KEY TAKEAWAYS

- Cost accounting revolves around three principal elements: materials, labor, and overhead. These components form the backbone of any cost accounting system.

- The primary function of cost accounting is to assist managers in decision-making by providing a detailed analysis of costs and expenses related to purchasing or producing goods. It helps in identifying areas where a business might be overspending.

- Cost accounting provides a balanced report that offers more detail than a basic Profit & Loss statement, without overwhelming with excessive complexity. This enables a clear understanding of expenditures on both a detailed and summary level.

What is Cost Accounting?

Definition and Purpose

Cost accounting, at its core, is a form of managerial accounting that measures and analyzes various costs related to a business’s operations. It involves recording, classifying, and summarizing these costs to aid management in planning, controlling, and decision-making processes. The primary purpose of cost accounting is to optimize cost efficiency—a crucial component in enhancing a company’s profitability while maintaining or improving product quality. Cost accounting assists businesses in gaining detailed insights through which they can support budgeting decisions, product/service pricing, and strategic planning. Additionally, cost accounting methods can be customized to suit the specific needs of a company’s management, thereby improving production efficiency and overall profitability. Understanding the cost accounting definition is essential as it lays the foundation for utilizing different cost categories to streamline business processes.

Key Concepts in Cost Accounting

In cost accounting, several key concepts form the foundation for effective cost management and analysis.

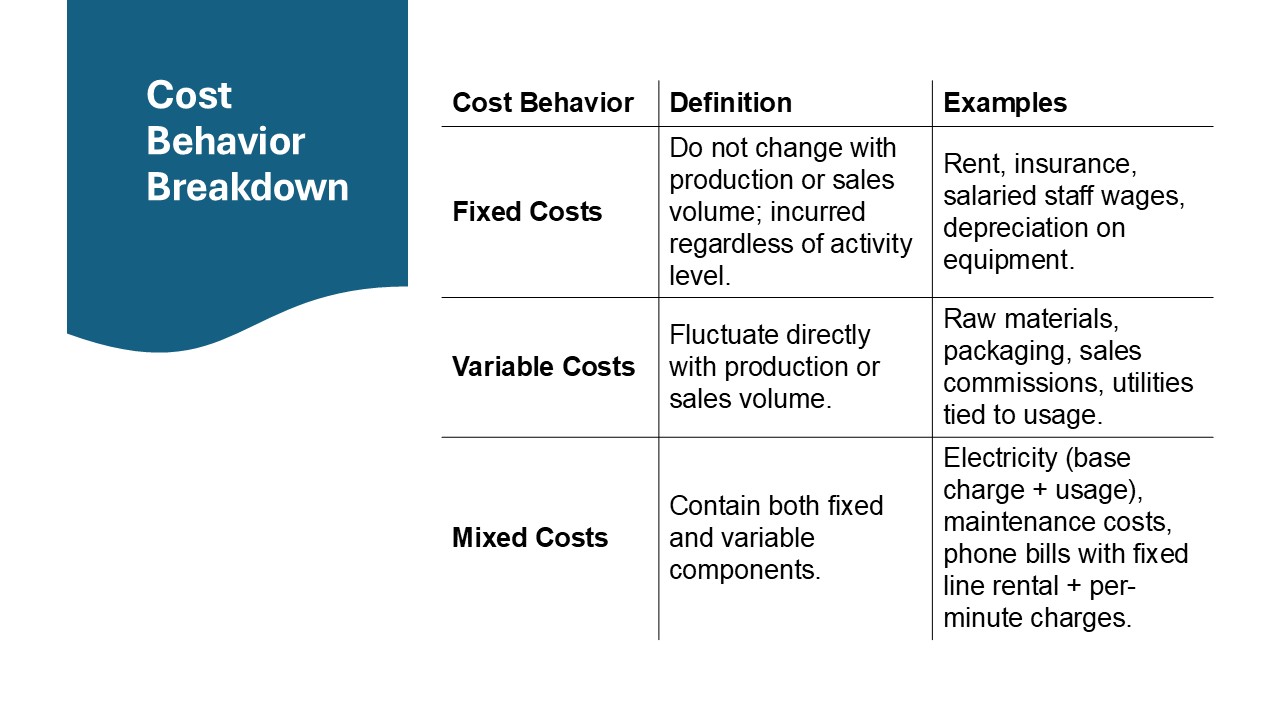

- Cost Behavior: This concept refers to how costs change in response to variations in business activity levels. Understanding whether costs are fixed, variable, or mixed helps in forecasting and budgeting while identifying throughput inefficiencies.

