KEY TAKEAWAYS

- Active Leadership and Decision-Making: General partners (GPs) play a pivotal role in steering the business through strategic decision-making. They are instrumental in managing the partnership’s operations, ensuring not only the pursuit of growth but also balancing the interests of all partners involved.

- Financial Oversight and Risk Management: GPs are responsible for the financial management of the fund, which includes finding and overseeing investments to maximize returns. Their expertise is crucial in navigating financial risks, which ultimately affects the partnership’s profitability and success.

- Investment and Operations Management: In a limited liability partnership context, GPs manage day-to-day operations. They create the fund, direct investment decisions, and manage investor relationships. For example, general partners like Peter Gregory at Raviga Capital make crucial investment decisions that affect both the success of the fund and protect the interests of limited partners.

Defining a General Partner

Key Characteristics of a General Partner

General partners (GPs) are pivotal in partnerships as they assume comprehensive responsibilities and carry significant decision-making power. They actively manage the day-to-day operations of the partnership and represent the partnership in legal matters. GPs also have the authority to make binding decisions, a trait that sets them apart from limited partners. They often invest their own capital, leading to a vested interest in the partnership’s success. This hands-on involvement and ownership mindset can drive them to pursue opportunities aligned with the partnership’s objectives. Their commitment is evidenced by their accountability for all partnership liabilities—a defining characteristic.

Historical Context and Evolution

The concept of a general partner has evolved significantly over time, tracing back to early commerce and trade partnerships where individuals pooled resources to undertake larger ventures. In ancient Rome, partnerships allowed for shared costs and risks in maritime trade. Over centuries, as commerce expanded, the role of general partners became more structured and pivotal, especially during the Industrial Revolution, which saw increased capital needs for burgeoning enterprises. Today, the role continues to evolve with the rise of venture capital and private equity, where general partners are integral in steering fund dynamics and fostering innovation universally.

Core Responsibilities and Duties

Investment Management and Decision Making

General partners wield significant influence over investment management and decision-making within a partnership. They are responsible for identifying promising investment opportunities and developing strategies to maximize returns on capital. By conducting rigorous due diligence and continuously monitoring investments, GPs aim to ensure the partnership’s growth and financial health throughout the lifecycle of the fund. Their involvement often includes the management of portfolio companies, providing crucial support for founders to encourage optimum performance. Additionally, their decision-making authority extends to divestitures, acquisitions, and the reallocation of the partnership’s resources, often involving complex analyses and projections. This proactive and strategic approach is crucial for navigating the volatile markets, meeting financial thresholds, and securing a competitive edge, ultimately leading to successful exits and potential upside for investors.

