Understanding Accounts Payable (AP)

Definition and Functionality

Accounts Payable (AP) involves the financial obligations a company owes to its suppliers for goods and services received. It represents short-term debts or liabilities that need to be settled, usually within a specified period. The primary function of AP is to manage these liabilities efficiently, ensuring timely payments to avoid late fees or potential damage to the company’s creditworthiness. Properly executing AP practices not only preserves valuable supplier relationships but also helps maintain an organization’s reputation and operational stability.

In a nutshell, AP is about organizing and tracking the money that flows out of the company. This includes verifying and processing invoices, authorizing payments, and recording transactions accurately in the financial records. By keeping these operations in check, businesses can ensure compliance, avoid financial penalties, and sustain positive relationships with their supply chain partners.

KEY TAKEAWAYS

- Accounts payable (AP) represents the money a company owes to its suppliers. It focuses on managing cash outflows, mitigating risks through timely payments, and handling vendor relationships. This process often carries a heavier administrative burden due to the complexities of validating and processing varying invoices, securing necessary approvals, and tracking decentralized spending across departments.

- Accounts receivable (AR) refers to the money customers owe the company. It emphasizes optimizing cash inflows, nurturing customer relationships, and minimizing overdue payments or bad debts. The process is generally more streamlined than AP, involving standardized invoicing and payment collections from customers.

- Understanding the distinction between AP and AR is crucial as they directly influence cash flow, financial statements, and business operations. Balancing these processes ensures accurate representation between asset and liability accounts on a balance sheet for both large and small businesses alike.

Process Flow in Businesses

The accounts payable process flow involves a series of key steps designed to ensure accurate and timely financial transactions through the accounting process. Here’s an overview of the typical process:

- Receival: When a business purchases goods or services, it receives an invoice from the supplier requesting payment. This invoice marks the initiation of the AP process.

- Record: The received invoice is recorded in the accounts payable ledger, capturing the invoice amount. Businesses often use accounting software to automate this step, leveraging technologies like invoice scanning and optical character recognition (OCR) to reduce manual input and errors.

- Match: To verify the accuracy of billing, the invoice is often matched with corresponding documents such as purchase orders, shipping receipts, and inspection reports. This step ensures that invoices are consistent with the agreed terms.

- Approval: The invoice must undergo a set of internal controls and an approval process. This helps confirm the legitimacy of the payment and that it aligns with the company’s financial strategies and obligations.

- Payment: Finally, the approved invoice is paid according to the terms set out by the supplier. This step often includes scheduling payments to optimize cash flow while ensuring timely settlement to avoid any late fees. Once paid, the transaction is cleared from the account by processing a debit cash entry, reflecting a withdrawal from the company’s resources. An accounting system may assist in managing these transactions efficiently.

An effective AP process is crucial for maintaining financial stability and fostering trust with suppliers. Implementing automation solutions to streamline this process can lead to discounts and better terms with suppliers, ultimately benefiting the company’s bottom line.

Common Challenges in AP Management

Managing accounts payable comes with a myriad of challenges that can impact a business’s financial health. One significant issue is the lack of visibility into decentralized spending across various departments. Without a cohesive overview, companies may struggle to track expenses accurately, leading to potential budget overruns or missed cost-saving opportunities. Additionally, reconciling debit and credit transactions can be intricate, particularly when dealing with interest receivable or handling a debit balance in accounts.

Another challenge is ensuring timely approvals and payments. Manual approval processes can result in bottlenecks, delaying payments and possibly incurring late fees or damaging supplier relationships. To combat this, many companies aim to transition to automated solutions, which streamline authorizations and ensure efficiency. Effective automation can also aid in managing matters such as fo supplies, ensuring that resources are managed optimally.

Errors in invoice data entry are a common concern in AP management. These inaccuracies can result in overpayments, underpayments, or disputes with suppliers. Implementing regular checks and adopting technology like OCR can mitigate these errors significantly.

Fraud prevention remains a critical challenge, with AP departments being particularly vulnerable to fraudulent invoices or unauthorized transactions. Establishing robust internal controls and conducting audits can help safeguard against these threats.

