KEY TAKEAWAYS

- The accounting cycle provides a straightforward roadmap, helping maintain clear and accurate bookkeeping.

- Regularly tracking financial transactions from the beginning makes subsequent steps significantly simpler and helps in avoiding unexpected financial surprises.

- Utilizing accounting software can save considerable time, reduce bookkeeping stress, and has become a common practice among 71% of small business owners.

Understanding the Accounting Cycle

Definition and Overview

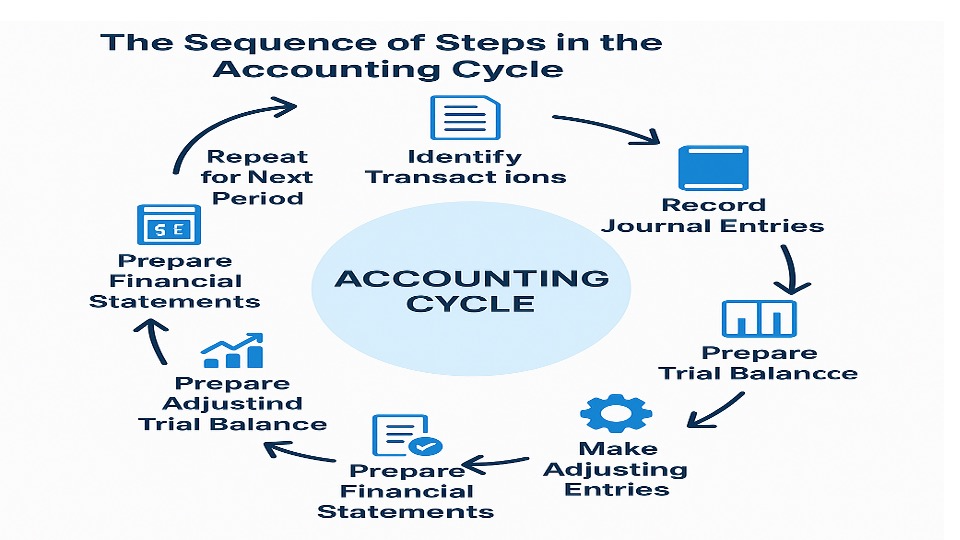

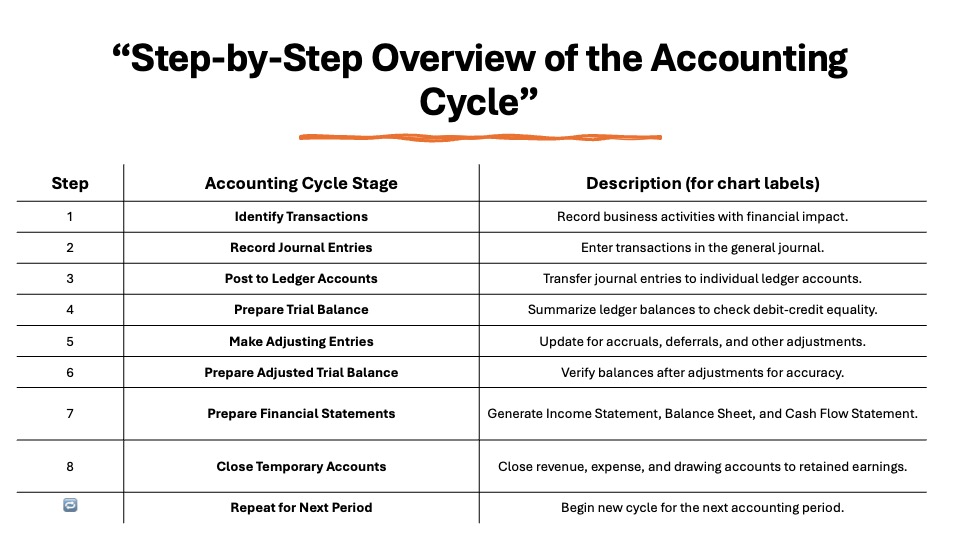

The accounting cycle is a series of steps designed to keep a company’s financial transactions organized and up-to-date. It forms the backbone of effective financial record-keeping, ensuring accuracy in tracking income, expenses, and overall financial health. Typically spanning an entire fiscal period, the cycle includes operations from identifying transactions to generating financial statements.

