KEY TAKEAWAYS

- Going concern is an accounting principle that assumes a company will continue to operate in the foreseeable future, and is an essential consideration for management, investors, and auditors. It suggests that an entity is more likely than not to survive for the next year and be able to meet its obligations.

- The viability of a going concern can be threatened by a variety of factors, including economic crises, health pandemics like COVID-19, operational shutdowns, liquidity issues, and disruptions to supply chains and customer bases, leading to negative impacts on revenue and operational capacity.

- The concept of going concern is not new and has been a required consideration under generally accepted accounting principles (GAAP) in the United States since 2014, with the requirement for auditors to evaluate this assumption being in place for even longer. However, assessing whether an entity is a going concern requires significant judgment, taking into account unique circumstances and future stresses that may affect the entity’s ability to continue operations.

The Importance of Assessing Going Concern for Auditors and Businesses

Assessing whether a company can be considered a going concern is crucial, both for auditors and the businesses themselves. For auditors, diving into an audit report is a significant part of their responsibilities; they must ensure that a reporting entity’s financial statements present a true and fair view. This includes meticulous scrutiny of the entity’s ability to continue operating in the foreseeable future. Here, guidance from generally accepted auditing standards (GAAS) is indispensable, as auditors follow this robust framework to evaluate audit evidence and determine if there is substantial doubt about a company’s ability to sustain its operations.

