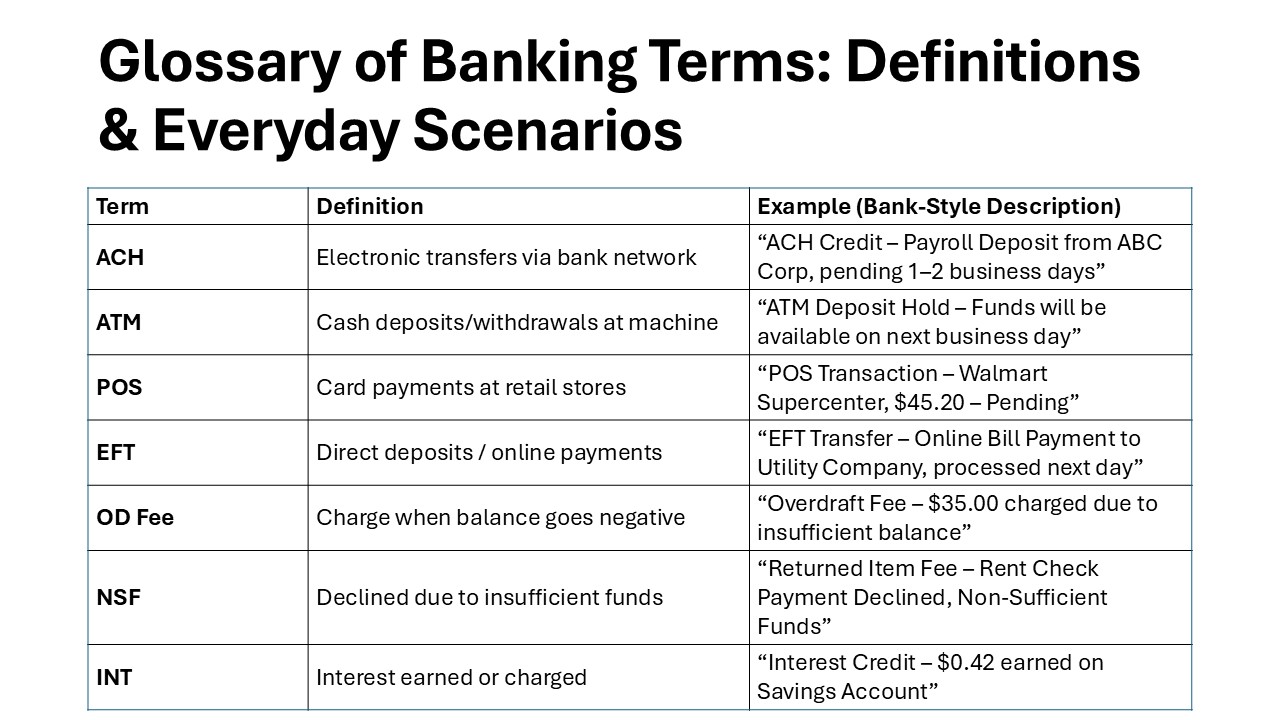

Common Abbreviations and Terms

Bank statements often employ a series of abbreviations and financial terms that can be confusing at first glance. Familiarizing yourself with these can aid in understanding your statement, whether through a printed copy, ATM statements, or a mobile banking app.

- ACH: Automated Clearing House, a network used for electronic payments and money transfers.

- ATM: Automated Teller Machine, which denotes cash withdrawals or deposits made through these machines.

- POS: Point of Sale, representing transactions made at retail locations via card payments.

- EFT: Electronic Funds Transfer, indicating transactions like direct deposits or online bill payments.

- OD Fee: Overdraft Fee, a charge applied when you withdraw more money than your account balance.

- NSF: Non-Sufficient Funds, referencing a transaction attempt that was declined due to insufficient funds.

- INT: Interest, often shown in the context of earned interest on savings accounts.

Understanding these abbreviations and terms ensures you can precisely interpret activities and fees on your statement, making it easier to maintain control of your finances. Enhance convenience by accessing your statement details via mobile banking or during your regular ATM transactions.

