Defining Book Value and Market Value

What is Book Value?

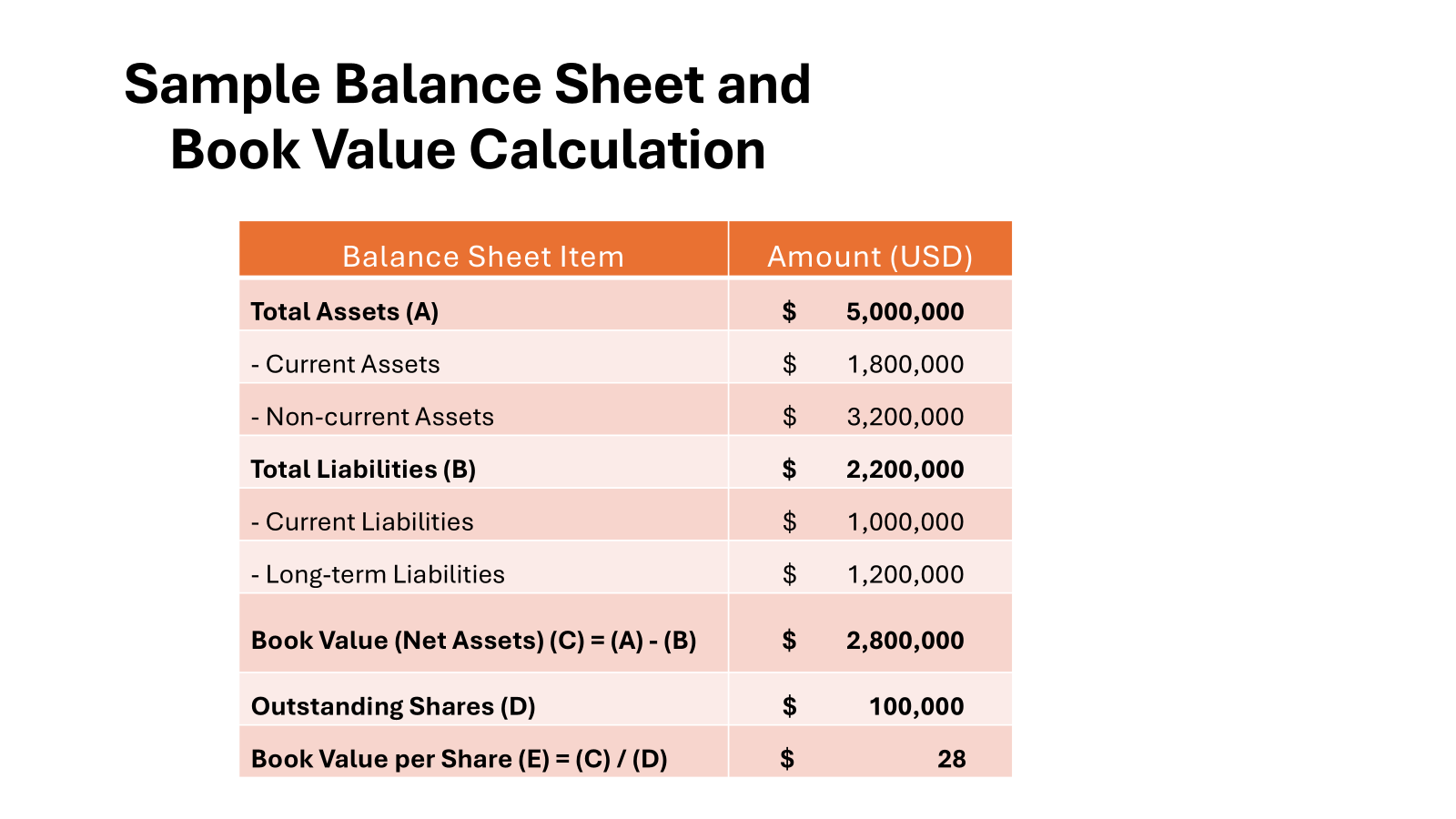

Book value represents the net asset value of a company according to its balance sheet. It’s calculated by subtracting total liabilities from total assets, providing a snapshot of what shareholders would theoretically receive if the company was liquidated. Book value is often regarded as an indicator of a company’s baseline worth, offering a tangible measure of its financial stability.

