KEY TAKEAWAYS

- Amortization refers to the systematic reduction in value of an intangible asset or the outstanding balance of a loan over time. For assets, such as copyrights or patents, this involves writing down their value over their useful life for accounting purposes, impacting both the income statement and balance sheet.

- For assets, the amortization process aligns with the matching principle of Generally Accepted Accounting Principles (GAAP), ensuring that expenses are recognized in the same period as the revenue they generate. Example: A EUR 1,000 television with a 10-year useful life would have an annual amortization of EUR 100.

- The concept of amortization also applies to loans, where it describes how the outstanding amount decreases through regular repayments over time. It is crucial for differentiating between the context of an asset or loan when discussing amortization.

Unpacking Amortization

Define Amortization

Amortization is the process of gradually reducing a debt over a specific period through scheduled, equal payments. These payments cover both the principal amount and interest, ensuring that by the end of the term, the debt is fully paid off. The technique ensures predictability and clarity in financial planning, making it an essential element in both personal and corporate finance by allowing for systematic payment of loans and an organized allocation of asset expenses.

Fundamental Definition and Concept

At its core, amortization represents the structured repayment of a loan or the systematic allocation of the cost of an intangible asset over its useful life. In the context of loans, every payment reduces both the principal and accrued interest, leading to eventual debt elimination. For intangible assets, such as patents or copyrights, amortization allocates the asset’s cost over the duration it’s expected to generate revenue or provide value, which enhances accurate financial reporting.

The primary aim is to match the expense recognition with revenue generation, which is critical for accounting accuracy and financial planning. This methodical approach helps in maintaining steady cash flows and precise accounting, whether you’re handling mortgage payments or managing assets on a balance sheet.