Step-by-Step Guide to Reading a Bank Statement

Checking Account Summary and Balance

The checking account summary is often located at the beginning of your bank statement, providing a snapshot of your financial activity over the statement period. It typically includes the opening and closing balances and summarizes the total deposits and withdrawals made during the period.

Each statement period begins with your closing balance from the previous period, furnishing a clear view of how funds have changed. The summarization of deposits gives you a count of various incoming funds, such as salaries, refunds, or transfers received. Likewise, withdrawals cover all expenses, be it bills, cash withdrawals, or point-of-sale purchases.

A keen glance at your balance helps assess your financial standing at any given time, allowing for timely financial decisions. Regularly reviewing this summary ensures you’re consistently tracking, managing, and adjusting your expenses.

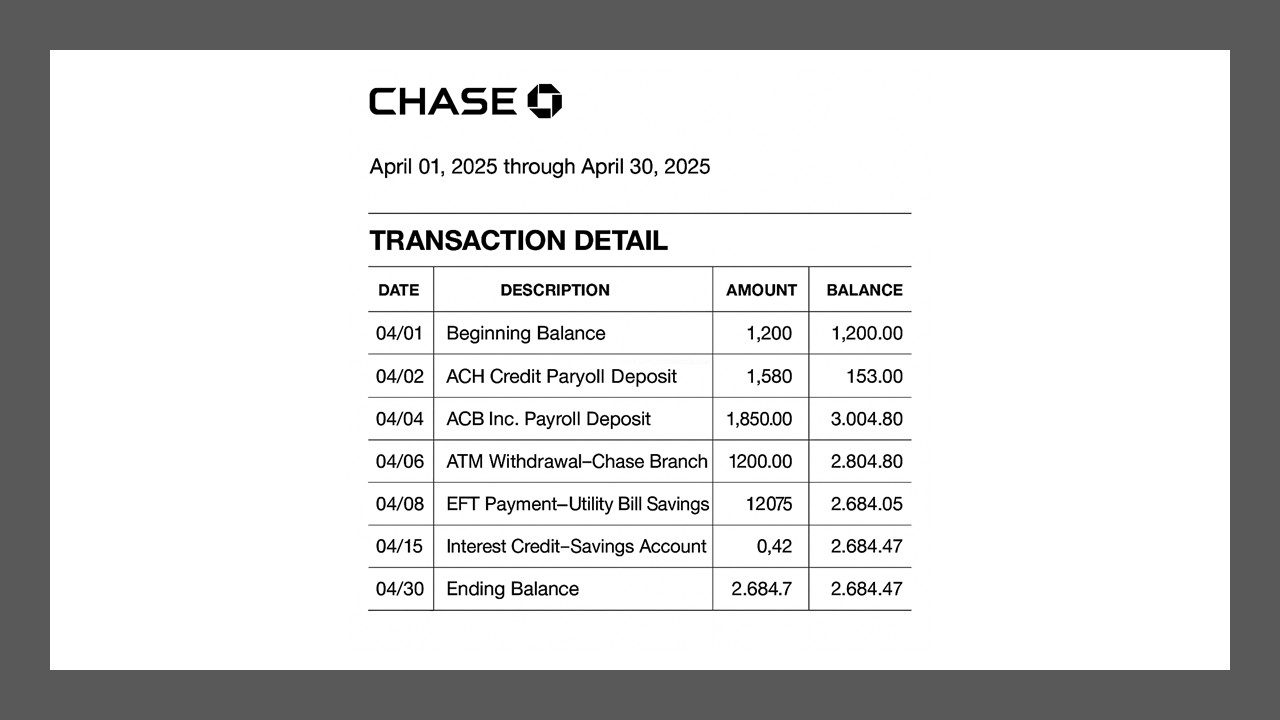

Reviewing Transaction Details

Transaction details provide a thorough record of all activities within your account for the statement period. Each transaction is typically recorded with the date, description, and transaction amount, providing a timeline of your financial interactions.

