KEY TAKEAWAYS

- Gross wages form the foundation for calculating taxes and employee take-home pay, underscoring the importance of paying employees all wages earned promptly to avoid legal and financial repercussions.

- Proper understanding of gross wages is essential for HR professionals as it aids in effective compensation management and helps attract and retain top talent through clear differentiation between gross and net wages.

- Gross wages include a wide range of compensations such as regular and overtime pay, bonuses, commissions, and fringe benefits, all of which are higher than net wages due to the deductions for taxes, health insurance, and other withholdings.

Decoding Gross Wages

Defining Gross Wages

Gross wages refer to the total amount of money an employee earns before any deductions are taken. This includes all sources of income, such as their base salary, overtime pay, bonuses, and any other compensation. It’s the starting point for payroll calculations and serves as the figure on which tax and other deductions are based. Understanding gross wages gives you a comprehensive view of the potential earnings.

Components of Gross Wages

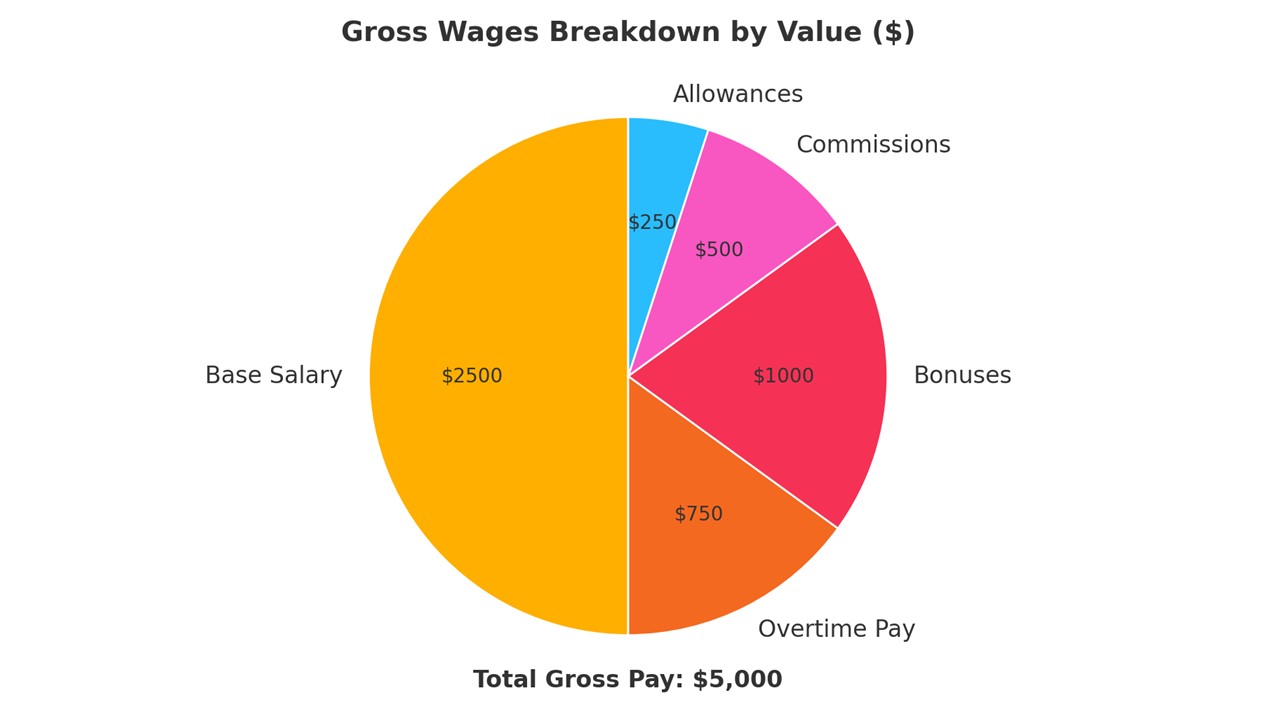

Gross wages comprise various components that collectively define an employee’s total earnings before deductions. These components include:

- Base Salary: The fixed annual or hourly wage agreed upon in the employment contract.

