Divestment in the Financial and Business Realm

In the financial and business world, divestment is like strategically shedding weight to improve performance or adapt to new avenues. Companies dive into this process to sell properties, divisions, or stakes in businesses, either to inject some liquidity, realign with strategic goals, or conform to new regulatory environments. It’s all about financial recalibration and redefining the company’s focus. Picture a business slicing off a piece of its pie – not because it’s not delicious, but perhaps it’s no longer the right flavor for its growth recipe or market taste trends.

KEY TAKEAWAYS

- Divestment, also known as divestiture, refers to the process of a company selling off subsidiary assets, investments, or divisions, which can help in maximizing the parent company’s value. This strategic move is often considered when certain parts of the company are underperforming or to achieve broader business, financial, social, or political objectives. Divestment serves the opposite purpose of investment.

- One of the primary reasons for divestment is to refocus a company’s operations. By divesting, a business can concentrate its resources on its main segments, potentially leading to better performance by shedding underperforming or non-core assets.

- Divestment can provide a company with several financial benefits. It not only simplifies the operating model, leading to increased transparency for investors, but also helps in unlocking value. Different entities formed through divestment may attract more accurate market valuation due to their distinct growth rates and financial profiles. Additionally, divestment can generate capital, used for reinvestment within the company, funding dividends and buybacks, pursuing acquisition targets, or reducing debt.

Exploring Types of Divestments

The Strategic Moves: Sell-offs, Carve-outs, and Spin-offs

When businesses are contemplating divestment, they typically contemplate three main strategic pathways: sell-offs, carve-outs, and spin-offs. Each serves its unique purpose based on the company’s goals and the nature of the asset being divested.

Sell-offs happen when a business needs to quickly convert assets into cash; they might decide to sell a part of the company, perhaps a product line or a subsidiary, to another entity. This could be a strategic move to pay down debt or focus on their core businesses.

Carve-outs are when a company opts for something a bit less drastic, cutting out a piece of a subsidiary or division and creating a new, independent company. This can breathe new life into a stalled part of the business, allowing it to flourish independently with its equity and management, while still retaining some connection to the parent company.

When divestment takes the form of a spin-off, it’s about creating a completely independent company from an existing part of the parent company. Shares of the newly formed entity are handed over to the parent company’s shareholders, and voila—a new pure-play company is born, which could potentially unlock hidden value for both entities.

From Direct Sales to Equity Carve-outs: A Closer Look

Taking a magnifying glass to the spectrum of divestment strategies, direct sales and equity carve-outs stand out for their distinctive characteristics. Direct sales of assets are fairly straightforward; they involve a parent company passing the baton of assets like real estate, intellectual property, or entire divisions directly to another party. It’s a clean break, often chosen to generate quick cash or exit from non-core business areas.

On the flip side, equity carve-outs take on a subtler approach. They’re the corporate equivalent of taking a subsidiary for a walk on the Wall Street runway, offering a portion of its equity to the public through stock market offerings. While this does generate cash, it’s also about strategically redefining the subsidiary’s market value and identity, with the parent company still cheering from the sidelines with a majority stake. This allows the subsidiary to tap into new resources and grow independently.

Both methods have their place in the strategic toolbox of corporate restructure, adjusting the scales of a company’s presence and influence in various markets.

Decoding the Reasons Behind Divestitures

Financial Restructuring for Growth

Divestment can be a lifeline for companies in turbulent financial waters, acting as a restructuring mechanism to foster growth. When companies look at their balance sheets and see figures that could use some positive energy, divestiture offers a way to raise capital, fast. This capital infusion can be used to reduce debt, ramp up investments in core ventures, or explore entirely new business opportunities. In essence, it’s about pruning the organizational tree to encourage healthier, more vigorous growth.

Moreover, by offloading underperforming or non-essential assets, companies can streamline operations and focus on areas with the greatest potential for return. It’s not just about salvaging funds; it’s equally a strategic maneuver to position the company for more robust growth, a better competitive stance, or just a more sustainable, agile operational model fit for the dynamic business climates of today.

Reflecting Social Responsibility and Ethical Choices

Divestment can be a powerful statement of a company’s commitment to social responsibility and ethical practice. When a business decides to divest from industries or countries with poor human rights records, controversial environmental practices, or other ethical quandaries, they’re sending a clear message about their values. It’s an acknowledgment that financial return isn’t the sole measure of success; a company’s legacy and reputation weigh heavily in the scales of modern consumer and investor expectations.

