KEY TAKEAWAYS

- Salvage value is essential in finance and investment; it influences depreciation calculations, tax planning, and investment decision-making.

- Factors such as market demand, technological advancements, and asset maintenance significantly impact an asset’s salvage value.

- Utilizing tools like Deskera ERP can enhance asset management and ensure accurate depreciation calculations, thereby improving financial management and resource allocation.

The Importance of Salvage Value in Depreciation

Key Role in Financial Reporting

Salvage value plays a pivotal role in financial reporting as it directly impacts the depreciation expense recorded on financial statements. By estimating the salvage value, businesses can accurately gauge the depreciation that should be allocated over an asset’s useful life. This ensures compliance with accounting standards, maintains the integrity of financial data, and presents a realistic view of an organization’s value.

Influence on Investment Decisions

When making investment decisions, understanding an asset’s salvage value is crucial. It can significantly affect the expected return on investment by providing a clearer picture of potential future cash flows. Investors and managers consider salvage value to assess whether an acquisition will yield profitability or if a different investment might offer better returns. An accurate estimation of salvage value, alongside liabilities assessment, is pivotal in determining the true equity generated from transactions.

Understanding Salvage Value

Definition and Basic Concepts

Salvage value, often referred to as residual value or scrap value, is the estimated amount an asset will be worth at the end of its useful life. This estimation reflects the expected selling price of the asset minus the costs of removal or sale. It’s crucial for determining the overall cost of an asset’s depreciation and varies depending on the type and condition of the asset. According to IAS 16, the value of equipment or machinery after its useful life is often termed the scrap value. Understanding salvage value helps in budgeting and long-term financial planning by ensuring accurate depreciation calculations.