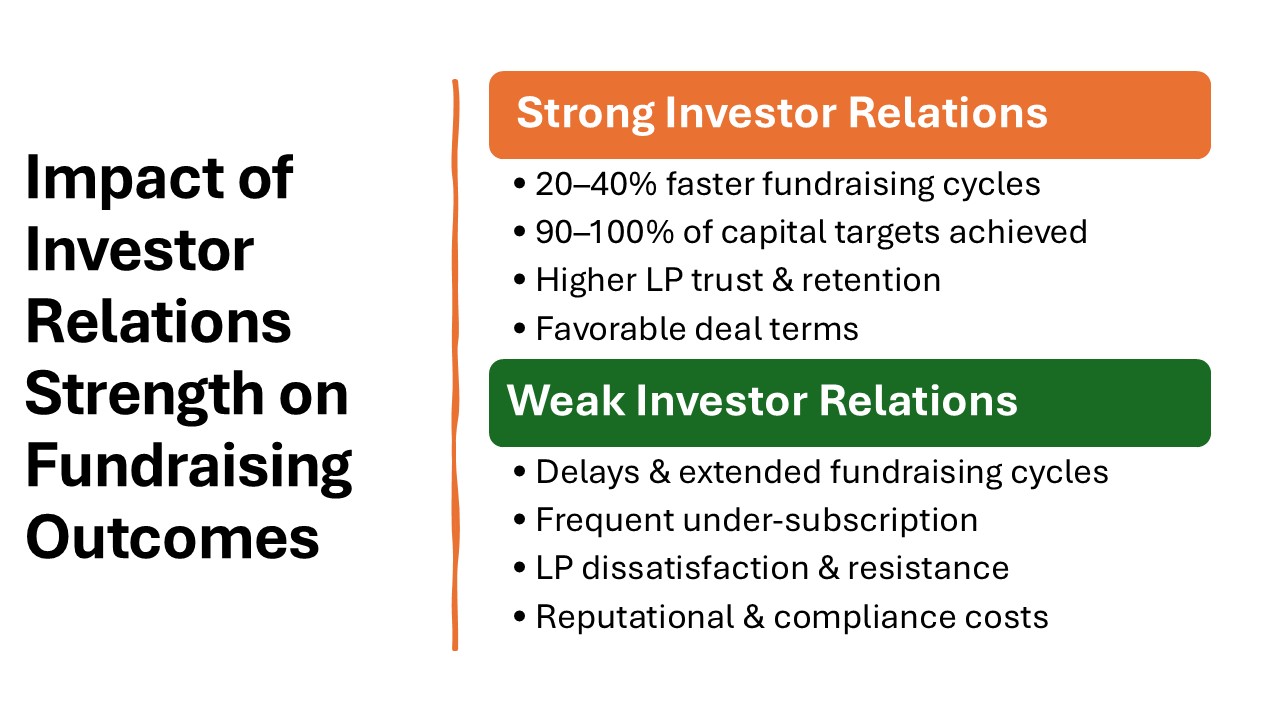

Fundraising and Investor Relations

For general partners, fundraising and managing investor relations are critical duties that require excellent communication and strategic planning skills. Beyond securing capital, GPs must adeptly manage limited partner (LP) structures, ensuring investors understand their roles and the potential returns on their investments. They often lead fundraising efforts by crafting compelling pitches to attract potential investors and secure the necessary financing for ventures. By providing clear updates, GPs can instill confidence in LPs during regular investor communication like annual LP meetings, while also covering GP management fees and other essential costs such as legal and taxes. This ongoing engagement fosters trust and encourages long-term commitments, acting on behalf of the partnership. By effectively managing investor expectations and upholding the investment thesis, GPs can create a solid foundation for continuing partnership success and growth.

Advantages and Challenges

Risks and Unlimited Liability

One of the most significant challenges facing general partners is the exposure to risks, given their role’s inherent nature of unlimited liability. Unlike limited partners, who risk only their invested capital, GPs are personally responsible for all the partnership’s debts and obligations. This exposure entails that their personal assets could undergo liquidation should the partnership face financial difficulties, allowing creditors to claim against them. While this risk can be daunting, it also serves as a powerful motivator for GPs to manage the partnership judiciously. Furthermore, the potential for personal financial loss underscores the importance of careful decision-making and prudent financial management to safeguard the partnership’s and the GPs’ interests. An effective strategy to mitigate these concerns is the formation of a business entity such as a Limited Liability Partnership (LLP), which offers a shield against personal liability for the actions of other partners.

Strategic Benefits

Serving as a general partner comes with notable strategic benefits that empower them to shape the partnership’s trajectory. Their broad authority enables them to implement innovative strategies that can enhance operational efficiencies and revenue streams. This role also provides the flexibility to adapt swiftly to market changes, allowing for a proactive approach to seize emerging opportunities. Moreover, the deep involvement in business operations grants GPs invaluable insights and expertise, which can be leveraged to steer the partnership toward long-term success. These strategic advantages often result in higher potential rewards, making the stakes and responsibilities worthwhile.