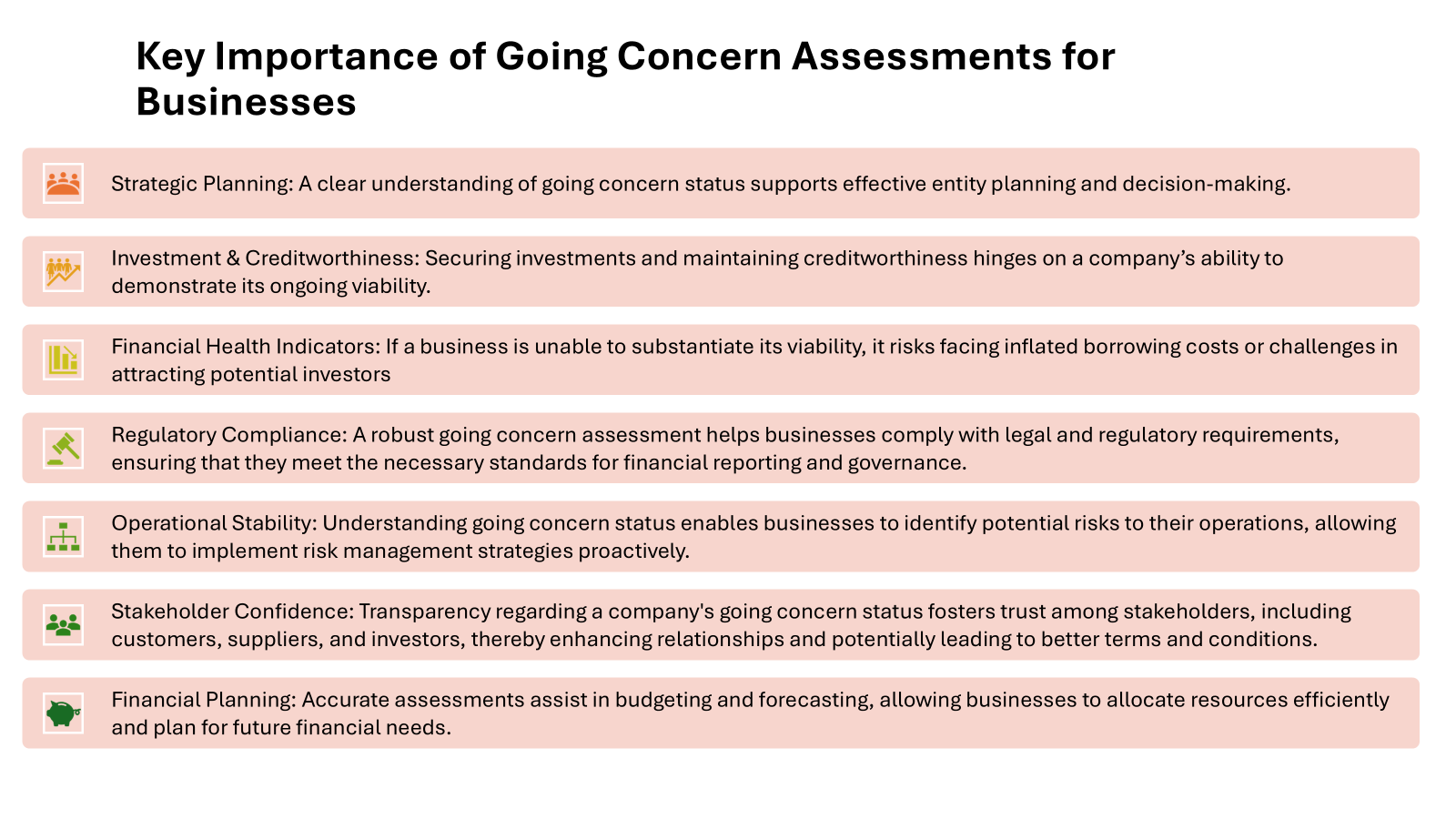

For businesses, understanding their going concern status is critical for entity planning, securing investments, and maintaining creditworthiness. If a business cannot substantiate its viability, it might confront inflated borrowing costs or difficulties in attracting investors. This evaluation acts as a barometer for financial wellbeing, with the potential to reshape everything from daily administration to expansive strategic initiatives.

Core Principles of Going Concern Assessment

Criteria Used to Evaluate a Company’s Going Concern Status

When it comes to pinpointing a company’s going concern status, certain criteria are key. Look at their liquidity ratios—which indicate if they can cover short-term obligations with current assets. Evaluating the firm’s access to debt financing forms a significant part of this analysis, as it can provide insights into their ability to raise new capital if necessary. An analysis of 12-month rolling cash flow projections is crucial to assess if sufficient cash flows are on the horizon to sustain operations. Check if they’re consistently meeting debt repayments, which ties into the importance of understanding a company’s debt covenants and their impact on operational flexibility. The inability to meet these covenants could signal potential loan defaults and raise serious questions about the business’s future. Encountering financial distress may lead companies to restructure their debt or seek distressed lending options to maintain liquidity.

Auditors assess the financial position with an emphasis of matter on key elements, such as the constant need to renegotiate debt terms—a sure sign of distress. Negative outcomes could result in breaches of loan covenants, potentially triggering a death spiral financing scenario where the cost of existing debt increases, further complicating the company’s financial standing. Additionally, they evaluate conditions under bankruptcy law that may indicate a looming inability to continue. External factors, like industry trends and market conditions, might not only affect the business’s continuity but could also precipitate a technical default even without an immediate liquidity crisis.

Internal considerations are just as important, with emphasis on management’s strategy to rectify adverse conditions, such as pursuing restructuring or asset sales—actions that could stave off a concern’s inability to continue as anticipated. Ultimately, the goal is to answer one central question: can they keep the lights on and the gears running for at least the next year?