- Cost Allocation: This involves assigning indirect costs to different cost objects, such as products or departments, ensuring that every cost is accounted for in operations. Incorporating input analysis, particularly in job order costing, allows businesses to evaluate input costs more accurately. This is essential for precise cost tracking and supplier management.

- Cost-Volume-Profit (CVP) Analysis: CVP is used to determine how changes in costs and volume affect a company’s operating income and net income. It’s a fundamental tool for evaluating financial health under various scenarios and identifying potential bottlenecks.

- Cost Center: A cost center is a division within a business that does not directly add to profit but still incurs costs, such as the HR department. Efficient management of cost centers, guided by activity cost data, is crucial for reducing wasteful expenses.

- Break-Even Point: This is the level of sales at which total revenues equal total costs, meaning no profit or loss. It’s a critical metric for assessing the feasibility and viability of business ventures, reflecting a lean thinking approach to minimize constraints and avoid excessive inventories. Calculating break-even is integral to understanding a company’s gross margin, which can highlight potential savings and areas of opportunity within the accounting cycle.

Incorporating these concepts into daily business practices, aligned with accounting standards like IFRS, can significantly improve financial control and performance.

Historical Context of Cost Accounting

Origins and Evolution

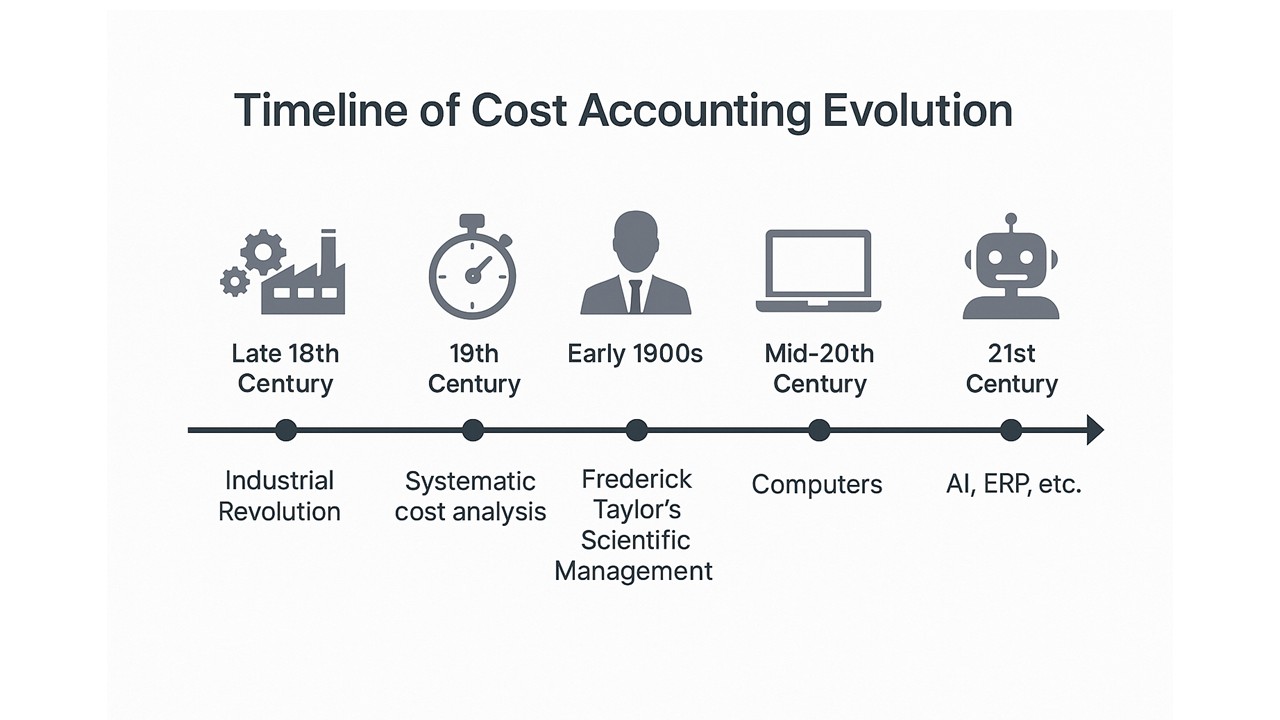

The origins of cost accounting can be traced back to the industrial revolution in the late 18th century, a period marked by significant advancements in manufacturing. As factories began mass-producing goods, there was a pressing need to meticulously track production costs to manage expenses and enhance profitability. This necessity led to the early development of cost accounting principles.

