KEY TAKEAWAYS

- Marginal Revenue represents the revenue gained from selling an additional unit and measures the revenue increment from such sales. It’s pivotal for determining the level of earnings related to extra output sold.

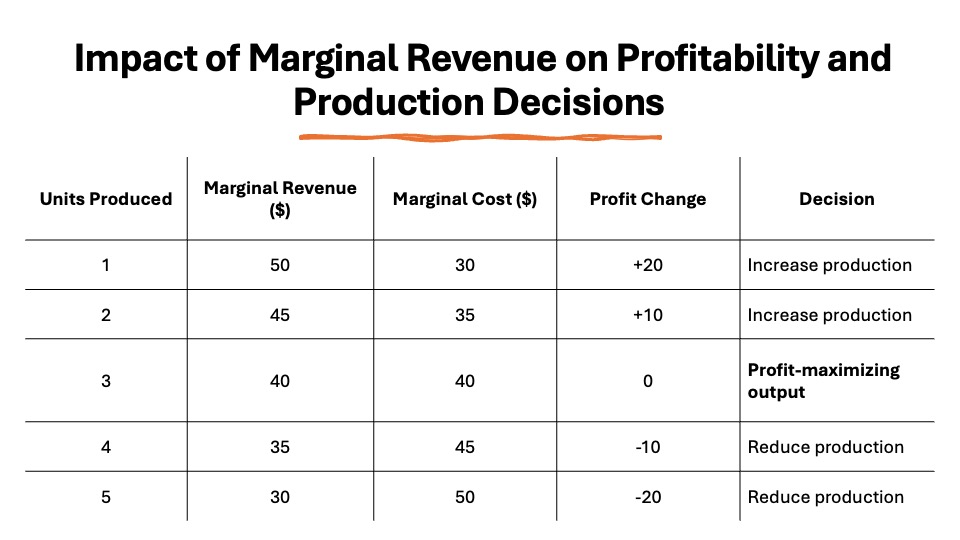

- To maximize profit, a company should adjust its production until marginal revenue equals marginal cost. This equilibrium ensures that resources are utilized efficiently, avoiding production when marginal costs outweigh marginal revenue.

- Regular analysis of marginal revenue is essential for making informed production decisions. Businesses can better understand their profitability and decide whether to increase or decrease production, impacting both the supply chain and consumer demand.

Decoding Marginal Revenue

Definition and Importance

Marginal revenue refers to the additional revenue that a company receives from selling one extra unit of a product. It’s a vital concept in economics and business, helping determine the most profitable level of production. Knowing the marginal revenue guides businesses in optimizing production levels and resource allocation, ensuring they capture the most significant profit margin. An efficient understanding of marginal revenue supports pricing strategies and competitive positioning.

The Role in Business Strategy

- Marginal revenue is crucial in shaping an effective business strategy. In a monopoly market, a monopoly firm or monopolist firm can use changes in marginal revenue to determine how much of a product to produce and at what price to sell it. By analyzing marginal revenue alongside marginal cost, businesses can determine the profit maximization point, or the profit-maximizing output level, where MR equals MC. This analysis informs whether changes in pricing or production volume can create a competitive edge in the market. In essence, understanding marginal revenue allows businesses to pivot strategically, aligning output with market demand and consumer preferences.

Unpacking the Marginal Revenue Formula

Step-by-Step Calculation

Calculating marginal revenue involves a straightforward process that helps you determine the additional income from selling one more unit of a product. Here’s how you can do it step-by-step:

- Identify Total Revenue Before the Additional Sale: Record the total revenue from current sales.

- Identify Total Revenue After the Additional Sale: Note the total revenue after selling one additional unit.

- Calculate the Change in Total Revenue: Subtract the total revenue before the sale from the total after the sale. This change is crucial.

- Determine the Change in Output Quantity Sold: Usually, this will be one unit, as you’re assessing the revenue from selling one more item.

- Apply the Formula: Divide the change in total revenue by the change in the output quantity sold. This result is your marginal revenue.

[ \text{Marginal Revenue (MR)} = \frac{\text{Change in Total Revenue}}{\text{Change in Output Quantity Sold}} \]

- Following these steps provides a clear understanding of the additional revenue generated, aiding pricing and production strategies. In accordance with the law of diminishing returns, ensure you assess at which quantities marginal benefits might start to decline.

