KEY TAKEAWAYS

- Favorable Tax Treatment: Qualified dividends enjoy lower tax rates, ranging from 0% to 20% based on income, as they are taxed at long-term capital gains rates compared to ordinary dividends taxed at regular income tax rates.

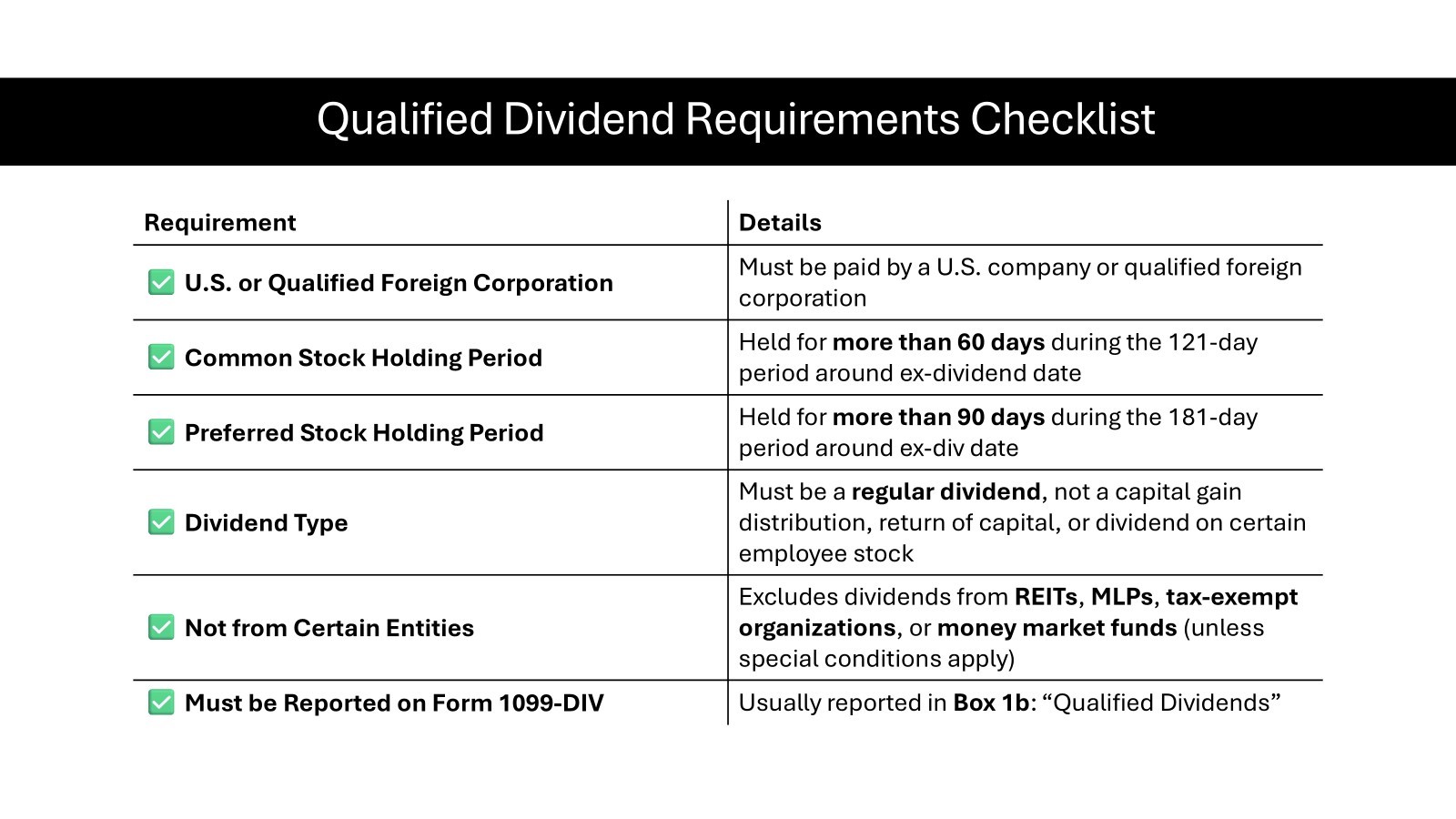

- Criteria for Qualification: For dividends to be considered qualified, they must be paid by a U.S. or qualified foreign corporation, be held for more than 60 days within a 121-day period around the ex-dividend date, and not fall under disqualified payments.