Lastly, managing supplier inquiries efficiently is crucial. A high volume of queries regarding payment status can overwhelm AP teams, hindering their efficiency. Providing suppliers with a self-service portal or clear communication channels can alleviate this pressure.

Delving into Accounts Receivable (AR)

Definition and Role

Accounts Receivable (AR) refers to the outstanding invoices a company has or the money it is owed by clients for goods or services delivered on credit. Essentially, AR represents a company’s pending incoming cash from its customers. This accounts for a company’s short-term assets on the balance sheet and is pivotal for maintaining cash flow and financial stability.

The role of AR is to effectively manage the credit extended to customers and ensure timely collections. This involves maintaining accurate records of customer transactions, invoicing according to agreed terms, and monitoring accounts for overdue payments. Efficient AR management is critical as it impacts liquidity directly, influencing the company’s ability to meet its financial commitments, such as payroll and supplier payments.

By diligently managing AR, businesses can reduce the risk of bad debts, optimize cash flow, and establish stronger customer relationships by offering flexible payment terms.

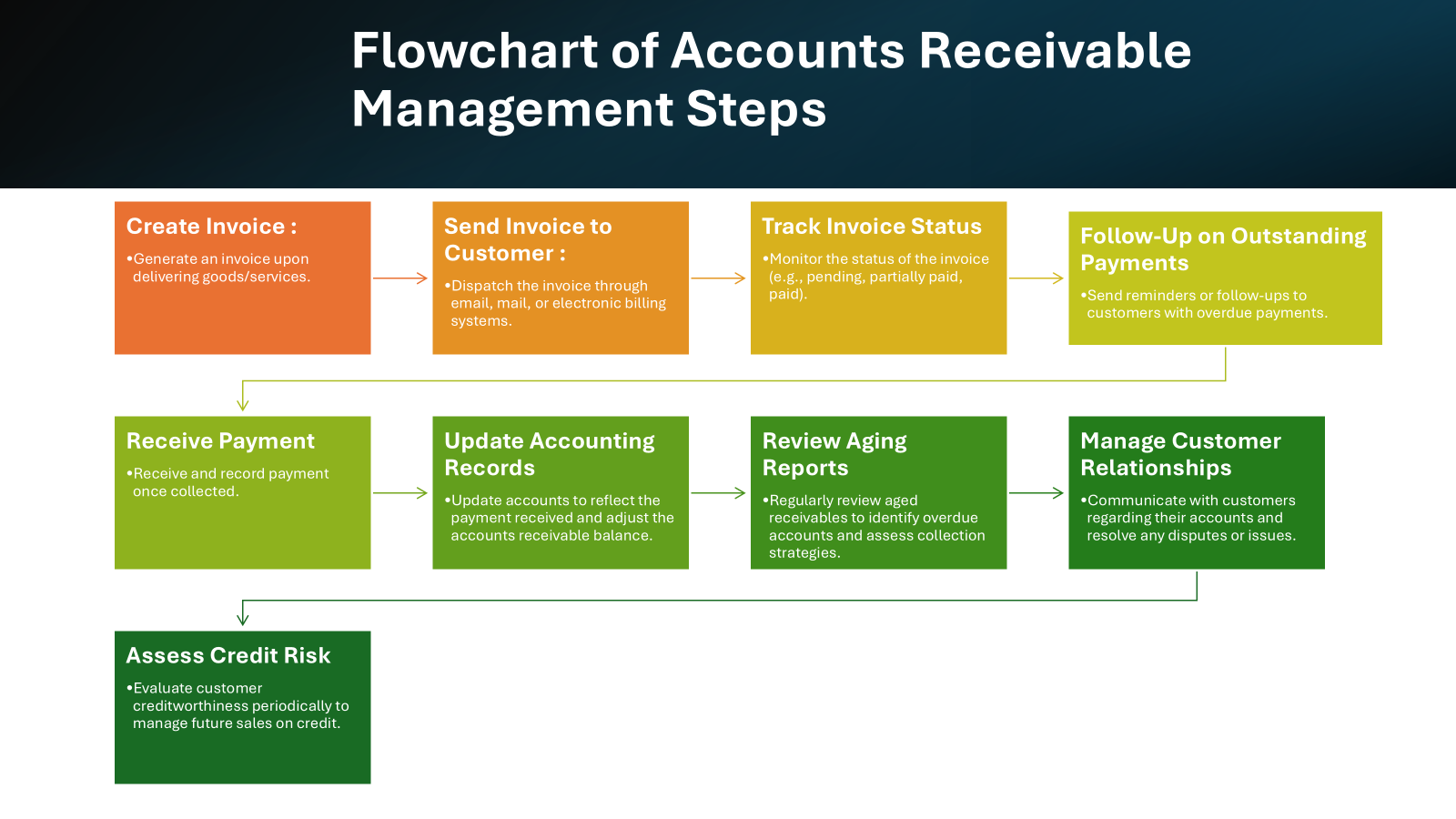

Steps in Managing AR Effectively

Managing accounts receivable effectively is crucial to ensure a company maintains healthy cash flow and minimizes bad debt risks. Here’s a step-by-step guide to optimizing AR management:

- Credit Policy Establishment: Define clear credit policies, specifying terms and conditions, including credit limits and payment deadlines. This sets expectations and reduces misunderstandings.

- Customer Vetting: Conduct thorough credit checks for new clients before extending credit. This reduces exposure to high-risk customers and potential defaults.

- Accurate Invoicing: Issue invoices promptly and ensure they are accurate, complete, and in line with the agreed terms. Use invoicing software to automate this process, reducing the chance of human error.

- Timely Follow-Ups: Implement a system for regular follow-ups with clients on outstanding payments. This might include reminder emails or calls that escalate in frequency and urgency as the due date approaches.

