KEY TAKEAWAYS

- Liquidity and Flexibility: Cash equivalents must be easily convertible into cash, emphasizing the need for high liquidity. They are essential for a company’s financial health as they enable quick access to funds, which is crucial for meeting immediate financial obligations without significant penalties or disruptions.

- Short-Term Maturity: Investments classified as cash equivalents generally have an original maturity of three months or less from the date of investment. This ensures that they are near maturity, minimizing potential value fluctuations and ensuring stability in their valuation.

- Low Risk Profile: These instruments include U.S. government Treasury bills, bank certificates of deposit, bankers’ acceptances, and corporate commercial paper, all noted for their low risk. Their inherent stability makes cash equivalents a reliable component of a company’s assets during financial assessments.

What Are Cash Equivalents?

Defining Cash Equivalents

Cash equivalents are highly liquid financial instruments that are readily convertible into a known amount of cash with minimal risk of a change in value. They typically have maturities of three months or less from the date of acquisition, embodying maturity characteristics that minimize interest rate risk. These assets support the cash equivalent balances that businesses maintain for liquidity purposes. Examples include Treasury bills and money market funds, while a banker’s acceptance can finance inventory, ensuring operational continuity. Organizations often manage separate cash equivalent accounts to distinguish these assets from other types, contributing to accurate financial reporting. Due to their stable nature, cash equivalents play a significant role in maintaining an organization’s liquidity and CCE balance. Having a well-managed CCE balance ensures that organizations can meet their financial obligations promptly. Cash in checking accounts allows access via electronic debit, integrating seamlessly with cash deposits for efficient financial operations. Because they are backed by their issuer, cash equivalents offer security and solvency to finance units, facilitating efficient reconciliation and disbursement. High CCE resources might indicate preparedness for substantial purchases, though holding excessive amounts can be seen as inefficient. The actual accounting definition encompasses a variety of factors beyond these basics, acknowledging their complexity.