- Tax Efficiency and Growth Potential: By taking advantage of lower tax rates, qualified dividends allow investors, especially high earners, to achieve tax-efficient income, reinvest more capital due to lower tax burdens, and foster better long-term portfolio growth through compounding gains.

Understanding Qualified Dividends

Definition and Overview

Qualified dividends are those that meet specific IRS criteria, allowing them to be taxed at the lower capital gains tax rates rather than the higher ordinary income tax rates. This tax treatment can result in substantial savings for investors, making understanding them essential. Typically, dividends are deemed qualified if they are paid by a U.S. corporation or a qualified foreign corporation and if you hold the underlying shares for a requisite period.

Key Requirements for Qualification

To qualify for the lower tax rate, dividends must meet several key criteria. First, the dividends must be paid by a U.S. corporation or a qualified foreign entity, which typically includes those incorporated in a country with an income tax treaty with the United States. Second, you must have held the stock for more than 60 days during the 121-day period that begins 60 days before the ex-dividend date. Lastly, the dividend must not fall under specific disallowed categories, such as those from tax-exempt entities. Eligible payers of dividends ensure transparency and compliance with tax laws. Meeting these criteria can help maximize your income portfolio’s efficiency by ensuring potential deductions and lower tax liability are achieved.

Examples of Qualified Dividends

Qualified dividends typically come from a range of securities that include U.S.-based corporations and certain qualifying foreign corporations. For example, dividends from common stocks of blue-chip companies listed on the New York Stock Exchange often qualify. Dividends from eligible American Depositary Receipts (ADRs) and mutual funds that comply with the IRS’s criteria can also be considered qualified. Additionally, shareholders can explore the offerings of real estate investment trusts (REITs), although these typically do not pay qualified dividends.