- Flexible Payment Options: Offer multiple payment options to facilitate easier customer payments. Providing varied methods like bank transfers, credit cards, or digital wallets can speed up collections.

- Monitor Metrics: Track AR metrics such as Days Sales Outstanding (DSO) to measure the efficiency of collections. Regularly analyzing these metrics can identify trends and areas forimprovement, ensuring the company can adapt its strategies effectively.

- Develop Relationship Management: Engage proactively with customers, especially those with payment challenges. Use customer relationship management (CRM) tools to document interactions and tailor approaches to individual circumstances.

- Implement Incentives: Introduce rewards for early payments, such as discounts, fostering quicker turnover of receivables and strengthening customer loyalty.

By following these strategic steps, businesses can enhance their AR processes, reduce outstanding receivables, and support a more stable cash flow.

Typical Issues Faced with AR

Managing accounts receivable effectively often presents several challenges that can impact cash flow and financial health. A common issue is delayed payments from customers, which can tie up cash and result in a liquidity crunch. This delay often occurs due to inefficient invoicing processes or lack of follow-up, leading to increased days sales outstanding (DSO).

Another issue is discrepancies in invoices, which can arise from errors in billing or disagreements over terms. These discrepancies often delay payment processes as they need additional time for resolution and can strain customer relationships. Companies must invest in systems that ensure billing accuracy to mitigate these issues.

Bad debt, or the inability to collect payments from customers, poses a significant risk as well. Without careful credit assessments and robust follow-up protocols, businesses may find themselves writing off large sums, impacting profitability.

Furthermore, manual processes and inadequate tracking can lead to lost invoices and overlooked customer communications. This situation often results in inefficiencies and missed collections.

Finally, dealing with customers facing financial difficulties or bankruptcy can be particularly challenging. These situations require sensitive handling and may necessitate negotiation for payment arrangements or settlements.