Recognizing the Red Flags That Indicate Going Concern Risks

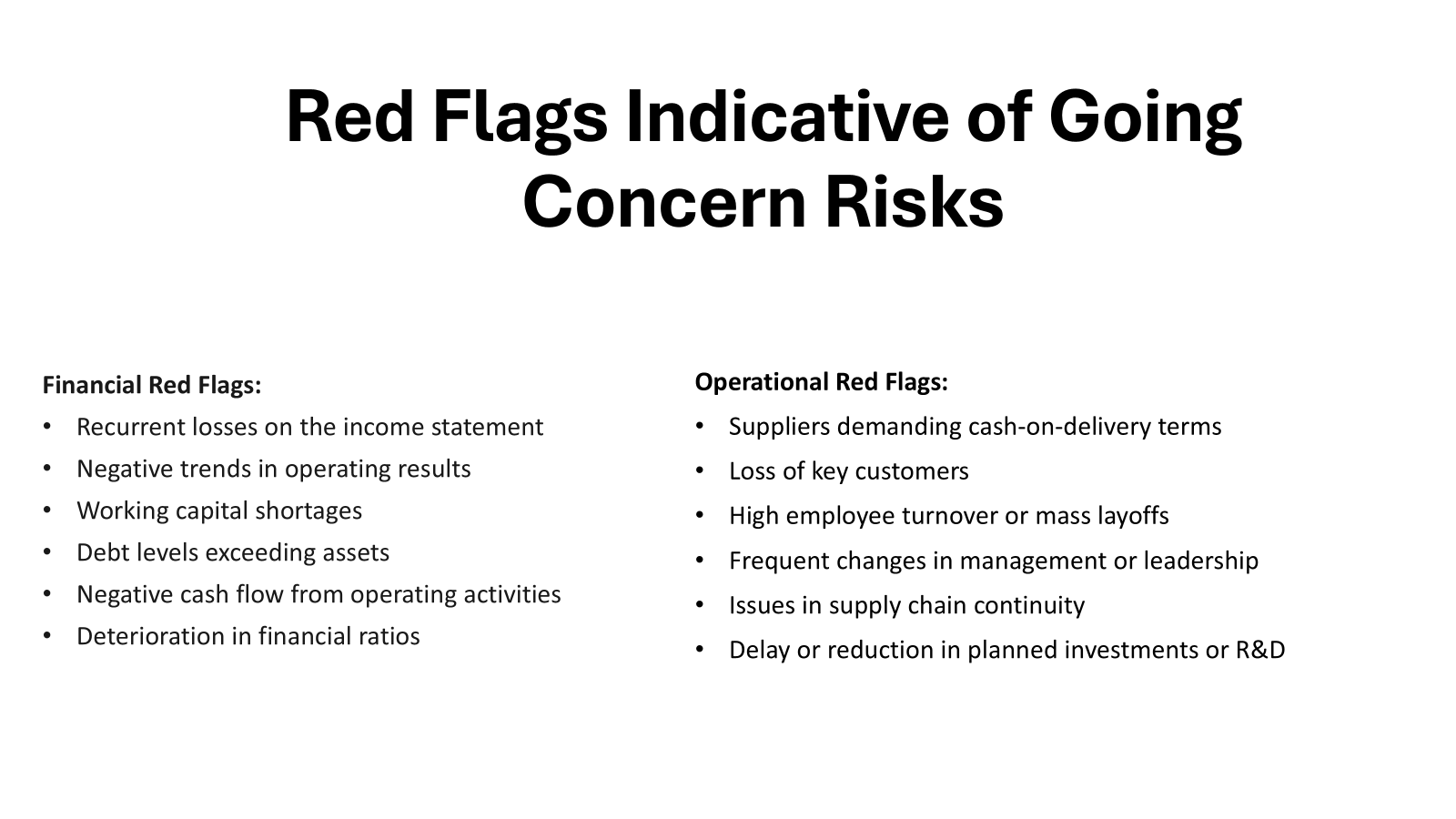

To spot the red flags indicating going concern risks, you must be attuned to both financial signals and operational cues. Indeed, auditors consider the expression of uncertainty about a firm’s ability to continue pivotal, as highlighted by the American Institute of Certified Public Accountants’ Cohen commission findings in the 1970s. Start with the numbers; are there recurrent losses casting a shadow on the income statement? A glance at the balance sheet might reveal working capital shortages or debt towering over assets. Cash flow statements shouldn’t be overlooked as they could betray a troubling narrative of cash bleeding from operating activities—especially crucial when that uncertainty is a deciding factor in the auditor’s report. Furthermore, examining evidential matter such as negative trends in operating results can provide insights into the likelihood of continuity challenges.

Beyond the ledgers and spreadsheets, stay alert for operational distress signals—perhaps suppliers are suddenly demanding cash-on-delivery, or key customers are vanishing. Internally, mass lay-offs or high employee turnover could hint at a sinking ship. If these signs are ignored, they may lead to projections of a grim future, affecting comfortable assumptions about fiscal health. Uncertainty compounds as these collective indicators send up a flare to signal a business potentially on the brink.

When management faces such adversity, there may be a denial of how critical the situation is, but they must create rolling cash flow projections to demonstrate their plans for maintaining solvency. It’s about connecting the dots to see if they’re sketching out a portrait of a company struggling to stay afloat or heading toward bankruptcy if corrective actions are not taken swiftly. As the conditions that contribute to this uncertainty change, so should the disclosed plans to alleviate them, providing the most current information on how the situation is resolving or worsening.