KEY TAKEAWAYS

- Book value provides a conservative estimate of a company’s net worth: It represents the worth of a company’s assets minus its liabilities, calculated using historical costs, and considers depreciation, amortization, and impairment. This metric is particularly useful for understanding a company’s financial foundation and can be instrumental in identifying undervalued stocks when the market price is lower than the company’s book value.

- Market value reflects investor sentiment and growth potential: Unlike book value, market value can fluctuate daily based on investor perception, company performance, and overall market conditions. It captures what investors are willing to pay for a company’s shares, indicating confidence in the company’s future earnings and industry trends. High market value compared to book value suggests strong investor confidence in the growth potential.

- Comparison reveals valuation insights: Investors compare book value and market value to assess whether a stock is overvalued, undervalued, or fairly valued. A market value lower than book value suggests potential undervaluation; conversely, a higher market value indicates expected growth prospects but may also signal overvaluation risks. When both values align, it suggests fair valuation in the eyes of both conservative and growth-oriented investors.

Understanding Market Value

Market value, on the other hand, refers to the current price at which a company’s shares trade on the stock market. It reflects the market’s perception of a company’s future earning potential and overall financial health. This value is dynamic, fluctuating with market trends, investor sentiment, and economic conditions. Unlike book value, market value is influenced by intangibles like brand reputation and growth expectations.