Formula Breakdown: Understanding Each Component

To fully grasp the marginal revenue formula, it’s important to understand each of its components:

- Total Revenue (TR): This is the total income generated from the sale of goods or services. It is calculated as the price per unit multiplied by the quantity sold.

- Change in Total Revenue (∆TR): This represents the difference in total revenue before and after selling an additional unit. It helps quantify the impact of selling more.

- Change in Quantity Sold (∆Q): This is the difference in the number of units sold. Typically, it represents a single unit change for marginal revenue purposes.

The formula itself looks like this: [ \text{Marginal Revenue (MR)} = \frac{\Delta \text{TR}}{\Delta Q} \]

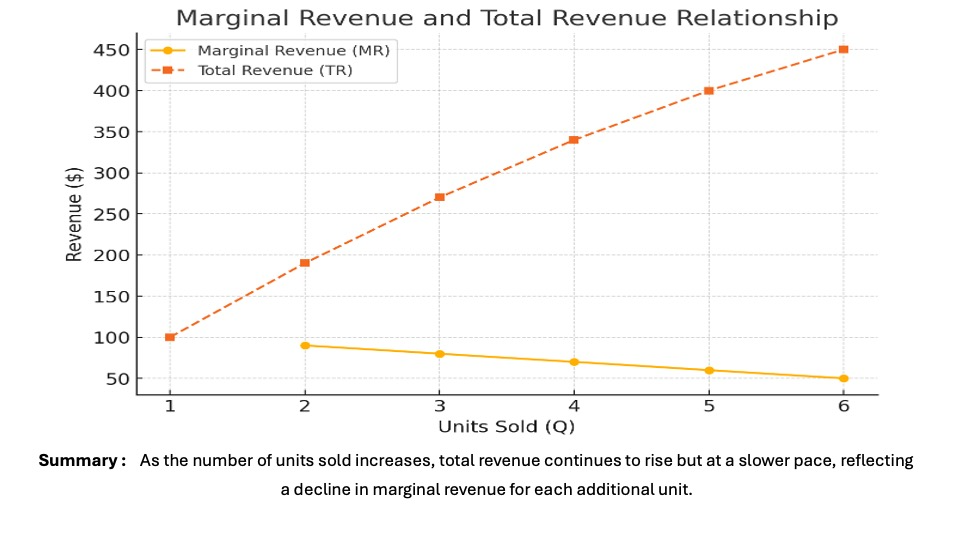

By breaking down these elements, businesses gain insights into demand elasticity and can see how small changes in sales affect overall revenue. This understanding is crucial for adjusting strategies such as pricing based on elasticity, which can be illustrated more visually through a LINE GRAPH.

Real-World Applications and Examples

Practical Business Scenarios

Understanding marginal revenue can be particularly insightful through practical business scenarios. Consider a coffee shop debating whether to introduce a new flavor. By calculating the marginal revenue from this addition, they can determine if the increment in revenue justifies the costs. Another example is an electronics company deciding between increasing production of a popular gadget or investing in a new product line. Marginal revenue calculations assist in these decisions, highlighting which options yield more profitability. These scenarios show how marginal revenue serves as a pivotal tool in strategic planning.