Over the 19th and early 20th centuries, cost accounting evolved considerably. The complexity of manufacturing processes necessitated more sophisticated tracking methods, giving rise to systematic cost analysis tools and practices. A pivotal evolution occurred with the introduction of scientific management by Frederick Taylor, which emphasized efficiency and systematic observation.

Throughout the 20th century, technological advancements further transformed cost accounting. The advent of computers allowed businesses to handle large volumes of financial data more efficiently, paving the way for modern cost accounting methods. Today, cost accounting not only aids in budgeting and pricing strategies but also supports comprehensive decision-making processes across various industries.

Influential Milestones

Several influential milestones have played a significant role in shaping cost accounting as it stands today:

- 1832 – Railways Adoption: The railway industry in the UK pioneered detailed cost records to manage logistics and operational expenses, setting a precedent for other industries.

- 1900 – Introduction of Scientific Management: Frederick Taylor’s principles of scientific management highlighted efficiency and productivity, stressing the importance of cost analysis in operational decisions.

- 1950s – Emergence of Standard Costing: As manufacturing complexity grew, standard costing techniques were developed to create benchmarks that facilitated performance evaluation across industries.

- 1970s – ABC Costing Development: The introduction of Activity-Based Costing (ABC) provided a more nuanced approach to cost allocation by focusing on activities as cost drivers.

- 21st Century – Integration of Technology: With rapid advances in computer technology, cost accounting now incorporates sophisticated software that enables real-time data analysis and streamlined processes.

These milestones have significantly contributed to the refinement and application of cost accounting in modern business environments, allowing companies to harness detailed financial insights for strategic growth.