Key Differences Between Book Value and Market Value

Calculation Methods

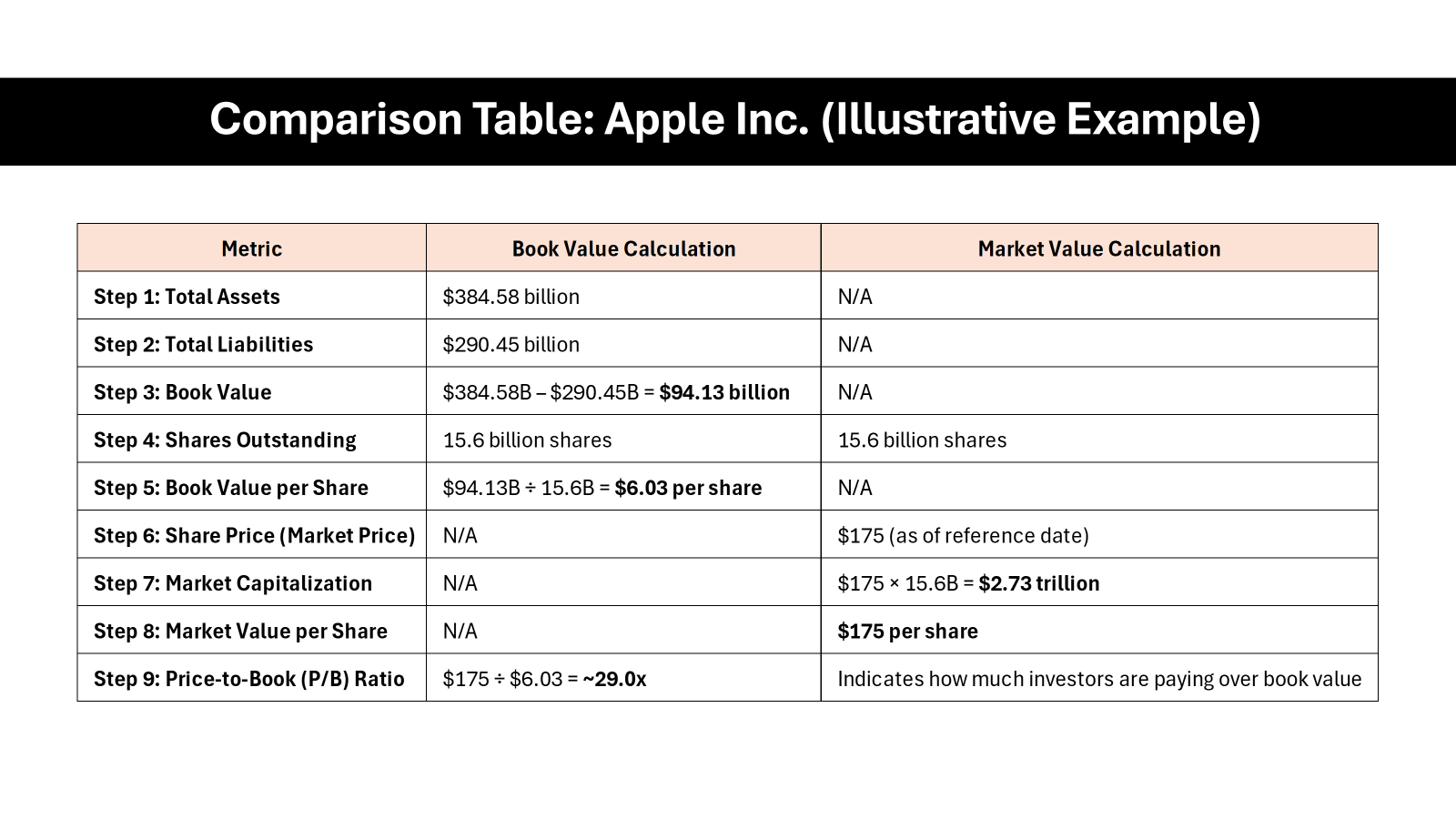

The calculation methods for book value and market value are distinct and straightforward. Book value is determined by subtracting total liabilities from total assets on a company’s balance sheet. This provides a concrete figure representing the company’s tangible worth.

In contrast, market value is calculated by multiplying the current share price by the total number of outstanding shares. This represents the company’s perceived value in the marketplace.

Factors Influencing Each Value

Several factors influence book and market values, impacting how they reflect a company’s worth. Book value is primarily affected by changes in the company’s physical assets and liabilities. Depreciation of assets, accounting policies, and any significant asset sales or acquisitions can alter this value.

Market value, however, is influenced by market trends, investor sentiment, economic conditions, and company performance expectations. External factors such as industry news, market speculation, and competitor activity also play a significant role in shaping market value.

Impact on Investment Decisions

Understanding the impact of book and market values is crucial for making informed investment decisions. While book value provides investors with a stable baseline of a company’s net worth, market value offers insights into how the market perceives its future potential. Investors often compare the two to identify undervalued or overvalued stocks. A stock trading below its book value might suggest it’s undervalued, while a higher market value could indicate strong future growth potential. These metrics help shape whether investors see a company as a good short-term gain or a stable, long-term investment.

Why Do These Metrics Matter for Investors?

Assessing a Company’s Financial Health

Book value serves as a fundamental tool for assessing a company’s financial health. It provides a clear picture of the company’s tangible assets minus liabilities, revealing the firm’s intrinsic financial strength. Market value, however, offers a view of the company’s potential growth and future earnings, reflecting how confident investors are about its prospects. By comparing these values, you can assess not only the company’s current financial status but also its market reputation and potential for future success. This assessment can be particularly valuable when you’re evaluating the stability and solidity of a company’s operations.

Long-term vs Short-term Investment Considerations

When considering investments, it’s essential to understand how book and market values can influence both long-term and short-term strategies. For long-term investments, focus on book value, as it provides a stable indicator of a company’s underlying worth and asset strength. This can be reassuring for investors seeking stable growth over time.

In contrast, short-term investments are more aligned with market value since it reflects real-time market dynamics and investor sentiment. Quick gains are often rooted in the movements of market value driven by news and market conditions. Balancing both metrics can help create a diverse and flexible investment portfolio.

Common Misconceptions and Limitations

Misinterpreting Book Value

Misinterpreting book value often occurs when investors mistake it for a direct representation of a company’s market value or potential for growth. It’s important to note that book value only reflects the net asset value excluding intangibles and potential growth factors. Investors might overlook elements such as brand strength or future earning potential, which aren’t captured in book value. Relying solely on this measure can lead to undervaluing companies with significant intangible assets or growth potential.

Overestimating Market Value

Overestimating market value can lead to unrealistic investment expectations. This metric is susceptible to fluctuations driven by market trends, speculation, and investor sentiment, which may not always align with a company’s actual performance or financial health. Over-reliance on market value might cause you to invest in overvalued stocks, risking potential losses if market perceptions shift. It’s crucial to balance this with other financial indicators to avoid making decisions based solely on hype or temporary market trends.