Importance in Financial Management

Understanding the accounting cycle is crucial for effective financial management as it ensures systematic tracking of all financial activities. This cycle aids in maintaining accurate accounting cycle records, which is vital for analyzing financial events and preparing essential financial statements. By adhering to established accounting principles, businesses can optimize their bookkeeping process and conduct thorough analyses, leading to informed decision-making and regulatory compliance. Additionally, a well-managed accounting life cycle is crucial for companies, reducing errors and enhancing the reliability of financial statements. Setting timeframes allows companies to manage their resources effectively and ensure they’re using a consistent accounting approach, whether it’s through general accounting practices or specific programs, such as the cash accounting method.

Step 1: Identify Transactions

Types of Transactions

Transactions in the accounting cycle include any business activities affecting the financial statements. They are typically categorized into operating, investing, and financing transactions. The first step in the accounting cycle is to identify and engage in transaction analysis for all transactions, which is crucial for preparing accurate financial reports and processing customer invoices. With double-entry accounting, each transaction is recorded as both a debit and a corresponding credit in two or more subledger accounts, creating a comprehensive breakdown of all accounting activities by account. Operating transactions involve day-to-day activities, like sales and expenses. Investing transactions relate to asset acquisitions and sales, while financing transactions encompass borrowing and equity-raising activities. These categories help streamline the recording process and facilitate accurate financial analysis.

Capturing Transaction Data

Capturing transaction data accurately is vital for the integrity of financial records. This process involves collecting and recording details from source documents such as invoices, receipts, bank statements, and credit memos. Ensure each transaction includes essential information like the date, amount, parties involved, and purpose. Digital tools like accounting software can simplify this process, reducing errors and saving time. Our suite of accounting degree and certificate programs offers a variety of ways to expand your knowledge or prepare to pursue your first credential in the field.

For bookkeepers and accounting teams, accurate data collection is crucial as it directly impacts the efficiency of the accounting cycle, timing, and organization. During this initial stage, companies go through every transaction that affects their financials, buying inventory and continuously creating customer invoices. Deepening your understanding of accounting terms and theory can further streamline processes and ensure compliance with eligibility criteria, such as those for QuickBooks Payments. Accurate data collection lays the groundwork for subsequent steps, such as payroll management, thereby enhancing overall productivity.

Step 2: Record Transactions in a Journal

Structured Documentation

Structured documentation is the cornerstone of effective journal recording in the accounting cycle. Each transaction should be meticulously detailed in the journal, capturing the date, accounts affected, amounts, and description. Entries are typically organized chronologically, allowing for easy tracing and review of transactions. This structured approach not only aids in maintaining compliance with financial reporting standards but also simplifies the auditing process.

Best Practices for Accuracy

Maintaining accuracy in transaction recording is critical. Implement the following best practices: regularly reconcile accounts to verify entries, use standardized journal formats, double-check calculations, and cross-reference entries with source documents. Regularly updating records reduces discrepancies and ensures data integrity. Training staff on consistency and using automated tools can further enhance accuracy.

Step 3: Post Transactions to the General Ledger

Organizing Financial Data

Organizing financial data through the general ledger is essential for transparent financial reporting. The ledger serves as the central repository for transaction data, grouped by account. Each account, such as assets, liabilities, or equity, is systematically categorized, making it easier to analyze financial health. Consistent updating and review of the ledger ensure accuracy and provide a clear picture of financial standing.

Ledger Maintenance Tips

Effective ledger maintenance involves ensuring that entries are accurate and posted in a timely manner. Regularly reconcile the ledger with bank statements and other financial records to spot discrepancies early. Create a routine for reviewing entries for any inconsistencies or errors. Leveraging accounting software can aid in maintaining up-to-date and error-free ledgers, making data retrieval efficient when preparing financial statements.

Step 4: Create the Trial Balance

Unadjusted vs. Adjusted Trial Balances

An unadjusted trial balance is the initial list of all accounts and their balances at the end of an accounting period, before any adjustments are made. It serves as a preliminary checkpoint to ensure that total debits equal total credits. Once adjustments, such as accrued expenses or accrued revenues, are applied, the adjusted trial balance is prepared. This updated list reflects the true financial position and is used to prepare financial statements.

Common Errors to Avoid

When preparing a trial balance, common errors can skew results. Double-check for transcription errors, such as incorrect figures or account names. Ensure that all transactions are recorded, and none are duplicated or omitted. Verify that adjustments are accurately recorded and balanced. Regular audits and software verification tools can help catch these mistakes early. Avoiding these errors leads to more reliable financial statements.