Types of Costs in Cost Accounting

Fixed vs. Variable Costs

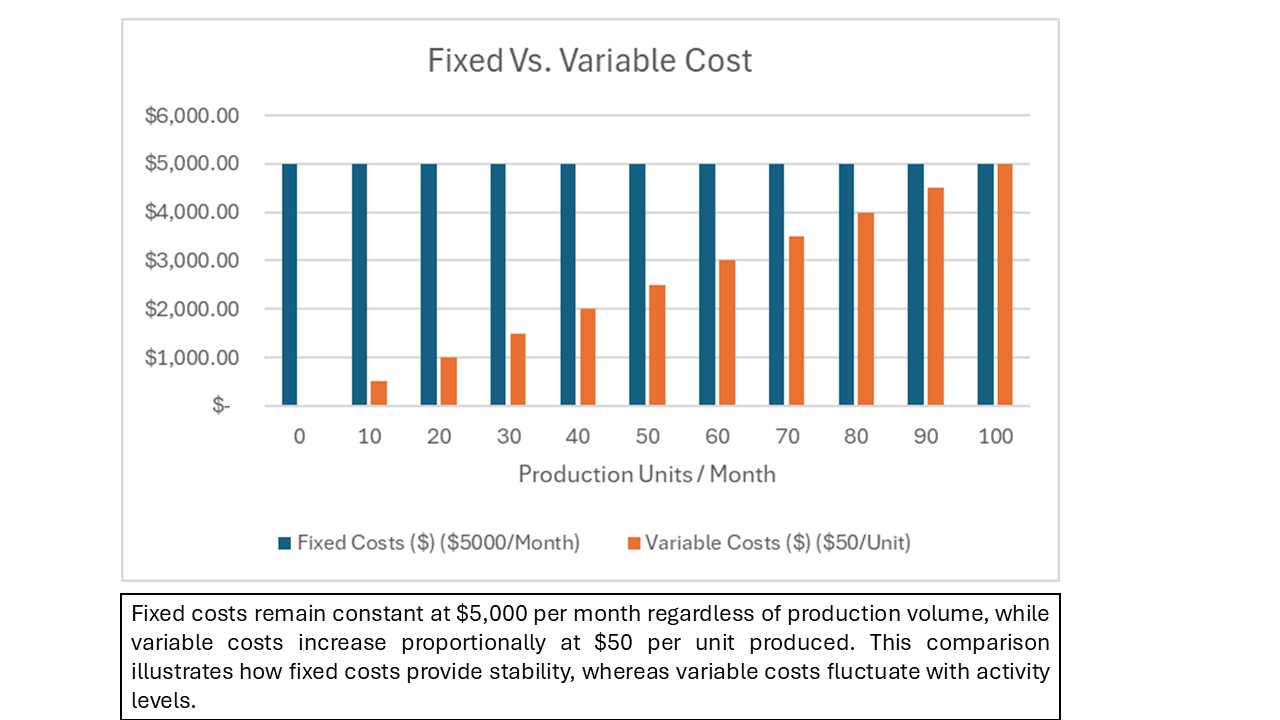

Understanding fixed and variable costs is fundamental in cost accounting, as it aids in resource allocation and financial planning.

- Fixed Costs: These remain constant regardless of the business output level. Examples include rent, salaries, and insurance. Because they do not fluctuate with production volume, fixed costs can provide stability and predictability in financial planning. However, they must be managed carefully as they represent a recurring commitment.

- Variable Costs: These vary directly with production levels. Direct materials and utility expenses are typical examples. Variable costs fluctuate with output, giving companies flexibility in adjusting them as needed to meet demand changes.

Both types of costs offer distinct advantages and challenges. Fixed costs are good for long-term budgeting but can burden a company during downturns. Variable costs are adaptable but require diligent management to prevent undue expense increases as production scales. Finding the right balance between these costs is crucial for sustainable financial health.

Direct and Indirect Costs

Direct and indirect costs are two essential classifications in cost accounting, each with distinct characteristics and implications for financial analysis.

- Direct Costs: These are expenses that can be directly traced to a specific product, project, or activity. Examples include raw materials, direct labor, and any cost that can be attributed specifically to a particular business segment. Direct costs are straightforward to track and are often variable, changing with production levels.

- Indirect Costs: Also known as overheads, these are costs incurred that cannot be directly tied to a single product or service. Examples include utilities, rent, and administrative salaries. Indirect costs often remain fixed over short periods and need to be allocated across different departments or products to provide a complete financial picture.

Understanding these categories ensures accurate pricing and product costing, which supports effective profitability analysis. Direct costs provide clarity in calculating the exact expense of producing goods, while indirect costs require careful allocation to prevent underestimated expenses. Proper management of both types is vital to a company’s financial strategy.

Methods of Cost Accounting

Job Costing Explained

Job costing is a cost accounting method used to track expenses associated with a specific job or batch of similar products. This method is particularly useful in industries where products are customized, such as construction, manufacturing, and professional services. In job costing, each job is assigned a unique identifier to accumulate and track costs that include materials, labor, and overhead. This detailed tracking allows businesses to estimate the total cost of each job accurately. The primary advantage of job costing is its ability to provide precise cost data, which assists in setting competitive prices and identifying cost-saving opportunities. For example, a custom furniture manufacturer can use job costing to calculate the precise costs of materials and labor for each unique piece, thus determining its profitability accurately.

Incorporating cost accounting methods, organizations can enhance their operational efficiency, while specific techniques like lean accounting focus on minimizing waste in processes involving production machinery.

Despite its benefits, job costing can be resource-intensive, requiring meticulous record-keeping to ensure accuracy. It also involves complex allocation of overhead costs to different jobs, which can be challenging without robust systems in place. The involvement of subsidiary input from various departments and thorough bookkeeping is essential to maintain accuracy in cost accounting material and data.

Process Costing Techniques

Process costing is a cost accounting technique best suited for industries where production is continuous and units are indistinguishable from each other, such as in chemicals, textiles, or food production. Unlike job costing, where costs are allocated to specific jobs, process costing aggregates costs over a period and assigns them to masses of units. In process costing, production is divided into distinct processes or departments. Costs—be it materials, labor, or overhead—are collected for each department. These expenses are then averaged over all units produced during the period, providing a cost per unit. This method simplifies the costing process for large batches produced continuously, making it easier to manage and forecast production costs.