Key Differences Between AP and AR

Fundamental Distinctions

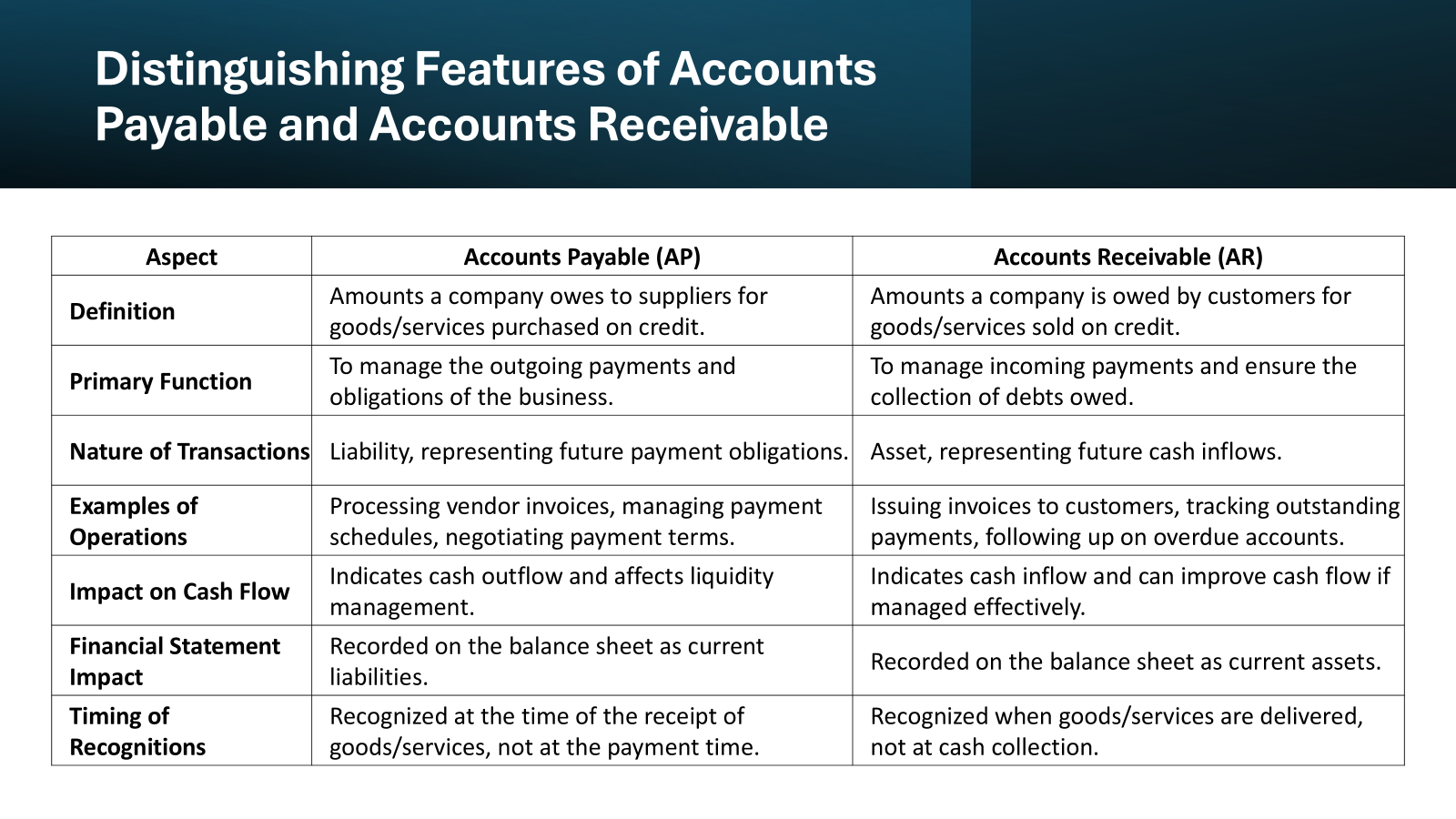

The fundamental distinctions between accounts payable (AP) and accounts receivable (AR) lie in their functions and impact on a business’s operations and financial statements.

Accounts Payable (AP) represents a short-term liability for a company. It accounts for the amount a business owes its suppliers for goods and services received. Essentially, it is the money expected to flow out of the company. Efficiently managing AP ensures that a company maintains a good relationship with its vendors and avoids late fees, while also keeping control over its cash outflows.