This ethical dimension of divestment represents a company aligning its operations with its moral compass, whether it’s stepping away from fossil fuels to confront climate change or withdrawing support from governments with problematic policies. Corporations today are increasingly held accountable not just for their direct actions but also for the company they keep, figuratively and financially.

By taking a stand, companies can strengthen their brand integrity and build trust among consumers and shareholders alike, tapping into a growing demand for ethical investment opportunities.

Real-world Divestment Scenarios

Case Studies on Corporate Divestment Strategies

Delving into real-world scenarios paints a vivid picture of divestment strategies in action. For example, take the case of a multinational conglomerate that decides to spin off its underperforming electronics division to better concentrate on its profitable healthcare and infrastructure businesses. This strategic divestiture allows the company to deliver stronger financials and offer shareholders enhanced value.

Another illustrative example might be a corporation selling off its stake in a joint venture due to strategic misalignment. By exiting the joint venture, the company is able to recuperate investment and redirect resources towards more promising market opportunities, demonstrating agility and foresight in its strategic planning.

These cases show that divestment is not about admitting defeat; rather, it’s about making calculated, courageous moves to keep the business robust and aligned with a coherent, forward-looking strategy.

Sociopolitical Factors Influencing Company Divestments

Sociopolitical climates play a pivotal role in shaping business strategies, and divestment decisions often reflect a company’s response to these factors. For instance, a company might divest from a region experiencing political instability because the risks associated with continuing operations there outweigh potential profits. This sort of preemptive move can protect the company from unpredictable losses and safeguard its global reputation.

Moreover, movements advocating for ethical investment can inspire companies to dissociate from sectors deemed harmful, like tobacco or fossil fuels. Such divestments are not just about adhering to regulations; they’re often about being on the right side of history, responding to the public’s growing demand for corporate responsibility in social and environmental spheres.

The interplay of these sociopolitical factors underscores the multifaceted nature of corporate divestment decisions, which may be influenced by regulatory pressures, ethical considerations, consumer behavior, and activist campaigns.

Navigating the Effects of Divestment

Short-Term Impacts and Long-Term Benefits

Upon announcing a divestment, companies might see immediate market reactions like stock price fluctuations. In the short term, there’s a whirlwind of activities – negotiating sales, transferring assets, and reassuring stakeholders. However, these efforts are not without their growing pains, which might temporarily affect a company’s performance metrics or market perception.

Yet, looking beyond the immediate horizon, the potential long-term benefits often justify these short-term disruptions. For example, divested assets may derive better focus and resources under new ownership, while the divesting company can allocate capital freed up towards more lucrative enterprise areas. Moreover, a company’s streamlined focus post-divestment often leads to heightened efficiency, innovation, and sometimes even a healthier corporate culture, as the business becomes more agile and better poised to adapt to market demands.

Investors and stakeholders tend to be patient if they’re confident in a company’s strategic vision – one where divestment is just one chapter in a narrative of growth, resilience, and future profitability.

Divestment as a Business Transformation Tool

Think of divestment as a sculptor’s tool for the corporate structure – it can redefine, reshape, and ultimately transform a business. When a company divests, they’re not just offloading assets; they’re fundamentally altering their composition to better meet the challenges of today and the opportunities of tomorrow. This strategic choice can be a catalyst for innovation, giving birth to agile subsidiaries or unlocking latent potential within the core business.

The strategic reshuffling of resources and focus that divestment facilitates can often lead to a spurt of renewed energy within the organization. Once free from the responsibility of managing unrelated business units, management can pour their attention, resources, and innovation into core competencies, propelling the business forward in its key markets.

It’s a transformative move that requires vision and bold decision-making. But when executed well, divesture positions a business not only for better financial performance but also for a more coherent and comprehensive market identity – key ingredients for long-term success in an ever-evolving business environment.

Divestment Versus Related Concepts

Disinvestment, Liquidation, and M&A – How Do They Differ?

Diving into the differences between disinvestment, liquidation, and mergers and acquisitions (M&A) reveals distinct strategies businesses use to navigate their corporate journeys. Disinvestment typically refers to selling off shares or stakes in companies; a way to rebalance the investment portfolio without necessarily relinquishing control over the asset. It’s akin to cashing out some chips from the table while still playing the game.