Importantly, process costing also aligns well with Generally Accepted Accounting Principles (GAAP), ensuring that financial reporting adheres to standardized methodology. Companies utilizing process costing often evaluate their capital expenditures, including asset acquisition, to maintain efficiency in production cycles.

One of the primary benefits of process costing is its efficiency in monitoring the costs over a production line. It enables businesses to pinpoint cost anomalies and optimize processes to reduce waste and improve output. On the downside, process costing may not offer the granularity needed for customized or small-batch production, limiting its application to more homogeneous environments. This method, however, remains critical for project accounting in large-scale manufacturing projects where understanding expenditure is key.

Activity-Based Costing Overview

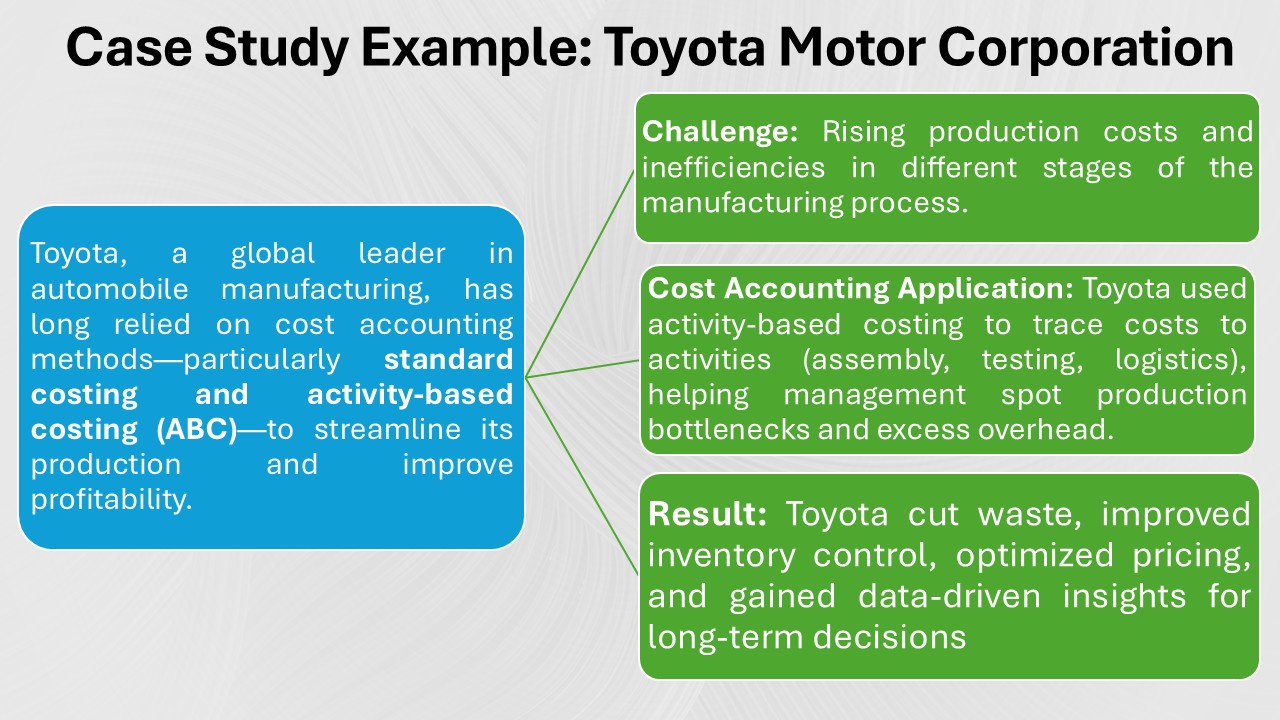

Activity-Based Costing (ABC) is a nuanced approach to cost accounting that enables businesses to allocate overhead more accurately by focusing on the activities that drive costs. Unlike traditional costing methods that spread expenses evenly, ABC assigns costs based on actual consumption by each product or service, thus reflecting true cost drivers. This is a significant deviation from standard cost accounting methods, which may mask inefficiency by allocating costs uniformly across all products.