Step 5: Analyze the Worksheet

Identifying Discrepancies

Identifying discrepancies during the worksheet analysis is crucial for financial accuracy. Compare ledger balances with recorded transactions, looking for mismatched entries or anomalies. Pay special attention to unusual account activities indicating potential errors, such as transactions posted to incorrect accounts or periods. Using automated tools can help flag irregularities quickly, ensuring that financial statements reflect true financial conditions.

Refining Financial Statements

Refining financial statements involves adjusting entries based on identified discrepancies and ensuring they present an accurate depiction of financial health. This may include correcting errors and making necessary end-of-period adjustments to accruals and deferrals. The goal is to deliver precise statements that stakeholders can trust, supporting informed decision-making. Consistent refinement promotes transparency and compliance with standards.

Step 6: Adjust Journal Entries

Correction of Errors

Correcting errors in journal entries is a crucial step in the accounting cycle. It begins by identifying discrepancies through regular checks and reconciliation. Once detected, errors are rectified by reversing the incorrect entry and creating a correct one, maintaining both transparency and accuracy. This process ensures financial data integrity, preventing misstatements on financial reports.

Reflecting True Financial Position

Adjusting journal entries is essential for reflecting the true financial position of a business. These adjustments account for accrued revenues and expenses, ensuring that all financial activities are accurately represented in the statements. By adjusting entries, companies align their records with actual financial events, providing a reliable picture of their economic standing. This enhances the credibility of financial reports presented to stakeholders.

Step 7: Generate Financial Statements

Types of Financial Statements

Financial statements comprise several key documents that present a company’s financial performance and position. The primary types include the Balance Sheet, which details assets, liabilities, and equity; the Income Statement, highlighting revenue, expenses, and profit; the Cash Flow Statement, showing cash inflows and outflows; and the Statement of Changes in Equity, which reflects changes in shareholders’ equity. Each type provides unique insights into different aspects of financial health.

Purpose and Usefulness

The purpose of financial statements is to offer a snapshot of a company’s financial health, enabling stakeholders to make informed decisions. They are useful tools for evaluating profitability, liquidity, and operational efficiency. Investors use them to assess potential returns, while creditors can evaluate a company’s creditworthiness. Overall, these statements provide transparency and facilitate strategic planning by offering clear insights into financial performance.

Step 8: Close the Books

Finalizing Accounts for the Period

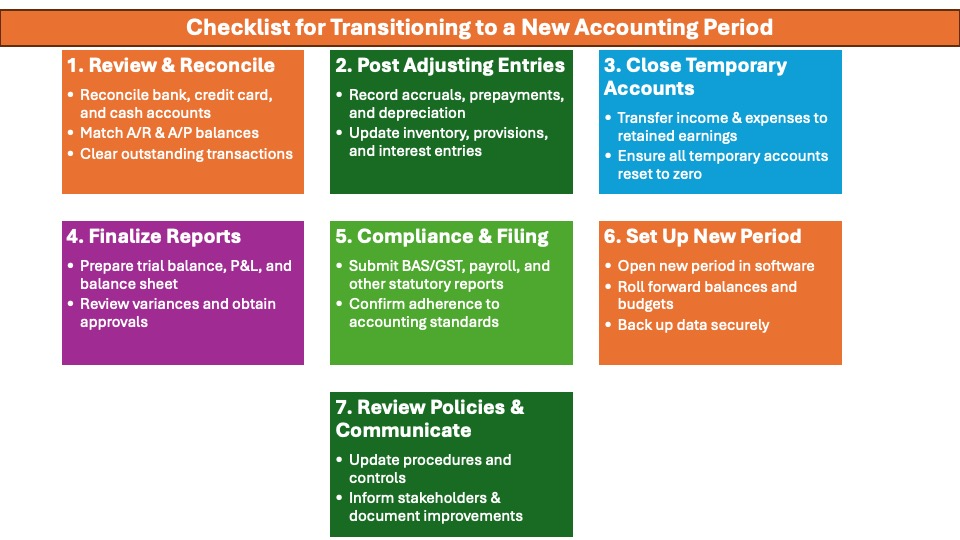

Finalizing accounts for the period involves closing temporary accounts, such as revenue and expenses, to transfer net income or loss to retained earnings. This step is crucial in the accounting cycle as it involves posting closing entries which reset the temporary accounts so the next period can begin with a zero balance. This ensures that the total credit balance and total debit balance align, allowing for accurate financial tracking. Moreover, the accounting cycle timing is pivotal, as it supports better performance analysis and provides clarity for investors and lenders on the company’s financial health. Understanding the timeframe for completing these steps is beneficial for maintaining organization and meeting business goals.