Comparison with Limited Partners

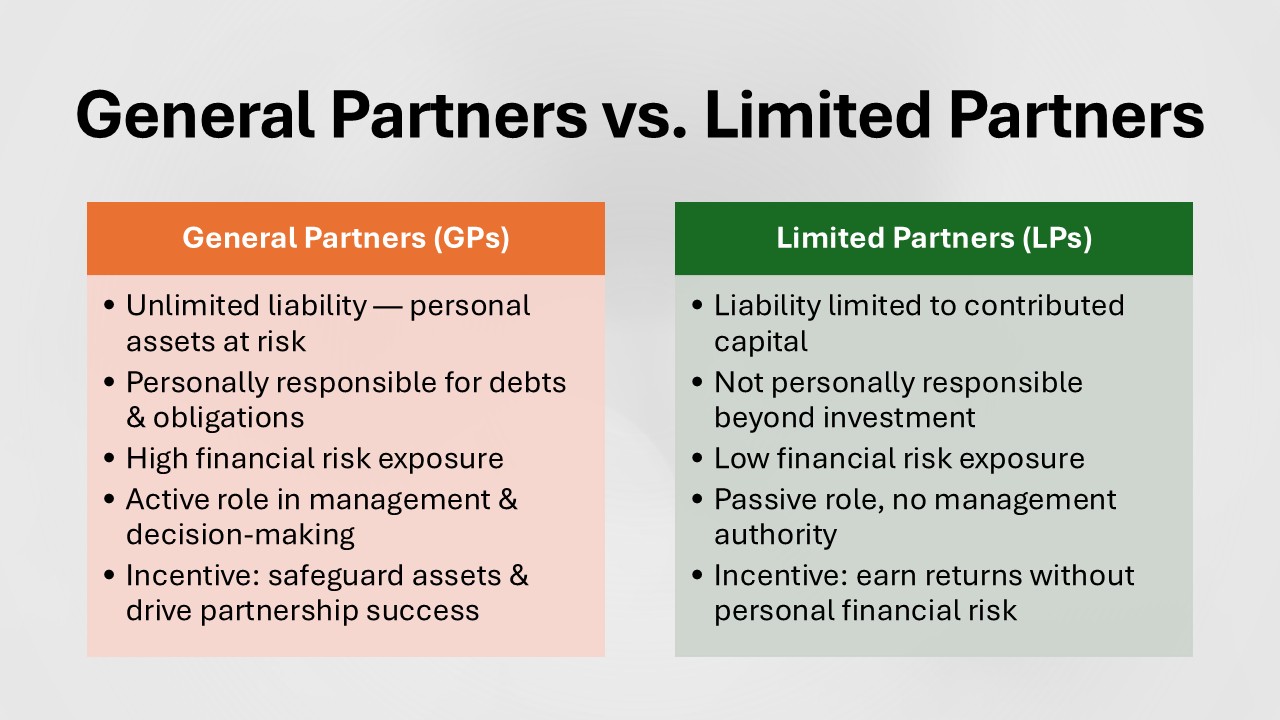

Liability Differences

The distinction between the liability of general partners and limited partners is a defining feature of partnerships. General partners face unlimited liability, meaning they are personally accountable for the partnership’s debts and obligations. This heightens their involvement in ensuring the partnership’s financial stability and successful operations. In contrast, limited partners benefit from limited liability, risking only the capital they have contributed to the partnership. This structure allows limited partners to invest without the concern of personal financial risk beyond their investment, distinguishing their level of engagement and accountability from that of general partners.

Decision-Making Authority

General partners wield substantial decision-making authority, giving them the power to shape the partnership’s strategic direction actively. They are responsible for making critical business decisions, ranging from investment choices to operational management. This authority allows GPs to respond swiftly to market changes, implement new initiatives, and negotiate with external stakeholders. Conversely, limited partners typically have no say in these business operations. Their involvement is usually passive, primarily focusing on financial contributions without participating in daily management. This contrast in decision-making authority underscores the differing roles and responsibilities within a partnership framework.