The ABC process begins by identifying key activities within the business, such as procurement, assembly, or customer service. Costs are then linked to these activities and assigned to products or services based on their actual use of each activity. This method allows for more precise cost allocation, revealing hidden inefficiencies and providing insights into resource utilization. Furthermore, life cycle costing can complement ABC by integrating the total cost of ownership for each product over its useful life, from initial investment to disposal.

One of the main advantages of ABC is its ability to highlight the true profitability of products and services, enabling managers to make more informed pricing and strategic decisions. However, ABC can be complex and resource-intensive to implement, requiring substantial data collection and analysis. Despite this, its use can result in significant financial benefits by uncovering previously concealed cost patterns and enhancing operational efficiency.

Marginal and Standard Costing

Marginal and standard costing are two distinct methods that offer different perspectives on cost analysis and decision-making.

- Marginal Costing: Also known as variable costing, this method considers only variable costs as product costs—those costs that change with production volume such as materials and direct labor. Fixed costs are treated as period costs and expensed in the period incurred. This approach allows companies to analyze the impact of production changes on profitability. Marginal costing is particularly useful for short-term decision-making processes, such as pricing strategies or determining the breakeven point, since it highlights the contribution each unit of product makes to fixed costs and profits.

- Standard Costing: This technique involves assigning expected costs to products based on expected production levels, setting benchmarks for labor, materials, and overhead. By comparing actual costs to these standards, businesses can identify variances and investigate reasons for deviations. Standard costing aids in budgetary control and performance measurement, though it requires regular updates to reflect changing market conditions.

Both methods have their benefits and drawbacks. Marginal costing offers simplicity and clarity for decision-making but can overlook the impact of fixed costs. Standard costing provides robust budgetary controls but can become complex if not regularly updated.

Importance of Cost Accounting in Business

Enhanced Decision Making

Cost accounting plays a pivotal role in enhancing decision-making by providing managers with detailed financial data to guide strategic choices. By accurately identifying the costs associated with various business activities, managers can evaluate the financial impact of different scenarios, factoring in elements like payroll taxes, and make informed decisions that align with the organization’s goals. With cost accounting, you gain insights into cost behavior, enabling you to predict how costs will change under different circumstances. This predictive ability helps in assessing potential investments, pricing strategies, and operational changes. Furthermore, the detailed breakdown of costs into fixed, variable, direct, and indirect categories allows for more precise budget control, minimizing financial risks. A key takeaway is that by utilizing these insights, businesses can optimize resource allocation, improve efficiency, and enhance overall profitability. Cost accounting transforms raw financial data into actionable intelligence, ultimately supporting more confident and strategic decision-making.

Note: The implementation of payroll taxes within cost accounting frameworks is crucial as it can significantly influence trading decisions and overall financial strategy.

Budgeting and Planning

Cost accounting is integral to effective budgeting and planning, providing essential data that businesses use to predict future financial performance and allocate resources efficiently. By analyzing detailed cost information, such as pricing data and property taxes, companies can develop realistic budgets that reflect operational needs and strategic objectives. The process begins with collecting and evaluating historical cost data, which might include government data and inventory purchases, helping to identify spending trends and areas for cost optimization. This data becomes the foundation for creating a comprehensive budget, detailing expected revenues, expenses, and capital needs. With cost accounting, you can model various scenarios, anticipating the financial impact of changes in production levels or constraints, pricing, or market conditions. Cost accounting assists in setting financial targets and operational benchmarks against which actual performance can be measured. This involves considering components like COGS (Cost of Goods Sold) and lease agreements. Accurately tracking inventory purchases aids in aligning budget projections with inventory management to prevent cost overruns. This leads to informed decision-making and adaptive strategies to address deviations from the budget. Ultimately, robust budgeting and planning backed by cost accounting ensures organizational agility and resilience in a dynamic business environment by optimizing throughput.

Profitability Analysis

Profitability analysis is a critical aspect of cost accounting, empowering businesses to evaluate how effectively they generate profit from their operations. By meticulously examining costs, including the replacement cost of equipment and revenues, companies can identify the most and least profitable products, services, and customer segments. Cost accounting facilitates a detailed understanding of both direct and indirect costs, allowing you to ascertain the true cost of each product or service, including factors like factory machinery depreciation and inventory value through work-in-progress. With this information, you can determine profit margins and assess the viability of various offerings. It also aids in pricing strategies, ensuring prices cover costs while remaining competitive.