Practical Steps in Conducting a Going Concern Audit

How Financial Ratios Can Signal Going Concern Issues

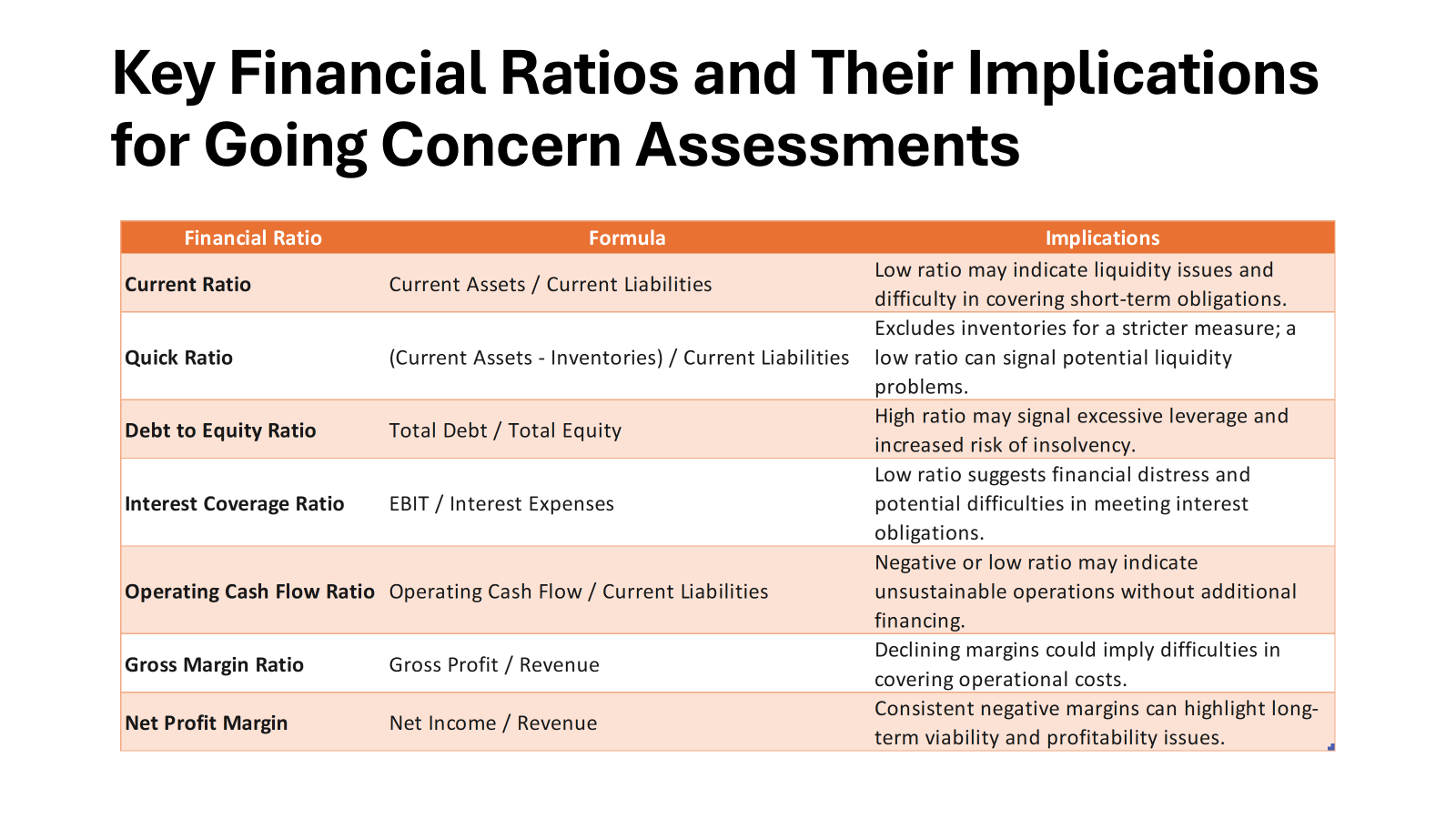

Financial ratios stand as the sentinels that can warn of going concern issues, long before trouble becomes apparent. They’re like the pulse you check to gauge a business’s health. Liquidity ratios, for example, shed light on whether a company can pay off short-term debts with its available assets. They’re critical, as running out of liquid assets is akin to a financial drought, which can quickly spell trouble. Similarly, solvency ratios tell you if a company can meet long-term obligations—an essential check for long-term viability. Profitability ratios give clues about the firm’s capacity to generate income relative to its expenses, sales, assets, or equity; consistent losses here are a major red flag. Finally, activity ratios can indicate operational efficiency; a negative trend could suggest deeper issues beyond the balance sheet. Monitoring these ratios isn’t just about scribbling down numbers—it’s about reading the life signs of a business and making appropriate projections. Regular analysis of these metrics could guide businesses in maintaining a clearer view of their financial prognosis and prompt the development of 12-month rolling cash flow projections to better prepare for various scenarios.