Case Studies and Practical Examples

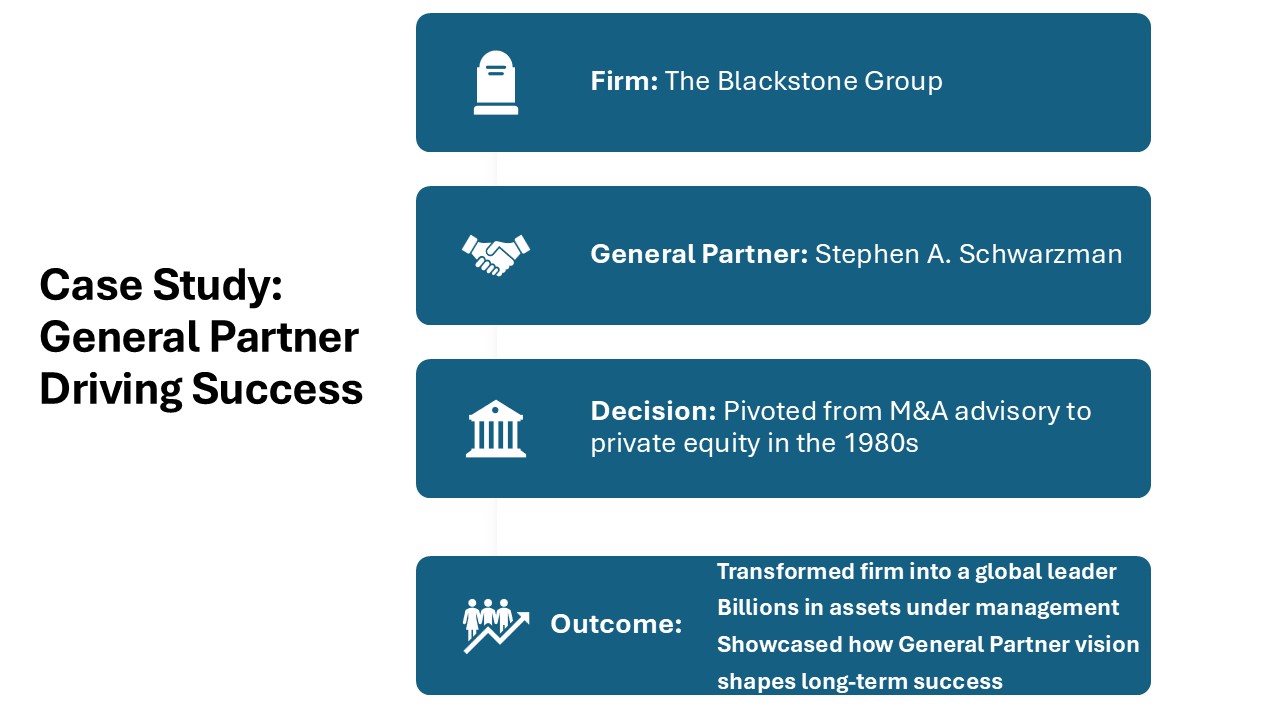

Successful General Partner Strategies

Successful general partners often employ strategies that emphasize innovation, risk management, and long-term growth. One key approach is fostering a diverse investment portfolio that balances high-reward opportunities with stable, low-risk investments. This diversification helps mitigate potential losses while maximizing returns. GPs also prioritize building strong networks and relationships with industry experts and stakeholders, facilitating access to valuable insights and business opportunities. Additionally, they focus on maintaining transparency and open communication with investors, ensuring trust and confidence. By adopting a data-driven approach, using market analyses and financial metrics, GPs can make informed and strategic decisions that drive the partnership forward.

Lessons from Notable Failures

Learning from failures is crucial for general partners seeking to refine their strategic approach. One common mistake seen in unsuccessful partnerships is inadequate risk assessment, where GPs underestimated the market volatility or unforeseen liabilities, leading to significant financial losses. Other failures often result from poor communication with limited partners and stakeholders, eroding trust and investor confidence. Additionally, overleveraging can strain resources, causing cash flow issues and operational inefficiencies. By analyzing these pitfalls, GPs can emphasize the importance of diligent due diligence, transparent investor relations, and prudent financial management in their strategies to avoid similar downfalls.

The Impact of General Partners in Venture Capital

Encouraging Risk Diversification

General partners play a pivotal role in promoting risk diversification within a partnership. By leveraging their deep industry knowledge, they can identify and balance investments across various sectors and asset classes. This strategic approach minimizes exposure to any single market’s volatility, safeguarding the partnership’s overall stability. They often employ asset allocation techniques, spreading resources across equities, bonds, and alternative investments. Diversification not only mitigates potential losses but also positions the partnership to capitalize on emerging opportunities. General partners’ proactive management and foresight in diversifying risks are essential for driving sustainable growth and preserving investor value.