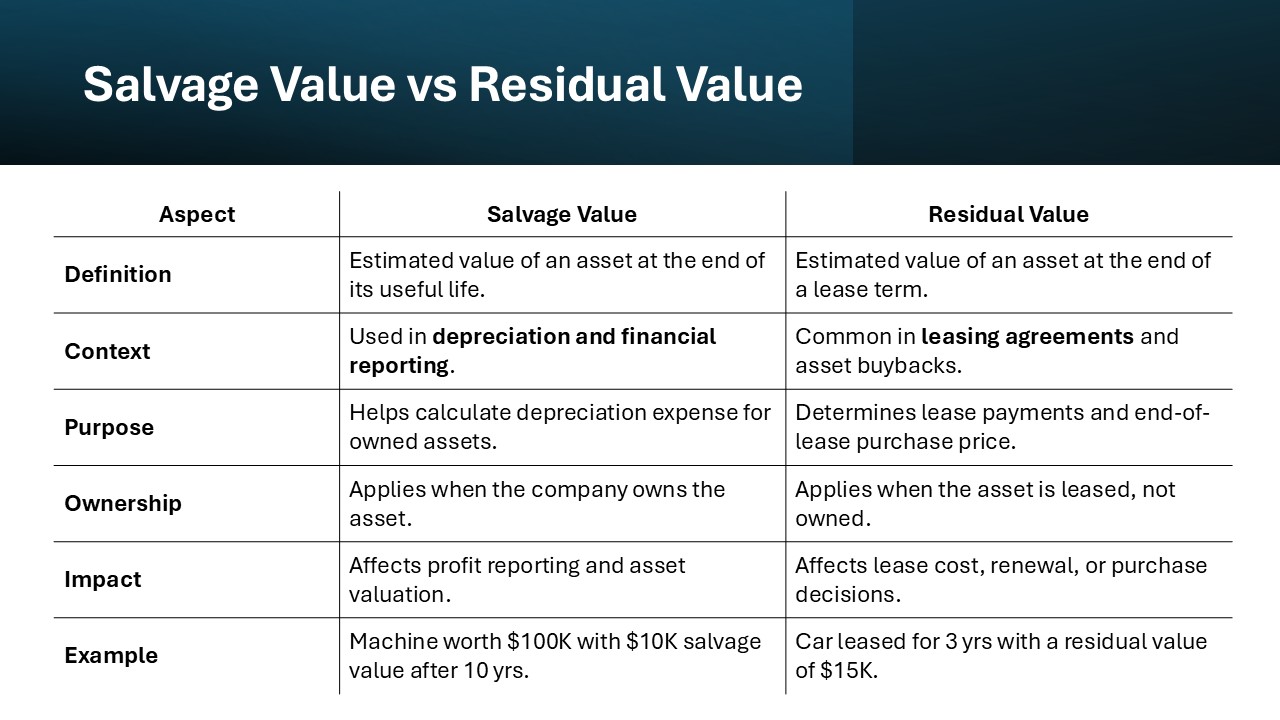

Salvage Value vs. Residual Value

While salvage value and residual value are often used interchangeably, subtle differences exist between the two. Salvage value typically relates to the valuation of physical assets in accounting, particularly for their role in depreciation calculations. Conversely, residual value is more commonly associated with leasing agreements, representing the expected value of an asset at the end of a lease term. Both serve the fundamental purpose of projecting an asset’s future worth, yet differ slightly in context and application.

These nuances can influence financial and investment strategies, depending on organizational goals and asset management needs.

Calculating Salvage Value

Essential Formulas

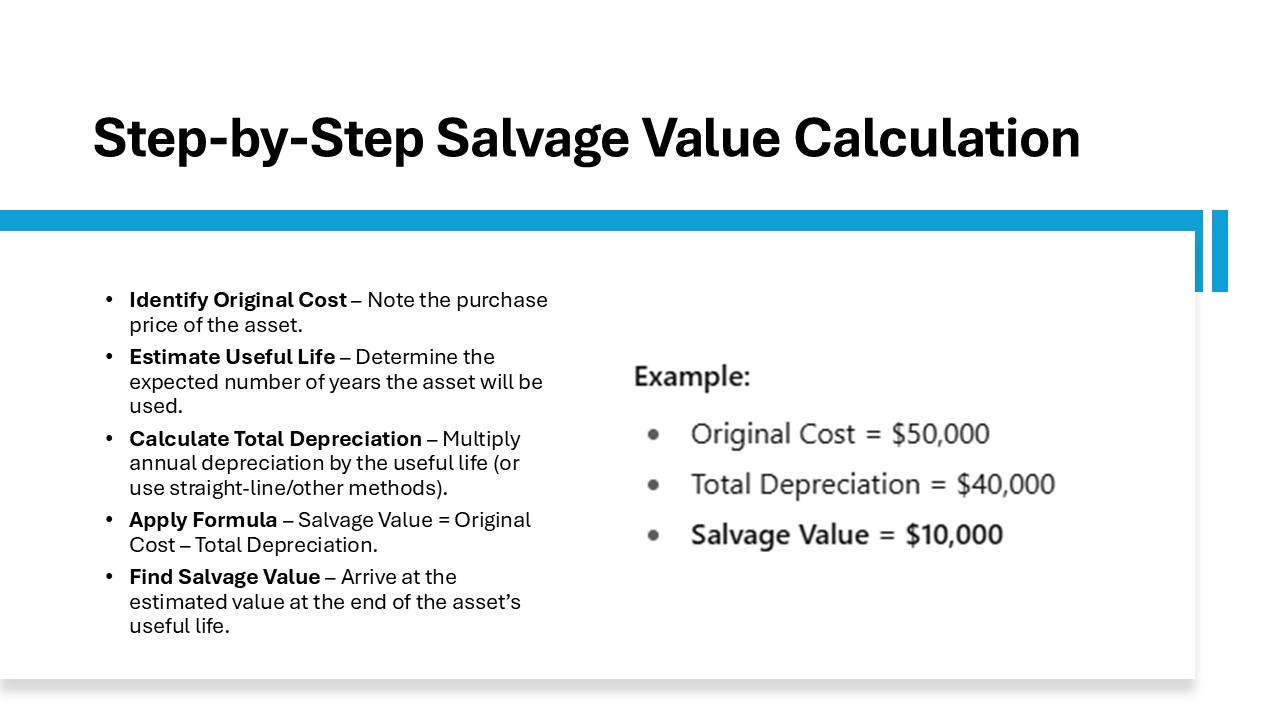

Calculating salvage value requires a basic understanding of asset depreciation methods. The essential formula for estimating salvage value involves subtracting the total depreciation from the asset’s original cost. This can be simplified as:

Salvage Value=Asset Cost−(Depreciation Rate×Useful Life of the Asset)

Salvage Value=Asset Cost−Total Depreciation

Different methods for calculating depreciation, such as straight-line or declining balance, may require alterations to the basic formula, but the core calculation remains constant. Understanding these formulas facilitates more accurate financial predictions and asset management. By standardizing this process, businesses can improve their financial stability and planning strategies.