Conversely, Accounts Receivable (AR) reflects a short-term asset. It captures the money owed to a company by its customers for products or services delivered on credit. AR management is crucial for maintaining cash inflow and provides insight into the financial health and creditworthiness of a company’s clientele.

While AP is concerned with settling debts, AR focuses on collecting owed payments. These opposing roles underscore their different impacts on cash flow: AP affects the cash leaving the business, while AR involves cash incoming.

Understanding these distinctions helps companies maintain a balanced and healthy cash flow, crucial for meeting financial obligations and supporting growth.

Impact on Financial Statements

Accounts payable and accounts receivable play distinct roles in influencing a company’s financial statements. Each has a specific effect on the balance sheet, income statement, and cash flow statement, reflecting their unique contributions to a business’s financial dynamics.

Accounts Payable (AP) appears on the balance sheet under current liabilities. It indicates the amounts that a company owes to suppliers and service providers. Timely management of AP ensures that liabilities do not exceed the company’s capacity to pay, thus preserving the organization’s creditworthiness.

Accounts Receivable (AR), on the other hand, is listed as a current asset on the balance sheet. It represents the revenue due from customers but not yet collected. Proper management of AR ensures that assets are realized timely, enhancing liquidity and the company’s ability to maneuver financially.

On the income statement, neither AP nor AR is directly recorded; however, they are integral in the accrual accounting method where revenues and expenses are recognized when they are incurred. Efficient AP management can minimize expenses related to late fees, whereas effective AR management can hasten revenue realization and improve profit margins.

The cash flow statement is where the real impact of AP and AR is felt. AP affects the cash flow from operating activities section by tracking outgoing payments to suppliers. Conversely, AR impacts cash flow as it represents the cash expected to be collected from customers — directly correlating with the cash inflows. The timing of these flows is crucial for maintaining liquidity and ensuring the business can meet its financial obligations promptly.

Proper management of both AP and AR is essential for achieving healthy cash flow, which in turn supports ongoing operations and strategic initiatives.

Implication on Cash Flow

Accounts payable and accounts receivable have significant implications for a company’s cash flow, influencing both the timing and availability of funds. Understanding their dynamics is crucial for maintaining adequate liquidity and financial stability.

Accounts Payable (AP) results in an outflow of cash from a business. As such, the payment terms negotiated with suppliers directly impact the timing of these outflows. By extending these terms, businesses can manage their immediate cash needs more effectively. However, excessive delays in payment can strain supplier relationships, potentially affecting future terms and inventory supply.

In contrast, Accounts Receivable (AR) involves cash inflows. The collection efficiency of AR dictates how quickly a business can convert its credit sales into cash. Prompt collection is vital for ensuring that the business maintains sufficient cash flow to meet ongoing operational needs. Delays in receiving payments can lead to a shortfall in available working capital, affecting the company’s ability to pay for expenses or reinvest in its operations.

Together, AP and AR need to be balanced to optimize cash flow. Proper financial planning and the adoption of strategies such as offering discounts for early payments or optimizing payment cycles can enhance cash management. This balance assures that a company can meet its operational needs while strategically planning for expansion and growth.

Balancing AP and AR not only safeguards liquidity but also supports the financial flexibility needed to seize growth opportunities, invest in new projects, and ensure the company’s long-term viability in the marketplace.

The Symmetry of AP and AR Processes

How They Complement Each Other

Accounts payable and accounts receivable complement each other by forming the backbone of a company’s working capital management. Together, they facilitate a smooth and continuous cash flow, balancing the inflow and outflow of money critical for daily operations.

The synchronization between AR and AP allows businesses to manage their cash more effectively. For instance, efficient AR processes ensure timely collections from customers, providing the necessary cash inflow to meet AP obligations. This reduces the need for short-term borrowing and minimizes the cost associated with credit.

Moreover, the interplay between AP and AR can foster robust supplier and customer relationships. Timely payment to vendors maintained by well-managed AP processes can lead to favorable credit terms and possible discounts. Similarly, efficient AR can enhance customer trust and loyalty, potentially increasing sales volumes and improving future cash inflows.

