KEY TAKEAWAYS

- Matching Principle: Capitalization aligns the costs and revenues, ensuring that expenses are reflected when the corresponding revenues are recognized. This method provides a more accurate representation of a company’s profitability by matching expenses to their related revenues.

- Compliance with GAAP: Proper capitalization is essential for adherence to Generally Accepted Accounting Principles (GAAP). It requires companies to capitalize qualifying assets correctly to maintain the integrity and accuracy of financial reporting.

- Financial Stability: Capitalization helps in preventing large expenditures from significantly impacting the income statement all at once. By spreading out these costs over time, companies can present more stable and clear earnings, offering a truer depiction of their financial health.

Understanding Asset Capitalization

Definition and Importance

Capitalization in accounting refers to the process of recognizing a cost as an asset rather than an immediate expense. This means that the cost is recorded on the balance sheet and is gradually expensed over its useful life through processes like depreciation or amortization, which appears as the income statement depreciation expense. Understanding why this is crucial comes down to accurate financial reporting, based on established accounting rules. Businesses rely on capitalization structures to finance assets effectively, using equity, debt, or hybrid securities. Capitalization allows businesses to spread the cost of long-lasting benefits over several years, thus aligning expenses with revenue generated from the asset. This practice not only smoothens income statements but also enhances balance sheet accuracy, providing a clear picture of financial health. Additionally, respecting the capitalization threshold—also known as the capitalization limit—ensures organizations don’t capitalize on minor expenses, keeping financial records clear and precise.

Key Benefits of Capitalization

Capitalization brings several advantages that can bolster a business’s financial standing. Here are some key benefits:

- Improved Financial Planning: By spreading the cost of an asset over its useful life, businesses can better predict future expenses and align them with revenue generation. The accounting team plays a crucial role in ensuring that this financial planning is precise.

- Enhanced Balance Sheet: Capitalization boosts the asset side of the balance sheet, potentially improving financial ratios and making the company more attractive to investors, even affecting compensation strategies within the organization.

- Tax Advantages: Certain capitalized costs might be eligible for tax deductions through depreciation, reducing taxable income over time, and lowering the company’s tax burden. This strategic move allows the company to pay lower taxes, enhancing cash flow.

- Increased Investment Opportunities: A stronger balance sheet can facilitate access to loans and credit, enabling further growth and expansion. Meeting the asset threshold for capitalization also helps businesses secure better funding options.

- Accurate Cost Matching: This method ensures that expenses match revenues, providing a more accurate reflection of a company’s financial performance, optimizing the timing of cost recognition.

These benefits underline why capitalization is a vital strategy for businesses aiming for sustainability and growth, aligning with practices in modern capital structure capitalization.

