KEY TAKEAWAYS

- Understanding Complexities: Capitalizing fixed assets involves understanding a range of rules and standards, requiring careful attention to ensure proper financial reporting. It is essential for maintaining financial accuracy and supporting transparent stakeholder communication.

- Estimation and Depreciation: Accurately estimating the useful life of an asset is crucial to managing depreciation effectively. Incorrect estimates can lead to financial discrepancies, emphasizing the importance of ongoing reviews and adjustments in asset management strategies.

- Strategic Financial Practice: Capitalization is not merely compliance; it is a strategic practice that enhances decision-making and financial integrity. By recognizing costs as long-term assets, businesses can better assess their revenue contributions and make informed investment decisions.

Understanding Asset Capitalization

Definition of Asset Capitalization

Asset capitalization refers to the accounting practice of recording an expenditure as an asset on the balance sheet, rather than an immediate expense on the income statement. This capitalization approach is used for items that are expected to generate economic benefits over multiple periods. By capitalizing an asset, a company can spread out its cost over the asset’s useful life, thereby matching expenses with the revenue generated by the asset. For example, it may record annual depreciation expense, converting capitalized costs into incremental expenses recognized throughout its useful life. This method provides a more accurate depiction of financial performance by aligning costs with the income they produce.

Importance of Asset Capitalization in Accounting

The importance of asset capitalization in accounting lies in its ability to enhance financial clarity and performance consistency. By capitalizing assets, businesses can defer recognition of immediate expenses and reflect long-term investments accurately, aligning with the matching principle in accounting. For instance, capitalization allows depreciation expense to be spread over an asset’s useful life, turning significant upfront costs into manageable, periodic financial considerations. This practice not only offers a clearer picture of a company’s profitability over time but also enhances asset management by focusing on depreciation and amortization as ongoing financial concerns. Furthermore, asset capitalization ensures compliance with accounting standards, playing a crucial role in financial audits and investor transparency. Additionally, while implementing capitalization, companies must be mindful of maintaining a balanced proportion of debt financing to avoid potential financial strain. The capitalization status in government reports does not necessitate the same measurement for all assets, allowing flexibility in reporting materiality in accordance with GAAP standards.