Example Calculations for Business Assets

Calculating the salvage value for business assets is a common practice to ensure precise depreciation reporting. Let’s consider a piece of machinery purchased for $50,000—this purchase price of machinery forms the basis for our calculations—with an estimated useful life of 10 years and annual depreciation using the straight-line method. If the cumulative depreciation over its life is projected at $40,000, the salvage value calculation would be:

Salvage Value=Original Cost−Total Depreciation

Salvage Value=50,000−40,000=10,000

In this example, the salvage value of the machinery is estimated at $10,000.

Such calculations aid in accurate financial projections and decision-making regarding asset disposition, helping businesses plan future expenditures more effectively. Additionally, using leasing calculation methods for machinery can provide insight into the potential benefits of leasing over purchasing.

Car Salvage Value Calculation Example

Determining the salvage value of a car involves considering the vehicle’s initial cost, its useful life, and the expected depreciation. Suppose a car is purchased for $30,000 with an anticipated useful life of 5 years, and the estimated total depreciation over this period is $25,000. The calculation of the car’s salvage value would be:

Salvage Value=Purchase Price−Total Depreciation

Salvage Value=$30,000−$25,000=$5,000

This estimation suggests that the car will retain a value of $5,000 at the end of its useful life. By predicting this figure, you can make informed decisions about vehicle replacement or disposal strategies.

Depreciation Methods Involving Salvage Value

Straight-Line Method

The straight-line method of depreciation is straightforward and widely used, especially when calculating salvage value. This method allocates an equal amount of depreciation expense annually over the useful life of an asset. The formula involves subtracting the salvage value from the original cost and dividing by the asset’s lifespan:

Annual Depreciation=(Asset Cost−Salvage Value)÷Useful Life

For instance, if an asset costs $10,000, has a useful life of 10 years, and a salvage value of $2,000, the annual depreciation would be:

Annual Depreciation=(10,000−2,000)÷10=800

Each year, $800 would be recorded as depreciation expense. This method’s simplicity and predictability make it a favored choice among businesses for consistent and transparent reporting.

Declining Balance Method

The declining balance method accelerates depreciation compared to the straight-line method, offering higher depreciation expenses in the initial years of an asset’s life. This method does not directly consider salvage value in annual calculations but ensures that the book value will not drop below the salvage value by asset end-life adjustments.

The formula for the declining balance method is:

Depreciation Expense=Depreciation Rate×Book Value at the Beginning of the Year

Let’s assume an asset costs $20,000, has a salvage value of $2,000, and a useful life of 5 years with a depreciation rate of 20%. The depreciation for the first year would be:

Depreciation Expense=0.20×20,000=4,000

As the book value decreases annually, the expense calculation changes, tapering as it approaches the salvage value. This method is ideal for assets that lose value quickly, offering tax benefits and more accurately reflecting the asset’s market value in its early years.

Units of Production Method

The units of production method ties depreciation to actual usage, making it particularly relevant for assets whose wear and tear depend more on usage than time. Instead of a fixed annual charge, depreciation varies with the asset’s operational output, like machine hours or units produced.

The formula for the units of production method is:

Depreciation Expense=((Cost−Salvage Value)÷Total Estimated Production)×Units Produced in Year

For example, if a machine costs $120,000, has a salvage value of $20,000, and a total estimated production of 100,000 units, the depreciation expense for producing 15,000 units in a year would be:

Depreciation Expense=((120,000−20,000)÷100,000)×15,000=15,000

This method provides an accurate reflection of asset usage, making it highly beneficial for manufacturing industries. By closely aligning costs with productivity, businesses can maintain financial precision and fairness in reporting.

Salvage Value in Various Industries

Real Estate and Property Management

In real estate and property management, salvage value plays a crucial role in estimating the eventual income from a property once an asset’s useful life concludes. Typically, these assets, such as buildings or land improvements, possess a long lifespan and require thoughtful consideration of factors like location, the potential for redevelopment, and market trends. For instance, a property’s salvage value might involve the expected price of land after removing any buildings or infrastructure.

Real estate professionals leverage salvage value to guide investment and disposal decisions. This allows them to maximize returns by accurately assessing future market conditions and potential redevelopment costs. Accurate salvage value estimation helps property managers anticipate and mitigate financial risks associated with their holdings.