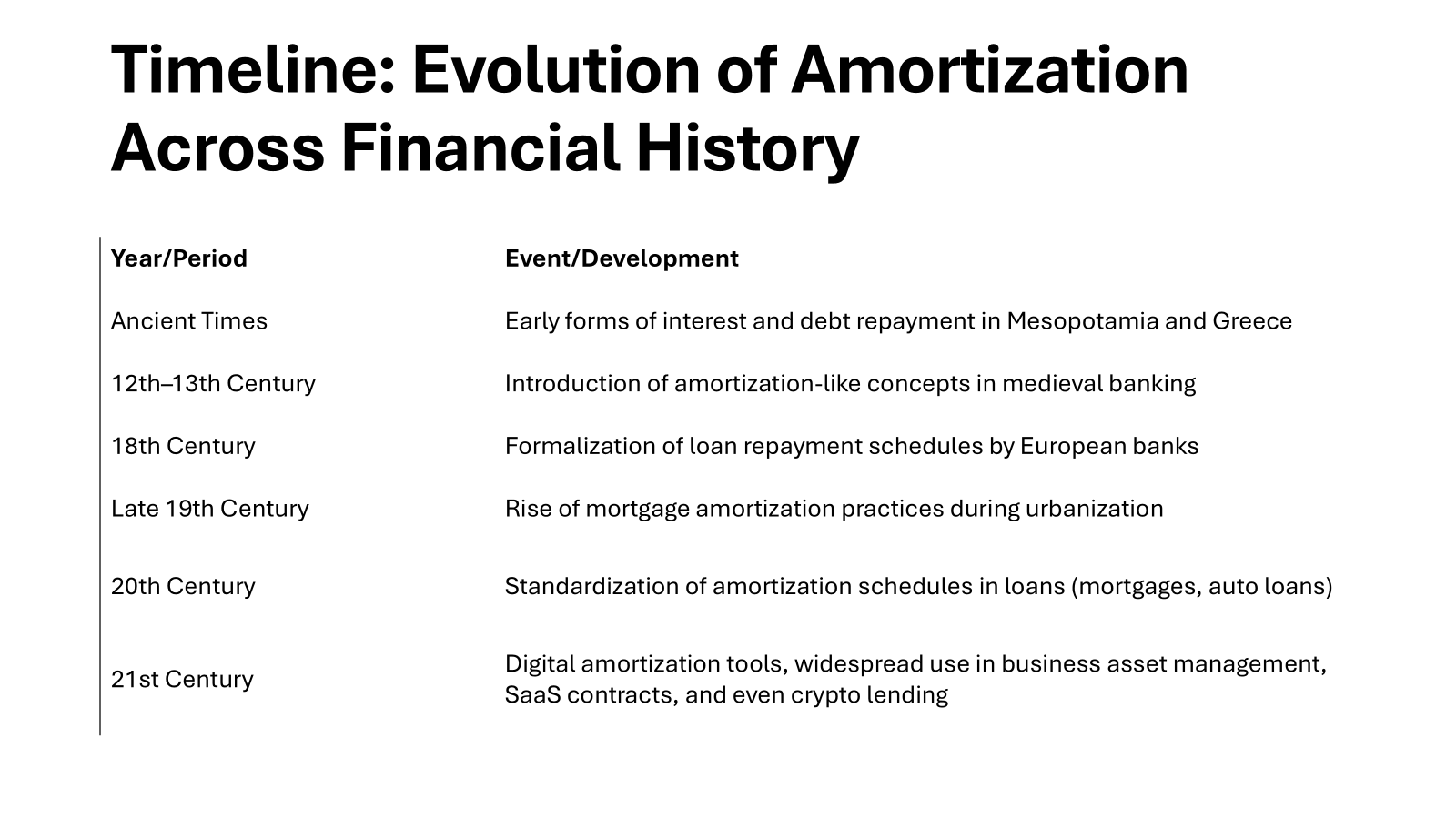

Historical Context and Evolution

Amortization, as a financial concept, has roots that extend back to when formal lending systems first emerged. Historically, principal payments on loans were only made at maturity, with interest paid periodically. As financial systems evolved, amortization became a critical solution to cater to rising needs for more predictable, manageable payments. This shift facilitated individual and business financial management, aligning expenses more appropriately with revenue streams.

The concept expanded beyond loans to intangible assets as economies recognized the need to allocate the costs of non-physical assets like patents or goodwill over their useful lives. This evolution helped standardize accounting practices, enhancing the accuracy of financial statements and ensuring companies could better track their asset investments over time.

The Mechanics of Amortization

How It Works in Loans

Amortization in loans refers to the process where the loan principal and the interest on the remaining balance are paid down over time in equal installments. Each payment reduces the outstanding balance, with early payments primarily covering interest while later ones focus more on the principal. This ensures that, over the term of the loan, the debt is fully repaid.

To better understand, consider a typical mortgage: monthly payments remain constant, but their composition shifts over time. Early in the schedule, interest takes up a larger portion of the payment, but as the principal decreases, the interest portion diminishes, allowing the principal repayment to accelerate.

By using an amortization schedule, you can plan finances more effectively, as it provides a detailed payment breakdown and shows how quickly you’ll repay the principal. This approach lends predictability, making it easier to budget for monthly expenses and longer-term financial commitments.

Examples in Intangible Assets

Amortization applies to intangible assets by spreading their cost over their useful lives, acknowledged in equal installments on a company’s financial statements. For instance, if your business acquires a patent valid for ten years at $10,000, you would amortize $1,000 annually. This approach systematically reduces the asset’s book value over time and reflects its consumption or use.

Other examples encompass copyrights, trademarks, and goodwill, each requiring tailored amortization schedules according to their expected economic benefit period. It’s notable that intangible assets, unlike physical ones, often lack residual value at the end of their useful life. Thus, amortization ensures that the cost is systematically recognized to match the revenue they generate.

Understanding these principles helps maintain accurate records, offering insights into the true value and remaining useful life of your intangible assets.

Amortization vs. Depreciation: Know the Difference

Key Differences Explained

Amortization and depreciation both refer to the process of allocating the cost of an asset over its useful life. However, they apply to different kinds of assets and are used under distinct contexts. Amortization pertains to intangible assets like patents and copyrights, allocating their cost evenly over a predetermined timeframe. Depreciation, on the other hand, applies to tangible assets, such as machinery and buildings, and often utilizes various methods like straight-line or declining balance to reflect their wear and tear.

Another key difference lies in how these processes impact cash flow. Depreciation can sometimes offer tax advantages before the actual cash outlay for replacing an asset, whereas amortization directly correlates with the asset’s expected economic life, without tax incentives typically associated with physical depreciation.

By understanding these differences, you can more effectively manage asset reporting and financial strategies, aligning them with your business’s long-term goals.

When to Use Each Method

Choosing between amortization and depreciation depends on the type of asset your business is dealing with. Use amortization when you have intangible assets that require cost allocation over their useful lives, such as patents, trademarks, or other intellectual properties. This method ensures that those non-physical assets are systematically expensed in line with the economic benefits they provide.