Driving Innovation and Growth

General partners are catalysts for innovation and growth within their partnerships. By championing creative solutions and encouraging an entrepreneurial mindset, they help to drive transformative projects and initiatives. Their strategic guidance often leads to investing in cutting-edge technologies and startups, positioning the partnership at the forefront of industry advancements. Partnerships like these frequently encompass various entities, such as institutional investors and high-net-worth individuals, who seek long-term startup investments without the need for active involvement in operations. GPs foster an environment that supports research and development, allowing for the exploration of new markets and expansion opportunities. Their leadership in implementing forward-thinking strategies not only accelerates growth but also enhances the partnership’s competitive advantage, ensuring sustained success in a dynamic business landscape. Pass-through taxation facilitates efficient asset allocation, as profits and losses are directly shared with partners, avoiding double taxation at the company level.

Future Trends and Predictions

Technological Advancements Influencing Roles

The roles of general partners are being reshaped by rapid technological advancements, allowing for more efficient and informed decision-making. Technologies such as artificial intelligence and big data analytics are enabling GPs to gain deeper insights into market trends and investment opportunities. These tools help in predictive analysis, allowing for better risk assessment and enhanced portfolio management. Additionally, technologies streamline operational processes, reducing overhead and increasing productivity. By embracing these advancements, general partners can optimize their strategies, stay agile in the face of change, and maintain a competitive edge in the ever-evolving market.

Shifts in Legal and Economic Frameworks

Recent shifts in legal and economic frameworks are redefining the landscape for general partners. Changes in regulatory policies, such as increased oversight and reporting requirements, are prompting GPs to adopt enhanced governance practices. These frameworks emphasize transparency, accountability, and risk management, compelling GPs to reassess their strategies. Economically, global market fluctuations and trade policies are influencing investment choices and risk assessments. General partners must be adept at navigating these shifts, leveraging legal insights and economic forecasts to adjust their actions proactively. Staying informed and agile in response to these changes is crucial for sustaining partnership growth.

FAQs

What is the definition of a general partner?

A general partner is an individual or entity responsible for managing the daily operations of a partnership. They have the authority to make decisions and are personally liable for the partnership’s liabilities and debts. Their hands-on role includes overseeing business strategies, investment decisions, and maintaining investor relations. General partners play a crucial role in ensuring the partnership’s success and sustainability.

What is the primary role of a general partner?

The primary role of a general partner is to manage the partnership’s daily operations and strategic decision-making. They oversee investment choices, guide business strategies, and maintain relationships with investors. Their hands-on management ensures the partnership’s efficiency and growth, while they also assume unlimited liability for its debts and obligations.

How do general partners differ from limited partners?

General partners differ from limited partners primarily in their level of involvement and liability. General partners manage daily operations and make strategic decisions, bearing unlimited liability for the partnership’s debts. Limited partners, however, primarily contribute capital and have limited liability, meaning they are not personally responsible for debts beyond their investment.

Why do general partners face unlimited liability?

General partners face unlimited liability because they actively manage the partnership and make binding decisions that impact its operations and finances. This responsibility makes them personally accountable for any debts or obligations the partnership incurs, as they have significant control over its strategic direction and financial outcomes.

How does one become a successful general partner?

Becoming a successful general partner involves developing strong leadership, decision-making, and strategic planning skills. Building a robust network, understanding market trends, and mastering financial management are essential. Effective communication and maintaining transparent investor relations also contribute to success. Continuous learning and adapting to industry changes further enhance a general partner’s effectiveness.

What is the difference between a general partnership and a limited partnership?

A general partnership involves all partners sharing equal responsibility in managing the business and bearing unlimited liability for debts. In contrast, a limited partnership includes both general partners, who manage the business and hold unlimited liability, and limited partners, who primarily invest capital and have limited liability, protecting their personal assets beyond their investment.