KEY TAKEAWAYS

- Inelastic demand is characterized by a price elasticity of demand coefficient between 0 and 1, which means the percentage change in quantity demanded is less than the percentage change in price.

- Consumers tend to maintain their purchasing habits for goods with inelastic demand, such as basic necessities like food, water, and medication, despite price changes.

- Inelastic demand implies that significant changes in price will result in only minor changes in the quantity demanded, demonstrating consumer insensitivity to price fluctuations.

Understanding Inelastic Demand

What Makes Demand Inelastic?

Demand becomes inelastic when changes in price lead to relatively small changes in the quantity demanded. This often occurs due to the necessity of a product or the lack of available substitutes. When consumers consider a product essential, such as medications or emergency services, even significant price changes do not substantially alter their buying behavior. The elasticity level can be influenced by various factors, including product necessity and absence of substitutes, which affect both micro and macro demand aspects. Another determinant is the end-user perception, where the lack of close alternatives limits consumer choice and leads to inelastic demand.

Key Characteristics of Inelastic Goods

- Inelastic goods typically share a set of distinct characteristics that make them less sensitive to price changes. Firstly, these goods are often necessities, meaning consumers need them regardless of the cost. Essentials like water, electricity, and certain medications, such as insulin, fall into this category. Because insulin is crucial for individuals with diabetes, demand remains steady even with price shifts, exemplifying the bottom line inelastic nature of such goods. Secondly, they tend to have few substitutes, making it challenging for consumers to switch to alternatives. For instance, branded medications without generic options illustrate this characteristic. Moreover, when taxes are imposed on these necessities, the burden largely falls on consumers, as their reliance remains steadfast despite higher prices. Another feature is that these goods usually make up a smaller portion of a consumer’s budget, such as salt or household cleaning products, where price changes don’t significantly impact overall spending. Additionally, the supply curve for inelastic goods reflects less responsiveness to price variations. In addition, inelastic goods often have a short time frame for substitution, where the consumer decision is immediate and not easily deferred. Finally, demand for inelastic goods regularly remains stable regardless of economic cycles, such as public transportation services. Additionally, products that have addiction elements, like certain medications, reinforce an inelastic demand where consumers continue purchases despite cost hikes.

Definition and Formula of Inelastic Demand

The Formula Explained

The formula for measuring inelastic demand is the price elasticity of demand (PED), which is calculated as the percentage change in quantity demanded divided by the percentage change in price. For inelastic goods, this value is less than 1, indicating that the quantity demanded responds weakly to price changes. Simply put, even when prices increase or decrease significantly, the change in the quantity demanded is minimal. Elasticity values closer to zero depict perfectly inelastic demand, illustrating that consumers will purchase the same quantity regardless of price. Understanding this formula helps in evaluating how sensitive demand for specific products is to pricing strategies.

Calculating Inelastic Demand Step-by-Step

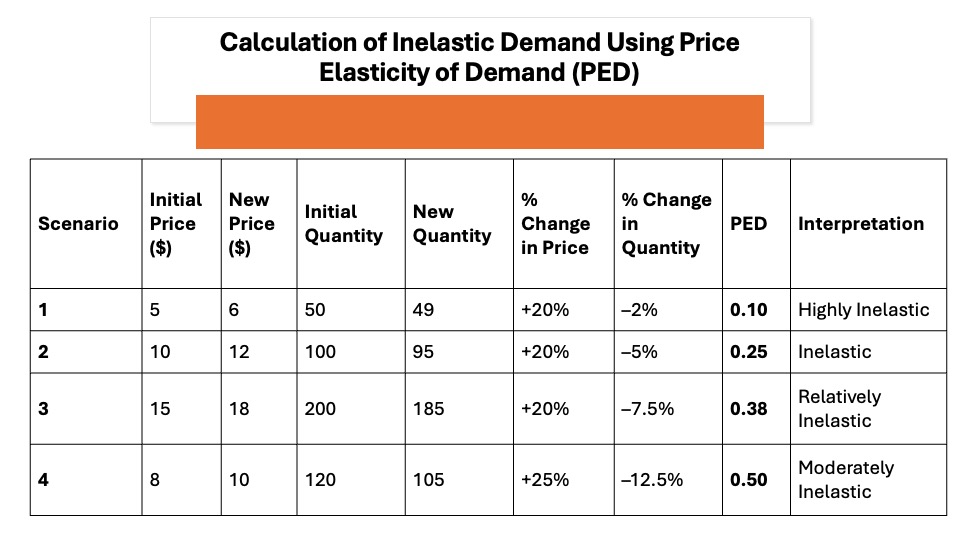

Calculating inelastic demand involves a few straightforward steps using the price elasticity of demand formula. Here’s a breakdown of the process:

- Identify Initial and New Values: Begin with the initial price and quantity, and the new price and quantity after a change. For example, if the initial price is $5 and increases to $6, and the quantity demanded falls from 50 units to 49.