Criteria for Capitalizing Assets

Asset Lifespan Considerations

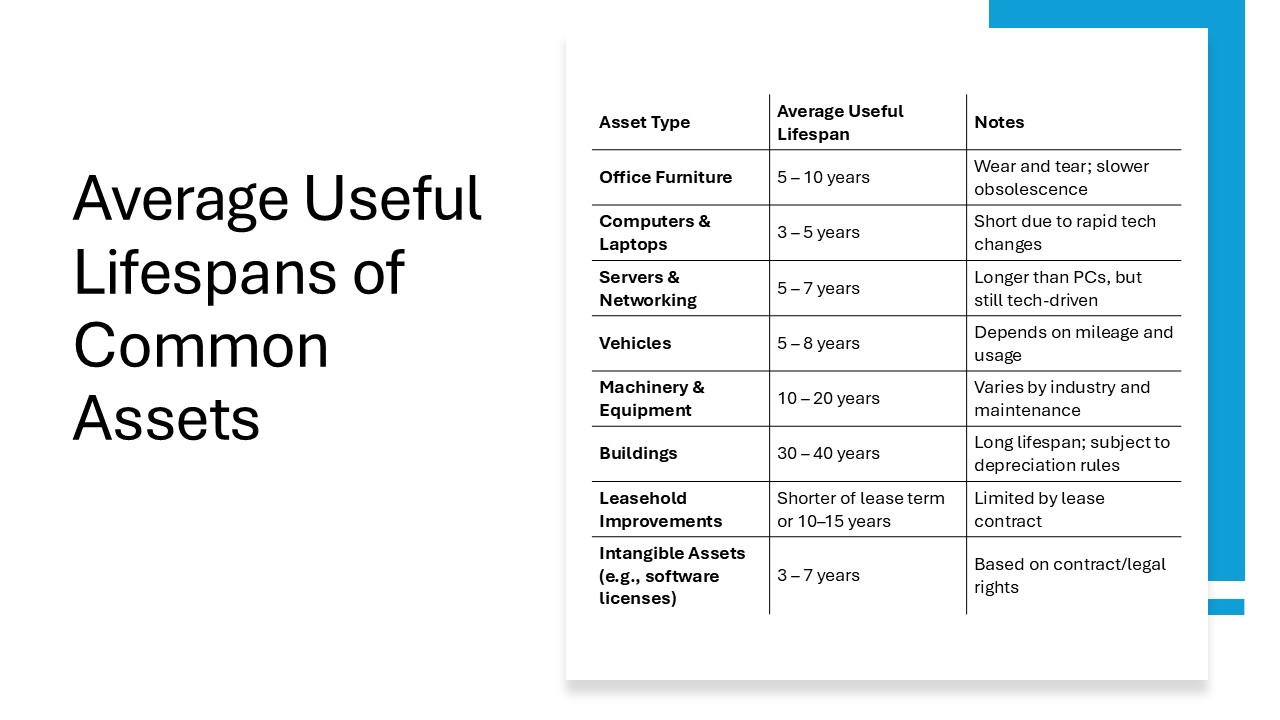

When capitalizing an asset, one of the critical considerations is its useful lifespan. An asset’s lifespan determines how long it will provide value to the company, which in turn influences how the cost is spread over time.

- Assessment of Economic Life: The economic lifespan should reflect how long the asset will generate economic benefits. This often requires expertise and judgment.

- Depreciation Methods: Different methods like straight-line or declining balance affect how expenses are recorded. Each method aligns differently with the asset’s economic utilization,

- Review and Adjustment: Lifespans should be regularly reviewed and adjusted if there are significant changes in usage or market conditions.

- Technological Obsolescence: For tech-related assets, fast-paced advancements could shorten anticipated lifespans, thus affecting the strategy for capitalization.

- Regulatory Compliance: Lifespan considerations must also meet standards set by accounting principles such as GAAP or IFRS.

Correctly determining an asset’s lifespan maximizes the benefits of capitalization while ensuring compliance and financialaccuracy. This balance is critical for maintaining the integrity and usefulness of financial reports.

Financial Impact of Capitalization

The decision to capitalize assets can have numerous financial implications for a business, impacting both its accounting practices and overall financial health. For derivatives traders, this practice might also play a crucial role, as capitalizing assets can influence trading margins and risk management strategies.

- Revenue Matching: Capitalization allows the costs to be matched with revenues generated by the asset, ensuring a steady and clear financial analysis over time, especially when considering income statement depreciation expense and its effect on profitability.

- Improved Cash Flow Management: By deferring expenses over the life of an asset, a company can maintain a healthier cash flow position, facilitating other business activities or investments. This can be particularly beneficial when managing inventory purchase agreements and associated cash requirements. This approach is equally vital for derivatives traders, who must navigate cash flow fluctuations in volatile markets.