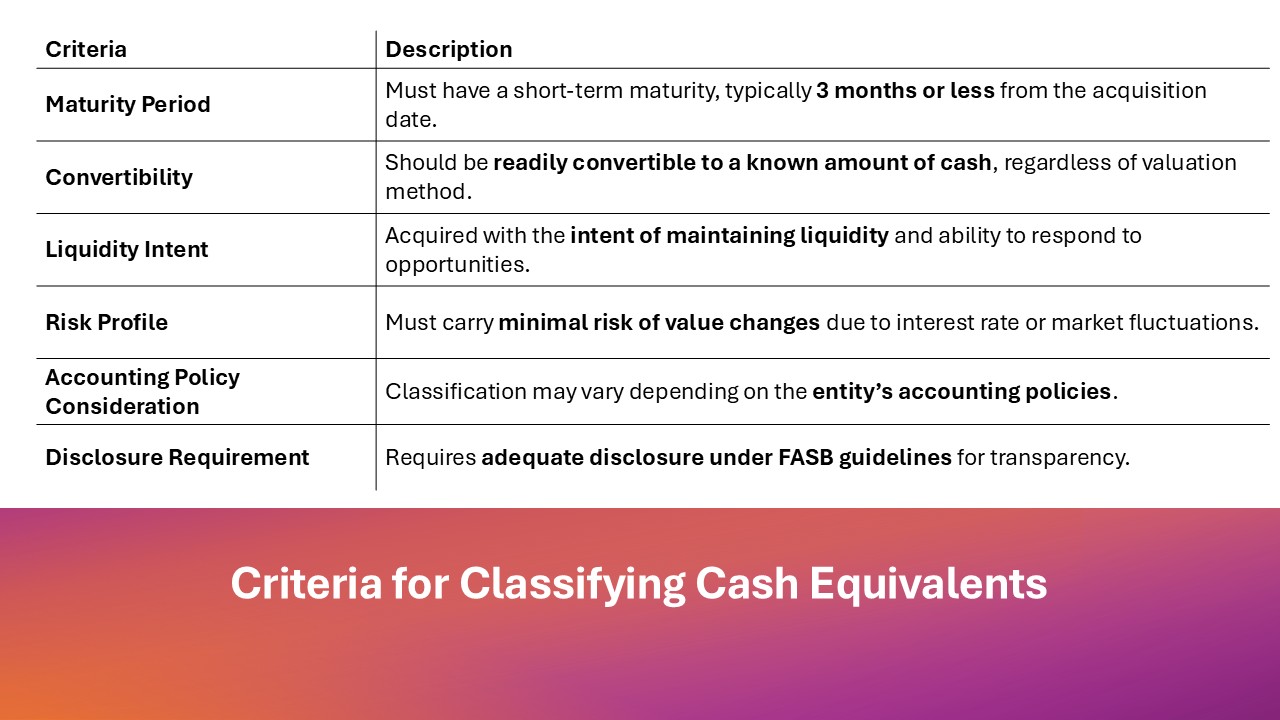

Criteria for Classification

For a financial instrument to be classified as a cash equivalent, it must meet specific criteria. First, it should have a short maturity period, usually three months or less from its acquisition date, in accordance with the generally accepted accounting principles. Second, it must be easily convertible to a known amount of cash despite the underlying valuation method employed by a company. Additionally, to achieve a maximum level of liquidity, the underlying investment should be chosen with the borrower’s intent to easily benefit from new opportunities. Lastly, it should pose minimal risk of changes in value due to interest rate fluctuations or other market conditions, and this determination may vary according to an entity’s accounting policy. These stringent criteria ensure that these assets offer security and prompt accessibility, crucial for effective financial management. Such classification also involves adequate disclosure according to FASB guidelines to enhance transparency.