Practical Examples

Book Value Greater Than Market Value – What It Means

When a company’s book value exceeds its market value, it could suggest that the stock is undervalued. This situation often indicates that the market might be overlooking the company’s tangible assets, or there could be pessimistic perceptions about its future prospects. For value investors, this scenario might present an opportunity to buy into fundamentally sound companies at a discount. However, it’s crucial to conduct further research to ensure the low market value isn’t due to underlying issues such as management problems or industry challenges.

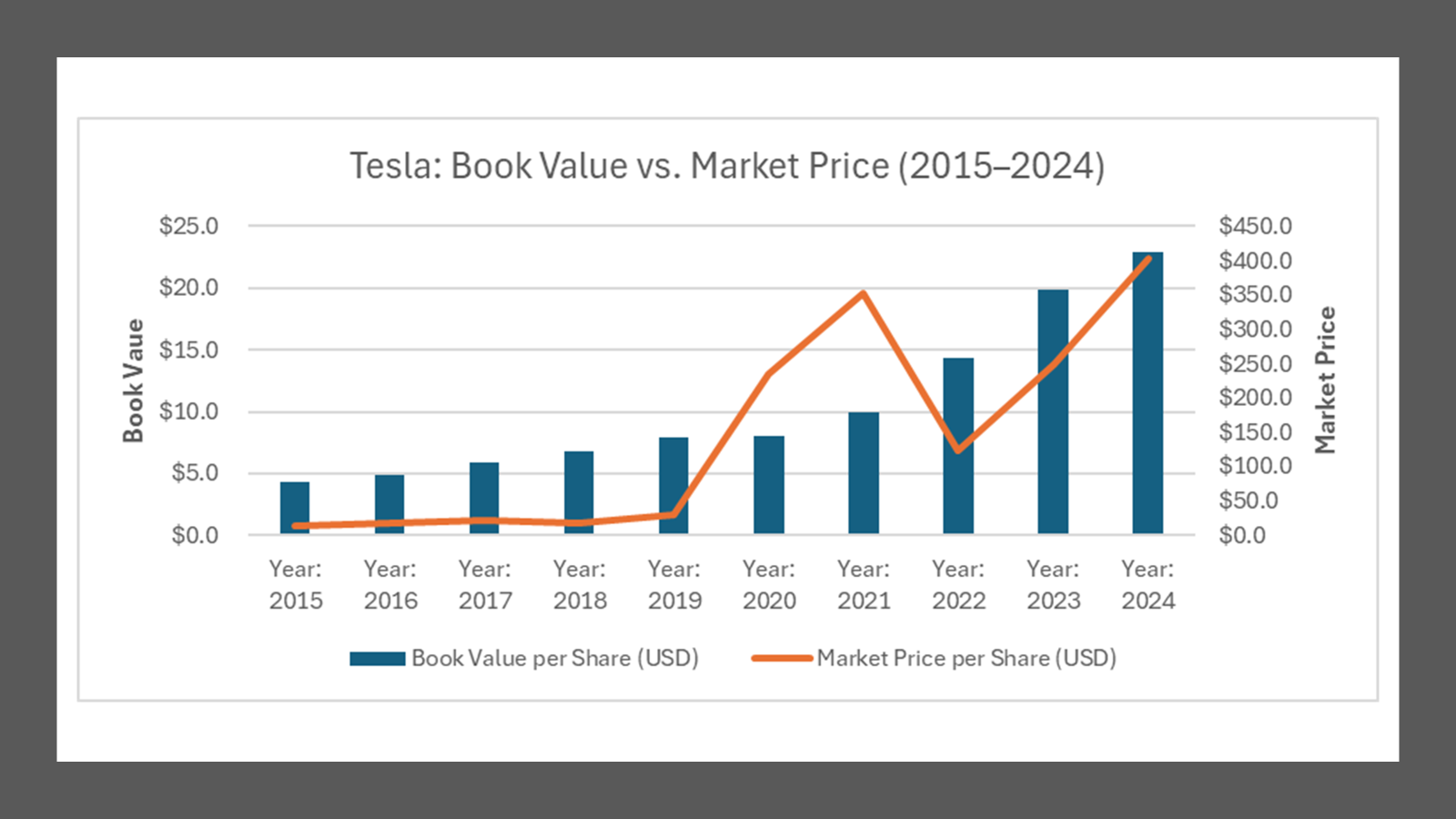

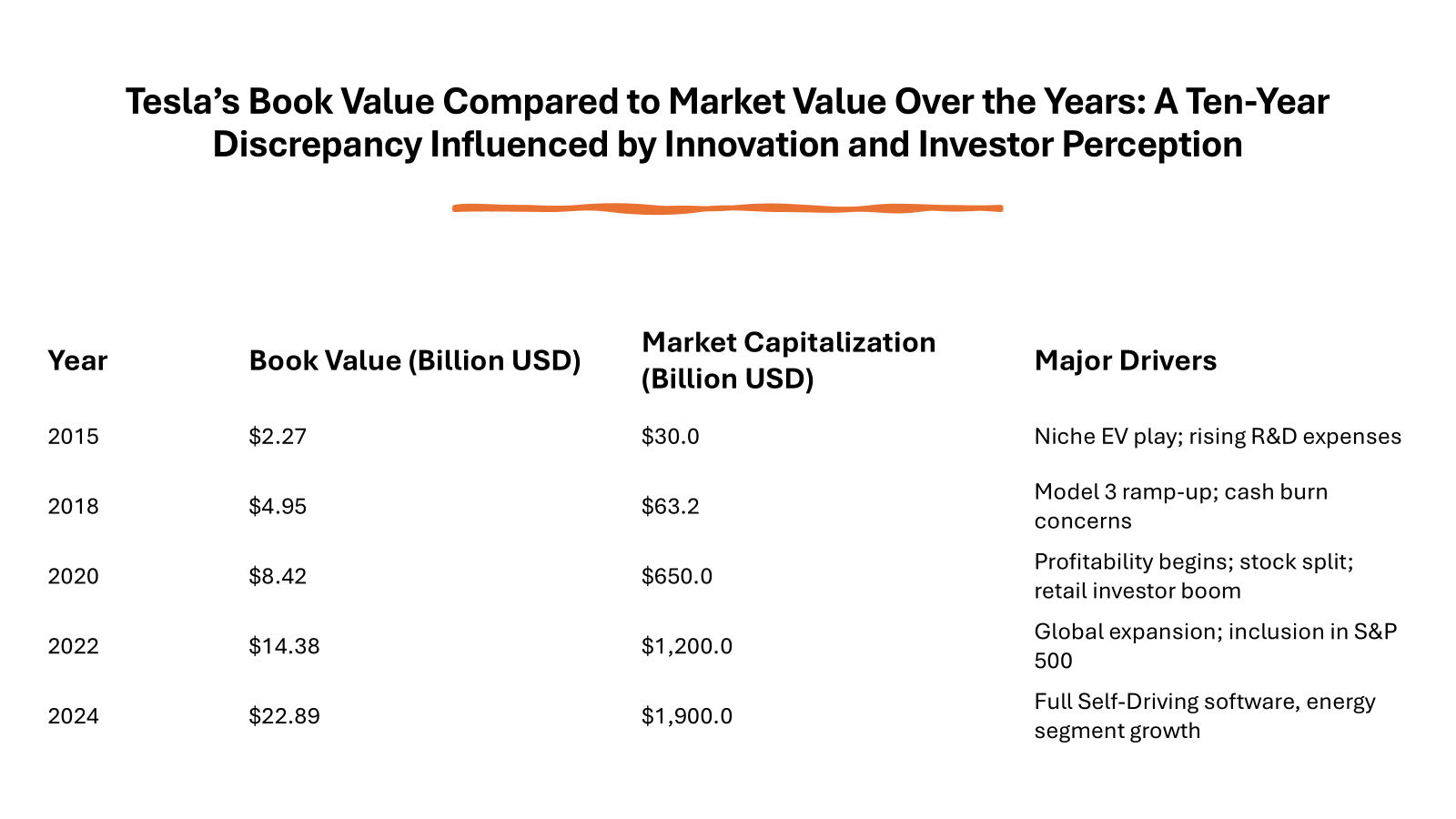

When Market Value Surpasses Book Value

When a company’s market value surpasses its book value, it highlights investor optimism and potential growth expectations. This scenario often reflects the market’s belief in the company’s ability to generate future earnings, driven by strong brand equity, strategic advantages, or growth initiatives. However, high market value compared to book value can sometimes indicate overvaluation, prompting further analysis to ensure that this difference is justified by tangible business performance improvements.