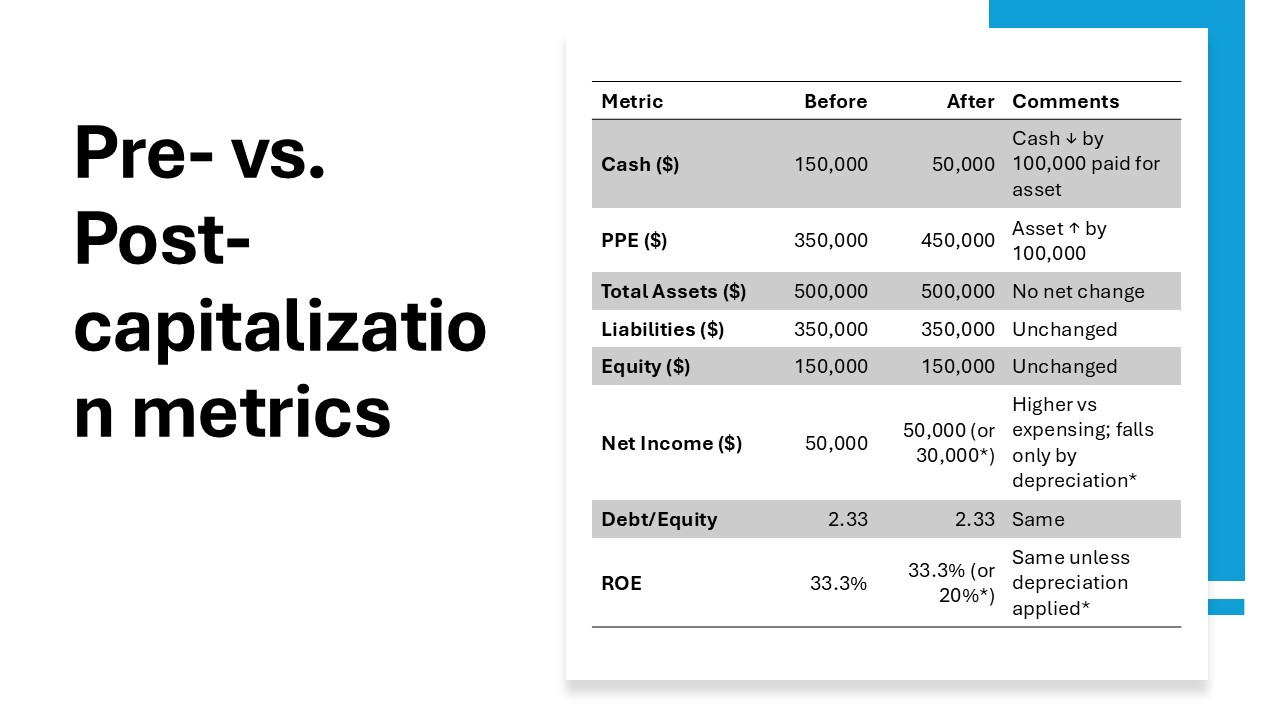

- Asset Value Reflection: Keeping costs on the balance sheet initially inflates the total asset value, which might positively affect financial ratios like return on assets (ROA) and return on equity (ROE). This strategy helps align with the company’s weighted average cost of capital (WACC), ensuring efficient capital use.

- Creditworthiness Enhancement: A robust balance sheet can lead to better credit ratings, aiding in favorable loan terms and financing options. This improvement can also ease dividend payments to shareholders. This is especially beneficial for derivatives traders seeking capital from lenders to support large inventory holdings and market positions.

- Investor Appeal: Capitalization might present a more stable earnings picture over time, making the business more attractive to potential investors. Aligning asset management with sources like operating leases impacts dividends when assets are effectively utilized.

These financial impacts highlight the strategic advantages of capitalization, allowing businesses to optimize their financial planning and resource allocation. Proper capitalization practices can significantly contribute to a company’s sustained financial health and market competitiveness by managing lease agreements and salvage value considerations.

Regulatory Guidelines (GAAP & IFRS)