Manufacturing and Equipment

In the manufacturing sector, salvage value is integral for assessing the life expectancy and residual worth of equipment and machinery. These calculations help manage budgets, streamline replacements, and plan for future investments. Factors influencing a machine’s salvage value include technology changes, wear and tear, maintenance practices, and market demand for used equipment.

For instance, machinery with a high initial cost and advanced technology might retain higher salvage value due to its resale potential. Conversely, rapidly obsolescing equipment may see diminished salvage value.

Accurate salvage value estimation in manufacturing aids in effective capital expenditure planning and aligning depreciation with operational productivity. This strategic insight supports decision-making for retiring, upgrading, or reselling equipment.

Legal and Tax Implications

Compliance and Reporting Requirements

When dealing with salvage values, compliance with accounting standards and regulations is essential. Businesses must adhere to guidelines such as the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) that dictate how assets’ salvage value should be estimated and reported. These standards ensure transparency and uniformity in financial statements, impacting taxation and investor perceptions. Documentation is essential for consistency in accounting practices and effective asset management. Salvage value must be carefully documented within a company’s financial reporting, often accompanied by detailed notes explaining estimation methods and assumptions. Regular audits and reviews are necessary to ensure compliance, as robust auditing capabilities verify all asset transactions are accurately recorded. Improper reporting can result in penalties or financial restatements. Taking these factors into account supports accurate financial portrayals and maintains stakeholder trust.

Before Tax and After Tax Considerations

When calculating salvage value, it’s essential to distinguish between before-tax and after-tax implications to achieve accurate financial assessments. The before-tax salvage value represents the estimated cash inflow from selling an asset at the end of its useful life. However, the after-tax salvage value is more reflective of the actual financial benefit, as it accounts for potential capital gains taxes incurred upon sale.

To determine after-tax salvage value, subtract the tax effect from the before-tax value using this formula:

After-Tax Salvage Value=Before-Tax Salvage Value−(Tax Rate×Gain on Sale)

For instance, if an asset sells for $10,000 with a $2,000 tax on capital gains, the after-tax salvage value is $8,000.

Taking these considerations into account ensures better financial planning and more strategically aligned decisions regarding asset liquidation and reinvestment.

Strategic Implications of Salvage Value

Risk Management and Financial Planning

Incorporating salvage value into risk management and financial planning enhances the precision of strategic decisions and ensures robust asset management. By accurately estimating salvage value, businesses can better plan for asset retirement, preventing financial shortfalls due to unexpected asset disposal costs.

Salvage value estimation helps mitigate risks associated with asset downturns or market fluctuations. For example, knowing the salvage value of machinery or property allows firms to buffer against market volatility or unexpected repairs.

In financial planning, this knowledge aids in the allocation of resources and capital budgeting decisions, empowering businesses to optimize their asset lifecycle and achieve sustainable growth. Emphasizing salvage value enables firms to navigate potential financial pitfalls with greater confidence.

Utilizing Salvage Value for Asset Management

Salvage value is a crucial component in effective asset management, facilitating informed decisions regarding asset utilization, disposal, and replacement. By leveraging salvage value estimates, businesses can strategically schedule asset retirements and replacements, ensuring alignment with productivity and financial objectives.

For instance, understanding the salvage value helps determine the optimal point to sell or retire an asset before its operational costs outweigh its benefits. Moreover, it aids in evaluating the financial viability of upgrading equipment or investing in new technology.

By using salvage value as a key metric, companies can achieve a balance between maintaining efficient operations and maximizing resale value, thereby enhancing overall asset performance and return on investment. This strategic approach underpins long-term financial health and asset management success.

Technological Advancements Impacting Salvage Value Calculations

AI and Predictive Forecasting

The advent of AI and predictive forecasting has revolutionized how businesses calculate salvage value, offering more precise and data-driven insights. By utilizing machine learning algorithms and vast datasets, AI can predict an asset’s future value with increased accuracy, taking into account historical data, market trends, and economic indicators.

Predictive forecasting enables real-time updates and adjustments to salvage value estimates, helping firms adapt quickly to changes in market conditions or asset performance. This technology allows companies to enhance decision-making, reduce risks, and optimize asset management strategies.

Incorporating AI-driven predictions into financial planning ensures a more dynamic and responsive approach to managing assets, ultimately boosting efficiency and profitability. This technological integration equips businesses with the agility needed to thrive in a constantly evolving market landscape.