Taxation of Qualified Dividends

Current Tax Rates and Implications

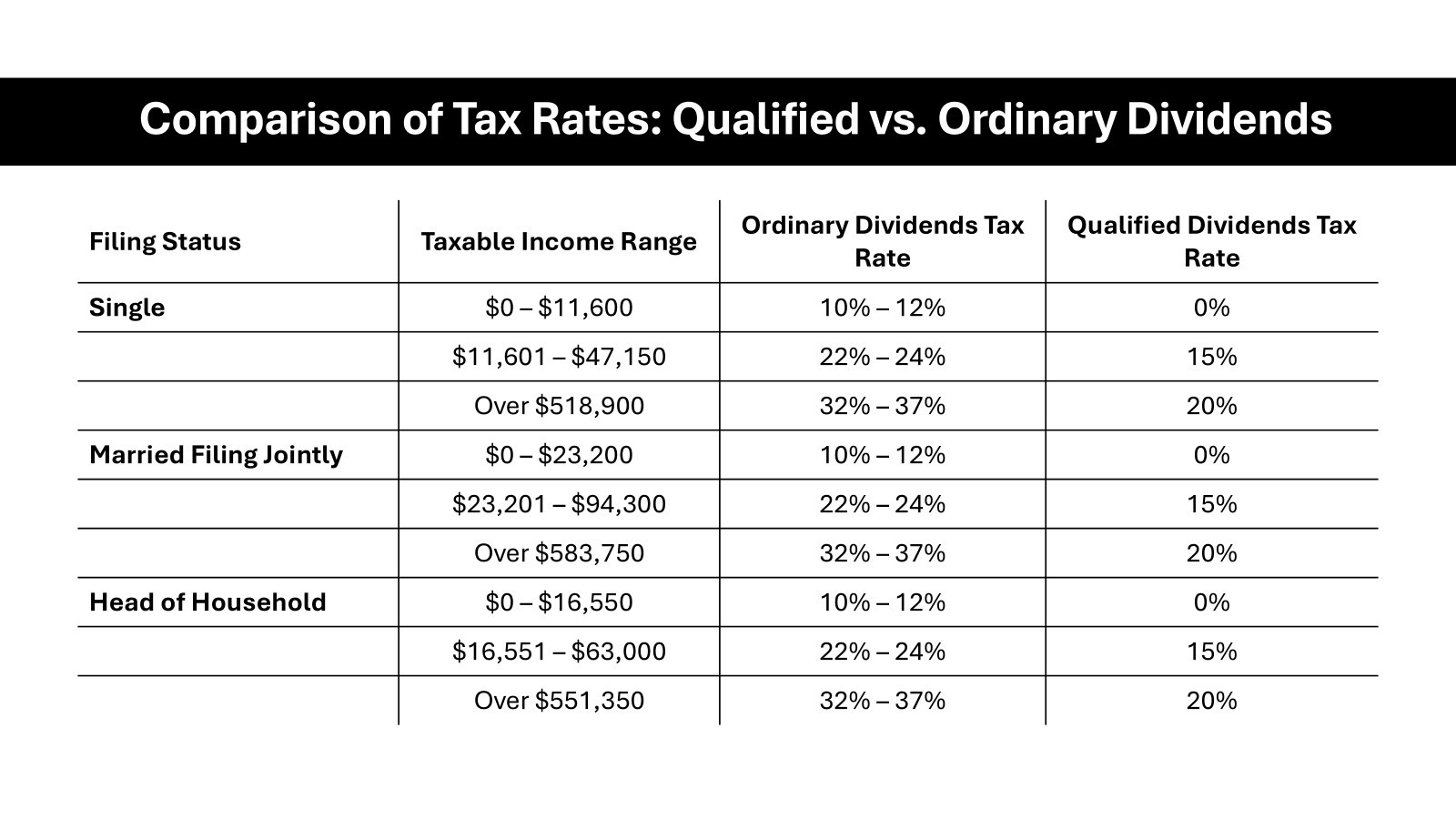

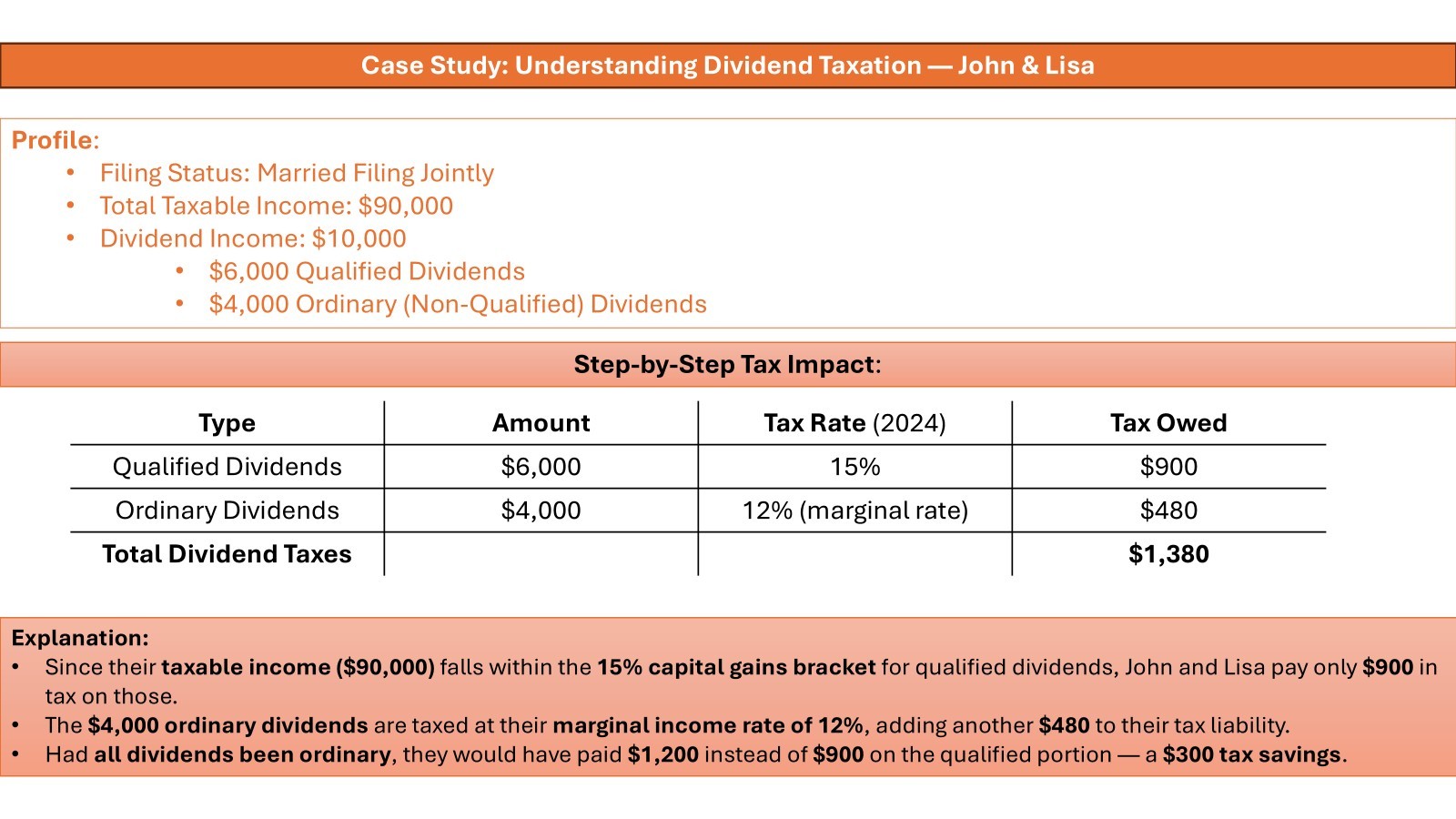

Qualified dividends enjoy preferential tax rates, similar to long-term capital gains. As of recent tax regulations, they are taxed at 0%, 15%, or 20%, depending on your taxable income and filing status. For those in the lower income brackets, the rate might be 0%, which can significantly enhance your after-tax return. Taking advantage of compound interest by reinvesting these dividends can further grow your portfolio. Additionally, navigating the complexities of taxes such as the 3.8% net investment income tax (NIIT) is crucial to maximize returns. These lower rates incentivize holding qualifying investments and carefully planning your income spread across tax brackets. Planning also involves understanding capital gains taxes. Tools like SmartAsset’s capital gains tax calculator can assist in estimating potential tax liabilities, thereby aiding in more strategic investment decisions.

Comparison with Ordinary Dividends

Qualified dividends differ from ordinary dividends primarily in how they are taxed. Ordinary dividends are taxed at the individual’s regular income tax rates, which can escalate to as high as 37% for the top earners. In contrast, qualified dividends benefit from much lower tax rates, capped at 20%. This distinction can influence investment choices and overall tax liability, with qualified dividends offering a more tax-efficient option for long-term investors.