On the other end is liquidation, which is the corporate equivalent of a final curtain call. It’s about converting all assets into cash, often under less-than-favorable circumstances, like bankruptcy or complete business closure. It’s a last resort when a company must settle debts or cease operations, often leaving nothing to rebuild from.

Comparatively, M&A is about growth through combination or absorption. In mergers, two companies unite to become a stronger entity, pooling resources and market presence. In acquisitions, the stronger company swallows the smaller one to expand its operations, enter new markets, or eliminate competition.

Each of these processes serves different business goals, from strategic portfolio adjustment, through survival and debt resolution, to aggressive growth and market consolidation.

Associative Terms: Divestitures, Dissociations, and Split-ups

The corporate lexicon is rich with terms like divestitures, dissociations, and split-ups, each painting a picture of corporate separation but in nuanced shades. Divestitures often involve a more formal and official process of selling a business unit or assets, generally to streamline the company’s focus and improve its financial health.

Dissociation, on the other hand, typically refers to a company breaking away from certain business practices, relationships, or markets. It’s a broader term that can reflect a change in philosophy, direction, or ethics; it’s the letting go of anything that no longer fits with the company’s current or desired identity.

Split-ups are a specific type of divestiture where a company breaks itself into smaller, independent, publicly-traded companies. It’s a strategy akin to unravelling a tapestry into individual threads, each believed to be stronger and more valuable on its own.

In essence, divestitures are the spacious umbrella under which dissociations and split-ups sit, with each term highlighting specific strategies and intentions behind a company’s choice to part ways with its once integral parts.

Divestment in Various Contexts

Divestment, often referred to as divestiture, is a strategic process that involves selling off subsidiary shares, business units, or assets. The practice is employed for various reasons, including optimizing a company’s portfolio, raising capital, or complying with regulatory requirements. In South Africa, divestment played a pivotal role during the apartheid era, as international companies withdrew their investments to pressure the government to end its policies of racial segregation.

The expertise required in divestment transactions is substantial. Financial advisors, legal experts, and industry specialists are often involved to ensure the process is smooth and compliant with relevant regulations. They help evaluate the assets, determine the optimal timing, and manage the complexities involved. The proceeds from divestment transactions can be significant, providing the parent company with funds to reinvest in core operations, reduce debt, or return value to shareholders.

A divestment counter is a strategic tool companies use to monitor and manage their divestment activities. It helps track the progress of ongoing transactions, evaluate the performance of divested units, and make informed decisions about future divestments. The breakup of a company through divestment can lead to the sale of subsidiary shares, where the parent company sells its ownership stake in a subsidiary to another entity or through public offerings.

Endowments, often linked with educational institutions and non-profits, may also engage in divestment to align their investments with their ethical or social values. This can involve divesting from certain industries or companies that do not meet their criteria. Trading of divested assets is crucial, as it determines the market value and potential buyers for the assets being sold.

Admin tasks in divestment include managing documentation, coordinating with stakeholders, and ensuring all legal and regulatory requirements are met. Cash transactions are a common method of payment in divestment deals, where the buyer pays the seller in cash for the assets or shares being acquired. Disposal of assets through divestment helps companies shed non-core or underperforming units, allowing them to focus on their primary business activities.

Subsidiaries of a company refer to entities that are owned or controlled by a parent company. Divestment of these subsidiaries can be a strategic move to optimize the parent company’s portfolio. The historical context of apartheid in South Africa highlights the role of economic pressure in driving social and political change through divestment. Finally, the term vest refers to the process by which an employee gains ownership of stock options or retirement benefits over time, which can be impacted by divestment activities if the employee is part of a divested unit.

Frequently Asked Questions

What is the meaning of divested?

The term ‘divested’ is about someone or something being stripped of their rights, possessions, or titles. In a business context, it refers to the act of selling off a subsidiary, investment, or asset. It’s the corporate act of letting go to refocus, restructure, or respond to external pressures.

What Is the Significance of Divestment in Modern Business?

Divestment in modern business is significant as it enables companies to optimize performance by shedding non-core operations, managing risk by exiting volatile markets, and demonstrating ethical positions on social and environmental issues. It’s a strategic tool that can help companies stay relevant and agile in a rapidly-changing business environment.