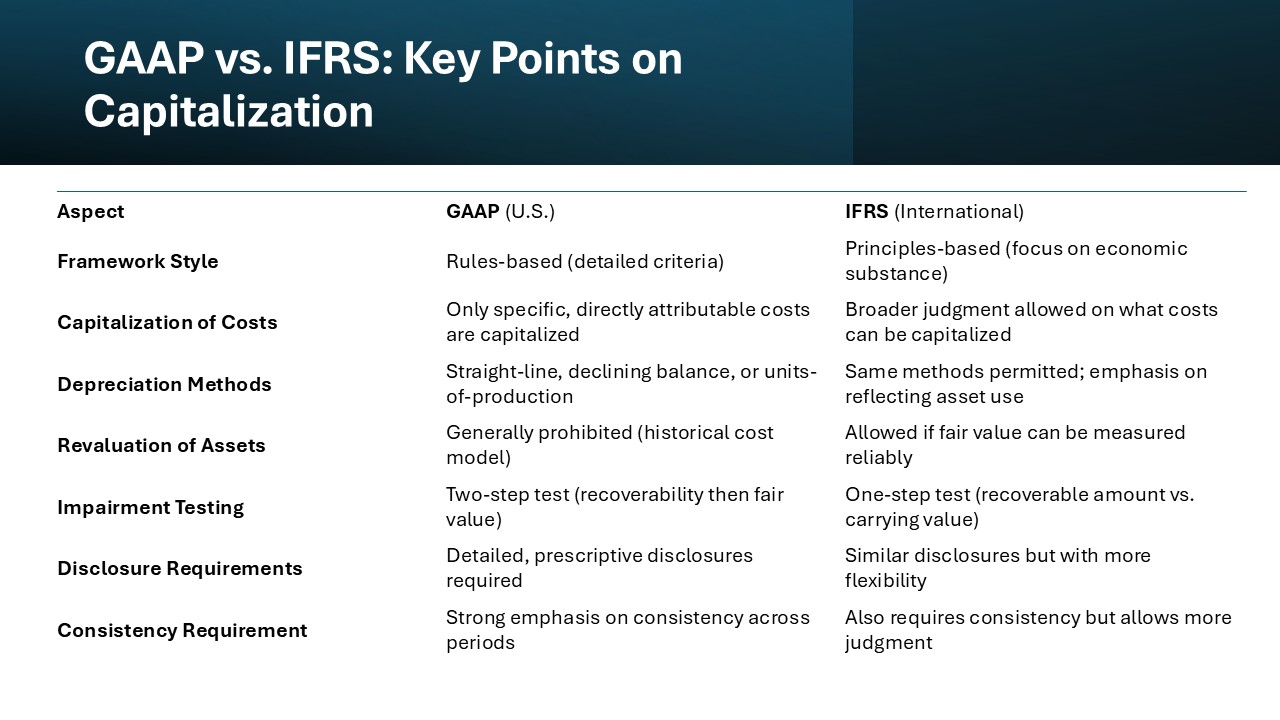

When it comes to capitalization, adhering to established regulatory guidelines is essential to ensure compliance and maintain financial integrity. Two primary frameworks govern these practices: the Generally Accepted Accounting Principles (GAAP) and the International Financial Reporting Standards (IFRS). These guidelines are frequently discussed in finance literature, including key insights from Investopedia. Institutes like the University of Lucerne provide courses that delve into these frameworks, offering an academic perspective on their application.

- GAAP Guidelines: Under GAAP, capitalization involves recording an asset’s acquisition cost and spreading it over its useful life through depreciation or amortization. It requires comprehensive documentation and consistency in financial reporting.

- IFRS Standards: IFRS provides a more principles-based approach, emphasizing the economic substance over strict criteria. It permits more flexibility in assessing asset value and depreciation methods. University courses can further illustrate the IFRS approach, like those offered by the University of Lucerne.

- Consistency and Comparability: Both frameworks ensure that financial statements are consistent and comparable across periods and entities, protecting stakeholders’ interests. Publications like those from the University of Chicago Press may further elaborate on these topics through innovative research.

- Asset Impairment Considerations: Both GAAP and IFRS require regular assessment for impairment, which could necessitate adjustments to an asset’s carrying value.

- Disclosure Requirements: Detailed disclosures in financial reports are mandatory under both systems to provide transparency to investors and regulators, these institutions echoing principles promoted by FINRA to maintain market integrity.

Navigating these guidelines is crucial for maintaining compliance and ensuring accurate financial statements. Understanding the differences and requirements of GAAP and IFRS enables businesses to effectively capitalize assets while fostering trust and transparency among stakeholders. University courses, such as those at the University of Lucerne, offer valuable insights into these frameworks.