- Overtime Pay: Additional compensation for hours worked beyond the standard workweek, often calculated at a higher rate.

- Bonuses: Extra earnings awarded for performance, seasonal work, or company profits.

- Commissions: Compensation based on sales or productivity targets achieved.

- Allowances: Financial support for specific purposes, such as travel or housing, provided by the employer.

Together, these elements form the complete picture of what an individual can potentially earn in a given period.

Importance of Gross Wages in Payroll

Gross wages play a pivotal role in payroll management due to their impact on financial planning and statutory compliance. They are essential for calculating tax withholdings, determining eligibility for benefits, and adhering to labor laws. Organizations use gross wages to budget labor costs accurately and make strategic decisions about staffing and compensation structures. Moreover, understanding gross wages helps in transparent salary negotiations and setting realistic financial expectations.

Understanding Net Income

What is Net Income?

Net income, often referred to as take-home pay, is the amount an employee receives after all deductions have been made from their gross wages. These deductions include taxes, social security, health insurance premiums, retirement contributions, and any other applicable withholdings. Net income represents the actual amount that an employee can spend or save, making it a crucial figure for personal financial planning.

Factors Affecting Net Income

Several factors influence net income, leading to variations in take-home pay across different employees. Key factors include:

- Tax Brackets: The amount of federal and state taxes deducted depends on the employee’s earnings and applicable tax rate.

- Benefit Contributions: Deductions for items such as health insurance, retirement plans, and flexible spending accounts reduce net income.

- Social Security and Medicare: Mandatory contributions to these federal programs directly reduce gross wages.

- State and Local Taxes: Additional taxes imposed by state and local governments vary by location.

- Union Dues and Wage Garnishments: Any contractual or legal deductions, such as union dues or debt-related garnishments, impact net income.

Understanding these factors helps in anticipating and adjusting take-home pay accordingly.

Net Pay vs. Gross Pay: What’s the Difference?

The primary difference between net pay and gross pay lies in deductions. Gross pay is the total income earned before any deductions, encompassing salary, bonuses, and other earnings. Net pay, however, is what remains of this total after deductions such as taxes and contributions. While gross pay gives a broad view of earnings potential, net pay is the figure that reflects what you can actually use. Comparing the two helps visualize the impact of taxes and other withholdings on income.

Gross vs. Net: A Detailed Comparison

Calculating Gross Wages

Calculating gross wages involves summing up all forms of compensation before deductions. Here’s how it can typically be calculated:

- Base Salary/Wages: Start with the agreed-upon annual or hourly salary.

- Overtime Pay: Add any earnings from overtime, calculated at your regular rate times a specified multiplier.

- Bonuses and Commissions: Include additional payouts from performance bonuses and sales commissions.

- Allowances and Other Benefits: Factor in any allowances like housing or transportation and other non-monetary benefits converted to monetary equivalents.

For example, if you earn a base salary of $40,000, receive $5,000 in bonuses, and $2,000 in overtime, your gross wages for the year would be $47,000.