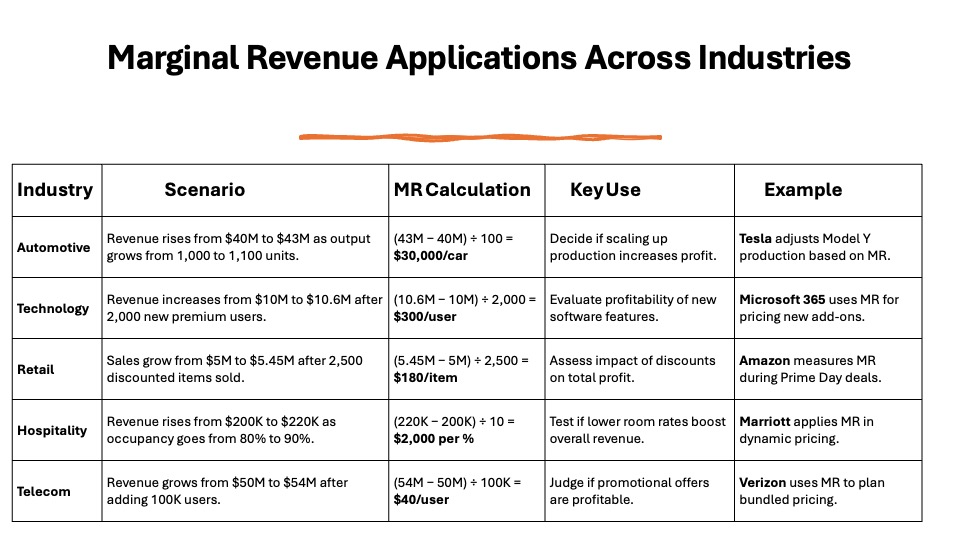

Industry-Specific Illustrations

Different industries utilize marginal revenue uniquely based on their operational context and market dynamics. In the automotive industry, manufacturers analyze marginal revenue to decide whether to scale up production of a high-demand model or focus on developing a hybrid alternative. Similarly, in the tech industry, software companies use marginal revenue to evaluate the benefits of adding a new feature to an existing program versus launching an entirely new application. Retailers, meanwhile, might use it to ascertain the profitability of extending sales promotions on popular products.

In the hospitality sector, hotels calculate marginal revenue when determining the potential gains from offering a discounted room rate to fill vacancies. In each case, industry-specific factors like market saturation or technological advancement significantly influence the interpretation and application of marginal revenue.

Common Mistakes to Avoid

When working with marginal revenue, businesses often encounter pitfalls due to misinterpretations or oversight. One common mistake is neglecting to consider the variable costs closely linked to each additional unit sold. Focusing solely on revenue without accounting for these costs can lead to inaccurate profitability assessments.

Another frequent error is assuming that marginal revenue remains constant. In reality, as additional units are sold, market conditions can change, affecting both price and demand. Failing to adjust for these fluctuations can result in suboptimal pricing strategies.

It’s also crucial not to confuse marginal revenue with total revenue; they cater to different strategic objectives. Misunderstanding these concepts can lead to misguided business decisions. Awareness and adjustment for these mistakes can refine strategic approaches and maximize profitability.

Marginal Revenue in Action: A Closer Look

Relationship with Demand Curve

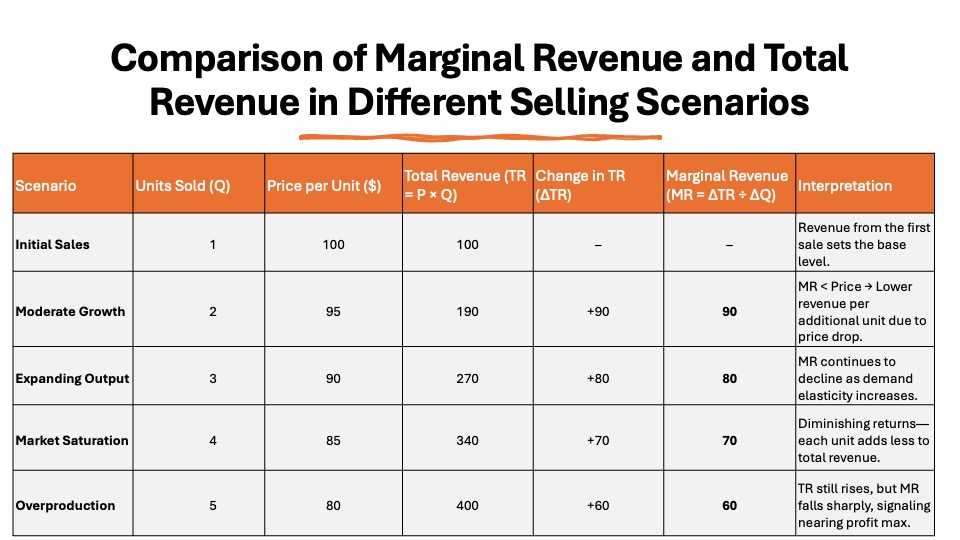

Marginal revenue closely interacts with the demand curve to reveal essential insights into pricing and sales strategies. Typically, the demand curve slopes downwards, indicating that as the price decreases, the quantity demanded increases. Marginal revenue generally lies below the demand curve, reflecting how each additional unit sold brings in less revenue than previous ones due to competitive pricing adjustments.

In a perfectly competitive market, marginal revenue equals the price, aligning with the horizontal demand curve. However, in monopolistic or oligopolistic markets, marginal revenue declines faster because price reductions necessary to sell additional units also lower revenue from existing sales.

Understanding this relationship is crucial for setting prices that balance revenue growth and consumer demand effectively.