Capitalization vs. Expensing

Key Differences Explained

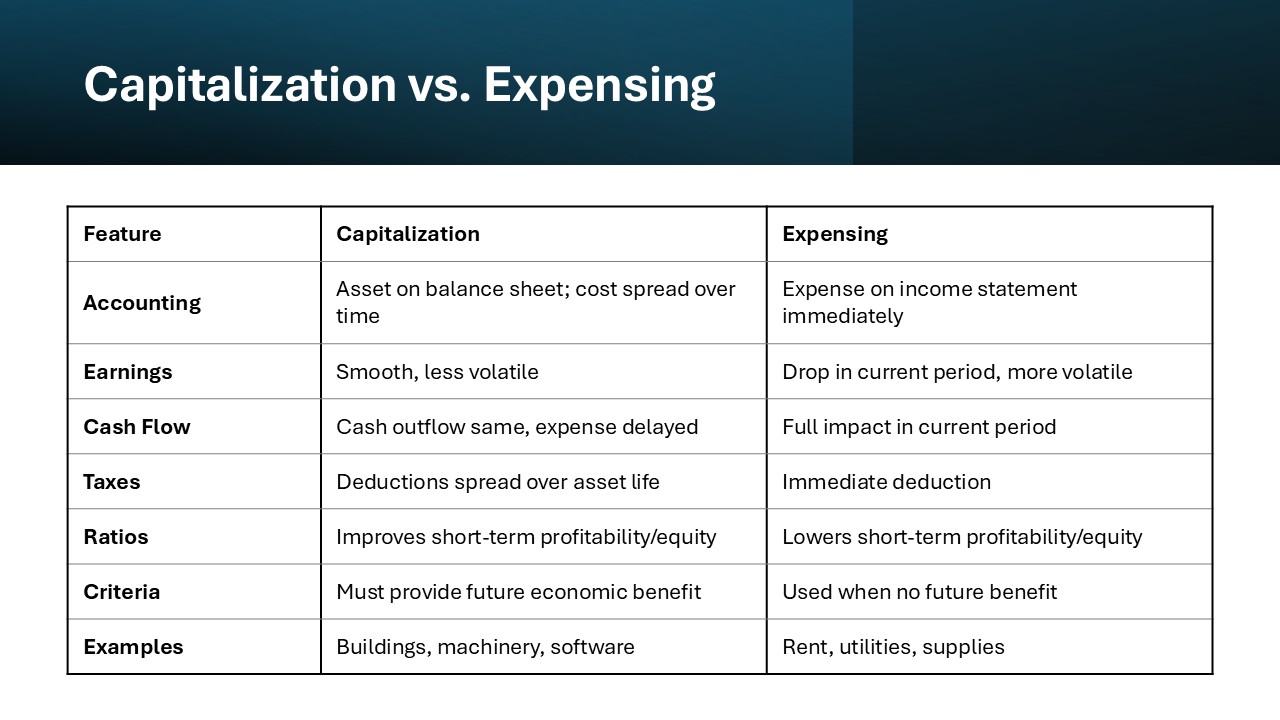

Capitalization and expensing represent two distinct approaches in accounting for costs. Understanding their key differences is crucial for strategic financial decision-making.

- Accounting Treatment: Capitalization involves recording an expenditure as an asset on the balance sheet, with the cost spread over the asset’s useful life. In contrast, expensing entails recognizing a cost immediately in the income statement for the period incurred.

- Impact on Earnings: Capitalization can smooth earnings over time, mitigating the effect of large expenditures on profitability in any single period. Expensing results in more volatile earnings, reflecting the full cost impact immediately.

- Cash Flow Effects: Both methods affect cash flow differently. Capitalization delays expense recognition but requires ongoing cash outlays for asset maintenance. Expensing impacts cash flow significantly in the short term without lingering financial obligations.

- Tax Implications: Capitalized costs may provide tax deferral advantages through depreciation, while expensed items often lead to immediate deductions, affecting taxable income.

- Reporting Requirements: Detailed guidelines under GAAP or IFRS specify the conditions under whichboth capitalization and expensing are applied, focusing on criteria such as asset lifespan and significance.

By understanding these differences, companies can make informed decisions about how best to manage their resources, maintain accurate financial records, and optimize their financial strategies for both short-term and long-term benefits. This insight aids in selecting the appropriate approach to maximize business efficiency and financial reporting clarity.

Strategic Decision-Making

Making strategic decisions regarding capitalization versus expensing requires a comprehensive evaluation of financial objectives and business goals. Here are some factors to consider in the decision-making process:

- Long-Term Financial Planning: Businesses should align their capitalization strategies with long-term objectives, such as growth targets and financial stability. Capitalization can offer more predictable financial outcomes, supporting strategic initiatives.

- Impact on Financial Metrics: Consider how each approach affects key financial metrics, such as earnings per share (EPS) or EBITDA. Capitalization might enhance these figures by spreading out costs, while expensing could impact them negatively in the immediate term.

- Industry Norms and Practices: Different industries may have prevailing practices due to regulatory standards or economic characteristics. Companies should consider how their approaches compare with industry peers.

- Risk Management: Evaluate the potential risks associated with each method, such as the risk of asset obsolescence impacting future asset value and expense recognition.

- Regulatory Compliance: Ensure that decisions comply with GAAP or IFRS standards to avoid legal pitfalls and maintain trust with stakeholders.

Ultimately, the decision to capitalize or expense a cost should align with the company’s broader financial strategy and operational goals. By carefully considering these factors, businesses can better manage their resources, enhance financial reporting accuracy, and position themselves for sustainable growth.