Reviewing Annual Financial Statements for Going Concern Insights

Digging through annual financial statements serves as a treasure hunt for cautionary tales on a company’s going concern status. Start where the story of numbers unfolds—the income statement, balance sheet, and cash flow statement. These documents are more than just historical records; they’re a playbook that reveals whether a business is scoring touchdowns or fumbling financially.

As you analyze these financial statements, consider subscribing to our newsletter for the latest insights into industry trends and projections that impact going concern considerations. The income statement’s bottom line shows whether a company’s financial performance is in the black or red, while the balance sheet reflects its ability to sustain operations in the mid-market landscape. Meanwhile, the cash flow statement reveals how well the cash is dancing to the rhythm of operations, investments, and financing activities. This statement is particularly critical during unpredictable situations such as the recent covid pandemic, which required robust financial management and strategic projections for continuity.

Moreover, the balance sheet acts like a scale, balancing assets against liabilities and equity. Also, keep an eye peeled for the notes accompanying these statements as they often paint the context around the numbers. Tucked away in these notes, you might find disclosures about debts, legal proceedings, or risk factors that can either comfort or sound the alarm about the company’s financial future.

Strategies for Addressing Going Concern Risks

Mitigation Tactics to Overcome Going Concern Threats

If a business spots storm clouds on their going concern horizon, they’re not without lifelines. They can bolster their position by securing a guarantee or obtaining fresh funding. For instance, a parent company could step in to reassure auditors by backing up the subsidiary’s debts—a corporate knight in shining armor. Or, business owners may infuse new capital themselves, providing a buffer to navigate through rocky financial waters and assure stakeholders of their commitment to the company’s future. Despite occasional signals to the contrary, such as financial distress or market downturns, these actions embody the proactive steps businesses can take.

Such moves can pivot an auditor’s view from skeptical to assured about the company’s ability to weather the fiscal storm. They are essentially creating a financial fortress that guards against the onslaught of creditor concerns, potentially turning tides in favor of the going concern presumption. It’s about showing there’s an actionable plan, and more importantly, the means to enact it.

Long-term Planning for Sustaining Business Solvency

To ensure the continuity of their business, proactive long-term planning is a must. This isn’t about a quick fix; it’s about sustainable strategies that keep solvency secure. Companies may embark on diversifying their product lines or penetrating new markets to enhance revenue streams, buffering against market volatility. Others might focus on debt restructuring to stretch out payments and ease cash flow pressures, or rigorously manage their expenditure to keep costs under tight surveillance.

These plans, once set in motion, could gradually strengthen the business’s financial resilience, painting a brighter picture for future going concern assessments. Moreover, these strategies should be documented and communicated transparently with stakeholders, reinforcing confidence in management’s ability to steer the company towards long-term prosperity. This forward-thinking approach can transform potential adversities into well-navigated adventures on the corporate seas.