Furthermore, profitability analysis helps pinpoint inefficiencies or unprofitable operations, enabling corrective actions like cost-cutting or process improvements. By leveraging accurate cost and revenue data, businesses can reallocate resources toward high-margin offerings and reconsider investments in less profitable areas. Factoring in machinery acquisition and other related fixed costs, businesses can enhance strategic planning. Ultimately, profitability analysis derived from cost accounting provides the insights necessary to improve financial performance and boost overall competitive advantage.

Integrating Technology in Cost Accounting

Modern Software Tools

Modern software tools have revolutionized cost accounting by automating complex calculations and providing real-time insights into financial performance. These tools streamline the collection, analysis, and reporting of cost data, making it easier for businesses to manage their financial operations efficiently. Contemporary cost accounting software offers advanced features like automated cost tracking, integration with other enterprise systems, and customizable reporting options. This level of integration ensures that all relevant financial data is up-to-date and consistent across the organization. Additionally, these tools provide user-friendly dashboards that offer visual representations of financial metrics, facilitating better understanding and quicker decision-making.

The usage of these tools addresses constraints typically found in traditional accounting by providing detailed insights into asset acquisition costs, taxes, and inefficiencies that may arise during processes. Furthermore, project accounting often benefits from these modern solutions, as they allow for precise evaluation of project’s sales dollar performance against budgetary expectations.

Another significant advantage is scalability. Whether you’re a small business or a large enterprise, modern software solutions can adapt to varying levels of complexity and data volume. This flexibility allows for tailored solutions that meet specific business needs, supporting growth and expansion. By using these advanced tools, companies can enhance accuracy, reduce time spent on manual accounting tasks, and focus more on strategic activities that drive business success. Even though methods such as job order costing are prevalent, integrating them into digital platforms makes managing them more efficient.

The Role of Automation

Automation in cost accounting has become a game-changer, significantly enhancing the accuracy and efficiency of financial processes. By deploying automated systems, businesses can minimize manual entry errors and speed up data processing, leading to more reliable and timely financial reports.

Automated solutions handle repetitive tasks such as data entry, cost allocation, and report generation without human intervention, freeing up valuable time and resources. This increased efficiency not only reduces operational costs but also allows accountants to focus on higher-level analysis and strategic planning.

Furthermore, automation enhances consistency in cost accounting practices. By applying standardized methods across the board, businesses can ensure uniformity in their cost measurements, improving the quality of data-driven decision-making. Automated systems also facilitate greater compliance with regulatory standards by maintaining precise records and audit trails.

Through automation, companies can achieve real-time insights into their financial status, enabling more agile responses to market changes and enhanced competitiveness in dynamic industries.

Real-Time Data Benefits

Applying real-time data in cost accounting offers numerous advantages that enhance operational efficiency and decision-making. Real-time data provides up-to-the-minute insights into costs and financial performance, enabling businesses to react swiftly to changes and make proactive decisions.

One of the primary benefits of real-time data is improved accuracy in cost analysis. With constant updates, discrepancies or errors in data reporting can be identified and corrected quickly, ensuring that financial records reflect the true state of the business. This accuracy is crucial for setting competitive pricing, managing cash flow, and optimizing inventory levels.

Moreover, real-time data supports dynamic forecasting and budgeting. Businesses can adjust forecasts instantly based on current trends and deviations from expected outcomes, maintaining alignment with strategic goals. This agility enhances the ability to capitalize on new opportunities or mitigate risks as they arise.

Lastly, real-time data fosters better communication and collaboration across departments, as everyone has access to the latest financial information. This transparency improves operational alignment and supports cohesive strategic initiatives.

Common Mistakes to Avoid

Ignoring Overhead Allocations

Ignoring overhead allocations in cost accounting can lead to significant financial blind spots, hampering a business’s ability to accurately assess its financial health. Overhead costs, which include utilities, rent, and administrative expenses, are essential to operating but are not directly tied to specific products or services. Proper allocation of these costs ensures that pricing, profitability analysis, and financial statements provide a true reflection of business operations.