Depreciation is appropriate for tangible assets like vehicles, industrial equipment, or office buildings. Select this method to account for physical wear and tear over time, spreading the cost based on an asset’s lifespan, which varies depending on estimated usage patterns or regulations.

Ultimately, both methods aim to match asset costs with income generation. Determining which method to use ensures your financial records accurately reflect asset value and helps in crafting efficient financial strategies.

Types of Amortization Schedules

Fixed vs. Variable Rate Schedules

Amortization schedules can fall into two main categories: fixed rate and variable rate. A fixed-rate schedule means your interest rate remains unchanged throughout the loan term, resulting in predictable monthly payments. This can be advantageous for budgeting, as you always know your financial commitment irrespective of market fluctuations. It’s an ideal choice if you prefer stability and a clear financial outlook.

In contrast, a variable rate schedule involves an interest rate that may change based on market conditions or a benchmark rate. This means your payments can vary over time. While this can potentially lead to lower payments if rates decrease, it also poses the risk of higher payments if interest rates climb. Variable schedules can be beneficial if you anticipate market rates will decline or if you want initially lower payments.

Your decision between fixed and variable should align with your risk tolerance and forecast of interest rate trends.

Real-life Examples

To better understand how amortization schedules work in real life, consider these examples:

- 30-Year Fixed-Rate Mortgage: Imagine you take a $300,000 mortgage at a fixed rate of 3.5% over 30 years. Your monthly payment remains constant at approximately $1,347. As you progress through the term, this schedule shows a gradual shift from paying interest to reducing the principal balance.

- Auto Loan with Variable Rate: Suppose you have a car loan of $25,000 with a variable interest rate starting at 2.5%. Initially, your payments might hover around $450 monthly, but as rates adjust, your payments could fluctuate, offering both savings and potential increases.

- Commercial Real Estate Loan: A business takes a $1 million loan for a property with a fixed 5% interest rate over 20 years. The detailed schedule helps the business plan and manage cash flows effectively, showcasing larger interest portions initially, decreasing over time.

Such examples highlight the real-world applicability of amortization, assisting individuals and businesses in strategically planning their finances over time.

Benefits of Understanding Amortization

Improving Financial Literacy

Understanding amortization significantly boosts financial literacy by simplifying the repayment structures of common financial products like loans and mortgages. By grasping how each payment reduces both interest and principal, you’ll make informed decisions about borrowing, refinancing, or investing. Furthermore, recognizing amortization concepts applied to intangible assets helps you understand expense allocation and asset valuation in financial statements.

Such knowledge empowers you to manage debts better, plan budgets effectively, and understand the long-term implications of financial commitments. Enhanced financial literacy leads to improved financial health, smart investment choices, and more robust financial strategies.

Strategic Financial Planning

Incorporating amortization into your strategic financial planning offers several advantages. By understanding how amortization works, you can align debt repayment schedules with cash flow forecasts, ensuring that you have enough liquidity to meet other financial obligations and opportunities. This strategic alignment allows for a more predictable financial future, letting you plan major expenses and investments with confidence.

Amortization also enables a precise understanding of asset valuation over time, crucial for long-term investment strategies and resource allocation decisions. By knowing when a loan will be paid off or how an asset’s value will decline, you can better gauge when to reinvest in new projects or save for upcoming expenditures.

The insight gained from amortization schedules aids in negotiating better loan terms and creating synergies between debt management and growth objectives, fostering a comprehensive approach to personal or business financial strategy.

Special Considerations in Amortization

Commercial Real Estate Financing

Amortization plays a pivotal role in commercial real estate financing by determining how the cost of a property or loan is spread over time. Typically, commercial property loans have longer amortization schedules than residential loans, often extending up to 25 or 30 years. However, the loan term itself might be shorter, necessitating a balloon payment—where the remaining loan balance must be paid off at the end of the term.

Understanding amortization in this context helps in managing cash flows, as it offers predictable monthly payments that cover both the principal and interest. It also aids in long-term strategic planning, allowing businesses to forecast when major expenses like refinancing or property upgrades will be viable.

Using amortization effectively, businesses can maximize real estate investments by aligning payment schedules with expected income from the property, such as rental income, ensuring stable and strategic financial operations.