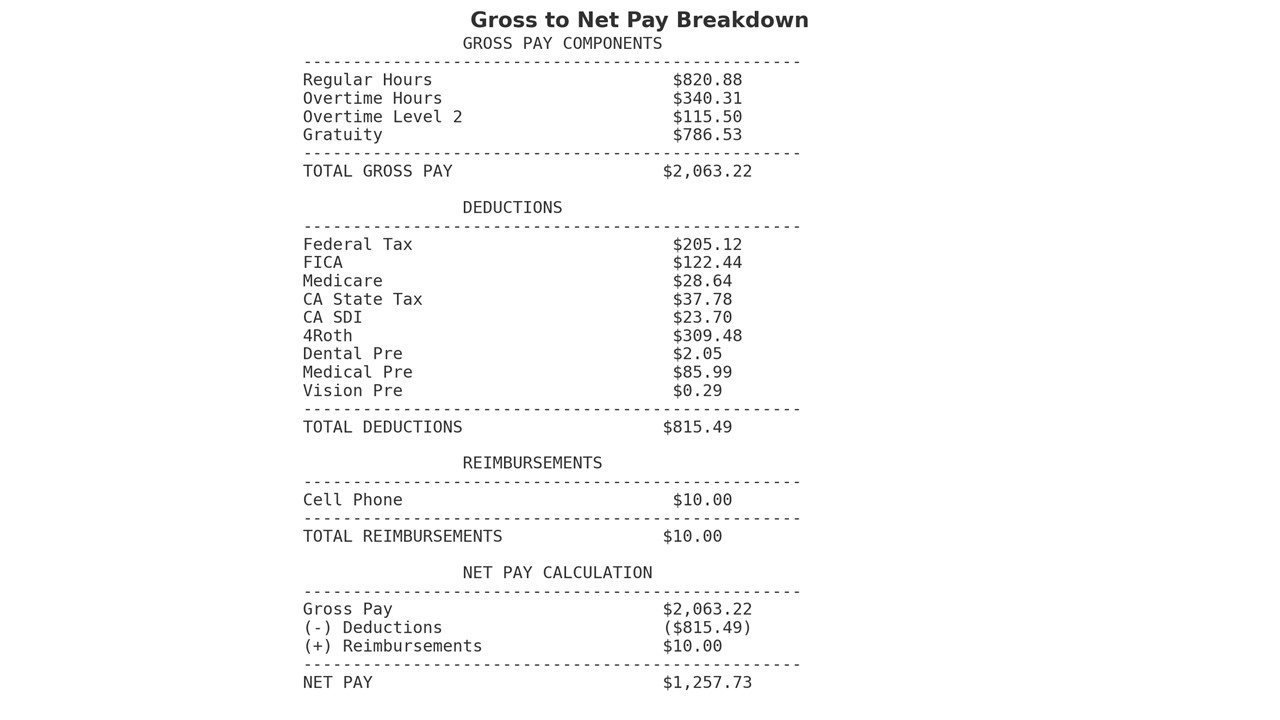

Calculating Net Pay

Calculating net pay involves deducting various taxes and contributions from your calculated gross wages. Here’s a step-by-step method:

- Calculate Gross Income: Begin with the total annual gross wages, which typically appears on a pay stub at the bottom of the page in a larger font.

- Deduct Federal Taxes: Use the applicable tax bracket to determine federal tax liability.

- Subtract State/Local Taxes: Account for any additional state income tax withholdings or local taxes based on your residence, recognizing that these vary by state.

- Social Security and Medicare: Deduct contributions made to social security and Medicare (typically 6.2% for social security and 1.45% for Medicare as of 2023).

- Other Deductions: Consider health insurance premiums, contributions to a retirement savings plan such as a 401(k), union dues, or any other personal deductions. These deductions often happen on a pretax basis, reducing taxable income.

For instance, if your gross income is $50,000 and total deductions (taxes, insurance, etc.) amount to $15,000, your net pay would be $35,000.