- Date: The day the transaction was processed. This helps in ensuring all activities are current and expected.

- Description: Offers a brief remark on the nature of the transaction, such as the merchant name for a purchase or the source for a deposit.

- Amount: The specific amount debited or credited, which aids in tracking precise financial changes.

By systematically reviewing these details, you can verify each transaction’s authenticity, thereby safeguarding against unauthorized activity. Also, it enables you to identify spending patterns, providing insights into budgeting and financial planning.

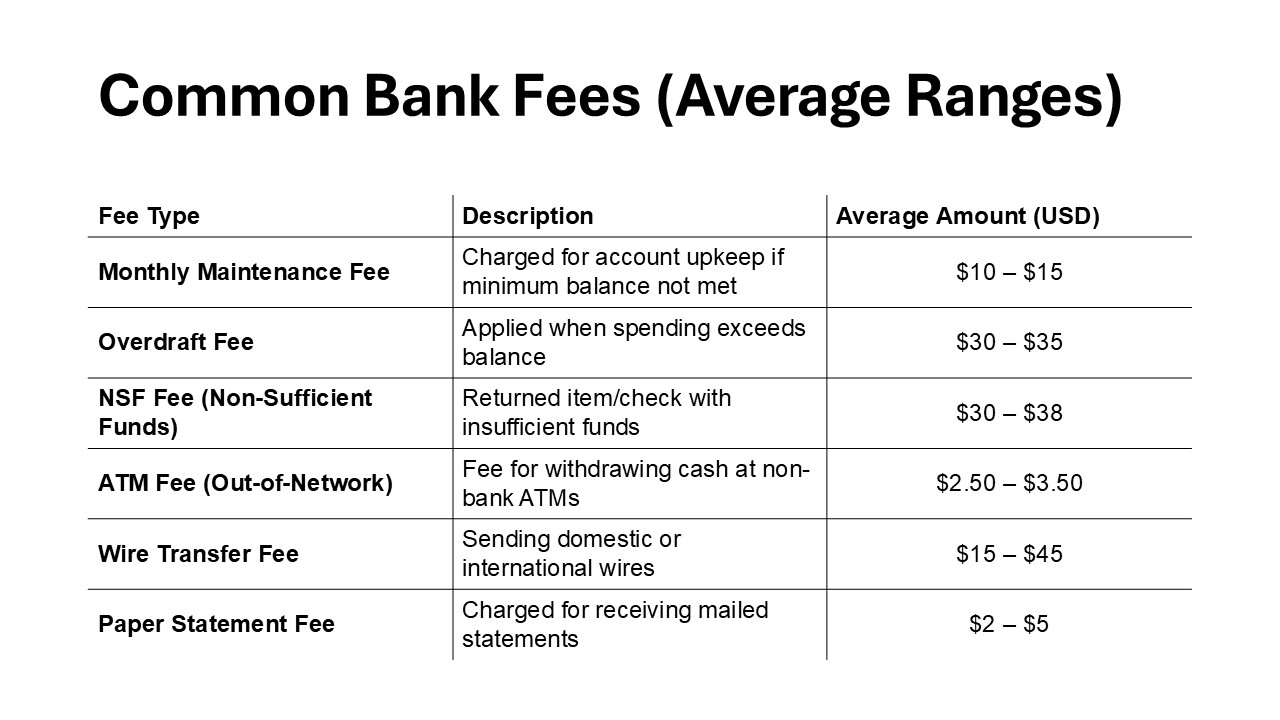

Identifying Fees and Interest Rates

Identifying fees and interest rates on your bank statement can help you manage costs and optimize your account usage. Bank statements offer financial transparency by detailing every transaction, allowing you to track where your money goes.

Fees: Banks often charge fees for specific services, such as monthly maintenance, overdraft, or ATM usage fees. In the overdraft section, these charges typically appear as negative amounts alongside a description explaining their nature. Understanding these charges allows you to pinpoint avoidable fees, maximizing your account’s efficiency.