Risks and Challenges to Watch

Engaging with amortization in the context of loans and asset management comes with its own set of risks and challenges. One major risk is interest rate volatility, particularly with variable rate loans, which can lead to unexpected increases in payment amounts, affecting cash flow and profitability. For businesses and individuals, this uncertainty can complicate financial planning and budgeting efforts.

Another challenge arises from the potential mismatch between amortization schedules and asset usefulness. If an asset becomes obsolete faster than expected, you might face financial strain from continuing to amortize beyond its productive life. This misalignment can also impact investment decisions, potentially leading to suboptimal resource allocation.

It’s crucial to constantly review and adjust financial strategies in response to changing circumstances. Staying proactive about these risks ensures you’re prepared to mitigate their impact, maintaining stability and nimbleness in your financial operations.

Conclusion

Amortization is an accounting technique used to gradually reduce the book value of an intangible asset or to allocate the cost of a loan over a period of time. According to the dictionary, amortization (noun) refers to the process of writing off the initial cost of an asset over its useful life. This method is commonly applied to intangible assets such as patents, trademarks, and goodwill. The calculations involved in amortization help businesses spread out the expense of these assets, making it easier to manage their financial statements and tax obligations.

When it comes to taxes, amortization can provide significant benefits. By amortizing the cost of an intangible asset, a business can reduce its taxable income over several years, rather than taking a large expense in a single year. This gradual expense recognition can lead to tax savings and improved cash flow management. Additionally, lenders often look at a company’s amortization practices to assess its financial health and stability. Proper amortization can enhance a company’s creditworthiness and make it more attractive to potential lenders.

In the context of loans, amortization refers to the process of spreading out loan payments over time, typically through regular installments that cover both principal and interest. This method ensures that the loan is paid off by the end of its term. The calculations for loan amortization involve determining the periodic payment amount, which remains consistent throughout the loan’s life. This consistency helps borrowers manage their finances more effectively and provides lenders with a predictable repayment schedule.

Amortization also plays a role in the valuation of liabilities. By systematically reducing the book value of a liability, businesses can better reflect their financial position. This process is essential for maintaining accurate financial records and ensuring compliance with accounting standards. Whether you’re browsing a blog on financial management or consulting with a syndicate of financial advisors, understanding the meaning and application of amortization is crucial for making informed decisions. I agree that mastering this accounting technique can significantly impact a company’s financial health and strategic planning.

FAQs

What is the meaning and definition of amortisation?

Amortization refers to the process of gradually paying off a debt over time through scheduled payments of principal and interest, or the systematic write-down of an intangible asset’s cost over its useful life. It helps manage debt repayment and calculate asset value over specified periods.

What are the benefits of amortizing a loan?

Amortizing a loan provides predictable monthly payments, which helps in budgeting and financial planning. It reduces the principal over time, decreasing interest costs in the long run and ensuring full repayment by the loan’s end. This approach offers clarity and financial discipline.

How is an amortization schedule created?

An amortization schedule is created by determining the loan term, interest rate, and loan amount. It then breaks down each payment across the term into interest and principal portions. This schedule illustrates how each payment reduces the principal and how much interest is paid over time.

Why do companies prefer amortization over depreciation?

Companies prefer amortization for intangible assets because it aligns expenses with the revenue generated over the asset’s useful life. Amortization applies consistently without variable valuation methods, providing straightforward financial reporting and enhancing budgeting predictability.

What are common pitfalls with loan amortization?

Common pitfalls with loan amortization include underestimating interest payment amounts, overlooking fees that alter payment schedules, and not accounting for changes in variable interest rates, all of which can disrupt financial planning and increase long-term costs.

Can intangible assets be amortized?

Yes, intangible assets, such as patents, trademarks, and copyrights, can be amortized. This process spreads their cost over their useful life, aligning expense recognition with the periods they provide economic benefits, thereby ensuring accurate financial reporting.

How do you calculate amortization using a formula?

Amortization is calculated using the formula:

where ( A ) is the payment amount, ( P ) is the principal, ( r ) is the monthly interest rate, and ( n ) is the total number of payments. This formula helps determine uniform payments over the loan’s life.

What is mortgage amortization?

Mortgage amortization is the process of paying off a home loan over time through regular payments. Each payment comprises both principal and interest, gradually reducing the overall loan balance until it’s fully paid off by the end of the loan term.