Examples to Simplify the Differences

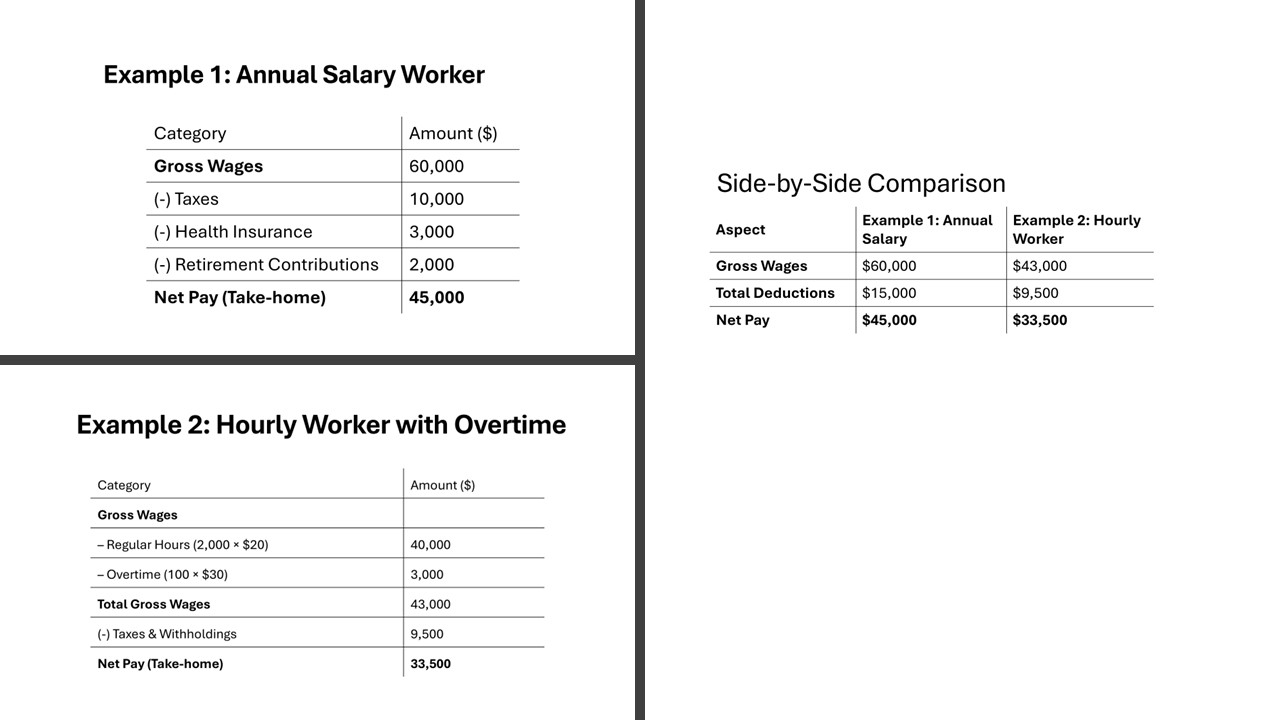

To clarify the distinction between gross and net pay, consider the following example:

Example 1: Annual Salary Worker

- Gross Wages: An employee earns a base salary of $60,000 annually.

- Deductions:Taxes: $10,000

- Health Insurance: $3,000

- Retirement Contributions: $2,000

- Net Pay: After deductions, the employee takes home $45,000.

Example 2: Hourly Worker with Overtime

- Gross Wages:Hourly Rate: $20

- Regular Hours: 2,000 hours ($40,000)

- Overtime (100 hours at $30/hour): $3,000

- Deductions:Taxes and other withholdings: $9,500

- Net Pay: After reducing gross wages by deductions, the net pay is $33,500.

These examples provide a clear picture of how gross wages are reduced through necessary deductions to arrive at net pay, underscoring the real-world implications on your earnings.

Implications for Employers and Employees

Why Employers Focus on Gross Wages

Employers concentrate on gross wages because they provide a comprehensive overview of their total payroll obligations, aiding in budgeting and financial planning. Gross wages reflect the full cost of employing staff, including overtime, bonuses, and other incentives. This focus helps employers determine competitive pay structures to attract and retain talent. Moreover, gross wages are the basis for statutory reporting and compliance with labor laws, ensuring that all legal obligations are consistently met.

How Employees Perceive Net Income

Employees often view net income as the most critical aspect of their earnings because it represents their actual take-home pay. This focus shapes their budget, lifestyle, and financial decisions. Knowing net income allows employees to plan for expenses, savings, and investments with more accuracy. Since net pay directly affects daily life, any changes to deductions or tax rates can significantly impact an employee’s perception of their overall compensation.

Misconceptions in Wage Analysis

Misconceptions in wage analysis frequently arise from misunderstandings about gross versus net income. Many people assume that their gross salary is the amount they will receive in their bank accounts, leading to budgeting errors. Another common myth is that increases in gross salary will proportionally increase net pay, ignoring the impact of higher tax brackets and deductions. Additionally, some employees are unaware of all deductions affecting their net income, such as healthcare costs and retirement contributions, which can lead to surprises on payday. Correcting these misconceptions requires a clear understanding of payroll components and regular review of pay statements.