Ultimately, the synergy between AP and AR ensures that companies can maintain liquidity, invest in growth, and adapt to changing market conditions without disruption.

Balancing Act for Optimal Cash Flow

Achieving optimal cash flow requires a keen balance between accounts payable and accounts receivable processes. This balancing act is pivotal for ensuring liquidity and financial health. To manage this effectively, businesses must strategically align their AP and AR cycles to optimize cash flow timing and availability.

Accounts Payable Strategy: Businesses should negotiate favorable payment terms with suppliers, seeking options like extended payment periods without incurring penalties. Implementing early payment programs that offer small discounts can be beneficial if cash flow allows, helping maintain strong supplier relationships and accessing better terms in the future.

Accounts Receivable Strategy: Swift collections from customers are crucial. Establishing clear credit terms and regular follow-ups ensures timely payments. Offering incentives, such as discounts for early payments, can accelerate collections. Automated reminders and statement reconciliations also aid in minimizing the AR cycle duration.

Integrated Approach: By closely monitoring the AP and AR processes, companies can predict cash flow trends and make informed financial decisions. This might involve aligning payable timelines with receivable inflows, ensuring there is enough liquidity to cover operational expenses and strategic investments.

Maintaining this balance ensures that businesses are not only meeting their current liabilities but also preparing for future opportunities. This strategic alignment contributes significantly to a company’s financial agility and long-term success.

Adopting a holistic approach to manage both AP and AR effectively can reduce borrowing needs, improve profitability, and provide the financial flexibility necessary to weather economic fluctuations. By achieving this balance, companies can optimize operations, focus on growth, and sustain competitive advantage.

Enhancements Through Automation

Streamlining Processes with Technology

Incorporating technology into accounts payable and accounts receivable processes can significantly streamline operations, improve accuracy, and enhance efficiency. By leveraging modern tech solutions, businesses can automate repetitive tasks, reduce human error, and facilitate better cash flow management.

For Accounts Payable (AP), technology such as Optical Character Recognition (OCR) enables the automatic conversion of diverse invoice formats into digital data. This reduces manual entry and improves accuracy. Automated data capture systems take it a step further by extracting key details like vendor names, dates, and amounts directly into the financial system. This automation speeds up invoice processing and ensures no payments are missed.

For Accounts Receivable (AR), adopting electronic invoicing and payment systems allows for faster transactions. Automatic reminder systems and integrated customer portals provide transparency, enabling customers to view and settle their accounts promptly. These tools help minimize days sales outstanding and improve cash inflow consistency.

Implementing a unified platform that integrates AP and AR processes offers an overview of cash flow in real-time. Such systems provide actionable insights through reporting and analytics, allowing for better financial decision-making and forecasting.

By streamlining these processes with technology, businesses can reduce the administrative burden, minimize errors, and maintain a steady cash flow.

Embracing these technological solutions equips companies with the agility needed to respond to financial challenges swiftly, fostering a proactive rather than reactive financial management approach. This not only enhances operational efficiency but also lays the foundation for sustainable growth and improved stakeholder relationships.

Real-world Benefits of Automating AP/AR

Automating accounts payable and accounts receivable processes brings tangible benefits that resonate across all aspects of business operations. Here’s a look at the real-world advantages that automation provides:

- Increased Efficiency: Automation significantly reduces the time required for manual data entry and processing. This accelerates AP and AR workflows, allowing financial teams to focus on strategic tasks rather than administrative duties.

- Improved Accuracy: By employing technologies like Optical Character Recognition (OCR) and automated data capture, businesses experience fewer errors in invoices and payments. This accuracy reduces the costly implications of mistakes, such as overpayments or disputes.

- Enhanced Cash Flow Management: Real-time reporting and analytics provide comprehensive visibility into financial health. Automation facilitates immediate access to information on invoice statuses, outstanding payments, and cash flow trends, enabling informed decisions to optimize liquidity.