- Calculate Percentage Changes: Determine the percentage change in price and quantity. Percentage change in price = [(New Price – Initial Price) / Initial Price] x 100. Percentage change in quantity = [(New Quantity – Initial Quantity) / Initial Quantity] x 100.

- Apply the Formula: Insert these values into the PED formula: PES = (Percentage Change in Quantity Demanded) / (Percentage Change in Price).

- Interpret the Result: A result less than 1 signifies inelastic demand. Using our example, if the calculated PED is 0.2, it indicates that demand is inelastic, as quantity demanded is less responsive to the price change.

By following these steps, you can determine how inelastic your product’s demand is, aiding in strategic decision-making.

Real-World Examples of Inelastic Demand

Everyday Products with Inelastic Demand

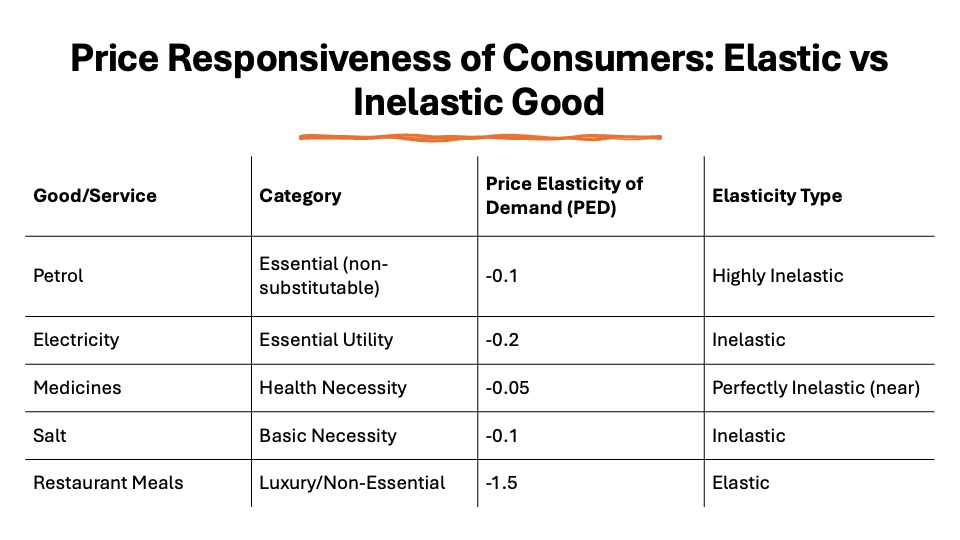

Everyday products that exhibit inelastic demand often include necessities and goods with limited substitutes. Common examples are toothpaste, where despite minor price fluctuations, consumer purchases remain consistent due to hygiene needs. Data results show that even with slightly increased pricing, quantity demanded for essentials remains stable. Additionally, prescription medications represent inelastic demand because patients require them regardless of price changes to maintain health. Another example is salt, an essential kitchen staple where price alterations rarely influence consumer buying patterns due to its necessity and low cost relative to overall expenditure.

Utilities such as electricity and water also fall into this category. Their indispensable nature means that regardless of price increases, consumers rarely cut back significantly. Lastly, gasoline is a well-known inelastic product because many depend on it for daily transportation. Even with price hikes, commuters continue purchasing about the same amount to meet their travel needs. Including comprehensive data results, such as a table with price elasticity listings, can provide clarity on how price changes affect quantity demanded in these categories.