Capitalization Thresholds and Policies

Setting Effective Capitalization Thresholds

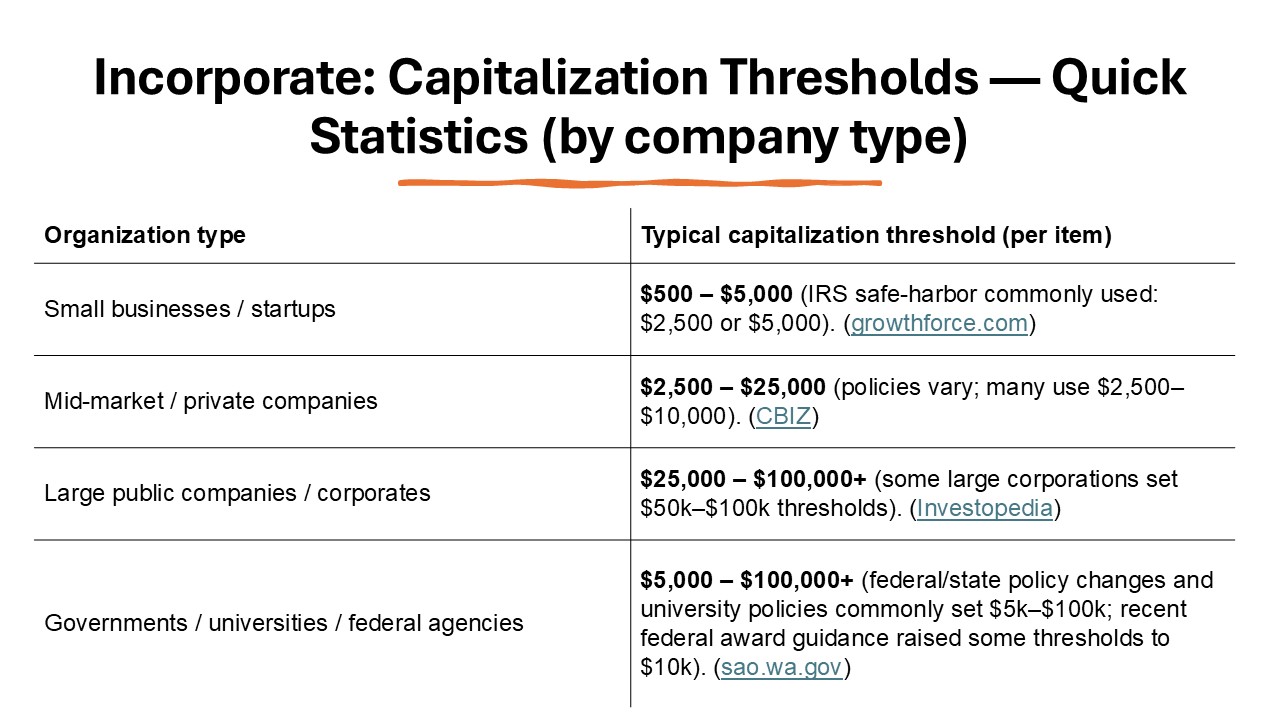

Setting effective capitalization thresholds is crucial for distinguishing between capital expenditures and regular operational expenses. A capitalization threshold is the minimum dollar value an asset must exceed to be capitalized on the balance sheet. Establishing these thresholds involves evaluating the company’s financial size and industry norms to ensure they are neither too high nor too low. Setting appropriate limits helps maintain administrative efficiency by avoiding overburdening financial systems with trivial items. Regularly reviewing and adjusting these thresholds aligns your practices with economic changes, business scales, and tax implications.