Key Types of Cash Equivalents

Treasury Bills and Their Role

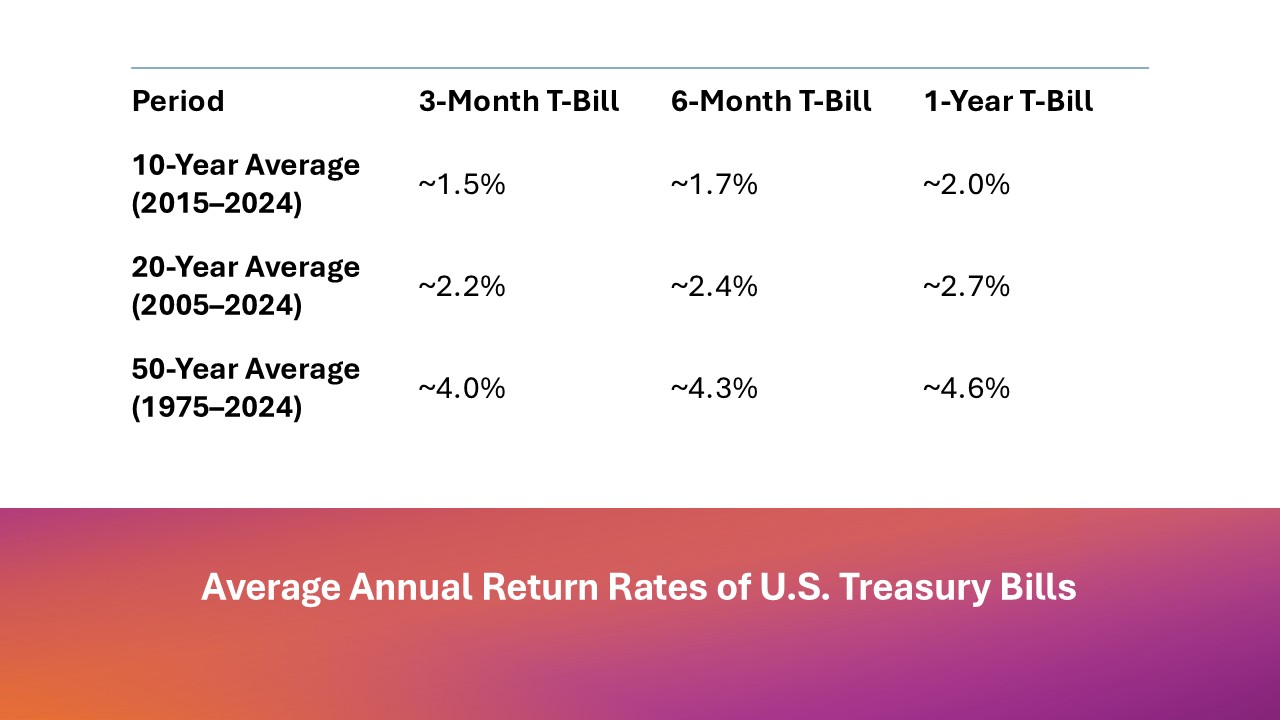

Treasury Bills (T-bills) are short-term government securities issued at a discount and mature at face value. They play a vital role as cash equivalents due to their liquidity, government backing, and low risk of default. T-bills yield proceeds that are the difference between the purchase price and the value at redemption, showcasing their stability. Typically, this level of detail can be found in the listings and footnotes of financial statements. Sold in various denominations with maturities ranging from a few days to one year, they offer availability to both individuals and companies intending to park funds temporarily without sacrificing security or liquidity. The takeaway is that their minimal risk profile makes them an attractive choice for those looking to avoid restricted cash scenarios or reliance on collateral. Furthermore, maintaining higher cash equivalent balances like T-bills can strategically position companies to capitalize on unforeseen business opportunities without liquidity concerns.

Commercial Paper Explained

Commercial paper is an unsecured, short-term debt instrument issued by corporations to meet their immediate financing needs, such as payroll or inventory expenses. It is often employed by companies due to the efficient lending process, which allows issuers to quickly access proceeds without the need for collateral. Typically issued at a discount, commercial paper matures in under nine months, with common maturities being 30, 60, or 90 days. Due to its unsecured nature, only firms with strong credit ratings can leverage commercial paper as cash equivalents, ensuring that investors face minimal default risk. These instruments are crucial as they enable companies to pay invoices and other immediate liabilities while maintaining liquidity. Creditors often give importance to the cash ratios of entities using commercial paper, as it assures them of the company’s capacity to meet debt obligations when due. This instrument offers corporations a cost-effective funding option while providing investors with an attractive interest rate compared to traditional savings accounts. Additionally, according to recent updates, when reconciling financial statements, commercial papers may be classified alongside cash equivalents, further emphasizing their role in managing cash flows.

Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are time deposits offered by banks that provide a fixed return over a specified period. While longer-term CDs lack the liquidity needed to qualify as cash equivalents, short-term CDs, typically those with maturities of three months or less, fit the criteria. According to Investopedia, these short-term CDs offer a slightly higher interest rate than standard savings accounts due to their fixed maturity date. Short-term CDs present a low-risk, stable option for investors seeking a predictable yield on cash reserves. In banking operations, demand deposits also play a crucial role, being cash in nature, to complement these CDs by ensuring liquidity. These CDs serve as vital tools for managing financial portfolios and can be a strategic complement to cash deposits, balancing immediate access to funds with locked potential gains. It’s important to note that these investments differ from demand deposit bank accounts, such as checking and savings accounts, which allow withdrawals anytime without penalties. Early withdrawal from CDs is generally limited and may incur penalties, which is a factor to consider when planning liquidity needs. Having a strategy for CCE resources is important, as they help manage investments efficiently, ensuring optimal liquidity and potential returns.

Money Market Funds

Money market funds are mutual funds that invest in short-term, high-quality securities representing liquidity and stability. These funds aim to maintain a stable net asset value, usually $1 per share, making them suitable cash equivalents. Investors appreciate money market funds for their balance of accessibility, relatively low risk, and competitive yields. On behalf of investors, issuers ensure that the funds typically include a diversified portfolio of Treasury bills, commercial paper, and certificates of deposit, meeting the safety and liquidity criteria necessary for cash equivalents. Additionally, bank overdrafts related to these funds are often classified as financing activities in financial statements. Borrower accounts and transactions within money market funds provide critical insights into liquid asset management strategies, highlighting the matter of maximizing investment yields. A cash receipt from these investments can provide a clear snapshot of liquid assets for personal or business financial records.

Features of Cash Equivalents

Liquidity and Accessibility

Liquidity and accessibility are core features of cash equivalents, allowing them to be quickly converted to cash without a significant loss in value. This ensures that they are available to meet immediate financial obligations. Cash equivalents, which include items such as banker’s acceptances and Treasury bills, provide ease of transactions and transfers. These types of accounts, along with others like inventory and prepaid assets, enable immediate access. However, unlike accounts receivable which lack guarantee and can’t be recorded as cash equivalents, these assets are easily liquidated. The short-term nature of these securities, combined with their ready price availability on public exchanges, supports seamless integration into daily operations, a matter of great importance when managing portfolios. This offers peace of mind to individuals and businesses needing fast access to funds while effectively utilizing cash equivalent accounts. The inclusion of such assets in financial listings ensures they are properly accounted for and managed.