Real-World Examples of Asset Capitalization

Technology and Equipment Investments

In the realm of asset capitalization, investments in technology and equipment are prominent examples. These capital-intensive assets are crucial for businesses to consider for several reasons:

- Longevity and Utility: Technology and equipment often have a substantial useful life. When capitalized, their costs are distributed over this lifespan, providing a balanced financial impact. Capitalizing on these assets minimizes income fluctuations, a strategy especially beneficial for small firms.

- Productivity Gains: These investments typically lead to operational efficiencies and increased productivity, which can offset their initial costs.

- Tax Depreciation Benefits: Businesses can benefit from tax deductions through depreciation of these capitalized assets, reducing the taxable income over several years.

- Enhanced Competitive Advantage: Keeping technology and equipment up-to-date ensures a company’s competitive edge, often justifying the initial capitalization expense. Additionally, major repairs extending an asset’s useful life can also be capitalized, supporting sustained competitive advantage.

- Initial Capital Outlay: While there’s a significant initial expenditure, spreading the cost lessens the financial burden on short-term income statements. This intersection of accounting practices and strategic investments supports sound financial planning.

However, challenges such as rapid technological obsolescence and potential high maintenance costs can arise. This approach is best for companies aiming to maintain competitiveness and efficiency while optimizing their long-term financial strategy. Capitalizing technology and equipment allows businesses to manage large expenditures effectively, aligning expenses with future benefits and growth objectives.

Capitalized Software Development Costs

Capitalizing software development costs is a strategic approach that allows businesses to better align these costs with the associated revenues and benefits over time. Here’s a closer look at why this practice is advantageous:

- Alignment with Future Benefits: Capitalizing development costs spreads the expenses over the software’s useful life, matching costs with the revenues the software generates.

- Improved Financial Metrics: By capitalizing these costs, businesses can enhance financial indicators like net income and EBITDA, which could lead to more favorable perceptions from investors and credit agencies.

- Maximized ROI on R&D Investments: Capitalizing allows businesses to recognize the value of their investment in research and development (R&D) over time, showcasing R&D as a long-term asset.

- Encouragement of Innovation: It supports ongoing innovation by providing a clear financial structure for investing in software development, potentially boosting a company’s competitive edge.

- Compliance with Accounting Standards: Following GAAP or IFRS guidelines ensures correct accounting practices. Development costs during the application development stage are capitalized, whereas costs in thepreliminary and post-implementation stages are typically expensed.

However, potential issues include correctly estimating the software’s useful life and the risk of technological obsolescence. This approach is particularly beneficial for tech-driven companies and startups that rely heavily on software development to drive growth and innovation.

Infrastructure Projects

Infrastructure projects, often large-scale and long-term, are prime candidates for capitalization due to their significant upfront costs and extended periods of benefit.

- Long-Term Investment: Infrastructure projects, such as roads, bridges, and buildings, typically provide services over many years, justifying the capitalization and spreading of these costs through depreciation.

- Capital Budgeting: By capitalizing these costs, businesses and government entities can better manage cash flows and budget for future infrastructure needs effectively.

- Asset Enhancement: As physical assets, infrastructure projects enhance the entity’s balance sheet value, illustrating substantial capital investments that can attract further funding or investment opportunities.

- Economic Impact Potential: Many infrastructure projects have broader economic impacts, improving access, efficiency, and productivity, which supports the justification for capital expenditure.

- Compliance and Assurance: Adhering to specific accounting regulations ensures that the capitalized infrastructure accurately reflects its intended purpose and value without distorting financial statements.

Despite these benefits, challenges such as project delays,cost overruns, and maintenance requirements can pose significant risks. Capitalizing infrastructure projects is most suitable for organizations with a long-term operational outlook, capable of managing complex projects and navigating the associated financial intricacies.

Challenges in Asset Capitalization

Common Pitfalls

Capitalizing assets, while beneficial, comes with its own set of challenges and pitfalls that businesses need to be wary of:

- Overcapitalization: There’s a risk of capitalizing too many costs that should be expensed, leading to inflated asset values and potentially misleading financial statements.

- Incorrect Useful Life Estimates: Inaccurate estimations can lead to either over or under-depreciation, affecting financial reports and tax liabilities adversely.

- Expense Misclassification: Failing to differentiate between capitalizable costs and expenses could result in non-compliance with accounting standards and subsequent financial restatements.