Readying for New Accounting Periods

Preparing for new accounting periods is vital to ensure seamless transitions and uninterrupted financial tracking. This involves reviewing and closing temporary accounts, ensuring that ledgers are balanced, and setting up the accounting system to record new transactions. It’s also the time to assess and update any accounting policies or procedures. By doing so, you pave the way for accurate financial reporting and analysis in the upcoming period.

Optimizing the Accounting Cycle with Technology

Automation Tools and Software

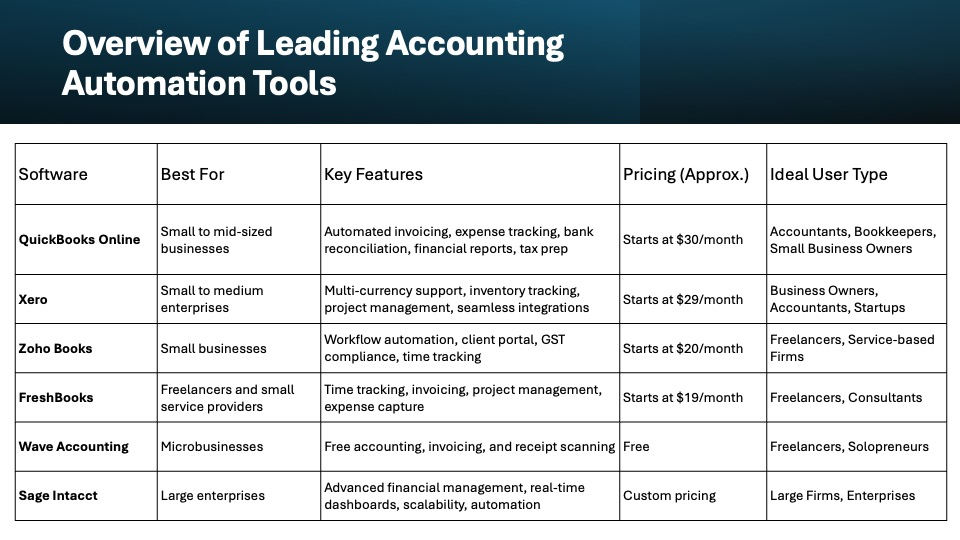

Automation tools and software are game-changers in optimizing the accounting cycle. They streamline data entry, reduce manual errors, and facilitate real-time financial reporting. Software like QuickBooks and Xero automate repetitive tasks such as journal entries, ledger updates, and financial statement generation, acting as an essential part of an accountant’s catalog of resources. These tools offer customizable dashboards and automated alerts, providing instant insights and enhancing operational efficiency by offering a means to monitor financial performance accurately. Additionally, the accuracy and uniformity enabled by these tools allow companies to precisely calculate the taxes owed on profits, ensuring compliance and avoiding costly errors.

Choosing the Right Software for Your Business

Selecting the right accounting software depends on your business size, complexity, and specific needs. Consider factors like scalability, ease of use, integration capabilities with existing systems, and customer support. For small businesses, affordability and simplicity might be priorities, whereas larger enterprises may require robust features and advanced reporting. A trial or demo can provide hands-on experience before committing.

FAQs

What is the accounting cycle’s main purpose?

The accounting cycle’s main purpose is to ensure accurate and systematic recording, summarizing, and reporting of financial transactions, resulting in reliable financial statements for decision-making.

How does technology streamline the accounting cycle?

Technology streamlines the accounting cycle by automating routine tasks, reducing errors, and facilitating real-time data analysis, thereby enhancing efficiency and accuracy in financial reporting.

What are common mistakes in maintaining the accounting cycle?

Common mistakes include neglecting to update records promptly, overlooking discrepancies, incorrect data entry, and failing to reconcile accounts routinely, all of which can lead to inaccurate financial statements.

How often should the accounting cycle be completed?

The accounting cycle is typically completed at the end of each accounting period, which could be monthly, quarterly, or annually, depending on the business’s reporting needs.

What are accounting cycles?

Accounting cycles are systematic processes that guide the recording, classification, and summarization of financial transactions, culminating in the preparation of financial statements for a specific period.