Practical Tips for Managing Payroll Effectively

Handling Multiple Pay Rates

Managing multiple pay rates involves a layered approach to ensure accuracy and compliance. Start by clearly defining each role and associated pay rate within employment contracts. Advanced payroll systems can automate calculations of different rates for various tasks, preventing errors. Regularly updating and auditing payroll records is crucial, especially when changes in roles or rates occur. Training payroll staff to handle multiple pay rates efficiently can minimize mistakes and enhance accuracy. Additionally, maintaining communication with employees about their specific pay rates helps establish transparency.

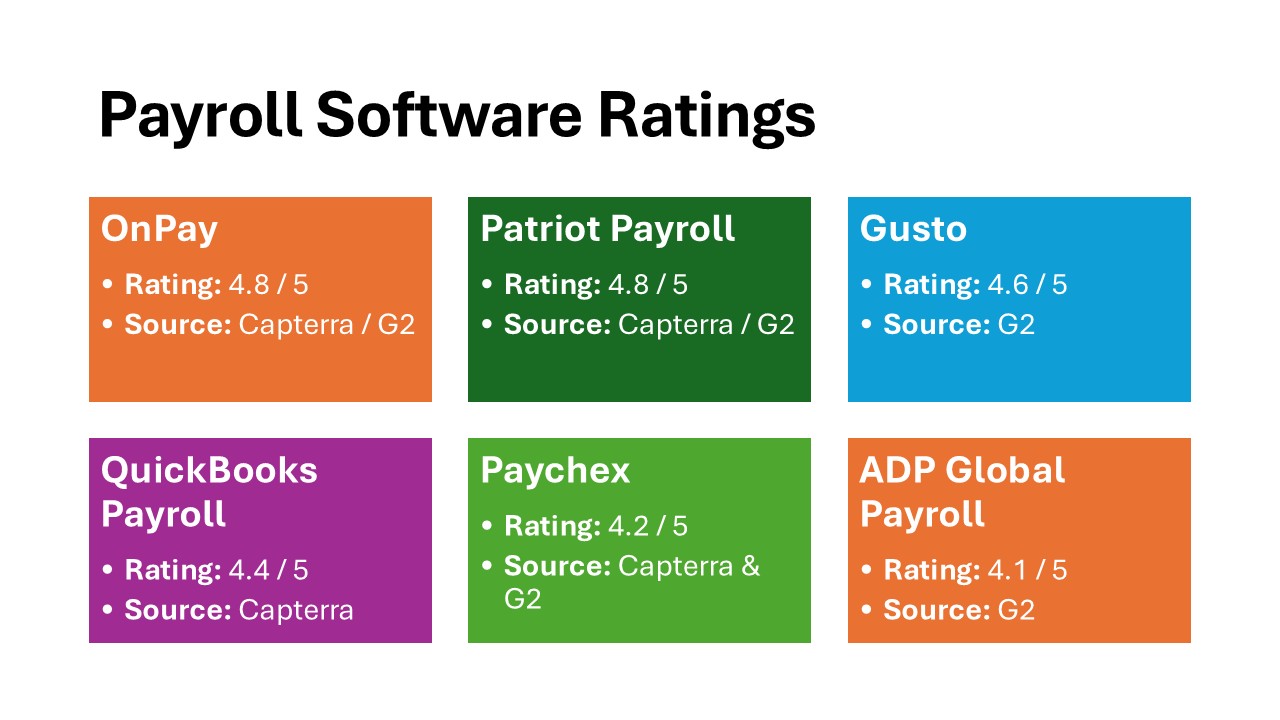

Stress-Free Payroll Solutions

Adopting stress-free payroll solutions can significantly enhance efficiency and reduce errors. Consider implementing cloud-based payroll software that automates calculations, tax filing, and compliance updates. These platforms often offer user-friendly dashboards, allowing easy tracking of payroll components and deadlines. Outsourcing payroll to third-party providers can eliminate administrative burdens, freeing up time for strategic tasks. Consistent training and updates for payroll personnel ensure they remain adept at utilizing these technologies. Automated reminders for key tasks, such as filing taxes, further contribute to a stress-free payroll process.