Policies for Capitalizing Different Types of Assets

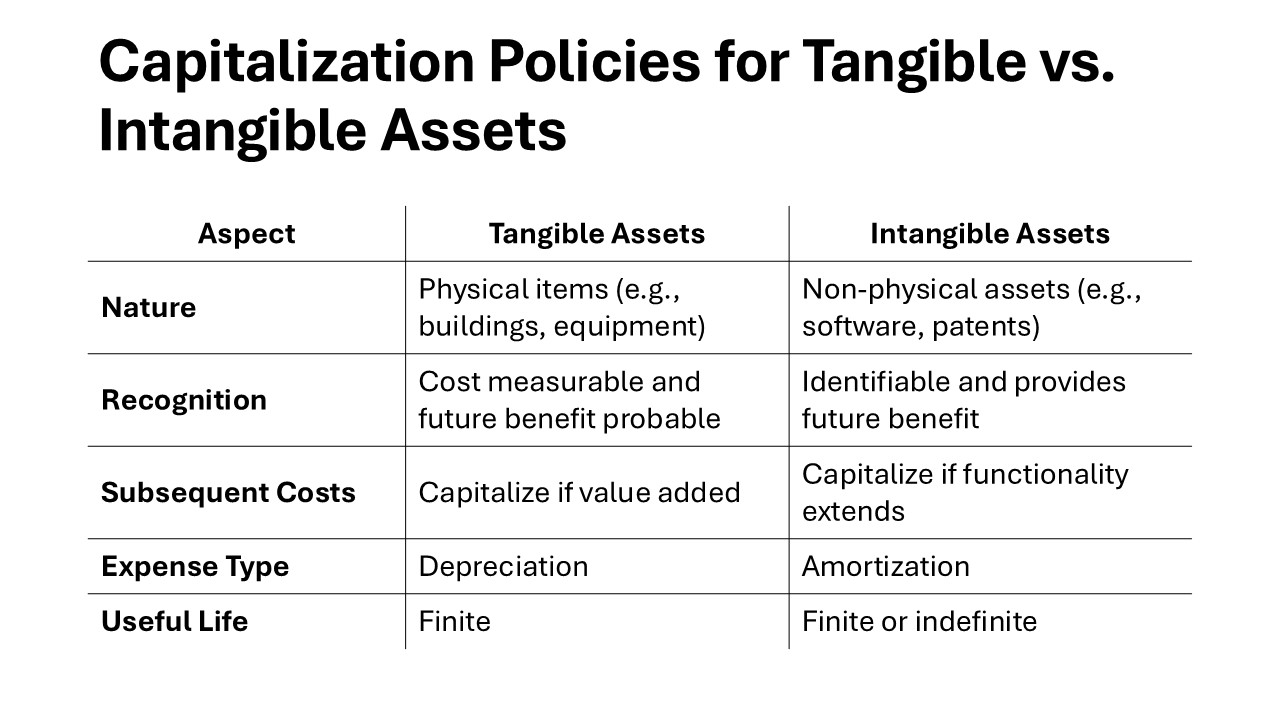

Capitalization policies for different types of assets ensure consistent and accurate financial treatment across varied asset categories. These policies can include guidelines on the capitalization of tangible assets like machinery and intangible assets such as patents or software. For example, tangible assets might be capitalized based on their purchase cost, installation fees, and any expenses that directly enhance their value or life expectancy. Consider leased equipment, where capitalization converts an operating lease to a capital lease by classifying the leased asset as a purchased asset included on the balance sheet. In contrast, intangible assets are often capitalized when developed internally and include associated costs like research and development.

A comprehensive capitalization policy should also address asset improvements and upgrades, outlining criteria for when expenditures should be capitalized as asset improvements rather than simple maintenance expenses. Although it’s crucial to capitalize labor only when directly linked to asset enhancement, general overhead costs should always be expensed. Clear policies must be communicated to accounting teams to prevent misclassification and ensure compliance with both internal standards and broader regulatory requirements.