Marginal Revenue vs. Total Revenue

Marginal revenue and total revenue are distinct yet interconnected concepts. Marginal revenue refers to the additional income from selling one more unit of a product, while total revenue encompasses the entire income from all units sold at a given price. As production increases, marginal revenue can inform decisions on whether to expand or contract output, aiming to maximize profit.

Although total revenue offers a broad perspective on overall sales, marginal revenue provides a finer lens, highlighting potential changes in profitability with each added unit. Importantly, while total revenue may continue to rise with increased sales, marginal revenue can decline as market dynamics shift and diminishing returns set in. Understanding both metrics enables businesses to align production strategies with optimal revenue generation.

Impact on Pricing Strategies

Marginal revenue plays a crucial role in shaping effective pricing strategies. By analyzing how additional sales units affect revenue, businesses can adjust prices to balance profitability with customer demand. If marginal revenue decreases as more units are sold, it suggests that lowering prices may be necessary to maintain competitiveness and increase sales volume. In the context of subscriptions, shifting pricing models from one-time sales to recurring revenue streams allows businesses to enhance customer retention and lifetime value.

Conversely, if marginal revenue exceeds marginal cost, the opportunity exists to raise prices without sacrificing sales volume, thereby boosting profitability. This scenario often involves calculating the markup to ensure pricing strategies are optimized concurrently. Companies can use marginal revenue insights to explore optimal price points, identify pricing thresholds that trigger lower demand, and develop tiered pricing models to maximize revenue across different consumer segments.

Ultimately, understanding the impact of marginal revenue on pricing fosters informed decisions that align closely with market conditions and customer preferences.

Tools and Techniques for Measuring Marginal Revenue

Utilizing Calculators and Software

Modern calculators and software are invaluable tools for accurately measuring marginal revenue, providing businesses with real-time data to drive strategic decisions. These digital solutions simplify complex calculations, offering user-friendly interfaces that allow you to input variables like total revenue and quantity changes. In markets with many sellers offering identical products, software can streamline the assessment of average revenue, which tends to be straightforward as each unit sells at market price in such competitive environments.

Advanced software often incorporates predictive analytics, helping forecast marginal revenue under varying market conditions and demand scenarios. They also facilitate integration with other financial metrics, enabling a comprehensive view of a company’s financial health. Using these tools, businesses can quickly identify trends, adjust strategies, and respond to market shifts with agility. Leveraging technology in this way ensures precise, efficient calculations, empowering smarter decision-making. By subscribing, businesses can receive insights and recommendations through a newsletter that enhances strategic development.

Integrating with Financial Models

Integrating marginal revenue into financial models enhances data-driven insights and strategic planning. These models align closely with microeconomics principles, focusing on market trends and customer needs. Financial models that incorporate marginal revenue enable businesses to simulate various scenarios, examining how changes in production or pricing impact profitability. This integration helps in aligning business objectives with market trends and customer needs.

Use marginal revenue data within models like break-even analysis, where it can illustrate how many units need to be sold at a particular price to cover costs and begin generating profits. It can also complement cash flow forecasting, offering a more dynamic understanding of revenue generation over time.

Moreover, by embedding marginal revenue into comprehensive financial models, businesses can refine budgeting processes, enhance investment strategies, and improve operational efficiencies. This makes financial planning more robust and adaptable to fluctuating market conditions. Furthermore, understanding the cost curve a company faces is crucial in these models, providing insights into cost structures and aiding in efficient decision-making.

FAQs

How does marginal revenue affect business decisions?

Marginal revenue affects business decisions by guiding production and pricing strategies. It helps determine the optimal output level where profit maximizes by comparing marginal revenue to marginal cost. This analysis aids businesses in deciding whether to increase production, enter new markets, or adjust prices to optimize revenue and profitability.

Can marginal revenue ever be negative?

Yes, marginal revenue can be negative. This occurs when the additional cost of selling one more unit exceeds the revenue gained from it, often due to price reductions that lower total revenue despite increased sales. Negative marginal revenue signals inefficiency, suggesting the need to reassess pricing or production strategies.

What is the difference between marginal revenue and profit?

Marginal revenue is the additional income from selling one more unit of a product, while profit is the total income remaining after all expenses, including production costs, are deducted from total revenue. While marginal revenue focuses on the incremental gain from each unit, profit assesses overall business efficiency and financial health.