Interest Rates: If your account accrues interest, the statement will highlight these earnings. Interest might be noted as a percentage, commonly referred to as APR (Annual Percentage Rate). The interest amount is often credited to your account, serving as a small but beneficial income. Being transparent about interest rates ensures customers know exactly how much they can earn.

By carefully analyzing both fees and interest rates, you can strategize on keeping costs minimal while potentially increasing earnings from interest. Consider integrating seamless connectivity with banking systems to get real-time analytics on these metrics.

Benefits of Regularly Reviewing Your Bank Statement

Spotting Errors and Fraudulent Activity

Regularly scrutinizing your bank statement is vital to spotting errors and detecting fraudulent activities swiftly, such as hidden instances of theft. Begin by checking each transaction against your records to ensure accuracy. Look for discrepancies such as duplicate charges, unexpected withdrawals, or fees that seem inconsistent with your account terms. Fraudulent activity can manifest as unknown transactions, where funds have been withdrawn or purchases made without your consent. If you identify any unauthorized activity, promptly report it to your bank to initiate an investigation and potentially recover lost funds. By maintaining vigilance, you can protect your financial health and prevent minor mistakes from escalating into larger issues. These measures not only help prevent fraud but also guard against potential theft.

Managing and Tracking Expenses Efficiently

Regularly reviewing your bank statement, whether accessed via a secure online banking platform or through a banking app on your smartphone or tablet, is a practical step toward efficient expense management and tracking. By examining each transaction, you gain a comprehensive view of your spending habits, allowing you to categorize expenses into needs and wants. This categorization enables you to adjust your budget, ensuring funds are allocated effectively toward priorities like bills, savings, and discretionary spending.

Moreover, tracking recurring expenses, such as subscriptions or memberships, helps you assess their value and necessity, potentially identifying opportunities to save. Aligning your budget with actual expenditures can also assist in setting spending limits in each category, preventing overspending and promoting overall financial health. Utilizing tools like budgeting apps or spreadsheets can streamline this process, providing easy visualizations of spending patterns over time.

Electronic vs. Paper Statements

Advantages of Going Digital

Choosing digital bank statements comes with a host of benefits that enhance convenience, accessibility, and eco-friendliness. With digital statements, you can access your banking information anytime and anywhere, eliminating the waiting time associated with traditional mail and allowing for real-time financial management. This ease of access is paired with a reduction in paper waste, contributing positively to environmental conservation efforts.

Moreover, digital statements often come with advanced features such as keyword search, which simplifies locating specific transactions quickly. They also facilitate easy integration with financial management apps and tools, helping you track and reconcile expenditures seamlessly. By opting for digital statements, you streamline organization and make information retrieval both efficient and straightforward.

Security Considerations

While digital bank statements offer numerous advantages, they also necessitate heightened security awareness. Protecting your digital financial data is paramount, given the rise of cyber threats. Always ensure your devices have up-to-date antivirus software and use robust, unique passwords for your online banking access.

Enable two-factor authentication whenever possible, adding an additional layer of security by requiring not just a password, but also a secondary verification method, like a text message or authenticator app. Be wary of phishing scams, which often masquerade as legitimate emails from your bank, and ensure any communication or login occurs through secure, trusted websites.

Regularly monitor your statements for unusual activity, as catching unauthorized transactions early is key to minimizing potential harm. By implementing these security measures, you can enjoy the convenience of digital statements without compromising your financial safety.

Tips for Effective Bank Statement Review

Tools and Resources for Accurate Reconciliation

Accurate reconciliation of your bank statements ensures that your financial records are up-to-date and discrepancies are quickly identified. Several tools and resources can aid in this process, making it more efficient and less prone to error by helping simplify the process of organizing financial data for accounting purposes.

- Budgeting Apps: Applications like Mint or YNAB (You Need A Budget) can automatically pull transaction data from your bank, categorize it, and allow you to compare it against your personal records.

- Spreadsheet Software: Tools like Microsoft Excel or Google Sheets provide customizable templates for manual reconciliation, giving you direct control over your budgeting formulas and transaction categories.