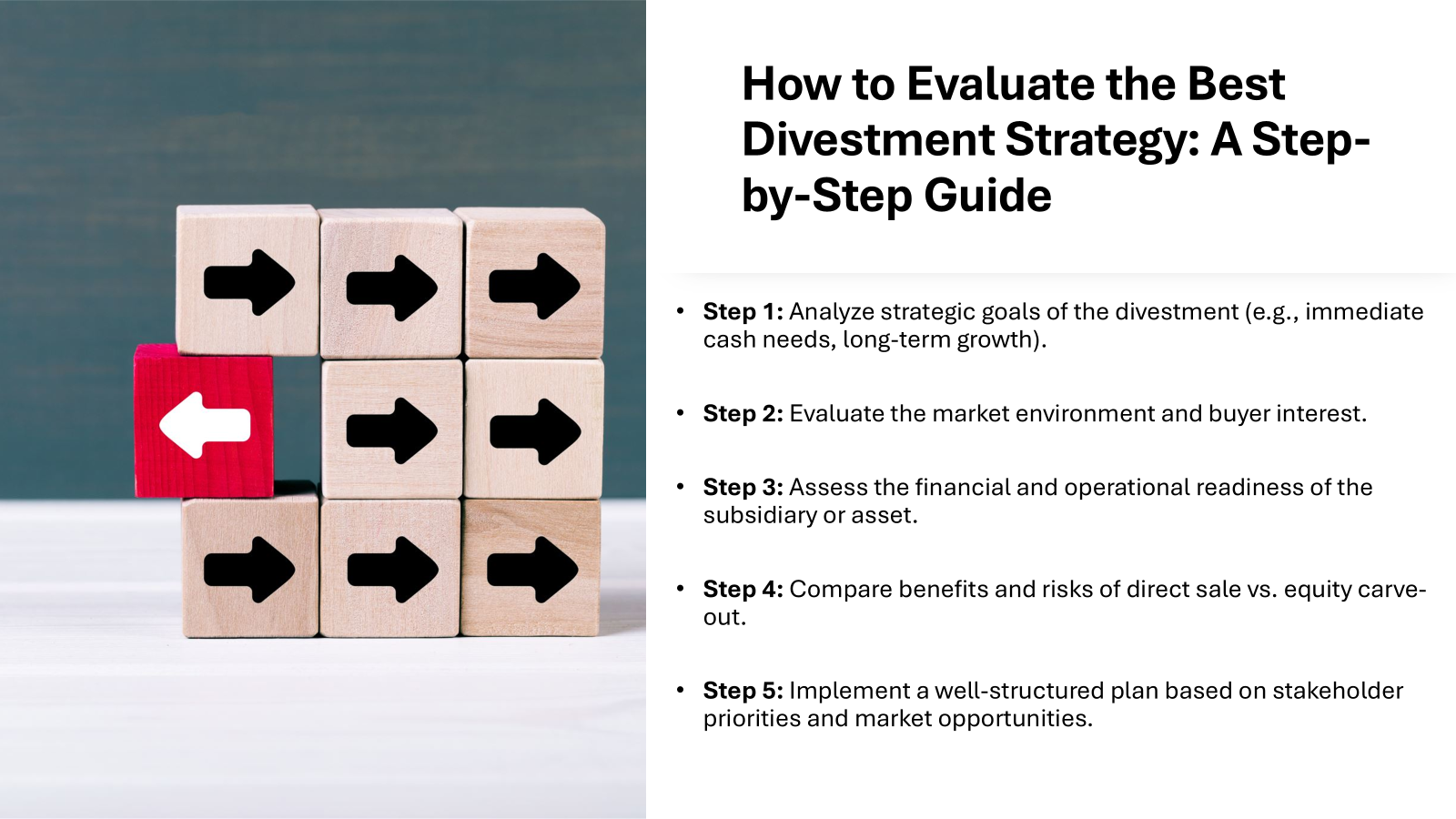

How Can Companies Plan and Execute Effective Divestment Strategies?

Companies can plan and execute effective divestment strategies by having a clear understanding of their long-term objectives and how divesting fits within them. It involves meticulous planning, assembling a skilled cross-disciplinary team, financial auditing, and market analysis. Executing the divestment then requires transparency, compliance with legal and tax considerations, and strategic marketing to find suitable buyers or investors.

In What Ways Does Divestment Serve Social and Ethical Goals?

Divestment serves social and ethical goals by allowing companies to align their operations with their values and public interest. By divesting from certain industries or regions, companies can take a stand against practices that counter their ethical standards, such as environmental harm or human rights abuses, influencing positive change while building brand integrity and trust with stakeholders.