Case Study: Gasoline as an Inelastic Product

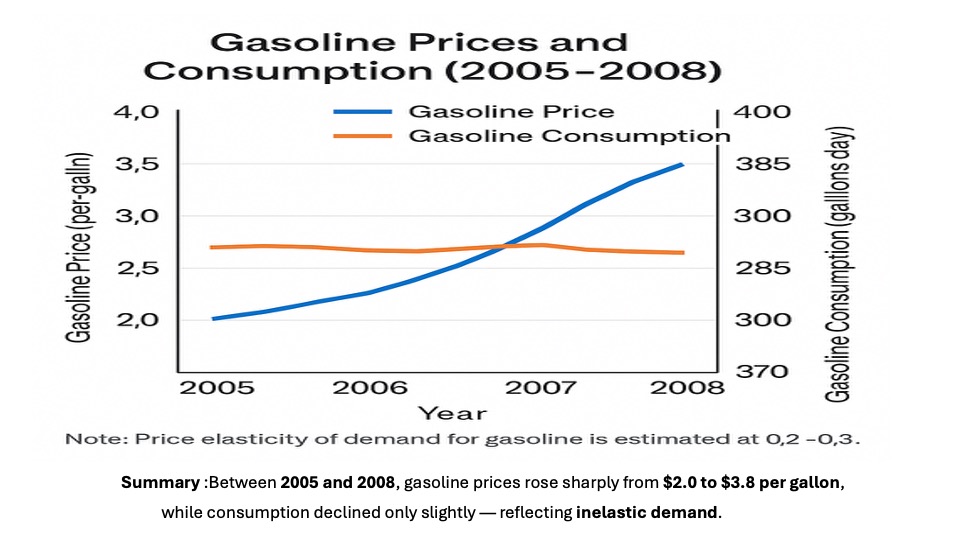

Gasoline serves as a classic case study in inelastic demand due to its critical role in daily commute and economic activities. Despite price fluctuations, the demand for gasoline remains relatively constant because it fuels vehicles essential for personal and commercial transportation. As people have few viable alternatives, especially in areas lacking public transport, they continue to purchase gasoline even as prices rise.

A notable example is the period from 2005 to 2008, where gasoline prices in the United States surged dramatically, yet the drop in consumption was minimal. Economic studies during this period revealed that the price elasticity of demand for gasoline hovered around 0.2 to 0.3. This implies that a 10% increase in price resulted in only a 2-3% reduction in quantity demanded, highlighting its inelastic nature. Understanding this characteristic helps policymakers predict consumer behavior during economic fluctuations and guides decisions in both the energy sector and environmental policy.

Factors Influencing Inelastic Demand

Scarcity and Availability Impact

Scarcity and availability significantly influence the inelasticity of demand for various goods. When a product is scarce, its limited availability often boosts its importance to consumers, making them less sensitive to price changes. This is evident in essential goods like water during droughts or vaccines during a health crisis; even substantial price increases do not deter purchases because the need surpasses the cost.

Scarcity can also increase inelastic demand when there are few or no substitutes available. For example, if a natural disaster disrupts the supply of bananas, consumers unable to find alternatives may still purchase at higher prices. Conversely, abundant availability of products without substitutes, like basic utilities, maintains inelastic demand because consumers depend on them regardless of cost variations.

By understanding these dynamics, businesses can optimize supply chains, and governments can plan for crisis management better.

Necessity versus Luxury Distinction

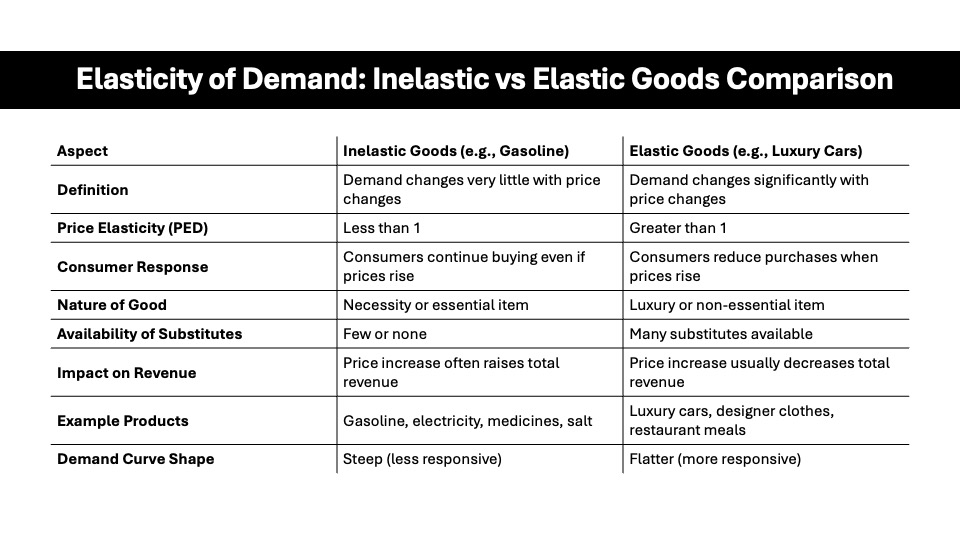

The distinction between necessities and luxuries plays a pivotal role in determining demand elasticity. Necessities are essential goods required for daily living, such as food, housing, and healthcare. Because they fulfill basic needs, consumers continue purchasing these items even when prices rise, resulting in inelastic demand. For example, the demand for staple foods like bread or milk remains steady, as they are integral to survival and daily nourishment.

In contrast, luxury items are considered non-essential and often reflect personal preferences or social status. These include high-end electronics, designer clothes, and luxury cars. The demand for such goods is typically elastic because consumers can defer purchases or seek alternatives when prices increase. The decision to buy luxury items is more discretionary, leading to significant shifts in quantity demanded in response to price changes.