- Bank’s Online Tools: Many banks offer online platforms equipped with budgeting and reporting tools. These platforms allow you to set alerts for transaction thresholds or irregular activities, making it easier than ever to stay on top of your accounting.

- Financial Management Books and Guides: Books on personal finance often include reconciliation methods and tips, offering insights from experts for better practices.

- Professional Financial Services: Consulting with a financial advisor or accountant can provide insight into more complex reconciliation challenges, especially useful for managing business accounts. Delving deeper into your accounting books can also help ensure that any inconsistencies aren’t a red flag for fraud.

Leveraging these tools and resources not only saves time but also increases the accuracy of your financial reconciliation.

Maintaining Records and Compliance

Keeping organized records and ensuring compliance with financial guidelines is crucial for both personal and business finances. Here are some ways to maintain records effectively:

- Digital Filing System: Utilize cloud storage services like Google Drive or Dropbox to keep digital copies of your bank statements and related financial documents. This ensures accessibility and backup in case of data loss.

- Consistent Organizing Method: Whether you choose chronological, by category, or by month, maintain a consistent system for organizing statements. This makes it easier to locate specific documents when needed.

- Compliance with Legal Requirements: Ensure you adhere to financial regulations relating to record-keeping, especially if you’re running a business. This includes retaining documents for specified durations as required by law.

- Routine Audits: Regularly reviewing your documentation helps identify discrepancies or missing documents, giving you the chance to rectify these issues promptly.

- Secure Disposal: Sensitive information should be disposed of securely when it’s no longer necessary. Shredding hard copies ensures that your personal and financial data are not compromised.

These practices ensure your records contribute positively to financial planning and legal compliance.

FAQs

How long should I keep my bank statements?

Keep bank statements for at least one year. For tax-related purposes, retain statements supporting tax returns for three to seven years based on your situation. It’s best to check specific guidelines or consult a financial advisor for particular record-keeping needs. Digitizing statements can also help manage storage efficiently.

What should I do if I notice an error on my bank statement?

If you notice an error on your bank statement, promptly contact your bank’s customer service. Provide detailed information about the discrepancy, including the date and amount. It’s crucial to act quickly, as many banks have a limited timeframe for dispute resolution, typically within 30 to 60 days. Keeping documentation and a record of your communication helps facilitate a smooth resolution process.

Can I access my bank statements online?

Yes, most banks offer online access to bank statements through their websites or mobile apps. This digital access allows you to view, download, and print your statements at your convenience. Ensure to register your account online, and remember to secure it with strong passwords and enable available security features for safe access.

What does a bank statement look like?

A bank statement typically includes your account number, statement period, and financial institution’s contact details at the top. Following this is a summary section showing your opening and closing balances, total deposits, and total withdrawals. Below, you’ll find a detailed list of transactions, each with dates, descriptions, and amounts. Fees, interest earned, and any account notices might also appear.

How do I request a bank statement from my bank?

To request a bank statement, you can log into your bank’s online platform and navigate to the statements section. Many banks also allow you to request statements via their mobile app. Alternatively, you can visit a branch or contact customer service by phone. Specify the time period for the statement needed, and choose between digital or paper format if options are available.

What does a bank statement show each month?

A monthly bank statement provides an overview of your account activity, including the starting and ending balances. It details all transactions, splitting them into deposits and withdrawals with dates and descriptions. This includes ATM withdrawals, debit card purchases, bill payments, and any other debits. The statement also itemizes any fees charged and highlights interest earned if applicable. This comprehensive snapshot aids in monitoring financial health and budgeting.

To interpret a banking statement, begin by reviewing the account summary for a snapshot of balances and overall activity. Examine transaction details next, checking dates, descriptions, and amounts to understand spending patterns. It is crucial when dealing with taxes in the United States to pay special attention to transaction details, as they can help in budgeting and financial planning. Look at fees and charges to identify avoidable costs and understand interest entries if applicable. This process helps assess financial health and detect any anomalies. In this blog, we emphasize understanding bank statements’ significance, especially their role in preparing for tax filing.