- Impairment Oversights: Regular impairment reviews are critical; not performing them can result in asset values being overstated, impacting balance sheet authenticity.

- Complex Compliance Requirements: Understanding and following GAAP or IFRS guidelines can be challenging, especially for companies without strong internal accounting expertise.

These pitfalls highlight the importance of rigorous accounting practices and ongoing reviews to ensure thatthe capitalized assets reflect true economic value and compliance. Careful planning and expert guidance can help mitigate these challenges, allowing businesses to capitalize effectively and accurately. Ultimately, this process necessitates a disciplined approach to financial reporting and asset management.

Legal and Compliance Issues

Legal and compliance issues are critical considerations when capitalizing assets, as failure to adhere to regulations can have severe consequences for businesses.

- Adherence to Standards: Ensuring compliance with GAAP or IFRS is crucial for maintaining the validity and reliability of financial statements. Missteps can lead to regulatory scrutiny and financial penalties.

- Regular Audits: Routine internal and external audits help verify that capitalized assets are recorded accurately and in compliance with relevant accounting standards.

- Disclosure Requirements: Thoroughly documenting the capitalization process and maintaining transparency in financial reports are mandatory under legal guidelines, protecting stakeholder interests.

- Legal Implications of Misstatement: Inaccurate capitalization can lead to legal liabilities, including lawsuits from investors or regulatory actions, if financial statements materially misrepresent company performance.

- Training and Guidance: Ongoing training for accounting staff on regulatory changes and proper capitalization techniques is vital to reduce the risk of errors and ensure compliance continuity.

By addressing these legal andcompliance challenges proactively, businesses can safeguard their financial integrity while building trust with investors and stakeholders. This approach ensures that capitalized assets are managed and reported correctly, minimizing legal risks and enhancing overall corporate governance.

Conclusion: The Strategic Role of Capitalization in Business Success

Capitalization plays a pivotal role in business success by fostering accurate financial reporting and strategic resource allocation. By opting to capitalize significant investments such as technology, infrastructure, and R&D efforts, companies can align their costs with the resulting revenues over an asset’s useful life. This approach not only enhances financial planning and stability but also optimizes tax advantages and enhances financial metrics, making a business more appealing to investors.

Moreover, understanding the nuances of regulatory frameworks like GAAP and IFRS ensures compliance, protecting businesses from legal and financial pitfalls. By effectively managing the capitalization process, companies can mitigate risks associated with expensing and better navigate the complexities of asset management.

In summary, thoughtfully applied capitalization strategies provide businesses with a robust framework for managing large expenditures. This strategic financial practice facilitates growth, fosters innovation, and underpins sustainable success in an increasingly competitive marketplace. By investing in the right assets and adhering to compliance requirements, businesses can achieve long-term prosperity and operational excellence.

FAQs

What is capitalized Expense? Define Capitalization

A capitalized expense is an expenditure recorded as an asset on the balance sheet rather than an immediate expense on the income statement. Capitalization refers to this process of allocating a cost across the useful life of an asset. It allows businesses to spread out the expense over time, matching it with the revenue the asset generates, leading to more stable financial statements.

What types of assets can be capitalized?

Assets that can be capitalized typically include long-term and significant investments such as property, plant, equipment, infrastructure projects, and intangible assets like software development costs. These assets must provide future economic benefits and have a useful life extending beyond a single accounting period. Their initial costs are recorded as assets, and they are gradually expensed through depreciation or amortization.

How does capitalization affect financial statements?

Capitalization affects financial statements by increasing assets on the balance sheet while decreasing immediate expenses on the income statement. This leads to a more stable portrayal of profitability over time, as costs are spread across the useful life of the asset through depreciation. It enhances balance sheet strength and can improve financial ratios, potentially making the business more attractive to investors and creditors.

Why is choosing to capitalize over expensing important?

Choosing to capitalize over expensing is important because it allows for a smoother financial presentation by spreading costs over the asset’s life, aligning expenses with the revenues generated. This approach reduces earnings volatility and can enhance key financial metrics, improving stakeholder confidence and aligning with long-term strategic planning goals.

What are the limitations of capitalizing assets?

The limitations of capitalizing assets include the complexity of estimating an asset’s useful life and ensuring accurate depreciation rates. Misestimations can affect financial accuracy. Capitalization can also obscure cash flow impacts, making it difficult to see immediate expenditure effects. Additionally, improper capitalizing practices may lead to compliance issues and potential financial restatements.