How to Capitalize Fixed Assets

Step-by-Step Process

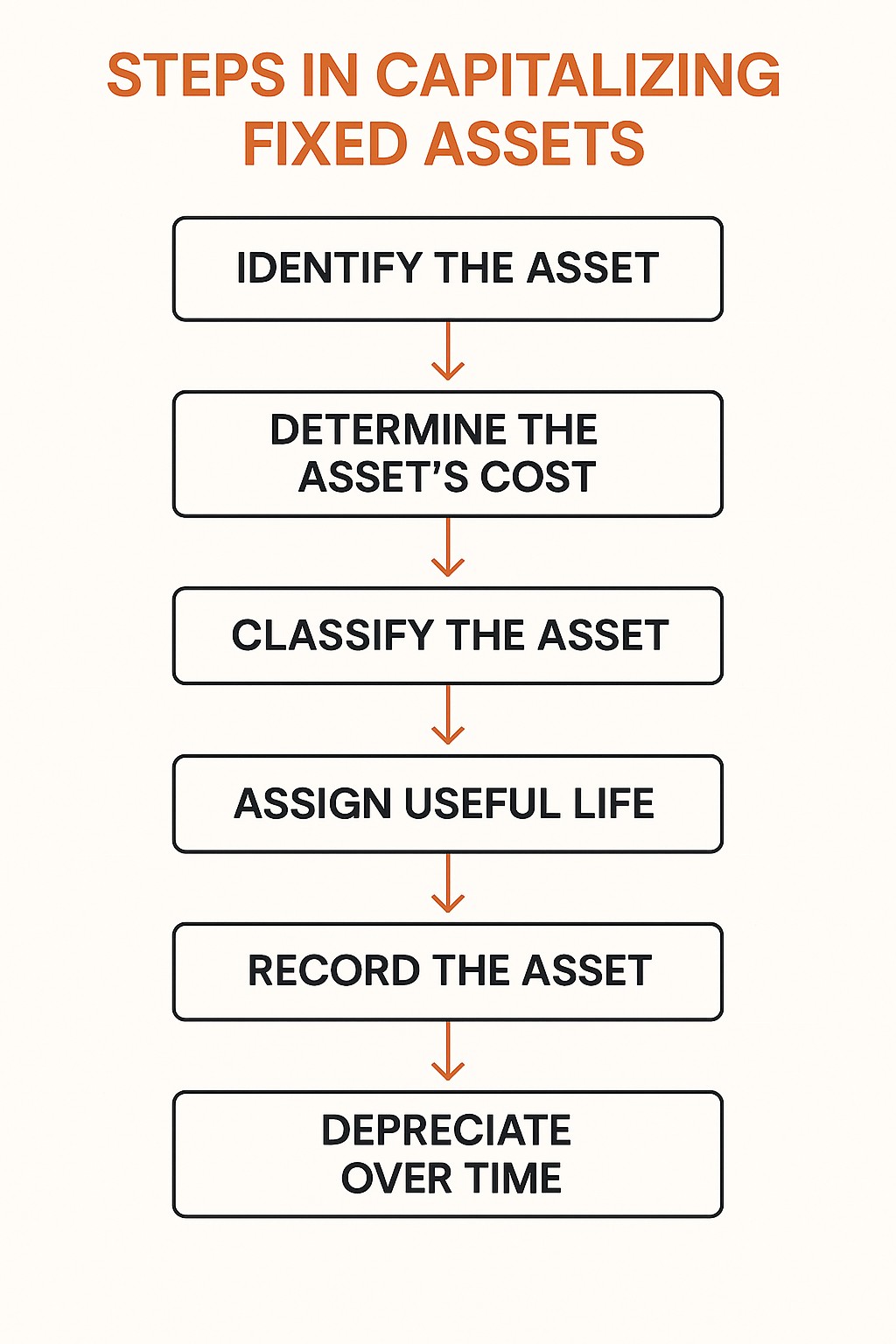

Capitalizing fixed assets involves a structured process that ensures accurate financial recording and compliance. Here’s a step-by-step guide to help navigate that journey:

- Identify the Asset: Determine whether the asset meets your capitalization criteria in terms of cost, lifespan, and economic benefit.

- Determine the Asset’s Cost: Include not only the purchase price but also installation, shipping, and any necessary modifications that enhance the asset’s value or extend its useful life, factoring in overhead costs related to acquisition.

- Classify the Asset: Assign a proper category, such as machinery or office equipment, which will govern the depreciation method and rate.

- Assign Useful Life: Estimate the period over which the asset will generate economic benefits, factoring in historical data and industry standards.

- Record the Asset: Enter the asset details into your accounting system, ensuring they’re reflected in the ledger and asset management database.

- Depreciate over Time: Calculate depreciation using standard methods like straight-line or declining balance, adjusting annually as needed. Regular review of depreciation expenses ensures compliance with accounting standards.

- Review and Adjust: Regularly reassess the asset’s condition and value, making adjustments for impairments or revaluation as required. Consider lease and debt financing impacts on asset valuation.

By following these steps, businesses can ensure their assets are accurately reflected in financial statements, contributing to sound financial analysis and decision-making.

Common Mistakes to Avoid

When capitalizing fixed assets, several common mistakes can occur, potentially leading to inaccurate financial reporting:

- Inaccurate Cost Allocation: Failing to include all incidental costs, such as transportation or installation, can result in undervaluing the asset.

- Improper Asset Classification: Misclassifying assets can lead to inappropriate depreciation methods, affecting the accuracy of financial statements. It’s crucial to understand the role of depreciation expense and how it transforms capitalized values into period expenses.

- Neglecting Useful Life Reassessment: Not regularly reviewing and adjusting the estimated useful life of an asset can cause discrepancies in depreciation calculations.

- Overcapitalization of Expenses: Capitalizing expenses that do not extend an asset’s useful life or enhance its value can lead to inflated asset values. The capitalization approach ensures expenses are appropriately distributed, impacting taxes as companies aim to optimize their tax liabilities.

- Inconsistent Application of Policies: Applying capitalization policies inconsistently across asset categories can lead to financial misstatements. Avoid reliance solely on debt financing, as an imbalance could compound errors in financial reporting.

Avoid these pitfalls by maintaining rigorous controls and regular reviews of your capitalization processes.

Examples of Asset Capitalization

Real-World Case Studies

Real-world case studies provide valuable insights into the practical application and challenges of asset capitalization, including the nuances of capital lease and operating lease management:

- TechCorp’s Software Capitalization: TechCorp successfully capitalized their internally developed software costs by following detailed policies. This strategic move led to improved asset management and a clearer presentation of R&D expenses, boosting investor confidence.

- ManufacturePro’s Machinery Investment: ManufacturePro faced an asset misclassification issue and subsequently overhauled their asset policies. They categorized all machinery under a unified depreciation method, enhancing financial accuracy and aligning with industry benchmarks. This also helped in better managing depreciation costs associated with their equipment.

- RetailChain’s Store Renovations: RetailChain chose to capitalize renovation expenses across multiple locations, viewing them as substantial upgrades that extended asset lives, thus spreading the cost over future periods and optimizing cash flows. They strategically managed overhead costs to avoid misallocation to capital projects.

- EnergyCo’s Environmental Equipment Installation: EnergyCo meticulously tracked installation and enhancement costs for their new green energy equipment, ensuring compliance with updated environmental standards and realizing tax incentives. Interest capitalization was a critical element in managing the costs associated with these large-scale installations.