The Future of Auditing Going Concerns

Technological Advancements Impacting Going Concern Evaluations

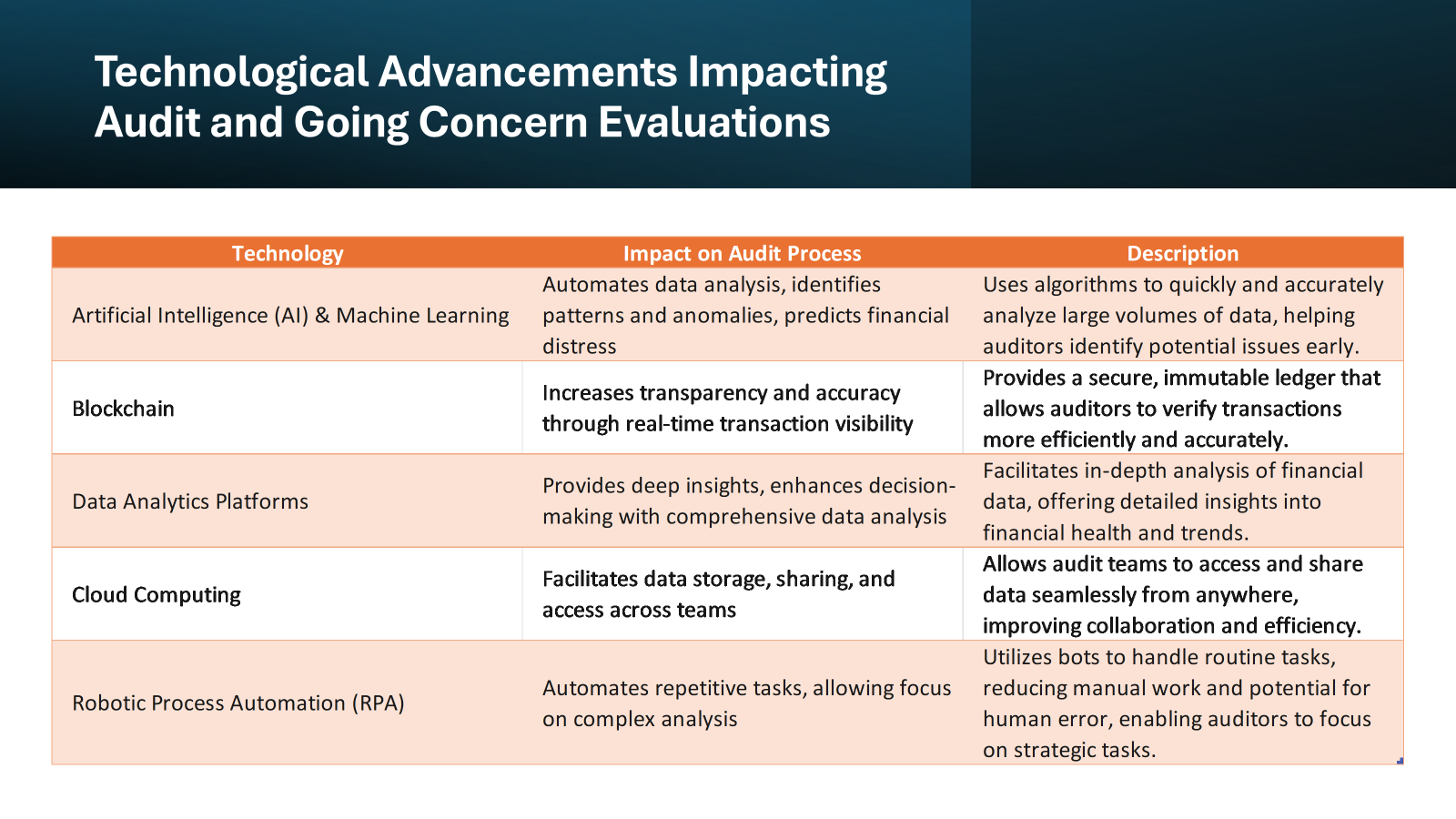

The audit world is buzzing with tech advancements, and going concern evaluations are catching the wave. Imagine AI and machine learning: these aren’t just sci-fi gadgets but tools that can crunch data and uncover patterns that may indicate financial distress far earlier than traditional methods. By analyzing vast swaths of financial data, algorithms can pinpoint anomalies or trends that warrant a closer look.

Blockchain is another game-changer, with its potential to offer real-time visibility into transactions, enhancing transparency and accuracy in financial reporting. And let’s not forget data analytics platforms that can dissect financial information with surgical precision, providing auditors with deep insights for more informed going concern assessments. These technologies are transforming the landscape of auditing, turning what was once a manual, time-intensive process into a more dynamic, analytics-driven practice.

Changing Regulations and Standards in the Post-Pandemic Era

In light of the economic turmoil caused by COVID-19, regulations and standards surrounding going concern assessments are being revised to be more stringent. They’re increasingly emphasizing transparency and the rigor of evaluations. In the wake of the pandemic, regulators are mandating earlier disclosures of going concern risks to alert stakeholders about potential financial instabilities.

Expect updates to auditing standards that will underline the necessity of forward-looking information and management’s strategies to mitigate financial uncertainties. Likewise, the importance of accurate and relevant non-GAAP financial measures in relation to going concern prognostications is likely to be examined more closely. For businesses navigating the aftermath of COVID-19, vigilance in adhering to these regulatory shifts is crucial—not just for legal compliance, but to cultivate trust amongst investors, creditors, and customers in an economy that’s still adapting to post-pandemic norms.