Conclusion

Book value and market value are two fundamental concepts in business valuation that provide insights into a company’s financial health and profitability. Book value represents the net asset value of a company as recorded on its ledger and financial statements, calculated by subtracting liabilities from assets. This value is based on historical costs and accounting principles, including amortization and depreciation. On the other hand, market value reflects the current trading price of a company’s shares in the stock market, influenced by investor perceptions, market conditions, and market capitalization.

The essence of understanding book value versus market value lies in recognizing their different roles in evaluating a company’s worth. Book value is often used in accounting topics to assess the intrinsic value of a company’s assets, while market value provides a snapshot of what investors are willing to pay for the company’s stock. Discrepancies between these values can indicate whether a company is undervalued or overvalued in the marketplace. For instance, if the market value is significantly higher than the book value, it may suggest strong investor confidence and potential for future growth.

Profitability is a key factor that influences both book value and market value. A profitable company is likely to have a higher market value due to positive investor sentiment and expectations of continued earnings. However, profitability also impacts book value through retained earnings, which increase the net asset value recorded on the company’s balance sheet. Additionally, taxes play a role in determining both values, as tax liabilities can affect net income and asset valuations.

In scenarios such as liquidation, the liquidation value of a company’s assets may differ from both book value and market value. Liquidation value represents the estimated amount that could be realized if the company’s assets were sold off quickly, often at a discount. Understanding these different valuation metrics is crucial for investors, accountants, and business managers to make informed decisions. Resources like Investopedia and company websites can provide valuable information and tools for analyzing these concepts in depth.

Effective management of inventory is crucial for maintaining accurate receipts and tracking withdrawals within a company’s operations. Proper inventory control ensures that assets are accounted for and available when needed, reducing the risk of shortages or overstock. Communication through email can streamline inventory management processes, allowing for timely updates and coordination among departments. By keeping detailed records of inventory movements, companies can optimize their asset utilization and enhance overall efficiency.

FAQs

What does book value for share represent?

Book value per share represents the value of a company’s equity on a per-share basis. It’s calculated by dividing total shareholders’ equity by the number of outstanding shares. This metric indicates the minimum amount a shareholder might receive per share if the company were liquidated.

How do you find the book value of a stock?

To find the book value of a stock, subtract the company’s total liabilities from its total assets to calculate the shareholders’ equity. Then, divide this equity by the total number of outstanding shares. The result is the book value per share, offering insights into the company’s net asset value.

Is it better to focus on book value or market value when investing?

It depends on your investment strategy. For long-term, value-oriented approaches, focus on book value to assess a company’s fundamental worth. For growth-oriented or short-term trading, market value is crucial, reflecting market sentiment and potential for gains. Ideally, consider both to diversify your investment insights.

What causes fluctuations in book value?

Fluctuations in book value occur due to changes in asset valuations, liabilities, and shareholder equity. Factors such as asset depreciation, acquisitions, divestitures, and changes in retained earnings can impact book value. Accounting adjustments and fluctuations in currency exchange rates might also play a role.

How often should investors assess market value changes?

Investors should monitor market value changes regularly, ideally on a daily or weekly basis, especially if they’re actively trading or involved in short-term investments. For long-term investors, less frequent monitoring, such as quarterly reviews, might suffice to ensure alignment with investment goals and market trends.

What is the meaning of book value in accounting?

In accounting, book value represents the net value of a company’s assets recorded on its balance sheet after accounting for depreciation and other liabilities. It’s a measure of the company’s tangible net worth and is used to assess the intrinsic value of a company’s equity.

How do investors use book value versus market value in decision-making?

Investors use book value to gauge a company’s fundamental health and stability, often seeking undervalued stocks that trade below this metric. In contrast, market value is used to assess investor sentiment and future growth potential. By comparing these values, investors can identify discrepancies and opportunities, making informed decisions on potential investments.