Modern Tools and Software for Valuation

Modern tools and software have transformed the precision with which businesses can calculate and manage salvage values. These digital solutions provide advanced features for assessing asset worth over time, integrating seamlessly with accounting and financial management systems. Many software options come with a user-friendly interface, allowing users to input asset specifics and generate detailed depreciation schedules via customizable templates, including salvage value calculations. Tools often incorporate features like real-time data analytics, customizable reports, and scenario modeling.

By leveraging these technologies, companies can streamline asset valuation processes, improve accuracy, and make data-driven decisions through modules designed for various aspects of asset management. This enhances overall asset management, ensuring that resource allocation aligns with strategic objectives and promotes long-term financial sustainability. Additionally, many software platforms offer email support as part of their customer service, ensuring users can maximize the tools’ potential.

FAQs

What does it mean to define salvage value?

Defining salvage value means estimating the amount an asset will be worth at the end of its useful life, after accounting for depreciation. It reflects the expected disposal value after costs like removal or sale, crucial for calculating depreciation and financial planning.

What factors influence the salvage value of an asset?

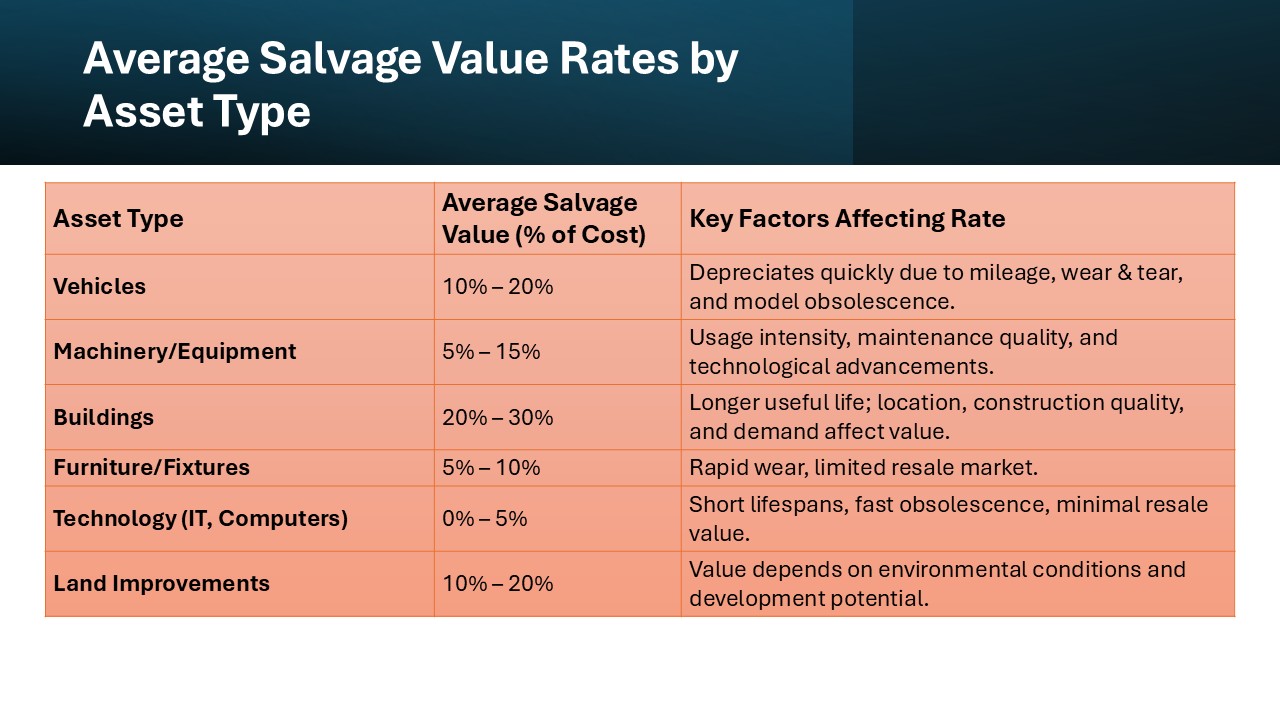

Several factors influence the salvage value of an asset, including its initial cost, condition at the end of its useful life, technological advancements, market demand for used assets, and maintenance history. External factors like economic conditions and regulatory changes can also impact the salvage value. how different factors have impacted the salvage value of specific assets in real-world scenarios.