By recognizing the necessity versus luxury distinction, businesses can better strategize pricing and inventory management, while consumers can make informed choices based on budget priorities.

Implications on Pricing and Profit

How Inelastic Demand Affects Pricing Strategies

Inelastic demand profoundly influences pricing strategies, providing businesses the opportunity to increase prices with minimal impact on sales volume. Since consumers of inelastic goods are less sensitive to price changes due to the necessity or lack of substitutes, companies can leverage this by setting higher prices to boost revenue without drastically affecting demand. This is particularly advantageous in industries such as utilities and pharmaceuticals, where goods are essential, and competitive pressures are low.

Moreover, businesses can use inelastic demand to justify price increases during cost upsurges, maintaining profitability without losing market share. This strategy is often employed by energy providers during fuel price hikes or by medical suppliers facing increased production costs.

While inelastic demand offers pricing power, businesses must approach changes carefully to avoid potential public backlash or regulatory scrutiny. Therefore, understanding demand elasticity helps tailor successful pricing strategies that balance profitability with consumer satisfaction.

Maximizing Profits with Inelastic Demand Goods

Maximizing profits with inelastic demand goods involves strategic pricing and cost management. Since consumers of inelastic goods, such as petrol and essential commodities, are less responsive to price increases, businesses can gradually raise prices, improving profit margins without significantly affecting sales volume. This approach is beneficial in sectors like pharmaceuticals or essential commodities, where demand remains steady despite cost changes.

Furthermore, companies can enhance profits by optimizing production efficiencies, reducing operational costs while maintaining quality. Investopedia notes that common inelastic goods like petrol have consistent demand, providing opportunities to leverage economies of scale when investing in technology or streamlining logistics. By doing so, businesses can lower per-unit costs, thus widening profit margins on inelastic products.

Additionally, offering bundled goods or value-added services can capitalize on the stable demand, attracting customers who appreciate convenience and perceived added value. For instance, utilities might offer fixed-rate plans that bundle multiple services.

However, it’s crucial to remain aware of potential consumer pushback or regulatory concerns when adjusting prices. Therefore, maintaining transparency and communicating the value proposition can aid in retaining trust and ensuring sustained profitability.

FAQs

What is the difference between inelastic and elastic demand?

Inelastic demand occurs when changes in price lead to small changes in the quantity demanded. Elastic demand, however, signifies that a small price change causes a significant shift in quantity demanded. Inelastic goods are often necessities with few substitutes, while elastic goods are typically non-essential with available alternatives.

Can inelastic demand change over time?

Yes, inelastic demand can change over time due to factors like the introduction of substitutes, changes in consumer preferences, or shifts in necessity. For instance, technological advancements may offer alternatives, converting inelastic demand into elastic demand. Economic conditions and societal trends also influence these changes.

Why do necessities often have inelastic demand?

Necessities often have inelastic demand because they are essential for daily living, and consumers must purchase them regardless of price fluctuations. These goods, like food and healthcare, are prioritized in budgets due to their indispensable nature. The lack of viable substitutes further reinforces their inelastic demand.

What is the difference between elastic vs inelastic demand?

Elastic demand means that a slight change in price causes a significant change in the quantity demanded, often seen in luxury goods or products with many substitutes. In contrast, inelastic demand signifies that even substantial price changes result in only minor adjustments in quantity demanded, typical of essential goods with few substitutes.

How does elasticity and inelasticity affect consumer behavior?

Elasticity affects consumer behavior by making people more responsive to price changes, often causing them to seek alternatives or alter purchasing habits. In contrast, inelasticity indicates less sensitivity, meaning consumers continue buying similar quantities despite price fluctuations. This difference impacts how individuals prioritize expenses and choose products.

How is a perfectly inelastic demand curve represented?

A perfectly inelastic demand curve is represented as a vertical line on a graph, indicating that the quantity demanded remains constant regardless of price changes. This scenario occurs when consumers will buy a fixed amount of the product no matter the cost, reflecting absolute necessity.

How does the elastic inelastic demand curve different in shape?

The elastic demand curve is typically flatter, reflecting that a small change in price leads to a large change in quantity demanded, indicating consumer sensitivity. In contrast, the inelastic demand curve is steeper, showing that even significant price changes result in minimal changes in quantity demanded, highlighting less price sensitivity.

What are the main characteristics of inelastic items?

Inelastic items are characterized by their status as necessities, their lack of close substitutes, and the small proportion of a consumer’s budget they occupy. Additionally, these items exhibit stable demand across different price levels and are less affected by economic fluctuations. Consumers often prioritize their purchase regardless of cost changes, reflecting their essential nature. with key differences in characteristics and consumer behavior to enhance readability and comprehension.