Common Payroll Mistakes to Avoid

Avoiding payroll mistakes is crucial to maintaining employee trust and staying compliant with regulations. Here are some common pitfalls and how to sidestep them:

- Incorrect Employee Classification: Misclassifying employees as independent contractors can lead to legal complications and fines.

- Missing Deadlines: Late payments and filings result in penalties. Utilize automated reminders to stay on schedule.

- Ignoring Overtime Rules: Failing to pay the correct overtime rates can result in disputes and legal action.

- Incorrect Tax Withholding: Ensure tax tables are up-to-date and deductions are accurate to avoid IRS penalties.

- Neglecting Record-Keeping: Poor documentation can cause errors and hinder audits. Maintain comprehensive records for all payroll activities.

Regular audits and training can prevent these mistakes, safeguarding your payroll process.

Navigating Tax Implications

Gross Wages vs. Taxable Wages

Gross wages and taxable wages are often confused, but they are distinct figures with specific implications for payroll processing. Gross wages encompass the total earnings before any deductions, including salary, bonuses, and allowances. Accurately determining gross pay is essential to adhere to employment laws, including maintaining compliance with minimum wage requirements as outlined by the Fair Labor Standards Act (FLSA). On the other hand, taxable wages are derived from gross wages after excluding non-taxable deductions such as certain retirement contributions and health insurance premiums. For example, if an employee has a gross wage of $50,000 and contributes $5,000 to a retirement plan, their taxable wage might be $45,000, assuming the contribution is tax-deductible. Understanding this distinction helps in accurate tax calculation and ensures compliance with tax regulations.

Reporting to Social Security

Reporting wages to Social Security is a crucial task for employers, as it ensures employees receive the correct future benefits. This involves accurately documenting the total wages subject to Social Security tax, commonly 6.2% as of 2023, of each employee’s gross earnings up to the annual wage base limit. Employers must report these figures annually using Form W-2, delivered to both the employee and the Social Security Administration (SSA). Accurate reporting affects employees’ benefits and helps maintain compliance with federal regulations. Regular audits of wage reporting can prevent errors and facilitate smooth SSA interactions.

Understanding Medicare and FICA Deductions

Medicare and FICA (Federal Insurance Contributions Act) deductions are integral components of employee payroll. FICA includes both Social Security and Medicare taxes, ensuring contributions to these essential federal programs.

FAQs

What is the gross wages meaning in payroll?

Gross wages in payroll refer to the total earnings of an employee before any deductions, such as taxes, insurance, and retirement contributions. This includes the base salary, overtime, bonuses, and other sources of income.

What constitutes gross wages on a paycheck?

Gross wages on a paycheck consist of all earnings before deductions, including base salary, overtime pay, bonuses, commissions, and any allowances or additional income received during the pay period.

How do you calculate net income from gross wages?

To calculate net income from gross wages, subtract all deductions, such as taxes, social security, Medicare, health insurance premiums, and retirement contributions, from the gross wages amount. The result is the net income, or take-home pay.

Is it possible for net pay to be higher than gross pay?

No, net pay cannot be higher than gross pay. Net pay is the amount left after all deductions are taken from gross wages, so it is always less than or equal to the gross pay.

How do I understand net vs gross income in salary terms?

Gross income is your total earnings before deductions, including salary, bonuses, and other payments. Net income is what’s left after deductions like taxes and insurance, reflecting your take-home pay. Understanding this helps you plan your budget and financial goals more accurately.

What is included in gross total income for employees?

Gross total income for employees includes all earnings before any deductions. This comprises base salary, overtime, commissions, bonuses, allowances, and any other taxable income.