- Cost Savings: Reducing manual workload and errors leads to significant cost savings. Businesses can cut down on late fees, exploit early payment discounts, and decrease labor overhead associated with manual processing.

- Strengthened Relationships: Improved efficiency in AP leads to satisfied suppliers due to timely payments, while efficient AR processes strengthen customer relationships through their accurate and timely invoicing and collections.

By automating these processes, companies enhancetheir operational agility, preparing them to scale effectively while maintaining streamlined finance operations.

Ultimately, automation facilitates a robust and responsive financial management strategy, empowering businesses to make proactive decisions that drive growth and profitability. All of these factors contribute to a competitive edge in today’s dynamic business environment.

Industry Best Practices

Recommended Strategies for AP

Implementing effective strategies for accounts payable (AP) can streamline processes, improve supplier relationships, and enhance cash management. Here are some recommended strategies:

- Adopt AP Automation Software: Choose software that offers features like electronic invoicing, automated workflows, and real-time reporting. Automation solutions, such as those integrating with accounting systems, reduce manual processing errors and accelerate invoice handling, enabling quicker payments and better oversight of invoice amounts.

- Establish Strong Vendor Relationships: Develop clear communication with vendors to negotiate favorable payment terms. Building trust can lead to better discounts and credit terms, ultimately reducing costs and improving cash flow through strategic credit transactions.

- Implement Clear Policies: Create and enforce standardized policies for invoice processing and payment approvals. This uniformity ensures that all team members understand procedures, reducing the likelihood of errors and inconsistencies.

- Optimize Payment Schedules: Take advantage of early payment discounts when cash flow allows, but also consider using the full payment term duration strategically to manage liquidity without incurring late fees or damaging vendor relationships.

- Conduct Regular Audits: Periodically review AP processes to identify inefficiencies or discrepancies. Regular audits help in maintaining accuracy, preventing fraud, and ensuring compliance with internal and industry standards.

By integrating these strategies, businesses can bolster their AP efficiency while maintaining a stable and predictable cash flow. This not only supports smooth operations but also minimizes risks associated with late payments and potential disputes.

These strategies build a foundation for a robust and efficient accounts payable system, ultimately enhancing overall financial management and enabling the company to focus on growth and innovation.

Effective Techniques for AR

Enhancing accounts receivable (AR) processes is crucial for maintaining a healthy cash flow and reducing financial risks. By implementing a structured accounting process, businesses can efficiently manage accounts receivable with the following techniques:

- Automate Invoicing: Implement electronic invoicing systems that facilitate quick and accurate billing. Automation reduces manual errors and speeds up the invoicing process, helping to ensure invoices reach customers promptly.

- Clear Payment Terms: Establish and communicate clear, concise payment terms with your customers. Detail due dates, penalties for late payments, and incentives for early payments. Ensuring all parties understand these terms reduces misunderstandings and delays.

- Regular Follow-ups: Develop a systematic follow-up schedule for outstanding invoices. Use automated reminders to notify customers of upcoming or overdue payments, thereby improving the likelihood of on-time collections.

- Flexible Payment Options: Offer a variety of payment methods, including online portals, credit cards, ACH transfers, and installment plans. Providing flexible options can facilitate easier and quicker payments from customers.

- Conduct Credit Checks: Regularly evaluate customer creditworthiness before extending credit, as you are essentially a creditor offering credit to a debtor. This practice minimizes the risk of bad debts by ensuring the financial stability of your clientele.

By integrating these techniques, alongside monitoring interest receivable and ensuring accounts maintain a debit balance on the balance sheet, businesses can enhance their AR efficiency, secure steady cash inflows, and maintain positive customer relationships. This proactive approach not only improves liquidity but also supports growth by reducing the capital tied up in receivables.

These techniques form the backbone of a well-managed AR system, enabling businesses to maintain robust cash flow while offering a reliable framework for customer interactions and financial planning.