Safety and Risks Involved

Cash equivalents are generally considered safe due to their short maturities and stability. Instruments like Treasury bills and money market funds are backed by strong entities, such as the government, further mitigating default risk. However, despite their safety, they are not completely risk-free. Interest rate fluctuations can impact returns, and while the risk of losing principal is minimal, it is not non-existent. Additionally, in rare cases, funds may face liquidity challenges during widespread financial crises. Financing activities related to these cash equivalents should be carefully examined for any involvement of collateral or lending, as this could affect the maturity characteristic and potential risks. Regulatory updates may also influence structure and behavior. Thus, while these instruments provide a safe harbor, it’s essential to remain mindful of any potential risks and consider how ownership and reconciliation might play a role in their repayment. Any liabilities, like taxes, tied to these investments need careful evaluation regarding available assets for timely payment.

Why Are Cash Equivalents Important?

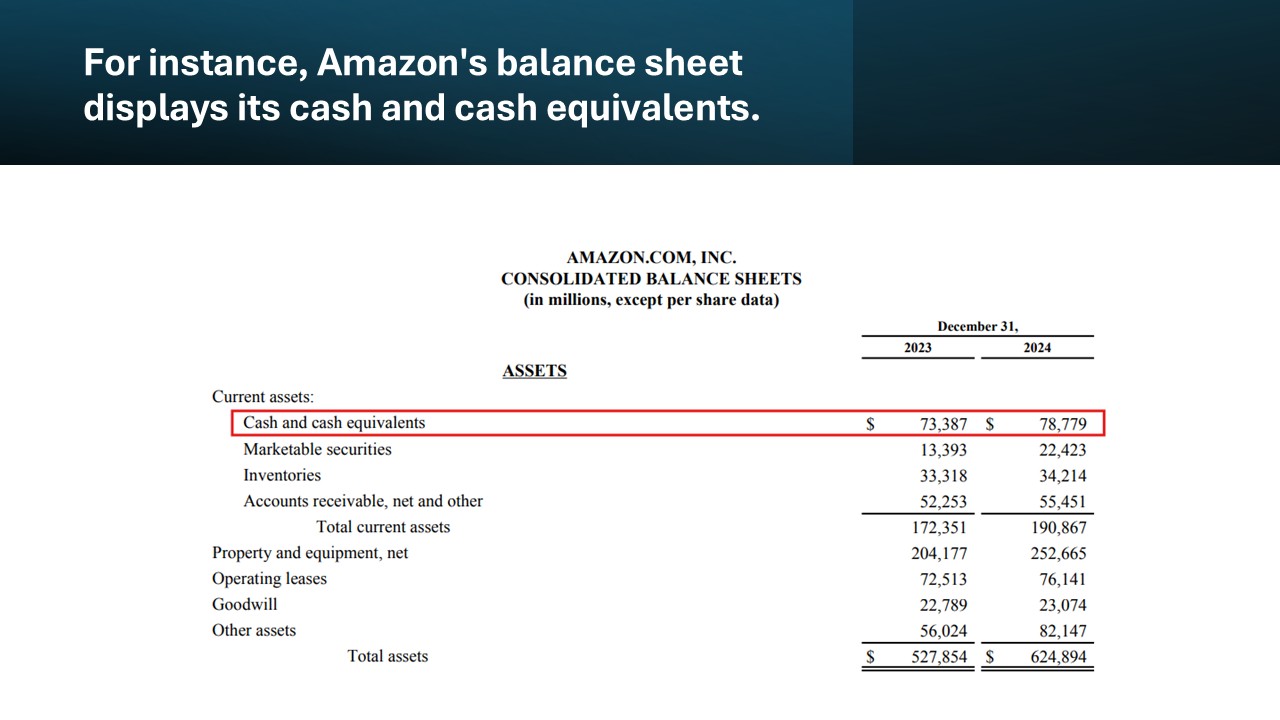

Impact on Financial Statements

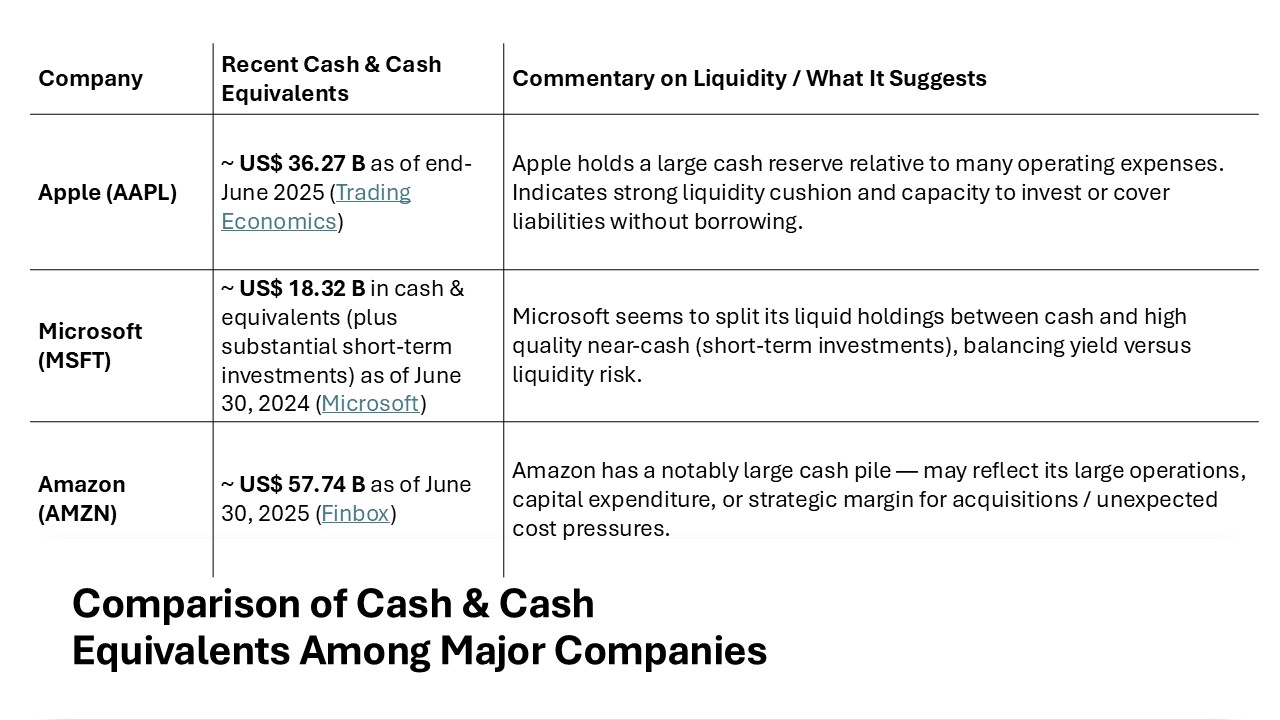

Cash and cash equivalents prominently feature on a company’s balance sheet under current assets, reflecting their role as immediate liquidity sources. In accordance with generally accepted accounting principles (GAAP), cash equivalents are often described as assets with original maturities of three months or less. These are crucial for supporting the company’s liquidity ratio and ability to meet short-term liabilities efficiently, such as servicing debts and paying invoices. These assets also uphold investor confidence, demonstrating prudent cash management and operational efficiency. Maintaining a robust level of cash equivalents, including managing arrangements with borrowers through bank borrowings and bank overdraft facilities, is often perceived by analysts as a sign of sound financial planning and operational resilience.

Role in Financial Modeling

In financial modeling, cash equivalents play a crucial role in depicting a company’s liquidity and short-term financial health. They are integral to various financial metrics, such as the cash ratio and net working capital, which analysts use to assess a firm’s ability to cover its short-term liabilities. Accurate representation of these assets in models ensures realistic cash flow projections, informing investment decisions and strategic planning. Furthermore, they provide a buffer in sensitivity analyses, helping model how a company can withstand economic fluctuations or operational setbacks.