Real-World Implications of Going Concern Determinations

Case Studies: Companies Navigating Going Concern Challenges

Real-world examples can really drive home the gravity and complexity of going concern challenges. Take a well-known retail giant who faced declining sales and mounting debt. In their case, a strategic overhaul involving store closures, e-commerce expansion, and supply chain optimization was employed to address persistent going concern doubts. Or consider a tech startup that, despite impressive innovation, grappled with cash flow issues. They tackled their going concern uncertainties head-on through successful rounds of funding and a pivot in their business model that capitalized on emerging market trends.

However, some businesses find themselves in more dire straits, facing the specter of bankruptcy. It represents a significant going concern challenge, indicating a company’s struggle to generate sufficient cash to support its operations. The process of filing for bankruptcy can be found detailed in various sections such as the Auditor’s report, Management discussion and analysis, and Notes to financial statements of a company’s financial documentation.

These case studies underscore that while going concern issues can indeed be daunting, and sometimes lead to bankruptcy, they’re not insurmountable. With the right strategies and agility, companies can navigate through the turbulence and emerge more robust and financially secure.

How Going Concern Assertions Affect Stakeholders

Going concern assertions have a ripple effect on stakeholders. Investors, for instance, may reevaluate their involvement with a company flagged with going concern doubts; they prefer stability and predictable returns. Creditors tighten their grips, contemplating higher interest rates or shorter payment terms to mitigate risks.

Employees, too, are on edge; job security wanes as they brace for budget cuts or layoffs. Suppliers and customers might reconsider their affiliations, fearing disruptions in their own operations. On the flip side, a positive going concern opinion can bolster stakeholder confidence, signaling a steady hand on the financial tiller. It’s a powerful affirmation that reverberates through the entire ecosystem surrounding a business.

FAQs about Assessing a Going Concern in Accounting

What Happens If a Company Is Not a Going Concern?

If a company is not considered a going concern, it indicates they might not be able to operate or meet their obligations in the near future. This precarious financial state implies a growing risk of having to file for bankruptcy if adequate measures aren’t promptly taken. Notably, this term “going concern” refers to the company’s ability to generate enough cash to support its operations and avoid insolvency. A lack of confidence in this capacity can trigger a re-evaluation of assets and liabilities, often leading to asset sales or restructuring to stay afloat. Credit challenges would likely ensue, with lenders possibly calling in debts or setting steep borrowing rates to mitigate their risks. Shareholders and investors might experience a decline in their investment value and may seek to minimize losses. For employees, the lack of going concern raises red flags about job security and future career opportunities. Ultimately, it’s a critical juncture that necessitates swift management intervention to prevent potential financial collapse.

How Does a Going Concern Affect Corporate Reporting and Investor Decisions?

A going concern qualification influences how assets and liabilities are reported—shifting from a liquidation to a continuation basis, which impacts asset valuations and depreciation methods. Investors, tuned into these nuances, use this information to make critical decisions. A clean going concern opinion can be the green light they’re looking for, affirming business stability and potential for growth, while any hint of doubt may prompt them to reconsider their investment, seeking safer harbors for their capital.

Why is it called going concern?

The term “going concern” originates from the notion that a business is “going” or operating currently and is expected to continue to do so for the foreseeable future. It’s a phrase that speaks to the continuity of the business’s operations, implying that it’s not winding down or facing the threat of liquidation. This terminology is embedded in accounting principles to indicate a company’s healthy financial status and its prospects for ongoing functionality and solvency.

What is an example of going concern?

An example of a going concern could be a popular local bakery that has been operating successfully for years. Despite a competitive market, their financial statements show consistent profits, robust cash flows, and a strong balance sheet with modest debt. They have a loyal customer base, no legal issues, and an up-to-date business model. These indicators suggest that the bakery is expected to continue its operations and there are no threats to its status as a going concern in the near future.

How do you determine if a company is a going concern?

You determine if a company is a going concern by conducting a thorough financial analysis, reviewing liquidity and profitability ratios, and assessing its ability to meet obligations in the short and long term. Examine its income and expenses, assets, and liabilities. The board of directors reviews this information to decide on the company’s going concern status, which they disclose in the financial report footnotes. If a company has a solid financial base and viable plans for continuing operations, it’s typically considered a going concern.