Conclusion

Accounts Payable (AP) and Accounts Receivable (AR) are essential components of a company’s financial operations, each serving distinct purposes. Accounts Payable refers to the amounts a company owes to its suppliers for goods and services received but not yet paid for. These are recorded as liabilities on the balance sheet. Effective management of AP involves timely processing of vendor invoices, maintaining accurate documentation, and ensuring proper invoice matching to avoid discrepancies. Companies often use discounting strategies to manage cash flow and take advantage of early payment discounts offered by suppliers.

In contrast, Accounts Receivable represents the amounts a company is owed by its customers for goods and services delivered but not yet paid for. These are recorded as assets on the balance sheet. Managing AR involves ensuring timely invoicing, monitoring customer payments, and following up on overdue accounts. Companies may offer customers discounts to encourage prompt payments, which can improve cash flow. The integrity of AR management is crucial for maintaining a healthy cash flow and ensuring that the company can meet its financial obligations.

Auditing plays a significant role in both AP and AR processes. Regular auditing ensures the accuracy and completeness of financial records, helping to identify any discrepancies or fraudulent activities. The use of artificial intelligence and data analytics in auditing can enhance the detection of unusual patterns and optimize the auditing process. For instance, AI can help in the optimization of invoice matching and the identification of anomalies in vendor invoices, thereby improving the overall integrity of financial reporting.

In summary, while Accounts Payable and Accounts Receivable serve opposite functions, they are both essential for a company’s financial health. Effective management of AP ensures that the company maintains good relationships with suppliers and avoids unnecessary interest or penalties. Efficient AR management ensures that the company collects payments on time, which is crucial for maintaining liquidity. Both processes require meticulous documentation, regular auditing, and the use of advanced technologies to optimize operations and maintain financial stability.

Accounts Payable (AP) and Accounts Receivable (AR) are crucial components of a company’s financial management. Accounts Payable refers to the amounts a company owes to its suppliers for goods and services received but not yet paid for. These are recorded as liabilities on the balance sheet. Effective management of AP involves timely processing of supplier invoices, maintaining accurate documentation, and ensuring proper invoice matching to avoid discrepancies. Companies often use templates to standardize the invoicing process and ensure consistency. The criteria for managing AP include timely payments to maintain good relationships with suppliers and avoid late fees.

On the other hand, Accounts Receivable represents the amounts a company is owed by its customers for goods and services delivered but not yet paid for. These are recorded as assets on the balance sheet. Managing AR involves ensuring timely invoicing, monitoring customer payments, and following up on overdue accounts. Companies may offer sales discounts to encourage prompt payments, which can improve cash flow. The general ledger is used to record all AR transactions, ensuring accurate financial reporting. Effective AR management is essential for maintaining liquidity and ensuring the company can meet its financial obligations.

FAQs

How you Define Accounts payables and Accounts receivable?

Accounts payable (AP) refers to the money a business owes to its suppliers or vendors for goods and services received on credit. It represents the company’s liabilities and is recorded as a short-term debt on the balance sheet. Conversely, accounts receivable (AR) is the money owed to a company by its customers for products or services provided on credit. It is listed as an asset on the balance sheet, reflecting expected incoming funds.

What is the primary difference between accounts payable and receivable?

The primary difference between accounts payable and accounts receivable is their roles in a company’s financial framework: accounts payable refers to liabilities or obligations to pay suppliers for services or goods received, while accounts receivable signifies assets, embodying the funds expected from customers for credit sales. This fundamental distinction affects both cash flow and balance sheet representation.

How do AP and AR affect a company’s cash flow?

AP and AR directly impact a company’s cash flow by managing the timing of cash inflows and outflows. Efficient AP management allows a company to delay cash outflows, retaining liquidity for a longer period. On the other hand, effective AR management ensures rapid cash inflows from customers, improving the company’s liquidity position and enabling it to meet financial obligations smoothly.

Can automation solve common challenges in managing AP and AR?

Yes, automation can address common challenges in managing AP and AR by streamlining processes, reducing errors, and improving efficiency. Automated systems can handle invoice processing, track receivables, send reminders, and generate real-time reports, leading to faster transaction cycles and better cash flow visibility. This minimizes manual errors and enhances overall financial management.