Real-World Examples of Cash Equivalents

Government Bonds as Cash Equivalents

Government bonds, particularly those with short-term maturities, can qualify as cash equivalents due to their liquidity and low-risk nature. These bonds are backed by the government’s credit, ensuring a high level of security for investors. While not all government bonds fit this classification, those with maturities of three months or less are often included in a company’s liquidity portfolio. Their inclusion serves as a safeguard in financial strategies, providing certainty in cash flow management.

Case Study on Corporate Use

Consider a global tech corporation that strategically manages its liquidity using cash equivalents to navigate market volatility. During an economic downturn, the company capitalized on its robust portfolio of cash equivalents, including Treasury bills and money market funds, to seamlessly finance operations and maintain stability. This approach not only met immediate financial obligations but also enabled strategic investments during the recession. The company’s financial agility underscores the importance of cash equivalents in sustaining operations without resorting to high-cost borrowing.

Advantages and Disadvantages

Pros of Using Cash Equivalents

Cash equivalents offer several advantages, making them a preferred choice for liquidity management:

- Stability: With low default risk, they provide a secure investment option.

- Liquidity: Easily convertible to cash, enabling swift access to funds.

- Predictability: Fixed returns aid in accurate financial planning.

- Diversification: A range of instruments offers options for portfolio diversification.

- Market Resilience: Helps weather economic fluctuations without substantial losses.

The benefits are clear, yet it’s vital to weigh these against potential downsides for comprehensive financial planning.

Potential Drawbacks

While cash equivalents are beneficial, they do come with certain drawbacks:

- Lower Returns: They generally offer lower yields compared to other investments, such as stocks or bonds.

- Inflation Risk: Returns may not keep pace with inflation, eroding purchasing power over time.

Despite these limitations, cash equivalents remain a crucial component for those prioritizing liquidity and safety over higher returns. They are best suited for conservative investors or short-term financial strategies.

Exclusions from Cash Equivalents

What Doesn’t Qualify?

Not all assets qualify as cash equivalents. For instance, stocks and long-term bonds are excluded due to their market volatility and extended maturity periods. Similarly, assets like real estate and collectibles don’t meet the criteria as they can’t be quickly converted to cash without a risk of significant value fluctuations. Understanding these exclusions is crucial for accurate financial reporting and ensuring that a company’s liquidity is genuinely reflected by its current, readily accessible assets.

Common Misconceptions

Several misconceptions surround cash equivalents, often leading to confusion in financial management. One common misunderstanding is that any liquid asset qualifies as a cash equivalent, when in fact, only those with short maturities and low risk do. Another misconception is conflating them with marketable securities, which can be more volatile and less readily converted to cash. Additionally, some believe that cash equivalents offer significant returns, whereas they are primarily for safety and liquidity rather than high yield. Clarifying these points ensures more effective and strategic cash management.

FAQs

How do cash equivalents differ from marketable securities?

Cash equivalents differ from marketable securities primarily in terms of risk and maturity. Cash equivalents are highly liquid, low-risk instruments with maturities of three months or less, offering stability. Marketable securities, while also liquid, often involve higher risk and longer maturities, making them subject to volatile market fluctuations.

Are stocks considered cash equivalents?

No, stocks are not considered cash equivalents. They are subject to market volatility and do not offer the liquidity or stability required for classification as cash equivalents. Stocks can fluctuate significantly in value over short periods, making them higher risk compared to typical cash equivalent instruments like Treasury bills or money market funds.

Can individual investors access cash equivalents?

Yes, individual investors can access cash equivalents through various financial products like money market funds, Treasury bills, and short-term CDs. These instruments are widely available through banks, brokers, and investment platforms, providing convenient options for individuals seeking safe, liquid investments with minimal risk.

What is the difference between cash and cash equivalents?

Cash refers to physical currency and bank account balances readily available for transactions. Cash equivalents, on the other hand, are short-term, highly liquid investments that can be quickly converted into cash with minimal risk. They include instruments like Treasury bills and money market funds, providing short-term flexibility while earning modest returns.

How cash and cash equivalents impact net working capital (nwc)?

Cash and cash equivalents positively impact net working capital (NWC) by enhancing liquidity and ensuring a firm’s ability to cover short-term liabilities. They constitute a significant part of current assets, increasing NWC when maintained at optimal levels. This supports operational efficiency and financial health, vital for managing day-to-day business activities.