- LogisticsInc’s Fleet Expansion: LogisticsInc capitalized costs associated with fleet expansion, including acquisition, modifications, and major overhauls. This approach allowed them to manage depreciation effectively, reflecting actual asset wear and tear. Handling the transformation from operating lease to capital lease enabled LogisticsInc to better reflect the true value of their assets.

These examples illustrate the diverse applications and potential pitfalls in asset capitalization, providing lessons on the importance of meticulous planning and adherence to established accounting guidelines.

Hypothetical Scenarios for Learning

Hypothetical scenarios can illuminate the nuances of asset capitalization and prepare you for real-world applications:

- Scenario 1: A small business purchases new office furnishings. They need to decide which items to capitalize based on their set capitalization threshold. Through careful assessment, it’s determined that items like desks and conference tables exceed the threshold and should be capitalized, improving clarity in financial reports.

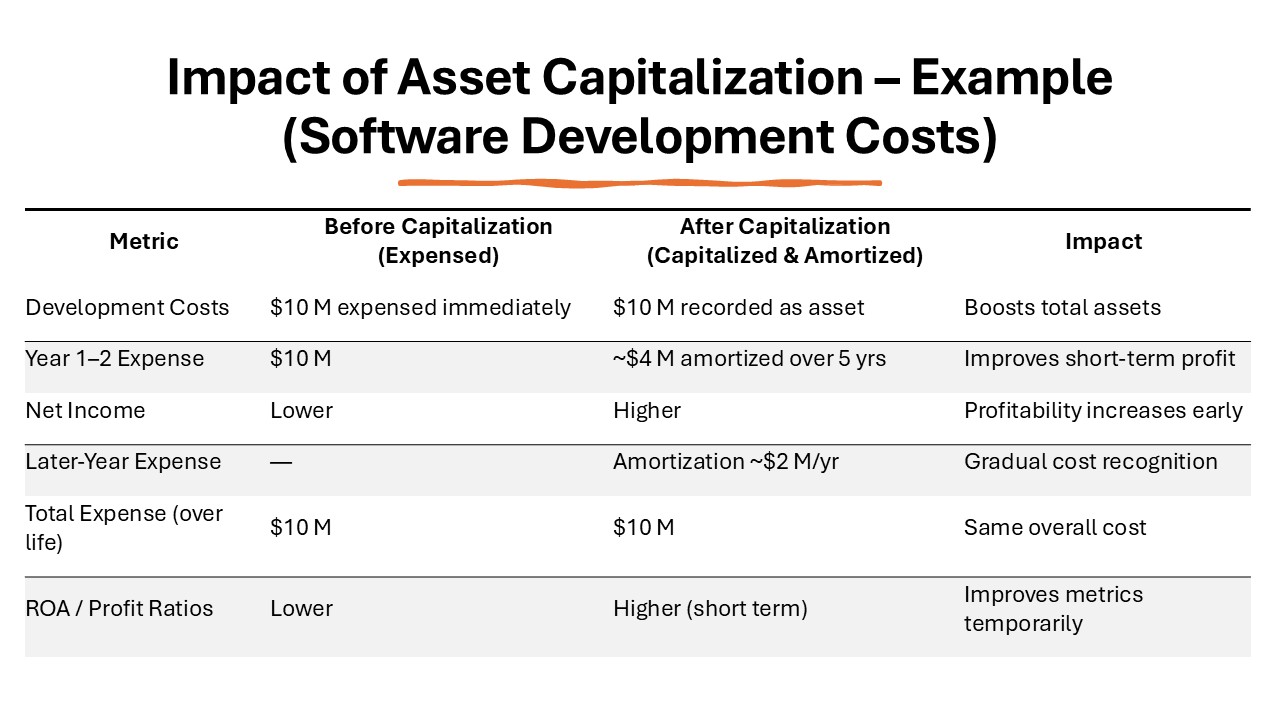

- Scenario 2: An e-commerce company invests in a new website platform. They face a choice: capitalize the software development costs or expense them immediately. Opting to capitalize, they spread the costs over the software’s useful life, aligning expenses with the platform’s revenue contributions.

- Scenario 3: A manufacturing firm upgrades its production line with advanced machinery. By capitalizing the costs, including delivery and installation, they mitigate the immediate financial impact, ensuring smoother cash flow over several years.