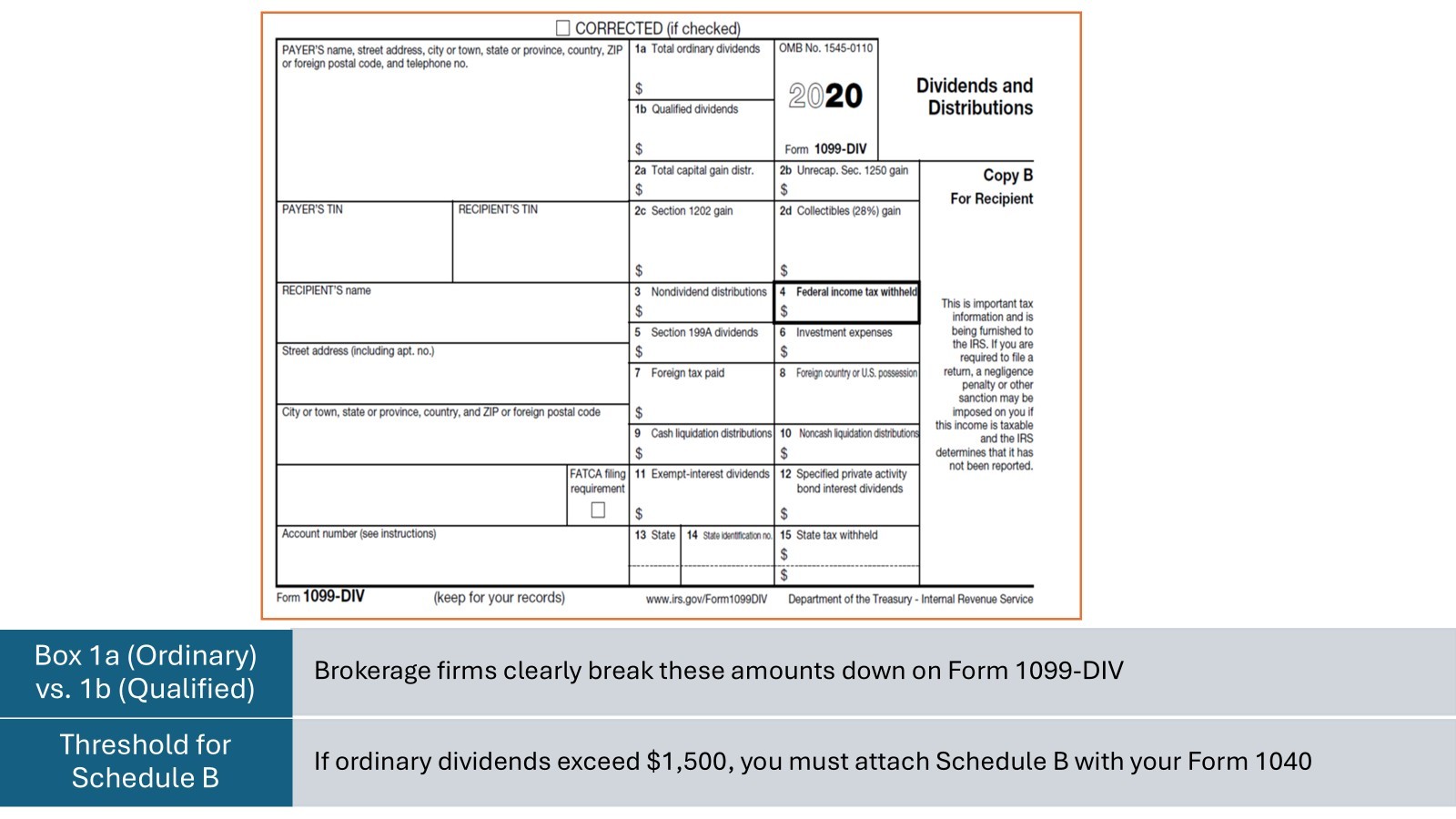

Impact on Your Tax Reporting

When reporting qualified dividends on your tax return, it’s essential to distinguish between ordinary and qualified types, as this affects your tax outcome. On IRS Form 1040, you’ll find a space in the Dividend section to list both types. Listing incorrectly can lead to overpayment or errors in tax liability. Proper documentation from 1099-DIV forms, issued by brokers, is crucial. Accurate reporting ensures you benefit fully from the lower rates applicable to qualified dividends.

Determining If Your Dividends Are Qualified

Holding Period Considerations

The holding period for qualified dividends is critical to ensuring the favorable tax rates apply. To meet the requirements, you must hold the stock for more than 60 days within the 121-day period starting 60 days before the ex-dividend date. This period ensures that long-term investment is rewarded, deterring short-term trading that might lead to market instability. Missing this requirement results in dividends being taxed as ordinary income, negating the tax efficiency.