How does salvage value affect financial statements?

Salvage value affects financial statements by influencing the calculation of depreciation expense, which is reported on the income statement. This also impacts the book value of assets on the balance sheet. Accurately estimating salvage value ensures compliance with accounting standards and provides a true reflection of asset value over time.

Is there a standard formula for calculating salvage value?

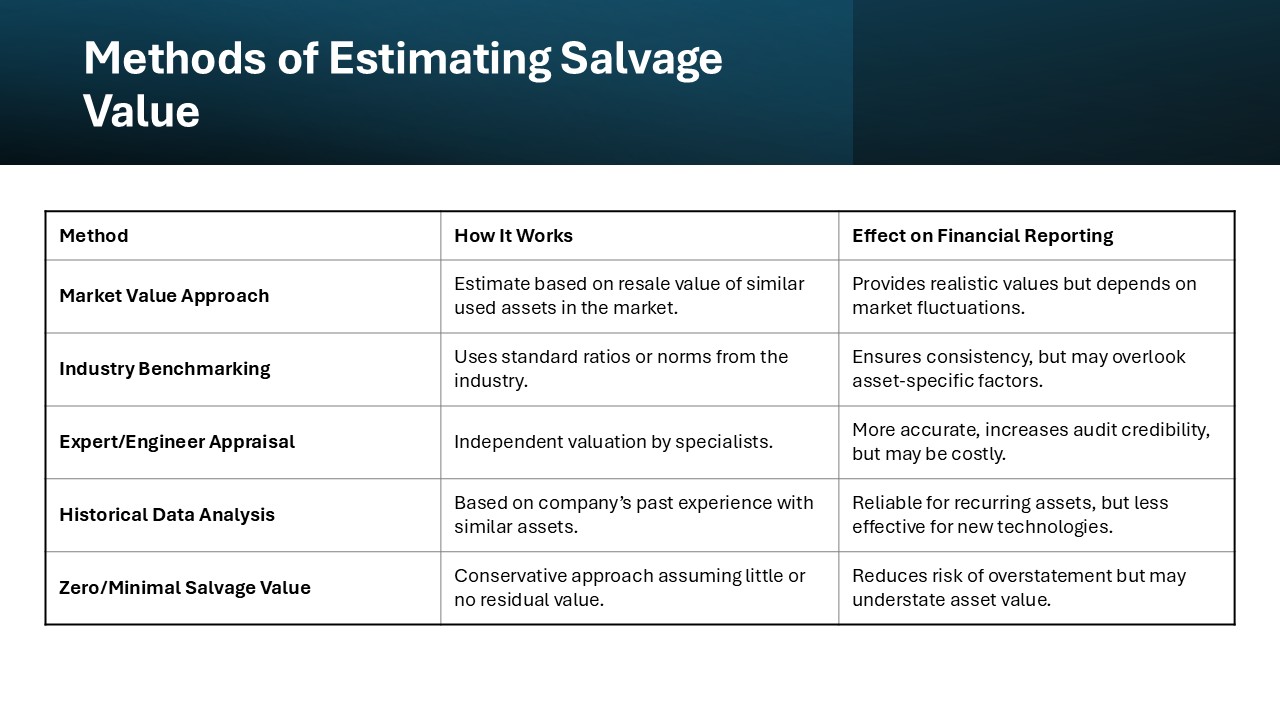

There is no single standard formula for calculating salvage value, as estimates depend on various factors like asset type and market conditions. Typically, the salvage value is determined by subtracting total depreciation from the asset’s original cost, often requiring judgment and market analysis.

Can salvage value change over time?

Yes, salvage value can change over time due to shifts in market conditions, technological advancements, and asset condition. Regular reassessment is crucial to ensure accurate financial reporting and adaptability in asset management strategies.

How do you calculate /determine salvage value of a car?

To calculate the salvage value of a car, assess its market value at the end of its useful life minus any costs for sale or removal. Consider factors like current market trends, the car’s condition, and depreciation rate. Often referred to as the scrap value or residual value, it plays a key role in determining the annual depreciation expense of an asset such as a car. Industry resources or professional appraisals can aid in determining an accurate estimate.

Is there a salvage value calculator I can use?

Yes, there are several online salvage value calculators available. These tools require inputs like an asset’s original cost, useful life, and estimated depreciation rate to provide a quick salvage value estimate. They offer a convenient way to simplify complex calculations for better financial planning.