- Scenario 4: A transportation company undergoes extensive vehicle refurbishments. They must decide whether these are capital improvements or simply repairs. By carefully evaluating the enhancements, they successfully capitalize them, extending asset lifespans and optimizing tax benefits.

- Scenario 5: A tech startup develops a unique mobile app in-house. Debating whether to capitalize or expense,they choose capitalization, capturing the value of initial development and aligning it with future revenue streams. This strategic move enhances their financial statements by reflecting the app as a growth-driven asset over time.

These hypothetical scenarios illustrate varied decisions in asset capitalization, highlighting the importance of strategic planning and adherence to accounting policies.

Capitalization under GAAP & IFRS

Key Differences Between GAAP and IFRS

Understanding the key differences between GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) is essential for global businesses:

- Asset Definition and Recognition: GAAP often has more detailed guidance than IFRS, which is principles-based. IFRS offers broader criteria, allowing more flexibility in recognizing assets.

- Capitalization Criteria: Under GAAP, the capitalization of costs related to asset improvement is often stricter, while IFRS may grant more leeway in classifying costs as enhancing the asset’s value.

- Depreciation Methods: While both standards allow various depreciation methods, IFRS typically emphasizes the use of a residual value through a component approach more often than GAAP.

- Revaluation Model: IFRS permits the revaluation of assets to their fair market value, an option not typically allowed under GAAP. This difference can lead to disparity in reported asset values.

- Intangible Assets: The treatment of intangible assets under GAAP is usually more conservative, with specific criteria for capitalization compared to IFRS, which provides more interpretive flexibility.

Recognizing these differences is crucial for accounting professionals working with international financial statements, ensuring compliance and clarity across various jurisdictions.

Harmonizing Capitalization Practices

Harmonizing capitalization practices involves aligning accounting methods to ensure consistency across different reporting standards like GAAP and IFRS. This process benefits multinational organizations by providing a uniform approach to asset management and financial reporting, reducing discrepancies that can arise from differing regional practices.

To achieve harmonization, businesses can start by establishing a comprehensive understanding of both GAAP and IFRS requirements. Developing unified policies that accommodate the nuances of each standard can facilitate smoother internal and external reporting processes. Additionally, leveraging technology platforms can streamline cross-border accounting practices, ensuring all financial data complies with international standards.

Regular training and updates for accounting staff are crucial to keep pace with changes in standards and to maintain consistency in application.Such efforts not only improve transparency and comparability in financial statements but also bolster stakeholder confidence in the organization’s financial integrity.

Challenges and Considerations in Capitalizing Assets

Managing Depreciation and Amortization

Managing depreciation and amortization effectively is key to ensuring that the financial statements accurately reflect an asset’s usage and value over time. For tangible assets, depreciation spreads the cost of an asset over its useful life, usually determined by factors like usage patterns and technological advancements. Common methods include straight-line and declining balance, each suitable for different types of assets and business models. Furthermore, incorporating the capitalization approach allows businesses to spread out the expense of benefits that extend beyond the current accounting cycle, transforming an initial cost into depreciation expense over time.

Amortization applies to intangible assets, systematically allocating the cost over the asset’s lifespan, similar to depreciation. This process helps in achieving the matching principle in accounting by aligning the expense of using the asset with the revenue it generates. Interest capitalization can also be considered for certain expenses to ensure accurate reflection over the asset’s productive period.

Maintaining consistency in calculating depreciation and amortization is vital for clear financial reporting. It is advisable to conduct regular reviews of asset lifecycles and reassess their remaining useful lives. Utilizing robust accounting software can significantly enhance precision and efficiency in managing these aspects, providing timely and accurate financial insights to stakeholders.

Handling Asset Impairments

Handling asset impairments involves assessing and acknowledging when an asset’s market value falls below its carrying amount, necessitating a write-down. This typically arises due to changes in market conditions, physical damage, obsolescence, or shifts in a company’s operational strategy. Identifying impairments promptly is critical for maintaining accurate financial records.

The process begins with a regular review of assets for indicators of impairment. If signs are present, a detailed test is conducted to determine the asset’s recoverable amount, which is the higher of its fair value less costs to sell or its value in use. If this recoverable amount is less than the carrying value, an impairment loss is recognized in the financial statements.