When overhead allocations are neglected or inaccurately distributed, it can skew product cost calculations, leading to misguided pricing strategies and impacting competitiveness. For instance, underestimating overhead may result in setting lower prices, which might not cover the total costs incurred by the business, thereby eroding profitability.

To avoid these pitfalls, it’s crucial to adopt systematic methods for accurately allocating overhead. This might involve using activity-based costing (ABC) to trace overheads to activities that consume resources. By addressing overhead allocation comprehensively, businesses can achieve more precise cost management and drive better strategic decisions.

Misclassifying Costs

Misclassifying costs in cost accounting can lead to substantial errors in financial analysis and decision-making. Proper classification is crucial for accurately determining product costs, setting pricing strategies, and conducting profitability analyses. Misclassification involves incorrectly categorizing expenses as either fixed or variable, direct or indirect, which can distort financial insights.

For example, incorrectly categorizing a variable cost as fixed might underestimate how business activity changes affect total costs. This misjudgment can lead to flawed budgeting and financial forecasting. Similarly, classifying a direct cost as indirect might obscure the true cost and profitability of a product or service.

To prevent such inaccuracies, businesses need to establish clear guidelines and use detailed tracking systems. Regular audits and reconciliations can help ensure that costs are classified correctly, reflecting the business’s operational realities.

Ultimately, accurate cost classification provides the clarity needed for strategic planning and resource allocation, supporting more informed and effective managerial decisions.

Inadequate Record Keeping

Inadequate record keeping in cost accounting can have dire consequences for a business’s financial accuracy and regulatory compliance. Detailed and precise record management is the foundation of effective cost control and financial transparency. When records are incomplete or disorganized, it becomes challenging to track expenses, analyze cost behavior, and make informed managerial decisions.

The lack of comprehensive records can lead to errors in financial reporting, misallocation of resources, and potential inaccuracies in tax filings. These errors may not only impact the bottom line but could also attract scrutiny from tax authorities or auditors, risking penalties and damaging a company’s reputation.

To combat these pitfalls, businesses should implement robust record-keeping systems that ensure all financial transactions are accurately captured and easily retrievable. This includes maintaining digital records, using integrated accounting software, and conducting regular audits. Furthermore, establishing clear policies and training employees on consistent documentation practices can support ongoing accuracy and reliability.

Strong record-keeping practices empower businesses to maintain financial integrity, comply with legal requirements, and support strategic decision-making by providing a solid, factual basis.

FAQs

What is the cost accounting meaning in simple terms?

Cost accounting is a method of tracking and analyzing all the costs associated with running a business to help managers make better financial decisions. It’s about understanding exactly where money is spent, identifying areas for cost savings, and assessing how different products or services contribute to overall profitability.

How does cost accounting differ from financial accounting?

Cost accounting focuses on internal analysis, helping businesses manage costs and improve efficiency by providing detailed insights into expenses and operations. Financial accounting, on the other hand, deals with external reporting, producing standardized financial statements for stakeholders like investors and regulatory bodies, highlighting the company’s overall financial position.

Can cost accounting be applied to service industries?

Yes, cost accounting can be applied to service industries. It helps in tracking and analyzing costs related to delivering services, such as labor and overhead, ensuring accurate pricing and profitability analysis. By understanding these costs, service providers can optimize their operations and improve financial performance, just like in manufacturing.

What are the main advantages of using cost accounting?

Cost accounting offers several advantages, including enhanced decision-making through detailed cost analysis, improved budgeting and forecasting, and better pricing strategies. It helps identify cost-saving opportunities, increases efficiency, and supports strategic planning by providing managers with clear insights into how resources are used and where efficiencies can be gained.

What is an example of costing in cost accounting?

An example of costing in cost accounting is determining the total cost of manufacturing a product, such as a chair. This includes calculating direct costs like materials and labor, as well as overhead costs like utilities and depreciation. By understanding these costs, managers can set appropriate prices and improve profitability.

How does NetSuite cost accounting work?

NetSuite’s cost accounting works by providing real-time visibility into costs through integrated financial management systems. It allows users to track expenses, automate cost calculations, and generate reports for better decision-making. NetSuite supports multiple costing methods, helping businesses refine financial operations and optimize resource allocations efficiently.