Identifying Qualified Dividends in Financial Statements

Identifying qualified dividends in financial statements is crucial for proper tax treatment. Typically, your brokerage will provide a 1099-DIV form annually, which breaks down the dividends received into qualified and non-qualified categories. Within financial statements, notes accompanying dividends paid will often specify status based on qualifying criteria. Compare this with IRS guidelines to ensure accuracy.

Common Mistakes and How to Avoid Them

Many investors make mistakes with qualified dividends by overlooking holding period requirements, inaccurately reporting on tax forms, or misclassifying dividends due to unreliable records. To avoid these pitfalls, maintain detailed transaction records, and review broker statements carefully. Additionally, consulting tax advisors can ensure compliance with IRS standards effectively, potentially maximizing your compensation through proper deductions. Kiplinger suggests keeping up with these updates and considering potential payouts. Regularly updating your knowledge on IRS standards can also prevent oversight. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. If you’re looking to add qualified dividends or other income-generating assets like equities to your portfolio, a financial advisor can help you develop a strategy that aligns with your goals and tax situation.

Dividend Strategies and Tax Efficiency

Leveraging Qualified Dividends for Investment Planning

Leveraging qualified dividends effectively in your investment portfolio can enhance your long-term returns by maximizing tax efficiency. By prioritizing investments that yield qualified dividends, you can reduce your overall tax liability while enjoying steady income streams. Align your investment choices with strategic goals, considering dividend yields, stock stability, and growth potential. Engaging with a financial advisor can ensure your approach aligns with both immediate income needs and future financial aspirations.

Comparing Stocks and Bonds: The Tax Angle

When comparing stocks and bonds from a tax perspective, stocks often provide a tax advantage through qualified dividends, which enjoy lower tax rates than the interest income from bonds, often taxed as ordinary income. While bonds offer predictable returns and lower risk, stocks with qualified dividends can offer greater after-tax returns. This makes stocks appealing for those who can handle more market volatility. Investors should consider balancing both asset types to optimize their portfolio for risk-adjusted, tax-efficient growth.

Special Considerations for Mutual Funds and ETFs

Investing in mutual funds and ETFs that distribute qualified dividends can offer tax efficiency, yet requires attention to detail. These funds often pool investments, meaning the manager’s choices affect your dividend qualifications. Ensure the fund’s dividend distributions are classified appropriately and check if the fund’s strategy aligns with your individual tax goals. Look for funds with a strong history of distributing qualified dividends to maximize tax benefits.

FAQs

What is the main difference between qualified and ordinary dividends?

The main difference lies in their taxation. Qualified dividends benefit from lower tax rates, akin to capital gains, while ordinary dividends are taxed at standard income tax rates. This distinction impacts the net income investors receive from dividends.

How do I report qualified dividends on my tax return?

Qualified dividends are reported on your IRS Form 1040. On the form, you’ll list them separately in the dividend section to take advantage of potential lower tax rates. Refer to your 1099-DIV form from your broker to ensure accurate reporting.

Are there specific forms required for reporting qualified dividends?

Yes, the primary form is the 1099-DIV, which your broker provides. It details both ordinary and qualified dividends. You use this information to accurately report dividends on IRS Form 1040, ensuring the correct tax treatment.

How are dividend and taxes related for individual investors?

Dividends are taxable income for investors. The type—qualified or ordinary—determines the tax rate applied. Qualified dividends enjoy lower tax rates, reducing overall tax burden, enhancing net income, and impacting investment choices.

Are dividends taxed as ordinary income by default?

Yes, dividends are taxed as ordinary income by default unless they meet specific IRS criteria to be classified as qualified dividends, which are then taxed at lower, capital gains rates.

Are qualified dividends taxable at a lower rate?

Yes, qualified dividends are taxed at a lower rate, similar to long-term capital gains, providing tax advantages over ordinary dividends and potentially increasing your net income from investments.