Organizations should establish clear policies and procedures for impairment testing, ensuring timely detection and reporting. Advanced accounting tools can assist by automating parts of the assessment process, thus enhancing accuracy and efficiency. The resulting transparency fosters trust among investors and supports informed decision-making.

Best Practices & Resources for Asset Capitalization

Tools and Technologies for Accurate Capitalization

Utilizing advanced tools and technologies can significantly enhance the accuracy of asset capitalization processes. These innovations provide the capability to manage complex financial data efficiently while ensuring compliance with relevant accounting standards, such as those concerning interest capitalization and overhead costs. The capitalization approach acknowledges that while some expenses like general overhead costs should be expensed, others that produce longer-term benefits may be capitalized.

- Asset Management Software: Specialized software helps track and categorize assets, facilitating accurate recording and depreciation calculations. These systems often include customizable dashboards for real-time monitoring of asset performance and value.

- ERP Solutions: Enterprise Resource Planning (ERP) systems integrate various functions, including finance, procurement, and asset management, ensuring consistent capitalization practices across departments and geographic locations.

- Cloud-Based Platforms: These platforms offer scalable solutions that support remote access and real-time updates, which are crucial for businesses operating across multiple locations or during financial audits. This can also help in managing transactions effectively.

- AI and Machine Learning Tools: These technologies can identify patterns and anomalies in asset data, providing insights that enhance decision-making and accuracy in capitalization.

- Robotic Process Automation (RPA): RPA minimizes manual errors by automating routine tasks such as data entry and report generation, leading to more accurate and timely financial information.

Adopting these technologies can streamline your asset capitalization workflow, reduce errors, and ultimately optimize your financial management processes. Interest capitalization practices can be improved, ensuring that financial statements accurately reflect asset values and taxes are optimized. By embracing these tools, organizations can achieve greater efficiency in handling capital assets and ensure that their financial statements reflect true asset values, bolstering strategic planning and compliance.

Accessing Further Educational Materials

Accessing further educational materials is vital for staying abreast of the latest developments in asset capitalization practices. Here are some recommended resources to deepen your understanding:

- Online Courses: Platforms like Coursera, edX, and LinkedIn Learning offer courses covering accounting fundamentals, with specific modules on asset capitalization and management practices.

- Webinars and Workshops: Attend webinars hosted by financial organizations and accounting bodies to gain insights into current trends and practical case studies from industry experts.

- Industry Reports and Whitepapers: Stay informed with reports from leading accounting firms and financial institutions that discuss recent changes in accounting standards and their implications on asset capitalization.

- Professional Journals: Subscriptions to journals such as The CPA Journal or Journal of Accountancy can provide access to peer-reviewed articles and research studies on advanced accounting topics.

- Books and Publications: Consider reading books that delve into accounting principles and asset management strategies, offering both theoretical knowledge and practical applications.

FAQs

What is the significance of capitalization thresholds?

Capitalization thresholds set the minimum cost at which an asset must be to be capitalized rather than expensed immediately. They ensure only significant expenditures are recorded as assets, simplifying financial reporting by omitting minor items from capitalization. Proper thresholds balance accurate asset management with administrative efficiency.

How do I determine which assets should be capitalized?

Determine which assets to capitalize by assessing their cost, useful life, and potential to provide future economic benefits. Capitalize assets that exceed your organization’s capitalization threshold, and are expected to benefit operations over multiple periods, such as machinery, buildings, or software. Evaluate against predetermined capitalization policies for consistency.

What are some common pitfalls in asset capitalization?

Common pitfalls in asset capitalization include misclassification of expenses, undervaluing assets by omitting related costs, inconsistent application of capitalization policies, failing to reassess useful lives, and overlooking impairment losses. These errors can lead to inaccurate financial statements and misinformed decision-making.

How do you define capitalization?

Capitalization in accounting refers to the process of recording a cost as an asset, rather than an expense, on the balance sheet. This practice applies to expenditures that provide future economic benefits over multiple periods, helping align with revenues generated by the asset. It includes costs related to purchasing, developing, or improving tangible and intangible assets.

How is capitalization meaning different from capitalization of assets?

The term “capitalization” broadly refers to the process of converting costs into a balance sheet asset. In contrast, “capitalization of assets” specifically involves recording expenses as long-term assets that will generate future economic benefits. While the former applies to financial structuring, the latter focuses on asset management in accounting.